AAON Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAON Bundle

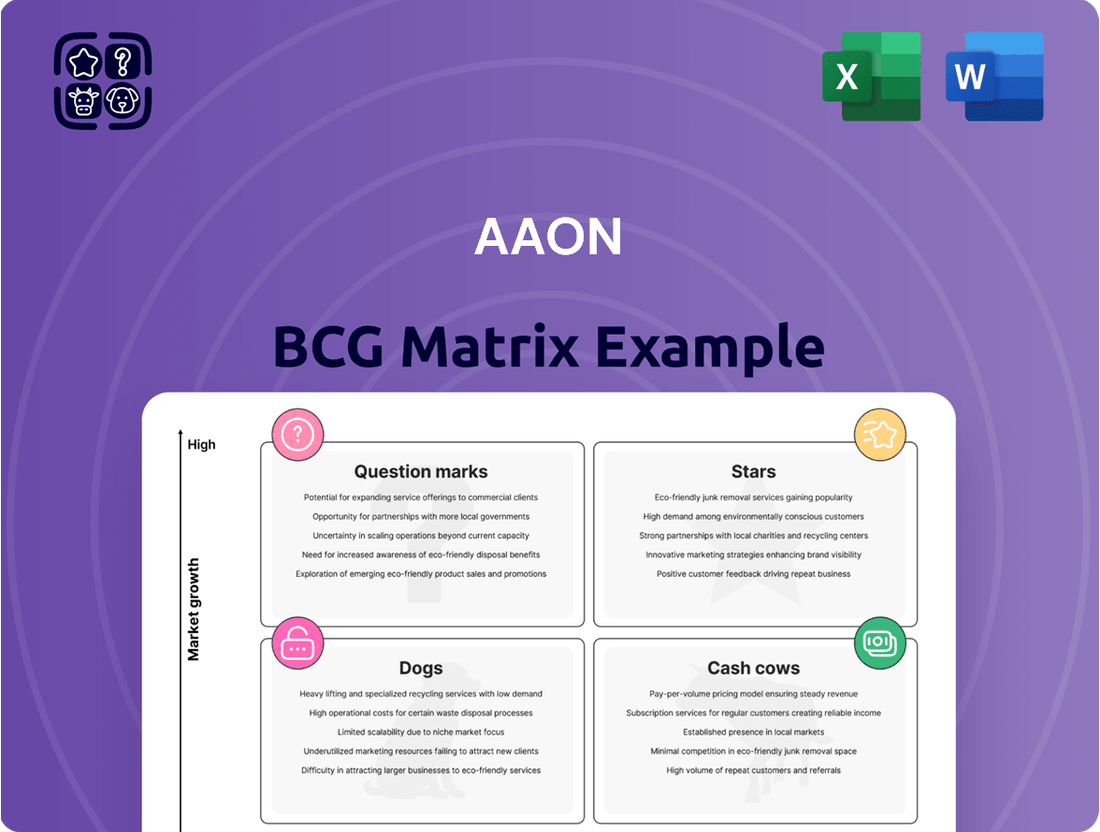

Curious about AAON's product portfolio performance? Our BCG Matrix preview highlights their current market standing, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full strategic picture and actionable insights.

Unlock the complete AAON BCG Matrix to gain a comprehensive understanding of their product lifecycle and market share. Purchase the full report for detailed quadrant analysis and data-driven recommendations to optimize your investment strategy.

Stars

AAON's BASX segment, focusing on data center cooling solutions, is a definitive Star in the BCG Matrix. This area, encompassing advanced air-side and liquid cooling technologies, has experienced remarkable expansion.

The explosive growth is evident in its Q1 2025 performance, with sales rocketing by an impressive 374.8% compared to the previous year. This surge is further underscored by a substantial backlog of BASX-branded products exceeding $623 million.

This strong market position is fueled by the escalating demand for AI and cloud computing infrastructure, sectors that require robust and efficient cooling systems. BASX is effectively capturing a significant share of this rapidly growing market.

The Alpha Class heat pumps, particularly the EXTREME Series featuring Stratus controls, are positioned as a star in the AAON BCG Matrix. This product line is experiencing robust growth and demonstrates significant market potential. Their advanced engineering focuses on enhanced efficiency and reduced emissions, directly addressing the growing demand for sustainable HVAC solutions driven by decarbonization initiatives and evolving regulatory landscapes.

AAON's Custom-Engineered HVAC Solutions fit squarely into the Stars category of the BCG Matrix. Their core strength lies in creating highly configurable and bespoke HVAC equipment for commercial and industrial clients. This specialization allows them to address very specific needs, securing a strong market position in specialized segments.

