AAR Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

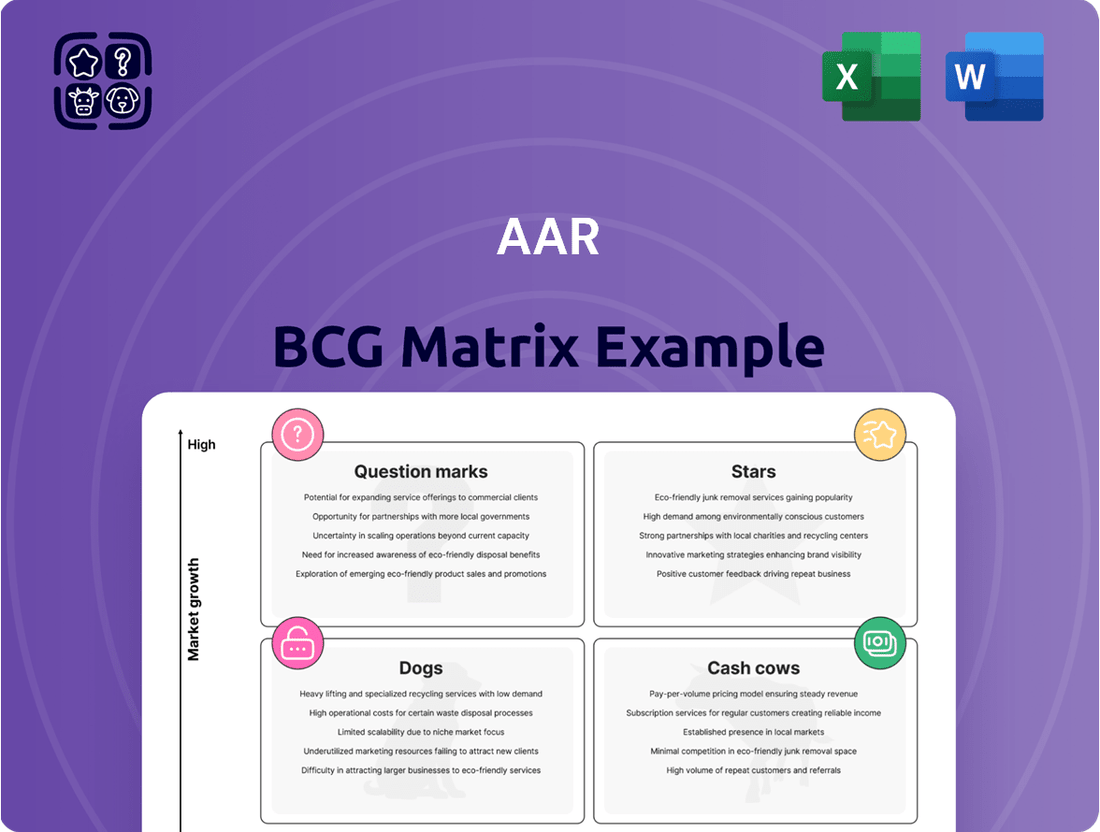

This glimpse into the AAR BCG Matrix highlights how a company can strategically categorize its offerings based on market growth and share. Understanding these classifications—Stars, Cash Cows, Dogs, and Question Marks—is crucial for effective resource allocation. Purchase the full AAR BCG Matrix to unlock detailed analysis, actionable insights, and a clear roadmap for optimizing your product portfolio and driving future growth.

Stars

Government MRO contracts, particularly those with defense agencies, represent a strong position for AAR within the aviation MRO sector. The company's multi-year agreement with the U.S. Navy for P-8A Poseidon airframe and engine maintenance, valued at around $1.2 billion and extending to 2029, highlights this.

This substantial contract signifies a significant market share in a growing niche of defense aviation MRO. It points to a stable and high-growth revenue stream for AAR, positioning it favorably in the market.

