Associated British Foods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated British Foods Bundle

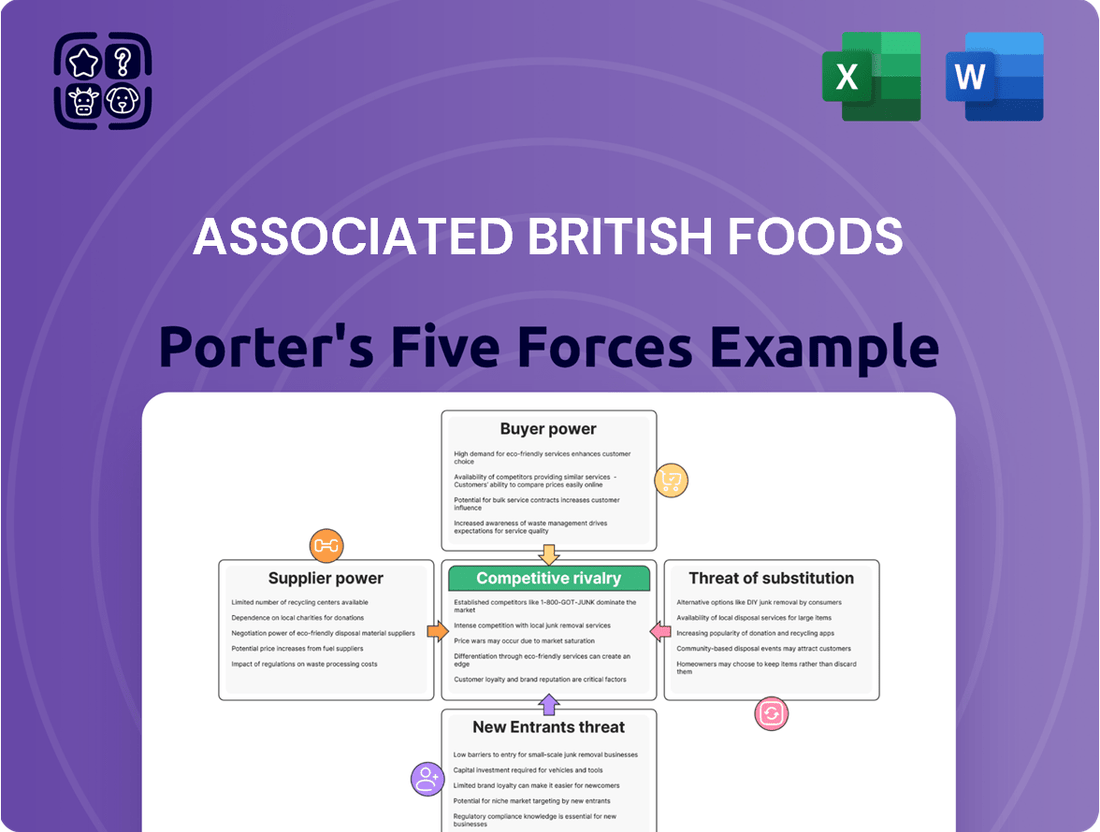

Associated British Foods operates in a dynamic market shaped by significant buyer and supplier power, alongside moderate threats from new entrants and substitutes. Understanding these forces is crucial for navigating its diverse portfolio, from grocery brands to sugar production.

The complete report reveals the real forces shaping Associated British Foods’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Associated British Foods (ABF) navigates a landscape where supplier concentration varies significantly across its diverse operations. For its sugar and ingredients segment, the agricultural sector can be fragmented, yet key commodity suppliers for sugar beet or grain can hold sway, especially during periods of tight supply. In 2024, global sugar prices saw fluctuations due to weather patterns in major producing regions, potentially increasing the bargaining power of those with stable yields.

