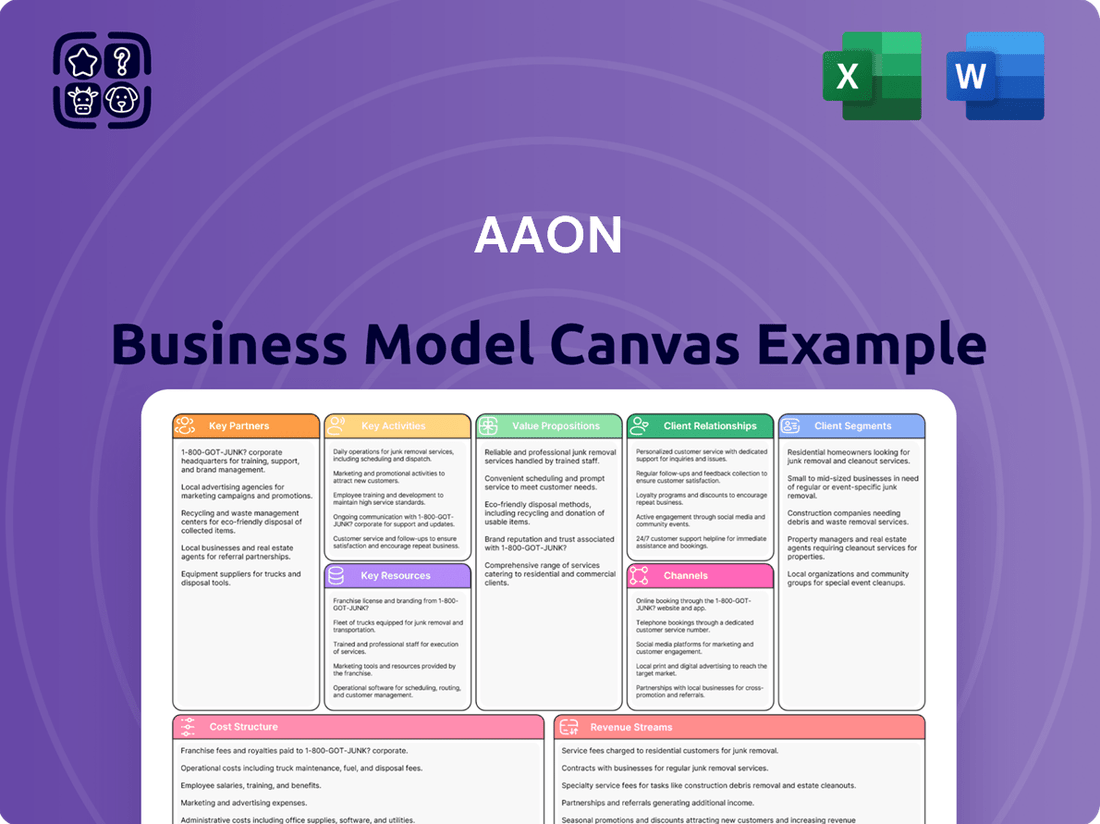

AAON Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAON Bundle

Unlock the full strategic blueprint behind AAON's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

AAON's strategic component suppliers are vital to its innovation and product quality. For instance, their collaboration with Copeland for advanced compressor technology ensures AAON's HVAC systems benefit from cutting-edge performance and energy efficiency.

These partnerships are not just about sourcing parts; they are about co-developing solutions that push the boundaries of HVAC technology. This focus on high-quality, specialized components allows AAON to maintain its competitive edge, particularly in areas like energy savings, which is a significant selling point for their customers.

AAON’s independent sales representative network is a cornerstone of its go-to-market strategy, effectively extending its reach to commercial and industrial clients across North America. These representatives are not just salespeople; they are local experts who understand regional needs and regulations, providing a vital link between AAON and its customer base.

In 2024, AAON continued to leverage this network, which is essential for its direct sales model. The performance of these independent firms directly impacts AAON's market penetration and revenue generation, as they handle the critical functions of customer engagement, product specification, and order generation for AAON's diverse HVAC product lines.

AAON actively engages in research and development collaborations with prominent academic institutions. Partnerships with Oklahoma State University, Montana State University, and the University of Maryland are crucial for advancing HVAC technology. These collaborations focus on integrating cutting-edge findings into AAON's commercial product lines, fostering innovation.

These strategic alliances are often spurred by significant governmental initiatives, such as challenges sponsored by the U.S. Department of Energy. For instance, in 2024, AAON continued to leverage these partnerships to accelerate the development of more energy-efficient and sustainable HVAC solutions. Such collaborations directly enhance AAON's competitive edge by bringing novel technologies to market faster.

Government and Regulatory Bodies

Partnerships with government and regulatory bodies are crucial for AAON. For instance, collaborations with entities like the U.S. Department of Energy (DOE) are essential for understanding and adapting to new energy efficiency standards and refrigerant regulations. AAON's proactive approach, including their early adoption of lower Global Warming Potential (GWP) refrigerants such as R-454B, demonstrates their commitment to compliance and positions them as a leader in environmental sustainability within the HVAC industry.

These relationships allow AAON to:

- Stay ahead of evolving efficiency mandates, ensuring product compliance.

- Gain insights into future regulatory changes, facilitating strategic product development.

- Influence industry standards through early adoption and advocacy for sustainable technologies.

- Access potential government incentives or research grants related to energy efficiency and environmental technologies.

