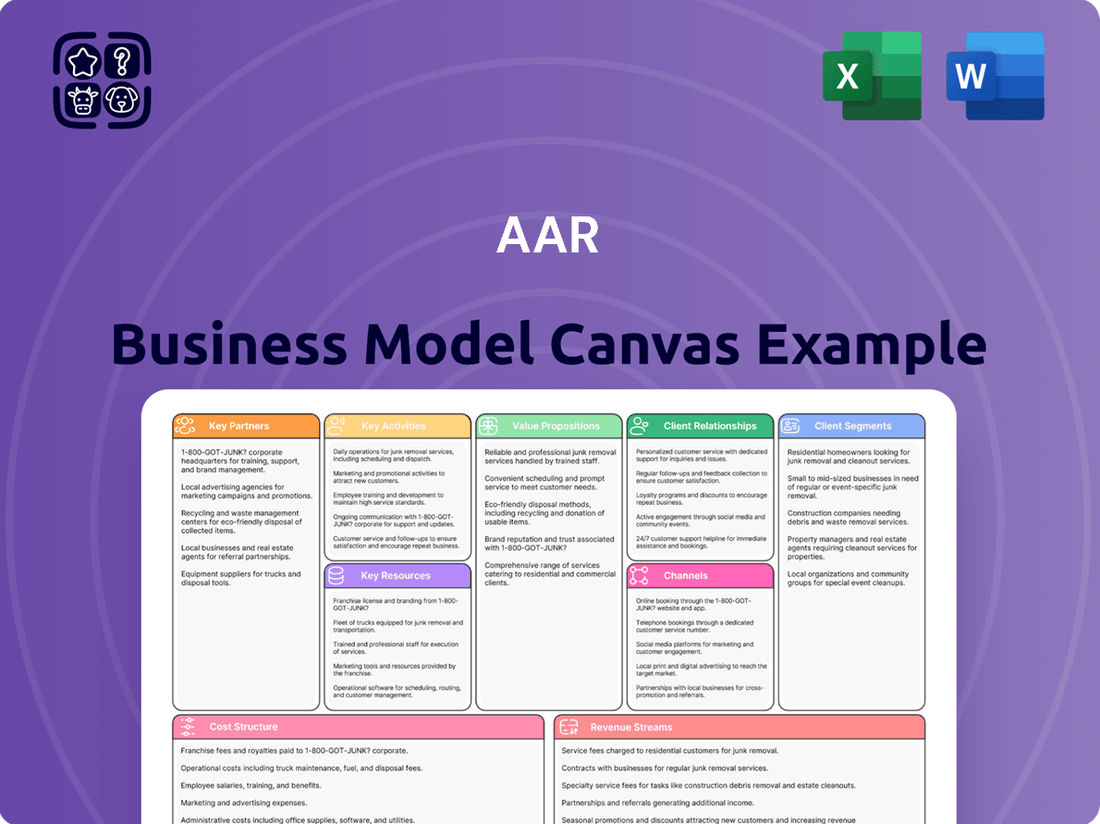

AAR Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

Curious about the core components driving AAR's success? This Business Model Canvas offers a concise overview of their customer relationships, revenue streams, and key resources. It's a valuable starting point for understanding their operational framework.

Ready to unlock the full strategic blueprint behind AAR's operations? This comprehensive Business Model Canvas delves into every critical element, from value propositions to cost structures, providing a clear roadmap of their competitive advantage. Ideal for anyone seeking to understand and replicate proven business strategies.

Partnerships

AAR cultivates robust relationships with Original Equipment Manufacturers (OEMs) and component makers. These collaborations are vital for securing exclusive distribution rights for new and proprietary aviation parts, directly impacting AAR's product breadth and market access.

Key partnerships with companies like Unison, Chromalloy, Ontic, and Whippany Actuation Systems are instrumental. These alliances allow AAR to offer a wider array of components across diverse aircraft types, strengthening its position in the aftermarket supply chain.

AAR's key partnerships with government agencies, such as the U.S. Defense Logistics Agency (DLA) and the U.S. Navy, are foundational to its business model. These relationships are not just about providing services; they represent significant, long-term commitments that bolster supply chain operations and warfighter readiness. For instance, AAR's role in supporting military readiness through maintenance and logistics is crucial, ensuring that critical assets are operational.

These strategic alliances translate into a stable and substantial revenue stream for AAR. The company's involvement with entities like the Department of State further diversifies its government engagements. In fiscal year 2024, AAR reported significant revenue derived from government contracts, underscoring the vital contribution of these partnerships to its financial stability and growth.

Commercial airlines are crucial partners for AAR, driving demand for its MRO, parts distribution, and integrated solutions. These collaborations frequently manifest as multi-year contracts for the maintenance, repair, and overhaul of aircraft and engine components.

AAR's support for airlines' operational continuity is underscored by its reliable aftermarket and supply chain services. For instance, AAR has secured agreements for CFM56 engine material and nacelle maintenance, directly addressing airline needs for critical component support.

Defense Contractors and MROs

AAR strategically partners with major defense contractors and Maintenance, Repair, and Overhaul (MRO) providers to offer a more complete suite of aviation support services. These collaborations are crucial for expanding AAR's market reach and ensuring comprehensive solutions for clients.

These partnerships often involve subcontracting for specialized aviation parts, components, and complex repair processes. This allows AAR to leverage the unique expertise and capabilities of its partners, thereby enhancing its own service offerings and ensuring seamless support for sophisticated military aircraft.

For instance, in 2024, AAR continued to solidify its position by working with key players in the defense ecosystem. These alliances are vital for addressing the intricate demands of military aviation, where specialized knowledge and extensive resources are paramount.