Primark, ABF's retail arm, relies on a vast network of textile manufacturers, primarily in Asia. While ABF's scale provides some purchasing power, the concentration of large-scale garment factories in countries like Bangladesh and Vietnam means a few dominant players can influence pricing and delivery terms. Reports from 2024 indicated ongoing supply chain pressures in the textile industry, including rising labor and material costs, which could amplify supplier leverage.

ABF's global presence, while generally a strength, can also highlight supplier concentration in specific regions or for particular raw materials. If a significant portion of a key input, such as a specific type of agricultural commodity or a specialized textile component, comes from a limited number of suppliers, ABF's overall bargaining power for that item might be reduced, even with its broad operational footprint.

Associated British Foods (ABF) faces significant switching costs when changing suppliers, particularly in its sugar and ingredients divisions. For instance, re-tooling production lines to accommodate different raw material specifications or re-certifying new suppliers for critical ingredients can be a substantial investment, potentially running into millions of pounds. This investment in new equipment and quality assurance processes directly impacts ABF’s flexibility.

Beyond physical re-tooling, ABF must also consider the disruption to its established logistical chains and the time required to vet and onboard new partners. Developing new relationships and ensuring the consistent quality of a new supplier’s output, whether it’s a specialized starch or a particular type of flour, can take months, impacting production schedules and potentially leading to lost sales. These operational hurdles strengthen the hand of existing suppliers.

Associated British Foods (ABF) faces varying levels of supplier bargaining power depending on the uniqueness of its inputs. For many of its food products, raw materials like wheat, sugar, and vegetable oils are largely commodities, meaning suppliers have limited power due to the availability of substitutes and numerous producers. However, in specialized areas, such as certain ingredients for its Twinings tea or specific formulations for its brands like Kingsmill, ABF might encounter suppliers offering more unique or proprietary components.

When inputs are highly differentiated or essential with few readily available alternatives, supplier bargaining power increases significantly. For instance, if ABF relies on a specific type of tea leaf grown only in a particular region or a unique yeast strain for its baking division, those suppliers can command higher prices or dictate terms. In 2024, the agricultural sector, a key supplier for ABF's food businesses, experienced price volatility due to weather patterns and geopolitical events, potentially amplifying the bargaining power of those suppliers who could guarantee consistent supply of specific, high-quality agricultural products.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Associated British Foods' (ABF) operations, such as by processing agricultural raw materials into finished food products or entering the retail fashion space, is a significant factor influencing supplier bargaining power. If ABF's suppliers possess the capability and inclination to move up the value chain, they could directly compete with ABF, thereby increasing their leverage in negotiations.

For instance, a large sugar beet supplier could potentially develop its own branded food products, bypassing ABF's processing and distribution channels. Similarly, textile suppliers to ABF's fashion segments might launch their own retail brands. This potential for forward integration means suppliers can credibly threaten to become competitors, forcing ABF to potentially offer more favorable terms to maintain its supply relationships.

- Increased Supplier Leverage: The credible threat of forward integration by ABF's suppliers enhances their bargaining power, as they can transition from suppliers to direct competitors.

- Potential for Competition: Suppliers with strong brands or efficient processing capabilities are more likely to consider forward integration, especially if ABF's margins are attractive.

- Impact on ABF's Margins: If suppliers successfully integrate forward, ABF may face increased competition and pressure on its profit margins across its diverse business segments.

Importance of ABF to Suppliers

The bargaining power of suppliers for Associated British Foods (ABF) is significantly influenced by ABF's importance as a customer to them. If ABF constitutes a minor part of a supplier's revenue, that supplier holds greater leverage in setting prices and terms.

Conversely, if ABF is a key client, suppliers are more inclined to offer competitive pricing and favorable conditions to secure ABF's continued business. This dynamic is crucial in understanding ABF's cost structure and operational resilience.

For instance, in the agricultural sector, where ABF sources many raw materials, the power balance can shift based on crop yields and global demand. In 2024, fluctuations in commodity prices, such as sugar and wheat, directly impacted the bargaining power of agricultural suppliers to ABF.

