Associated British Foods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated British Foods Bundle

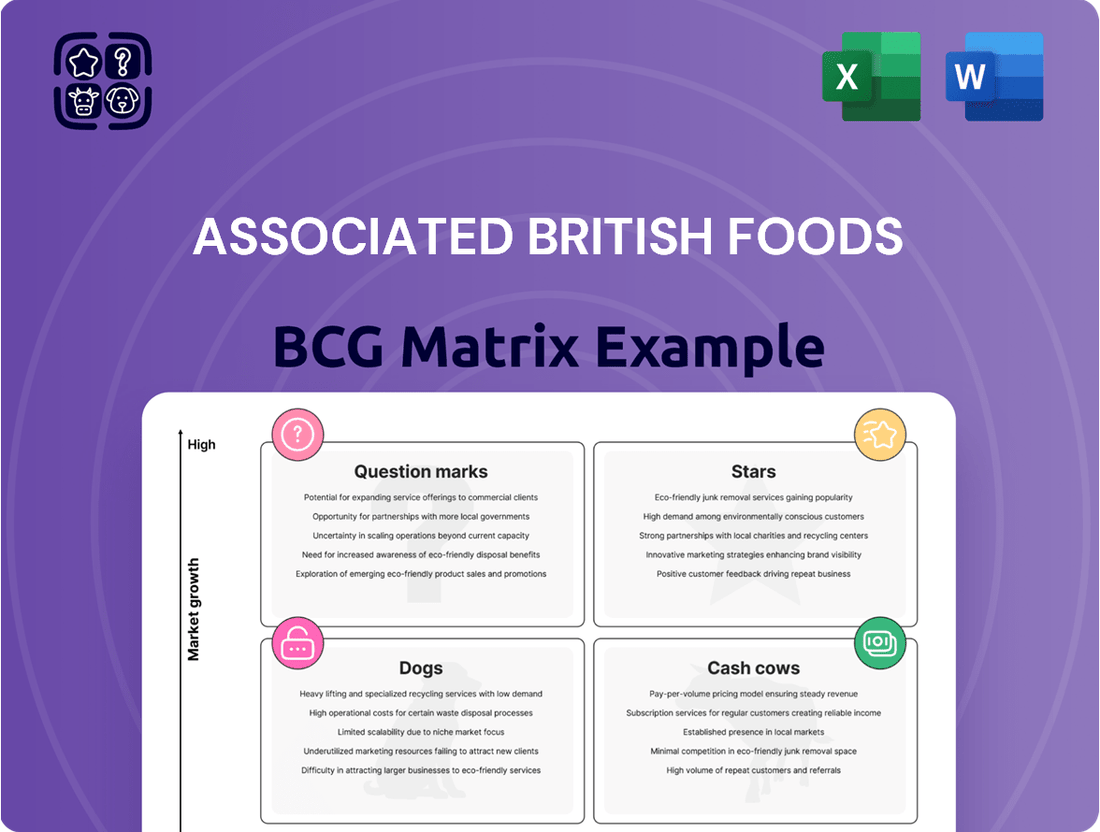

Associated British Foods' diverse portfolio spans from household staples to high-growth brands. Understanding where each sits on the BCG Matrix—whether a dominant Star, a reliable Cash Cow, a struggling Dog, or a promising Question Mark—is crucial for strategic allocation of resources.

This preview offers a glimpse into their market positioning, but to truly unlock the strategic potential, you need the full BCG Matrix report. Gain a comprehensive understanding of their product portfolio's performance and identify actionable insights for future growth and investment.

Don't miss out on the detailed quadrant placements and data-backed recommendations that will empower your decision-making. Purchase the complete BCG Matrix for Associated British Foods and gain a competitive edge by knowing exactly where to focus your efforts.

Stars

Primark is aggressively pursuing international expansion, notably strengthening its presence in the United States, Italy, France, Spain, Portugal, and Central and Eastern Europe. This strategic move is a primary driver of its impressive sales growth, with expectations of sustained mid-single-digit increases in the coming years.

