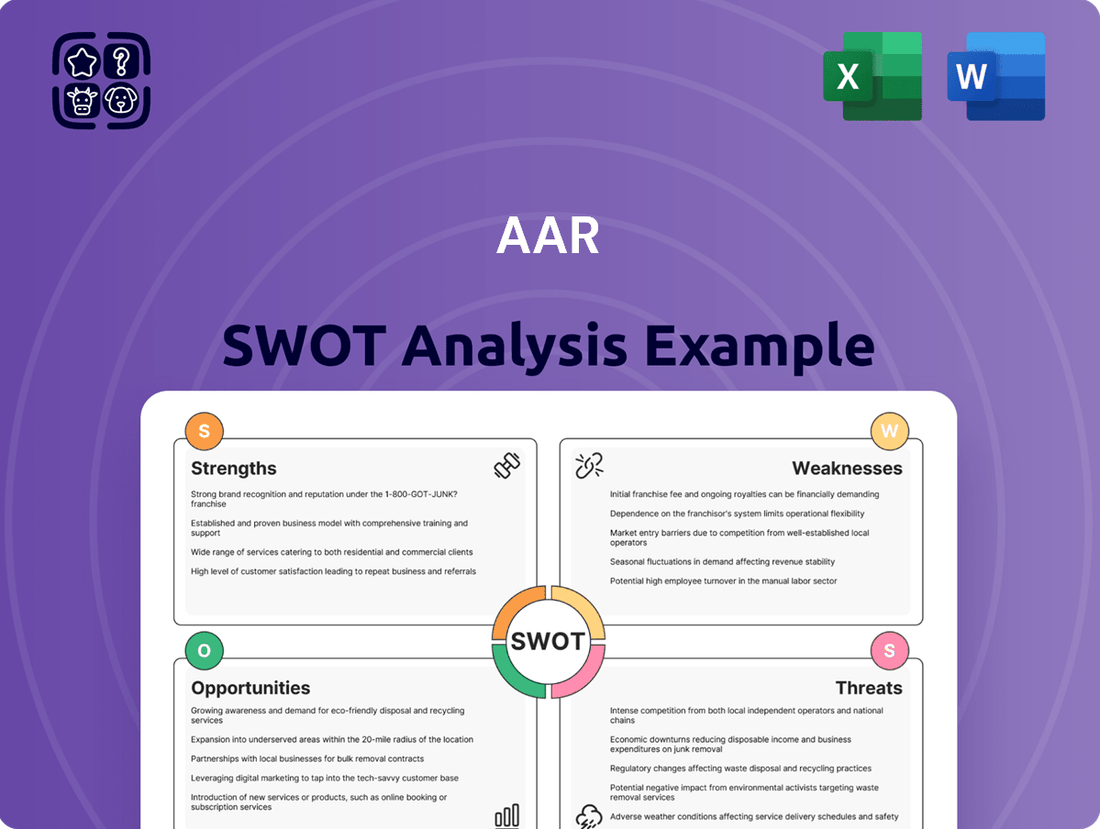

AAR SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

Our AAR SWOT analysis offers a compelling glimpse into their strategic landscape, highlighting key advantages and potential challenges. Ready to delve deeper and uncover the full picture?

Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your own strategic planning and decision-making.

Strengths

AAR Corp boasts a comprehensive service portfolio encompassing MRO, supply chain management, logistics, parts distribution, manufacturing, and engineering solutions. This extensive offering serves commercial airlines, government, and defense clients globally, creating a diversified revenue base. For instance, in fiscal year 2024, AAR reported a significant increase in its aftermarket segment, driven by demand for its integrated support solutions.

AAR stands as a dominant force in the global aviation aftermarket, a testament to its leadership and extensive reach across more than 20 nations. This established presence, dating back to 1955, has cultivated a robust market position.

