AAR Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

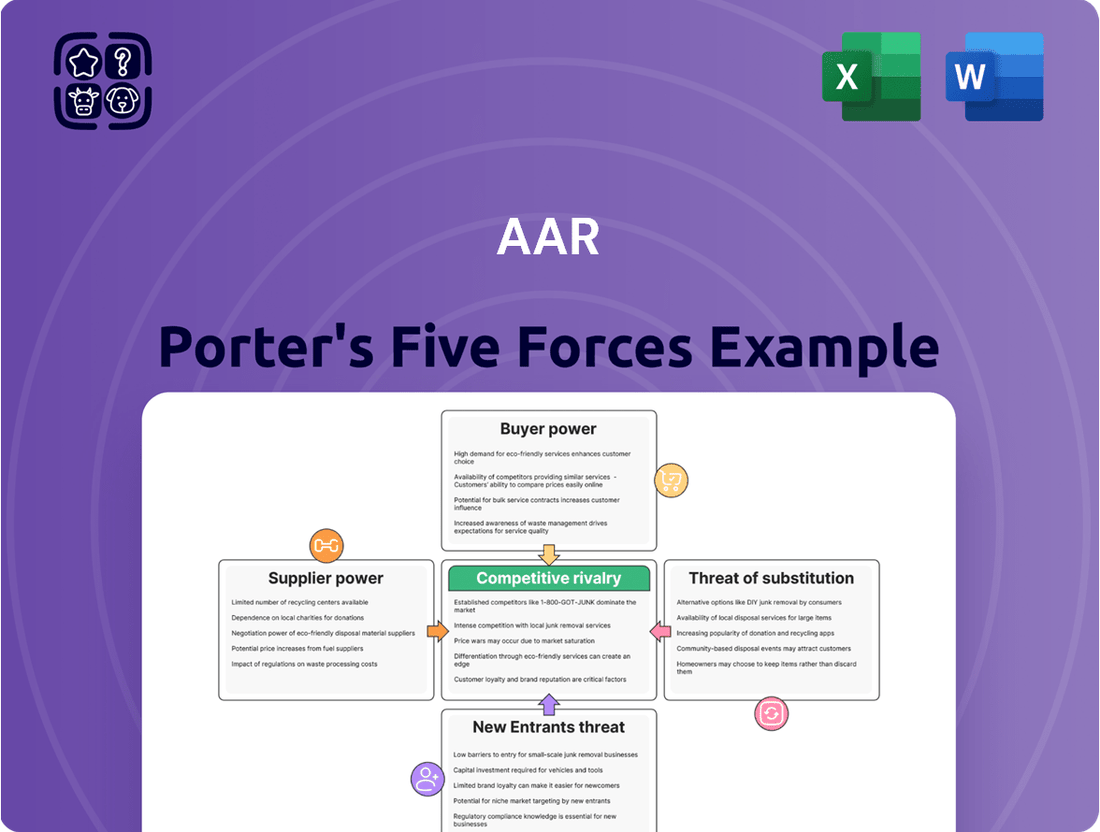

Porter's Five Forces Analysis helps us understand the competitive landscape AAR operates within. It examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This framework is crucial for identifying AAR's strategic positioning and potential vulnerabilities.

The complete report reveals the real forces shaping AAR’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The aerospace and defense sector, where AAR operates, often features a concentrated supplier base for highly specialized components. This means a few key companies control the production of essential parts like advanced avionics and unique composite materials. For instance, in 2024, the market for commercial aircraft engines is dominated by a handful of major players, giving them considerable pricing power.

Switching suppliers in the aviation Maintenance, Repair, and Overhaul (MRO) sector presents considerable challenges for companies like AAR. These challenges include the significant costs associated with re-certifying new suppliers, validating their processes, and the potential for operational disruptions during the transition. For instance, obtaining regulatory approvals for new parts or repair processes can take months and involve substantial fees, making a shift from an established supplier a complex undertaking.

These high switching costs effectively create a substantial barrier to entry for potential new suppliers looking to enter the market. Consequently, this strengthens the bargaining power of AAR's existing suppliers. They can leverage the difficulty and expense AAR would face in finding and integrating a new partner to negotiate more favorable terms, potentially impacting AAR's cost structure and profitability.

Many critical aerospace components and complex systems are safeguarded by proprietary technology and robust intellectual property rights, primarily held by Original Equipment Manufacturers (OEMs). This situation significantly constrains AAR's options for sourcing essential parts or specialized services, thereby amplifying the bargaining leverage of these pivotal suppliers.