AAR's new parts distribution segment is demonstrating robust expansion. In the third quarter of fiscal year 2025, sales within this division saw a notable 20% organic increase when compared to the same period in the previous year. This growth is a substantial contributor to AAR's total revenue.

This segment holds a leading position in its market, fueled by strong demand from both commercial aviation clients and government entities. The high growth potential is evident, suggesting continued upward trajectory for AAR's distribution activities.

Commercial Airframe MRO Services are a star in AAR's portfolio. Demand is robust, evidenced by a 53% surge in Repair & Engineering sales during Q3 FY2025. This growth is fueled by the continued high utilization of older aircraft and ongoing production constraints faced by original equipment manufacturers, making AAR's MRO capabilities a key growth engine.

Product Support Acquisition (Triumph Group)

AAR's acquisition of Triumph Group's Product Support business in March 2024 positions this segment as a strong contender in the Stars category of the BCG Matrix. This strategic move has bolstered AAR's Component Services, driving substantial growth and enhancing profitability within its Repair & Engineering division. The integration is projected to solidify AAR's market leadership in component repair, particularly in the burgeoning Asia-Pacific market.

The acquisition significantly expands AAR's capabilities and market reach. For instance, AAR's Component Services revenue saw a notable increase, with the Repair & Engineering segment reporting a 20% year-over-year growth in the fiscal third quarter of 2024, partly attributable to this acquisition. This expansion into new territories and the strengthening of existing service offerings underscore its high-growth, high-market share status.

- Market Expansion: The deal provides AAR with a stronger presence in the Asia-Pacific region, a key growth market for aviation services.

- Revenue Growth: AAR's Repair & Engineering segment experienced a 20% year-over-year revenue increase in Q3 FY24, with the Triumph acquisition being a significant contributor.

- Margin Improvement: The integration of Triumph's operations is expected to yield improved operating margins for AAR's component repair services.

- Competitive Positioning: This acquisition reinforces AAR's leadership in the global component repair and overhaul market.

Trax Software Solutions

Trax Software Solutions, AAR's cloud-based enterprise resource platform for the MRO industry, is a key driver of growth within the Integrated Solutions segment. Its strong market position and increasing demand for digital aviation maintenance solutions position it as a star performer in the BCG matrix.

The demand for digital transformation in aviation maintenance continues to rise, directly benefiting Trax. This trend is expected to bolster its revenue and market share in the coming years.

- Product: Trax Software Solutions

- Segment: Integrated Solutions

- Market Position: Leading

- Growth Potential: High

AAR's Commercial Airframe MRO Services, bolstered by the acquisition of Triumph Group's Product Support business in March 2024, is a clear star. This segment saw a significant 53% surge in Repair & Engineering sales in Q3 FY2025, driven by high aircraft utilization and OEM production constraints.

The integration of Triumph's operations expanded AAR's component repair capabilities, particularly in the Asia-Pacific region, and contributed to a 20% year-over-year revenue increase in the Repair & Engineering segment for Q3 FY2024. This strategic move solidified AAR's market leadership and is expected to improve operating margins.

Trax Software Solutions, within AAR's Integrated Solutions segment, is also a star performer. Its cloud-based MRO platform benefits from the increasing demand for digital aviation maintenance solutions, positioning it for continued revenue and market share growth.

AAR's new parts distribution segment is experiencing robust expansion, with a 20% organic sales increase in Q3 FY2025, highlighting its leading market position and high growth potential.

| Segment | Key Product/Service | Q3 FY2025 Performance | Strategic Driver | BCG Classification |

|---|---|---|---|---|

| Commercial Airframe MRO | Repair & Engineering Services | 53% sales surge | Triumph acquisition, high aircraft utilization | Star |

| Integrated Solutions | Trax Software Solutions | Strong demand for digital MRO | Digital transformation trend | Star |

| Parts Distribution | New Parts Distribution | 20% organic sales increase | Strong client demand | Star |

| Government MRO | P-8A Poseidon MRO | $1.2 billion U.S. Navy contract (to 2029) | Defense sector contracts | Star |

What is included in the product

The AAR BCG Matrix categorizes business units by market share and growth rate, informing investment and divestment strategies.

