Associated British Foods Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated British Foods Bundle

Unlock the strategic brilliance behind Associated British Foods's diversified empire with our comprehensive Business Model Canvas. Discover how their integrated approach across food, ingredients, and retail creates a robust and resilient business. This detailed breakdown is essential for anyone seeking to understand their path to sustained success.

Partnerships

Associated British Foods (ABF) depends on a robust global network of suppliers for essential agricultural products like sugar beet and various grains. These relationships are vital for maintaining the consistent quality and availability of raw materials needed across ABF's extensive food and ingredients divisions.

For instance, ABF's sugar business relies on a steady supply of sugar beet, a key input. In 2024, the company continued to manage these agricultural inputs, which are subject to weather patterns and global commodity prices, impacting production costs and output.

Furthermore, ABF's commitment to ethical and sustainable sourcing extends to its fashion retail arm, Primark. This means building strong partnerships with suppliers of materials like cotton, ensuring responsible practices throughout the supply chain, a focus that gained further traction in 2024 with increasing consumer and regulatory scrutiny.

Associated British Foods (ABF) strategically leverages manufacturing and production partners to enhance its operational capabilities. While ABF boasts significant in-house manufacturing, it also engages external co-packers and contract manufacturers for specialized product lines or to bolster production capacity, ensuring agility in meeting diverse market demands.

These collaborations are crucial for ABF’s ability to scale operations efficiently and respond to fluctuating consumer needs across its broad portfolio of food and ingredient products. In 2024, ABF continued to optimize its supply chain, with such partnerships playing a vital role in maintaining cost-effectiveness and production flexibility, particularly in its Sugar and Ingredients segments.

Associated British Foods (ABF) relies heavily on its logistics and distribution partners to ensure its diverse product range, from groceries to fashion, reaches consumers efficiently across the globe. These partnerships are critical for managing ABF's extensive supply chains, which span numerous countries and involve a wide array of products.

Key partners include major freight carriers, specialized warehousing companies, and local distribution networks. These entities are essential for the timely and cost-effective delivery of goods to ABF's retail outlets, including the extensive Primark stores, and to its industrial customers in the sugar and ingredients segments. For instance, ABF's grocery brands like Kingsmill and Twinings depend on robust distribution to maintain shelf presence.

In 2024, ABF continued to navigate the complexities of global logistics, facing ongoing challenges such as port congestion and rising fuel costs. The company’s ability to adapt and maintain strong relationships with its logistics providers, such as those handling its European sugar distribution or its international food ingredient shipments, directly impacts its operational efficiency and profitability.

Retail Collaborations and Landlords

For its Primark retail operations, Associated British Foods relies heavily on strategic partnerships with landlords to secure prime locations for its expanding store network. These collaborations are fundamental to Primark's store rollout strategy, ensuring a robust physical presence in key markets. For instance, Primark's continued expansion in Europe, a core market, is directly facilitated by these landlord relationships.

Beyond securing physical spaces, Primark also benefits from collaborations with other retailers and shopping centers. These alliances can significantly boost footfall and elevate brand visibility by leveraging shared customer traffic. This approach is particularly relevant as Primark actively pursues growth in markets like the United States, where establishing brand recognition is crucial.

As of early 2024, Primark continues its aggressive expansion, with a notable focus on increasing its footprint in the US. This expansion strategy is intrinsically linked to its ability to forge and maintain strong relationships with property owners and shopping center developers.

- Landlord Partnerships: Essential for securing prime retail real estate to support Primark's store expansion plans.

- Shopping Center Collaborations: Enhance footfall and brand visibility by integrating with existing retail ecosystems.

- Geographic Expansion: Partnerships are key enablers for Primark's growth in markets like Europe and the United States.

Ethical and Sustainability Organizations

Associated British Foods (ABF), with a significant portion of its operations through Primark, actively collaborates with ethical and sustainability organizations. These partnerships are crucial for driving responsible practices throughout its extensive supply chain.

Primark's engagement with the Ethical Trading Initiative (ETI) is a prime example, focusing on improving worker welfare and ensuring fair labor standards. This collaboration helps ABF navigate complex global supply chains and uphold its commitment to human rights.

The company also spearheads initiatives like the Primark Cotton Project. This program, which began in 2013, aims to source more sustainable cotton, with a target of 100% sustainably sourced cotton by 2027. By 2023, Primark had already achieved 48% sustainably sourced cotton, demonstrating tangible progress in its environmental commitments.

- Ethical Trading Initiative (ETI) Partnership: Focuses on improving labor conditions and worker rights in the supply chain.

- Primark Cotton Project: Aims to increase the proportion of sustainably sourced cotton, with a goal of 100% by 2027.

- Sustainability Progress: Achieved 48% sustainably sourced cotton by 2023, indicating strong momentum towards its 2027 target.

Associated British Foods (ABF) relies on a diverse array of key partners to support its multifaceted business operations. These include agricultural suppliers for raw materials, manufacturing collaborators for specialized production, and logistics providers to ensure efficient product distribution across its global network.

Primark, ABF's retail segment, heavily depends on landlord partnerships for securing prime store locations and collaborates with shopping centers to enhance customer traffic and brand visibility, particularly as it expands into new markets like the United States.

Furthermore, ABF engages with ethical and sustainability organizations, such as the Ethical Trading Initiative, to uphold responsible practices within its supply chain, with initiatives like the Primark Cotton Project demonstrating a commitment to sustainable sourcing, aiming for 100% sustainably sourced cotton by 2027.

| Partner Type | Key Function | Examples/Focus Areas | 2024 Relevance |

| Agricultural Suppliers | Raw material provision (sugar beet, grains, cotton) | Ensuring quality and availability; managing commodity price volatility. | Crucial for cost management and production stability in Sugar and Ingredients. |

| Manufacturing Partners | Specialized production, capacity expansion | Co-packing and contract manufacturing for specific product lines. | Enhancing operational agility and responsiveness to market demand. |

| Logistics & Distribution | Global supply chain management | Freight carriers, warehousing, local delivery networks for food and fashion. | Vital for timely and cost-effective delivery, navigating global logistics challenges. |

| Landlords & Retail Centers | Securing retail space, driving footfall | Prime store locations for Primark expansion, leveraging shared customer traffic. | Facilitating Primark's growth strategy in Europe and the US. |

| Ethical & Sustainability Orgs | Promoting responsible practices | Ethical Trading Initiative, Primark Cotton Project (aiming for 100% sustainable cotton by 2027). | Upholding human rights and environmental commitments in the supply chain. |

What is included in the product

A detailed breakdown of Associated British Foods' diversified strategy, covering its broad customer base across food, ingredients, and retail, and its extensive value propositions in delivering affordable quality and essential goods.

