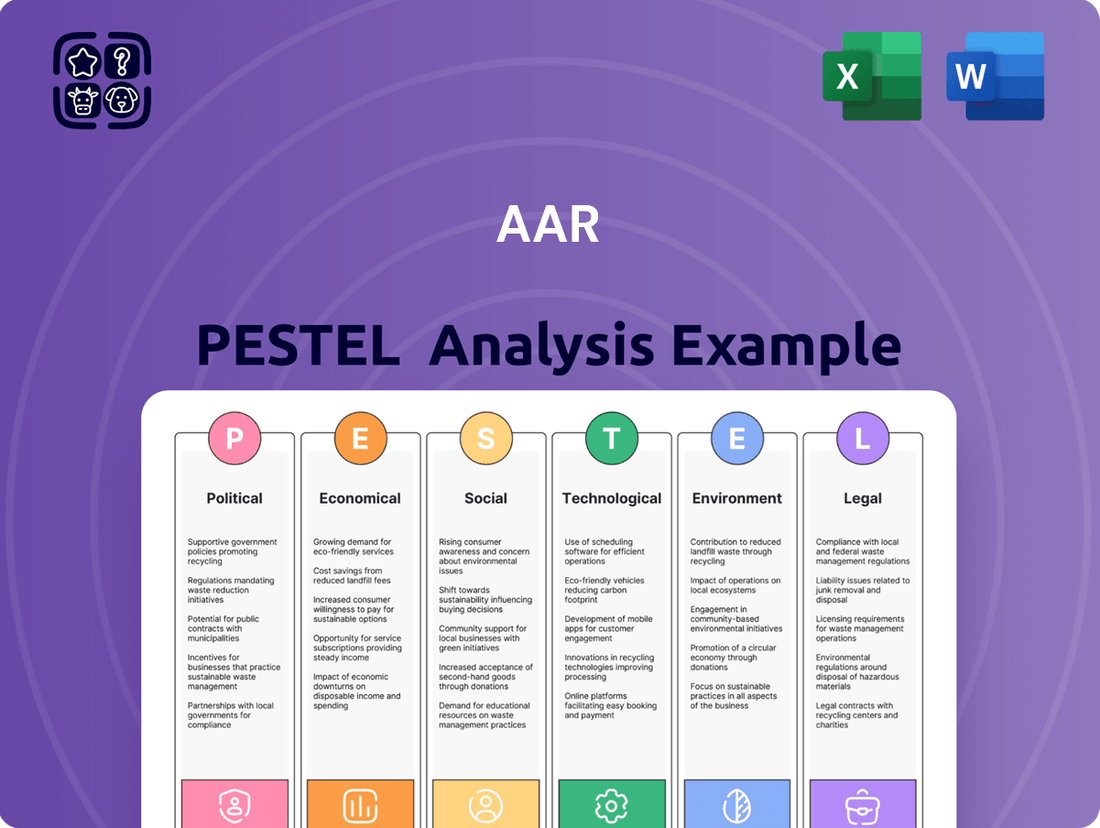

AAR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

Unlock the critical external factors shaping AAR's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and how they influence the company's strategic direction. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now for an unparalleled strategic advantage.

Political factors

AAR Corp's revenue is heavily influenced by government contracts, especially those with the U.S. Navy and other defense agencies. These agreements are crucial for their maintenance, repair, and overhaul (MRO) services and parts distribution for military aircraft.

Rising global defense budgets and ongoing geopolitical tensions are expected to boost demand for AAR's services. For instance, the U.S. defense budget request for fiscal year 2025 specifically targets investments in the defense industrial base, a move that directly supports AAR's government-focused operations and future contract opportunities.

Changes in aviation regulations, both domestic and international, directly impact AAR's operations. Stricter environmental standards from bodies like ICAO and the EU are pushing for more sustainable Maintenance, Repair, and Overhaul (MRO) practices and component upgrades. For instance, the EU's Green Deal initiatives are increasingly influencing fleet modernization and MRO service demands.

Furthermore, evolving safety standards for new aviation technologies, such as Urban Air Mobility (UAM) and electric aircraft, necessitate AAR's adaptation in services and certifications. As of early 2024, regulatory frameworks for UAM are still under development globally, presenting both challenges and opportunities for MRO providers like AAR to establish early expertise.

Global trade policies significantly influence AAR's operations. For instance, the United States International Trade Commission reported that in 2023, tariffs on imported goods, particularly those impacting aerospace components, added an estimated $1.5 billion in costs to U.S. businesses.

These tariffs directly affect AAR's supply chain by increasing the cost of certified replacement parts. This escalation in expenses can lead to higher prices for maintenance, repair, and overhaul (MRO) services and affect the availability of crucial components for distribution.

