Associated British Foods Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated British Foods Bundle

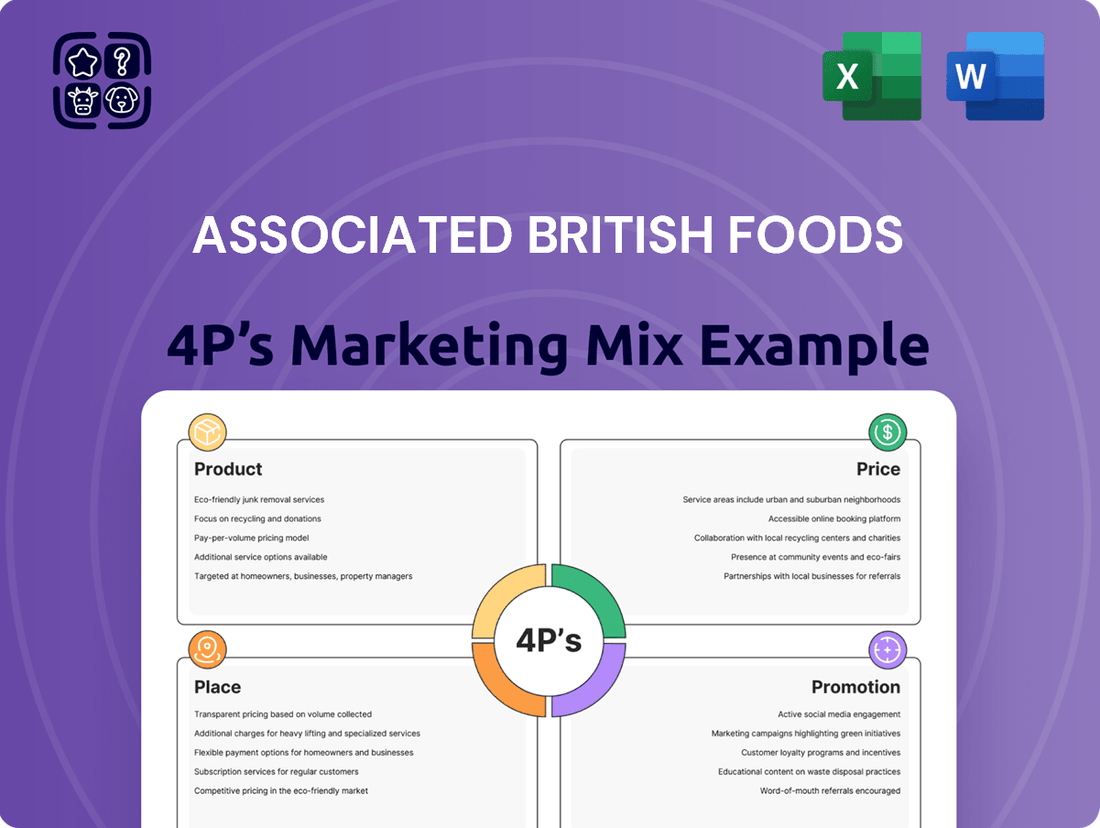

Associated British Foods masterfully leverages its diverse product portfolio, from iconic food brands to sugar and ingredients, to meet varied consumer needs. Their pricing strategies are carefully calibrated across different market segments, ensuring accessibility and perceived value. Discover how their intricate distribution networks and impactful promotional campaigns create a compelling market presence.

Ready to unlock the full strategic blueprint? Get instant access to our comprehensive 4Ps Marketing Mix Analysis for Associated British Foods, providing actionable insights and real-world examples to elevate your own marketing understanding.

Product

Associated British Foods (ABF) maintains a remarkably diverse food and ingredients portfolio, encompassing everything from everyday staples like Kingsmill bread and Silver Spoon sugar to specialized ingredients supplied to industrial customers. This breadth allows ABF to serve a wide range of consumers and businesses, securing a strong foothold in numerous segments of the food industry.