- ABF's reliance on specific suppliers: If ABF depends heavily on a few suppliers for critical ingredients, those suppliers gain more power.

- Supplier concentration: A fragmented supplier base generally reduces supplier bargaining power, whereas a concentrated one increases it.

- Switching costs for ABF: High costs associated with changing suppliers reinforce the bargaining power of existing suppliers.

The bargaining power of suppliers for Associated British Foods (ABF) is a nuanced factor, heavily influenced by the specific industry segment and the nature of the inputs. In 2024, global commodity markets, particularly for agricultural products like sugar and grains, experienced price volatility due to weather and geopolitical events. This volatility can empower suppliers who can guarantee consistent supply of key raw materials, impacting ABF's cost of goods sold.

For Primark, the retail fashion segment, ABF's sheer scale provides considerable purchasing power against a fragmented base of textile manufacturers. However, the concentration of large-scale garment production in specific regions means that key factories can still exert influence, especially when facing supply chain disruptions. Reports in 2024 highlighted rising labor and material costs in the textile industry, potentially increasing supplier leverage.

Switching costs are a critical determinant of supplier power. For ABF, re-tooling production lines for new raw material specifications or re-certifying ingredient suppliers can represent millions in investment and significant operational disruption, thereby strengthening the position of established suppliers.

| Factor | Impact on ABF | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Varies by segment; concentrated textile manufacturing in Asia. |

| Switching Costs | High costs benefit existing suppliers. | Significant for specialized ingredients and production lines. |

| Input Differentiation | Unique inputs grant suppliers more power. | Commodities have less supplier power; specialized ingredients have more. |

| Forward Integration Threat | Suppliers becoming competitors increases their leverage. | Potential for food processors or textile manufacturers to enter ABF's markets. |

| ABF's Importance to Supplier | ABF as a key customer reduces supplier power. | Depends on the segment; ABF is a major buyer for many agricultural suppliers. |

What is included in the product

This analysis unpacks the competitive landscape for Associated British Foods, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse food and retail markets.

Effortlessly identify and strategize against competitive threats with a clear, actionable breakdown of each Porter's Force, enabling proactive business decisions.

Customers Bargaining Power

Associated British Foods (ABF) faces varying customer price sensitivity across its diverse segments. For instance, in its grocery division, consumers purchasing everyday staples like Twinings tea or Kingsmill bread are generally more price-sensitive, especially during periods of economic uncertainty. In 2024, inflation continued to impact household budgets, making value propositions crucial for grocery brands.

Conversely, Primark customers, while seeking affordability, may exhibit lower price sensitivity for fashion items due to the brand's strong emphasis on trendiness and perceived value. However, the highly competitive fast-fashion market means that even small price increases could shift demand. The industrial ingredients segment, supplying to other businesses, will see price sensitivity dictated by the cost of raw materials and the availability of alternative suppliers.

The availability of substitutes significantly impacts Associated British Foods' (ABF) bargaining power of customers. For ABF's grocery segment, customers can easily switch to private label brands or products from numerous other food manufacturers, especially in staple categories where brand loyalty might be lower. This is evident in the competitive UK grocery market, where discounters like Aldi and Lidl, offering a wide range of own-brand products, have captured substantial market share, reaching approximately 16.7% by early 2024.

In the ingredients sector, customers, often other businesses, have a moderate to high degree of choice. They can source ingredients from various global suppliers, and the switching costs can vary depending on the specificity of the ingredient and the supplier relationship. For instance, if ABF's sugar prices increase, buyers can explore other sugar producers or even alternative sweeteners if feasible for their product formulation.

At Primark, the value fashion retailer, customers have a very high availability of substitutes. The fast fashion market is intensely competitive, with numerous global and local retailers offering similar low-priced apparel. Competitors like Shein, Boohoo, and even traditional high street brands with value lines provide ample alternatives, making it easy for consumers to find comparable products if they find Primark's prices or offerings unsatisfactory. This intense competition in the fashion retail space means customers have considerable power to switch if they perceive better value elsewhere.