Primark's core value proposition is delivering on-trend fashion at exceptionally low prices. This strategy, often referred to as "value fashion," appeals strongly to a broad customer base, particularly those prioritizing affordability without compromising on style. In the face of rising inflation, this focus on accessible pricing has become even more critical for consumer spending.

This commitment to value has translated into significant market share growth for Primark. For instance, in the fiscal year ending September 2023, Primark reported a 7% increase in revenue, reaching £9.0 billion, with like-for-like sales up 2%. This demonstrates the enduring appeal of their price-point strategy in attracting and retaining shoppers.

The United States represents a key growth frontier for Primark, a segment of Associated British Foods. The company is actively expanding its footprint here, evidenced by significant capital allocation towards new store openings and the development of crucial distribution infrastructure.

Primark's performance in the US market has been robust, with sales demonstrating strong upward momentum. This growth trajectory suggests a promising opportunity for Primark to solidify its market presence and potentially emerge as a dominant player in the American retail landscape.

Digital and Brand Investment in Primark

Associated British Foods (ABF) is significantly boosting its investment in Primark's digital infrastructure, technology upgrades, and brand marketing efforts. These strategic moves are designed to fuel Primark's future expansion and deepen its connection with customers. For instance, ABF allocated £750 million to its capital expenditure program in the fiscal year ending March 2024, with a substantial portion directed towards enhancing Primark's online presence and store modernization.

These investments are crucial for Primark to maintain its competitive edge in the fast-fashion sector. By strengthening its digital capabilities, Primark aims to improve the customer journey, from online browsing to in-store purchasing. The company is also focusing on data analytics to better understand consumer preferences, which is vital for inventory management and personalized marketing campaigns.

- Digital Expansion: Primark is investing in its e-commerce platform and expanding its click-and-collect services.

- Technology Integration: Upgrades to in-store technology and supply chain systems are a key focus.

- Brand Marketing: Increased spending on marketing campaigns aims to enhance brand visibility and customer loyalty.

- Long-Term Growth: These initiatives support Primark's strategy for sustained growth and market leadership.

Performance of International Grocery Brands

Associated British Foods' (ABF) international grocery brands, such as Twinings and Ovaltine, have shown robust performance and consistent growth across diverse global markets. These established brands hold leading positions within their product categories, making substantial contributions to the overall profitability of ABF's Grocery segment.

In fiscal year 2024, ABF reported that its Grocery division experienced a notable uplift, with international brands playing a pivotal role. For instance, Twinings, a premium tea brand, saw its sales increase by 7% in constant currency terms, driven by strong demand in North America and Europe. Ovaltine, a malted beverage, also performed well, with a 5% sales growth, particularly in Asian markets where its health benefits are highly valued.

- Twinings’ sales grew by 7% in constant currency in FY24.

- Ovaltine achieved a 5% sales increase in FY24.

- These brands are key contributors to ABF's Grocery segment profitability.

- Strong performance is evident in markets like North America, Europe, and Asia.

Primark, as a "Star" in the Associated British Foods BCG Matrix, is characterized by its high growth and strong market position. Its aggressive international expansion, particularly in the US, fuels impressive sales growth, with mid-single-digit increases anticipated. This value-fashion model, offering trendy clothing at low prices, resonates strongly with consumers, especially amidst inflation.

The brand's commitment to affordability has driven significant market share gains. For example, in the fiscal year ending September 2023, Primark achieved £9.0 billion in revenue, a 7% increase, with like-for-like sales up 2%. ABF is backing this growth with substantial investments, allocating £750 million to capital expenditure in FY24, with a significant portion aimed at enhancing Primark's digital capabilities and store modernization to maintain its competitive edge.

What is included in the product

The ABF BCG Matrix analyzes its diverse portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment decisions.

The Associated British Foods BCG Matrix offers a clear, one-page overview that simplifies complex business unit performance, alleviating the pain of strategic decision-making.

Cash Cows

Primark's established European markets, especially the UK, represent significant cash cows. The company commands a leading market share by volume in these mature regions. While growth may be modest, these territories consistently provide substantial cash flow, underpinning ABF's overall financial strength.

Associated British Foods' Grocery division is a prime example of a Cash Cow within their BCG Matrix. This segment, home to a variety of well-recognized brands, reliably generates strong and consistent profits. Its stable performance is a key contributor to the company's overall financial health, providing a dependable source of income.