Disruptions stemming from trade disputes, such as those seen between major economies in 2024, can create uncertainty. This uncertainty may force AAR to seek alternative suppliers, potentially impacting lead times and overall operational efficiency for its parts distribution and MRO segments.

Political Stability and Geopolitical Tensions

Geopolitical tensions globally are driving increased defense spending, a clear positive for AAR's defense sector. For instance, the U.S. Department of Defense's budget request for fiscal year 2025 includes significant allocations for advanced defense systems and readiness, reflecting this trend.

However, political instability in key regions poses a dual threat to AAR's commercial operations. Disruptions to air travel due to conflicts can dampen demand for commercial Maintenance, Repair, and Overhaul (MRO) services and logistics. The ongoing conflict in Eastern Europe, for example, has continued to impact global air cargo routes and passenger demand in affected areas.

- Increased Defense Budgets: Global defense spending is projected to continue its upward trajectory, with NATO members committing to higher defense expenditures, benefiting AAR's defense segment.

- Supply Chain Vulnerabilities: Geopolitical events, such as trade disputes and regional conflicts, highlight the fragility of aerospace supply chains, necessitating greater resilience efforts by companies like AAR.

- Impact on Commercial Aviation: Political instability can lead to flight cancellations, rerouting, and reduced passenger confidence, directly affecting the demand for commercial MRO and parts.

- Focus on Resilience: The aerospace and defense industry is actively investing in strategies to mitigate supply chain risks, a crucial consideration for AAR's operational planning and service delivery.

Government Support for Aviation Industry

Government initiatives play a crucial role in shaping the aviation landscape, directly impacting companies like AAR. For instance, in response to the COVID-19 pandemic, governments worldwide provided substantial aid packages to airlines and related industries. The CARES Act in the United States, enacted in 2020, allocated billions in relief to the aviation sector, including grants and loans for airlines, which indirectly supports MRO (Maintenance, Repair, and Overhaul) providers like AAR.

Looking ahead, government support for infrastructure development and modernization remains a key factor. Many nations are investing in upgrading airports and air traffic control systems to handle increased capacity and adopt new technologies. This focus on infrastructure can translate into greater demand for AAR's services in maintaining and upgrading aircraft fleets. For example, the Infrastructure Investment and Jobs Act in the US includes provisions for airport improvements, potentially boosting the aviation ecosystem.

Furthermore, government programs addressing workforce development in aviation are vital. As the industry faces potential shortages of skilled technicians and engineers, government-backed training initiatives and apprenticeships can help secure a pipeline of talent. This support is critical for AAR's operational capacity and future growth. In 2024, discussions around such programs are ongoing, aiming to bolster the skilled workforce needed for the evolving aviation sector.

Key government support areas impacting AAR include:

- Financial relief packages during economic downturns, such as the CARES Act in the US.

- Investments in airport infrastructure and modernization projects.

- Programs focused on aviation workforce development and training.

- Potential incentives for fleet modernization and sustainable aviation technologies.

Government policies heavily influence AAR's defense contracts, with fiscal year 2025 defense budget requests indicating continued investment in areas supporting AAR's MRO and parts distribution. Geopolitical events are also driving increased defense spending globally, benefiting AAR's defense segment.

Regulatory changes, particularly in aviation safety and environmental standards from bodies like ICAO and the EU, directly impact AAR's operational practices and service demands, pushing for more sustainable MRO solutions.

Trade policies and tariffs on imported aerospace components, as highlighted by the USITC's 2023 report, directly affect AAR's supply chain costs and component availability.

Political instability in key regions can disrupt commercial aviation demand for MRO services and logistics, as seen with ongoing conflicts affecting air cargo and passenger travel.

| Factor | Impact on AAR | Supporting Data/Trend (2024-2025) |

| Defense Spending | Increased demand for MRO and parts for military aircraft. | US FY2025 defense budget request emphasizes readiness and advanced systems. NATO members increasing defense expenditures. |

| Aviation Regulations | Need for adaptation to new safety and environmental standards. | EU Green Deal influencing MRO practices; UAM regulations still developing globally. |

| Trade Policies | Increased supply chain costs and potential component shortages. | Tariffs on imported aerospace components added an estimated $1.5 billion in costs to U.S. businesses in 2023. |

| Geopolitical Instability | Reduced demand for commercial MRO due to travel disruptions; increased defense demand. | Ongoing conflicts impacting global air cargo and passenger demand in affected regions. |

What is included in the product

This comprehensive analysis examines the external macro-environmental factors influencing the AAR across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and data-driven recommendations to help stakeholders navigate market complexities and capitalize on emerging opportunities.

