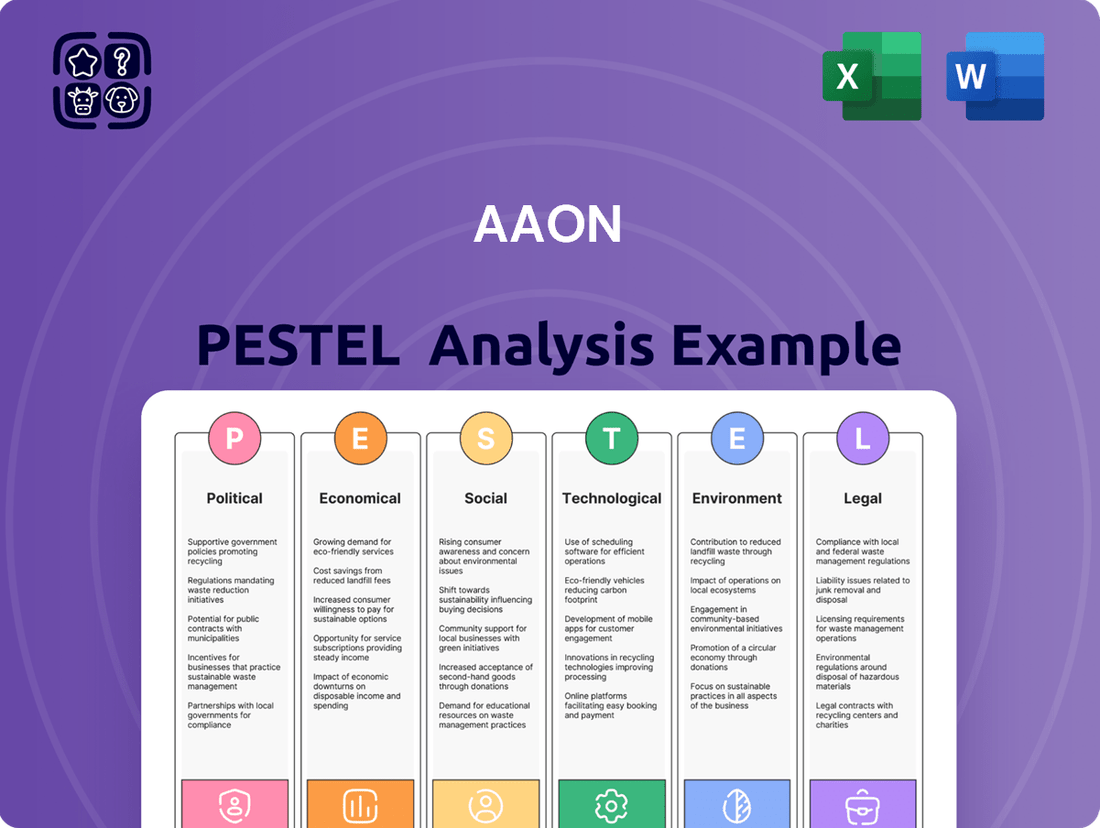

AAON PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAON Bundle

Unlock AAON's strategic landscape with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. Gain critical insights to inform your investment decisions and competitive strategy. Download the full, actionable report now and stay ahead of the curve.

Political factors

New Environmental Protection Agency (EPA) regulations, effective January 1, 2025, are mandating a significant shift away from high-Global Warming Potential (GWP) refrigerants, such as R-410A, in HVAC systems. This phase-out requires the adoption of more eco-friendly alternatives like R-454B and R-32, directly influencing AAON's product development and production processes. The industry saw manufacturers cease production and import of residential and light commercial air conditioning and heat pump systems utilizing R-410A by the end of 2024.

The U.S. Department of Energy is set to implement more stringent energy efficiency standards for HVAC systems starting in 2025. This means new equipment will need to achieve higher SEER2 and HSPF2 ratings, pushing the industry towards greater efficiency.

The Inflation Reduction Act also plays a significant role by offering federal tax credits that incentivize the purchase of energy-efficient technologies, particularly heat pumps. This creates a favorable market environment for companies like AAON that focus on these solutions.

