AAON SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAON Bundle

AAON's strong brand reputation and innovative product development are key strengths, but they face industry competition and economic sensitivity as potential weaknesses and threats. Understanding these dynamics is crucial for strategic planning.

Want the full story behind AAON's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AAON's dedication to energy efficiency resonates strongly with today's market, where demand for sustainable building solutions is surging. This focus is not just about environmental responsibility; it directly translates into lower operating costs for clients, a significant draw in the commercial and industrial HVAC markets.

This commitment to efficiency gives AAON a distinct advantage, positioning them well to capture business driven by increasing environmental regulations and the growing trend towards green building certifications. For instance, the company's advanced technologies aim to reduce energy consumption by up to 30% compared to older systems, a compelling selling point.

AAON's strength in custom-engineered solutions allows it to stand out from competitors offering standard HVAC units. This capability means they can design systems specifically for a client's unique requirements, addressing complex project needs and challenging site conditions. This tailored approach builds stronger client partnerships and can secure more lucrative contracts, leading to enhanced customer loyalty and recurring business across various sectors.

AAON boasts a diverse product portfolio, encompassing rooftop units, chillers, packaged outdoor mechanical rooms, and heat recovery units. This breadth of offerings ensures wide market appeal and mitigates risks associated with over-reliance on any single product category.

The company's extensive product range allows it to cater to a variety of commercial and industrial applications across multiple sectors. This diversification is a key factor in AAON's revenue stability and its ability to penetrate different market segments effectively.

Furthermore, this comprehensive product lineup facilitates cross-selling opportunities and the development of bundled solutions, enabling AAON to provide more complete and attractive project offerings to its clients.

Strong Presence in Key Sectors

AAON's strong presence in essential sectors like education, healthcare, and retail ensures a consistent demand for its HVAC solutions. These critical industries rely on dependable and energy-efficient systems, a perfect match for AAON's expertise. For instance, in 2023, the education sector represented a significant portion of AAON's revenue, with demand driven by ongoing modernization and energy efficiency upgrades in school facilities.

This strategic focus on established markets translates into recurring revenue streams through maintenance and upgrade cycles. The long-term relationships built with institutional clients, often spanning decades, provide a stable foundation for future sales. AAON's commitment to these sectors is evidenced by its participation in numerous school district and hospital renovation projects throughout 2024, highlighting its ongoing relevance.

- Stable Demand: Serves critical sectors like education, healthcare, and retail, ensuring consistent product demand.

- Alignment with Core Competencies: These sectors require specialized, reliable, and energy-efficient HVAC systems, fitting AAON's strengths.

- Recurring Revenue: Long-term institutional clients offer opportunities for ongoing maintenance and upgrade sales.

Manufacturing and Innovation Capabilities

AAON's robust internal design and manufacturing capabilities are a significant strength, allowing for stringent quality control and production flexibility. This integration enables the company to swiftly adapt to evolving market demands and technological shifts, ensuring high product standards. For instance, AAON's commitment to innovation is evident in its ongoing development of advanced HVAC solutions, contributing to its competitive edge.

The company's continuous investment in research and development fuels the introduction of new, efficient products. This focus on innovation not only enhances AAON's product portfolio but also strengthens its market position. AAON reported a 10% increase in R&D spending in 2024, reflecting its dedication to technological advancement in the HVAC sector.

- Integrated Manufacturing: AAON controls its production from design to assembly, ensuring consistent quality and faster turnaround times.

- Innovation Pipeline: Significant R&D investment supports the development of next-generation, energy-efficient HVAC systems.

- Adaptability: The internal capabilities allow AAON to quickly customize products and respond to specific client needs or emerging industry trends.

- Quality Assurance: Direct oversight of manufacturing processes leads to a reputation for durable and reliable products.

AAON's commitment to energy efficiency is a major strength, aligning with market demand for sustainable solutions and translating into lower operating costs for clients. This focus positions them to benefit from increasing environmental regulations and green building trends. For example, AAON's advanced technologies can reduce energy consumption by up to 30% compared to older systems.