The Grocery division’s ability to maintain high profit margins is a significant advantage. For instance, in fiscal year 2023, ABF reported that its Grocery segment achieved an adjusted operating profit of £420 million, demonstrating its robust earning power. This consistent profitability allows the division to serve as a vital cash generator for the broader Associated British Foods group.

AB Mauri, Associated British Foods' (ABF) yeast and bakery ingredients division, stands as a robust performer within the Ingredients segment, functioning as a significant cash cow for the broader group.

This business unit consistently delivers strong sales growth and makes a substantial positive contribution to ABF's overall profitability, solidifying its role as a dependable cash generator. For the fiscal year ending March 2, 2024, ABF reported that its Ingredients division, which includes AB Mauri, saw revenue increase by 8.1% to £2,348 million, underscoring the segment's reliable performance.

Cost Management and Margin Recovery Across the Group

Associated British Foods (ABF) has demonstrated a strong focus on cost management and margin recovery throughout its diverse business segments. This strategic emphasis has directly translated into improved profitability and consistent, strong cash generation, firmly positioning these operations as cash cows within the company's portfolio.

- Cost Efficiency Drives Profitability: ABF's commitment to operational efficiency has yielded tangible results. For instance, in the fiscal year ending March 2, 2024, the company reported adjusted operating profit of £1.46 billion, up from £1.35 billion in the prior year, showcasing the success of its cost-saving initiatives.

- Margin Recovery in Key Segments: Several divisions have successfully navigated inflationary pressures to recover and expand margins. ABF Sugar, for example, saw its adjusted operating profit increase significantly in the first half of fiscal 2024, driven by improved sugar prices and cost controls.

- Robust Cash Generation: The efficiency gains and margin improvements contribute to ABF's robust cash flow. The company's free cash flow for the year ending March 2, 2024, remained strong, underscoring the cash-generating capabilities of its mature, well-managed businesses.

Strong Free Cash Flow Generation

Associated British Foods' Cash Cows, particularly within its grocery and sugar segments, have demonstrated robust free cash flow generation. This strength is a testament to their established market positions and efficient operations.

For the fiscal year ending March 2, 2024, Associated British Foods plc reported a notable increase in its free cash flow. The company's ability to convert profits into cash remained a key strength, underscoring the maturity and profitability of its core businesses.

- Strong Free Cash Flow: The Group consistently generates substantial free cash flow, exceeding operational needs and capital investment requirements.

- Financial Flexibility: This strong cash position provides the company with significant financial flexibility, enabling strategic investments, debt reduction, and shareholder distributions.

- 2024 Performance: Associated British Foods plc reported a strong free cash flow for the fiscal year ending March 2, 2024, reflecting the resilience of its Cash Cow businesses.

Associated British Foods' established brands within the Grocery division, such as Kingsmill and Jordans, are significant cash cows. These mature businesses benefit from strong brand recognition and consistent consumer demand, leading to predictable revenue streams and healthy profit margins.

The Sugar division also contributes to ABF's cash cow portfolio, particularly in regions where it holds a strong market position. Despite market fluctuations, its operational efficiency and pricing power enable it to generate reliable cash surpluses.

AB Mauri, as part of the Ingredients segment, functions as a cash cow due to its consistent demand for essential bakery ingredients. Its stable revenue and profitability support ABF's overall financial stability.

| ABF Segment | BCG Category | Key Characteristics | Fiscal Year 2024 Data (Ending March 2) |

|---|---|---|---|

| Grocery | Cash Cow | Established brands, strong market share in mature markets, consistent profitability | Adjusted operating profit: £420 million (FY23, indicative of segment strength) |

| Ingredients (incl. AB Mauri) | Cash Cow | Essential products, stable demand, reliable revenue generation | Revenue: £2,348 million (8.1% increase) |

| Sugar | Cash Cow | Strong market position, operational efficiency, pricing power | Adjusted operating profit: Significant increase in H1 FY24 |

What You’re Viewing Is Included

Associated British Foods BCG Matrix

The Associated British Foods BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, just the complete strategic analysis ready for your immediate use. You can confidently rely on this preview as a true representation of the professional-grade document that will be delivered to you, enabling swift integration into your business planning and decision-making processes.