AAON's existing commitment to energy efficiency and its ability to provide custom-engineered products position it well to capitalize on these evolving regulations and incentives. However, ongoing investment in research and development will be crucial to stay ahead of these increasingly demanding efficiency benchmarks.

Federal investments, like the Infrastructure Investment and Jobs Act (IIJA) and the CHIPS and Science Act, are fueling significant growth in nonresidential construction, particularly in transportation and manufacturing facilities. This surge in government spending directly benefits AAON by creating demand for HVAC systems in new builds and retrofits.

The IIJA alone allocates $1.2 trillion, with a substantial portion directed towards infrastructure upgrades, which AAON can capitalize on. Sectors like utilities and manufacturing are seeing increased activity, translating into more projects requiring AAON's specialized HVAC solutions.

The burgeoning data center market, a direct beneficiary of these initiatives, has notably increased demand for AAON's BASX-branded liquid cooling equipment, showcasing a clear linkage between government investment and specific product growth.

Trade Policies and Global Market Dynamics

Global trade policies and shifting market dynamics directly impact the cost of raw materials and components essential for HVAC manufacturing. For instance, tariffs imposed on steel or aluminum could increase production expenses for companies like AAON. The International Monetary Fund (IMF) projected global trade growth to slow to 2.8% in 2024, down from 3.5% in 2023, indicating a potentially tighter environment for sourcing materials.

Supply chain disruptions, exacerbated by geopolitical events and logistical bottlenecks, can significantly affect production costs and lead times. In 2024, continued port congestion and elevated shipping rates, though showing signs of easing from peak 2022 levels, remained a concern for manufacturers relying on international components. These fluctuations can create unpredictable lead times for AAON's product delivery.

- Tariffs on key materials like steel and aluminum can directly inflate AAON's cost of goods sold.

- Global trade slowdowns, as projected by the IMF for 2024, may limit access to diverse and cost-effective component suppliers.

- Persistent logistical challenges, including shipping costs and port delays, can extend production timelines and increase inventory carrying costs for AAON.

Building Performance Standards (BPS)

Local policy initiatives like Building Performance Standards (BPS) are increasingly influencing the commercial real estate sector, pushing building owners to cut down on emissions. These standards, now adopted in around 50 cities and several states, are driving demand for energy efficiency upgrades in existing structures.

This growing regulatory landscape creates a substantial market opening for AAON. The company is well-positioned to supply energy-efficient HVAC solutions for retrofitting and replacing equipment in commercial and industrial buildings, aligning with the BPS mandates.

- BPS Adoption: Approximately 50 cities and some states have implemented or are considering BPS.

- Focus: Prioritizing retrofitting for energy efficiency in existing buildings.

- Opportunity: AAON can capitalize on increased demand for energy-efficient replacement and retrofit solutions.

Governmental support for green technologies, such as the Inflation Reduction Act, directly benefits AAON by incentivizing the adoption of energy-efficient HVAC systems. Federal investments through the Infrastructure Investment and Jobs Act are also stimulating demand in sectors like manufacturing and transportation, creating opportunities for new construction and retrofits that require AAON's specialized equipment.

The increasing adoption of Building Performance Standards by cities and states is driving demand for energy efficiency upgrades in existing commercial buildings, a market segment where AAON's retrofitting solutions are well-suited.

Governmental focus on infrastructure and energy efficiency, coupled with evolving environmental regulations, creates a favorable market for AAON's product portfolio. The company's ability to provide custom-engineered, energy-efficient solutions positions it to benefit from these trends.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing AAON across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A clear, actionable summary of AAON's PESTLE factors, presented in an easily digestible format, helps alleviate the pain of information overload during strategic planning. This allows teams to quickly identify key external influences and focus on developing effective responses.

Economic factors

The construction industry navigated a tough 2024, with overall activity seeing a 13% decrease by May 2025 compared to the previous year. However, a positive shift is anticipated for 2025 as economic conditions are expected to improve, signaling a recovery for the sector.

Despite the broader downturn, critical segments like infrastructure development, institutional building (schools, hospitals), and the burgeoning data center market are demonstrating robust growth. This targeted expansion directly benefits companies like AAON, which supply essential HVAC systems for these vital projects.

