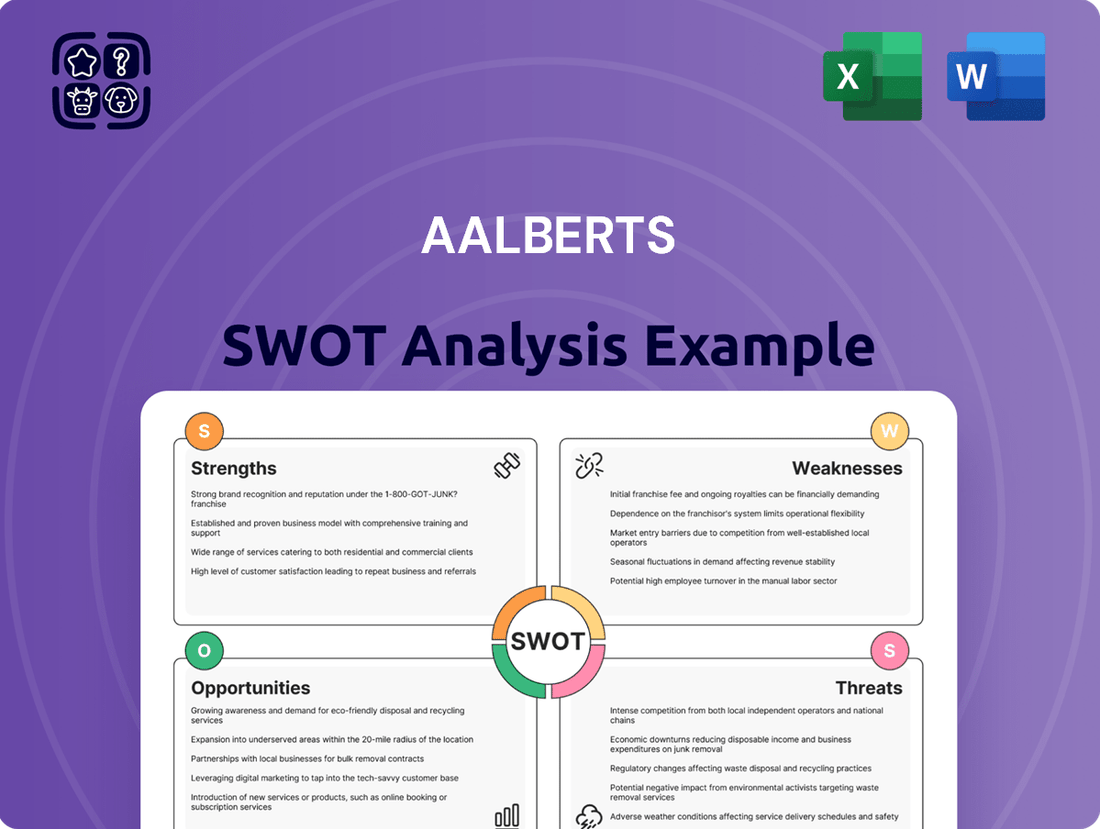

Aalberts SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aalberts Bundle

Aalberts demonstrates robust strengths in its diversified portfolio and technological innovation, but faces potential threats from market volatility and increasing competition. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Aalberts' market position, growth drivers, and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Aalberts benefits significantly from its presence in four distinct end markets: Sustainable Buildings, Semiconductor Efficiency, E-mobility Transition, and Industrial Productivity. This broad market exposure acts as a natural hedge against sector-specific economic downturns, fostering a more resilient revenue stream.

By concentrating on 'mission-critical technologies' that are essential across these diverse industries, Aalberts cultivates a wide-ranging customer portfolio. This strategic approach inherently lessens the company's dependence on the cyclical performance of any single industry, thereby enhancing its overall stability.

Aalberts demonstrates a robust commitment to sustainability, with a significant portion of its revenue, over 70%, directly tied to Sustainable Development Goals (SDGs). This focus, coupled with ambitious targets for net-zero carbon emissions by 2050 or sooner, positions the company favorably in an increasingly environmentally aware global market.

The company's dedication to innovation is equally compelling, evidenced by an innovation rate of 19% recorded in 2024. This ongoing investment in advanced technologies and eco-friendly solutions not only drives future growth but also solidifies Aalberts' competitive edge in developing sustainable products and services.