AAR PESTLE Analysis offers a structured framework to identify and mitigate potential external threats, thereby reducing uncertainty and anxiety in strategic decision-making.

Economic factors

The financial health of the global airline sector is a critical driver for AAR's business. For 2025, the industry anticipates a net profit of approximately $36 billion, a modest increase that signals continued, albeit cautious, recovery. This profitability directly correlates with airline spending on maintenance, repair, and overhaul (MRO) services, as well as parts.

Passenger traffic is a key indicator of airline demand, and projections for 2025 are strong, with an estimated 5.2 billion passengers expected to fly. This surge in travel underscores a healthy appetite for air transport, which in turn fuels the need for AAR's essential services to keep fleets operational and safe.

The aviation Maintenance, Repair, and Overhaul (MRO) market is on a significant upswing, with projections indicating it will reach $82.2 billion by 2025. This robust expansion is fueled by a steady compound annual growth rate of 6.2%.

Several key economic drivers are propelling this growth. The increasing size of global aircraft fleets, coupled with the necessity for more frequent upkeep on aging aircraft, creates a consistent demand for MRO services.

Furthermore, a notable trend towards airlines outsourcing their MRO needs to specialized third-party providers is a major contributor. Companies like AAR, a prominent player in the MRO sector, are strategically positioned to benefit from this expanding market opportunity.

Persistent supply chain disruptions, including part shortages and extended lead times for critical aerospace components, continue to be a significant hurdle. For instance, in 2024, the International Air Transport Association (IATA) highlighted ongoing challenges in securing sufficient new aircraft parts, impacting both manufacturers and maintenance providers.

These disruptions directly influence the demand for Maintenance, Repair, and Overhaul (MRO) services, as airlines seek to maximize the lifespan of their existing fleets due to delayed new aircraft deliveries. This trend is expected to continue through 2025, benefiting companies like AAR that offer comprehensive MRO solutions.

However, these same supply chain issues also translate to increased operational costs for AAR, affecting its ability to procure necessary parts efficiently and potentially impacting profitability if these costs cannot be fully passed on to customers.

Fuel Costs and Operating Expenses

Fluctuations in jet fuel prices are a major driver of airline operating expenses, directly affecting profitability and capital investment decisions, including MRO spending. While projections suggest average jet fuel prices might be lower in 2025 than in 2024, these costs remain a substantial portion of an airline's budget, necessitating a continued focus on cost control.

The airline industry's sensitivity to fuel costs means that even with anticipated price moderation, airlines will likely maintain stringent cost management strategies. This focus on efficiency can influence how much they allocate to maintenance, repair, and overhaul (MRO) activities, potentially favoring cost-effective solutions or delaying non-essential upgrades.

- Jet fuel costs represent a significant percentage of an airline's total operating expenses.

- Projections indicate a potential decrease in average jet fuel prices for 2025 compared to 2024.

- Airlines are expected to continue prioritizing tight cost control measures, impacting MRO investment decisions.

Investment in Aerospace and Defense

Global investment in aerospace and defense is on an upward trajectory, driven by both robust commercial aviation demand and increasing defense spending worldwide. For AAR, this translates into significant growth potential as governments and companies inject capital into modernizing fleets and enhancing defense capabilities. For instance, the U.S. Department of Defense's budget request for fiscal year 2025 includes substantial funding for aircraft procurement and modernization, directly benefiting MRO providers like AAR.

This heightened investment environment specifically targets the strengthening of the defense industrial base, encouraging innovation and the adoption of cutting-edge technologies. The integration of artificial intelligence (AI) into supply chain management is a key focus, aiming to boost efficiency and reduce costs. AAR's ability to leverage these trends, particularly in areas like advanced parts distribution and sophisticated maintenance, repair, and overhaul (MRO) services, positions it to secure more lucrative contracts.

- Increased Defense Budgets: Global defense spending is projected to reach $2.4 trillion in 2024, a rise that stimulates demand for aerospace and defense services.

- Commercial Aviation Growth: The International Air Transport Association (IATA) forecasts global air passenger traffic to reach 4.7 billion in 2024, up from 4.3 billion in 2023, driving demand for MRO.

- Technological Integration: Investments in AI and digital solutions for supply chain optimization are becoming critical for efficiency, with companies like AAR investing in these areas.

- Strategic Investments: Governments are prioritizing investments in their domestic defense industrial bases, creating opportunities for local MRO and parts suppliers.