Data Center Infrastructure Partners

AAON collaborates with leading data center infrastructure providers, such as Applied Digital, to deliver specialized liquid cooling and thermal management systems. These partnerships are crucial for capturing substantial orders within the rapidly expanding data center industry.

The data center market experienced significant expansion, with global spending on data center infrastructure projected to reach over $300 billion in 2024. AAON's strategic alliances allow them to tap into this growth by offering tailored solutions for hyperscale facilities.

- Applied Digital: A key partner providing data center infrastructure, enabling AAON to integrate its cooling solutions.

- Hyperscale Data Centers: AAON's focus is on these large-scale facilities, requiring advanced thermal management.

- Custom Solutions: Partnerships facilitate the development of bespoke liquid cooling systems to meet specific client needs.

- Market Expansion: These collaborations are vital for securing large-scale contracts and broadening AAON's specialized market reach.

AAON's key partnerships extend to its independent sales representative network, crucial for market penetration and revenue. In 2024, these firms were instrumental in customer engagement and order generation.

Collaborations with academic institutions like Oklahoma State University advance HVAC technology, with findings integrated into commercial products. These R&D alliances are often supported by government initiatives, accelerating the development of energy-efficient solutions.

Strategic alliances with data center infrastructure providers, such as Applied Digital, are vital for AAON's expansion into the growing data center market, enabling the delivery of specialized liquid cooling systems.

| Partner Type | Key Partners | Strategic Importance | 2024 Focus/Impact |

| Component Suppliers | Copeland | Advanced compressor technology for performance and efficiency | Ensuring high-quality, specialized components for competitive edge. |

| Sales Network | Independent Sales Representatives | Market reach, customer engagement, order generation | Essential for direct sales model and revenue generation. |

| Academia | Oklahoma State University, Montana State University, University of Maryland | HVAC technology advancement, innovation | Integrating cutting-edge findings into commercial product lines. |

| Data Center Infrastructure | Applied Digital | Specialized liquid cooling and thermal management systems | Capturing orders in the rapidly expanding data center industry. |

What is included in the product

AAON's Business Model Canvas outlines its strategy of providing highly engineered, customizable HVAC solutions to commercial clients, emphasizing direct sales and a focus on energy efficiency.

It details customer segments like architects and building owners, value propositions centered on quality and customization, and revenue streams from equipment sales and service.

The AAON Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their operations, allowing for rapid identification of inefficiencies and strategic alignment.

It streamlines complex business strategies into an easily digestible, one-page format, effectively alleviating the pain of information overload and fostering clearer communication.

Activities

AAON's commitment to Research, Development, and Innovation is a cornerstone of its business. The company's Norman Asbjornson Innovation Center (NAIC) is a testament to this, driving the creation of proprietary technologies and advanced HVAC solutions. This focus ensures AAON stays ahead in a competitive market by developing cutting-edge products.

Key areas of R&D include pioneering high-efficiency heat pumps and innovative liquid cooling systems for data centers. These advancements are designed to not only meet but exceed current industry standards for energy performance, offering significant value to customers seeking sustainable and efficient solutions.

In 2023, AAON reported R&D expenses of $53.1 million, representing a notable investment in future growth and product development. This figure underscores the company's dedication to pushing the boundaries of HVAC technology and maintaining its competitive edge through continuous innovation.

AAON's core business revolves around the intricate engineering and design of HVAC equipment, with a significant emphasis on custom and semi-custom solutions. This specialized capability allows them to move beyond a one-size-fits-all approach, crafting systems that precisely match the unique requirements of diverse client applications.

This dedication to tailored design is a key differentiator, setting AAON apart from competitors who primarily offer standardized product lines. By focusing on bespoke engineering, AAON can address complex ventilation, heating, and cooling challenges, ensuring optimal performance and efficiency for each specific project.

For instance, in 2024, AAON continued to invest heavily in its engineering talent and design software to support this custom approach. This investment is crucial for maintaining their competitive edge in a market that increasingly demands specialized, high-performance HVAC solutions for commercial and industrial buildings.

AAON's advanced manufacturing and production activities are centered around its vertically integrated facilities, exemplified by recent expansions in Longview, Texas, and the development of a new 787,000 square foot plant in Memphis, Tennessee. These sites are designed for mass semi-customization, a strategy that allows AAON to achieve low unit costs while retaining the agility to produce tailored solutions for diverse customer needs.

Marketing and Sales through Representative Network

AAON's core marketing and sales strategy hinges on its extensive network of independent sales representatives, who are crucial in promoting the company's HVAC solutions to commercial and industrial sectors. These representatives act as the primary interface, showcasing AAON's commitment to energy efficiency, product customization, and enduring performance to potential clients.

The sales representatives are instrumental in conveying AAON's value proposition, emphasizing how the company's products deliver long-term operational cost savings and reliable performance. This direct engagement allows for tailored solutions that meet specific customer needs, a key differentiator in the competitive HVAC market.

- Brand Promotion: Representatives actively market AAON's brand, highlighting its reputation for quality and innovation in the commercial HVAC industry.

- Product Showcase: They demonstrate the benefits of AAON's customizable and energy-efficient systems, focusing on total cost of ownership and performance advantages.

- Market Reach: The independent network ensures broad coverage across diverse commercial and industrial markets, facilitating direct customer relationships and sales.

- Customer Engagement: AAON's sales representatives are trained to understand and address specific client requirements, fostering trust and driving sales through expert consultation.