In 2023, ABF's grocery division, which includes brands like Twinings and Jordans cereals, reported revenue of £2.3 billion, demonstrating the strength of its consumer-facing brands. The company's commitment to innovation is evident as it actively adjusts its product lines to align with shifting consumer tastes and health-conscious dietary trends, ensuring continued relevance in a dynamic market.

Associated British Foods' grocery segment boasts a portfolio of beloved consumer brands like Twinings tea and Jordans cereals. These brands are meticulously crafted to appeal to specific consumer needs, emphasizing superior quality, delightful taste, and everyday convenience. This focus fosters deep brand loyalty among its customer base.

Product development for these brands is a continuous process, involving both the refinement of established product lines and the introduction of innovative new variations. For instance, in 2024, ABF continued to expand its Twinings range with new herbal infusions and sustainable packaging initiatives, aiming to capture evolving consumer preferences for health and environmental responsibility.

Primark, ABF's value fashion segment, delivers trendy apparel, accessories, and home goods at accessible price points. Its core product strategy revolves around high-volume sales and rapid fashion cycles, ensuring a constant influx of new styles to capture evolving consumer preferences. This approach is supported by efficient design and sourcing processes, enabling competitive pricing without compromising on desirability.

In the 2023 financial year, Primark reported a significant increase in revenue, reaching £9.0 billion, up 15% from the previous year. This growth reflects the continued success of its product offering, with like-for-like sales in the UK up 7.9% and in Europe (excluding the UK) up 10.1%. The company's commitment to offering fashionable items at low prices, such as its £2 t-shirts and £15 dresses, continues to resonate with a broad customer base.

Focus on Quality and Innovation

Associated British Foods (ABF) prioritizes exceptional product quality across its varied business units. For instance, their sugar division adheres to stringent purity standards, while the Primark segment focuses on delivering durable and well-made apparel. This dedication to quality builds consumer trust and brand loyalty.

Innovation is a cornerstone of ABF's product strategy, driving advancements in food science, agricultural techniques, and fashion design. This forward-thinking approach ensures their offerings not only meet current market demands but also anticipate future consumer needs, maintaining a competitive edge.

ABF's commitment to quality and innovation is reflected in its financial performance. For the fiscal year ended March 2, 2024, ABF reported revenue of £19,287 million, with its Grocery segment alone contributing £4,771 million, underscoring the market's positive reception to its quality-focused product lines.

Key aspects of ABF's product focus include:

- Unwavering Quality Standards: Ensuring consistency and excellence from raw materials to finished goods across all segments.

- Continuous Product Development: Investing in R&D for new food products, improved agricultural methods, and evolving fashion trends.

- Market Relevance: Adapting product portfolios to meet changing consumer preferences and technological advancements.

- Brand Reputation: Leveraging quality and innovation to build and maintain strong brand equity in competitive markets.

Tailored Development

Associated British Foods (ABF) excels in tailored product development, a cornerstone of its marketing strategy. This approach means products are specifically designed to meet the unique demands of different markets and customer groups. For instance, ABF's ingredients division crafts bespoke solutions for industrial food manufacturers, ensuring their specific processing needs and flavor profiles are met. This customization is crucial for maintaining strong B2B relationships and securing long-term contracts.

In its retail segment, particularly with Primark, tailored development translates to creating fashion that resonates with local tastes and cultural preferences across its global store network. This includes adapting product assortments to suit regional fashion trends, weather patterns, and consumer spending habits. This localized strategy is a key driver of Primark's success, allowing it to capture market share by offering relevant and affordable fashion.

- Bespoke Ingredients: ABF Ingredients reported strong performance in 2024, driven by demand for specialized ingredients in the food and beverage sector.

- Culturally Relevant Fashion: Primark’s expansion into new markets in 2024 and early 2025 has been supported by localized product offerings, contributing to its revenue growth.