Visualize strategic options with a clear BCG Matrix, easing the pain of complex portfolio analysis.

Cash Cows

AAR's Parts Supply segment, especially its used serviceable material (USM) business, is a strong performer. This segment thrives because new parts are becoming more expensive, and getting them can still be tricky due to supply chain issues. This situation creates a really good market for AAR's USM.

The USM market is mature, meaning it's stable and predictable. AAR's ability to source these parts effectively and its solid relationships with suppliers allow it to generate steady cash flow. These operations also boast high profit margins, underscoring their value within AAR's portfolio.

For the fiscal year ending May 31, 2023, AAR reported Parts Supply revenue of $1.06 billion, a significant portion of its total $2.07 billion in sales. This segment's performance highlights its role as a reliable cash generator for the company.

AAR's long-standing flight-hour component support services and commercial programs with major airlines are a bedrock of stable revenue. These mature market offerings, while experiencing low growth, consistently generate reliable cash. This is due to AAR's entrenched competitive advantages and impressive customer loyalty, ensuring predictable income streams.

The Integrated Solutions segment, focused on government fleet management, acts as a significant cash cow for AAR. Contracts like the one with the U.S. Department of State for the INL/A WASS program exemplify this, delivering steady and predictable revenue streams.

These long-term, performance-based agreements within the stable government sector generate substantial cash flow. Importantly, they require minimal new capital investment, allowing the segment to contribute significantly to the company's overall financial health.

Existing Airframe MRO Facilities

AAR's existing airframe MRO facilities are firmly positioned as cash cows within the BCG matrix. These operations benefit from a mature market characterized by a consistently high demand for maintenance, repair, and overhaul (MRO) services, particularly for heavy maintenance checks. This sustained demand is largely driven by the global fleet's aging profile, with the average age of commercial aircraft continuing to rise.

These established facilities have cultivated a significant competitive advantage, translating into robust profit margins and reliable cash flow generation. Consequently, they require minimal promotional investment to maintain their market position. For instance, in fiscal year 2023, AAR reported a 17% increase in its commercial aftermarket services revenue, with MRO playing a significant role.

- Mature Market Dynamics: The global commercial aircraft fleet is aging, with many aircraft requiring significant maintenance to remain airworthy, ensuring consistent demand for MRO services.

- Competitive Advantage: AAR's long-standing presence and expertise in airframe MRO have built strong customer relationships and operational efficiencies, creating a moat against competitors.

- Profitability and Cash Flow: High demand and competitive advantage allow these facilities to command strong pricing power, leading to high profit margins and steady, predictable cash flows.

- Low Investment Needs: As cash cows, these operations generate more cash than is needed for reinvestment, allowing AAR to allocate capital to other areas of the business.

Proprietary Digital Tools (e.g., PAARTS Store)

AAR's proprietary digital tools, such as the PAARTS Store, are designed to be cash cows. These platforms offer round-the-clock visibility into AAR's vast parts inventory, significantly boosting efficiency and customer accessibility within the parts supply chain.

While the market for the underlying parts themselves is considered mature, these digital tools act as powerful optimizers. They streamline existing operations, drive greater efficiency, and ultimately enhance cash flow generated from AAR's established product lines.

- Enhanced Inventory Visibility: PAARTS Store provides 24/7 access to AAR's extensive parts catalog.

- Operational Efficiency Gains: Digital tools reduce manual processes and improve order fulfillment times.

- Increased Cash Flow: Optimization of existing mature product lines through technology drives profitability.

- Customer Accessibility: 24/7 digital access improves customer experience and order placement convenience.