The global HVAC system market is on an upward trajectory, projected to expand at a compound annual growth rate of 7.4% between 2024 and 2030. Within this, the commercial air conditioning segment is particularly strong, forecasting a 7.43% growth rate from 2025 to 2030.

Inflation remains a significant factor, driving up costs for construction projects, from labor to materials. This trend directly affects the budgeting and execution of new builds and renovations, impacting companies like AAON that supply essential components.

However, a more positive outlook is emerging with interest rates expected to trend downward through 2025. This anticipated easing of financing conditions could stimulate private sector investment in construction, potentially boosting demand for AAON's products.

AAON's Q1 2025 performance illustrates this sensitivity; its Oklahoma segment saw lower production volumes. This was partly due to the refrigerant transition's temporary adverse effects, highlighting how operational adjustments in response to economic or regulatory shifts can influence financial results.

The prices of essential construction materials like steel, lumber, and concrete are projected to continue their volatile trend throughout 2024 and into 2025, directly influencing project budgets and potentially increasing costs for manufacturers like AAON.

Persistent supply chain disruptions and logistical hurdles remain a significant concern, impacting both the availability and the ultimate cost of crucial components needed for AAON's manufacturing processes.

For instance, AAON encountered specific supply chain difficulties with R-454B refrigerant components during the first quarter of 2025, which notably contributed to a downturn in sales within its Oklahoma operational segment.

Consumer and Business Spending Trends

Consumer and business spending trends significantly influence the HVAC market, particularly for companies like AAON. The growing demand for energy-efficient and sustainable cooling solutions is a major driver, reflecting shifts in consumer priorities toward environmental responsibility. This trend is supported by data showing a strong interest in home improvements, with a notable portion of U.S. adults planning home purchases in 2025, which directly translates to potential new HVAC installations.

Commercial sectors are also showing increased spending on HVAC systems, driven by a similar focus on sustainability and optimizing energy usage. Investments in upgrading or replacing existing systems to meet modern efficiency standards are becoming more common. This heightened awareness and investment in energy-saving technologies create a favorable market environment for HVAC manufacturers offering advanced solutions.

- Increased demand for energy-efficient HVAC systems

- Projected growth in residential home improvement spending

- Significant percentage of U.S. adults planning home purchases in 2025

- Commercial sector investment in sustainable and energy-optimized HVAC solutions

Labor Shortages and Wage Pressures

The construction and HVAC sectors are grappling with a significant shortage of skilled labor. Projections indicate around 42,500 annual job openings for heating, air conditioning, and refrigeration mechanics and installers. This persistent gap directly translates into upward pressure on wages as companies compete for talent, potentially increasing operational costs for manufacturers like AAON.

These labor constraints can also cause project delays for AAON's clients, impacting their timelines and potentially leading to increased project expenses. This situation necessitates a strategic focus on attracting and retaining qualified personnel.

- Skilled Labor Gap: Approximately 42,500 annual job openings projected for HVAC mechanics and installers.

- Wage Inflation: Increased competition for limited skilled workers drives up labor costs.

- Operational Impact: Potential for project delays and increased expenses for AAON and its customers.

- Industry Response: Companies are investing in workforce development and training programs to mitigate shortages.

Economic headwinds in 2024 impacted construction, with activity down 13% by May 2025. However, a recovery is expected in 2025, driven by anticipated interest rate decreases stimulating private investment. Inflationary pressures on materials and labor persist, influencing project costs and manufacturer expenses.

The global HVAC market is set for robust growth, projected at a 7.4% CAGR from 2024-2030, with commercial AC leading at 7.43% growth from 2025-2030. This expansion is fueled by demand for energy-efficient solutions and commercial sector upgrades. Consumer spending on home improvements and new home purchases in 2025 also bolster HVAC demand.