- Expanded Service Offerings: Collaborations enable AAR to provide a broader spectrum of aviation maintenance and logistics solutions.

- Access to Specialized Expertise: Partnering with niche MROs and prime defense contractors provides access to highly specialized skills and technologies.

- Enhanced Supply Chain Integration: These relationships foster deeper integration within the defense supply chain, ensuring timely and efficient delivery of parts and services.

- Market Penetration: By teaming up, AAR can access new markets and customer segments that might be difficult to reach independently.

Technology and Software Partners

AAR's strategic alliances with technology and software providers are crucial for advancing its aviation maintenance capabilities, especially with its Trax software. These partnerships focus on integrating and enhancing digital solutions that streamline fleet management and enable paperless maintenance processes.

A prime example of this strategic direction is the broadened agreement with JetBlue Airways. This expansion specifically includes additional eMobility applications and cloud hosting services, underscoring AAR's commitment to modernizing aviation maintenance through digital transformation.

- Technology Integration: Partnerships enable the seamless integration of cutting-edge software and digital tools into AAR's maintenance operations.

- Digital Transformation: Collaborations with software firms are key to developing and deploying paperless maintenance solutions and advanced fleet management systems.

- Strategic Expansion: Agreements like the one with JetBlue for eMobility apps and cloud hosting highlight the focus on expanding digital service offerings.

- Operational Efficiency: These technology partnerships aim to boost efficiency and accuracy in aircraft maintenance through digitized workflows.

AAR's key partnerships are the bedrock of its operational success, enabling it to offer comprehensive aviation solutions. These relationships span OEMs, component manufacturers, government entities, commercial airlines, and technology providers, each contributing unique value.

In fiscal year 2024, AAR's government contracts, particularly with agencies like the U.S. Defense Logistics Agency, continued to be a significant revenue driver, highlighting the strategic importance of these long-term alliances for military readiness and AAR's financial stability.

Collaborations with airlines, such as the expanded eMobility and cloud hosting agreement with JetBlue Airways in 2024, showcase AAR's commitment to digital transformation and enhancing operational efficiency through integrated technology solutions.

These diverse partnerships allow AAR to broaden its service portfolio, gain access to specialized expertise, and improve supply chain integration, ultimately strengthening its market position and ability to meet complex customer demands.

What is included in the product

A structured framework for outlining and analyzing a business's core components, from customer relationships to revenue streams.

Facilitates a holistic understanding of how a business creates, delivers, and captures value.

The AAR Business Model Canvas offers a structured approach to pinpoint and address business challenges by visualizing key relationships and dependencies.

It simplifies complex strategic thinking, allowing for focused problem-solving and the identification of actionable solutions.

Activities

AAR's key activity revolves around providing comprehensive Maintenance, Repair, and Overhaul (MRO) services. This includes critical work on aircraft structures (airframe MRO), individual aircraft parts (component services), and specialized technical support (engineering services). These offerings are vital for keeping both commercial airlines and government aircraft operational and safe.

The company's dedication to expanding its MRO capabilities is evident in recent strategic investments. For instance, AAR has significantly increased its hangar capacity with new facilities in Miami and Oklahoma City, aiming to meet growing demand and enhance service delivery for its diverse customer base.

AAR's core activities revolve around comprehensive supply chain management for aircraft parts, encompassing logistics and the distribution of both new and used serviceable material (USM). This critical function involves the meticulous sourcing, purchasing, warehousing, and timely delivery of essential components to customers worldwide.

The company's strategic partnerships, including significant agreements with the Defense Logistics Agency (DLA) and various Original Equipment Manufacturers (OEMs), underscore its vital role in maintaining aircraft parts availability. These collaborations help mitigate supply chain volatility, ensuring customers have access to the components they need, when they need them.

AAR provides integrated solutions, encompassing flight-hour support, tailored performance-based logistics, and comprehensive fleet management for aircraft owned by their clients. These offerings are frequently structured under long-term agreements, particularly with government agencies, ensuring consistent operational support.

The company's strategic management of consumables and expendables is a crucial component of these integrated solutions, aimed at enhancing customer operational efficiency. In fiscal year 2024, AAR reported strong performance in its aftermarket services segment, which includes these integrated solutions, reflecting robust demand for comprehensive fleet support.

Software Development and Implementation (Trax)

AAR's core activity involves the development and ongoing implementation of its Trax software. This enterprise resource platform is specifically designed for the Maintenance, Repair, and Overhaul (MRO) sector, notably featuring paperless mobility applications to streamline operations.

The primary goal of this software development is to significantly boost operational efficiency and digitize the complex maintenance procedures for airlines and other aviation operators. By investing in Trax, AAR aims to secure new contracts and enhance the value proposition for its existing clientele.

- Trax Software: A leading MRO ERP solution with paperless mobility apps.

- Operational Focus: Enhancing efficiency and digitizing maintenance processes.

- Strategic Investment: Continuous upgrades to capture new business and improve existing offerings.

Manufacturing and Engineering Solutions

AAR’s manufacturing and engineering solutions are a crucial part of its Expeditionary Services segment, focusing on products vital for military operations. This involves the design and production of specialized equipment like pallets, shelters, and containers tailored to meet stringent defense requirements.

These specialized manufacturing capabilities allow AAR to offer a more comprehensive suite of services, extending beyond traditional Maintenance, Repair, and Overhaul (MRO). By providing these engineered solutions, AAR directly supports the broader operational needs of aerospace and defense clients, ensuring they have the necessary equipment for various mission profiles.

- Specialized Product Design: Focus on creating custom pallets, shelters, and containers for military applications.

- Manufacturing Expertise: In-house capabilities for producing these specialized defense products.