- Market Segmentation: ABF's ability to segment its customer base and tailor products ensures high customer satisfaction and loyalty across its diverse business units.

- Innovation Focus: Continued investment in R&D allows ABF to stay ahead of evolving consumer preferences and regulatory changes, ensuring its product pipeline remains relevant.

Associated British Foods' product strategy is defined by its extensive diversification and a commitment to quality across all its brands. From everyday grocery items like Kingsmill bread to specialized ingredients and value fashion through Primark, ABF ensures its offerings cater to a broad consumer base.

The company continuously innovates, adapting its product lines to align with evolving consumer trends, such as health consciousness and sustainability. This proactive approach, exemplified by Twinings' new herbal infusions and eco-friendly packaging in 2024, reinforces brand relevance.

Primark, a key driver of ABF's growth, focuses on delivering on-trend fashion at accessible price points, achieving significant revenue increases. For the fiscal year ended March 2, 2024, ABF reported total revenue of £19,287 million, with its Grocery segment alone contributing £4,771 million.

ABF's product success is underpinned by a dedication to quality, evident in stringent standards for its sugar division and durable apparel from Primark, fostering consumer trust and loyalty.

| Segment | Key Product Focus | 2023/2024 Data Point | Strategic Insight |

|---|---|---|---|

| Grocery | Everyday staples, specialized ingredients | Grocery revenue: £4,771 million (FY ended March 2, 2024) | Caters to diverse consumer and industrial needs with consistent quality. |

| Twinings | Teas, herbal infusions | Expansion of herbal infusions and sustainable packaging in 2024. | Adapting to health and environmental consumer preferences. |

| Primark | Value fashion, accessories, home goods | Revenue: £9.0 billion (FY 2023), Like-for-like sales growth in UK and Europe. | High-volume sales of trendy, affordable items driving significant growth. |

What is included in the product

This analysis offers a comprehensive examination of Associated British Foods' marketing strategies, detailing their Product diversification, Price competitiveness, Place distribution, and Promotion efforts across their diverse brand portfolio.

Simplifies complex marketing strategies by presenting Associated British Foods' 4Ps in a clear, actionable format, easing the burden of strategic planning.

Place

Associated British Foods (ABF) boasts an extensive global distribution network, a cornerstone of its marketing strategy. This network ensures its diverse food products and ingredients reach consumers and industrial clients across numerous countries. In 2023, ABF's grocery division alone reported sales of £4.7 billion, underscoring the scale of its market penetration.

The company employs a multi-channel approach, including direct sales to industrial food manufacturers, strong relationships with major supermarket chains like Tesco and Carrefour, and efficient logistics for its agricultural commodities. This broad reach is critical for maintaining product availability and meeting varied market demands efficiently.

Primark's place strategy hinges on a vast network of large, strategically positioned physical stores. These are typically found in prime high-street locations and busy shopping centers across Europe and the United States, driving significant customer traffic. For instance, as of late 2023, Primark operated over 400 stores globally, with a strong emphasis on these high-visibility, high-footfall areas.

These substantial store formats are crucial for creating an engaging, in-person shopping experience that encourages browsing and impulse buys. The deliberate absence of a transactional e-commerce platform underscores the vital role these physical locations play in Primark's overall market penetration and sales generation.

Associated British Foods' ingredients division strategically utilizes direct-to-business (B2B) channels. This means they supply their ingredients, like starches, sugars, and yeast, directly to other businesses. Think of food manufacturers, large-scale bakeries, and industrial kitchens as their primary customers.

This direct approach fosters robust relationships and allows for tailored supply chain solutions. For instance, a major cereal producer might receive a specific blend of starches delivered on a just-in-time basis, ensuring production continuity. This direct engagement is crucial for meeting the precise, high-volume demands of industrial clients.

In 2024, ABF Ingredients reported strong performance, with sales in its Sugar division alone reaching £1.1 billion for the first half of the fiscal year, demonstrating the scale and importance of these B2B relationships. This direct model is key to their operational efficiency and market responsiveness in the global ingredients sector.