Energy Recovery Units

AAON's energy recovery units are positioned in a high-growth market segment due to the escalating demand for energy efficiency in commercial buildings. These systems are crucial for reducing operational expenses and environmental impact for their clientele.

The market for energy recovery ventilation (ERV) systems, a core component of AAON's offerings, saw significant expansion. For instance, the global ERV market was valued at approximately USD 3.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030. This growth is fueled by stringent building codes and a rising consciousness about sustainability.

- Market Growth: The demand for energy-efficient HVAC solutions like ERUs is robust, driven by regulatory support and cost savings for building owners.

- Sustainability Focus: ERUs directly address the need to lower carbon footprints, aligning with global environmental goals and corporate sustainability initiatives.

- Operational Savings: By pre-conditioning incoming fresh air using exhaust air, these units can reduce heating and cooling loads, leading to substantial energy bill reductions for end-users.

- Technological Advancements: Ongoing innovation in heat exchanger technology and smart controls further enhances the performance and appeal of these units.

Strategic Partnerships for Advanced Cooling

AAON's strategic partnerships, such as its collaboration with Applied Digital, are crucial for its position in the advanced cooling market, particularly for AI data centers. This alliance leverages AAON's BASX division to provide specialized cooling solutions, directly addressing the rapidly growing demand for high-density computing infrastructure. By aligning with key players in the burgeoning AI sector, AAON is not just participating in a growth area but actively shaping its presence within it.

These collaborations are instrumental in solidifying AAON's market standing by focusing on cutting-edge cooling technologies. For instance, the partnership with Applied Digital aims to develop purpose-built AI data center campuses, a segment experiencing exponential growth. This strategic focus ensures AAON is well-positioned to capitalize on future market needs for efficient and advanced thermal management solutions, a critical component for the sustained operation of AI hardware.

- AI Data Center Growth: The global AI data center market is projected to see significant expansion, with investments in specialized infrastructure like that developed with Applied Digital.

- BASX Integration: AAON's BASX technology is designed to handle the unique thermal challenges of AI workloads, making these partnerships a natural fit for high-performance computing environments.

- Market Leadership: By securing these early-stage partnerships, AAON aims to establish itself as a leader in providing essential cooling infrastructure for the next generation of digital innovation.

AAON's BASX segment, particularly its cooling solutions for data centers, is a clear Star. This segment has seen phenomenal growth, with Q1 2025 sales soaring 374.8% year-over-year, supported by a BASX backlog exceeding $623 million. This surge is driven by the insatiable demand for AI and cloud computing infrastructure, where efficient cooling is paramount, and BASX is effectively capturing market share.

The Alpha Class heat pumps, especially the EXTREME Series with Stratus controls, are also Stars. These units offer superior efficiency and reduced emissions, aligning with the growing demand for sustainable HVAC solutions spurred by decarbonization efforts and evolving regulations.

AAON's energy recovery units are positioned as Stars due to the strong market growth for energy efficiency in commercial buildings. These units are vital for reducing operational costs and environmental impact for their customers, with the global ERV market projected to grow at over 7% annually through 2030.

| Product Segment | BCG Category | Key Growth Drivers | 2025 Performance Highlight |

|---|---|---|---|

| BASX (Data Center Cooling) | Star | AI & Cloud Computing Demand | Sales +374.8% (Q1 2025) |

| Alpha Class Heat Pumps (EXTREME Series) | Star | Sustainability & Efficiency Demand | Robust Growth & Market Potential |

| Energy Recovery Units | Star | Energy Efficiency Mandates | Strong ERV Market Growth (>7% CAGR) |

What is included in the product

The AAON BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

A clear visual representation of AAON's portfolio, simplifying complex strategic decisions.

Cash Cows

AAON's RN and RZ series rooftop units are firmly positioned as Cash Cows within the company's product portfolio. These established units boast a substantial installed base and command a significant market share in the commercial HVAC sector, indicating strong brand loyalty and consistent demand.

Despite potential headwinds in traditional non-residential construction, the replacement market for these mature products likely ensures a steady and predictable revenue stream. This consistent cash flow generation is a hallmark of a Cash Cow, providing financial stability for AAON.

AAON's Oklahoma segment, a powerhouse in semi-custom and custom HVAC systems, has long been a bedrock of the company's success. This segment commands a significant historical market share, indicating a deep-rooted customer base and established brand loyalty.