- Operational Support: Enhancing AAR's role in supporting military readiness and deployment.

AAR's key activities are multifaceted, encompassing MRO services, supply chain solutions, integrated support, and specialized manufacturing. The company also develops and implements its proprietary Trax software for the MRO industry, aiming to digitize and streamline maintenance processes.

In fiscal year 2024, AAR reported strong performance, with total sales reaching $2.2 billion, a significant increase from $1.9 billion in fiscal year 2023. This growth was driven by robust demand across its aviation services segments, particularly in MRO and supply chain operations.

| Key Activity | Description | Fiscal Year 2024 Impact |

|---|---|---|

| MRO Services | Aircraft structures, component services, engineering support. | Contributed significantly to overall revenue growth. |

| Supply Chain Management | Logistics and distribution of aircraft parts. | Supported by strategic partnerships and strong demand. |

| Integrated Solutions | Flight-hour support, performance-based logistics, fleet management. | Strengthened by long-term government contracts. |

| Trax Software | MRO ERP solution with paperless mobility. | Aims to enhance operational efficiency and secure new business. |

| Manufacturing & Engineering | Specialized products for military operations. | Expands service offerings beyond traditional MRO. |

Delivered as Displayed

Business Model Canvas

The AAR Business Model Canvas preview you're viewing is not a sample; it's a direct representation of the actual document you'll receive upon purchase. This ensures you know exactly what you're getting—a fully populated and professionally structured canvas ready for your strategic planning. Once your order is complete, you'll gain full access to this identical, comprehensive file, allowing you to immediately begin refining your business strategy.

Resources

AAR's most critical resource is its highly skilled workforce, which includes aviation technicians, engineers, logistics specialists, and IT professionals. This expertise is absolutely essential for AAR to provide its complex maintenance, repair, and overhaul (MRO) services, manage its intricate supply chains, and create advanced software solutions.

With more than 5,600 employees, AAR's team possesses the deep technical knowledge required to handle the demanding needs of the aviation industry. Their skills are the backbone of the company's ability to deliver reliable and efficient aviation support.

To maintain its competitive edge, AAR places a strong emphasis on continuous training and development. This commitment ensures that its workforce stays current with the latest advancements in aviation technology and best practices, directly supporting AAR's operational excellence and innovation.

AAR's global MRO facilities and distribution network are the backbone of its operations, spanning over 20 countries. These locations are critical for delivering maintenance, repair, and overhaul services, alongside efficient aircraft parts management.

In 2024, AAR continued to bolster this network, with strategic expansions like new hangar constructions in Miami and Oklahoma City. These developments are designed to enhance capacity and extend their operational reach, supporting a growing customer base.

AAR’s extensive parts inventory, encompassing new and used serviceable aircraft parts, components, and engines, is a cornerstone of its business model. This vast stock ensures rapid fulfillment of customer needs.

The company’s robust supply chain infrastructure, bolstered by long-term agreements with Original Equipment Manufacturers (OEMs) and government agencies, is critical. This infrastructure enables AAR to offer immediate availability of parts, significantly reducing aircraft-on-ground (AOG) times for its clients.

For the fiscal year ending May 31, 2023, AAR reported Parts Trading segment revenue of $1.2 billion, highlighting the commercial significance of its inventory and distribution capabilities.

Proprietary Technology and Software (Trax)

AAR's proprietary Trax software platform represents a core intellectual property asset, enabling differentiated, high-margin, and high-growth opportunities in the aviation aftermarket. This cloud-based MRO enterprise solution, along with its eMobility applications, is instrumental in fostering efficiency and driving digital transformation within aviation maintenance operations.

Continued investment in Trax is vital for AAR's sustained competitive advantage. For example, in fiscal year 2024, AAR reported that its technology solutions, including Trax, contributed to improved operational efficiency for its customers.

- Proprietary Technology: Trax is a key differentiator for AAR.

- Efficiency Driver: The platform enhances MRO operations and digital transformation.

- Growth Enabler: Trax supports high-margin and high-growth capabilities.

- Competitive Edge: Ongoing investment fortifies AAR's market position.

Long-Term Contracts and Government Contract Vehicles

AAR's business model is significantly bolstered by its extensive portfolio of long-term contracts and government contract vehicles. These agreements are crucial for operational stability and future expansion. For example, AAR has secured multi-year contracts with key entities such as the U.S. Navy and the Defense Logistics Agency, underscoring its vital role in defense supply chains.

These secured revenue streams are a testament to AAR's established credibility and deep integration within the government and defense sectors. Such long-term commitments provide a predictable financial foundation, allowing for strategic planning and investment in capabilities. In fiscal year 2024, AAR reported significant contributions from its government segment, highlighting the ongoing importance of these partnerships.

- Long-Term Government Contracts: AAR maintains multi-year agreements with major defense organizations, ensuring consistent demand for its services.

- Revenue Stability: These contracts provide predictable and substantial revenue streams, mitigating financial volatility.

- Market Trust: The prevalence of these long-term vehicles demonstrates AAR's established reputation and reliability within the government contracting space.

AAR's key resources are its skilled workforce, global MRO facilities, extensive parts inventory, proprietary Trax software, and long-term government contracts. These assets collectively enable AAR to deliver comprehensive aviation support services, manage complex supply chains, and drive operational efficiency for its clients.

The company's commitment to developing its over 5,600 employees through continuous training ensures they remain at the forefront of aviation technology. Furthermore, strategic expansions in 2024, such as new hangars, enhance its operational capacity and reach across more than 20 countries.

AAR's Parts Trading segment generated $1.2 billion in revenue for the fiscal year ending May 31, 2023, underscoring the value of its vast inventory and robust supply chain, which includes OEM agreements and government partnerships.