This Business Model Canvas reflects ABF's operational reality, showcasing its integrated supply chains and strong brand portfolio to serve multiple market segments effectively.

The Associated British Foods Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot of its diverse operations, enabling quick identification of synergies and potential inefficiencies across its food, ingredients, and retail segments.

Activities

Associated British Foods' key activities revolve around the extensive manufacturing and processing of a diverse range of food products. This encompasses everything from staple items like sugar and groceries to highly specialized ingredients tailored for industrial applications. The company's operational focus includes meticulous management of agricultural supply chains and the efficient running of sophisticated processing facilities, all while upholding rigorous quality and safety protocols.

In 2024, ABF's grocery division, for instance, continued to be a powerhouse, with brands like Kingsmill and Jordans reporting strong consumer demand. The company’s sugar segment also played a significant role, benefiting from favorable commodity prices in certain markets, contributing to its overall robust performance in food and ingredient production.

Associated British Foods' retail operations are centered on effectively managing its vast Primark store network. This involves crucial tasks like ensuring optimal product presentation, efficient stock control, and delivering excellent customer experiences across all locations. This operational backbone is fundamental to Primark's success.

A major strategic focus for Primark is its ongoing store expansion. The company is actively pursuing a rollout strategy, with significant investment in new stores across Europe and the United States. This expansion is a primary engine for driving increased sales and market penetration.

In 2024, Primark continued its aggressive expansion, opening 27 new stores, bringing its total to 442 stores globally by the end of the fiscal year. This growth strategy directly fuels retail revenue, with the company reporting a 7% increase in Primark sales for the year, reaching £9.0 billion.

Associated British Foods (ABF) meticulously manages its intricate global supply chains, spanning both its extensive food manufacturing and retail operations. This involves overseeing the entire journey from securing raw materials to the final delivery of consumer products, emphasizing strong supplier partnerships and efficient logistics.

Ensuring ethical sourcing and sustainability is a core component of ABF's supply chain strategy. For instance, in 2024, the company continued its focus on responsible palm oil sourcing, with a significant portion of its palm oil supply meeting RSPO (Roundtable on Sustainable Palm Oil) certification standards, reflecting a commitment to environmental and social governance.

Optimizing these complex networks is paramount for cost control and building resilience against disruptions. ABF's efforts in 2024 aimed to enhance visibility and agility within its supply chain, a crucial factor given global economic uncertainties and the need to maintain competitive pricing for its diverse product portfolio.

Brand Development and Marketing

Associated British Foods (ABF) actively invests in developing, marketing, and promoting its extensive range of consumer food brands, such as Twinings and Ovaltine, alongside its prominent fashion retailer, Primark. This ongoing commitment ensures brand relevance and fosters consumer loyalty through dedicated market research, product innovation, and strategic advertising campaigns.

For instance, in the fiscal year 2023, ABF reported significant marketing expenditures across its segments. The Grocery division, which houses many of its food brands, saw continued investment in brand building. Similarly, Primark's marketing efforts are crucial for its value-driven proposition, with the brand consistently investing in digital and in-store promotions to attract and retain its customer base.

- Brand Investment: ABF prioritizes ongoing investment in its diverse consumer food brands and the Primark retail brand.

- Marketing Strategies: Activities include market research, product innovation, and targeted advertising to maintain brand strength.

- Consumer Loyalty: These efforts are designed to ensure brand relevance and cultivate strong consumer loyalty.

- Market Leadership: Strong brand equity is fundamental to ABF's objective of achieving and maintaining market leadership across its various sectors.

Research and Development for Ingredients

Associated British Foods' ingredients division prioritizes ongoing research and development to create novel products and solutions tailored for industrial clients. This commitment to innovation leverages scientific knowledge and technological progress to address shifting market needs.

The company's R&D efforts are particularly focused on specialized ingredients, such as yeast and various bakery components. This specialization allows them to cater to niche markets and develop high-value offerings.

For instance, in 2024, ABF Ingredients continued its investment in developing advanced fermentation techniques and exploring new applications for enzymes. This strategic focus is crucial for maintaining a competitive edge in the global ingredients market, which is increasingly driven by demand for healthier and more sustainable food solutions.

- Innovation in Yeast and Enzymes: Continued development of specialized yeast strains for improved baking performance and fermentation processes.

- Biotechnology Advancements: Investment in R&D for novel enzymes and ingredients derived from biotechnological processes to enhance food production efficiency and quality.

- Customer-Centric Solutions: Focus on developing tailored ingredient solutions that meet specific industrial customer requirements in sectors like bakery, beverages, and nutrition.

Associated British Foods' key activities are multifaceted, encompassing the production and distribution of food products, the operation of a major fashion retailer, and the development of specialized ingredients.

In 2024, the company's grocery segment saw strong performance, with brands like Kingsmill contributing significantly. The sugar division also benefited from favorable market conditions, bolstering the company's food and ingredient manufacturing capabilities.

Primark's retail operations are a vital component, focusing on efficient store management and customer experience, supported by an aggressive expansion strategy that saw 27 new stores opened in 2024, bringing the total to 442 globally.

ABF also actively manages complex global supply chains, emphasizing ethical sourcing, such as its commitment to sustainable palm oil in 2024, and invests heavily in brand development and marketing for its diverse portfolio.

The ingredients division continues to drive innovation, particularly in yeast and enzymes, with R&D efforts focused on creating advanced, customer-centric solutions for the food industry.

| Key Activity Area | 2024 Highlights | Strategic Focus |

|---|---|---|

| Food Manufacturing & Ingredients | Strong performance in grocery and sugar segments. | Leveraging agricultural supply chains and processing expertise. |

| Retail (Primark) | 27 new stores opened, total 442 globally. 7% sales increase to £9.0 billion. | Aggressive store expansion and optimizing customer experience. |

| Supply Chain Management | Continued focus on responsible palm oil sourcing (RSPO certified). | Enhancing visibility, agility, and ethical sourcing. |

| Brand Development & Marketing | Continued investment in brand building for food brands and Primark. | Ensuring brand relevance, consumer loyalty, and market leadership. |

| Research & Development (Ingredients) | Investment in advanced fermentation and enzyme applications. | Developing novel, specialized ingredients and biotechnological solutions. |