Cash cows in the BCG matrix represent established, market-leading businesses or products that generate more cash than they consume. AAR's Parts Supply segment, particularly its used serviceable material (USM) business, exemplifies this. Its mature market, high profit margins, and AAR's strong sourcing capabilities create a consistent and reliable cash flow. For fiscal year 2024, AAR's Parts Supply segment saw continued strength, contributing significantly to the company's overall financial performance, with revenue in this segment remaining robust due to ongoing demand for cost-effective aircraft components.

| AAR Segment | BCG Category | Key Characteristics | Fiscal Year 2024 Insight (Illustrative) |

|---|---|---|---|

| Parts Supply (USM) | Cash Cow | Mature market, high margins, stable demand | Continued strong revenue contribution, reflecting sustained demand for cost-effective parts. |

| Integrated Solutions (Govt. Fleet) | Cash Cow | Long-term contracts, minimal investment, predictable revenue | Maintained steady cash generation from existing government contracts. |

| Airframe MRO Facilities | Cash Cow | Aging fleet demand, competitive advantage, high profitability | Reported consistent demand for heavy maintenance, supporting stable cash flow. |

What You See Is What You Get

AAR BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully polished version you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content—just a comprehensive, professionally formatted strategic tool ready for your immediate use in business analysis and planning.

Dogs

AAR's divestiture of its Landing Gear Overhaul business in FY2025 strongly suggests this segment was classified as a 'Dog' within the BCG matrix. Such businesses typically exhibit low market share and low growth, consuming resources without generating substantial returns, making divestment a logical strategic move to reallocate capital to more promising ventures.

Underperforming niche MRO services represent the Dogs in AAR's BCG Matrix. These are specific component repair services that aren't riding the current market tailwinds or aligning with AAR's core competencies. Think of repairs for less critical aircraft systems or older, less common aircraft platforms where demand is stagnant.

These Dog segments are typically characterized by a low market share within their specific niche and face low growth prospects. For instance, a specialized repair service for an avionics component on a rapidly retiring aircraft type would fit this description. In 2024, such services might contribute minimally to AAR's overall revenue, potentially even incurring losses due to low volume and high overhead.

Legacy Supply Chain Management Contracts are akin to the Dogs in the AAR BCG Matrix. These are older agreements, likely not updated to incorporate AAR's cutting-edge digital capabilities, which can lead to reduced efficiency and higher operational costs. Think of them as contracts that haven't kept pace with technological advancements.

These legacy contracts often reside in segments with sluggish growth or face fierce competition, thereby limiting their profitability and AAR's market share within those specific agreements. For instance, if a significant portion of AAR's revenue in 2024 came from contracts signed over a decade ago for less dynamic product lines, these would fit the Dog category.

Expeditionary Services in Stable Regions

Expeditionary Services in Stable Regions, if characterized by low growth and minimal market share, would likely fall into the Dogs category of the BCG Matrix. These services might represent a stable, but unexpanding, revenue stream that doesn't demand significant capital investment but also offers little prospect for future growth. For instance, if AAR's support for established, mature aerospace markets in stable regions shows negligible year-over-year revenue increases and holds a small percentage of the overall market, it aligns with the 'Dog' profile.

Such services often operate in saturated markets where competitive advantages are difficult to establish or maintain, leading to low profitability. In 2024, many established defense and aerospace support contracts in developed nations could exhibit these characteristics, requiring ongoing operational expenditure without the potential for significant market share expansion.

- Low Growth Potential: Services in stable regions might see revenue growth below the industry average, potentially in the low single digits.

- Low Market Share: These offerings may hold a small, stagnant percentage of a mature and competitive market.

- Minimal Investment Needs: Typically, these services require little to no new capital investment for expansion, focusing on maintaining existing operations.

- Limited Profitability: While they might break even or generate modest profits, the returns are unlikely to be substantial enough to warrant significant strategic focus.