Economic factors significantly shape AAR's operating environment, with airline profitability directly influencing demand for MRO services. The global airline industry is projected to achieve a net profit of around $36 billion in 2025, indicating a positive, albeit measured, recovery and sustained need for fleet upkeep. This economic climate, alongside a projected 5.2 billion passengers in 2025, underscores the demand for AAR's core services.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on AAR |

|---|---|---|---|

| Global Airline Net Profit | Not specified, but recovery ongoing | ~$36 billion | Higher profitability supports MRO spending. |

| Global Passenger Traffic | 4.7 billion | 5.2 billion | Increased travel drives demand for operational aircraft. |

| MRO Market Size | ~$77.4 billion (estimated) | ~$82.2 billion | Significant market growth presents expansion opportunities. |

| Jet Fuel Price Trend | Volatile, but potentially moderating | Potential decrease from 2024 averages | Lower fuel costs can improve airline margins, but cost control persists. |

| Global Defense Spending | ~$2.4 trillion | Continued growth expected | Increased defense budgets boost demand for AAR's defense-related services. |

What You See Is What You Get

AAR PESTLE Analysis

The AAR PESTLE analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting AAR.

The content and structure shown in the preview is the same document you’ll download after payment, providing a detailed and actionable PESTLE analysis for AAR.

Sociological factors

The aviation sector, including Maintenance, Repair, and Overhaul (MRO) operations, is grappling with a pronounced shortage of skilled workers, especially aircraft mechanics and pilots. This critical deficit is partly due to an aging workforce approaching retirement and insufficient new talent entering the field.

This ongoing workforce gap presents considerable hurdles for companies like AAR in securing and retaining the necessary qualified personnel. For instance, the U.S. Bureau of Labor Statistics projected a 12% growth for aircraft mechanics and technicians between 2022 and 2032, faster than the average for all occupations, highlighting the demand.

In response, the industry is actively pursuing strategies to draw in and develop new talent. AAR, therefore, may need to bolster its investments in comprehensive training programs and offer more competitive compensation packages to attract and keep its essential workforce.

The post-pandemic era has seen a significant resurgence in air travel demand, fueled by increased disposable incomes and a strong desire for international tourism. This rebound directly translates into a greater need for aircraft maintenance, repair, and overhaul (MRO) services, benefiting companies like AAR.

For AAR, this surge in passenger numbers and the subsequent increase in flight frequencies are positive indicators for its commercial MRO and parts distribution segments. As airlines operate more flights, the wear and tear on aircraft naturally increase, leading to higher demand for maintenance and replacement parts.

In 2023, global air passenger traffic reached 94% of pre-pandemic levels, with projections for 2024 indicating a full recovery and even surpassing 2019 figures. This trend suggests a sustained demand for AAR's services as airlines aim to expand their fleets and operational capacity.

The public and regulatory bodies place an immense emphasis on aviation safety and reliability, making it a non-negotiable aspect of air travel. This societal expectation directly influences the demand for robust maintenance, repair, and overhaul (MRO) services.

AAR, as a key player in the MRO sector, is instrumental in upholding these standards, ensuring aircraft are airworthy and safe for operation. This commitment to safety is not just a regulatory requirement but a fundamental driver of customer trust and loyalty.

For instance, the Federal Aviation Administration (FAA) reported in 2023 that the U.S. airline industry maintained a strong safety record, with a significant portion of flights operating without incident. This statistic underscores the public's reliance on and expectation of such performance, directly benefiting companies like AAR that prioritize meticulous maintenance.

This societal focus on safety translates into a competitive advantage for experienced MRO providers like AAR, as airlines are more likely to partner with those demonstrating a proven track record of adherence to rigorous safety protocols and delivering exceptional reliability.

Impact of Digitalization on Workforce Skills

The aviation sector's rapid embrace of digitalization, seen in the shift to digital maintenance records and predictive analytics, is fundamentally reshaping skill requirements. AAR's workforce must acquire proficiency in data analysis, digital systems management, and cybersecurity to effectively utilize these advancements.

To address this evolving landscape, AAR is investing in continuous training and upskilling initiatives. For instance, in 2024, AAR reported a significant increase in its training budget allocation, with a specific focus on digital competencies, aiming to ensure its employees can operate and leverage new digital platforms efficiently.

- Digital Skill Gap: A growing need for employees proficient in data analytics, AI, and cloud computing within aviation maintenance operations.

- Upskilling Investment: AAR's commitment to ongoing training programs to bridge the digital skill gap and enhance workforce adaptability.

- Predictive Maintenance Adoption: The increasing reliance on AI-driven predictive maintenance tools necessitates a workforce capable of interpreting and acting on data insights.

- Workforce Transformation: The necessity for a cultural shift towards continuous learning to keep pace with technological advancements in aviation.