Labor shortages in the HVAC sector, with an estimated 42,500 annual job openings for installers, are driving wage inflation and potential project delays. Companies like AAON face increased operational costs due to competition for skilled workers, necessitating investment in training and retention programs.

| Economic Factor | 2024/2025 Impact | Outlook |

|---|---|---|

| Construction Activity | 13% decrease by May 2025 | Expected recovery in 2025 |

| Interest Rates | Deterrent to private investment | Projected downward trend through 2025 |

| Inflation | Increased costs for materials and labor | Persistent pressure on project budgets |

| HVAC Market Growth | 7.4% CAGR (2024-2030) | Strong demand for energy efficiency |

What You See Is What You Get

AAON PESTLE Analysis

The preview shown here is the exact AAON PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get the complete PESTLE analysis for AAON.

The content and structure shown in the preview is the same AAON PESTLE Analysis document you’ll download after payment, providing all the insights you need.

Sociological factors

The COVID-19 pandemic dramatically amplified public focus on indoor air quality (IAQ). This heightened awareness has directly translated into a stronger market demand for HVAC systems featuring sophisticated air purification and ventilation capabilities, including UV-C light purifiers and HEPA filters. For instance, the global air purifier market was valued at approximately $13.7 billion in 2023 and is projected to grow significantly in the coming years, indicating a clear consumer and commercial imperative for cleaner air.

AAON is well-positioned to leverage this trend by highlighting and further developing its offerings that enhance IAQ within commercial and industrial environments. The company's commitment to providing advanced filtration and ventilation solutions aligns perfectly with the growing need for healthier indoor spaces, a demand that is expected to persist well beyond the immediate pandemic impact.

Societal trends are increasingly favoring sustainable and eco-friendly options, influencing consumer and business choices. This shift directly benefits companies like AAON, whose focus on energy efficiency resonates with a growing demand for reduced environmental impact and lower energy bills.

Homeowners and businesses are actively seeking ways to minimize their carbon footprint and energy usage. Consequently, there's a surge in demand for HVAC systems that are not only efficient but also contribute to overall energy conservation, a core strength of AAON's product offerings.

In 2024, the global market for green building materials and technologies, which includes energy-efficient HVAC, was projected to reach over $300 billion, with continued robust growth expected through 2025. This market expansion underscores the significant opportunity for AAON as consumers and businesses prioritize sustainability.

As commercial and industrial buildings age, there's a constant demand for maintaining, repairing, and replacing their HVAC systems. This ongoing need creates a stable market for AAON's offerings, particularly as older equipment often falls short of today's energy efficiency and environmental regulations.

The replacement and retrofit market is a significant driver in the HVAC sector. For instance, in 2024, this segment accounted for roughly 55% of the U.S. residential HVAC market, highlighting the substantial opportunity for companies like AAON that specialize in upgrading existing infrastructure.

Urbanization and Construction Boom

The ongoing trend of urbanization fuels a significant demand for Heating, Ventilation, and Air Conditioning (HVAC) systems. As more people move to cities, there's a corresponding increase in the construction of commercial and industrial spaces, all of which require robust HVAC solutions. This creates a steady market for companies like AAON.

While the U.S. construction sector has seen a slowdown, the global picture remains positive. Projections indicate that worldwide construction activity will expand by 1.8% in 2025. This growth is particularly strong in non-residential building and civil engineering projects, which are expected to see increases of 2.8% and 4.4% respectively in 2024, directly benefiting the demand for AAON's specialized equipment.

- Global construction growth: Expected to reach 1.8% in 2025.

- Non-residential construction: Forecasted to grow by 2.8% in 2024.

- Civil engineering projects: Anticipated to increase by 4.4% in 2024.

- Urbanization impact: Drives demand for new commercial and industrial buildings requiring HVAC systems.

Workforce Demographics and Skill Gaps

The HVAC industry, including manufacturers like AAON, is grappling with an aging workforce. For instance, the U.S. Bureau of Labor Statistics projected that by 2031, the median age of all occupations would continue to rise, impacting industries reliant on physical labor and specialized technical skills. This demographic trend directly contributes to a skilled labor gap, making it harder to find qualified installers and service technicians.

To counter this, significant investment in training and education is crucial to attract and retain emerging talent. AAON, as a key player, may find it beneficial to actively support or even develop its own robust training programs. These initiatives would ensure a pipeline of skilled professionals capable of understanding and servicing AAON's increasingly sophisticated HVAC systems, thereby maintaining product performance and customer satisfaction.