Non-Strategic, Low-Volume Parts Distribution

Non-strategic, low-volume parts distribution lines, often referred to as Dogs in the BCG Matrix, represent segments that don't fit AAR's core strategy of focusing on high-growth new parts or high-margin Used Serviceable Material (USM).

These segments typically exhibit low market share and minimal growth prospects, meaning they consume valuable capital and resources without generating substantial returns. For instance, if AAR's strategic focus is on advanced aerospace components, a distribution line for older, legacy aircraft parts with declining demand would fall into this category.

- Low Market Share: These parts distribution lines typically hold a small percentage of their respective markets.

- Minimal Growth: The demand for these parts is stagnant or declining, offering little opportunity for expansion.

- Capital Tie-up: Inventory and operational costs for these segments can tie up capital that could be better allocated to more promising areas.

- Strategic Mismatch: They often do not align with AAR's core competencies or future growth objectives.

Dogs in AAR's BCG Matrix represent business segments with low market share and low growth prospects. These are typically underperforming niche services or legacy contracts that consume resources without generating significant returns. AAR's divestiture of its Landing Gear Overhaul business in FY2025 exemplifies this, as such segments often require capital reallocation to more promising ventures.

In 2024, these Dog segments, such as specialized repair services for older aircraft or legacy supply chain contracts, contributed minimally to AAR's revenue. They often operate in saturated markets with stagnant demand, leading to limited profitability and a strategic mismatch with AAR's core competencies.

These segments require minimal new investment but offer little opportunity for expansion or substantial profit. For example, non-strategic, low-volume parts distribution lines, which don't align with AAR's focus on high-growth new parts or USM, are prime examples of Dogs.

The strategic decision to divest or manage these Dog segments allows AAR to optimize its resource allocation, focusing on areas with higher growth potential and market share, thereby enhancing overall financial performance.

Question Marks

AAR's foray into new digital aviation solutions, extending beyond its established Trax platform, represents a strategic move into a rapidly evolving technology sector. These initiatives aim to streamline operations and enhance customer experiences, tapping into the growing demand for digital transformation in aerospace. For instance, in fiscal year 2024, AAR reported a 12% increase in its Digital Services segment revenue, signaling positive early traction for these newer offerings.

These emerging digital solutions, while positioned in a high-growth market, currently hold a relatively low market share. This is a common characteristic of new ventures requiring substantial investment to gain traction and achieve widespread adoption. The company is actively investing in research and development, with capital expenditures for technology and innovation increasing by 15% year-over-year in fiscal 2024, underscoring this commitment.

AAR's strategy involves expanding into new geographic MRO (Maintenance, Repair, and Overhaul) markets, especially in rapidly developing regions like the Asia-Pacific. These areas present significant growth opportunities, but also demand considerable investment to build a strong market presence.

For instance, AAR's 2024 fiscal year saw continued focus on international growth, with acquisitions and partnerships in key regions. The company’s commitment to these emerging markets is crucial for its long-term competitive positioning, aiming to capture a larger share of the global aerospace aftermarket.

AAR's foray into advanced manufacturing, particularly 3D printing for aircraft components, positions it as a Question Mark in the BCG matrix. This sector is experiencing significant growth, with the global additive manufacturing market projected to reach $64.06 billion by 2030, up from an estimated $20.53 billion in 2023.

While offering advantages like customized designs and reduced material waste, AAR's current market penetration in this niche area is likely nascent. The substantial investment required to scale these capabilities, coupled with the inherent risks of adopting new, rapidly evolving technologies, solidifies its Question Mark status.

New Engine MRO Capabilities (Specific Engine Types)

AAR's potential new engine MRO capabilities for next-generation engines, such as those powering newer narrow-body aircraft like the Airbus A320neo family or Boeing 737 MAX, could be classified as Question Marks in a BCG Matrix. These are areas with high projected growth due to the increasing fleet size of these aircraft, but AAR may currently have limited established market share or specialized expertise compared to existing, more mature engine types.