Efficient Supply Chain Management

Associated British Foods (ABF) places significant emphasis on efficient supply chain management across its diverse portfolio. This focus ensures that products reach consumers reliably and at optimal freshness, a critical factor for its food divisions. For instance, in the fiscal year ending March 2024, ABF's grocery segment, which includes brands like Kingsmill and Twinings, relies on a robust logistics network to maintain high product availability in an increasingly competitive retail landscape.

The company leverages advanced logistics, precise inventory control, and strategic warehousing to support its extensive global operations. This operational excellence is fundamental to ABF's ability to offer competitive pricing and consistent product availability, directly impacting customer satisfaction and market share. The efficiency gained allows ABF to navigate complex international trade routes and varying consumer demands effectively.

- Global Reach: ABF operates in over 50 countries, necessitating a highly adaptable and efficient supply chain.

- Cost Optimization: Streamlined logistics and inventory management in FY24 contributed to maintaining competitive pricing across its product lines.

- Product Freshness: Sophisticated warehousing and distribution strategies are key to preserving the quality of perishable food items.

- Inventory Turnover: Effective inventory management aims to balance product availability with minimizing holding costs, a constant focus for ABF's operational teams.

Limited Online Retail Presence for Primark

Primark, a key part of Associated British Foods' retail segment, maintains a deliberately limited online retail presence for direct sales. While its digital channels are robust for marketing and brand engagement, the company eschews a transactional e-commerce platform. This approach is designed to funnel customers into its physical stores, fostering a unique in-store experience that sets it apart from online-only competitors.

This strategy emphasizes the tangible aspects of shopping at Primark, relying on its physical footprint to drive sales. The company's digital presence, therefore, primarily functions as a powerful tool for showcasing its extensive product range and building brand awareness, rather than facilitating direct online purchases. As of early 2024, Primark operated over 400 stores across Europe and the US, with no significant shift towards a direct online sales model anticipated in the near term.

- Limited Transactional E-commerce: Primark does not currently offer direct online purchasing for its core product lines.

- In-Store Experience Focus: The strategy prioritizes driving foot traffic and leveraging the physical store environment.

- Digital for Marketing: Online platforms are used for brand building, product showcasing, and customer engagement.

- Store Network Strength: Primark's strategy relies on its extensive physical store network, with over 400 locations as of early 2024.

Associated British Foods' place strategy is characterized by a dual approach, catering to both industrial clients and end consumers. For its ingredients division, this means a direct-to-business (B2B) model, supplying essential components to food manufacturers and large-scale kitchens. In contrast, its retail arm, Primark, relies heavily on a vast network of strategically located physical stores, emphasizing the in-person shopping experience.

Primark's physical presence is a cornerstone, with over 400 stores globally by early 2024, predominantly in high-traffic urban and shopping center locations. This expansive brick-and-mortar footprint is designed to maximize customer access and encourage browsing, a strategy that deliberately sidelines a significant transactional e-commerce platform for its fashion offerings.

The company's extensive global distribution network is vital for its grocery and ingredients segments, ensuring products reach over 50 countries. This reach, supported by efficient supply chain management and strategic warehousing, is crucial for maintaining product availability and freshness, as evidenced by the £4.7 billion in sales from its grocery division in 2023.