Despite facing some temporary challenges in 2024, notably the impact of refrigerant transitions and a slowdown in non-residential construction, the segment's performance paints a resilient picture. The reported two-year growth from 2022 to 2024 underscores its robust underlying market position and consistent profitability, even amidst industry shifts.

AAON Coil Products, a key player in manufacturing heating and cooling coils, serves as a foundational supplier for HVAC systems, both for internal use and potentially for external sales. This segment's role in providing essential components for a market with consistent demand suggests it generates a stable and predictable cash flow for AAON.

In 2024, the HVAC market continued its steady growth, driven by new construction and replacement demand. AAON Coil Products, by supplying critical components, is positioned to benefit from this ongoing activity, contributing reliable revenue streams that support the company's overall financial health.

Aftermarket Parts and Services

AAON's aftermarket parts and services segment functions as a classic cash cow. The continuous demand for replacement components and maintenance for its vast installed base of commercial and industrial HVAC equipment provides a consistent, high-margin revenue stream with limited growth potential.

This segment is crucial for AAON's financial stability, acting as a reliable generator of cash. For instance, in 2023, AAON reported that its service and replacement business contributed significantly to its overall profitability, underscoring its cash cow status.

- Consistent Revenue: The ongoing need for maintenance and replacement parts for AAON's installed base ensures predictable income.

- High Margins: Services and specialized parts typically command higher profit margins compared to new equipment sales.

- Low Growth Environment: While stable, this segment is not expected to experience rapid expansion, characteristic of a cash cow.

- Financial Stability: This segment provides a reliable source of cash to fund other business areas or investments.

Established Client Relationships and Brand Loyalty

AAON's established client relationships and brand loyalty are key drivers in its Cash Cows segment. The company has cultivated deep connections across diverse sectors, including education, healthcare, and retail, by consistently delivering custom-engineered solutions and prioritizing energy efficiency.

This focus on tailored products and energy savings has fostered a loyal customer base, leading to significant repeat business. For example, AAON reported a 7.7% increase in revenue for the first quarter of 2024 compared to the same period in 2023, demonstrating the stability and consistent performance of these established relationships.

- Long-standing partnerships in education, healthcare, and retail sectors.

- Custom-engineered solutions and energy efficiency drive customer retention.

- Repeat business contributes to stable, predictable revenue streams.

- Brand loyalty ensures consistent performance even in mature markets.

AAON's RN and RZ series rooftop units, along with its Oklahoma segment's semi-custom and custom HVAC systems, exemplify classic cash cows. These products benefit from a substantial installed base and strong brand loyalty, ensuring consistent demand and predictable revenue streams. The aftermarket parts and services segment further solidifies this position by providing high-margin, recurring income from maintenance and replacement needs.

The consistent performance of these segments is crucial for AAON's financial health, generating stable cash flow to support other areas of the business. For instance, AAON reported a 7.7% increase in revenue for Q1 2024 compared to Q1 2023, highlighting the stability of its established product lines and customer relationships.

These cash cow products are characterized by their strong market share in mature segments, offering reliable profitability with limited growth potential. This stability is further bolstered by long-standing customer partnerships in key sectors like education and healthcare.

| Product/Segment | BCG Category | Key Characteristics | 2024 Data/Insight |

|---|---|---|---|

| RN & RZ Rooftop Units | Cash Cow | Established, significant market share, strong brand loyalty, consistent demand. | Continued demand in replacement market, supporting steady revenue. |

| Oklahoma Segment (Semi-Custom/Custom HVAC) | Cash Cow | Deep-rooted customer base, established brand loyalty, consistent profitability. | Reported two-year growth from 2022-2024, demonstrating resilience despite industry shifts. |

| Aftermarket Parts & Services | Cash Cow | Continuous demand for maintenance/replacement, high-margin revenue, limited growth potential. | Crucial for financial stability, providing reliable cash generation. |

What You’re Viewing Is Included

AAON BCG Matrix

The AAON BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means you'll have access to the same in-depth analysis, clear visualizations, and actionable insights without any watermarks or demo limitations. The strategic framework presented here is ready for immediate integration into your business planning processes. You can confidently expect the exact same professional-grade report to be delivered to you, enabling you to make informed decisions about AAON's product portfolio.

Dogs

Older, less energy-efficient HVAC models from AAON could be categorized as Dogs in the BCG matrix. These units often struggle to meet current environmental standards and may require costly retrofits or replacements to comply with evolving regulations, such as those pushing for lower Global Warming Potential (GWP) refrigerants.

With the increasing demand for sustainable and energy-saving solutions, these legacy products likely hold a small market share. For instance, in 2024, the HVAC market saw a significant push towards variable refrigerant flow (VRF) systems and heat pumps, which are inherently more efficient than older, single-stage systems. AAON's older models might not compete effectively in this landscape, potentially leading to declining sales and profitability.