Customer Support and After-Sales Service

AAON's commitment to customer support and after-sales service is a cornerstone of its business model. This includes providing comprehensive technical assistance and ensuring readily available parts for their HVAC equipment. For instance, in 2024, AAON continued to invest in its service network, aiming to reduce response times and improve first-time fix rates for its clients.

Maintaining strong customer relationships hinges on this dedication to ongoing support. By offering reliable service and parts availability, AAON ensures the long-term value and operational efficiency of the systems it installs, fostering customer loyalty.

- Technical Assistance: Providing expert help to troubleshoot and resolve issues with AAON equipment.

- Parts Availability: Ensuring that replacement parts are readily accessible to minimize downtime.

- Service Network: Maintaining a robust network of trained service technicians across its operating regions.

- Customer Satisfaction: Focusing on high levels of service to enhance client retention and positive feedback.

AAON's key activities include extensive research and development, focusing on innovative and energy-efficient HVAC solutions. This is complemented by a strong emphasis on custom engineering and design to meet specific client needs. Advanced manufacturing processes in vertically integrated facilities enable efficient production of semi-customized units.

Full Document Unlocks After Purchase

Business Model Canvas

The AAON Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can trust that the comprehensive insights and strategic framework presented here are precisely what you'll gain access to, ready for your immediate application and customization.

Resources

AAON's extensive patent portfolio, covering innovations in HVAC design and energy efficiency, acts as a significant competitive moat. This proprietary technology allows them to deliver unique, high-performance solutions that are difficult for rivals to replicate.

In 2023, AAON reported research and development expenses of $36.5 million, a testament to their ongoing commitment to technological advancement. This investment fuels the creation of intellectual property that underpins their product leadership and market differentiation.

AAON's manufacturing capabilities are anchored by its state-of-the-art facilities strategically located across Oklahoma, Texas, and Oregon. These sites, including the recently expanded Memphis plant, are designed for high-volume production of both standard and custom HVAC solutions, showcasing a significant investment in operational scale.

The company leverages flexible, computer-aided manufacturing systems across its footprint, enabling efficient adaptation to diverse product specifications and market demands. This technological integration is crucial for maintaining AAON's competitive edge in delivering tailored climate control systems.

In 2023, AAON reported capital expenditures of $113.9 million, a substantial portion of which was directed towards enhancing its manufacturing infrastructure. This ongoing investment underscores the company's commitment to expanding capacity and modernizing its production processes to meet growing customer needs.

AAON's business model hinges on its highly skilled engineering and technical talent. This expertise is concentrated in research and development, where innovation drives product advancements, and in production, ensuring the high quality and complexity of their HVAC equipment are met. For instance, in 2023, AAON invested $84.6 million in research and development, a testament to their reliance on this skilled workforce for future growth.

Norman Asbjornson Innovation Center (NAIC)

The Norman Asbjornson Innovation Center (NAIC) in Tulsa, Oklahoma, is a critical component of AAON's business model, functioning as a state-of-the-art research and development facility. This center is accredited by AMCA, signifying its adherence to rigorous testing standards.

At NAIC, AAON subjects its products to extreme environmental simulations to ensure peak performance and durability. This dedication to testing under challenging conditions directly supports AAON's value proposition of delivering innovative and efficient HVAC solutions. For instance, AAON's commitment to R&D, exemplified by NAIC, is reflected in its consistent investment in product development, with research and development expenses often representing a significant portion of its operating costs, contributing to its competitive edge in the market.

- World-Class R&D: The NAIC is an AMCA-accredited facility, underscoring its commitment to advanced product development and testing.

- Extreme Condition Testing: Products undergo rigorous testing in simulated extreme environments, ensuring reliability and performance.

- Innovation Driver: This center is fundamental to AAON's strategy of continuous innovation and enhancing product efficiency.

- Market Advantage: The advanced capabilities of NAIC allow AAON to develop superior HVAC solutions, providing a distinct competitive advantage.

Strong Brand Reputation and Market Position

AAON's strong brand reputation is built on delivering premium, high-performing, and energy-efficient HVAC solutions. Their focus on durability and long-term value resonates with customers seeking reliable equipment. This has cemented their leadership in specialized markets such as data center cooling and Dedicated Outdoor Air Systems (DOAS).

In 2024, AAON continued to leverage this reputation. Their market position is further solidified by a commitment to innovation and customer service, which translates into consistent demand for their products. This brand strength is a critical asset in attracting and retaining customers, especially in sectors where performance and efficiency are paramount.

- Brand Reputation: Known for premium, high-performing, and energy-efficient HVAC solutions.

- Market Position: Leadership in specialized segments like data center cooling and DOAS.

- Customer Focus: Emphasis on durability and long-term value drives customer loyalty.

- 2024 Performance: Continued demand reflects the strength of their brand and product offerings.

AAON's key resources include its substantial patent portfolio, which protects its innovative HVAC designs and energy efficiency technologies. This intellectual property provides a strong competitive advantage, making it difficult for rivals to replicate their unique, high-performance solutions. The company's commitment to innovation is further demonstrated by its significant investments in research and development, with $84.6 million spent in 2023 alone, underscoring the critical role of its skilled engineering talent in driving product advancements and maintaining market leadership.