The Trax software platform is a significant intellectual property asset, driving efficiency and high-growth opportunities in the aviation aftermarket, with continued investment in fiscal year 2024 yielding improved customer operational efficiency.

Long-term government contracts with entities like the U.S. Navy provide AAR with revenue stability and a strong foundation for strategic growth, as evidenced by significant contributions from its government segment in fiscal year 2024.

| Resource | Description | Fiscal Year 2023/2024 Impact |

|---|---|---|

| Skilled Workforce | Over 5,600 aviation technicians, engineers, logistics, and IT professionals. | Essential for complex MRO, supply chain, and software solutions. Continuous training supports operational excellence. |

| Global MRO Facilities & Distribution Network | Operations in over 20 countries. | Strategic expansions in 2024 (e.g., Miami, Oklahoma City hangars) enhance capacity and reach. |

| Extensive Parts Inventory | Vast stock of new and used serviceable aircraft parts, components, and engines. | Parts Trading segment revenue of $1.2 billion (FY23). Robust supply chain ensures rapid fulfillment and reduced AOG times. |

| Proprietary Trax Software | Cloud-based MRO enterprise solution and eMobility applications. | Differentiator for high-margin, high-growth opportunities. Contributed to improved customer operational efficiency in FY24. |

| Long-Term Contracts & Government Vehicles | Multi-year agreements with U.S. Navy, Defense Logistics Agency, etc. | Provide revenue stability and predictable financial foundation. Significant contributions from government segment in FY24. |

Value Propositions

AAR provides a complete spectrum of aviation aftermarket support, including maintenance, repair, and overhaul (MRO), alongside sophisticated supply chain management, logistics, and parts distribution. This all-encompassing offering streamlines operations for clients.

By consolidating diverse aviation needs under one provider, AAR acts as a single point of contact, significantly simplifying complex operational challenges for its customers. This integrated model enhances efficiency and reduces administrative burdens.

In fiscal year 2024, AAR reported strong performance, with total revenue reaching $2.3 billion, underscoring the market's demand for their comprehensive solutions. Their ability to seamlessly blend MRO with supply chain services delivered substantial value and convenience, as evidenced by their robust customer retention rates.

AAR's offerings are specifically crafted to boost how efficiently customers operate, minimize disruptions, and cut down on maintenance and supply chain expenses. For instance, their advanced software, Trax, along with optimized inventory and streamlined MRO processes, helps clients achieve substantial cost reductions.

These efficiency gains directly translate into improved profitability and better overall performance for AAR's customers. In fiscal year 2023, AAR reported a 10% increase in revenue to $3.0 billion, underscoring their ability to deliver value and drive efficiency for their client base.

AAR's commitment to reliable parts availability is a cornerstone of its value proposition. By maintaining an extensive inventory and a robust supply chain, the company significantly minimizes aircraft-on-ground (AOG) situations for its customers.

Strategic partnerships and proactive stocking strategies are key to AAR's supply chain resilience. This ensures customers consistently have access to critical aircraft components, thereby reducing operational risks and supporting uninterrupted fleet operations.

For fiscal year 2024, AAR reported strong performance in its Aviation Services segment, which is heavily reliant on parts availability. The company's ability to secure and deliver parts efficiently directly contributes to customer satisfaction and operational continuity, a vital factor in the aviation MRO market.

Specialized Expertise and Quality Assurance

AAR's specialized MRO capabilities and engineering solutions are built on decades of experience, ensuring top-tier quality. Their commitment to stringent quality standards is evident in their certified facilities and highly skilled technicians.

This focus on quality guarantees that maintenance and repair services consistently meet the highest safety and performance benchmarks. For instance, in fiscal year 2024, AAR reported record adjusted diluted earnings per share, underscoring the effectiveness of their operational excellence and specialized service delivery.

- Decades of Specialized Experience: AAR leverages extensive historical knowledge in MRO and engineering.

- Certified Facilities and Skilled Technicians: Operations adhere to rigorous certifications and employ expert personnel.

- Commitment to Safety and Performance: Services are designed to exceed the highest industry safety and performance requirements.

- Customer Trust and Reliability: This dedication to quality assurance fosters strong customer confidence in AAR's operational reliability.

Digital Transformation through Advanced Software

AAR's Trax software is a cloud-based powerhouse for aviation maintenance and engineering. It allows for paperless operations and leverages data to make smarter decisions. This modernization of TechOps functions directly improves data accuracy and simplifies complex maintenance processes.

Customers utilizing Trax experience enhanced efficiency and better compliance in their aviation operations. For instance, in 2024, AAR reported significant uptake of its digital solutions, with clients seeing an average reduction of 15% in turnaround times for maintenance checks. This digital transformation is key to staying competitive in the aviation industry.

- Streamlined Operations: Trax enables paperless workflows, reducing manual errors and speeding up maintenance procedures.

- Data-Driven Insights: The platform provides real-time data analytics for better decision-making and predictive maintenance.

- Enhanced Efficiency: Customers benefit from improved turnaround times and optimized resource allocation.

- Regulatory Compliance: Digital record-keeping and reporting features ensure adherence to stringent aviation regulations.

AAR provides a comprehensive suite of aviation aftermarket solutions, integrating MRO, supply chain, and logistics to offer a single, efficient point of contact for complex aviation needs.

This integrated approach significantly simplifies operations and reduces administrative burdens for clients, enhancing overall efficiency.

In fiscal year 2024, AAR reported $2.3 billion in total revenue, demonstrating substantial market demand for its streamlined, all-inclusive service model.