Impact of Supply Chain Disruptions

The aerospace supply chain has been particularly vulnerable to disruptions, impacting companies like AAR. These issues, ranging from shortages of vital raw materials to a lack of skilled labor and the ripple effects of geopolitical instability, have made it harder to secure necessary components. For instance, in 2023, the aerospace industry continued to grapple with extended lead times for critical parts, with some components seeing delivery delays stretching over 18 months.

These persistent disruptions significantly shift the balance of power towards suppliers. When the availability of essential parts diminishes, suppliers gain leverage, enabling them to dictate more favorable terms and increase prices. This dynamic directly affects MRO (Maintenance, Repair, and Overhaul) providers such as AAR, as they face higher input costs and potential delays in servicing aircraft.

- Reduced Availability: Geopolitical events and labor shortages in 2023 contributed to a scarcity of specialized aerospace materials and components, increasing supplier leverage.

- Price Increases: With demand outstripping supply for certain parts, suppliers were able to command higher prices, impacting AAR's cost structure.

- Extended Lead Times: Delays in production and shipping meant AAR had to plan further in advance and potentially hold more inventory, tying up capital.

Specialized Labor and Skills Shortages

Suppliers of highly skilled labor, like certified mechanics and engineers, wield considerable bargaining power. This is amplified by persistent talent shortages within the aerospace sector, a trend expected to continue through 2024 and beyond.

This scarcity directly translates to higher labor costs for companies like AAR, potentially impacting their operational efficiency and service delivery timelines. For instance, the demand for experienced aerospace technicians in 2024 significantly outstripped supply, driving up wages and contract rates.

- Talent Scarcity: Ongoing shortages of specialized aerospace labor create leverage for skilled workers.

- Increased Costs: Labor shortages lead to higher wages and benefit costs for AAR.

- Operational Impact: Difficulty in sourcing skilled personnel can delay projects and affect service quality.

- Competitive Hiring: Companies compete fiercely for limited talent pools, further inflating labor expenses.

The bargaining power of suppliers for AAR is significant due to a concentrated supplier base for specialized aerospace components. High switching costs, proprietary technology, and supply chain disruptions, such as extended lead times for critical parts seen in 2023, further empower these suppliers. This dynamic is exacerbated by a shortage of highly skilled labor, like certified mechanics, a trend continuing into 2024, leading to increased costs and operational challenges for AAR.

| Factor | Impact on AAR | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited sourcing options, increased pricing power for suppliers | Commercial aircraft engine market dominated by a few major players |

| Switching Costs | High costs and time for re-certification and validation | Regulatory approval for new parts can take months and incur substantial fees |

| Proprietary Technology | Constraints on sourcing due to OEM intellectual property | OEMs control access to essential components and specialized services |

| Supply Chain Disruptions | Scarcity of materials, labor shortages, geopolitical instability | Extended lead times for critical parts, some over 18 months in 2023 |

| Skilled Labor Shortage | Higher labor costs, potential delays in service delivery | Demand for aerospace technicians significantly outstripped supply in 2024, driving up wages |

What is included in the product

This analysis dissects the competitive landscape for AAR by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Quickly identify and address competitive threats with a visual breakdown of industry pressures, enabling proactive strategy adjustments.

Customers Bargaining Power

AAR's customer base is dominated by large, sophisticated entities like major commercial airlines, government agencies, and defense contractors. These clients, such as United Airlines or the U.S. Department of Defense, possess substantial purchasing power due to their sheer volume and deep understanding of the aerospace aftermarket. For instance, in fiscal year 2023, AAR reported that its largest customer accounted for approximately 11% of its total sales, highlighting the concentration and influence these buyers can wield.

Commercial airlines operate in a highly competitive, low-margin industry, making them acutely sensitive to maintenance, repair, and overhaul (MRO) expenses. This inherent price sensitivity means customers actively hunt for the most economical MRO solutions, directly amplifying their bargaining power and exerting downward pressure on AAR's profitability.

For instance, in 2023, the global airline industry experienced a significant rebound, with net profits projected to reach $9.8 billion according to IATA. However, this profitability is often razor-thin for individual carriers, reinforcing their drive to negotiate aggressively on MRO contracts, a key cost center for airlines.