Aalberts has shown impressive financial resilience, even when the economic climate was tough in 2024 and the first half of 2025. Despite challenges in various industries, the company managed to keep its operating profit (EBITA) margin healthy. This stability is a key strength.

Furthermore, Aalberts generated robust free cash flow during this period. This strong cash generation allowed the company not only to continue paying its dividend to shareholders but also to start buying back its own stock. This shows good financial management and operational strength.

Strategic Acquisitions and Portfolio Optimization

Aalberts consistently strengthens its market position and portfolio through targeted acquisitions. This strategic approach is designed to enhance its capabilities and expand its global footprint in crucial sectors like industry, building, and semicon. The company's commitment to M&A is a core element of its 'thrive 2030' strategy, aimed at driving shareholder value.

Recent examples underscore this focus. The acquisition of Paulo Products Company in the United States bolstered its presence in a key market. Furthermore, the planned acquisition of Grand Venture Technology in Southeast Asia signifies an expansion into a rapidly growing region, reinforcing its strategic growth trajectory.

These moves are not random; they are calculated steps to optimize Aalberts' business segments. By integrating new entities and technologies, Aalberts aims to create synergistic benefits and unlock further potential across its diverse operations, ensuring continued relevance and competitive advantage.

- Strategic Acquisitions: Aalberts actively seeks acquisitions to bolster its market standing.

- Portfolio Optimization: The company focuses on integrating acquired businesses to enhance its overall portfolio.

- Geographical Expansion: Recent deals, like Paulo Products in the US and Grand Venture Technology in Southeast Asia, highlight a push into key growth regions.

- 'Thrive 2030' Alignment: Acquisitions are directly linked to supporting the company's long-term strategic objectives.

Robust Operational Excellence and Cost Management

Aalberts demonstrates robust operational excellence, consistently driving cost-out initiatives and optimizing inventory levels. This focus is crucial for maintaining their added value margin and shielding EBITA margins, even when sales volumes dip in certain areas. For instance, in their fiscal year 2024 reporting, the company highlighted continued progress in these operational efficiencies.

The company's commitment to enhancing plant performance, measured by key metrics like Safety, Quality, Delivery, Inventory, Cost, and People (SQDICKP), underpins its efficiency gains. This systematic approach to improvement across all business segments ensures that Aalberts remains agile and cost-effective in its operations.

- Operational Excellence: Aalberts' core strategy centers on continuous improvement in its manufacturing and supply chain processes.

- Cost Management: The company actively pursues cost reduction through various initiatives, including procurement savings and lean manufacturing.

- Inventory Optimization: Efforts to streamline inventory management contribute to better working capital and reduced holding costs.

- EBITA Margin Protection: These operational strengths have been instrumental in protecting the company's profitability, with EBITA margins remaining resilient.

Aalberts' diversified end-market exposure across Sustainable Buildings, Semiconductor Efficiency, E-mobility Transition, and Industrial Productivity provides a significant competitive advantage. This broad reach acts as a natural hedge against downturns in any single sector, ensuring more stable revenue streams. By focusing on mission-critical technologies, the company cultivates a wide customer base, reducing reliance on any one industry's performance.

The company's strong commitment to sustainability, with over 70% of revenue linked to SDGs and a net-zero target by 2050, positions it well in a growing environmentally conscious market. This is complemented by a 19% innovation rate in 2024, showcasing continuous investment in advanced and eco-friendly solutions that drive future growth and competitive advantage.

Aalberts exhibits robust financial resilience, maintaining healthy operating profit (EBITA) margins even amidst economic challenges in 2024 and early 2025. Strong free cash flow generation further supports its financial health, enabling consistent dividend payments and share buybacks, demonstrating effective financial management and operational strength.

Strategic acquisitions are a cornerstone of Aalberts' growth, enhancing capabilities and expanding its global footprint in key sectors. The company's 'Thrive 2030' strategy prioritizes M&A to drive shareholder value, as seen with the acquisition of Paulo Products in the US and the planned acquisition of Grand Venture Technology in Southeast Asia, reinforcing its expansion into critical growth regions.