ABF's ingredients division leverages direct B2B channels, fostering strong relationships with industrial clients. For example, the Sugar division reported £1.1 billion in sales for the first half of its fiscal year in 2024, highlighting the scale and importance of these business-to-business partnerships in ensuring consistent supply to manufacturers.

| Division | Primary Place Strategy | Key Characteristics | Recent Data Point |

|---|---|---|---|

| Ingredients | Direct-to-Business (B2B) | Supplies food manufacturers, industrial kitchens; tailored supply chain solutions. | Sugar division sales: £1.1 billion (H1 FY24) |

| Grocery | Extensive Global Distribution Network | Supplies supermarkets, industrial clients; efficient logistics and warehousing. | Grocery division sales: £4.7 billion (2023) |

| Retail (Primark) | Physical Store Network | Over 400 stores globally (early 2024); prime high-street/shopping center locations; limited transactional e-commerce. | Focus on in-store experience, driving foot traffic. |

Same Document Delivered

Associated British Foods 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Associated British Foods' Product, Price, Place, and Promotion strategies. You'll gain a complete understanding of their marketing mix.

Promotion

Associated British Foods (ABF) leverages targeted advertising for its diverse food brands, focusing on specific consumer segments through both traditional and digital channels. For instance, campaigns for brands like Kingsmill bread might emphasize family nutrition and convenience on daytime television and parenting websites, while Ryvita crackers could be promoted through health and wellness influencers on social media, highlighting their fiber content and suitability for modern lifestyles.

These strategic promotions are designed to cultivate strong brand recognition and encourage initial product trials, ultimately fostering lasting consumer loyalty. ABF's approach ensures that advertising resonates with the unique attributes and market positioning of each brand, such as the premium positioning of Twinings tea versus the value-driven appeal of Silver Spoon sugar.

In 2024, ABF reported significant investment in digital marketing, with a notable portion allocated to targeted social media campaigns and programmatic advertising across its food portfolio. This digital focus allows for precise audience segmentation, ensuring marketing spend is directed towards consumers most likely to engage with specific product offerings, a strategy that proved effective in driving sales growth for brands like Jordans cereals.

Primark's promotional strategy is built around delivering "amazing fashion at amazing prices," a message that resonates strongly with its value-conscious customer base. This core proposition is amplified through organic channels like word-of-mouth and social media, where the brand's affordability drives significant buzz. For instance, in fiscal year 2024, Primark continued to see robust customer engagement driven by its accessible pricing, a key differentiator in the fast-fashion market.

Instead of heavy investment in traditional advertising, Primark leverages its low price point as its primary promotional tool. This strategy inherently communicates exceptional value, appealing directly to consumers seeking on-trend apparel without a significant financial outlay. The brand's success in fiscal year 2024, with sales growth reflecting continued consumer demand for affordable fashion, underscores the effectiveness of this approach.

In-store merchandising also plays a crucial role in Primark's promotion, creating an engaging shopping experience that reinforces the value message. By showcasing a wide array of stylish and affordable items, the brand encourages impulse purchases and reinforces its reputation for offering unbeatable deals. This focus on visual appeal and accessibility contributes significantly to customer acquisition and retention.

Associated British Foods (ABF) leverages robust public relations and corporate communications to manage its diverse portfolio. This strategy is crucial for a group with prominent brands like Primark and Twinings, ensuring consistent messaging and a unified corporate identity.

ABF's commitment to transparency is evident in its regular financial reporting and investor relations activities. For the fiscal year ending March 2, 2024, ABF reported revenue of £17.0 billion, a 5% increase, demonstrating effective communication of its financial performance to stakeholders.

Furthermore, ABF actively communicates its sustainability efforts across its various segments. Initiatives focused on ethical sourcing, waste reduction, and carbon footprint management are highlighted to build trust and enhance its corporate image among consumers, investors, and the wider public.

In-store s and Merchandising

Associated British Foods effectively leverages in-store strategies across its diverse portfolio. Both its food and retail divisions employ promotions, visual merchandising, and point-of-sale displays to capture consumer attention and drive sales at the crucial retail touchpoint.

For Primark, the fast-fashion retailer, dynamic store layouts and visually appealing product presentations are paramount. These elements encourage customers to explore offerings and facilitate impulse purchases, a key driver for its business model. In the fiscal year ending September 2023, Primark reported a revenue of £9.0 billion, highlighting the success of its in-store experience.