Customer switching costs for Associated British Foods (ABF) vary significantly by segment. For many of its consumer brands, like Primark clothing or Twinings tea, these costs are minimal. Consumers can easily switch to a competitor's similar product with little to no inconvenience or financial penalty, granting them considerable bargaining power.

However, in ABF's Ingredients division, switching costs can be much higher. Industrial customers, such as food manufacturers, might need to undertake costly and time-consuming reformulation and re-certification processes if they change their supplier for key ingredients like starches or proteins. This can lock customers in and reduce their bargaining power.

For instance, a bakery switching from an ABF-supplied emulsifier might need to re-test their entire product line to ensure consistent quality and shelf life, a process that can easily cost thousands of pounds and delay new product launches. This inherent friction in switching strengthens ABF's position in these B2B markets.

Customer Information and Transparency

Customers today have access to an unprecedented amount of information. Online reviews, detailed product specifications, and readily available price comparison tools mean that consumers are more informed than ever before when making purchasing decisions across Associated British Foods’ diverse portfolio, from groceries to apparel.

This heightened transparency directly impacts ABF by potentially increasing customer bargaining power. For instance, in the retail sector, readily available data on competitor pricing for similar clothing items or food products allows consumers to more easily identify and demand better value, putting pressure on ABF’s pricing strategies.

- In 2024, the global e-commerce market reached an estimated $6.3 trillion, highlighting the digital channels through which customers access product information and compare prices.

- Customer review platforms often see millions of user-generated opinions, influencing purchasing decisions for many consumer goods.

- Price comparison websites can aggregate pricing for thousands of SKUs, enabling consumers to quickly find the lowest cost options for everyday items.

Threat of Backward Integration by Customers

Associated British Foods (ABF) faces a moderate threat from backward integration by its customers, particularly large industrial clients and major retail chains. These entities possess the scale and resources to potentially produce their own ingredients or finished food products, thereby reducing their reliance on ABF.

If major customers, such as large supermarket chains or food manufacturers, were to integrate backward, they could exert significant pricing pressure on ABF. For instance, a large retailer developing its own private-label ingredient production could demand lower prices from ABF for its existing supply contracts or shift a substantial portion of its volume. This threat is amplified when ABF's products represent a significant cost component for its customers.

- Customer Integration Potential: Large retail groups, like Tesco or Sainsbury's in the UK, often have extensive private-label operations, giving them a strong incentive and capability to produce key ingredients in-house if cost-effective.

- Impact on ABF: A credible threat of backward integration by a major customer can lead to demands for price reductions or more favorable contract terms, directly impacting ABF's revenue and profit margins.

- Industry Examples: In the past, some large food manufacturers have brought certain ingredient processing steps in-house, especially for high-volume, commoditized inputs, to gain greater control over costs and supply chain.

The bargaining power of customers for Associated British Foods (ABF) is generally moderate, influenced by segment-specific factors like price sensitivity, availability of substitutes, and switching costs. In 2024, persistent inflation meant consumers across ABF's grocery and retail divisions remained highly attuned to price, increasing their leverage.

Primark, while offering value, faces intense competition from other fast-fashion retailers, giving its customers significant power to switch based on price and trend. Conversely, ABF's Ingredients division can mitigate some customer power through higher switching costs for industrial clients who invest in specific formulations.