The company's reputation is further solidified by its inclusion as one of America's Most Responsible Companies 2025 by Newsweek, highlighting a commitment to Environmental, Social, and Governance (ESG) principles. This positive brand image is a powerful asset for attracting new business and fostering loyalty among its existing client base.

AAR has strategically bolstered its service offerings and global presence through key acquisitions. A prime example is the acquisition of Triumph Group's Product Support business, which significantly enhanced AAR's component repair capabilities and proprietary technologies, especially in the rapidly expanding Asia-Pacific market. This move directly contributed to a substantial increase in their service portfolio.

Furthermore, AAR actively cultivates strategic partnerships to broaden its market reach and service depth. The joint venture with Air France Industries KLM Engineering & Maintenance in the Asia-Pacific region is a testament to this strategy, opening new avenues for growth. Additionally, their extended agreement with FTAI Aviation for CFM56 engine material reinforces their commitment to providing comprehensive solutions to their clientele.

Resilient Business Model in a Growing Market

AAR's business model is proving exceptionally resilient, especially within the expanding aviation aftermarket. The global fleet of aircraft is aging, meaning more planes require maintenance and parts, a trend amplified by higher flight schedules and persistent delays in new aircraft production. This scenario directly benefits AAR, as airlines are incentivized to keep older aircraft flying longer, driving up the demand for essential maintenance, repair, and overhaul (MRO) services.

The aviation MRO market itself is a picture of robust growth, with projections indicating continued strong expansion. For instance, the global aviation MRO market was valued at approximately $90 billion in 2023 and is anticipated to reach over $120 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 6%. This sustained demand underscores AAR's strategic positioning to capitalize on these favorable market dynamics.

- Aging Global Aircraft Fleet: An increasing number of aircraft are exceeding their initial service lives, necessitating more frequent and extensive maintenance.

- Increased Aircraft Utilization: Higher flight hours per aircraft translate directly to accelerated wear and tear, boosting demand for MRO services.

- New Aircraft Delivery Delays: Supply chain issues and production challenges for new aircraft mean airlines must extend the operational life of their existing fleets.

- Projected Market Growth: The aviation MRO sector is forecast to experience consistent growth, with market size expected to exceed $120 billion by 2028.

Commitment to Sustainability and Digital Innovation

AAR's dedication to sustainability is evident in its 2024 Sustainability Report, outlining concrete steps in waste reduction and energy efficiency. This commitment is further bolstered by strategic investments in digital innovation, such as the Trax software.

The selection of Trax by Delta TechOps to upgrade maintenance and engineering systems underscores AAR's leadership in digital transformation within the MRO industry. This technological advancement is crucial for enhancing operational efficiency and securing new business opportunities.

- Sustainability Initiatives: AAR's 2024 report details progress in waste reduction and energy efficiency.

- Digital Transformation: Investment in Trax software for modernizing MRO systems.

- Industry Recognition: Delta TechOps selected Trax, highlighting AAR's technological edge.

- Efficiency Gains: Digital solutions are designed to improve operational performance and attract clients.

AAR's comprehensive service portfolio, covering MRO, supply chain, and engineering, provides a diversified revenue stream. Its strong global presence, established over decades, underpins a robust market position. Furthermore, AAR's commitment to ESG principles, recognized by Newsweek, enhances its brand reputation and client loyalty. Strategic acquisitions and partnerships, like the one with Triumph Group, have significantly expanded its capabilities and market reach.

The company's business model is well-positioned to capitalize on the growing aviation aftermarket, driven by an aging global fleet and production delays for new aircraft. This trend is further supported by the overall expansion of the aviation MRO market, which was valued at approximately $90 billion in 2023 and is projected to exceed $120 billion by 2028. AAR's investments in digital transformation, exemplified by the Trax software adoption by Delta TechOps, enhance operational efficiency and attract new business.

| Metric | Value | Year | Source |

|---|---|---|---|

| Global Aviation MRO Market Value | ~$90 billion | 2023 | Industry Reports |

| Projected Global Aviation MRO Market Value | >$120 billion | 2028 | Industry Reports |

| AAR Fiscal Year 2024 Performance | Significant increase in aftermarket segment | FY2024 | AAR Financial Reports |

| AAR Market Presence | Over 20 nations | Ongoing | AAR Corporate Information |

What is included in the product

Analyzes AAR’s competitive position by examining its internal strengths and weaknesses alongside external opportunities and threats.