- Aging Workforce: A significant portion of experienced HVAC technicians are nearing retirement age.

- Skilled Labor Shortage: The demand for qualified HVAC professionals outstrips the available supply.

- Training Investment: AAON may need to invest in programs to upskill existing staff and attract new talent.

- Technological Advancement: New hires need training on advanced systems, requiring specialized educational pathways.

Societal shifts toward health and wellness are significantly impacting the HVAC market, with a heightened focus on indoor air quality (IAQ). This trend is driving demand for advanced filtration and ventilation, a space where AAON is positioned to excel. Furthermore, a growing preference for sustainability and energy efficiency aligns with AAON's product strengths, as consumers and businesses actively seek to reduce their environmental footprint and energy costs.

Technological factors

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) is transforming HVAC systems. These advancements allow for remote monitoring, predictive maintenance, and smarter energy management, leading to significant operational efficiencies for building owners. For instance, smart thermostats powered by AI can now learn occupant behavior to optimize heating and cooling schedules, potentially reducing energy waste by up to 20% in residential settings.

AAON can capitalize on these technological shifts by developing and incorporating advanced smart features into its product lines. This includes offering HVAC units with enhanced connectivity for seamless IoT integration and AI-driven control systems. The market is increasingly favoring smart building solutions, with the global smart HVAC market projected to reach $38.5 billion by 2027, growing at a CAGR of 15.8% from 2020.

The global push to phase out refrigerants with high Global Warming Potential (GWP) is a significant technological driver. For instance, the Kigali Amendment to the Montreal Protocol, which entered into force in 2019, mandates a gradual reduction in HFCs, with developed nations already making substantial cuts. This is accelerating the development and adoption of lower-GWP alternatives such as R-454B and R-32.

AAON, like other HVAC manufacturers, must strategically invest in research and development to integrate these next-generation refrigerants into its product lines. This adaptation is crucial not only for regulatory compliance but also for optimizing system efficiency and performance with these new chemical compositions, ensuring continued market competitiveness.

Electrification is reshaping the commercial HVAC landscape, with heat pumps at the forefront. Their energy efficiency and adaptability across diverse climates are driving significant adoption. For instance, the global heat pump market was valued at approximately $60 billion in 2023 and is projected to reach over $110 billion by 2030, demonstrating robust growth.

Variable Refrigerant Flow (VRF) systems are also gaining traction, offering precise temperature management and enhanced energy conservation, which are key selling points for businesses looking to reduce operating costs.

AAON's existing product line, including its heat recovery units, is well-positioned to capitalize on this electrification trend. Further development in advanced heat pump technologies and VRF integration could significantly enhance AAON's market share in this rapidly expanding sector.

Modular and Prefabricated Construction Methods

Modular and prefabricated construction methods are transforming the building sector, emphasizing efficiency and waste reduction. This trend directly impacts HVAC system integration, driving demand for standardized, pre-engineered solutions that seamlessly fit into modular designs. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to reach over $200 billion by 2030, showcasing significant growth potential.

These advancements present AAON with a clear opportunity to innovate. By developing HVAC units specifically designed for modular building integration, AAON can capitalize on this expanding market. This could involve offering compact, easily transportable, and pre-commissioned systems that reduce on-site labor and installation time, aligning with the core benefits of modular construction.

The shift towards modular construction also influences the types of HVAC products that will be in demand:

- Increased demand for integrated HVAC modules: Pre-assembled units that combine heating, cooling, and ventilation components.

- Focus on standardization: HVAC solutions designed to fit common modular wall and floor panel dimensions.

- Emphasis on energy efficiency: Modular builds often prioritize sustainability, requiring highly efficient HVAC systems.

- Potential for smart building integration: HVAC systems that can be easily networked and controlled within a smart modular framework.

Enhanced Energy Recovery and Ventilation Systems

The drive for greater energy efficiency and improved indoor air quality is fueling a significant uptick in demand for sophisticated energy recovery ventilation (ERV) systems. These advanced units are designed to recapture thermal energy from outgoing air, thereby lessening the energy burden for heating and cooling within buildings. AAON's established proficiency in heat recovery units places it in a strong position to capitalize on this expanding market trend.