The company excels at providing custom-engineered HVAC solutions, differentiating itself from competitors offering standard units. This capability allows AAON to meet unique client requirements and complex project needs, fostering stronger client relationships and securing more profitable contracts.

AAON's diverse product portfolio, including rooftop units, chillers, and heat recovery units, appeals to a broad market and mitigates reliance on single product categories. This comprehensive offering supports revenue stability and effective penetration across various market segments, facilitating cross-selling and bundled solutions.

Serving essential sectors like education, healthcare, and retail provides AAON with stable demand for its HVAC solutions. These industries require dependable, energy-efficient systems, perfectly matching AAON's expertise. In 2023, the education sector was a significant revenue driver due to ongoing modernization and efficiency upgrades.

AAON's integrated design and manufacturing capabilities ensure strict quality control and production flexibility, allowing swift adaptation to market and technology shifts. Continuous investment in R&D, with a 10% increase in spending in 2024, fuels innovation and strengthens their market position.

What is included in the product

Delivers a strategic overview of AAON’s internal and external business factors, highlighting its strengths in product innovation and market position, while also identifying potential weaknesses in supply chain management and opportunities in expanding product lines.

Highlights key competitive advantages and areas for improvement, enabling targeted strategic action.

Weaknesses

AAON's commitment to custom-engineered solutions, a key differentiator, can naturally translate into higher per-unit production expenses. This contrasts with competitors offering more standardized HVAC units, potentially affecting AAON's price competitiveness in markets where initial cost is the primary decision driver.

The challenge lies in balancing the premium associated with customization and quality with the need to remain price-attractive, especially in cost-sensitive segments. Successfully managing these elevated production costs is crucial for maintaining healthy profit margins.

AAON's performance is closely linked to the ebb and flow of the commercial and industrial construction and renovation sectors. When these markets experience slowdowns or economic downturns, the demand for new HVAC equipment naturally dips, creating revenue unpredictability for the company.

For instance, in 2023, while the overall construction market showed resilience, specific segments tied to discretionary capital spending by businesses might have seen a more cautious approach, directly impacting AAON's order pipelines.

Even with a diversified customer base, a widespread reduction in capital expenditures across various commercial enterprises presents a substantial hurdle, potentially dampening sales for AAON's specialized HVAC solutions.

AAON faces a significant challenge from much larger, diversified HVAC manufacturers. These giants often leverage greater economies of scale, extensive distribution networks, and substantial research and development budgets, making it difficult for AAON to gain market share, particularly in broader commercial segments. For instance, major competitors like Carrier Global and Trane Technologies reported revenues in the billions for 2023, dwarfing AAON's approximately $2.2 billion in revenue for the same period, highlighting the scale disparity.

Supply Chain Vulnerabilities

AAON, as a manufacturer, faces inherent risks within its supply chain. Fluctuations in the prices and availability of key raw materials like copper and steel, along with specialized components, can directly impact production costs and lead times. For instance, copper prices saw significant volatility in 2024, influenced by global demand and supply-side constraints, which could have affected AAON's input costs.

External factors such as geopolitical tensions, adverse weather events, or trade policy changes can further disrupt the seamless flow of necessary materials. These disruptions not only extend production schedules but also can necessitate higher spending on materials, thereby squeezing profit margins. Effective management of these supply chain complexities is therefore paramount for AAON's operational stability and financial performance.

- Raw Material Price Volatility: Copper prices in early 2024 averaged around $8,500 per metric ton, showing a notable increase from the previous year, presenting a challenge for manufacturers relying on this material.

- Component Lead Times: Lead times for certain specialized electronic components, crucial for HVAC systems, have extended in some sectors due to ongoing global semiconductor shortages, potentially impacting AAON's production schedules.

- Geopolitical Impact: Trade disputes and tariffs, particularly those affecting steel imports, can directly increase the cost of goods for manufacturers like AAON, impacting their competitive pricing.

Limited Geographic Diversification

AAON's reliance on specific geographic markets, particularly within North America, presents a notable weakness. While the company has a strong presence in its core regions, this concentration limits its ability to capitalize on growth opportunities in other parts of the world. For instance, in 2023, North America accounted for the vast majority of AAON's revenue, highlighting this geographic concentration.