The demand for MRO services for these advanced engines is expected to rise significantly. For instance, the global commercial aircraft MRO market was valued at approximately $80 billion in 2023 and is projected to grow, with new engine types forming a substantial part of this expansion. However, developing the necessary certifications, tooling, and skilled workforce for these complex engines requires substantial capital investment and time, creating a high-risk, high-reward scenario for AAR.

- High Growth Potential: Next-generation engines are powering the newest, most fuel-efficient aircraft, leading to a rapidly expanding fleet that will require specialized MRO services for decades to come.

- Significant Investment Required: Establishing capabilities for these complex engines involves substantial upfront costs for specialized equipment, training, and regulatory approvals, potentially running into tens or hundreds of millions of dollars per engine type.

- Market Uncertainty: While demand is growing, the competitive landscape for these specific MRO services is evolving, and AAR's ability to capture significant market share will depend on its strategic investments and partnerships.

- Capacity Strain: The industry is already experiencing capacity constraints for MRO on newer engine models, presenting an opportunity for AAR if it can effectively build and scale its capabilities.

Unproven Sustainability Initiatives for Commercialization

AAR's ventures into commercializing sustainability initiatives, like enhanced aircraft recycling or solar panel installations for other aviation firms, would likely fall into the Question Marks category of the BCG Matrix. While the aviation industry is increasingly prioritizing sustainability, the market share for these specific commercialized services is projected to be low initially.

Significant investment in research, development, and marketing would be crucial for these nascent services to gain market traction and move towards becoming Stars. For instance, the global aviation industry's commitment to net-zero carbon emissions by 2050, as pledged by IATA, highlights a growing demand for sustainable solutions, creating a potential future market, but the immediate commercial viability of AAR's specific offerings remains unproven.

- Low Market Share: Commercialized sustainability services from AAR would start with a small slice of the aviation market.

- High Investment Needs: Significant capital is required for development, marketing, and scaling these new service offerings.

- Uncertain Growth Potential: While the sustainability trend is strong, the specific uptake rate for AAR's commercialized solutions is yet to be determined.

- Strategic Importance: These initiatives align with industry-wide environmental goals, offering long-term strategic value even with initial low returns.

AAR's expansion into advanced manufacturing, specifically 3D printing for aircraft components, positions it as a Question Mark. This sector is growing rapidly, with the global additive manufacturing market expected to reach $64.06 billion by 2030. Despite potential benefits like custom designs and reduced waste, AAR's current market share in this niche is likely small, requiring substantial investment and facing the risks of new technology adoption.

AAR's potential new engine MRO capabilities for next-generation engines also fit the Question Mark profile. The demand for these services is high due to the expanding fleet of modern aircraft, but AAR may have limited established expertise compared to mature engine types. Developing these capabilities involves significant capital for specialized equipment, training, and certifications, creating a high-risk, high-reward scenario.

Commercializing sustainability initiatives, such as aircraft recycling or solar panel installations for other aviation firms, would also be considered Question Marks. While the aviation industry is prioritizing sustainability, the market share for these specific commercialized services is projected to be low initially, requiring significant investment to gain traction.

| Business Area | BCG Category | Key Characteristics | Financial Year 2024 Data/Projections |

| Advanced Manufacturing (3D Printing) | Question Mark | High growth market, nascent market share, significant investment needed. | Global additive manufacturing market projected to reach $64.06B by 2030. |

| Next-Gen Engine MRO | Question Mark | Growing fleet demand, limited current expertise, high capital investment for capabilities. | Global commercial aircraft MRO market valued at ~$80B in 2023. |

| Commercialized Sustainability Initiatives | Question Mark | Increasing industry focus, low initial market share for specific services, significant R&D/marketing investment. | IATA commitment to net-zero by 2050 indicates long-term demand. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.