The digital age, with readily available price comparison tools and online reviews, has further amplified customer awareness and bargaining power across all of ABF's markets, making transparency a key factor in competitive dynamics.

| ABF Segment | Customer Bargaining Power Factors | 2024 Context/Data |

|---|---|---|

| Grocery (e.g., Twinings, Kingsmill) | High price sensitivity, low switching costs, many substitutes (private labels). | Inflation continued to impact household budgets, making value propositions critical. UK discounters' market share reached ~16.7% by early 2024. |

| Fashion (Primark) | Moderate price sensitivity (value focus), very low switching costs, numerous substitutes. | Highly competitive fast-fashion market with global players like Shein. |

| Ingredients (B2B) | Variable price sensitivity, moderate to high switching costs (reformulation), availability of alternative suppliers. | Customers may face significant costs to change ingredient suppliers, potentially locking them in. |

Preview Before You Purchase

Associated British Foods Porter's Five Forces Analysis

This preview showcases the identical Associated British Foods Porter's Five Forces Analysis you will receive immediately upon purchase. It provides an in-depth examination of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You can trust that the comprehensive insights and strategic implications presented here are exactly what you'll gain access to, fully formatted and ready for your immediate use.

Rivalry Among Competitors

Associated British Foods (ABF) operates in diverse sectors, including grocery, sugar, agriculture, ingredients, and apparel. The food and grocery sector, a significant part of ABF's business, generally exhibits moderate growth. For instance, in 2024, the UK grocery market saw a modest increase, with inflation playing a role in value growth, though volume growth remained more subdued. This environment means that while there's room for expansion, gaining market share often requires intense competition.

Associated British Foods (ABF) operates in diverse sectors, facing a varied competitive landscape. In its sugar segment, for instance, it contends with large global players like Tate & Lyle and Illovo Sugar, alongside numerous regional sugar producers, especially in key markets like Europe and Africa. This mix of large, established entities and smaller, localized businesses contributes to a dynamic and often intense competitive environment.

Within its grocery division, ABF encounters a broad spectrum of competitors. This includes major multinational food conglomerates such as Nestlé and Unilever, as well as a multitude of national and regional brands, private label offerings from supermarkets, and a growing presence of online-only food retailers. The strategies employed by these rivals range from aggressive pricing and extensive marketing campaigns to niche product development and direct-to-consumer models, all of which intensify rivalry.

The ABF Ingredients business faces competition from specialized ingredient suppliers and larger chemical companies that also produce food ingredients. For example, companies like DSM and Corbion are significant players. The diversity here lies not only in size but also in technological focus and geographic reach, with some competitors excelling in specific biotechnological processes or serving particular regional demands, creating a complex competitive matrix.

In the apparel sector, particularly with its Primark brand, ABF competes against a vast array of fast-fashion retailers. Global giants like Inditex (Zara, Bershka) and H&M are major rivals, alongside numerous smaller, often online-focused, fashion brands. The rapid pace of trend cycles and the constant pressure on pricing in this segment mean that ABF must continuously adapt its supply chain and product offerings to remain competitive.

Associated British Foods (ABF) benefits from significant product differentiation, particularly in its consumer-facing segments. Brands like Kingsmill bread or Twinings tea command strong consumer loyalty, allowing for premium pricing and reducing direct price wars. This contrasts with its commodity businesses, such as sugar, where rivalry is primarily driven by cost efficiency and price.

In 2024, ABF's grocery division, which houses many of its differentiated brands, continued to show resilience. While specific sales figures for individual brands aren't always broken out, the overall performance of this segment often reflects the strength of its brand equity. For instance, Twinings has a long-standing reputation for quality in the premium tea market, a segment less susceptible to aggressive price competition compared to basic sugar or flour.

Exit Barriers

Associated British Foods (ABF) operates in diverse segments, and exiting certain markets can be challenging. For instance, the significant investment in specialized manufacturing plants for sugar or animal feed creates high fixed costs. These assets often lack alternative uses, making it difficult and costly to divest or repurpose them. This ties companies to these segments, even if profitability wanes, thereby sustaining competitive intensity.

The food manufacturing industry, in general, presents considerable exit barriers for ABF and its rivals. These include:

- Specialized Assets: Many food production facilities are highly specialized, making them difficult to sell or redeploy.