Standardized, catalog-based HVAC products for AAON might fall into the Dogs category of the BCG Matrix. These are typically products where AAON, despite its strength in custom solutions, faces intense competition from larger manufacturers with economies of scale. In 2024, the HVAC market saw continued demand but also increased price sensitivity in these standardized segments.

Products heavily reliant on fading market niches, often categorized as Dogs in the BCG Matrix, represent a significant challenge for companies like AAON. These are offerings catering to highly specific commercial or industrial segments that are experiencing a decline, perhaps due to technological obsolescence or shifting consumer preferences. For instance, if AAON has HVAC systems designed for older, less energy-efficient building standards that are no longer being constructed, these products would fall into this category.

The critical issue with these niche products is their inability to adapt to broader market trends such as the increasing demand for decarbonization or the rapid expansion of data centers. As the market shifts towards more sustainable and technologically advanced solutions, products tied to declining niches will see their market share erode. This diminishing relevance directly impacts their growth prospects, potentially leading to reduced investment and eventual divestment.

Underperforming Regional Sales Divisions

Underperforming regional sales divisions within AAON, those with persistently low sales volumes and market share relative to their operational expenses, represent potential Dogs in the BCG Matrix. These divisions may be consuming valuable resources without demonstrating a clear path to improvement or significant contribution to the company's overall growth trajectory.

These underperforming areas might require careful evaluation for potential divestiture or restructuring. For instance, if a specific region's sales growth has been stagnant or declining, such as a 2% year-over-year decrease in a particular territory during 2024, while its operational costs have risen by 5%, it would strongly indicate a Dog classification.

- Low Market Share: Divisions consistently falling below industry benchmarks for market penetration.

- High Operational Costs: Expenses in these regions disproportionately outweigh generated revenue.

- Stagnant Growth: Minimal to no sales volume increase over extended periods, potentially showing a decline.

- Resource Drain: Diverting capital and management attention from more promising business units.

Products with High Warranty Claims or Service Costs

Products with high warranty claims or service costs are often categorized as Dogs in the AAON BCG Matrix. These products, despite potentially generating sales, eat into profits due to the significant expenses associated with their upkeep and repair. This scenario directly impacts the net return, making them less attractive from an investment perspective.

For instance, a product line experiencing a 15% increase in warranty claims year-over-year, exceeding industry averages by a substantial margin, would signal a potential Dog. Such a trend suggests underlying quality issues or design flaws that manifest post-sale, leading to a drain on financial resources and diminished profitability.

- High Warranty Costs: Products with warranty claim costs that represent more than 5% of their selling price.

- Extended Service Requirements: Lines demanding frequent or costly post-sale technical support, increasing operational overhead.

- Low Profitability: Products whose net profit margin falls below 3% after accounting for all associated service and warranty expenses.

- Negative ROI: Investments in product servicing and warranty fulfillment that yield a negative return on investment.

AAON's older, less energy-efficient HVAC units, particularly those not meeting evolving environmental standards like lower GWP refrigerants, are prime candidates for the Dog category. These products struggle to compete in a market increasingly favoring advanced solutions, as seen in the 2024 surge in demand for VRF and heat pump systems.

Standardized HVAC products from AAON, facing intense competition from larger, scale-advantaged manufacturers, also fit the Dog profile. Despite market demand in 2024, price sensitivity in these segments limits growth potential for AAON's less differentiated offerings.

Products tied to fading market niches, such as HVAC systems for outdated building standards, represent Dogs. Their inability to align with broader trends like decarbonization, evident in 2024's market focus, leads to eroding market share and reduced investment appeal.

Underperforming regional sales divisions with stagnant growth and high operational costs, like a territory showing a 2% sales decline in 2024 against a 5% cost increase, are also Dogs. These units drain resources without contributing significantly to overall company performance.

Question Marks

Liquid cooling technology, while a proven star in data centers, presents a compelling question mark when applied to broader commercial and industrial sectors. The market demand for these advanced cooling solutions outside of high-density computing environments is still developing, meaning AAON's market share in these nascent areas is likely low.

These emerging applications, such as specialized manufacturing processes or advanced HVAC systems in large commercial buildings, hold significant growth potential. However, realizing this potential requires substantial upfront investment in research, development, and market penetration strategies to build brand awareness and establish a foothold.