Globalization and Cultural Diversity in Operations

AAR's extensive global footprint, serving customers across numerous countries, necessitates a deep understanding of diverse cultural landscapes. This involves navigating varied labor practices, consumer preferences, and business etiquettes, all of which directly impact operational efficiency and market penetration.

Adapting to these cultural nuances is paramount for AAR's international supply chain and customer relationship management. For instance, in 2024, companies operating in regions with strong collectivist cultures often find success by emphasizing team-based incentives and community engagement, a stark contrast to more individualistic markets.

- Cultural Adaptation: AAR must tailor its operational strategies to align with local customs, impacting everything from employee training to marketing campaigns.

- Labor Practices: Understanding and complying with diverse international labor laws and expectations, such as varying holiday schedules or work-life balance norms, is critical.

- Customer Expectations: Meeting the unique service and product expectations of customers in different cultural contexts ensures stronger client relationships and brand loyalty.

- Cross-Cultural Communication: Effective communication strategies are vital to bridge cultural divides, fostering smoother collaboration within AAR's global workforce and with its international partners.

Societal expectations regarding aviation safety and reliability are paramount, directly driving the demand for robust MRO services like those offered by AAR. Airlines prioritize partnering with providers demonstrating a proven history of adhering to stringent safety protocols, reinforcing AAR's competitive advantage. The public's trust in the FAA's oversight, which in 2023 highlighted a strong safety record for U.S. airlines, underscores this reliance on meticulous maintenance standards.

Technological factors

Predictive maintenance, powered by machine learning and AI, is no longer a luxury but a core requirement in aviation MRO. These advanced tools allow for the proactive identification of potential component failures, enabling optimized scheduling of preventative maintenance and significantly minimizing costly unplanned aircraft downtime. For instance, the global predictive maintenance market is projected to reach over $11 billion by 2027, highlighting its growing importance.

AAR's strategic adoption of these technologies, exemplified by its Trax software, directly translates to enhanced operational efficiency and reduced expenditures. By anticipating maintenance needs, AAR can better manage its resources, leading to a more streamlined workflow. This focus on technological integration is paramount for maintaining a competitive edge and ensuring the highest standards of aircraft safety and reliability in the dynamic aviation landscape.

The aviation industry's push towards digitalization is significantly impacting Maintenance, Repair, and Overhaul (MRO) operations. This shift involves a move to paperless systems and enhanced data exchange between airlines, MRO providers like AAR, and original equipment manufacturers (OEMs).

This digital transformation is designed to make maintenance processes more efficient, optimize spare parts inventory, and ultimately boost aircraft operational readiness. For instance, by 2024, the global aviation MRO market is projected to reach $100.5 billion, underscoring the economic importance of these efficiency gains.

AAR's strategic investments in digital solutions, including its proprietary Trax software, are crucial for maintaining its competitive edge and operational effectiveness in this evolving landscape.

The aviation industry is rapidly advancing with technologies like Urban Air Mobility (UAM), electric, and hybrid aircraft. These innovations, expected to see significant growth in the coming years, will necessitate new maintenance, repair, and overhaul (MRO) capabilities. For instance, the global UAM market is projected to reach $30 billion by 2030, according to various industry reports, highlighting a substantial shift in aircraft types that will require specialized MRO support.

AAR must proactively develop expertise in servicing these novel propulsion systems and their unique maintenance needs. This includes investing in training for technicians and acquiring specialized tooling to handle electric powertrains and advanced battery systems, which will differ significantly from traditional jet engine maintenance.

Advanced Materials and Manufacturing

Innovations in advanced materials like composites and ceramics are significantly reshaping aircraft design, leading to lighter, more fuel-efficient planes. This trend directly impacts Maintenance, Repair, and Overhaul (MRO) by potentially reducing component wear and tear, thereby lowering the frequency of some maintenance tasks. However, these cutting-edge materials also necessitate specialized repair techniques and training for MRO providers.

AAR's involvement in manufacturing and engineering solutions positions them to capitalize on these advancements. For instance, the aerospace industry saw a substantial increase in the use of composites, with estimates suggesting they could account for over 50% of an aircraft's structure in new designs by the late 2020s. This shift requires MROs to invest in new tooling and expertise to handle these materials effectively.

The evolving landscape of aircraft manufacturing, driven by technological progress in materials and production methods, presents both opportunities and challenges for MRO providers like AAR.

- Advanced Materials Impact: Innovations in materials like carbon fiber composites reduce aircraft weight and improve fuel efficiency, potentially altering traditional MRO schedules.

- Specialized Repair Needs: New materials demand specialized repair techniques and highly trained technicians, creating a need for continuous upskilling within the MRO sector.