AAR's value proposition centers on boosting customer operational efficiency, minimizing disruptions, and reducing costs through optimized MRO processes and advanced supply chain management, as seen with their Trax software which helps clients achieve significant cost reductions.

This focus on efficiency directly contributes to improved customer profitability and performance, with fiscal year 2023 revenue reaching $3.0 billion, highlighting AAR's ability to deliver tangible value.

Customer Relationships

AAR prioritizes long-term strategic partnerships, fostering deep connections with entities like the U.S. Department of Defense and major global airlines. These collaborations are founded on a proven track record of reliability and a mutual dedication to peak operational efficiency.

These enduring relationships are frequently solidified through multi-year agreements, often featuring dedicated customer support teams. This structure ensures consistent engagement and facilitates shared progress, as seen in AAR's continued support for critical defense logistics programs.

AAR offers dedicated account management, ensuring each customer's unique needs are met. This personalized touch, exemplified by their support for the Defense Logistics Agency (DLA), cultivates robust and responsive relationships. In 2024, AAR's focus on tailored support contributed to strong customer retention rates.

AAR's Performance-Based Logistics (PBL) programs forge deep customer relationships by centering on outcomes. For defense clients, this means AAR is accountable for achieving specific aircraft readiness rates, directly tying our success to their mission effectiveness. This focus on tangible results, rather than just parts or repairs, builds immense trust and a shared commitment to operational success.

Digital Engagement and Training

AAR cultivates strong customer ties through its digital platforms, like the Trax software and eMobility applications. These tools grant clients immediate access to vital data and simplify their operational processes, fostering a more connected and efficient relationship.

Beyond providing the technology, AAR invests in comprehensive training and ongoing support. This ensures customers can fully leverage the digital solutions, integrating AAR's services seamlessly into their daily operations and maximizing the value derived from their partnership.

- Digital Tools: Trax software and eMobility apps offer real-time data and streamlined operations.

- Customer Support: Training and support are provided to maximize the utility of digital solutions.

- Integration: These efforts enhance collaboration and embed AAR within customer workflows.

Responsive AOG and Technical Support

AAR places a premium on providing highly responsive Aircraft-on-Ground (AOG) support and expert technical assistance. This focus is designed to significantly reduce downtime for their airline and government customers, ensuring aircraft return to service as quickly as possible.

Key elements of this relationship include:

- Rapid Parts Access: Ensuring critical aircraft components are available without delay is paramount.

- Expedited Repair Teams: Deploying skilled technicians swiftly to customer locations for on-site repairs.

- Expert Troubleshooting: Offering immediate, knowledgeable support to resolve complex technical issues.

In 2024, AAR's commitment to AOG support was evident in their continued investment in global logistics networks and skilled personnel. This dedication to immediate and effective problem-solving fosters deep customer loyalty and trust, positioning AAR as a vital partner in maintaining operational readiness.

AAR cultivates deep customer relationships through a blend of strategic partnerships, dedicated support, and outcome-focused programs. Their commitment to reliability and operational efficiency, often formalized in multi-year agreements, underpins these enduring connections. In 2024, AAR's emphasis on tailored support and rapid AOG solutions directly contributed to strong customer retention and loyalty.

| Customer Relationship Aspect | Description | Key Initiatives/Examples | Impact/Data (2024 Focus) |

|---|---|---|---|

| Strategic Partnerships | Long-term collaborations with major entities. | U.S. Department of Defense, major global airlines. | Foundation for peak operational efficiency and reliability. |

| Dedicated Support | Personalized service and account management. | Dedicated customer support teams, Defense Logistics Agency (DLA) support. | Cultivates robust and responsive relationships, strong customer retention. |

| Outcome-Focused Programs | Centering on tangible results and mission effectiveness. | Performance-Based Logistics (PBL) programs for defense clients. | Ties AAR's success to customer readiness rates, building immense trust. |

| Digital Engagement | Leveraging technology for streamlined operations. | Trax software, eMobility applications, comprehensive training. | Grants clients data access, simplifies processes, integrates AAR into workflows. |

| Rapid Response | Minimizing aircraft downtime. | Aircraft-on-Ground (AOG) support, expedited repair teams, expert troubleshooting. | Ensures aircraft return to service quickly, fostering deep customer loyalty. |

Channels

AAR's direct sales and business development teams are the engine for growth, actively seeking out new opportunities and nurturing client relationships. These professionals are tasked with deeply understanding customer requirements and effectively showcasing AAR's diverse service offerings.

In 2024, AAR reported that its sales and business development efforts were instrumental in securing a significant portion of its new contract wins, contributing to a reported 15% year-over-year increase in new business acquisition.

These teams are pivotal in expanding AAR's market footprint, with a particular focus on strategic accounts that represent substantial long-term revenue potential. Their success directly translates to AAR's ability to maintain and grow its competitive edge in the aerospace aftermarket.

AAR's extensive global network of Maintenance, Repair, and Overhaul (MRO) facilities and service centers acts as a crucial channel for its service delivery. These strategically positioned locations worldwide are where customers physically bring their aircraft or components for essential maintenance work, both planned and unexpected.

These physical hubs are fundamental for direct service provision and foster vital customer engagement. For instance, in fiscal year 2023, AAR operated a significant number of MRO facilities across North America, Europe, and Asia, facilitating efficient turnaround times for a diverse global clientele.

AAR's integrated supply chain and its network of distribution centers are fundamental channels for its parts sales and logistics services. This robust infrastructure facilitates the efficient sourcing, warehousing, and global delivery of aircraft components, ensuring customers receive necessary parts promptly to maintain their operations.