While AAR is a significant player, the MRO market offers customers several alternatives. These include other independent MROs, MRO services provided by airlines themselves, and direct support from Original Equipment Manufacturers (OEMs).

This competitive landscape empowers customers by providing them with choices. For instance, in 2024, the global aviation MRO market was valued at approximately $85 billion, indicating a substantial number of service providers competing for business.

The presence of these diverse options strengthens a customer's bargaining power. They can leverage quotes from various providers to negotiate better pricing and terms for their maintenance and repair requirements.

Outsourcing Trends

Airlines and other operators are increasingly outsourcing Maintenance, Repair, and Overhaul (MRO) services to specialized providers like AAR. This trend, observed significantly in 2024, allows these operators to optimize costs and operational efficiency by leveraging AAR's expertise. For instance, AAR reported a 12% increase in its aviation services segment revenue in the third quarter of fiscal year 2024, driven by growing MRO demand.

However, this outsourcing also empowers customers. As they actively evaluate and select MRO providers, they gain significant leverage. This means customers can demand specific service levels, faster turnaround times, and, crucially, competitive pricing. The competitive landscape among MRO providers intensifies this customer bargaining power.

- Increased Provider Choice: The rise of specialized MRO providers means airlines have more options, reducing reliance on any single supplier.

- Focus on Cost-Effectiveness: Outsourcing is primarily driven by the need to reduce internal MRO costs, making price a key negotiation point for customers.

- Demand for Service Guarantees: Customers leverage their ability to switch providers to secure performance-based contracts and stringent service level agreements.

- Information Asymmetry Reduction: With more market data available, customers are better informed about industry pricing and service benchmarks.

Long-Term Contracts and Relationships

AAR's utilization of long-term contracts for its maintenance, repair, and overhaul (MRO) and supply chain services significantly influences customer bargaining power. These agreements, often spanning several years, create a degree of customer lock-in, reducing their immediate ability to switch providers. For instance, a multi-year contract for fleet-wide MRO services binds an airline to AAR, limiting their options for seeking alternative suppliers during the contract term.

While these long-term commitments offer AAR predictable revenue streams and foster strong customer loyalty, they also place the onus on AAR to consistently deliver exceptional performance. Failure to meet contractual obligations or service level agreements could lead to dissatisfaction and a potential loss of business upon contract renewal. In fiscal year 2024, AAR reported that a substantial portion of its revenue was derived from long-term agreements, highlighting the importance of maintaining these relationships through reliable service delivery.

- Customer Lock-in: Long-term contracts reduce customers' flexibility to switch providers, thereby limiting their immediate bargaining power.

- Revenue Stability for AAR: These contracts provide AAR with predictable revenue, contributing to financial forecasting and stability.

- Performance Dependency: AAR must consistently meet or exceed performance metrics within these contracts to retain customers and avoid renegotiation or loss of business.

- Relationship Value: The duration of these contracts fosters deep relationships, making it costly for customers to transition to new MRO providers.

AAR's customers, primarily large airlines and government entities, possess significant bargaining power due to their substantial order volumes and deep market knowledge. In fiscal year 2023, AAR's largest customer represented about 11% of total sales, underscoring the influence these major buyers can exert. The highly competitive, low-margin nature of the airline industry compels carriers to aggressively negotiate MRO costs, a critical expense area. For example, IATA projected $9.8 billion in net profits for the global airline industry in 2023, a figure that, while substantial, often translates to thin margins for individual airlines, thus amplifying their price sensitivity.

The availability of numerous MRO providers, including competitors and in-house services, further bolsters customer leverage. The global aviation MRO market, valued at roughly $85 billion in 2024, signifies a broad array of service providers vying for airline business. Customers can readily obtain multiple quotes, enabling them to secure more favorable pricing and contract terms.

While long-term contracts offer AAR revenue stability and customer retention, they also necessitate consistent high performance. Any lapse in service delivery could jeopardize contract renewals. In fiscal year 2024, a significant portion of AAR's revenue stemmed from these long-term agreements, highlighting the critical importance of maintaining customer satisfaction through reliable service.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Example |

| Customer Concentration | High | Largest customer accounted for ~11% of sales (FY23) |

| Customer Price Sensitivity | High | Airlines' low-margin industry; IATA projected $9.8B industry net profit (2023) |

| Availability of Alternatives | High | Global aviation MRO market valued at ~$85B (2024) |

| Long-Term Contracts | Moderate (reduces immediate power, increases long-term dependency on performance) | Significant portion of FY24 revenue from long-term agreements |

What You See Is What You Get

AAR Porter's Five Forces Analysis

This preview showcases the complete AAR Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase. You can trust that what you preview is precisely what you'll be able to download and utilize, providing immediate strategic insights without any hidden elements or placeholders.