Preview Before You Purchase

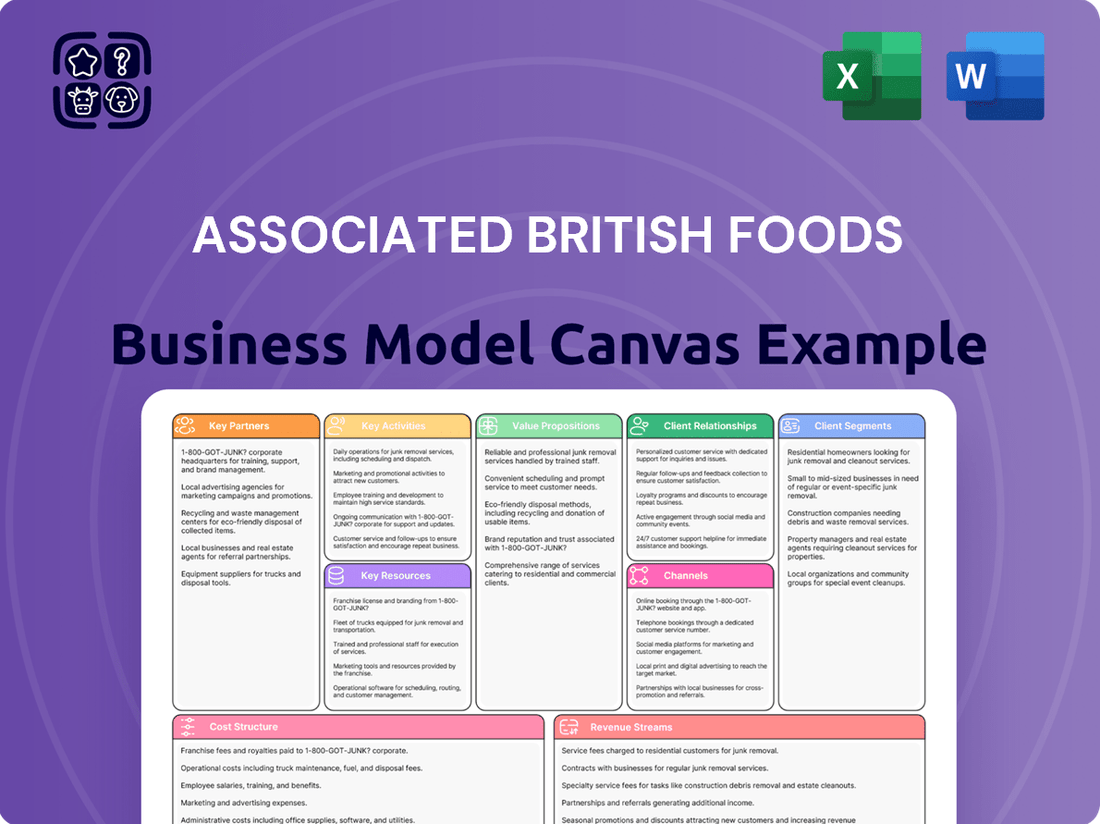

Business Model Canvas

The Associated British Foods Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, professionally formatted structure and content that will be yours to use immediately after completing your order. Rest assured, there are no mockups or samples here; it's a direct glimpse into the final deliverable, ready for your strategic analysis.

Resources

Associated British Foods (ABF) operates a vast global network of manufacturing and processing facilities, crucial for its sugar, grocery, and ingredients segments. These physical assets, including numerous factories, mills, and processing plants spread across multiple countries, are the backbone of its large-scale production capabilities.

These facilities are strategically positioned to efficiently transform raw materials into finished goods, supporting ABF's extensive global supply chain and distribution efforts. For instance, in 2024, ABF's sugar division continued to leverage its extensive European sugar beet processing capacity, a key element in its competitive advantage.

Primark's extensive retail store network is a cornerstone of Associated British Foods' success. As of late 2023, Primark operated 451 stores spanning 17 countries, boasting a substantial 18.8 million square feet of selling space. This vast physical footprint is a critical resource, enabling direct customer engagement and driving considerable sales volume.

This widespread network is not static; ABF continues to invest in Primark's growth. The ongoing expansion strategy further solidifies this key resource, ensuring Primark can capture new markets and deepen its penetration in existing ones, thereby enhancing its competitive advantage and revenue-generating capacity.

Associated British Foods (ABF) leverages a powerful portfolio of well-established consumer brands, including Twinings, Ovaltine, and Silver Spoon, alongside the highly successful Primark brand. These brands represent significant intellectual property, fostering strong market recognition and deep customer loyalty.

The trust and familiarity associated with these brands are critical drivers of ABF's market position and profitability. For instance, Twinings, with its heritage dating back to 1706, continues to be a leading name in the global tea market, demonstrating enduring brand equity.

In fiscal year 2024, ABF’s grocery division, which houses many of these consumer brands, reported robust performance, contributing substantially to the group’s overall revenue. This highlights the direct financial impact of ABF's strong brand assets.

Skilled Workforce and Management Expertise

Associated British Foods (ABF) leverages its extensive global workforce of 138,000 employees as a core asset. This human capital encompasses a wide range of skills, from specialized manufacturing technicians to customer-facing retail associates, all essential to the company's diverse operations.

The depth of experience within ABF's management teams is particularly vital. These leaders provide the strategic direction and operational oversight necessary to navigate complex international markets and drive continuous improvement across all business segments. Their expertise directly fuels the company's ability to innovate and maintain competitive advantage.

ABF's commitment to developing its workforce is evident in its operational efficiency. For example, in 2024, the company continued to invest in training programs aimed at enhancing productivity and safety across its manufacturing facilities, contributing to a more skilled and adaptable employee base.

- Skilled Labor: ABF employs a vast number of individuals with specialized skills in food production, ingredient technology, and agricultural practices.

- Retail Expertise: A significant portion of the workforce is dedicated to customer service and store management within its retail divisions, ensuring a positive shopping experience.

- Management Acumen: Experienced leadership teams across ABF's various sectors are crucial for strategic planning, financial management, and operational execution.

- Global Reach: The sheer scale of its workforce, spread across numerous countries, provides ABF with invaluable local market knowledge and operational flexibility.

Financial Capital and Strong Balance Sheet

Associated British Foods' strong financial capital and robust balance sheet are foundational to its business model. This financial muscle allows for significant investments across its diverse segments, from innovation in ingredients to expanding its retail presence.

The company's ability to generate substantial revenue, exemplified by its consistent performance, underpins its capacity to fund growth initiatives and navigate economic uncertainties. This financial resilience is a key enabler for strategic decision-making.

For instance, ABF's financial strength supports its pursuit of both organic expansion and strategic acquisitions, ensuring it can capitalize on emerging market opportunities and enhance its competitive positioning. This proactive approach to capital allocation is vital for sustained growth.

- Financial Strength: ABF's substantial revenue generation and healthy balance sheet provide the capital needed for investments in expansion, technology, and acquisitions.