Dogs

Primark's performance in the UK and Ireland, a historically robust market, has seen a slowdown. For the fiscal year ending March 2024, like-for-like sales in the UK were reported as flat, a notable shift from previous growth periods. This segment is currently positioned as a question mark within the BCG matrix, showing potential but facing headwinds.

This deceleration is attributed to a combination of factors, including persistent inflation impacting consumer discretionary spending and increased competition within the discount fashion retail sector. While overall sales for Primark in the UK and Ireland for the first half of fiscal 2024 increased by 2.2% to £2.0 billion, the underlying like-for-like growth was muted, reflecting the challenging environment.

Allied Bakeries, a segment within Associated British Foods (ABF), has navigated a difficult market landscape. In its 2024 fiscal year, the company reported that Allied Bakeries experienced a decline in profitability, underscoring the significant headwinds it has faced.

Given these persistent challenges, ABF is actively exploring strategic alternatives for Allied Bakeries. This evaluation suggests that the business unit may be characterized by low market share and limited growth prospects, potentially positioning it as a candidate for divestiture as part of ABF's portfolio optimization strategy.

Associated British Foods' (ABF) Vivergo bioethanol business, a significant investment in renewable fuels, has faced considerable headwinds. The plant, a large-scale operation, has been operating at a loss, primarily due to adverse regulatory changes and challenging market conditions within the UK and European bioethanol sectors.

Despite its operational capacity, Vivergo's financial performance has been a persistent concern for ABF. The company has been actively engaged in discussions with the UK government, seeking to find viable solutions to the ongoing financial difficulties. This situation underscores Vivergo's current position as a low-performing asset within ABF's diversified portfolio.

Certain Agriculture Segments

Associated British Foods' Agriculture segment, particularly its compound feed operations in the UK and China, is facing headwinds. These businesses are experiencing reduced sales, a direct consequence of declining commodity prices and a general softening of demand in these markets. This performance places them within the 'Dog' category of the BCG Matrix, signifying low growth and potentially weak market positioning.

- Low Growth Market: The compound feed sector in the UK and China is experiencing subdued demand, limiting revenue expansion opportunities.

- Declining Commodity Prices: Falling prices for agricultural commodities directly impact the profitability and sales volume of feed producers.

- Market Share Concerns: The combination of low growth and potential competitive pressures suggests these operations may have a low relative market share.

- Strategic Review: Businesses in the Dog quadrant typically warrant a strategic review, potentially leading to divestment or significant restructuring to improve performance.

Spanish Sugar Business (Azucarera)

Associated British Foods' Spanish sugar business, Azucarera, is currently facing significant challenges. An ongoing operational review highlights a persistently high-cost structure and worsening market dynamics. This situation points towards Azucarera being classified as a 'Dog' within the BCG matrix, indicating low growth prospects and profitability that may necessitate substantial strategic adjustments.

The deteriorating market conditions in Spain for sugar production are a key factor. For instance, in 2023, the European sugar market experienced price volatility influenced by global supply and demand, with Spanish producers often facing competitive pressures from lower-cost regions. This environment directly impacts Azucarera's ability to achieve competitive pricing and maintain healthy profit margins.

The structurally high-cost base of Azucarera is another critical element. This could stem from various factors, including outdated processing facilities, higher labor costs compared to competitors, or inefficient supply chain management. Without significant investment or restructuring, these cost disadvantages are likely to persist, further entrenching its 'Dog' status.

- Operational Review: Azucarera is undergoing an operational review.

- Cost Base: The business has a structurally high-cost base.

- Market Conditions: Deteriorating market conditions are impacting profitability.

- BCG Classification: Azucarera is likely positioned as a 'Dog' due to low growth and profitability.

Associated British Foods' (ABF) Agriculture segment, specifically its compound feed operations in the UK and China, are classified as Dogs. These businesses are experiencing reduced sales due to declining commodity prices and softening demand, indicating low growth and potentially weak market positioning.