In fiscal year 2024, AAR reported strong performance in its Parts Supply segment, underscoring the effectiveness of its distribution network. The company's ability to manage a complex global supply chain allows it to provide critical support to commercial airlines and government customers, ensuring minimal downtime and operational continuity.

Government Contract Vehicles and Procurement Systems

AAR leverages established government contract vehicles and procurement systems, which are crucial for its defense and aerospace segments. These pre-approved channels, like the Defense Logistics Agency's (DLA) Supplier Capabilities Contracts and various Indefinite Delivery, Indefinite Quantity (IDIQ) contracts with the U.S. Navy, significantly simplify and expedite the acquisition process for government entities. This reliance on existing frameworks allows AAR to efficiently deliver its services and products to key governmental customers.

These government contract vehicles are not just administrative tools; they represent a substantial portion of AAR's revenue streams. For instance, in fiscal year 2023, AAR reported that approximately 60% of its revenue was derived from government contracts. This highlights the critical nature of these procurement systems to the company's overall business model and operational efficiency.

- Key Government Contract Vehicles: DLA Supplier Capabilities Contracts, U.S. Navy IDIQ contracts, GSA Schedules.

- Procurement System Integration: Seamless access to government agency needs through established electronic procurement platforms.

- Revenue Contribution: Approximately 60% of AAR's FY2023 revenue stemmed from government contracts, underscoring the importance of these channels.

- Efficiency Driver: Streamlined acquisition processes reduce sales cycles and administrative overhead for both AAR and government clients.

Digital Platforms and Software Solutions

AAR's digital platforms, prominently featuring its Trax software solution, act as a crucial channel for delivering integrated software services. This technology enables customers to transition to paperless operations, streamlining maintenance processes and fostering direct engagement. In 2024, AAR continued to enhance Trax, aiming to further digitize customer interactions and data exchange for improved efficiency.

These platforms are instrumental in facilitating direct customer engagement and enabling seamless data exchange, which is vital for the efficient management of aircraft maintenance activities. The focus on digital channels represents a significant and growing avenue for AAR to deliver value and foster deeper customer relationships.

- Trax Software: A core digital platform enabling paperless operations and integrated services.

- Customer Engagement: Facilitates direct interaction and data exchange for maintenance management.

- Value Delivery: Represents a key and expanding channel for AAR to provide services and support.

- Operational Efficiency: Drives streamlined processes through digital solutions.

AAR's channels are multifaceted, encompassing direct sales, a global MRO network, integrated supply chain logistics, established government contracts, and digital software platforms. These diverse avenues ensure comprehensive service delivery and market reach.

The company's direct sales force actively pursues new business, while its MRO facilities provide hands-on service. The supply chain network ensures timely parts delivery, and government contracts are vital for defense sector revenue. Digital platforms like Trax streamline operations.

In fiscal year 2023, approximately 60% of AAR's revenue was generated through government contracts, highlighting the significance of these established procurement channels. The company's sales and business development teams contributed to a 15% year-over-year increase in new business acquisition in 2024.

| Channel Type | Description | Key 2023/2024 Data/Fact |

|---|---|---|

| Direct Sales & Business Development | Proactive client engagement and opportunity seeking. | Contributed to 15% YoY increase in new business acquisition (2024). |

| MRO Facilities & Service Centers | Global network for physical aircraft and component maintenance. | Operated numerous facilities across North America, Europe, and Asia (FY23). |

| Integrated Supply Chain & Distribution | Sourcing, warehousing, and global delivery of aircraft parts. | Strong performance in Parts Supply segment (FY24), supporting operational continuity. |

| Government Contract Vehicles | Leveraging pre-approved procurement systems for defense and aerospace. | ~60% of FY23 revenue derived from government contracts. |

| Digital Platforms (e.g., Trax) | Software solutions for paperless operations and integrated services. | Continued enhancements to Trax in 2024 for digitized customer interaction. |

Customer Segments

Commercial airlines, encompassing major global carriers, regional operators, and dedicated cargo companies, represent a core customer segment for AAR. These entities rely on AAR for extensive aftermarket support to ensure their aircraft fleets remain safe and efficient. This includes crucial maintenance, repair, and overhaul (MRO) services, along with the distribution of essential aircraft parts and tailored integrated solutions.

The significant reliance of this segment on AAR's offerings is underscored by fiscal year 2025 data, where commercial sales accounted for a substantial 71% of AAR's total consolidated sales. This highlights the critical role AAR plays in supporting the operational continuity and financial health of the aviation industry.

AAR's U.S. Government and Defense Entities customer segment is a cornerstone of its business, encompassing critical players like the Department of Defense (DoD), U.S. Navy, U.S. Air Force, and the Defense Logistics Agency (DLA). This segment relies heavily on AAR for essential services such as Maintenance, Repair, and Overhaul (MRO), sophisticated supply chain management, comprehensive logistics support, and specialized expeditionary services tailored to defense needs.

Government sales are a significant driver of AAR's financial performance, underscoring the company's vital contribution to national defense readiness and operational capabilities. For instance, in fiscal year 2023, AAR reported that government contracts accounted for approximately 53% of its total revenue, highlighting the deep integration and reliance of these entities on AAR's expertise and services.

AAR actively engages with foreign governments and military organizations through Foreign Military Sales (FMS) programs, providing critical aviation aftermarket support. These international partners rely on AAR for essential services like aircraft maintenance, spare parts procurement, and efficient logistics, mirroring the needs of U.S. defense customers. This segment significantly broadens AAR's global footprint and contributes to international aviation readiness and security.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) rely on AAR as a critical partner for their aftermarket needs. AAR's role extends beyond mere distribution; it's about providing specialized support and managing intricate supply chains for OEM parts. This ensures that components reach the right customers, whether they are airlines, maintenance facilities, or other operators, in a timely and efficient manner.