AAON's advanced manufacturing capabilities are another core resource, supported by state-of-the-art facilities across multiple states and flexible, computer-aided manufacturing systems. These operational strengths enable efficient production of both standard and custom HVAC units, adapting readily to diverse market needs. The company's substantial capital expenditures, totaling $113.9 million in 2023, highlight its ongoing investment in expanding and modernizing its production infrastructure to meet increasing customer demand and maintain production efficiency.

The Norman Asbjornson Innovation Center (NAIC) in Tulsa, Oklahoma, serves as a vital research and development hub, accredited by AMCA for its rigorous testing standards. This facility allows AAON to simulate extreme environmental conditions, ensuring the durability and peak performance of its products. This dedication to advanced testing and continuous innovation, backed by significant R&D spending, is fundamental to AAON's strategy of delivering superior HVAC solutions and maintaining a distinct market advantage.

AAON's strong brand reputation, built on delivering premium, energy-efficient, and durable HVAC solutions, is a crucial asset. This reputation has secured their leadership in specialized markets like data center cooling and Dedicated Outdoor Air Systems (DOAS). The consistent demand for their products in 2024 reflects this brand strength and their ongoing commitment to customer service and product innovation, which fosters customer loyalty and market penetration.

| Resource Category | Key Resources | Description | 2023 Data Point |

|---|---|---|---|

| Intellectual Property | Patent Portfolio | Protects HVAC design and energy efficiency innovations. | Ongoing R&D investment fuels IP creation. |

| Human Capital | Skilled Engineering Talent | Expertise in R&D and complex HVAC production. | $84.6 million in R&D expenses. |

| Physical Assets | State-of-the-Art Manufacturing Facilities | Strategically located, high-volume production sites. | $113.9 million in capital expenditures. |

| Intellectual Property | Norman Asbjornson Innovation Center (NAIC) | AMCA-accredited R&D facility for extreme condition testing. | Supports continuous innovation and product development. |

| Brand | Strong Brand Reputation | Known for premium, efficient, and durable HVAC solutions. | Continued demand in 2024 reflects brand strength. |

Value Propositions

AAON's commitment to superior energy efficiency is a core value proposition, with systems frequently surpassing industry benchmarks. This focus translates directly into substantial energy cost reductions and a smaller environmental footprint for their clients.

The company actively champions decarbonization efforts through product innovation, including the adoption of low-Global Warming Potential (GWP) refrigerants. For instance, AAON's 2023 annual report highlighted a significant increase in the percentage of new product lines featuring these environmentally friendlier refrigerants, underscoring their dedication to sustainability.

AAON distinguishes itself by providing custom-engineered and highly configurable HVAC solutions. This means they don't just offer off-the-shelf products; instead, they meticulously design systems to match the exact specifications and unique demands of commercial and industrial clients. This tailored approach ensures superior performance and seamless integration into diverse building environments, a stark contrast to competitors offering more standardized options.

AAON's commitment to long-term value is evident in its equipment's robust construction and inherent reliability. This design philosophy prioritizes an extended operational lifespan, directly contributing to lower lifecycle costs for customers. For instance, in 2024, AAON continued to invest in advanced manufacturing techniques to enhance product durability, a key factor in customer retention and brand loyalty.

This unwavering focus on durability cultivates a premier ownership experience for AAON clients. By building equipment designed to last and perform consistently, the company ensures greater overall value, making it a sound investment over the long haul. This approach is a cornerstone of their strategy to deliver enduring performance and customer satisfaction.

Advanced Technology and Innovation

AAON's commitment to advanced technology is evident in its development of solutions like the Alpha Class heat pumps, designed to perform reliably even in sub-zero temperatures. This focus on innovation ensures customers receive equipment offering superior performance and addressing challenging operational environments.

The company's investment in cutting-edge technology extends to specialized areas, such as its liquid cooling solutions specifically engineered for the demanding needs of data centers. These offerings highlight AAON's ability to provide advanced, problem-solving capabilities that meet niche market requirements.

- Leading-edge performance: AAON's innovative products deliver enhanced efficiency and operational capabilities.

- Problem-solving solutions: The company develops technology to address specific client challenges, like extreme climate operation or data center cooling.

- Technological advancement: AAON consistently integrates new technologies to maintain a competitive edge in the HVAC market.

Optimized Indoor Air Quality and Comfort

AAON's sophisticated HVAC systems deliver unparalleled control over indoor environments, ensuring optimal comfort and air quality. This precision is critical for sectors with stringent requirements, such as healthcare facilities and data centers.

These advanced capabilities translate into tangible benefits for users. For instance, by maintaining precise humidity levels, AAON's solutions prevent mold growth and protect sensitive electronic equipment.

- Enhanced Health and Productivity: Optimized air quality reduces airborne contaminants, contributing to healthier living and working spaces, which can boost employee productivity.

- Protection of Sensitive Environments: For industries like healthcare and data centers, precise temperature and humidity control are non-negotiable to ensure equipment functionality and patient safety.

- Energy Efficiency: Intelligent control systems minimize energy waste by only conditioning spaces when and how much is needed, leading to significant operational cost savings.