For instance, the global market for ERVs was valued at approximately USD 3.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7.5% through 2030. This growth is largely attributed to stricter building codes and a growing awareness of the health benefits associated with better ventilation. AAON's product portfolio, featuring integrated heat recovery solutions, directly addresses these market dynamics.

- Increased demand for ERVs driven by energy efficiency mandates.

- ERV systems reduce building heating and cooling loads by recovering energy from exhaust air.

- AAON's specialization in heat recovery units aligns with market needs.

- The ERV market is expected to see substantial growth in the coming years.

The HVAC industry is rapidly evolving with technological advancements like IoT and AI, enabling smart monitoring and predictive maintenance. This trend is supported by the projected growth of the smart HVAC market, which was expected to reach $38.5 billion by 2027. AAON can leverage these innovations by integrating advanced connectivity and AI-driven controls into its offerings.

The global push for lower Global Warming Potential (GWP) refrigerants, driven by regulations like the Kigali Amendment, necessitates R&D investment in new refrigerant technologies. Similarly, the electrification trend, particularly the rise of heat pumps, is reshaping the market, with the heat pump sector valued at around $60 billion in 2023. AAON's existing product lines, including heat recovery units, are well-positioned to benefit from these shifts.

| Technology Trend | Market Impact | AAON Opportunity |

|---|---|---|

| IoT & AI Integration | Enhanced efficiency, predictive maintenance | Develop smart HVAC units with connectivity |

| Low-GWP Refrigerants | Regulatory compliance, system optimization | Invest in R&D for new refrigerant integration |

| Electrification (Heat Pumps) | Increased demand for efficient systems | Expand advanced heat pump and VRF offerings |

| Modular Construction | Demand for standardized, integrated HVAC | Design HVAC for seamless modular integration |

| Energy Recovery Ventilation (ERV) | Growing demand for energy efficiency | Capitalize on heat recovery expertise |

Legal factors

The American Innovation and Manufacturing (AIM) Act grants the EPA significant authority to manage hydrofluorocarbons (HFCs), initiating a phased reduction in high-global warming potential (GWP) refrigerants. This regulatory shift mandates that starting January 1, 2025, new residential and light commercial HVAC systems must incorporate refrigerants with a GWP of 700 or lower, like R-454B and R-32.

AAON's commitment to compliance with these stringent EPA regulations is critical for avoiding penalties and ensuring continued access to key markets. The company must adapt its manufacturing and product development to meet these new refrigerant standards, impacting product lines and supply chain considerations.

Evolving building codes and stricter energy efficiency standards, like those from the U.S. Department of Energy, are pushing HVAC systems to achieve higher performance. This means products must meet new benchmarks, such as SEER2 and HSPF2 ratings, which directly influences AAON's product development and specifications.

Compliance with these mandates is essential for both new construction projects and major renovations, creating a direct impact on the design and capabilities of AAON's HVAC solutions. The projected savings from the 2025 Energy Code alone are estimated at $4.8 billion in lifetime energy costs, highlighting the significance of these regulatory shifts.

Broader environmental regulations, extending beyond refrigerants, are significantly shaping the HVAC sector by targeting greenhouse gas emissions and carbon reduction. This regulatory landscape is a key driver for the industry's shift towards decarbonization, promoting the adoption of fully electric systems and heat pumps. AAON's focus on energy efficiency directly supports these environmental mandates, positioning the company favorably within this evolving regulatory framework.

Product Liability and Safety Standards

AAON must navigate evolving product liability and safety standards, particularly with the transition to A2L refrigerants like R-454B and R-32. These refrigerants, classified as mildly flammable, necessitate rigorous design, testing, and certification to meet new safety benchmarks. Failure to comply could expose AAON to significant product liability claims and damage its reputation.

Ensuring adherence to these stringent safety regulations is paramount for AAON. For instance, the ASHRAE 15 standard, which governs the safety of refrigeration systems, is continuously updated to incorporate new refrigerant classifications and associated risks. AAON's commitment to meeting these evolving standards directly impacts its ability to mitigate legal exposure and maintain customer confidence in its HVAC equipment.