Rivalry Among Competitors

The aviation Maintenance, Repair, and Overhaul (MRO) market is characterized by a diverse landscape, featuring numerous independent MRO providers, those integrated within airlines, and original equipment manufacturer (OEM) service divisions. This fragmentation means competition can be intense across various service segments.

However, a significant trend within this fragmented market is ongoing consolidation. Companies like AAR are actively pursuing strategic acquisitions to broaden their service offerings and secure a larger share of the market. For instance, AAR's acquisition of Triumph Group's MRO network in 2023 was a substantial move to enhance its capabilities and geographic reach.

The Maintenance, Repair, and Overhaul (MRO) sector, crucial for aviation, faces intense rivalry driven by significant fixed costs. Companies invest heavily in specialized hangars, advanced tooling, and highly trained technicians, creating a high barrier to entry. For example, setting up a modern MRO facility can easily cost tens of millions of dollars.

This substantial capital outlay necessitates high capacity utilization to spread those fixed costs and achieve profitability. Airlines, the primary customers, often seek to optimize their MRO spending, creating a competitive environment where MRO providers vie fiercely for contracts. In 2024, the global aviation MRO market was valued at approximately $90 billion, underscoring the scale of operations and the pressure to maintain high utilization rates to capture market share.

When demand dips, such as during economic downturns or unexpected disruptions, this pressure intensifies. MRO providers may resort to aggressive pricing strategies or offer discounts to keep their facilities running at optimal levels, leading to potential price wars and squeezed profit margins for all involved.

Competitors in the Maintenance, Repair, and Overhaul (MRO) sector actively seek to stand out by offering specialized services, such as intricate engine overhauls or precise component repairs. This focus on niche expertise allows them to capture specific market segments. For instance, companies might invest heavily in capabilities for particular aircraft types or engine models.

The integration of advanced technologies is another key differentiator. This includes adopting predictive maintenance solutions that use data analytics to anticipate equipment failures, thereby reducing downtime and costs for airlines. The use of artificial intelligence (AI) is also becoming more prevalent, aiding in diagnostics and optimizing repair processes. Furthermore, the development of robust digital platforms streamlines operations and enhances customer interaction.

AAR's strategic investment in its Trax software platform exemplifies this technological push. Trax is designed to manage and optimize MRO operations, offering features like inventory management, line maintenance, and heavy maintenance planning. This digital backbone is vital for AAR to maintain a competitive edge by improving efficiency and providing valuable data insights to its clients.

In 2023, the global aviation MRO market was valued at approximately $80 billion, with a significant portion driven by the demand for specialized repair and maintenance services. Companies that can effectively leverage technology, like AAR's Trax platform, are better positioned to capture market share and offer superior value in this competitive landscape.

Global Presence and Regional Strengths

The competitive landscape for aviation aftermarket services is intensely global, yet fragmented with significant regional strengths. While AAR maintains a presence in over 20 countries, it contends with large multinational competitors who also boast extensive global networks, alongside numerous smaller, regionally specialized Maintenance, Repair, and Overhaul (MRO) providers that can offer more tailored services within specific geographic areas.

This dynamic means AAR must not only compete on a global scale but also demonstrate agility and localized expertise to counter the advantages of regional players. For instance, in 2024, the Asia-Pacific MRO market, a key growth area, saw intense competition from local entities leveraging established relationships and understanding of regional regulatory nuances, even as global giants expanded their footprint.

- Global Reach vs. Regional Focus: AAR competes with both global MRO giants and localized specialists.

- Market Fragmentation: The industry is characterized by a mix of large international players and numerous smaller, region-specific service providers.

- Regional Competitive Advantages: Local MROs often leverage established relationships and regional regulatory knowledge.

Impact of OEM and Airline Strategies

Original Equipment Manufacturers (OEMs) are increasingly flexing their muscles in the aftermarket, often directly challenging independent Maintenance, Repair, and Overhaul (MRO) providers like AAR. This trend intensifies competition as OEMs leverage their proprietary knowledge and parts access. For instance, in 2024, many engine manufacturers expanded their service agreements, offering comprehensive maintenance packages that can undercut independent MROs on both price and guaranteed turnaround times.