- High Fixed Costs: Significant capital is invested in plant, equipment, and distribution networks, which are largely irrecoverable upon exit.

- Labor Agreements: Existing labor contracts and potential severance costs can add to the expense of exiting a market.

- Brand Reputation: Companies may have built strong brand equity in specific food categories, making a complete withdrawal emotionally and strategically difficult.

Strategic Stakes and Aggressiveness

Associated British Foods (ABF) operates in diverse segments, from grocery brands like Kingsmill to sugar and ingredients, each carrying significant strategic weight. Competitors in these areas, such as Unilever in branded goods or Tate & Lyle in ingredients, often exhibit high levels of aggressiveness. This intensity is fueled by the pursuit of market share and the desire to secure profitable positions, leading to substantial investments in pricing strategies, promotional campaigns, and product innovation.

The strategic stakes are particularly high in the branded food segments where brand loyalty and shelf space are paramount. For instance, in the UK bakery market, ABF's Kingsmill faces intense competition from Hovis and Warburtons, who are known for their aggressive marketing and promotional activities to capture consumer attention. Similarly, in the global sugar market, ABF's substantial operations are challenged by major international players who can leverage economies of scale and global supply chains, making competition a constant battle for efficiency and market access.

- Strategic Importance: ABF's diverse portfolio means different segments have varying strategic importance, impacting competitive intensity.

- Competitor Aggressiveness: Rivals in branded goods and ingredients often engage in fierce price wars and marketing battles.

- Investment Focus: Companies with high stakes heavily invest in pricing, marketing, and innovation to gain or maintain market share.

- Market Dynamics: The pursuit of market share and competitive advantage drives aggressive strategies across ABF's operating markets.

Competitive rivalry is a significant force within Associated British Foods' (ABF) operating segments. In the grocery sector, for example, ABF's brands like Kingsmill face stiff competition from established players such as Hovis and Warburtons, who frequently engage in aggressive pricing and promotional activities. This intense rivalry is further amplified by the presence of private label offerings from supermarkets, which often compete on price, and the growing influence of online grocery retailers, adding another layer of competitive pressure. The pursuit of market share and consumer loyalty necessitates continuous innovation and strategic marketing efforts from ABF and its competitors.

SSubstitutes Threaten

The price-performance trade-off for substitutes significantly impacts Associated British Foods (ABF). For example, in the sugar market, artificial sweeteners offer a similar sweetening effect at a potentially lower cost per unit of sweetness, though taste and perceived health benefits can vary.

In the broader food sector, ready-to-eat meals or meal kits present a substitute for traditional grocery shopping and home cooking, offering convenience that competes with the cost-effectiveness of buying raw ingredients. ABF's diverse portfolio, from Twinings tea to Kingsmill bread, faces competition from private label brands and other specialty producers who may offer comparable quality at lower price points.

The fashion segment, represented by ABF's Primark, contends with a wide array of fast-fashion retailers and online marketplaces, where consumers can often find trendy items at very competitive prices, even if the perceived quality or longevity differs.

Associated British Foods (ABF) faces moderate threat from substitutes, particularly in its grocery and sugar segments. For instance, consumers can readily switch between different brands of sugar or opt for alternative sweeteners, impacting ABF's sugar division. In 2024, the global sugar market experienced price volatility, with benchmark raw sugar prices fluctuating significantly, underscoring the price sensitivity of consumers and their propensity to seek cheaper alternatives if ABF's pricing becomes uncompetitive.

Associated British Foods (ABF) faces a moderate threat from substitutes, largely dependent on the specific segment. For instance, in the grocery sector, readily available private-label brands from competitors offer a direct substitute for ABF's branded products, impacting price sensitivity. In 2024, the UK grocery market saw continued growth in the discounter channel, which heavily relies on private labels, indicating a persistent substitute pressure.