- Investment Capacity: This financial robustness enables the company to actively pursue growth opportunities across its various business areas.

- Market Resilience: ABF's strong financial position allows it to effectively withstand and adapt to fluctuations in the market.

- Strategic Flexibility: The company leverages its financial capital to maintain strategic flexibility, facilitating timely responses to market dynamics and competitive pressures.

Associated British Foods' intellectual property extends beyond its consumer brands to encompass proprietary technologies and processes within its ingredients and sugar segments. These innovations are critical for product development and operational efficiency.

The company's investment in research and development fuels its ability to create specialized ingredients and optimize sugar production methods. This focus on R&D is a key differentiator, allowing ABF to offer unique solutions to its B2B customers.

In 2024, ABF's ingredients division continued to highlight its expertise in areas like enzymes and yeast, showcasing the tangible output of its intellectual capital.

Associated British Foods' extensive global distribution network is a vital resource, ensuring its products reach consumers and businesses efficiently. This network includes logistics infrastructure and established relationships with distributors.

The company's supply chain capabilities are finely tuned to manage the complexities of its diverse product portfolio, from perishable groceries to bulk ingredients.

ABF's commitment to supply chain optimization was evident in 2024, as it continued to refine its logistics to improve delivery times and reduce costs across its operations.

| Key Resource | Description | 2024 Relevance |

| Intellectual Property | Proprietary technologies, R&D, specialized processes | Innovation in ingredients and optimized sugar production |

| Distribution Network | Logistics infrastructure, established distributor relationships | Efficient product reach across global markets |

Value Propositions

Primark's core value proposition is offering trendy, up-to-date fashion at remarkably low prices, democratizing style for a broad customer base. This focus on affordability without sacrificing current trends is a key driver of its customer appeal.

This accessibility is directly supported by Primark's highly efficient, low-cost operational structure, allowing them to maintain competitive pricing. For instance, in the first half of fiscal year 2024, Associated British Foods reported that Primark's revenue grew by 7% to £4.2 billion, demonstrating the continued success of its value-driven model.

Associated British Foods (ABF) delivers a broad portfolio of food products designed to be safe, nutritious, and budget-friendly, serving essential consumer needs across its diverse business segments. This commitment is evident in its grocery, sugar, and agriculture operations, where accessibility and quality are paramount.

For instance, in the fiscal year ending March 2, 2024, ABF's Grocery segment reported revenue of £4.9 billion, showcasing the scale of its offerings. The company's dedication to providing staple foods at competitive prices underpins its value proposition, ensuring consumers can access necessary nutrition without excessive cost.

Associated British Foods' ingredients division delivers premium yeast, bakery ingredients, and tailored specialty components to industrial clients worldwide. This core offering is designed to be the essential building block that elevates the quality and operational efficiency of their customers' diverse product lines.

The division's strength lies in its deep-rooted expertise and a continuous drive for innovation within the ingredient sector. For instance, in fiscal year 2024, ABF Ingredients saw robust performance, with sales growth reflecting the demand for these specialized inputs in a competitive global market.

Diverse Portfolio of Trusted and Popular Brands

Associated British Foods (ABF) boasts a diverse collection of highly recognized and trusted consumer brands across multiple food sectors. This broad appeal ensures consumers have access to familiar and reliable options that align with varying tastes and dietary needs.

The strength of these brands drives significant customer loyalty and encourages repeat business, a key factor in sustained revenue generation. For example, ABF’s Sugar division, a significant contributor, benefits from established market positions in key geographies.

In 2024, ABF's grocery segment, which houses many of these popular brands, continued to demonstrate resilience. The company's ability to maintain brand relevance and consumer trust is a cornerstone of its business model, translating into consistent sales performance.

- Brand Recognition: ABF's portfolio includes iconic names like Twinings, Kingsmill, and Jordans Cereals, fostering immediate consumer trust.

- Market Penetration: These brands hold strong market share in their respective categories, ensuring broad availability and accessibility.

- Consumer Loyalty: The established reputation of ABF's brands cultivates repeat purchases and reduces customer acquisition costs.

- Diversification Benefits: The wide range of brands mitigates risk by not relying on a single product or market segment.

Commitment to Sustainable and Ethical Sourcing

Associated British Foods (ABF) is deeply committed to ensuring its products are sourced sustainably and ethically. This focus is particularly evident in Primark's extensive supply chain, where ABF actively works to improve practices. This commitment appeals to a growing segment of consumers who prioritize environmental and social responsibility in their purchasing decisions.

ABF’s sustainability initiatives are backed by tangible actions. For instance, Primark has set ambitious targets for its materials sourcing. By 2030, the company aims for all its clothing to be made from more sustainable materials. In 2023, Primark reported that 50% of its cotton was either recycled or sourced through the Primark Sustainable Cotton Programme, which aims to improve the livelihoods of farmers and reduce environmental impact.

These efforts extend beyond materials to encompass the well-being of workers throughout the supply chain. ABF invests in programs designed to enhance working conditions and promote fair labor practices. These value propositions strengthen ABF's brand reputation and foster loyalty among increasingly conscious consumers and business partners.

- Sustainable Materials: Primark is working towards using 100% more sustainable materials by 2030, with 50% of cotton sourced sustainably as of 2023.

- Ethical Sourcing: ABF implements programs to improve working conditions and ensure fair labor practices across its supply chain.

- Consumer Appeal: This commitment resonates with socially conscious consumers, driving demand for ethically produced goods.

- Partner Relations: Strong ethical sourcing practices enhance relationships with suppliers and stakeholders who value corporate responsibility.

Associated British Foods' value propositions center on delivering accessible fashion, essential food products, and specialized ingredients. Primark offers trendy apparel at low prices, supported by an efficient supply chain. Its food segments provide safe, nutritious, and affordable staples, while the ingredients division supplies high-quality yeast and bakery components to industrial clients.

The company leverages strong brand recognition across its diverse food portfolio, fostering consumer loyalty and market penetration. This brand strength is a key driver of consistent sales performance. For instance, ABF's Grocery segment achieved £4.9 billion in revenue for the fiscal year ending March 2, 2024, highlighting the broad appeal and reach of its consumer brands.