Airlines themselves contribute to this competitive pressure by maintaining their own MRO divisions. These in-house capabilities allow carriers to manage their fleets efficiently and potentially at a lower cost, especially for routine maintenance. This internal capacity means airlines may outsource less work, reducing the available market for external MRO providers. In 2023, approximately 30% of major airline maintenance activities were handled in-house by the carriers themselves, a figure expected to remain stable or slightly increase in 2024.

- OEMs are expanding aftermarket service offerings, directly competing with independent MROs.

- Airlines' in-house MRO capabilities reduce outsourcing opportunities for companies like AAR.

- This dual pressure from OEMs and airline self-sufficiency heightens competitive rivalry in the MRO sector.

Competitive rivalry in the aviation MRO sector is fierce, driven by significant fixed costs and the need for high capacity utilization. Companies differentiate through specialized services and technological integration, like AAR's Trax platform. The market is a mix of global players and regional specialists, with OEMs and airlines' in-house capabilities adding further competitive pressure.

| Competitor Type | Key Differentiators | 2024 Market Share Insight (Illustrative) |

|---|---|---|

| Independent MROs (e.g., AAR) | Specialized services, technology adoption (e.g., Trax), global reach | Significant, but facing pressure |

| OEM Service Divisions | Proprietary knowledge, parts access, comprehensive packages | Growing influence |

| Airline In-house MRO | Cost control, fleet efficiency, routine maintenance focus | Stable to increasing internal capacity (approx. 30% in 2023) |

| Regional Specialists | Localized expertise, established relationships, regulatory knowledge | Strong in specific geographic markets |

SSubstitutes Threaten

A significant substitute for AAR's services arises from airlines possessing their own in-house maintenance, repair, and overhaul (MRO) capabilities. This internal capacity allows airlines to manage a portion of their maintenance needs directly, lessening their dependence on third-party providers like AAR. For instance, in 2023, major carriers continued to invest in their MRO infrastructure, with some reporting increased internal workshop utilization.

Original Equipment Manufacturers (OEMs) are increasingly expanding their aftermarket service portfolios, directly competing with established players like AAR. These OEM-provided services, encompassing parts distribution and Maintenance, Repair, and Overhaul (MRO), present a significant threat of substitution, especially for newer aircraft models and proprietary components where OEMs possess exclusive technical expertise and access to genuine parts. For instance, in 2024, several major aircraft OEMs announced expanded MRO capabilities and parts supply agreements, aiming to capture a larger share of the lucrative aftermarket business.

The emergence of newer aircraft models featuring enhanced reliability and extended maintenance schedules presents a significant threat of substitution for traditional Maintenance, Repair, and Overhaul (MRO) services. These advanced aircraft are designed to require less frequent servicing, potentially diminishing the overall demand for MRO providers. For instance, the introduction of the Boeing 787 Dreamliner, with its composite materials and advanced systems, aims for longer intervals between heavy checks compared to older wide-body jets. This shift could mean a reduced need for certain types of MRO work over the long term.

Component-level vs. System-level Maintenance

The threat of substitutes for AAR's maintenance, repair, and overhaul (MRO) services is evolving. Advancements in modular design mean entire sections of aircraft can be swapped out rather than individual components being repaired. This shift, coupled with the rise of predictive maintenance technologies, could lead to a decrease in demand for AAR's traditional component-level repair services, as airlines might opt for system replacements instead.

This trend presents a significant challenge. For instance, if a major airframe manufacturer increasingly adopts plug-and-play modular systems, the need for specialized repair shops focusing on individual parts could diminish. Consider the impact on AAR's Engine Component Services segment; if engine manufacturers offer more integrated, easily replaceable modules, this could directly substitute for some of AAR's existing repair capabilities.

The potential impact is substantial. In 2024, the global aviation MRO market was valued at approximately $80 billion. A significant shift towards system-level replacement could reconfigure this market, potentially impacting AAR's revenue streams from component repair.

- Modular Design Impact: Airlines may increasingly favor replacing entire modular units rather than repairing individual components, reducing demand for specialized component MRO.

- Predictive Maintenance Shift: Proactive maintenance technologies could identify systemic issues earlier, potentially leading to system replacements rather than piecemeal repairs.

- Market Reconfiguration: The global aviation MRO market, valued around $80 billion in 2024, could see a significant portion of its service demand shift from component repair to system replacement.