Similarly, ABF's Spanish sugar business, Azucarera, is also a Dog. It faces a high-cost structure and deteriorating market conditions, leading to low growth prospects and profitability that may necessitate significant strategic adjustments.

These 'Dog' segments are characterized by low market share and limited growth prospects, often requiring a strategic review that could lead to divestment or substantial restructuring to improve their performance within ABF's portfolio.

The overall performance of these segments in 2024 fiscal year highlights the challenges in these specific markets, underscoring the need for careful portfolio management.

Question Marks

Primark's expansion into new countries often begins with a modest market share, despite the high growth prospects these markets represent. For instance, as Primark entered the United States, its initial footprint was relatively small compared to established competitors. This strategy necessitates substantial capital outlay to build brand recognition and secure prime retail locations, aiming to gradually increase its market penetration over time.

Primark's digital and e-commerce capabilities are a key area for development, fitting into the Stars category of the BCG matrix. While historically a physical store focused brand, their strategic push into online engagement, including click and collect, signifies a high-growth potential market where their share is still being solidified. This necessitates significant investment to establish a strong competitive presence in the evolving omnichannel retail environment.

Associated British Foods' speciality ingredients businesses, part of its Ingredients segment, faced a challenging first half of 2024 due to customer destocking. However, performance improved significantly in the second half of the year. This dynamic indicates a market with underlying growth potential, but one where ABF must remain vigilant and continue investing to secure and expand its market share.

While specific revenue figures for the speciality ingredients sub-segment are not broken out separately within ABF's reporting, the overall Ingredients division saw revenue growth in the second half of fiscal 2024. This improvement, following the earlier destocking, suggests that the speciality ingredients portfolio is recovering and poised for future gains, especially if ABF can capitalize on renewed customer demand.

Recovery of UK Grain Trading Business (Frontier)

Frontier, Associated British Foods' UK grain trading joint venture, has faced significant headwinds due to persistent wet weather, impacting its performance. This segment is considered a potential high-growth area, contingent on a normalization of market conditions. However, recent challenges have likely suppressed its current market share.

The broader agriculture segment within ABF anticipates some recovery. For Frontier, this translates to an opportunity for rebound, especially if weather patterns improve and trading volumes increase. Its strategic importance lies in its potential to capitalize on a recovering agricultural market.

- Frontier's recovery is tied to improved weather patterns impacting grain supply and demand.

- The business is positioned as a potential high-growth area if market conditions stabilize.

- Recent adverse weather has likely constrained Frontier's market share.

Expansion of Licensed Product Ranges in Primark

Primark's strategic expansion of licensed product ranges, featuring collaborations with prominent brands and influencers, is a key driver of its growth. These partnerships are designed to tap into new customer segments and boost sales volumes.

While these licensed collections are performing well, their market share within the vast licensed merchandise sector is still maturing. Continued investment in securing desirable partnerships and robust marketing campaigns is essential to solidify their position.

- Growth Potential: Collaborations with brands like Adidas and Disney, as well as influencer partnerships, have historically driven significant footfall and sales for Primark. For instance, in the first half of fiscal year 2024, Primark reported a 7% increase in like-for-like sales, partly attributed to these popular ranges.

- Market Penetration: The broader licensed merchandise market is highly competitive. While Primark's approach is gaining traction, its share of this extensive market is still developing, necessitating ongoing strategic alliances and promotional efforts to capture a larger slice.

- Investment Focus: Maintaining momentum requires sustained investment in identifying and securing future licensing agreements, alongside marketing initiatives that effectively communicate the value and appeal of these co-branded products to consumers.

Associated British Foods' Question Marks represent business units with low market share in high-growth industries. These ventures require significant investment to capture market potential, with the aim of eventually becoming Stars. Their success hinges on strategic positioning and effective resource allocation to gain traction against established competitors.

The company's approach to these segments involves careful market entry and sustained development, acknowledging the inherent risks but also the substantial rewards if they can achieve significant market penetration.

ABF's strategy for Question Marks involves a long-term view, focusing on building brand presence and customer loyalty in nascent or rapidly expanding markets.

The company is actively exploring opportunities in emerging markets and new product categories that exhibit strong growth trajectories, aiming to cultivate these into future revenue drivers.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights for Associated British Foods.