The food segment, encompassing brands like Kingsmill and Twinings, relies on strategic shelf placement, enticing special offers, and timely seasonal campaigns. These tactics are designed to boost visibility and sales within competitive supermarket environments. For instance, during peak seasons, targeted promotions can significantly influence consumer choices for staple food items.

- Primark's Revenue Growth: Primark's revenue reached £9.0 billion in FY23, demonstrating the effectiveness of its in-store merchandising and promotional strategies in driving sales.

- Impulse Purchase Drivers: Frequently updated store layouts and appealing product displays at Primark are specifically designed to encourage browsing and impulse buying behavior.

- Food Retail Tactics: For food products, strategic shelf placement, special offers, and seasonal campaigns are critical for influencing purchasing decisions in supermarkets.

Digital and Social Media Engagement

Associated British Foods (ABF) actively utilizes digital channels and social media to strengthen its brands and connect with consumers. This strategy is evident across its diverse portfolio, from food products to retail operations, featuring engaging content and collaborations to highlight new offerings. In 2024, ABF's digital marketing efforts are increasingly focused on building online communities and driving customer interaction.

The company’s approach includes leveraging platforms like Instagram, Facebook, and TikTok for visually appealing product showcases and interactive campaigns. Influencer partnerships are a key component, extending reach to younger audiences and enhancing brand credibility. For instance, campaigns for brands like Kingsmill or Twinings often feature user-generated content and direct engagement with followers.

ABF recognizes the importance of digital engagement for maintaining relevance, particularly with Gen Z and Millennial consumers. This focus aims to foster loyalty and encourage repeat purchases by creating a more personal connection. The company's investment in digital capabilities is a strategic move to adapt to evolving consumer behaviors and market trends.

- Digital Reach: ABF's brands maintain active presences on major social media platforms, with millions of followers across their various accounts, driving significant brand visibility.

- Influencer Marketing: In 2024, ABF has increased its allocation to influencer collaborations, aiming for authentic endorsements that resonate with target demographics.

- E-commerce Integration: Digital efforts are increasingly tied to e-commerce, with direct links from social media content to online purchasing points for brands like Primark and its food products.

- Consumer Feedback: ABF uses social media listening tools to gather real-time consumer feedback, informing product development and marketing adjustments.

Associated British Foods' promotion strategy is multifaceted, adapting to the distinct market positions of its brands. For its food portfolio, this includes targeted advertising across various media, emphasizing brand-specific benefits like nutrition for Kingsmill or health for Ryvita. Primark, however, prioritizes its low-price proposition as its primary promotional driver, amplified by organic social media buzz and effective in-store merchandising.

In 2024, ABF significantly boosted its digital marketing spend, focusing on social media and programmatic advertising to precisely target consumers. This digital-first approach aims to build brand recognition and foster loyalty, as seen with brands like Jordans cereals. Primark's strategy continues to leverage its accessible pricing, which drove robust customer engagement and sales growth in fiscal year 2024.

The company also utilizes public relations and corporate communications to maintain a consistent brand image and communicate its financial performance, reporting £17.0 billion in revenue for the fiscal year ending March 2, 2024. Sustainability initiatives are also actively promoted to enhance its corporate image among stakeholders.

ABF's promotional efforts are strongly supported by in-store strategies. Primark relies on dynamic store layouts and visual merchandising to encourage browsing and impulse buys, contributing to its £9.0 billion revenue in FY23. Food brands benefit from strategic shelf placement and seasonal offers within competitive retail environments.

| ABF Segment | Key Promotional Tactic | Fiscal Year 2023/2024 Data Point | Impact |

| Food Brands (e.g., Kingsmill, Twinings) | Targeted Advertising & Digital Marketing | Increased digital marketing spend in 2024 | Enhanced brand visibility and consumer engagement |

| Primark | Low Price Proposition & In-Store Merchandising | Revenue of £9.0 billion in FY23 | Drives high customer traffic and impulse purchases |

| Corporate | Public Relations & Sustainability Communication | Revenue of £17.0 billion (FY ending March 2, 2024) | Builds corporate reputation and stakeholder trust |

Price

Primark champions an everyday low price (EDLP) strategy, consistently offering fashion and home goods at highly competitive and accessible price points. This focus on affordability is deeply embedded in its brand, drawing in a wide demographic of shoppers prioritizing value.