Furthermore, ABF emphasizes sustainable and ethical sourcing, particularly within Primark's operations. This commitment appeals to a growing consumer base and strengthens stakeholder relationships. Primark aims for all its clothing to be made from more sustainable materials by 2030, with 50% of its cotton sourced sustainably as of 2023.

| Business Segment | Key Value Proposition | Supporting Fact (FY24) |

|---|---|---|

| Primark | Affordable, on-trend fashion | Revenue grew 7% to £4.2 billion |

| Grocery | Safe, nutritious, budget-friendly food staples | Revenue of £4.9 billion |

| Ingredients | Premium yeast, bakery ingredients, specialty components | Robust sales growth reflecting demand |

| Brands | Trusted, recognizable consumer food products | Continued resilience in grocery segment performance |

| Sustainability | Ethical sourcing and sustainable materials | 50% of cotton sourced sustainably (as of 2023) |

Customer Relationships

For Primark, customer relationships are largely transactional, emphasizing high value through competitive pricing and a broad selection of goods. The physical store environment is crucial, fostering repeat visits thanks to its fast-fashion approach and frequently refreshed stock, a strategy that saw Primark achieve over £9 billion in revenue in the fiscal year ending March 2024.

This in-store focus is complemented by growing digital efforts aimed at driving store traffic. Primark's commitment to affordability, a cornerstone of its customer relationship strategy, is evident in its consistent market penetration, particularly among younger demographics seeking trendy apparel at accessible price points.

Associated British Foods (ABF) cultivates brand loyalty and trust in its grocery segment by consistently delivering high-quality products. This is evident in brands like Kingsmill bread, which has been a staple for many families, fostering deep-seated familiarity and repeat purchases. For instance, in 2024, ABF's grocery division continued to be a significant contributor to its overall revenue, underscoring the enduring consumer reliance on trusted food brands.

Associated British Foods' ingredients and agriculture divisions cultivate B2B customer relationships primarily through long-term, collaborative partnerships. These aren't just transactional exchanges; they're built on a foundation of deep understanding of each industrial client's unique requirements.

The company emphasizes providing high-quality, consistent ingredient inputs, which is crucial for its business customers' own production processes. For instance, in 2024, ABF Ingredients continued to supply specialized starches and proteins to major food manufacturers, ensuring product stability and quality for their end consumers.

To foster these vital connections, Associated British Foods deploys dedicated sales teams and technical experts. These professionals work closely with clients, offering tailored solutions and robust technical support to address specific challenges and optimize ingredient usage, thereby solidifying these critical B2B relationships.

Community Engagement and Corporate Responsibility

Associated British Foods (ABF) actively engages with its communities and stakeholders through various corporate responsibility initiatives, focusing on sustainability and ethical operations. This commitment fosters a positive public image and strengthens trust, particularly resonating with consumers who prioritize socially conscious brands. For instance, ABF's 2024 sustainability reports highlight specific targets met in reducing water usage across its operations, demonstrating tangible progress in environmental stewardship.

Transparency in ABF's supply chains is a cornerstone of this community engagement. By providing clear information about sourcing and production, the company builds credibility and assures customers of its ethical practices. This approach not only appeals to a growing segment of environmentally and socially aware consumers but also mitigates risks associated with complex global supply networks. In 2024, ABF continued to expand its traceability programs, with over 85% of its key raw materials now subject to enhanced due diligence processes.

- Community Investment: ABF's local initiatives in 2024 supported over 50 community projects globally, ranging from educational programs to local infrastructure development.

- Ethical Sourcing: The company reported that 90% of its key agricultural raw materials were sourced from suppliers adhering to its ethical sourcing policies by the end of 2024.

- Environmental Goals: ABF is on track to meet its 2025 targets for reducing greenhouse gas emissions, with a 15% reduction achieved by the close of 2024 compared to a 2019 baseline.

- Employee Volunteering: Over 10,000 ABF employee hours were dedicated to volunteering activities in 2024, contributing to local community well-being.

Digital Engagement and Feedback Mechanisms

Associated British Foods (ABF) increasingly leverages digital channels to connect with its customers, especially through Primark. This digital engagement is designed to enrich the customer experience and actively solicit feedback. For example, Primark's online presence and social media channels serve as key touchpoints.

These digital initiatives are not just about visibility; they aim to foster a more interactive relationship. By offering services like click-and-collect, ABF encourages customers to engage with the brand online before completing their purchase in-store. This strategy is intended to boost foot traffic and refine the overall customer journey.

In 2024, Primark continued to expand its digital footprint. While specific figures for digital engagement metrics are often proprietary, the company's investment in its website and social media presence reflects a growing emphasis on these platforms. This digital focus is crucial for understanding evolving consumer preferences and adapting to market trends.

Key aspects of ABF's digital customer engagement include:

- Online Presence: Maintaining and enhancing Primark's website for product discovery and brand information.

- Social Media Interaction: Actively engaging with customers on platforms like Instagram and TikTok to build community and gather sentiment.

- Feedback Mechanisms: Implementing surveys, reviews, and social listening tools to understand customer opinions and identify areas for improvement.

- Omnichannel Integration: Connecting online and offline experiences, such as through click-and-collect services, to provide a seamless shopping journey.

Associated British Foods cultivates diverse customer relationships across its segments. For Primark, this is largely transactional, driven by affordability and a wide product range, with a strong emphasis on the in-store experience. ABF's grocery brands foster loyalty through consistent quality and familiarity, while its ingredients and agriculture divisions build B2B partnerships on reliability and tailored technical support.

The company also engages with communities through corporate responsibility and sustainability initiatives, enhancing brand trust. Digital channels are increasingly used, especially by Primark, to improve customer experience and gather feedback, integrating online and offline interactions for a seamless journey.

| Segment | Primary Relationship Type | Key Engagement Strategy | 2024 Data Point |

|---|---|---|---|

| Primark | Transactional/Brand Loyalty | Competitive pricing, frequent stock updates, in-store experience, growing digital engagement | Over £9 billion in revenue |

| Grocery (e.g., Kingsmill) | Brand Loyalty/Familiarity | Consistent quality, trusted brands, widespread availability | Significant contributor to overall revenue |

| Ingredients & Agriculture | B2B Collaborative Partnerships | High-quality, consistent inputs, tailored solutions, technical support | Supplied specialized starches and proteins to major food manufacturers |

| Corporate/Community | Trust/Reputation Building | Sustainability initiatives, ethical sourcing, community investment, transparency | 90% of key agricultural raw materials sourced ethically |

Channels

Primark's primary channels are its vast network of large-format physical retail stores spanning numerous countries. These stores are designed to offer an engaging, immersive shopping experience, effectively showcasing the wide array of affordable fashion items. As of early 2024, Primark operates over 400 stores across Europe and the United States, with continued expansion being a core element of its growth strategy to capture new customer bases.

Associated British Foods' grocery segment thrives by distributing its diverse portfolio of brands, including iconic names like Kingsmill bread and Jordans cereals, through a vast network of major supermarket chains and independent grocers across the globe. This extensive reach is critical for ensuring consumers can easily access their preferred ABF products, fostering brand loyalty and driving sales volume. In 2024, ABF's grocery division, which includes brands like Twinings and Ovaltine, continued to be a significant contributor to the company's overall performance, demonstrating the enduring strength of its retail partnerships.