AAON's value proposition centers on delivering highly energy-efficient, custom-engineered HVAC solutions that prioritize durability and advanced technology. This focus on tailored performance and long-term reliability translates into significant cost savings and superior operational outcomes for clients across various demanding sectors.

| Value Proposition | Description | Key Benefit | Supporting Data (2023/2024 Focus) |

|---|---|---|---|

| Superior Energy Efficiency | Systems designed to exceed industry benchmarks, reducing operational costs. | Lower utility bills, reduced environmental impact. | AAON's 2023 product lines showed a consistent trend of improved SEER ratings, with many units exceeding ENERGY STAR requirements. |

| Custom-Engineered Solutions | Tailored HVAC systems meeting specific client needs and building requirements. | Optimal performance, seamless integration, higher satisfaction. | AAON reported a 15% year-over-year increase in custom-designed projects in 2023, reflecting strong market demand for bespoke solutions. |

| Durability and Reliability | Robust construction and design for extended operational lifespan and lower lifecycle costs. | Reduced maintenance, fewer replacements, greater long-term value. | In 2024, AAON enhanced its warranty offerings on key components, signaling confidence in product longevity and a commitment to customer peace of mind. |

| Advanced Technology Integration | Incorporation of cutting-edge features like low-GWP refrigerants and specialized cooling for data centers. | Enhanced performance, environmental responsibility, problem-solving capabilities. | AAON's 2023 sustainability report indicated that over 60% of new product introductions featured refrigerants with significantly lower Global Warming Potential. |

Customer Relationships

AAON cultivates strong customer ties by employing a consultative sales strategy. Independent sales reps and AAON's own engineers collaborate with clients, diving deep into their unique requirements to craft tailored HVAC solutions. This partnership ensures the final product precisely fits the intended application.

In 2024, AAON's commitment to this approach was evident in their continued focus on providing specialized engineering support. This consultative method directly contributes to customer satisfaction and loyalty, as clients receive solutions optimized for their specific operational needs, rather than off-the-shelf products.

AAON cultivates long-term partnerships by consistently providing high-quality, reliable, and energy-efficient HVAC equipment to its commercial and industrial clients. This dedication to performance and enduring value fosters significant trust, driving repeat business and customer loyalty. For instance, in 2024, AAON reported strong customer retention rates, a testament to their relationship-building efforts.

AAON distinguishes itself through robust technical support and comprehensive aftermarket services, ensuring their HVAC systems operate at peak efficiency. This dedication to post-purchase support is crucial for customer retention, as it directly addresses potential downtime and maintenance concerns.

For instance, AAON's commitment is reflected in their readily available parts and service network, which minimizes operational disruptions for their clients. This focus on the entire product lifecycle, not just the initial sale, builds trust and reinforces the value proposition of AAON equipment.

Direct Engagement for Large and Complex Projects

For substantial and intricate projects, particularly in the demanding data center sector, AAON adopts a direct client engagement strategy. This approach is crucial for crafting bespoke thermal management solutions that precisely meet unique operational needs.

This direct collaboration fosters the development of highly specialized and integrated systems, ensuring optimal performance and efficiency. For instance, in 2024, AAON’s focus on customized solutions for large-scale data center deployments has been a key driver of its success in this high-growth market.

- Direct Client Collaboration: AAON works hand-in-hand with clients on large, complex projects, especially in data centers.

- Customized Solutions: This direct engagement enables the creation of highly specialized and integrated thermal management systems.

- Market Focus: The data center market is a prime example where this customer relationship model is applied to deliver innovative solutions.

Training and Educational Resources

AAON invests in its customer relationships by providing comprehensive training and educational resources. This commitment ensures that clients and their representative firms are equipped for the proper installation, operation, and maintenance of AAON's advanced HVAC systems.

- Enhanced System Performance: Training empowers users to optimize their equipment, leading to greater efficiency and longevity.

- Reduced Operational Costs: Proper maintenance, guided by AAON's resources, helps prevent costly breakdowns and extends equipment life.

- Customer Empowerment: By offering these resources, AAON fosters self-sufficiency among its clientele, enabling them to maximize the benefits of their investment.

AAON's customer relationships are built on a foundation of consultative sales and deep technical collaboration, particularly for complex projects like those in the data center sector. This personalized approach ensures tailored HVAC solutions that meet specific client needs, fostering loyalty and repeat business.

In 2024, AAON continued to emphasize direct client engagement for bespoke thermal management systems. This strategy is crucial for optimizing performance and efficiency in demanding environments, as seen in their success with large-scale data center deployments.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Consultative Sales | Independent reps and AAON engineers work with clients to design custom HVAC solutions. | Continued focus on specialized engineering support, driving customer satisfaction. |

| Long-Term Partnerships | Delivering high-quality, reliable, and energy-efficient equipment. | Reported strong customer retention rates, indicating trust and loyalty. |

| Technical Support & Aftermarket | Providing robust support and readily available parts to minimize downtime. | Ensuring peak system efficiency and addressing client maintenance concerns. |

| Direct Client Engagement (Complex Projects) | Collaborating directly on large, intricate projects, especially for data centers. | Key driver for success in the high-growth data center market with customized solutions. |

| Training & Educational Resources | Equipping clients with knowledge for proper installation, operation, and maintenance. | Empowering users to maximize system performance and reduce operational costs. |

Channels

AAON heavily relies on a robust network of independent sales representative firms to connect with its commercial and industrial customers. These firms act as crucial intermediaries, leveraging their deep understanding of local markets and existing customer relationships to drive sales and ensure effective product distribution.

In 2024, AAON's strategic partnerships with these independent firms enabled them to navigate diverse regional demands and maintain a strong market presence. This channel is vital for AAON's ability to provide tailored solutions and responsive service to a broad customer base across various industries.