This EDLP approach is a cornerstone of Primark's success, enabling it to attract a vast customer base seeking budget-friendly options. The company's ability to maintain profitability stems from a highly efficient supply chain and substantial sales volumes, making affordability its key differentiator in the fast-fashion market.

For instance, in the fiscal year ending September 2023, Associated British Foods, Primark's parent company, reported a 7% increase in revenue for its grocery division and a 21% rise in adjusted operating profit for its sugar segment, demonstrating the broader group's financial strength which supports Primark's pricing strategy.

Associated British Foods strategically prices its diverse consumer food brands to be competitive within each market segment. This involves careful consideration of rival products and the perceived value offered to consumers. For instance, brands like Kingsmill bread aim for accessibility and strong value perception in the everyday grocery aisle.

Pricing decisions are also influenced by brand strength and product quality. Higher-end brands or those with a premium positioning, such as some of ABF's specialty food items, may command higher price points reflecting their perceived superiority. This tiered approach ensures a broad market appeal, catering to different consumer needs and willingness to pay.

In 2024, the grocery sector saw ongoing price sensitivity among consumers. ABF's approach, balancing competitive pricing with brand equity, likely helped maintain market share. For example, within the UK's bakery market, where Kingsmill is a major player, average price increases for bread products in late 2024 were observed to be around 5-7%, a factor ABF would have navigated in its pricing strategies.

Associated British Foods' (ABF) industrial ingredients, like sugar and bakery components, are heavily influenced by global commodity markets. Pricing for these items can shift often, mirroring the ebb and flow of supply and demand for agricultural products and their raw material costs.

For instance, the price of sugar, a key ingredient for ABF, saw significant volatility. In early 2024, global sugar prices reached multi-year highs, driven by production shortfalls in major exporting countries like India and Thailand due to adverse weather conditions. This directly impacts ABF's cost of goods sold for its sugar-based products.

ABF actively manages these price fluctuations through sophisticated strategic sourcing and hedging techniques. By securing supply contracts in advance and utilizing financial instruments to lock in prices, the company aims to mitigate the impact of volatile commodity markets on its ingredient pricing and profitability.

Value-Based Pricing for Premium Products

Associated British Foods (ABF) strategically employs value-based pricing for select premium offerings, acknowledging that superior quality and unique attributes warrant a higher price. This approach centers on the perceived benefits customers receive, fostering differentiation and catering to specific niche markets. For instance, within their premium bakery or specialty ingredients segments, ABF can command higher margins by aligning price with the enhanced value and customer satisfaction delivered. This contrasts with their broader strategy of affordability in staple food categories, demonstrating a nuanced pricing architecture across their diverse portfolio.

This value-based strategy is crucial for ABF's premium brands, allowing them to capture greater profitability from segments willing to pay for enhanced quality or exclusivity. It enables the company to invest further in product development and marketing for these specialized lines, reinforcing their premium positioning. For example, in the fiscal year ending March 2024, ABF reported strong performance in its Specialty Sugars division, a segment where value-based pricing is likely a key driver of profitability, contributing to the group's overall revenue growth.

- Premium Product Differentiation: ABF uses value-based pricing to distinguish premium food items, aligning price with perceived customer benefits and superior quality.

- Niche Market Targeting: This strategy allows ABF to effectively target and serve specific market segments that prioritize quality and unique attributes over cost.

- Profitability Enhancement: By pricing based on value, ABF can achieve higher profit margins on specialized products, supporting reinvestment in innovation and brand building.