- AAR's Role: AAR's manufacturing and engineering capabilities allow them to support the integration and maintenance of aircraft utilizing these advanced materials.

Cybersecurity in Aviation Systems

The aviation industry's increasing reliance on interconnected systems and digital data mandates stringent cybersecurity protocols. For AAR, this means safeguarding both its operational infrastructure and sensitive customer information, particularly as the sector transitions to digital maintenance records. The global cybersecurity market for aviation is projected to reach $16.7 billion by 2027, highlighting the critical nature of these investments.

AAR must implement advanced solutions to counter evolving cyber threats, ensuring the integrity and confidentiality of data related to aircraft maintenance, repair, and overhaul (MRO) services. This includes protecting against data breaches and ensuring the operational resilience of its digital platforms.

- Increased Connectivity: The proliferation of connected aircraft systems and the growing volume of passenger data amplify the attack surface for cyber threats.

- Digital Transformation: AAR's move towards digital maintenance records necessitates robust security to prevent data tampering and ensure compliance with aviation regulations.

- Regulatory Scrutiny: Aviation authorities worldwide are intensifying cybersecurity requirements, demanding comprehensive risk management and threat mitigation strategies from MRO providers like AAR.

- Financial Impact: Cybersecurity incidents can lead to significant financial losses through operational downtime, reputational damage, and regulatory fines, underscoring the need for proactive defense.

Technological advancements are fundamentally reshaping aviation MRO. Predictive maintenance, leveraging AI and machine learning, is becoming standard, aiming to prevent failures before they occur and reduce downtime. This is crucial as the global aviation MRO market is expected to reach $100.5 billion by 2024, with efficiency gains being paramount.

The industry's digital transformation, including paperless systems and enhanced data exchange, streamlines operations and optimizes inventory. AAR's Trax software exemplifies this, boosting efficiency and lowering costs. Furthermore, the rise of Urban Air Mobility and electric aircraft by 2030, with the UAM market projected at $30 billion, demands new MRO expertise and specialized training.

Innovations in advanced materials, like composites, are making aircraft lighter and more fuel-efficient. While this may reduce some maintenance needs, it requires MROs to adopt new repair techniques and upskill their workforce, as composites could form over 50% of new aircraft structures by the late 2020s. Cybersecurity is also a major concern, with the aviation cybersecurity market projected to reach $16.7 billion by 2027, necessitating robust data protection for digital maintenance records.

| Technology Area | Impact on MRO | AAR's Strategic Response | Market Projection/Data Point |

| Predictive Maintenance (AI/ML) | Proactive issue identification, reduced downtime | Utilizing Trax software for optimized scheduling | Global predictive maintenance market > $11 billion by 2027 |

| Digitalization & Data Exchange | Streamlined operations, optimized inventory | Investing in digital solutions, paperless systems | Global aviation MRO market $100.5 billion by 2024 |

| New Aircraft Technologies (UAM, Electric) | Need for new MRO capabilities and training | Developing expertise in new propulsion systems | Global UAM market $30 billion by 2030 |

| Advanced Materials (Composites) | Altered maintenance needs, specialized repair techniques | Leveraging manufacturing/engineering for advanced materials | Composites > 50% of new aircraft structures by late 2020s |

| Cybersecurity | Protecting digital records and operational infrastructure | Implementing advanced security protocols | Aviation cybersecurity market $16.7 billion by 2027 |

Legal factors

AAR navigates a complex web of aviation safety regulations, overseen by bodies like the Federal Aviation Administration (FAA) in the U.S. and the European Union Aviation Safety Agency (EASA). These stringent rules govern every aspect of their MRO, supply chain, and manufacturing operations, making compliance non-negotiable. For instance, the FAA's Part 145 regulations dictate the standards for repair stations, directly impacting AAR's service delivery.

Evolving safety mandates, particularly those addressing new technologies like advanced avionics or sustainable aviation fuels, necessitate continuous adaptation of AAR's procedures and recertification efforts. As of early 2024, the FAA continues to refine its oversight of unmanned aircraft systems (UAS) maintenance, a sector where AAR is actively exploring opportunities, requiring updated compliance frameworks.

Environmental regulations are tightening, impacting the aviation industry significantly. Schemes like the International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and the EU's Refuel Aviation Regulation are pushing airlines towards sustainability. This means MRO providers like AAR must adapt, potentially assisting customers with sustainable aviation fuels (SAF) adoption and fuel-efficient operational changes.

AAR may also face new reporting requirements, not just for CO2 but also for non-CO2 emissions. For instance, CORSIA's first compliance period (2021-2023) focused on CO2 emissions, but future phases are expected to broaden the scope. This necessitates investment in data collection and reporting capabilities to ensure compliance and support airline customers in their environmental strategies.