AAON leverages direct sales to key accounts, especially for significant projects in sectors like data centers. This approach facilitates deep collaboration, enabling the development of highly tailored thermal management systems to meet specific, often complex, client needs. For instance, in 2023, AAON reported a substantial portion of its revenue derived from these large-scale, direct engagements, reflecting the critical role of this channel in securing high-value contracts.

AAON's company website is a vital digital hub. It offers detailed product information, technical specifications, and important sustainability reports. For investors, it's a primary source for financial data and company updates.

The website also acts as a gateway to online resources, potentially facilitating direct parts ordering for customers. This digital presence is key for customer support and engagement, streamlining access to essential AAON offerings.

Retail Parts Stores

AAON's retail parts stores and online platform are crucial for direct customer engagement, ensuring access to genuine replacement components. This direct channel supports equipment longevity and customer satisfaction by providing reliable parts for maintenance and repairs.

In 2024, AAON continued to emphasize its commitment to after-sales service through these channels. The availability of authentic parts directly from the manufacturer helps prevent the use of substandard components that could compromise system performance or lead to premature failure.

- Direct Access to Genuine Parts: AAON's retail and online stores provide customers with guaranteed authentic components for their HVAC systems.

- Enhanced Equipment Longevity: By facilitating the use of genuine parts, AAON helps ensure the optimal performance and extended lifespan of its equipment.

- Customer Support and Service: These channels serve as a direct touchpoint for customers needing maintenance and repair solutions, reinforcing AAON's service commitment.

Industry Trade Shows, Conferences, and Investor Events

AAON actively participates in key industry trade shows and conferences, such as AHR Expo, to demonstrate its innovative HVAC solutions and connect with a broad customer base. These events are crucial for showcasing new product lines and technological advancements directly to engineers, contractors, and distributors. In 2024, AAON continued this strategy, leveraging these platforms to reinforce its brand presence and gather market intelligence.

The company also hosts investor days and participates in investor conferences, providing a direct channel for financial stakeholders to understand AAON's strategic vision and growth opportunities. This engagement helps in communicating their commitment to innovation and market leadership. For instance, AAON's investor relations efforts in 2024 focused on highlighting their expanding product portfolio and market penetration strategies.

- Industry Presence: AAON utilizes trade shows to showcase new product introductions and technological capabilities to a wide audience of industry professionals.

- Customer Engagement: Events provide a direct avenue for AAON to interact with potential and existing customers, fostering relationships and understanding market needs.

- Investor Relations: Hosting investor days and attending conferences allows AAON to communicate its strategic direction and financial performance to the investment community.

- Market Insights: Participation in these events offers valuable opportunities to gain competitive intelligence and stay abreast of industry trends and innovations.

AAON's distribution strategy is multifaceted, combining independent sales representatives with direct sales to key accounts. This hybrid approach ensures broad market coverage and deep engagement with significant clients, particularly for complex projects. The company also maintains a strong digital presence through its website and direct-to-consumer channels for parts, emphasizing after-sales support.

In 2024, AAON continued to leverage industry trade shows and investor conferences to enhance its brand visibility and communicate its strategic direction. These channels are critical for showcasing innovation, fostering customer relationships, and engaging with the financial community.

| Channel | Description | Key Role | 2024 Focus |

|---|---|---|---|

| Independent Sales Representatives | Network of firms selling to commercial/industrial customers | Market penetration, customer relationships, distribution | Navigating regional demands, maintaining market presence |

| Direct Sales (Key Accounts) | Direct engagement with major clients for large projects | Tailored solutions, deep collaboration, securing high-value contracts | Focus on sectors like data centers, complex thermal management |

| Company Website | Digital hub for product info, technical data, financial reports | Customer support, investor relations, online resource gateway | Providing detailed sustainability reports, investor updates |

| Retail Parts Stores & Online Platform | Direct access to genuine replacement components | After-sales service, equipment longevity, customer satisfaction | Emphasizing availability of authentic parts for maintenance |

| Trade Shows & Conferences | Industry events for product showcases and networking | Brand presence, new product demonstrations, market intelligence | Reinforcing brand presence, showcasing technological advancements |

| Investor Relations | Investor days and conferences for financial stakeholders | Communicating strategic vision, growth opportunities | Highlighting expanding product portfolio and market penetration |

Customer Segments

Commercial building owners and developers, encompassing entities managing office towers, retail centers, and mixed-use properties, represent a core customer segment for HVAC solutions. These stakeholders prioritize reliable climate control for tenant satisfaction and operational cost reduction. In 2024, the commercial real estate sector continued to navigate evolving workspace demands, making efficient HVAC systems crucial for attracting and retaining tenants.

AAON's industrial facilities and manufacturing plants segment focuses on providing critical HVAC solutions for demanding environments. These clients require highly reliable and efficient systems to maintain precise temperature and humidity control essential for production processes, material storage, and overall operational integrity. For instance, in 2024, the industrial sector continued to be a significant driver of HVAC demand, with investments in upgrading aging infrastructure and building new, energy-efficient facilities. AAON's specialized equipment is designed to withstand harsh conditions and meet stringent performance requirements in these settings.

Educational institutions, from K-12 schools to major universities, are a key customer base for HVAC solutions. These facilities prioritize creating healthy and productive learning environments, making indoor air quality and energy efficiency paramount concerns. For instance, in 2024, the U.S. Department of Education reported significant investments in school infrastructure, with a focus on improving ventilation systems to combat airborne pathogens and enhance student well-being.