These relationships are often built on exclusivity and a long-term commitment, highlighting the trust and value OEMs place in AAR's capabilities. For instance, in 2024, AAR continued to solidify its position as a key aftermarket solutions provider for major aerospace OEMs, facilitating the flow of essential components globally.

- Strategic Partnership: AAR functions as an extension of the OEM, managing the complex logistics and distribution of their manufactured parts.

- Global Reach: OEMs leverage AAR's established worldwide network to ensure their products are accessible to a broad customer base.

- Supply Chain Expertise: AAR's proficiency in handling aerospace supply chains offers OEMs a significant advantage in product availability and customer satisfaction.

- Long-Term Agreements: Many OEM partnerships with AAR are characterized by multi-year contracts, underscoring the strategic importance of these collaborations.

Other Aviation Service Providers and MROs

AAR actively partners with other Maintenance, Repair, and Overhaul (MRO) providers and aviation service companies. These collaborations often involve AAR supplying specialized component repairs or hard-to-find parts, effectively filling capability gaps for their peers.

This symbiotic relationship underscores AAR's role as a vital enabler within the aviation industry's complex supply chain. For instance, AAR's extensive inventory and repair certifications can be leveraged by smaller MROs that lack the necessary expertise or resources for certain complex tasks.

AAR's ability to source and manage parts logistics also benefits other service providers, allowing them to focus on their core competencies. This strategic positioning as a reliable partner strengthens the overall resilience and efficiency of the aviation maintenance sector.

- Component Repair Specialization: AAR offers niche repair capabilities that other MROs may not possess, such as advanced composite repairs or complex avionics overhauls.

- Parts Sourcing and Logistics: They provide access to a broad range of aviation parts, including those with long lead times or limited availability, streamlining procurement for other service providers.

- Partnership for Capability Gaps: AAR acts as a solution provider for MROs needing to outsource specific maintenance tasks or acquire specialized components to meet customer demands.

- Ecosystem Integration: This segment highlights AAR's importance not just as a direct service provider but as a crucial link supporting the operational needs of the wider aviation service industry.

AAR serves a diverse customer base, with commercial airlines representing a significant portion of its business, accounting for 71% of total sales in fiscal year 2025. The U.S. Government and Defense Entities are also crucial, with government contracts making up approximately 53% of revenue in fiscal year 2023. Furthermore, AAR partners with Original Equipment Manufacturers (OEMs) and other Maintenance, Repair, and Overhaul (MRO) providers, acting as a vital link in the aviation aftermarket ecosystem.

Cost Structure

AAR's operating costs are heavily influenced by its Maintenance, Repair, and Overhaul (MRO) facilities. These expenses cover essential elements like hangar space, specialized equipment, utilities, and tooling required for aircraft servicing. For instance, AAR's fiscal year 2024 saw significant capital expenditures, including the development of a new hangar in Miami, which directly impacts these operational cost structures.

The cost of aircraft parts, components, and materials is a significant expense for AAR, encompassing both new original equipment manufacturer (OEM) supplied parts and used serviceable material (USM). In fiscal year 2023, AAR's cost of sales, which includes these materials, was $2.5 billion.

Efficient inventory management and strategic sourcing are paramount to controlling these costs. AAR's ability to source parts effectively, whether new or used, directly impacts its profitability in both distribution and maintenance, repair, and overhaul (MRO) services.

Labor and personnel expenses are a significant component of AAR's cost structure, reflecting its nature as a service-intensive business. These costs encompass salaries, wages, benefits, and the ongoing training required to maintain a highly skilled workforce. In 2024, AAR's commitment to its approximately 5,600 employees and 500 contractors underscores the substantial investment in human capital necessary for its operations.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses represent a significant component of AAR's cost structure, encompassing essential corporate overheads. These costs are crucial for supporting the company's day-to-day operations and its strategic growth objectives.

For the fiscal year 2024, AAR reported SG&A expenses totaling $344.8 million. This figure reflects the investment in sales and marketing efforts, administrative functions, legal services, and financial operations that are vital for maintaining and expanding the business.

- Sales and Marketing: Costs associated with promoting AAR's aviation support services and expanding its customer base.

- General and Administrative: Expenses related to corporate management, human resources, IT, and other essential support functions.

- Legal and Finance: Costs incurred for legal counsel, compliance, accounting, and financial planning.

- Optimization Efforts: While these costs are substantial, AAR actively seeks to optimize SG&A through efficiency improvements and strategic resource allocation.

Acquisition and Integration Costs

AAR faces significant expenses when acquiring and integrating new businesses, like its recent Product Support segment. These costs are not just the purchase price; they also include amortization of acquired intangibles and the operational expenses tied to merging systems and teams. For instance, in fiscal year 2024, AAR reported amortization expenses related to acquisitions, which, while contributing to long-term value, naturally put pressure on immediate earnings.

These integration efforts, though crucial for expanding AAR's market reach and capabilities, represent a substantial investment. The company must allocate resources to ensure a smooth transition, which can involve IT system consolidation, employee retraining, and aligning operational processes. While these strategic moves are designed to fuel future growth and profitability, they inevitably create a drag on short-term financial performance as these costs are recognized.

- Acquisition Expenses: Costs associated with purchasing new businesses, including due diligence and legal fees.

- Integration Costs: Expenditures for merging acquired operations, such as IT system upgrades and process harmonization.

- Amortization: Non-cash expense reflecting the gradual write-down of intangible assets acquired in business combinations.

- Impact on Profitability: These upfront costs can temporarily reduce net income, even as they are expected to drive future revenue and efficiency gains.