International trade laws and sanctions significantly shape AAR's global operations, especially its vital parts distribution and service offerings to government and defense sectors. Navigating these complex legal frameworks is paramount; for instance, the US Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR) directly impact the movement of defense-related articles and technologies. Failure to comply can result in severe penalties, including hefty fines and the suspension of export privileges, as seen in past enforcement actions against aerospace companies for export control violations.

Labor Laws and Workforce Regulations

Labor laws significantly shape AAR's approach to managing its workforce. Regulations concerning employment conditions, training mandates, and the handling of workforce shortages directly influence human resource strategies and operational costs.

The persistent aviation workforce shortage, a critical issue in 2024 and projected into 2025, may prompt governments to introduce new incentives or stricter requirements for training and recruitment. AAR must proactively adapt to these potential regulatory shifts to maintain a robust and skilled employee base, ensuring operational continuity and competitive advantage.

- Workforce Shortages: The International Air Transport Association (IATA) has highlighted a global shortage of skilled aviation personnel, impacting maintenance, repair, and overhaul (MRO) providers like AAR.

- Training Regulations: Evolving aviation safety regulations may necessitate increased investment in continuous training and certification for technicians, adding to operational expenses.

- Employment Conditions: Changes in labor laws regarding working hours, benefits, and employee rights can affect AAR's labor costs and its ability to attract and retain talent in a competitive market.

- Recruitment Incentives: Government programs aimed at addressing the aviation skills gap could offer AAR opportunities for subsidized training or recruitment, but also may come with specific compliance obligations.

Data Privacy and Digitalization Regulations

The increasing digitalization of aircraft maintenance records and the implementation of advanced analytics by companies like AAR bring data privacy regulations to the forefront. Compliance with frameworks such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is critical, particularly when handling sensitive operational or customer information. AAR's data handling must align with these evolving legal requirements to avoid penalties and maintain trust.

The aviation sector is also seeing shifts in data access policies. For instance, proposed Federal Aviation Administration (FAA) regulations aimed at restricting public access to aircraft owner information underscore the dynamic nature of data privacy within aviation. This evolving regulatory landscape necessitates proactive adaptation by AAR to ensure continued compliance and operational integrity.

- GDPR Fines: Non-compliance with GDPR can result in fines of up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA Impact: The CCPA grants consumers rights over their personal information, impacting how businesses like AAR collect, use, and share data.

- FAA Data Proposals: The FAA's considerations on aircraft owner data access reflect a broader trend towards enhanced data protection in aviation.

AAR's operations are heavily influenced by evolving aviation safety regulations from bodies like the FAA and EASA, impacting MRO standards and new technology integration. For example, FAA's Part 145 regulations set the benchmark for repair stations, directly affecting AAR's service delivery and requiring ongoing adaptation to mandates concerning advanced avionics and sustainable fuels. As of early 2024, the FAA's focus on unmanned aircraft systems (UAS) maintenance necessitates updated compliance frameworks for AAR's exploration in this growing sector.

Environmental factors

The growing global demand for Sustainable Aviation Fuels (SAF) is a significant environmental factor influencing the aviation sector and, consequently, AAR's Maintenance, Repair, and Overhaul (MRO) operations. Regulations such as the EU's Refuel Aviation Regulation, which mandates minimum SAF usage, are driving this trend.

This regulatory push translates into a direct need for aircraft and components that can effectively utilize SAF. Airlines are increasingly seeking MRO providers capable of servicing these newer fuel systems, potentially requiring new training and tooling for AAR's technicians. The International Air Transport Association (IATA) projects that SAF could account for 65% of the sustainable aviation fuel used by the industry by 2050.

International and regional bodies are increasingly setting ambitious carbon emission reduction targets for the aviation sector. For instance, the International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) aims to stabilize net carbon dioxide emissions from international aviation at 2019 levels. AAR, as a major MRO provider, is well-positioned to support these goals.

AAR can contribute to these environmental efforts by offering maintenance, repair, and overhaul (MRO) services that specifically enhance aircraft fuel efficiency. This includes component upgrades and retrofits designed for newer, more eco-friendly aircraft. Furthermore, AAR's expertise can be leveraged to support the integration and operationalization of emerging technologies like electric and hybrid propulsion systems, which are crucial for meeting long-term decarbonization objectives.

Environmental regulations are increasingly focusing on noise pollution, with stricter limits being set for new aircraft models. This push for quieter aircraft is directly influencing engine development and overall aircraft design, pushing manufacturers towards more advanced, noise-reducing technologies.