The financial implications of non-compliance are substantial. Product recalls, litigation costs, and potential fines can severely impact profitability. In 2024, the HVAC industry saw increased scrutiny on refrigerant handling and equipment safety, with regulatory bodies like the EPA in the US actively enforcing new guidelines. AAON's proactive approach to safety standards is therefore a critical component of its risk management strategy.

- Regulatory Compliance: AAON must ensure its products meet the latest safety standards for A2L refrigerants, such as ASHRAE 15.

- Product Liability Mitigation: Adherence to these standards is crucial to avoid costly product liability claims and lawsuits.

- Consumer Trust: Demonstrating a commitment to safety enhances brand reputation and fosters consumer confidence.

- Financial Impact: Non-compliance can lead to significant financial penalties, recalls, and reduced market access.

Intellectual Property and Patents

Protecting intellectual property is paramount for AAON in the competitive HVAC sector. Patents and trademarks are crucial for safeguarding innovations in energy-efficient designs, custom solutions, and smart HVAC technologies, ensuring AAON maintains its market advantage. Legal frameworks governing intellectual property are therefore essential for AAON to shield its proprietary technologies from infringement.

The United States Patent and Trademark Office (USPTO) reported a significant increase in utility patent applications, with over 350,000 filed in 2023. This trend underscores the growing importance of patent protection in manufacturing sectors like HVAC. AAON’s ability to secure and defend its patents directly impacts its ability to commercialize new technologies and maintain a competitive pricing strategy.

- Patent Protection: Securing patents for novel HVAC technologies, such as advanced heat exchanger designs or unique control algorithms, is vital.

- Trademark Safeguarding: Protecting AAON's brand name and product logos through trademarks prevents market confusion and brand dilution.

- Trade Secret Management: Implementing robust internal policies to protect proprietary manufacturing processes and customer data is equally important.

- Infringement Monitoring: Actively monitoring the market for potential patent or trademark infringements allows AAON to take timely legal action.

AAON faces legal obligations stemming from the AIM Act, mandating a transition to lower GWP refrigerants like R-454B and R-32 for new residential and light commercial HVAC systems by January 1, 2025. Failure to comply with these regulations, enforced by bodies like the EPA, can result in significant penalties and restricted market access. The company must also navigate evolving product liability and safety standards, particularly concerning the mildly flammable nature of A2L refrigerants, as outlined in standards like ASHRAE 15, to prevent costly lawsuits and maintain consumer trust.

Intellectual property law is crucial for AAON's competitive edge, requiring robust patent and trademark protection for its innovations in energy efficiency and smart HVAC technologies. With over 350,000 utility patent applications filed in the US in 2023, safeguarding proprietary designs against infringement is essential for maintaining market advantage and pricing strategies.

Environmental factors

Climate change is significantly boosting the demand for advanced HVAC systems. As temperatures become more erratic and extreme, businesses and industries are prioritizing reliable climate control, directly benefiting AAON. For instance, the increasing frequency of heatwaves, like those experienced in 2024, necessitates more robust cooling solutions.

The drive for resilient infrastructure also plays a key role. Building owners are investing in equipment that can withstand unseasonal weather events, creating a sustained market for AAON's durable and efficient products. This trend is supported by growing regulatory focus on building performance in the face of climate risks.

The environmental impact of refrigerants, especially their Global Warming Potential (GWP), is a major focus. High-GWP refrigerants contribute significantly to climate change, making their reduction a global priority.

New EPA regulations, effective January 1, 2025, will phase out refrigerants like R-410A, which has a GWP of 2088. This necessitates a shift to lower-GWP alternatives, such as R-454B (GWP 466) and R-32 (GWP 675).

AAON must proactively adapt its product lines to incorporate these next-generation refrigerants to ensure compliance with these evolving environmental mandates and to actively lower its carbon footprint.

The global push for energy efficiency and decarbonization in buildings is accelerating, driven by the urgent need to cut greenhouse gas emissions. This trend directly fuels demand for advanced HVAC technologies like highly efficient systems, heat pumps, and integrated renewable energy solutions.