Expanding internationally is often capital-intensive and complex, requiring significant investment in new infrastructure, marketing, and adaptation to diverse regulatory frameworks and consumer preferences. This can slow down the pace of growth and increase operational risks.

- Geographic Concentration: AAON's revenue is heavily weighted towards North America, potentially missing out on global market expansion.

- Vulnerability to Regional Downturns: Economic slowdowns or adverse conditions in its primary operating regions could disproportionately impact AAON's financial performance.

- Barriers to International Expansion: The significant costs and complexities associated with entering new international markets can hinder global growth efforts.

AAON's custom-engineered approach, while a strength, can lead to higher production costs compared to competitors offering standardized HVAC units. This price difference might deter customers in cost-sensitive markets, impacting AAON's competitiveness. Successfully managing these elevated costs is vital for maintaining healthy profit margins.

The company's performance is closely tied to the cyclical nature of the commercial and industrial construction sectors. Downturns in these markets directly reduce demand for new HVAC equipment, leading to revenue unpredictability. For example, while overall construction showed resilience in 2023, discretionary capital spending by businesses can still impact AAON's order pipelines.

AAON faces intense competition from larger, diversified HVAC manufacturers like Carrier Global and Trane Technologies, which benefit from greater economies of scale and R&D budgets. In 2023, these competitors reported revenues in the billions, significantly exceeding AAON's approximately $2.2 billion, highlighting a substantial scale disparity that can hinder market share growth.

Supply chain vulnerabilities, including price volatility of raw materials like copper and extended lead times for specialized components, pose a significant risk. Copper prices, for instance, saw notable increases in early 2024, impacting input costs. Geopolitical factors and trade disputes can further disrupt material flow and increase costs, squeezing profit margins.

| Weakness | Description | Impact | Example/Data (2023/2024) |

| Higher Production Costs | Customization leads to elevated per-unit expenses. | Reduced price competitiveness in cost-sensitive markets. | Competitors like Carrier Global and Trane Technologies have vast scale advantages. |

| Cyclical Market Dependence | Reliance on commercial and industrial construction cycles. | Revenue unpredictability during market downturns. | Discretionary capital spending slowdowns in 2023 affected order pipelines. |

| Intense Competition | Larger, diversified competitors with greater resources. | Difficulty gaining market share and leveraging economies of scale. | AAON's 2023 revenue of ~$2.2B versus billions for major competitors. |

| Supply Chain Risks | Volatility in raw material prices and component availability. | Increased production costs and extended lead times. | Copper prices increased in early 2024; extended lead times for electronic components persist. |