AAON's commitment to research and development in emerging decarbonization technologies, including novel refrigerants beyond its existing Alpha Class line, positions it for future growth. These innovative areas are characterized by significant market potential but also inherent uncertainty regarding widespread adoption and AAON's ultimate market penetration. For instance, the global refrigerants market is projected to reach $24.5 billion by 2027, with a compound annual growth rate of 4.2%, highlighting the substantial opportunity in this sector.

Developing HVAC solutions for niche, rapidly evolving industries like advanced semiconductor manufacturing or specialized biotech labs presents a classic question mark scenario for AAON. These sectors often demand highly customized, precise environmental controls, and AAON's current market share is likely low due to the specialized nature and nascent stage of these markets. For instance, the semiconductor industry's demand for ultra-cleanroom environments with stringent temperature and humidity control is a prime example of such a niche. The potential for these markets to explode in growth, transforming them into future stars, is significant, but the investment required and the inherent uncertainty make them high-risk ventures.

Geothermal/Water-Source Heat Pumps (if market share is low)

AAON's geothermal/water-source heat pump segment, while part of their sustainable solutions offering, likely represents a low market share within their overall product portfolio. Despite a growing global market for these technologies, driven by increasing environmental awareness and government incentives, AAON's current penetration in this specific niche appears limited. For instance, the global geothermal heat pump market was valued at approximately USD 5.5 billion in 2023 and is projected to grow at a CAGR of around 6.5% through 2030, indicating substantial potential.

Given this scenario, AAON's geothermal/water-source heat pumps would be classified as a Question Mark in the BCG Matrix. This classification signifies that the product has high growth potential in a growing market but currently holds a low market share.

- Low Market Share: AAON's current position in the geothermal/water-source heat pump market is likely small compared to established competitors.

- High Market Growth: The demand for geothermal and water-source heat pumps is increasing significantly due to their energy efficiency and environmental benefits.

- Investment Requirement: To capture a larger share of this growing market, AAON would need to make substantial investments in research and development, manufacturing capacity, and marketing efforts.

- Strategic Decision: AAON must decide whether to invest heavily to turn these Question Marks into Stars or divest from the segment if it's not strategically aligned or profitable.

Advanced Integrated Control Systems (beyond Stratus)

AAON's potential for advanced integrated control systems, moving beyond its current Stratus platform, represents a significant growth opportunity. The market for AI-powered building management is expanding rapidly, with projections indicating substantial growth in the coming years. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is expected to reach over $200 billion by 2030, a compound annual growth rate of around 14%.

Focusing on AI-driven enhancements and broader market penetration for these sophisticated systems is crucial for AAON. This includes targeting emerging smart building applications where seamless integration and intelligent automation are paramount. While the market is ripe for innovation, widespread adoption is still in its nascent stages, and AAON's competitive positioning is actively developing.

Key areas for AAON's advanced integrated control systems include:

- Enhanced AI Capabilities: Integrating predictive maintenance, energy optimization algorithms, and occupant behavior analysis into control systems.

- New Market Segments: Targeting the growing demand for smart healthcare facilities, advanced educational campuses, and intelligent retail spaces.

- Stratus Evolution: Developing next-generation Stratus features that offer deeper integration with IoT devices and advanced data analytics for smarter building operations.

- Partnerships and Alliances: Collaborating with AI technology providers and smart device manufacturers to broaden system compatibility and functionality.

Question Marks represent areas where AAON has a low market share but operates in a high-growth market. These ventures require careful consideration regarding investment to potentially transform them into Stars or if they should be divested.

The challenge lies in balancing the significant potential of these emerging markets with the substantial investment needed for research, development, and market penetration. Success hinges on AAON's ability to effectively navigate these uncertain, yet promising, landscapes.

For AAON, these Question Marks highlight opportunities in nascent technologies and specialized sectors where their current market presence is minimal, but future growth prospects are considerable, demanding strategic capital allocation.

The company must strategically assess which Question Marks warrant further investment to increase market share and which might be better to exit if they do not align with long-term strategic goals or demonstrate a clear path to profitability.

| Category | Market Growth | AAON Market Share | Strategic Implication |

|---|---|---|---|

| Liquid Cooling (Non-Data Center) | High | Low | Requires R&D and market development investment. |

| Advanced Integrated Control Systems (AI-Driven) | High | Low | Needs investment in AI capabilities and new market segments. |

| Geothermal/Water-Source Heat Pumps | High | Low | Potential for growth, but requires significant market penetration efforts. |

| HVAC for Niche, Evolving Industries (e.g., Semiconductor) | High | Low | High investment and uncertainty, but significant future potential. |

BCG Matrix Data Sources

Our AAON BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.