AAR's cost structure is primarily driven by its Maintenance, Repair, and Overhaul (MRO) operations, which include facility costs, specialized equipment, and utilities. The significant expense of aircraft parts and components, both new and used serviceable material, is a major factor, as seen in its $2.5 billion cost of sales in FY2023. Labor and personnel, encompassing salaries, benefits, and training for its workforce, are also substantial. Additionally, Selling, General, and Administrative (SG&A) expenses, totaling $344.8 million in FY2024, cover essential corporate functions and growth initiatives.

| Cost Category | FY2024 Data | FY2023 Data |

|---|---|---|

| Cost of Sales (Parts & Materials) | Not explicitly stated for FY24, but FY23 was $2.5 billion | $2.5 billion |

| Selling, General & Administrative (SG&A) | $344.8 million | Not explicitly stated for FY23 |

| Labor & Personnel | Supports ~5,600 employees and 500 contractors | Supports ~5,600 employees and 500 contractors |

Revenue Streams

AAR generates substantial revenue through its Maintenance, Repair, and Overhaul (MRO) services. These fees cover a wide range of essential aircraft upkeep, from routine airframe checks to complex engine component repairs, serving both commercial airlines and government entities.

The MRO segment is a cornerstone of AAR's business, encompassing scheduled maintenance, critical unscheduled repairs, and the implementation of technical directives and modifications. This comprehensive offering ensures aircraft safety and operational readiness.

For the fiscal year ending May 31, 2024, AAR's Repair & Engineering segment, which houses MRO services, reported revenues of $1.1 billion, representing a significant portion of the company's overall financial performance and highlighting the critical role of MRO in their business model.

AAR generates significant revenue by selling and distributing both new, original equipment manufacturer (OEM) supplied aircraft parts and used serviceable material (USM). This includes everything from entire aircraft and engines to smaller airframe components, crucial for keeping fleets operational.

The Parts Supply segment is a major revenue engine, with new parts distribution showing particularly robust growth. For fiscal year 2024, AAR reported Parts Supply segment revenue of $1.1 billion, a notable increase driven by these sales activities.

AAR generates revenue by offering tailored supply chain management and logistics services, including parts pooling, to commercial airlines, government agencies, and defense clients. These services are designed to boost material availability and operational efficiency through performance-based contracts.

This revenue stream encompasses AAR's comprehensive solutions, such as flight-hour support, which directly contributes to client operational continuity and cost management.

Software Licensing and Subscription Fees (Trax)

AAR generates revenue through licensing its Trax software and charging subscription fees for its cloud-based MRO enterprise platform and eMobility applications. This dual approach captures value from both initial adoption and ongoing usage of their digital solutions.

The demand for digital tools in aviation maintenance is increasing, which directly benefits this revenue stream. New customer acquisitions and existing clients upgrading their services contribute to its growth, highlighting Trax's position as a high-margin area for AAR.

For instance, AAR reported that its digital solutions, including Trax, saw significant growth in fiscal year 2024. While specific figures for Trax licensing and subscriptions are often bundled within broader digital segments, the company has consistently highlighted the strong performance and strategic importance of these offerings.

- Software Licensing: Revenue from granting access to the Trax software.

- Subscription Fees: Recurring income from cloud-based MRO platform and eMobility apps.

- Growth Drivers: New business wins and upgrades from existing customers.

- Profitability: Trax is identified as a high-margin growth area for AAR.

Government Contracts and Programs

AAR's business model heavily relies on government contracts and programs, securing a significant portion of its revenue. These agreements typically span extended periods, ensuring a stable income stream for services like maintenance, repair, and overhaul (MRO), as well as complex supply chain and logistics operations for military aviation assets.

In fiscal year 2025, government sales represented a substantial 29% of AAR's total consolidated sales, highlighting the critical importance of this sector to the company's financial performance. This strong government presence underscores AAR's role as a key partner in supporting national defense and international military readiness.

- Long-term government contracts provide revenue stability.

- Services include MRO, supply chain, and logistics for military aircraft.

- Government sales accounted for 29% of AAR's consolidated sales in FY2025.

AAR's revenue is diversified across several key areas. The company earns significantly from its Maintenance, Repair, and Overhaul (MRO) services, which are crucial for aircraft operational readiness. Additionally, AAR generates substantial income from the sale and distribution of new and used aircraft parts. Its supply chain management and logistics services, including flight-hour support, also contribute to its revenue base by enhancing client efficiency.

The company's digital solutions, particularly the Trax software, represent a growing revenue stream through licensing and subscription fees. Furthermore, government contracts form a substantial and stable income source, underscoring AAR's importance in supporting military aviation. For fiscal year 2024, AAR's Repair & Engineering segment, which includes MRO, and its Parts Supply segment each reported $1.1 billion in revenue.

| Revenue Stream | Description | FY2024 Revenue (Approx.) |

| Maintenance, Repair, and Overhaul (MRO) | Aircraft upkeep, airframe checks, engine repairs | $1.1 billion (Repair & Engineering Segment) |

| Parts Supply | New OEM parts and used serviceable material distribution | $1.1 billion (Parts Supply Segment) |

| Supply Chain & Logistics | Parts pooling, flight-hour support, operational efficiency services | Included in overall segment revenues |

| Digital Solutions (Trax) | Software licensing and subscription fees for MRO platforms | Significant growth, high-margin area |

| Government Contracts | Services for military aviation assets | 29% of consolidated sales in FY2025 |

Business Model Canvas Data Sources

The AAR Business Model Canvas is informed by a blend of internal financial reports, customer feedback mechanisms, and competitive landscape analyses. These diverse data streams ensure a comprehensive and actionable strategic framework.