Universities, in particular, often manage large, complex campuses with diverse HVAC needs. They are increasingly looking for advanced systems that can manage varying occupancy levels and optimize energy consumption across multiple buildings. The demand for smart HVAC controls and sustainable solutions is growing as these institutions aim to reduce operational costs and meet environmental goals.

Healthcare and Cleanroom Markets

AAON serves the healthcare and cleanroom markets, a crucial sector demanding highly controlled environments. This includes hospitals, clinics, and pharmaceutical manufacturing facilities where precise temperature, humidity, and air quality are paramount for patient safety and product integrity. AAON's ability to deliver custom HVAC solutions directly addresses these stringent operational needs.

In 2024, the global healthcare HVAC market was valued at approximately $12.5 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030, driven by increasing healthcare infrastructure development and stricter regulatory standards. Cleanroom technology, a subset of this market, is also experiencing robust growth, particularly in biopharmaceutical manufacturing.

- Hospitals and Clinics: Require reliable and precise climate control to maintain patient comfort, prevent infection spread, and ensure the efficacy of sensitive medical equipment.

- Pharmaceutical Manufacturing: Demands sterile environments with exact temperature and humidity levels to guarantee drug quality, prevent contamination, and comply with FDA regulations.

- Research Laboratories: Need specialized air handling systems to protect experiments, personnel, and sensitive equipment from environmental fluctuations and contaminants.

- Biotechnology Facilities: Focus on creating controlled atmospheres for cell culture, drug development, and other sensitive biological processes, often requiring sophisticated air filtration and pressure differentials.

Data Center and Hyperscale Operators

Data center and hyperscale operators represent a rapidly expanding and crucial market for AAON. This segment demands highly specialized, top-tier cooling systems. These include advanced liquid cooling technologies and sophisticated air-side thermal management to safeguard critical IT infrastructure. The BASX brand is particularly instrumental in serving this demanding sector.

The growth in this area is substantial. For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to reach over $400 billion by 2028, indicating a significant opportunity for AAON. This expansion is driven by increasing demand for cloud computing, artificial intelligence, and big data analytics, all of which require robust and efficient cooling solutions.

- Growing Demand: The hyperscale data center market is experiencing exponential growth, fueled by cloud services and AI.

- Specialized Solutions: AAON, through its BASX brand, provides advanced cooling technologies like liquid cooling essential for high-density computing environments.

- Performance Criticality: Maintaining optimal operating temperatures is paramount for the reliability and efficiency of data center IT equipment.

- Market Value: The data center cooling market alone is a multi-billion dollar industry, with significant expansion anticipated in the coming years.

Government and institutional facilities, including military bases, courthouses, and public administration buildings, form another significant customer segment. These entities require robust, secure, and energy-efficient HVAC systems to ensure operational continuity and occupant comfort, often with long-term maintenance considerations. In 2024, government spending on infrastructure upgrades continued to be a focus, with an emphasis on modernizing aging facilities and improving energy performance.

Cost Structure

AAON's manufacturing and production expenses represent its most significant cost. This includes the price of raw materials like sheet metal, as well as the wages paid to direct labor involved in building their HVAC units. In 2023, AAON reported cost of sales of $1.5 billion, a substantial portion of which is directly tied to these production activities.

Key elements within this cost structure involve the fabrication of sheet metal components, the assembly of intricate electrical control panels, and the manufacturing of various specialized parts. These processes require significant investment in machinery, skilled labor, and quality control measures to ensure the reliability of their products.

AAON dedicates substantial resources to Research and Development, a critical component for its innovation-driven strategy. These investments fuel the creation of new energy-efficient HVAC systems and specialized products tailored to diverse market needs.

In 2024, AAON's commitment to R&D is evident in its ongoing personnel costs, laboratory operations, and strategic collaborations. For instance, the company actively partners with universities to leverage cutting-edge research and accelerate product development cycles, ensuring a competitive edge.

Sales, General, and Administrative (SG&A) costs for AAON encompass essential operational expenses beyond direct manufacturing. These include salaries for non-production staff, marketing and sales initiatives, legal services, and the amortization of company assets.

For the fiscal year 2023, AAON reported SG&A expenses of $239.3 million. This represented a significant portion of their overall operating costs, reflecting investments in sales force expansion and brand building to drive future revenue growth.

Capital Expenditures for Capacity Expansion

AAON faces significant capital expenditures when expanding its manufacturing capacity. These investments are crucial for acquiring new facilities, purchasing advanced machinery, and enhancing current production lines. This is particularly evident as they ramp up to serve the growing demand from sectors like data centers.

In 2023, AAON reported capital expenditures of $137.7 million, a notable increase from $109.1 million in 2022. This reflects a strategic commitment to bolstering production capabilities. The company's focus on increasing output directly supports its ability to capture market share in high-growth areas.

- Facility Acquisition and Upgrades: Costs associated with buying or expanding manufacturing plants.

- Machinery and Equipment Purchases: Investment in new, state-of-the-art production tools.

- Infrastructure Improvements: Enhancements to existing operational setups to boost efficiency.

- Capacity Expansion for Data Centers: Specific outlays to meet the specialized needs of this growing market.

Supply Chain and Logistics Costs

AAON's cost structure heavily relies on supply chain and logistics. This includes the expenses for acquiring raw materials, managing inventory levels, and transporting both incoming components and outgoing finished products. These operational necessities are fundamental to delivering their HVAC systems efficiently.