Technological Advancements

Technological advancements pose a significant threat of substitutes for Associated British Foods (ABF). Innovations in food production, such as lab-grown meat or advanced plant-based alternatives, could offer consumers more sustainable or cost-effective options, directly competing with ABF's grocery divisions. For instance, the global plant-based food market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating a rising consumer preference for these alternatives.

In the apparel sector, advancements in textile technology and sustainable materials could lead to substitutes that are perceived as superior in terms of environmental impact or performance. Digital platforms offering virtual fashion or rental services also present a substitute for traditional clothing purchases, potentially impacting ABF's retail segments like Primark. The resale market for clothing, facilitated by technology, is also expanding rapidly, offering consumers alternatives to buying new items.

- Novel food production methods, such as precision fermentation and cellular agriculture, could disrupt traditional protein markets.

- Advanced materials science may yield textiles with enhanced properties, offering alternatives to conventional fabrics used in apparel.

- Digital solutions, including virtual try-ons and online rental platforms, are changing consumer behavior in fashion.

- The increasing consumer demand for sustainable and ethically sourced products is driving innovation in substitute offerings across ABF's diverse business units.

Changing Consumer Preferences

Changing consumer preferences pose a significant threat to Associated British Foods (ABF). Evolving tastes, particularly a growing demand for healthier and more sustainable options, can lead consumers to seek alternatives to ABF's core product offerings. For instance, the surge in plant-based diets directly substitutes traditional meat products, impacting ABF's grocery and ingredients segments. Similarly, increased environmental awareness drives demand for ethically sourced and eco-friendly fashion, potentially diverting consumers from brands within ABF's retail division, like Primark.

This shift is evident in market data. The global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to grow substantially. In fashion, the resale market is also booming, with reports indicating it could reach $350 billion by 2027, presenting a direct substitute for new clothing purchases. These trends highlight how evolving consumer values can erode demand for established products and brands.

- Health Consciousness: Growing consumer focus on wellness drives demand for low-sugar, low-fat, and natural ingredient products, potentially substituting conventional processed foods.

- Sustainability Concerns: Increased awareness of environmental impact encourages the adoption of sustainable fashion and ethically sourced food products, acting as alternatives to mass-produced goods.

- Dietary Shifts: The rise of veganism, vegetarianism, and flexitarianism directly challenges the market share of meat and dairy producers within ABF's portfolio.

- Ethical Sourcing: Consumers are increasingly scrutinizing supply chains, favoring brands with transparent and ethical sourcing practices over those perceived as less responsible.

Associated British Foods (ABF) faces a moderate threat from substitutes, particularly in its grocery and sugar segments. Consumers can readily switch between different brands of sugar or opt for alternative sweeteners, impacting ABF's sugar division. In 2024, the global sugar market experienced price volatility, with benchmark raw sugar prices fluctuating significantly, underscoring the price sensitivity of consumers and their propensity to seek cheaper alternatives if ABF's pricing becomes uncompetitive.

Entrants Threaten

Entering the food manufacturing, ingredients, or retail fashion sectors, where Associated British Foods (ABF) is active, demands substantial financial investment. For instance, establishing a modern food processing plant can easily cost tens of millions of dollars, factoring in machinery, technology, and regulatory compliance.

Building a robust distribution network, crucial for reaching consumers efficiently, adds another layer of significant capital expenditure. ABF's extensive operations suggest that a new entrant would need to invest heavily in logistics infrastructure, including warehouses and transportation fleets, potentially running into hundreds of millions.

Furthermore, setting up a retail presence, whether physical stores or a comprehensive e-commerce platform, requires considerable upfront capital for store fit-outs, inventory, and marketing. In 2024, the cost of securing prime retail locations and developing a strong brand presence presents a formidable financial hurdle for aspiring competitors.

Associated British Foods (ABF) significantly leverages economies of scale across its diverse operations. For instance, in its Sugar division, ABF's large-scale sugar production facilities allow for lower per-unit manufacturing costs. This cost advantage makes it incredibly difficult for new entrants to achieve comparable pricing, thereby deterring their entry into the market.