Simplifies complex strategic thinking by organizing key internal and external factors into a clear, actionable framework.

Weaknesses

AAR, like much of the aviation industry, remains vulnerable to supply chain disruptions. These ongoing issues, particularly concerning spare parts, directly translate into longer repair times and increased operational expenses. For instance, in early 2024, many MRO providers reported an average increase of 20% in lead times for critical components, a challenge AAR must navigate.

AAR, like many in the Maintenance, Repair, and Overhaul (MRO) sector, faces significant labor challenges. The industry is experiencing a critical shortage of skilled technicians and engineers, exacerbated by an aging workforce and difficulties in attracting new talent. This scarcity directly translates into rising labor costs due to increased wage demands, potentially impacting AAR's profitability and its ability to scale operations efficiently to meet market demand.

AAR's fortunes are intrinsically linked to the global aviation sector's well-being. Economic slowdowns, geopolitical tensions, or unexpected global health events can significantly disrupt air travel, directly impacting the demand for AAR's maintenance, repair, and overhaul (MRO) services.

While the aviation industry has shown resilience and recovery following the COVID-19 pandemic, with air traffic returning to near pre-pandemic levels in many regions, the sector remains susceptible to external shocks. For instance, the International Air Transport Association (IATA) projected global airline industry net profits to reach $25.7 billion in 2024, a notable improvement but still highlighting the industry's sensitivity to economic fluctuations.

Intense Competition

The aviation aftermarket is a crowded arena, with numerous Maintenance, Repair, and Overhaul (MRO) providers, original equipment manufacturers (OEMs), and airlines themselves offering in-house repair capabilities. This intense competition can exert downward pressure on pricing and potentially erode market share for players like AAR. For instance, in the fiscal year ending May 31, 2024, AAR reported total sales of $3.4 billion, a figure achieved within a market segment where competitors constantly vie for contracts and customer loyalty.

Maintaining a competitive edge in this environment demands relentless innovation and clear differentiation. AAR must continually invest in new technologies, expand its service offerings, and optimize its operational efficiency to stand out. The ability to adapt to evolving customer needs and regulatory changes is paramount. This dynamic landscape means that even a leading position, such as AAR's, requires constant vigilance and strategic adjustments to counter competitive threats and secure future growth opportunities.

Integration Risks of Acquisitions

While acquisitions can accelerate growth, they introduce significant integration risks that AAR must navigate carefully. The successful assimilation of Triumph Group's Product Support business, a move aimed at bolstering AAR's market position, hinges on effective operational and cultural integration to unlock projected synergies. Failure in this process could result in unforeseen expenses and a delay in realizing the strategic advantages of the acquisition.

Key integration challenges for AAR include:

- Systems and Process Alignment: Merging disparate IT systems, supply chains, and operational workflows from Triumph Group requires meticulous planning and execution to prevent disruptions in service delivery and maintain efficiency.

- Cultural Integration: Bridging any cultural differences between AAR and the acquired Triumph Group business is crucial for employee morale, retention, and collaborative success.

- Synergy Realization: Achieving the anticipated cost savings and revenue enhancements from the acquisition depends on the smooth integration of operations and the effective leveraging of combined capabilities.

- Financial Performance Impact: Any integration missteps could negatively impact AAR's financial performance in the short to medium term, potentially affecting profitability and shareholder value.