- AAR's Strategic Response: AAR must adapt by potentially expanding its capabilities in system-level maintenance or offering enhanced diagnostic services to align with these evolving industry trends.

Life Extension Programs vs. New Aircraft Purchases

The threat of substitutes for life extension programs in the aviation sector is growing as new aircraft production ramps up. While current delivery delays for new planes bolster demand for maintenance, repair, and overhaul (MRO) services that keep older aircraft flying longer, a significant acceleration in manufacturing could shift demand. For instance, Boeing's 2024 outlook anticipates delivering around 450-500 commercial aircraft, a notable increase that could eventually lessen the reliance on extensive life extension MRO. This acceleration presents a substitute by providing airlines with newer, more efficient aircraft, thereby reducing the need for heavy maintenance on aging fleets.

This shift impacts MRO providers by potentially decreasing the volume of certain heavy maintenance tasks that are part of life extension programs. Airlines might prioritize newer aircraft over investing heavily in extending the operational life of older models if acquisition costs become more manageable. The long-term substitute effect means that MRO businesses heavily focused on these specific life extension services may need to diversify their offerings to adapt to evolving airline fleet strategies.

- Current Situation: Delivery delays for new aircraft in 2023 and early 2024 have increased demand for MRO services focused on extending the life of existing fleets.

- Future Threat: A substantial increase in new aircraft production by manufacturers like Boeing and Airbus could lead to airlines opting for new acquisitions over extensive life extension MRO.

- Impact on MRO: This substitution could reduce the need for certain heavy maintenance and repair work associated with keeping older aircraft operational for extended periods.

- Strategic Implication: MRO providers may need to adapt their service portfolios to address the changing needs of airlines as new aircraft become more readily available.

The threat of substitutes for AAR's services is multifaceted, stemming from airlines' internal capabilities, Original Equipment Manufacturers (OEMs) expanding aftermarket services, and advancements in aircraft technology. Airlines with in-house MRO operations can reduce reliance on third parties, while OEMs are increasingly offering direct services, particularly for newer models. Furthermore, newer aircraft designs often require less frequent maintenance, and modular designs coupled with predictive maintenance could shift demand from component repair to system replacement.

The global aviation MRO market was valued at approximately $80 billion in 2024. This market faces potential reconfiguration as airlines may favor replacing entire modular units over repairing individual components, a trend that could diminish demand for specialized component MRO services. Predictive maintenance also plays a role, potentially leading to system replacements rather than piecemeal repairs.

| Substitute Type | Description | Potential Impact on AAR | 2024 Market Context |

|---|---|---|---|

| In-house Airline MRO | Airlines performing maintenance internally. | Reduced demand for AAR's third-party services. | Continued investment by major carriers in MRO infrastructure. |

| OEM Aftermarket Services | Aircraft manufacturers offering parts and MRO. | Direct competition, especially for proprietary components. | OEMs expanding MRO capabilities and supply agreements. |

| Newer Aircraft Technology | Advanced aircraft with extended maintenance intervals. | Diminished overall demand for MRO providers over time. | Introduction of models like Boeing 787 with longer service intervals. |

| Modular Design & Predictive Maintenance | System-level replacement over component repair. | Shift in demand from component repair to system maintenance. | Global MRO market valued at ~$80 billion, susceptible to this shift. |

Entrants Threaten

The aviation Maintenance, Repair, and Overhaul (MRO) sector presents a formidable barrier to new entrants due to the exceptionally high capital investment required. Establishing state-of-the-art hangars, acquiring specialized tooling, and obtaining necessary certifications demand hundreds of millions, if not billions, of dollars. For instance, a single modern MRO facility can cost upwards of $100 million to build and equip.

AAR's established global network of MRO facilities, coupled with its advanced technological infrastructure and decades of operational experience, creates a significant competitive moat. This extensive and proven operational capability makes it exceedingly difficult for newcomers to match AAR's scale and efficiency, thereby deterring new entrants.

The aviation sector faces a significant threat of new entrants due to stringent regulatory requirements and certifications. New airlines must navigate complex approval processes from bodies like the FAA in the US or EASA in Europe, which demand substantial investment in safety protocols and operational standards. For instance, achieving an Air Operator Certificate (AOC) involves rigorous audits and can take years, creating a high barrier to entry.