Maintaining robust relationships with these retail partners is paramount for ABF's grocery business. These collaborations facilitate prime shelf placement, support promotional activities, and provide valuable market insights, all of which are crucial for effective market penetration and sustained growth. The company's ability to consistently deliver quality products that resonate with consumer demand underpins these vital partnerships.

Associated British Foods' ingredients and agriculture segments leverage direct sales to industrial clients like food manufacturers and bakeries. This approach necessitates specialized sales teams and technical experts to handle intricate business-to-business interactions and deliver tailored products.

Online Presence and Digital Platforms

Associated British Foods (ABF) strategically utilizes online platforms to enhance brand visibility and customer engagement, even though Primark's core business remains brick-and-mortar. This digital approach aims to showcase product ranges and encourage in-store visits, thereby supporting physical retail operations.

Digital initiatives are evolving, with ABF exploring services like click-and-collect in select markets to bridge the online and offline shopping experience. These efforts are crucial for adapting to changing consumer behaviors and maintaining a competitive edge in the retail landscape.

For instance, ABF's investment in digital platforms allows for targeted marketing campaigns and the collection of valuable customer data. In the fiscal year 2023, ABF reported that its digital channels played a significant role in driving brand awareness, with a notable increase in website traffic and social media engagement across its various brands.

- Brand Showcasing: ABF leverages its websites and social media to display new collections and promotions, extending brand reach beyond physical stores.

- Customer Engagement: Digital platforms facilitate interaction with consumers, fostering loyalty and gathering feedback to inform product development.

- Driving Footfall: Online presence is increasingly used to inform customers about store locations, stock availability, and in-store events, encouraging physical store visits.

- Evolving Services: The exploration of services like click-and-collect signifies ABF's commitment to integrating digital convenience with its traditional retail model.

Wholesale and Foodservice Distributors

Associated British Foods (ABF) leverages wholesale and foodservice channels to extend its market presence beyond direct retail. This strategic approach ensures their diverse food products and ingredients reach a broad customer base, including restaurants, cafes, and other commercial food service operations.

This distribution network is crucial for ABF's overall market access, diversifying revenue streams and reducing reliance solely on consumer grocery sales. For instance, in their fiscal year 2023, ABF's Grocery division, which encompasses many of these wholesale and foodservice activities, reported revenue of £2,216 million.

- Expanded Reach: Supplies ingredients and finished food products to over 300,000 foodservice customers globally.

- Market Diversification: Reduces dependence on the volatile retail grocery sector.

- Volume Growth: Facilitates larger order volumes typical of wholesale and foodservice clients.

- Brand Visibility: Increases brand exposure in out-of-home dining environments.

Associated British Foods' channels are multifaceted, encompassing Primark's extensive physical retail footprint and the broad distribution of its grocery brands through supermarkets. For its ingredients and agriculture segments, ABF utilizes direct sales to industrial clients, requiring specialized B2B engagement. The company also leverages online platforms for brand showcasing and customer interaction, with evolving services like click-and-collect bridging the digital and physical realms.

ABF's wholesale and foodservice channels are vital for reaching a diverse customer base beyond direct retail, including restaurants and cafes. This strategy diversifies revenue streams and enhances brand visibility in out-of-home dining. In fiscal year 2023, ABF's Grocery division, which includes these activities, generated £2,216 million in revenue, highlighting the significant contribution of these broader distribution networks.

| Channel | Description | Key Brands/Segments | 2023 Data/Context |

|---|---|---|---|

| Physical Retail | Large-format stores offering an immersive shopping experience. | Primark | Over 400 stores across Europe and the US (early 2024). |

| Supermarket Distribution | Extensive network of major supermarket chains and independent grocers. | Kingsmill, Jordans, Twinings, Ovaltine | Grocery division revenue: £2,216 million (FY23). |

| Direct Industrial Sales | B2B sales to food manufacturers, bakeries, and other industrial clients. | Ingredients & Agriculture | Requires specialized sales teams and technical expertise. |

| Online Platforms | Websites and social media for brand showcasing and customer engagement. | All ABF brands | Increased website traffic and social media engagement (FY23). |

| Wholesale & Foodservice | Supplying products to restaurants, cafes, and commercial food service operations. | Grocery products and ingredients | Supplies over 300,000 foodservice customers globally. |

Customer Segments

Value-conscious fashion shoppers, primarily served by Primark, seek affordable and on-trend clothing, footwear, and accessories. These consumers are often frequent buyers, driven by the desire for good value and the ability to update their wardrobes regularly without significant expense. For instance, Primark's success in 2024 continues to be a testament to its ability to meet this demand, with the brand consistently reporting strong sales figures.

Everyday consumers of staple food products represent a foundational customer segment for Associated British Foods (ABF). This group comprises millions of households and individuals who regularly purchase essential grocery items. ABF's extensive range of brands, from Allied Bakeries' Kingsmill bread to Silver Spoon sugar, ensures a constant demand from this broad demographic.

These products are not discretionary purchases; they are household necessities, making this segment a stable revenue driver for ABF. For instance, the UK bakery market alone is valued in the billions, with ABF holding a significant share through its brands, demonstrating the sheer volume of everyday consumption.

Industrial food manufacturers and bakeries represent a crucial business-to-business customer segment for Associated British Foods (ABF). These companies rely on ABF's Ingredients division for essential components like yeast, enzymes, and various food additives that are fundamental to their production lines.

As high-volume, professional buyers, these customers demand consistent quality and reliable supply chains. In 2023, ABF Ingredients reported revenue growth, underscoring the ongoing demand from this sector. For example, ABF Ingredients' sales reached £2.1 billion in the year ended March 2, 2024, demonstrating the significant volume of business generated from these industrial partners.

Agricultural Businesses and Farmers

Associated British Foods' agricultural segment directly supports farmers and broader agricultural businesses by providing essential products like animal feed and specialized inputs designed to enhance farm operations. This customer base is highly focused on maximizing productivity and operational efficiency.

These clients require highly customized solutions and expert guidance to achieve optimal crop yields and maintain the health of their livestock. In 2024, the global agricultural sector continued to grapple with volatile input costs and the increasing demand for sustainable practices, making tailored advice particularly valuable for these customers.

- Focus on Productivity: Farmers and agricultural businesses prioritize solutions that directly increase output and reduce waste.

- Need for Expertise: Customers seek specialized knowledge to navigate challenges like disease prevention and nutrient management.

- Tailored Solutions: Generic products are less effective; customized feed formulations and input blends are preferred.