AAR's reliance on the broader aviation industry makes it susceptible to economic downturns and geopolitical instability, which can curb air travel and thus demand for MRO services. For instance, while the International Air Transport Association projected global airline net profits of $25.7 billion for 2024, this figure underscores the sector's sensitivity to economic shifts.

The company operates in a highly competitive MRO market, facing pressure from OEMs and other aftermarket providers, which can impact pricing and market share. With $3.4 billion in sales for the fiscal year ending May 31, 2024, AAR competes in a landscape demanding constant innovation and differentiation to maintain its position.

Acquisitions, while strategic, introduce integration risks. The successful assimilation of Triumph Group's Product Support business, for example, depends on aligning systems, processes, and cultures to realize projected synergies and avoid negative financial impacts.

Full Version Awaits

AAR SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global aviation Maintenance, Repair, and Overhaul (MRO) market is experiencing robust expansion, with projections indicating continued strong growth through 2030. This upward trend is fueled by a growing global airline fleet, with over 23,000 aircraft expected by 2043, and increased aircraft utilization rates post-pandemic. Furthermore, the rising average age of aircraft in operation, many of which are now over 15 years old, necessitates more frequent and comprehensive MRO services.

This sustained demand presents a substantial opportunity for AAR to solidify its market position and broaden its service portfolio. As airlines focus on fleet modernization and efficiency, the need for specialized MRO solutions, including airframe, engine, and component services, is paramount. AAR can leverage this demand by expanding its capabilities and service networks to capture a larger share of this lucrative market.

The MRO sector is rapidly embracing digital tools like AI for proactive maintenance and advanced data analytics, creating a fertile ground for innovation. AAR's strategic investment in its Trax software, coupled with a keen focus on leveraging data, positions it to significantly boost operational efficiency and introduce cutting-edge solutions.

This technological push allows AAR to differentiate itself by offering superior, data-driven MRO services. By optimizing data utilization, AAR can anticipate maintenance needs more accurately, reduce downtime for its clients, and ultimately provide a more valuable and integrated service offering in the evolving aerospace market.

Emerging markets, especially in Asia-Pacific, the Middle East, and Latin America, are seeing a significant surge in air travel and fleet growth. This trend directly translates into a greater demand for Maintenance, Repair, and Overhaul (MRO) services. For instance, the International Air Transport Association (IATA) projected that Asia-Pacific would be the largest market for air travel by 2024, with traffic expected to double from pre-pandemic levels.

AAR is well-positioned to capitalize on this burgeoning demand. With its established global footprint and existing strategic alliances, the company can intensify its efforts to penetrate these high-growth territories. This strategic focus allows AAR to tap into the escalating need for reliable aviation aftermarket solutions, thereby expanding its market share and revenue streams.

Increased Outsourcing by Airlines

Airlines are increasingly turning to external specialists for maintenance, repair, and overhaul (MRO) services. This strategic shift allows them to trim operational expenses and concentrate on their primary business of flying passengers and cargo. For independent MRO providers like AAR, this trend translates into a prime opportunity to land new agreements and broaden their client portfolio by delivering efficient and budget-friendly solutions.

The global aviation MRO market is projected to experience robust growth, with estimates suggesting it could reach over $115 billion by 2027, up from approximately $85 billion in 2022. This expansion is largely driven by the increasing complexity of aircraft, aging fleets, and the aforementioned outsourcing trend.

- Cost Reduction Focus: Airlines are actively seeking ways to lower their operating costs, making outsourcing MRO a financially attractive option.

- Core Competency Alignment: By outsourcing non-core functions like maintenance, airlines can dedicate more resources to customer service, route development, and operational efficiency.

- Market Growth Potential: The expanding global aviation sector, particularly in emerging markets, fuels demand for MRO services, creating a larger pool of potential clients.

- Specialized Expertise: Independent MRO providers often possess specialized skills and technologies that can be more cost-effective for airlines than maintaining in-house capabilities.