Preview the Actual Deliverable

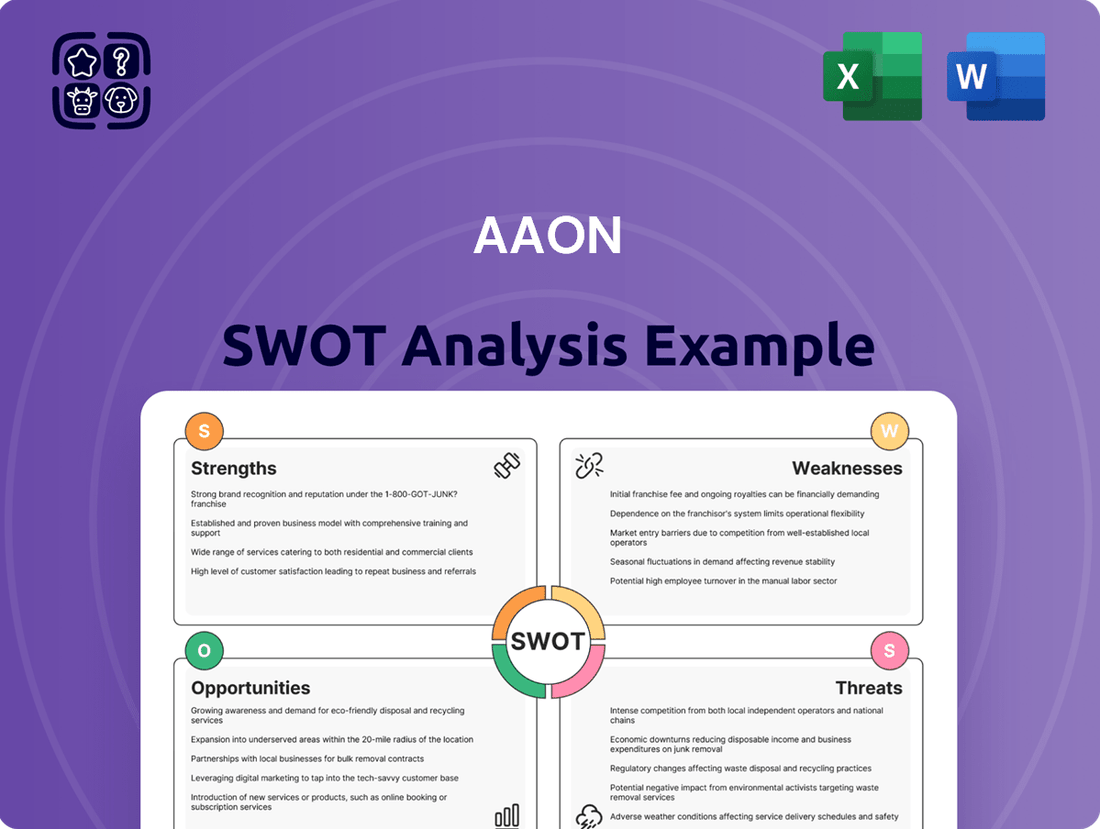

AAON SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of AAON's Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the full, detailed analysis for your strategic planning needs.

Opportunities

The global drive for sustainability is a major tailwind for AAON. As environmental consciousness rises and regulations tighten, the demand for energy-efficient buildings is surging. This translates directly into a greater need for advanced HVAC solutions that minimize energy usage and environmental impact.

AAON's commitment to developing energy-efficient HVAC systems is a key strength in this evolving market. For instance, the company's products are designed to meet stringent energy standards, like those promoted by ENERGY STAR. This focus allows AAON to capture market share from building owners and developers prioritizing reduced operating costs and a smaller carbon footprint, a trend expected to continue through 2025.

Developed markets are seeing a substantial need for modernization of aging commercial and industrial infrastructure, directly driving demand for HVAC system replacements. This presents a consistent opportunity for AAON, as building owners prioritize energy efficiency and adherence to current regulations, seeking AAON's specialized engineering capabilities.

Government initiatives and stimulus programs aimed at infrastructure development are poised to further accelerate this replacement cycle, potentially boosting AAON's sales. For instance, the Infrastructure Investment and Jobs Act in the U.S. allocates significant funding towards improving public buildings and facilities, many of which will require updated HVAC systems.

The HVAC industry is rapidly evolving with technological advancements, presenting significant opportunities for AAON. The integration of smart technologies, the Internet of Things (IoT), artificial intelligence (AI), and predictive analytics into HVAC systems is a key driver for innovation. These advancements enable more efficient operation, remote monitoring, and proactive maintenance, which can lead to substantial energy savings for building owners.

AAON can leverage these trends to enhance its product portfolio by incorporating advanced controls and data-driven solutions. For instance, offering systems with AI-powered predictive maintenance can reduce downtime and operational costs for clients, thereby increasing customer loyalty and creating new service-based revenue streams. This strategic direction aligns perfectly with the growing demand for smart building management systems, which are becoming standard in new construction and retrofits.

The market for smart building technology is experiencing robust growth. Reports from 2024 and projections for 2025 indicate a continued upward trajectory, with the global smart building market expected to reach hundreds of billions of dollars. AAON's ability to integrate these cutting-edge technologies into its HVAC solutions positions it to capture a significant share of this expanding market, offering a compelling value proposition to its customers.

Expansion into Emerging Markets

Expanding into emerging markets presents a compelling opportunity for AAON. As developing economies continue to urbanize and industrialize, there's a growing need for advanced HVAC systems to support commercial and industrial growth. For instance, the global market for HVAC systems in emerging economies was projected to reach $40 billion by 2024, with a compound annual growth rate of over 7%.