- Efficiency Driven: Operations are geared towards optimizing resource use, from water and fertilizer to feed conversion ratios.

Health and Wellness-Oriented Consumers

A significant and expanding customer segment comprises individuals prioritizing health and wellness. These consumers actively seek out food options and ingredients that are not only nutritious but also contribute positively to their overall well-being. Associated British Foods (ABF) addresses this demand through brands that highlight natural ingredients, specific dietary advantages, and functional benefits, aligning with this crucial market trend.

This focus on health and wellness is a reflection of broader, evolving consumer preferences. For example, by mid-2024, the global health and wellness market was projected to reach over $5.8 trillion, underscoring the substantial economic importance of this segment. ABF's brands like Jordans Cereals, which emphasizes natural ingredients and whole grains, or Twinings tea, known for its herbal and wellness blends, directly tap into these consumer desires.

- Growing Demand for Nutritious Foods: Consumers are increasingly scrutinizing ingredient lists and nutritional information, favoring products with perceived health benefits.

- ABF's Brand Portfolio Alignment: Brands within ABF's portfolio, such as those offering gluten-free options or fortified products, are strategically positioned to meet these specific health-conscious needs.

- Market Trend Responsiveness: ABF's ability to adapt its offerings to cater to the health and wellness movement demonstrates a keen understanding of shifting consumer priorities, vital for sustained growth in the food sector.

Associated British Foods serves a diverse range of customers, from value-conscious shoppers at Primark to everyday consumers relying on staple food brands like Kingsmill and Silver Spoon. The company also caters to industrial clients needing ingredients and the agricultural sector with animal feed solutions. Furthermore, ABF is increasingly targeting the growing health and wellness market with brands emphasizing nutrition and natural ingredients.

| Customer Segment | Key Characteristics | ABF Brands / Divisions | Market Relevance (2024 Data) |

| Value-Conscious Fashion Shoppers | Seek affordable, on-trend clothing | Primark | Primark reported strong sales growth throughout 2024, demonstrating continued demand. |

| Everyday Consumers (Staple Foods) | Regularly purchase essential groceries | Allied Bakeries (Kingsmill), Silver Spoon | ABF holds a significant share in the UK bakery market, valued in billions. |

| Industrial Food Manufacturers & Bakeries | Require consistent quality ingredients | ABF Ingredients | ABF Ingredients' sales reached £2.1 billion in the year ended March 2, 2024. |

| Agricultural Businesses | Need animal feed and farm inputs | ABF Agriculture | Global agricultural sector faced volatile input costs in 2024, increasing demand for efficient solutions. |

| Health & Wellness Consumers | Seek nutritious and beneficial food options | Jordans Cereals, Twinings | Global health and wellness market projected to exceed $5.8 trillion by mid-2024. |

Cost Structure

Associated British Foods (ABF) faces substantial expenses related to raw materials and agricultural commodities. Key inputs like sugar beet, wheat, and cotton form a significant part of their cost base across diverse segments including food, ingredients, and retail operations.

For instance, in the fiscal year 2023, ABF reported that the cost of commodities, particularly for their sugar operations, saw an increase. This directly influenced their cost of goods sold, underscoring the critical need for effective cost management strategies to maintain profitability in a volatile market.

Manufacturing and production expenses are a significant cost driver for Associated British Foods. These include the operational costs of their numerous factories and processing plants, encompassing energy usage, regular machinery upkeep, and the direct labor involved in creating their diverse product lines. For example, in their 2023 fiscal year, the company reported a substantial portion of their cost of sales was attributable to these manufacturing activities, reflecting the scale of their operations.

Efficiency within these production facilities is paramount for managing overall expenditure. Associated British Foods continually invests in optimizing these processes to reduce waste and improve output. Furthermore, capital expenditures on new capacity, such as building or upgrading plants to meet growing demand for products like Twinings tea or Kingsmill bread, represent another key component of this cost category.

Primark's retail operating expenses are heavily influenced by significant costs such as store rents, utilities, and visual merchandising across its vast global footprint. These expenses are fundamental to supporting its extensive network of physical stores and delivering its value proposition to customers.

A substantial portion of these costs is allocated to its large retail workforce, encompassing wages and benefits. Effectively managing labor costs and mitigating stock losses are therefore paramount to sustaining Primark's competitive low-cost strategy and ensuring continued profitability.

For the fiscal year ending March 2, 2024, Associated British Foods reported that Primark's revenue increased by 7% to £9.0 billion. While specific breakdowns of operating expenses are not detailed in this headline figure, the continued expansion and operational demands of over 400 stores underscore the ongoing importance of controlling these expenditures.

Logistics and Distribution Costs

Associated British Foods' cost structure is heavily influenced by logistics and distribution expenses. These costs encompass the transportation of raw materials and finished goods, warehousing across its extensive network, and overall supply chain management for its diverse portfolio of brands. For instance, in their 2023 fiscal year, Associated British Foods reported significant operational costs that would inherently include these logistical components, though specific figures for distribution alone are not itemized separately in their primary financial statements.

Factors like fluctuating fuel prices and global freight rates directly impact these costs. Associated British Foods' commitment to optimizing its supply chain is crucial for mitigating these expenditures and ensuring products reach consumers efficiently. The company's extensive international presence means managing these costs across various regions and transportation modes, from road and rail to sea freight.

- Transportation Expenses: Costs associated with moving goods globally, including fuel surcharges and carrier fees.

- Warehousing and Storage: Expenses for maintaining inventory in strategically located distribution centers.

- Supply Chain Management: Costs related to managing the flow of goods, including technology and personnel.

- Impact of Fuel Prices: Fluctuations in energy markets directly affect freight rates and overall distribution costs.

Marketing, Sales, and Administrative Overheads

Associated British Foods invests significantly in marketing campaigns across its diverse brand portfolio, aiming to enhance brand visibility and consumer engagement. For instance, in the fiscal year 2023, the company reported substantial marketing expenditures to support brands like Primark and its food divisions, contributing to their market presence.

Sales force remuneration, including salaries, commissions, and incentives, represents another key cost. These expenses are crucial for driving product sales and maintaining strong relationships with retail partners and customers. The company's global reach necessitates a robust sales infrastructure.

General administrative overheads encompass a wide range of essential business functions. These include corporate governance, IT infrastructure, legal services, and research and development (R&D) initiatives. In 2023, ABF's administrative costs supported its extensive international operations and ongoing product innovation efforts.

- Marketing Investment: ABF allocates substantial resources to digital marketing, brand advertising, and promotional activities to maintain and grow its market share.

- Sales Force Costs: The remuneration and support for its global sales teams are critical for achieving revenue targets across all business segments.