Newcomers face significant hurdles in securing shelf space in major supermarkets, a critical distribution channel for ABF's grocery brands like Kingsmill. Established players benefit from long-standing relationships with retailers, often involving slotting fees and promotional support that new entrants struggle to match. For instance, in 2024, the UK grocery market saw continued consolidation, making it even harder for smaller brands to gain visibility.

Brand Loyalty and Differentiation

Associated British Foods (ABF) benefits from significant brand loyalty across its diverse portfolio, particularly in its grocery segment. Brands like Kingsmill in the UK bread market and Twinings tea have established strong consumer trust, making it difficult for new entrants to gain traction without substantial investment in marketing and product development. This loyalty acts as a significant barrier, as new players must not only offer competitive pricing but also build comparable brand recognition and perceived quality.

Primark, ABF's fast-fashion retailer, also demonstrates robust brand loyalty, driven by its value proposition and trend-driven offerings. While the fast-fashion sector is competitive, Primark's ability to consistently deliver affordable, stylish clothing creates a dedicated customer base. For new entrants to challenge Primark, they would need to replicate this winning combination of price, style, and accessibility, a feat that typically requires considerable time and capital outlay to achieve.

The strength of ABF's brand loyalty is underscored by its consistent market share in key categories. For instance, in the UK, Kingsmill has historically held a significant share of the bread market, often exceeding 20%. Similarly, Twinings remains a leading brand in the premium tea segment. This established consumer preference means that new entrants face a steep uphill battle to capture market share, necessitating large marketing budgets and innovative strategies to disrupt existing loyalties.

- Brand Loyalty Strength: ABF's established brands like Kingsmill and Twinings enjoy high consumer trust, creating a barrier for new entrants.

- Primark's Appeal: Primark's success is built on a strong value proposition and trend responsiveness, fostering customer loyalty in the competitive fashion market.

- Market Share Dominance: In 2024, ABF's key brands maintained strong market positions, indicating the difficulty new competitors face in gaining significant market share.

- Investment Barrier: New entrants must commit substantial marketing funds and time to build brand recognition and overcome existing consumer loyalties.

Government Policy and Regulations

Government policies significantly shape the threat of new entrants for Associated British Foods. Stringent food safety standards, for example, require substantial investment in compliance and quality control, making it harder for smaller players to enter the market. In 2024, the UK's Food Standards Agency continued to enforce rigorous regulations across the food industry, impacting operational costs for all businesses, including potential new entrants.

Licensing requirements and labor laws, particularly for retail operations like those of ABF's subsidiaries, also act as barriers. Navigating these can be complex and costly, deterring those without established expertise or capital. For instance, changes in minimum wage laws or specific retail operating permits can add a layer of difficulty for nascent businesses aiming to compete with established firms.

- Food Safety Regulations: Strict adherence to evolving food safety standards, such as those mandated by the European Food Safety Authority (EFSA) and national bodies, necessitates significant capital expenditure on testing, traceability, and hygiene protocols.

- Environmental Standards: Compliance with environmental regulations, including waste management and emissions targets, adds operational costs and complexity for new food producers and retailers.

- Labor Laws: Adherence to labor laws, including minimum wage, working hours, and employee benefits, can increase the cost of labor, a key component in the retail and food manufacturing sectors.

The threat of new entrants for Associated British Foods (ABF) is moderate due to high capital requirements and established brand loyalty. Building new food processing plants or retail infrastructure demands tens of millions, while securing prime retail locations in 2024 remains costly. ABF's strong brands like Kingsmill and Twinings, coupled with Primark's value proposition, have cultivated significant customer trust, making it difficult for newcomers to gain market share without substantial marketing investment.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Associated British Foods leverages data from company annual reports, investor presentations, and financial databases like Bloomberg and Refinitiv. We also incorporate insights from industry-specific market research reports and trade publications to understand competitive dynamics.