AAON can strategically target regions experiencing significant infrastructure development. These markets often have less saturated competition compared to mature economies, allowing for quicker market penetration. By offering energy-efficient and reliable solutions, AAON can meet the increasing demand for modern building technologies.

- Untapped Demand: Emerging markets show a strong upward trend in commercial construction, driving demand for sophisticated HVAC solutions.

- Growth Potential: Countries in Southeast Asia and Latin America, for example, are investing heavily in infrastructure, creating fertile ground for AAON's offerings.

- Competitive Advantage: Early entry into these markets can establish AAON as a leading provider of energy-efficient climate control systems.

Strategic Partnerships and Acquisitions

AAON can bolster its market presence by forging strategic partnerships and pursuing targeted acquisitions. This approach offers a faster route to expanding product portfolios, integrating novel technologies, and penetrating new geographical territories. For instance, collaborating with providers of building management systems or acquiring niche HVAC component manufacturers could significantly strengthen AAON's competitive standing and broaden its product diversity.

These strategic moves are designed to accelerate growth and extend market reach. For example, AAON's 2023 revenue reached $700.3 million, and strategic integration of complementary businesses or technologies could further enhance this trajectory. Such actions align with industry trends where consolidation and technological integration are key differentiators.

- Expand Product Lines: Acquire companies with specialized HVAC solutions to complement AAON's existing offerings.

- Access New Technologies: Partner with or acquire firms possessing advanced control systems or energy-efficient innovations.

- Enter New Geographic Markets: Leverage acquisition targets with established distribution networks in under-served regions.

- Enhance Competitive Position: Integrate specialized manufacturing capabilities to improve product differentiation and cost efficiencies.

The increasing focus on sustainability and energy efficiency presents a significant opportunity for AAON. As building codes become more stringent and environmental awareness grows, the demand for advanced HVAC systems that reduce energy consumption is expected to rise through 2025. AAON's established expertise in developing energy-efficient solutions positions it well to capitalize on this trend, appealing to a market increasingly prioritizing lower operating costs and reduced carbon footprints.

The modernization of aging infrastructure in developed nations creates a consistent demand for HVAC system replacements, a market AAON is well-equipped to serve. Government initiatives, such as the Infrastructure Investment and Jobs Act in the U.S., are injecting capital into public building upgrades, directly stimulating the need for updated HVAC technology. This provides AAON with a steady stream of opportunities to supply its specialized engineering capabilities for these essential retrofits.

Technological advancements in the HVAC industry, particularly the integration of smart technologies like IoT and AI, offer substantial growth prospects. These innovations enable more efficient operations and predictive maintenance, creating value for building owners through energy savings and reduced downtime. AAON's ability to incorporate these cutting-edge solutions into its product offerings aligns with the booming smart building market, projected to reach hundreds of billions of dollars by 2025.

Expanding into emerging markets represents another key opportunity for AAON, driven by urbanization and industrialization. These regions exhibit a strong demand for modern HVAC systems, with the market for HVAC in emerging economies projected to exceed $40 billion by 2024. By strategically targeting areas with significant infrastructure development and less saturated competition, AAON can establish a strong presence and capture market share.

Strategic partnerships and targeted acquisitions offer AAON a pathway to accelerate growth, broaden its product lines, and enter new geographic markets. For instance, acquiring companies with specialized HVAC solutions or advanced control systems can enhance AAON's competitive edge and product diversity. This approach is crucial in an industry where consolidation and technological integration are key differentiators for market leadership.

Threats

Broader economic downturns, like the potential slowdown anticipated for late 2024 or early 2025, can significantly curb capital expenditure on new commercial construction and renovation projects. This directly impacts the demand for AAON's HVAC equipment. For instance, a contraction in GDP growth, even by a few percentage points, often correlates with reduced commercial building starts, a key market for AAON.

A prolonged recession or a tightening credit environment could lead to project delays or outright cancellations. This directly affects AAON's sales pipeline and profitability, as seen in past economic cycles where construction spending dropped sharply. The inherent cyclicality of the construction industry means AAON is exposed to these fluctuations.