Sustainability Initiatives and Green MRO

The aviation sector's growing commitment to sustainability presents a significant opportunity for AAR. Demand for professionals skilled in eco-friendly maintenance and sustainable aviation fuel (SAF) integration is on the rise, creating new service avenues. For instance, by 2025, the International Air Transport Association (IATA) projects SAF production to reach 10 billion liters, highlighting the industry's shift.

AAR's proactive sustainability efforts, including its expanded recycling programs and solar panel installations, strategically position the company to capitalize on this trend. These initiatives not only reduce operational costs but also appeal to an increasing number of environmentally conscious airlines and customers seeking partners aligned with their ESG goals. AAR's 2024 sustainability report highlighted a 15% increase in recycled materials compared to the previous year.

This focus on green MRO (Maintenance, Repair, and Overhaul) allows AAR to differentiate itself in the market. The company can leverage its expertise to offer specialized services that support airlines in meeting their own sustainability targets, potentially leading to new contracts and enhanced brand reputation.

- Growing Demand for Green MRO: The aviation industry is increasingly prioritizing environmentally responsible maintenance practices.

- AAR's Sustainability Investments: Company initiatives like enhanced recycling and solar power adoption align with market trends.

- Attracting Eco-Conscious Clients: AAR's sustainability focus can serve as a key differentiator to attract environmentally aware customers.

The global MRO market is expanding, with demand driven by a growing fleet and older aircraft requiring more maintenance. AAR can capitalize on this by expanding its service offerings and network. The increasing adoption of digital tools like AI in MRO presents an opportunity for AAR to enhance efficiency and offer innovative solutions, leveraging its Trax software and data analytics capabilities to provide superior, data-driven services and reduce client downtime.

Emerging markets, particularly in Asia-Pacific, are experiencing significant aviation growth, creating a substantial demand for MRO services. IATA projected Asia-Pacific to be the largest air travel market by 2024, with traffic doubling pre-pandemic levels. AAR, with its global presence, is well-positioned to expand into these high-growth regions, securing new contracts and increasing market share.

Airlines are increasingly outsourcing MRO to focus on core operations and reduce costs. The global MRO market was valued at approximately $85 billion in 2022 and is projected to exceed $115 billion by 2027. This trend benefits independent MRO providers like AAR, offering opportunities to gain new clients by providing cost-effective and specialized maintenance solutions.

The aviation industry's push towards sustainability creates new service avenues for AAR. With IATA projecting SAF production to reach 10 billion liters by 2025, demand for eco-friendly maintenance is rising. AAR's sustainability initiatives, including a 15% increase in recycled materials in 2024, align with this trend, attracting environmentally conscious clients and enhancing its brand reputation.

Threats

AAR is still navigating significant supply chain challenges, with spare part shortages and lengthy delivery times remaining a persistent issue in the aviation sector. These ongoing disruptions directly translate to higher operational expenses for AAR, hindering its capacity to meet repair deadlines and potentially impacting client satisfaction.

The aviation industry faces a significant and worsening shortage of skilled mechanics and engineers, a trend expected to intensify through 2025. This scarcity directly impacts AAR by driving up wages as companies compete for limited talent. For instance, a 2024 industry report highlighted that the average salary for aviation mechanics saw a 7% increase year-over-year, a figure likely to climb further.

This escalating labor cost puts pressure on AAR's operational expenses, potentially squeezing profit margins if not effectively managed. The difficulty in recruiting and retaining qualified personnel also poses a risk to AAR's workforce capacity, potentially hindering its ability to meet service demands and undertake new projects efficiently.

Global economic downturns, such as the potential slowdown anticipated in 2024 due to persistent inflation and interest rate hikes, pose a significant threat to AAR. Reduced consumer spending power directly impacts air travel demand, a key driver for AAR's aftermarket services.

Geopolitical instability, including ongoing conflicts and trade disputes, can further disrupt supply chains and increase operational costs for AAR. For instance, the impact of the Russia-Ukraine conflict on global energy prices and supply routes highlights these risks.