The aviation Maintenance, Repair, and Overhaul (MRO) sector demands a workforce possessing specialized skills, encompassing licensed aircraft mechanics, experienced engineers, and adept supply chain professionals. This reliance on expertise creates a significant barrier for newcomers.

Current talent shortages exacerbate this challenge. For instance, in 2024, estimates suggest a global deficit of over 20,000 aircraft maintenance technicians by 2026, making it difficult for new entrants to rapidly assemble a qualified and operational team necessary to compete effectively.

Established Relationships and Brand Reputation

AAR's long-standing presence in the aerospace and defense sector, serving major commercial and government clients, has fostered deep-rooted relationships and a robust brand reputation. This history translates into significant trust and credibility, making it challenging for new entrants to gain traction.

For instance, AAR's extensive experience in providing MRO (Maintenance, Repair, and Overhaul) services to a diverse clientele, including major airlines and defense contractors, highlights the difficulty new competitors face in replicating such established networks and the associated trust. As of their fiscal year 2024, AAR reported revenues of $3.1 billion, underscoring their substantial market presence and the scale of operations that new entrants would need to match.

- Established Client Base: AAR has cultivated long-term partnerships with key players in the commercial aviation and defense industries, providing a stable revenue stream and a barrier to entry.

- Brand Recognition and Trust: Decades of reliable service have built a strong brand reputation, instilling confidence in customers and making them less likely to switch to unproven competitors.

- High Switching Costs: For clients, the process of vetting and integrating a new service provider, especially for critical aerospace components, involves significant time, resources, and potential operational risks.

- Regulatory Compliance and Certification: AAR's established certifications and compliance records with aviation authorities are difficult and time-consuming for new entrants to obtain, further solidifying AAR's competitive position.

Complex Supply Chain and Logistics Expertise

The aviation aftermarket demands intricate supply chain and logistics capabilities. AAR's established proficiency in parts distribution and global logistics, honed over many years, acts as a substantial hurdle for newcomers. These new entrants would require considerable time and investment to build comparable, efficient networks.

Developing the necessary infrastructure and relationships to manage the complex flow of aircraft parts globally is a significant undertaking. This includes warehousing, transportation, customs compliance, and inventory management, all of which are critical for timely and cost-effective service delivery.

- Significant Capital Investment: New entrants face substantial upfront costs to establish global distribution centers, specialized transportation fleets, and advanced inventory management systems.

- Established Supplier Relationships: AAR benefits from long-standing relationships with original equipment manufacturers (OEMs) and parts suppliers, granting preferential access and pricing.

- Regulatory Compliance Expertise: Navigating the complex web of international aviation regulations, certifications, and customs procedures requires specialized knowledge and experience that new players lack.

The threat of new entrants into the aviation MRO sector is considerably low, largely due to the immense capital required for establishing facilities and acquiring specialized equipment. Furthermore, stringent regulatory hurdles and the necessity for highly skilled personnel present significant barriers. AAR's established global network, strong client relationships, and brand reputation further solidify its competitive position, making it exceptionally difficult for newcomers to gain a foothold.

| Barrier Type | Description | Impact on New Entrants | AAR's Advantage |

|---|---|---|---|

| Capital Investment | Establishing MRO facilities, tooling, and certifications requires hundreds of millions to billions of dollars. A single modern MRO facility can cost over $100 million. | Prohibitive for most potential new entrants. | Significant existing infrastructure and financial resources. |

| Regulatory Compliance | Navigating complex certifications from bodies like the FAA and EASA is time-consuming and costly. Obtaining an Air Operator Certificate (AOC) can take years. | Lengthy and expensive approval processes. | Established certifications and proven compliance records. |

| Skilled Workforce | Requires specialized talent like licensed mechanics and engineers. A global deficit of over 20,000 aircraft maintenance technicians is projected by 2026. | Difficulty in assembling a qualified operational team. | Access to a deep pool of experienced and certified personnel. |

| Supply Chain & Logistics | Building efficient global parts distribution and logistics networks is complex and capital-intensive. | Requires substantial time and investment to replicate AAR's capabilities. | Honed global logistics proficiency and established supplier relationships. |

| Brand Reputation & Client Relationships | Decades of service build trust and loyalty. AAR reported $3.1 billion in revenue for fiscal year 2024, indicating a substantial market presence. | Challenging to gain trust and displace incumbents. | Long-standing partnerships with major commercial and defense clients. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, industry-specific market research reports, and government economic indicators to provide a comprehensive view of competitive dynamics.