AAON's strategic focus on energy efficiency and tailored engineering solutions positions it to capitalize on this environmental imperative. By offering products that enhance operational carbon footprint reduction, AAON aligns with client goals for sustainability and regulatory compliance, a critical factor in the 2024-2025 market landscape.

Sustainable Building Practices and Green Certifications

The commercial construction sector is increasingly embracing sustainable building methods, focusing on eco-friendly materials, waste minimization, and certifications like LEED and Energy Star. This trend directly influences developers to favor energy-efficient HVAC solutions, creating a favorable market for companies like AAON that offer such products.

AAON is well-positioned to capitalize on this shift. By ensuring its HVAC systems meet stringent energy efficiency standards and potentially pursuing green certifications for its manufacturing processes, AAON can enhance its appeal to a growing segment of environmentally conscious builders and owners. For instance, in 2023, the global green building market was valued at approximately $317.7 billion and is projected to reach $765.1 billion by 2030, indicating substantial growth potential.

- Growing Demand for Green Buildings: The increasing emphasis on sustainability in construction drives demand for energy-efficient HVAC systems, a core offering for AAON.

- LEED and Energy Star Focus: Developers are actively seeking projects that achieve certifications like LEED, which often prioritize high-performance HVAC equipment.

- Market Opportunity for AAON: AAON's ability to align its product development and manufacturing with these green building trends presents a significant growth avenue.

- Industry Growth Projections: The expanding green building market, with significant projected growth through 2030, underscores the long-term viability of sustainable HVAC solutions.

Resource Scarcity and Circular Economy Principles

The construction industry is increasingly prioritizing resource scarcity and circular economy principles. This means a greater emphasis on reusing and recycling building materials, as well as designing structures built to last longer. While this directly affects raw materials, it also indirectly influences HVAC systems. There's a growing demand for units that are more durable, easier to repair, and ultimately recyclable, fitting into a larger sustainability movement within building design and operation.

This shift can impact AAON by encouraging the development of HVAC components with longer lifespans and modular designs that facilitate repair and eventual material recovery. For instance, the global circular economy market is projected to reach $4.5 trillion by 2030, signaling a significant economic driver for sustainable practices across industries, including construction and manufacturing. By 2025, it's estimated that 70% of companies will have some form of circular economy strategy in place.

- Increased demand for durable and repairable HVAC components.

- Potential for new product development focusing on recyclability.

- Alignment with growing investor and consumer preference for sustainable products.

- Opportunity to differentiate AAON through eco-friendly design and lifecycle management.

Environmental regulations are increasingly shaping the HVAC market, pushing for lower Global Warming Potential (GWP) refrigerants. New EPA regulations effective January 1, 2025, mandate a phase-out of high-GWP refrigerants like R-410A, requiring a transition to alternatives such as R-454B and R-32.

AAON's commitment to energy efficiency and sustainability is a key advantage, aligning with growing demand for green buildings and certifications like LEED. The global green building market's projected growth to $765.1 billion by 2030 highlights this trend.

The industry's focus on circular economy principles is driving demand for durable, repairable, and recyclable HVAC components. By 2025, an estimated 70% of companies are expected to have a circular economy strategy, presenting opportunities for AAON to innovate in product design and lifecycle management.

| Environmental Factor | Impact on AAON | 2024-2025 Data/Projections |

|---|---|---|

| Refrigerant Regulations | Mandates shift to lower-GWP refrigerants (e.g., R-454B, R-32) | EPA phase-out of R-410A (GWP 2088) effective Jan 1, 2025 |

| Energy Efficiency Demand | Drives demand for high-performance HVAC systems | Global green building market projected to reach $765.1 billion by 2030 |

| Circular Economy Focus | Increases demand for durable, repairable, and recyclable products | 70% of companies expected to have a circular economy strategy by 2025 |

PESTLE Analysis Data Sources

Our AAON PESTLE Analysis is built on a comprehensive review of data from government regulatory bodies, industry associations, and financial market reports. We incorporate insights from economic forecasts, technological advancements, and environmental impact studies to provide a well-rounded view.