These external pressures can lead to a decrease in demand for aircraft maintenance, repair, and overhaul (MRO) services, potentially resulting in contract delays or cancellations for AAR, and impacting its projected revenue growth for the 2024-2025 fiscal year.

Technological Disruption and Rapid Innovation

AAR faces a significant threat from technological disruption and the relentless pace of innovation in the aviation sector. If AAR cannot adapt to new aircraft technologies, like the increasing adoption of sustainable aviation fuels (SAFs) and the development of advanced air mobility (AAM) vehicles, its existing service offerings could become less relevant.

Failure to invest in and integrate emerging technologies, such as AI-driven predictive maintenance or advanced composite repair techniques, could lead to a competitive disadvantage. For instance, the market for maintaining next-generation aircraft with novel propulsion systems will require specialized skills and equipment that AAR must proactively develop.

The company's ability to stay ahead of these changes is crucial. In 2024, the aviation industry is seeing substantial R&D investment in areas like electric and hybrid-electric propulsion, which will necessitate new MRO capabilities. AAR's strategic response to these advancements will directly impact its long-term market position.

- Technological Obsolescence: AAR risks its current MRO capabilities becoming outdated as new aircraft designs and materials emerge.

- Investment Lag: Insufficient investment in R&D for new technologies like advanced air mobility could leave AAR behind competitors.

- Skills Gap: The need for technicians trained in new propulsion systems and digital maintenance platforms presents a potential workforce challenge.

- Market Share Erosion: Competitors who more effectively adopt new technologies could capture market share from AAR.

Regulatory and Compliance Changes

The aviation sector faces ongoing shifts in safety and compliance mandates. For AAR, adapting to new regulations, such as updated emissions standards or evolving airworthiness directives, can introduce significant operational costs and potential delays. For instance, the Federal Aviation Administration (FAA) continuously updates its regulations, impacting everything from maintenance procedures to pilot training requirements, which directly affect service providers like AAR.

Failure to keep pace with these evolving standards can result in substantial penalties, operational interruptions, and a tarnished brand image. AAR's commitment to compliance is paramount, as demonstrated by its significant investments in training and technology to meet these rigorous requirements. Staying ahead of regulatory changes, such as those concerning cybersecurity or sustainable aviation fuels, is a critical challenge.

Key areas of potential impact include:

- Increased operational costs due to new compliance measures.

- Potential for service disruptions if regulatory requirements are not met promptly.

- Reputational risk if AAR is perceived as lagging in adherence to safety and environmental standards.

AAR is susceptible to global economic slowdowns, which can reduce air travel demand and, consequently, the need for MRO services. Persistent inflation and rising interest rates, factors contributing to a potential economic downturn in 2024, directly impact consumer spending and corporate travel budgets.

Geopolitical instability, including ongoing conflicts and trade disputes, poses a significant threat by disrupting supply chains and inflating operational costs. The war in Ukraine, for example, has demonstrably impacted global energy prices and logistics, increasing the cost of doing business for companies like AAR.

These external economic and geopolitical factors can lead to reduced demand for aircraft maintenance, repair, and overhaul (MRO) services, potentially causing contract delays or cancellations. This directly affects AAR's revenue projections for the 2024-2025 fiscal period.

| Economic Factor | Potential Impact on AAR | Data Point (2024 Projection) |

|---|---|---|

| Global GDP Growth Slowdown | Reduced air travel demand, impacting MRO services | IMF projected global growth of 3.2% for 2024, a slight decrease from 2023. |

| Inflationary Pressures | Increased operational costs (parts, labor, energy) | OECD average inflation projected at 5.1% for 2024. |

| Geopolitical Instability | Supply chain disruptions, higher logistics costs | Continued volatility in energy markets and trade routes. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from AAR's official financial reports, comprehensive market research, and expert industry analyses to provide a thorough and insightful SWOT evaluation.