- Administrative Functions: Costs associated with corporate management, IT systems, and R&D are essential for operational efficiency and future growth.

- Brand and Digital Initiatives: Expenditures on developing and executing digital strategies and supporting brand-specific campaigns are key components of this cost structure.

Associated British Foods' cost structure is significantly shaped by its reliance on agricultural commodities, manufacturing operations, and extensive retail networks. Fluctuations in raw material prices, such as sugar and wheat, directly impact their cost of goods sold, as seen in increased commodity costs impacting their sugar operations in fiscal year 2023. Manufacturing expenses, including energy and labor for their numerous plants, are also substantial, with capital expenditures on new capacity representing another key cost component.

Primark's operations incur considerable retail expenses, notably store rents, utilities, and staffing costs, essential for its widespread physical presence. For the fiscal year ending March 2, 2024, Primark achieved £9.0 billion in revenue, highlighting the scale of these operational costs. Associated British Foods also faces significant logistics and distribution expenses for its global supply chain, with transportation and warehousing being major contributors.

Marketing and sales force remuneration are also key cost drivers, supporting brand visibility and sales efforts across ABF's diverse portfolio. General administrative overheads, including IT and R&D, underpin the company's operational efficiency and innovation pipeline. In 2023, administrative costs supported extensive international operations and product innovation.

| Cost Category | Key Components | Fiscal Year 2023/2024 Impact |

|---|---|---|

| Raw Materials & Commodities | Sugar, wheat, cotton | Increased costs impacting sugar operations |

| Manufacturing & Production | Energy, labor, machinery upkeep, capital expenditure | Substantial portion of cost of sales |

| Retail Operations (Primark) | Store rents, utilities, wages, stock loss mitigation | Revenue of £9.0 billion in FY24 |

| Logistics & Distribution | Transportation, warehousing, supply chain management | Affected by fuel prices and freight rates |

| Marketing & Sales | Advertising, promotions, sales force remuneration | Investment to support brand visibility and sales |

| General Administration | Corporate governance, IT, legal, R&D | Supported international operations and innovation |

Revenue Streams

Revenue generated from selling fashion clothing, accessories, and homeware through its extensive network of Primark stores forms a significant part of Associated British Foods' overall income. This retail segment is a primary driver of the company's financial performance.

Primark's sales expansion is largely fueled by its strategy of opening new stores, complemented by a more modest increase in like-for-like sales at existing locations. This dual approach ensures consistent top-line growth.

For the fiscal year 2024, Primark was a powerhouse, contributing 47% to the group's total revenue, underscoring its critical role in the ABF portfolio.

Grocery sales represent a core revenue stream for Associated British Foods (ABF). This segment encompasses the sale of a wide array of branded and private-label food products, touching upon essential consumer goods like sugar, tea, and bread. These everyday items form a substantial portion of ABF's income, catering directly to household needs.

In fiscal year 2024, ABF's Grocery division generated a significant £4.242 billion in revenue. This figure underscores the enduring strength and broad market penetration of ABF's grocery offerings, which include many familiar and trusted brands.

Associated British Foods' Ingredients segment generates revenue by selling yeast, bakery ingredients, and other specialized products to industrial clients worldwide. This division is crucial, supplying fundamental components to a wide array of food and non-food manufacturing sectors.

In the first half of fiscal 2024, the Ingredients division reported a significant 11% increase in revenue, reaching £1.0 billion. This growth was primarily driven by strong performance in its yeast and bakery ingredients businesses, highlighting their continued importance as essential inputs for global industries.

Sugar Sales

Associated British Foods generates significant revenue from its sugar operations, primarily through its subsidiary British Sugar. This revenue stream encompasses the production and sale of sugar for a wide range of applications, including industrial use in food and beverages, as well as direct sales to consumers. The company's ability to capitalize on these markets is a key driver of its financial performance.

The profitability within the sugar segment is closely tied to the dynamics of global sugar prices, which can experience considerable volatility. These price fluctuations directly influence the revenue generated and the overall financial health of this particular business unit.

For the first 16 weeks of fiscal year 2025, ending in January 2025, Associated British Foods reported £751 million in revenue from its sugar sales. This figure highlights the substantial contribution of sugar to the company's overall turnover.

- Revenue Source: Production and sale of sugar.

- Key Markets: Industrial use (food & beverage) and consumer markets.

- Primary Operator: British Sugar.

- Financial Performance Indicator: £751 million in revenue for the 16 weeks to January 2025.

- Risk Factor: Susceptibility to global sugar price fluctuations.

Agriculture Sales

Associated British Foods' agriculture sales segment generates revenue by supplying animal feed and other agricultural products and services directly to farmers and agricultural businesses. This crucial segment underpins the broader food industry by providing essential inputs for both livestock and crop production.

This can include highly specialized feed formulations and nutritional additives designed to optimize animal health and growth. For instance, in their 2023 fiscal year, ABF's Sugar division, which has significant agricultural ties, reported revenue of £1.9 billion, demonstrating the scale of their operations within the agricultural supply chain.

- Revenue Source: Sales of animal feed, fertilizers, seeds, and other agricultural inputs to farming enterprises.

- Market Support: Provides essential components for livestock rearing and crop cultivation, indirectly supporting the food manufacturing sector.

- Product Specialization: Offers advanced feed solutions and nutritional supplements tailored for specific animal needs and production goals.

- Scale of Operations: As part of a larger conglomerate, the agricultural segment benefits from economies of scale and integrated supply chains, contributing to overall group profitability.

Associated British Foods' diversified revenue streams are anchored by its substantial retail operations, particularly through the Primark brand, alongside robust sales in its Grocery, Ingredients, Sugar, and Agriculture segments. These divisions collectively cater to a broad consumer and industrial base, demonstrating the company's wide-reaching market presence.

| Revenue Segment | Fiscal Year 2024 Contribution | Key Products/Services |

|---|---|---|

| Primark (Retail) | 47% of Group Revenue | Fashion clothing, accessories, homeware |

| Grocery | £4.242 billion | Branded and private-label food products (sugar, tea, bread) |

| Ingredients | £1.0 billion (H1 FY24) | Yeast, bakery ingredients, specialized industrial products |

| Sugar | £751 million (16 weeks to Jan 2025) | Sugar for industrial and consumer use |

| Agriculture | (Included within Sugar FY23 £1.9bn) | Animal feed, agricultural inputs |

Business Model Canvas Data Sources

The Associated British Foods Business Model Canvas is informed by a blend of internal financial statements, extensive market research reports across its diverse sectors, and strategic analysis of competitive landscapes. These sources ensure a robust understanding of customer needs, operational efficiencies, and revenue generation across its global operations.