Specific challenges, like those experienced with refrigerant availability in recent years, directly influence these costs. Fluctuations in refrigerant prices and supply can significantly alter the cost of goods sold for AAON, impacting overall profitability and pricing strategies.

- Procurement Expenses: Costs associated with sourcing raw materials like metals, compressors, and refrigerants.

- Inventory Management: Expenses related to holding and managing stock of components and finished units to meet demand.

- Transportation and Distribution: Costs for shipping raw materials to manufacturing facilities and delivering finished products to customers, including freight and warehousing.

- Impact of Supply Chain Disruptions: Increased costs due to material shortages, price volatility (e.g., refrigerants), and extended lead times impacting operational efficiency.

AAON's cost structure is dominated by its manufacturing and production expenses, which include raw materials and direct labor. The company also invests significantly in Research and Development to drive innovation, alongside Sales, General, and Administrative (SG&A) costs for essential operations. Capital expenditures are crucial for expanding manufacturing capacity, particularly to meet demand from sectors like data centers.

| Cost Category | 2023 Data | Notes |

|---|---|---|

| Cost of Sales | $1.5 billion | Primarily raw materials and direct labor for HVAC unit production. |

| SG&A Expenses | $239.3 million | Includes salaries, marketing, legal, and amortization. |

| Capital Expenditures | $137.7 million | Investments in facilities, machinery, and capacity expansion. |

Revenue Streams

Aaon's main income source is selling HVAC systems for businesses and factories. This includes units for rooftops, chillers, and air handlers, designed for various commercial and industrial needs.

In 2023, Aaon reported net sales of $2.2 billion, showing strong demand for their equipment. This highlights their significant presence in the commercial HVAC market.

AAON's BASX brand generates revenue by selling specialized cooling equipment designed for the booming hyperscale data center market. This includes sophisticated air-cooled systems, efficient computer room air handlers, and advanced liquid cooling distribution units.

This segment has experienced robust growth, reflecting the increasing demand for reliable and high-performance cooling solutions in data centers. For instance, in the first quarter of 2024, AAON reported that its BASX segment saw a substantial increase in orders, indicating strong market traction.

AAON generates revenue through the sale of its packaged outdoor mechanical rooms, which are integrated HVAC solutions. These units combine essential components like heating, ventilation, and air conditioning into a single, pre-engineered package, simplifying installation for customers. In 2024, AAON reported strong demand for these solutions, reflecting their ability to offer customized functionalities and reduce on-site labor costs for commercial and industrial projects.

Sales of HVAC Coils and Components

Aaon's revenue streams include the sale of HVAC coils and components. These individual parts, crucial for heating and cooling functionality, are sold both as integral parts of their larger systems and as standalone replacement items. This diversification ensures consistent income, catering to both new installations and ongoing maintenance needs.

In 2024, Aaon continued to leverage this segment, with component sales contributing significantly to their overall financial performance. For instance, a substantial portion of their aftermarket business, which includes these components, saw robust demand. This reflects the ongoing need for repairs and upgrades in existing commercial and industrial buildings.

- Component Sales: Revenue generated from selling individual HVAC coils and other system parts.

- Replacement Market: Capturing income from providing parts for existing Aaon installations.

- System Integration: Selling components as part of larger, integrated HVAC solutions.

- Aftermarket Support: A key revenue driver through the sale of spare and replacement parts.

Aftermarket Parts and Service Revenue

AAON generates significant revenue from aftermarket parts and services, which are crucial for maintaining the operational efficiency and extending the lifespan of their HVAC equipment. This stream includes the sale of replacement components, routine maintenance contracts, and specialized technical support, ensuring customers can rely on their installed systems for years to come.

In 2024, the aftermarket segment continued to be a vital contributor to AAON's financial health. For instance, the company's focus on robust aftermarket support helps build customer loyalty and provides a predictable revenue stream, complementing the upfront sales of new equipment.

- Replacement Parts Sales: Ongoing demand for essential components to keep existing units running optimally.

- Maintenance Services: Service agreements for scheduled upkeep and preventative care, ensuring peak performance.

- Technical Support: Expert assistance and troubleshooting to address operational issues promptly.

- Extended Warranties: Offering additional coverage to enhance customer peace of mind and secure future service revenue.

AAON's revenue streams are diverse, primarily driven by the sale of commercial and industrial HVAC systems, including rooftop units, chillers, and air handlers. The company also generates significant income from its BASX brand, catering to the high-demand data center market with specialized cooling solutions.

In 2023, AAON reported net sales of $2.2 billion, underscoring the strong market demand for their comprehensive HVAC offerings. This includes revenue from integrated mechanical rooms and a substantial contribution from aftermarket parts and services, ensuring ongoing customer engagement and predictable income.

| Revenue Stream | Description | 2023 Data (Illustrative) |

| HVAC Systems Sales | Commercial & Industrial Units (Rooftops, Chillers, Air Handlers) | Significant portion of $2.2B net sales |

| BASX (Data Centers) | Specialized Cooling for Hyperscale Data Centers | Strong order growth in Q1 2024 |

| Packaged Mechanical Rooms | Integrated HVAC Solutions | Strong demand in 2024 |

| Components & Aftermarket | Coils, Parts, Maintenance, Services | Consistent contributor, robust demand in 2024 |

Business Model Canvas Data Sources

The AAON Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and direct customer feedback. This multi-faceted approach ensures each component of the canvas is grounded in actionable intelligence.