For AAR, this evolving landscape means a potential shift in the types of services and maintenance, repair, and overhaul (MRO) procedures they will need to offer. The demand for modifications and component replacements aimed at noise reduction, such as advanced acoustic liners or redesigned engine nacelles, is likely to grow. For instance, the European Union's Aviation Emissions and Removals (EU ETS) framework, while primarily focused on carbon, also indirectly encourages efficiency which can correlate with noise reduction efforts.

Waste Management and Recycling in Aviation

Airports and airlines are facing growing pressure to enhance their waste management and recycling efforts, particularly concerning in-flight waste. For instance, in 2023, the International Air Transport Association (IATA) reported that cabin waste generation per passenger averaged 1.76 kg. This increasing environmental scrutiny translates into evolving operational demands.

These evolving environmental standards can create new avenues for AAR within its logistics and supply chain operations. The need for specialized handling, collection, and disposal of diverse waste streams, including hazardous materials and recyclables, presents opportunities for AAR to offer integrated waste management solutions. Such services could range from collection and sorting to processing and compliant disposal, aligning with AAR's core competencies.

- Increased demand for specialized waste handling: Airlines and airports are seeking partners to manage complex waste streams, including hazardous materials and recyclables.

- Regulatory compliance: Stricter environmental regulations necessitate expert knowledge in waste processing and disposal, creating a market for compliant service providers.

- Sustainability initiatives: A growing focus on corporate social responsibility and environmental, social, and governance (ESG) goals drives demand for sustainable waste management solutions.

- Potential for new service offerings: AAR could leverage its existing infrastructure and expertise to develop and offer comprehensive waste management and recycling services to the aviation sector.

Climate Change Impact on Operations

The escalating impacts of climate change, including more frequent and intense extreme weather events, pose significant challenges to aviation operations. These disruptions can lead to flight cancellations, delays, and damage to aircraft and airport infrastructure, potentially increasing the demand for maintenance, repair, and overhaul (MRO) services. For instance, the Federal Aviation Administration (FAA) reported over 11,000 hours of air traffic control delays attributed to weather in 2023 alone.

AAR, like other aviation service providers, must consider how these environmental shifts necessitate more robust and resilient supply chain strategies. This includes anticipating potential disruptions to parts availability and logistics due to severe weather impacting manufacturing or transportation hubs. The long-term operational planning must factor in the need for adaptable MRO solutions and potentially investing in infrastructure that can withstand more volatile weather patterns.

- Increased MRO Demand: Extreme weather events can cause physical damage to aircraft, driving demand for repair and maintenance services.

- Supply Chain Resilience: Companies like AAR need to fortify their supply chains against weather-related disruptions, ensuring parts availability.

- Infrastructure Adaptation: Airports and maintenance facilities may require upgrades to better withstand severe weather, impacting operational costs and planning.

- Operational Disruptions: Flight delays and cancellations due to weather directly affect aircraft utilization, indirectly impacting MRO scheduling and demand.

The aviation industry's commitment to sustainability, driven by regulations like the EU's Refuel Aviation mandate, is increasing the demand for Sustainable Aviation Fuels (SAF). This shift necessitates MRO providers like AAR to adapt their services for aircraft compatible with SAF, potentially requiring new technician training and specialized tooling. By 2050, IATA projects SAF will constitute 65% of sustainable aviation fuel used.

Global efforts to reduce aviation's carbon footprint, such as ICAO's CORSIA, aim to stabilize emissions. AAR can support these goals by enhancing aircraft fuel efficiency through component upgrades and retrofits, and by facilitating the integration of electric and hybrid propulsion systems. Environmental regulations also target noise pollution, pushing for quieter aircraft and influencing engine design, which may lead to increased demand for AAR's noise-reduction modification services.

The growing focus on waste management in aviation, with cabin waste averaging 1.76 kg per passenger in 2023 per IATA, presents opportunities for AAR in logistics. Offering specialized handling, collection, and disposal of diverse waste streams, including hazardous materials and recyclables, aligns with AAR's capabilities and can create new service avenues.

Extreme weather events, which caused over 11,000 hours of air traffic control delays due to weather in the US in 2023 according to the FAA, are increasing MRO demand through aircraft damage and supply chain disruptions. AAR must develop resilient supply chains and adaptable MRO solutions to counter these weather-related impacts, potentially investing in infrastructure upgrades.

PESTLE Analysis Data Sources

Our PESTLE Analysis draws upon a robust blend of official government publications, reputable economic forecasting agencies, and leading industry-specific research. This multi-faceted approach ensures that each aspect, from political stability to technological advancements, is supported by credible and current data.