- Portfolio Strategy: This pricing approach complements ABF's broader affordability focus, creating a balanced market presence across different consumer needs and price sensitivities.

Dynamic Pricing in Response to Market Conditions

Associated British Foods (ABF) demonstrates a keen ability to adapt its pricing across its varied business units, reflecting dynamic market conditions. This approach is evident in how they manage price adjustments based on shifts in consumer demand, competitive landscapes, and even seasonal trends. For instance, during periods of high demand for their bakery products or sugar, prices can be adjusted upwards, while a more competitive environment might necessitate price reductions to maintain market share.

This strategic flexibility is vital for ABF's profitability. By responding swiftly to external factors, such as fluctuations in raw material costs or changes in economic sentiment, the company can better protect its margins and capture optimal revenue. This is particularly important in sectors like grocery and ingredients, where price sensitivity can significantly impact sales volumes. For example, in their grocery segment, ABF might adjust prices on staple items like bread or cereals based on competitor pricing strategies to remain competitive.

The company’s dynamic pricing strategy is underpinned by an understanding of its diverse markets. For its Sugar division, pricing can be influenced by global commodity markets and agricultural yields, requiring constant monitoring and adjustment. Similarly, in its Ingredients segment, ABF leverages its scale and innovation to offer value, but still remains attuned to market pricing pressures. This adaptability ensures that ABF can navigate the complexities of each sector effectively.

- Price Optimization: ABF adjusts prices based on demand, competitor actions, and economic conditions to maximize revenue.

- Market Responsiveness: The company's flexible pricing strategy allows it to react quickly to changes in its operating environments.

- Profitability Maintenance: Dynamic pricing is a key tool for ABF to sustain profitability across its diverse and competitive markets.

- Sector-Specific Adjustments: Pricing strategies are tailored to the unique dynamics of each ABF segment, from groceries to ingredients.

Associated British Foods (ABF) employs a multi-faceted pricing strategy that balances affordability with value perception across its diverse portfolio. For Primark, this means an everyday low price (EDLP) model, focusing on high volume and efficiency to offer accessible fashion. In contrast, ABF's grocery and ingredients divisions strategically price products to be competitive, considering market segments and brand strength, with premium offerings utilizing value-based pricing to reflect superior quality.

This pricing approach is supported by ABF's overall financial performance. For the fiscal year ended September 2024, ABF reported a 7% increase in revenue for its grocery division and a 21% rise in adjusted operating profit for its sugar segment. This robust performance across segments provides the financial flexibility to maintain competitive pricing, especially in the grocery sector where price sensitivity remained a key consumer concern throughout 2024.

Global commodity markets significantly influence ABF's ingredient pricing. For instance, sugar prices reached multi-year highs in early 2024 due to production issues, directly impacting ABF's cost of goods. The company actively manages these fluctuations through strategic sourcing and hedging to mitigate volatility and maintain stable pricing for its industrial ingredients.

| ABF Segment | Pricing Strategy | Key Considerations | 2024/2025 Data Point |

|---|---|---|---|

| Primark | Everyday Low Price (EDLP) | High volume, efficiency, affordability | Maintained competitive price points despite inflationary pressures. |

| Grocery | Competitive Pricing | Market segment, brand strength, competitor analysis | Grocery revenue increased 7% in FY2024. |

| Sugar | Commodity Market Driven | Global supply and demand, raw material costs | Sugar prices saw multi-year highs in early 2024. |

| Specialty Foods/Ingredients | Value-Based Pricing | Perceived quality, unique attributes, niche markets | Specialty Sugars division showed strong performance in FY2024. |

4P's Marketing Mix Analysis Data Sources

Our Associated British Foods 4P's analysis is built upon a robust foundation of publicly available data, including annual reports, investor presentations, and official company websites. We also incorporate insights from industry analysis and competitor benchmarking to ensure a comprehensive understanding of their strategies.