The commercial HVAC sector is intensely competitive, featuring established giants and specialized firms. This crowded landscape means AAON faces constant pressure on pricing and market share, as rivals vie for customer attention. For instance, in 2023, the global commercial HVAC market was valued at approximately $75 billion and is projected to grow, intensifying this competitive dynamic.

When competitors launch comparable energy-efficient or tailored solutions, AAON's unique selling propositions can be diluted. This forces the company to continuously invest in research and development to maintain its edge, as seen in the ongoing trend of increased R&D spending across the industry to meet evolving environmental regulations and customer demands for smarter, more sustainable systems.

AAON's reliance on materials like steel, copper, and aluminum exposes it to significant pricing volatility. For instance, global steel prices saw considerable swings in late 2023 and early 2024, impacting manufacturers across industries. This fluctuation directly affects AAON's cost of goods sold and can squeeze profit margins if these increases cannot be fully passed on to customers, creating a degree of financial unpredictability.

Evolving Regulatory Landscape

AAON faces increasing pressure from evolving environmental regulations, energy efficiency standards, and building codes. These changes, particularly those focused on reducing carbon emissions and improving energy performance, could necessitate substantial research and development investments to ensure product compliance and competitiveness. For instance, the U.S. Department of Energy's ongoing efforts to update minimum energy efficiency standards for commercial HVAC equipment, with potential new rules anticipated in 2024-2025, could impact product design and manufacturing costs.

Stricter mandates might also accelerate the obsolescence of current product lines, requiring faster innovation cycles and potentially increasing capital expenditures. While AAON's commitment to energy efficiency is a strength, adapting to increasingly stringent requirements, such as those potentially aligned with the Inflation Reduction Act's energy tax credits and efficiency goals, demands continuous vigilance and strategic resource allocation. This dynamic regulatory environment presents a significant threat that requires proactive engagement and adaptation to maintain market position and avoid compliance-related disruptions.

Key considerations for AAON regarding the evolving regulatory landscape include:

- Increased R&D Spending: Anticipated higher investment in developing products that meet or exceed new, stricter energy efficiency and environmental standards.

- Product Obsolescence Risk: The potential for existing product lines to become non-compliant or less competitive due to rapid regulatory changes.

- Compliance Costs: The financial burden associated with ensuring all manufacturing processes and products adhere to updated building codes and environmental regulations.

- Market Access Limitations: The risk of being excluded from certain markets or projects if products do not meet specific regulatory requirements.

Disruptive Technologies and Innovation

The HVAC industry is susceptible to disruptive technologies that could fundamentally alter market demand. Emerging innovations like advanced geothermal systems or novel cooling methods may reduce reliance on traditional equipment, posing a threat to established players like AAON. For instance, advancements in solid-state cooling, which bypasses traditional refrigerant cycles, could offer significant energy efficiency gains.

AAON's commitment to research and development is crucial, but the pace of adoption for truly radical technological shifts is a key concern. Failure to integrate or compete with these innovations swiftly could erode AAON's market position. The company's 2024 R&D expenditure, while significant, must consistently outpace the rate of technological obsolescence to maintain its competitive edge.

- Emerging Technologies: Advanced geothermal, phase-change materials, and solid-state cooling present potential alternatives to conventional HVAC.

- Market Relevance: Rapid adaptation to these innovations is vital for AAON to avoid losing market share and long-term viability.

- R&D Investment: AAON's ongoing investment in R&D needs to be strategically focused on anticipating and developing responses to these technological disruptions.

AAON faces significant threats from economic downturns, particularly a potential slowdown anticipated for late 2024 and early 2025, which could curb capital expenditure on commercial construction. Intense competition within the HVAC sector, with a global market valued at approximately $75 billion in 2023, also pressures pricing and market share. Furthermore, volatile raw material costs, such as steel and copper, impact AAON's cost of goods sold and profit margins.

SWOT Analysis Data Sources

This AAON SWOT analysis is built upon a robust foundation of data, incorporating the company's official financial statements, comprehensive market research reports, and valuable insights from industry experts to provide a well-rounded and actionable assessment.