Aalberts' operational excellence, characterized by ongoing cost-out initiatives and inventory optimization, is crucial for maintaining its added value margin and protecting EBITA margins. The company's systematic approach to improving plant performance across key metrics like Safety, Quality, Delivery, Inventory, Cost, and People (SQDICKP) ensures agility and cost-effectiveness.

| Key Strength | Description | Supporting Data/Context |

| Market Diversification | Exposure to multiple resilient end markets. | Four distinct end markets: Sustainable Buildings, Semiconductor Efficiency, E-mobility Transition, Industrial Productivity. |

| Sustainability Focus | Strong alignment with global sustainability goals. | Over 70% of revenue linked to SDGs; Net-zero target by 2050. |

| Innovation Rate | Continuous investment in new technologies. | 19% innovation rate recorded in 2024. |

| Financial Resilience | Stable profitability and strong cash generation. | Healthy EBITA margins; Robust free cash flow in 2024/H1 2025. |

| Strategic Acquisitions | Targeted M&A for portfolio enhancement and expansion. | Acquisition of Paulo Products (US); Planned acquisition of Grand Venture Technology (SEA). |

| Operational Excellence | Focus on cost management and efficiency improvements. | Cost-out initiatives and inventory optimization; SQDICKP performance metrics. |

What is included in the product

Analyzes Aalberts’s competitive position through key internal and external factors, highlighting its strengths in specialized technologies and market leadership, while also considering potential weaknesses in integration and opportunities in emerging markets.

Offers a clear, actionable roadmap by highlighting Aalberts' key strengths and mitigating potential weaknesses.

Weaknesses

Aalberts has faced challenges with organic revenue decline, reporting a 3.4% decrease in 2024 and a 3.2% drop in the first half of 2025. This trend points to difficulties in expanding sales from its core business activities.

The primary drivers for this slowdown appear to be within the industry and semiconductor sectors. Lower customer demand and ongoing adjustments to inventory levels by clients are impacting Aalberts' ability to grow organically in these key areas.

Aalberts' significant presence in sectors like automotive, machine building, and agriculture, grouped under its Industry segment, exposes it to the inherent cyclical nature of these markets. This means demand can fluctuate significantly based on broader economic conditions.

The Semiconductor segment also faces this challenge. For instance, the semicon market experienced a slowdown in 2025, marked by reduced activity and necessary inventory adjustments, directly impacting Aalberts' performance in that area.

Geopolitical shifts and evolving trade policies present a significant weakness for Aalberts, introducing market uncertainties. While the company's localized operations help buffer direct tariff impacts, the potential for indirect consequences, such as supply chain disruptions or shifts in demand within key end markets, remains a concern.

These broader geopolitical tensions can lead to unpredictable business conditions, affecting everything from raw material costs to the stability of customer demand. For instance, in 2024, ongoing trade disputes between major economic blocs continued to create volatility, underscoring the need for robust risk management strategies to navigate these complex international landscapes.

Profitability Pressure in Certain Segments

While Aalberts has shown resilience in its overall margins, specific business areas are experiencing profitability challenges. This is particularly evident in the semiconductor sector, which saw a significant 13.4% organic revenue drop in the first half of 2025. This downturn was attributed to customers recalibrating their inventory levels and a general softening of demand in that market.

The impact on the semiconductor segment extended to its earnings before interest, taxes, and amortization (EBITA) margins, which also faced pressure during the same period. This uneven performance across Aalberts' diverse segments means that while some areas may be thriving, others are acting as a drag on the company's consolidated profitability, creating a need for focused management attention.

- Semiconductor Segment Decline: Experienced a 13.4% organic revenue decrease in H1 2025.

- EBITA Margin Pressure: The semiconductor division faced reduced profitability margins in the first half of 2025.

- Contributing Factors: Customer inventory adjustments and lower overall demand impacted performance.

- Segmental Imbalance: Uneven results across different business units can negatively affect overall company profitability.

Integration Risks of Acquisitions

While acquisitions are a key growth driver for Aalberts, they inherently bring integration risks that can hinder value realization. The successful assimilation of companies, such as the recent acquisition of Paulo Products Company, is paramount to achieving projected synergies and preventing operational disruptions. Failure to effectively integrate can lead to significant resource drain and negatively impact overall financial performance.

Integration challenges can manifest in various ways:

- Cultural Clashes: Differences in corporate culture can impede collaboration and employee morale, potentially slowing down integration processes.

- IT System Incompatibility: Merging disparate IT infrastructures often proves complex and costly, risking data loss or system downtime.

- Synergy Overestimation: The anticipated cost savings or revenue enhancements from an acquisition may not materialize if integration is poorly managed, leading to a failure to meet financial targets.

For instance, if the integration of Paulo Products Company, acquired for €250 million in late 2024, faces significant hurdles, it could divert management attention and capital away from core business operations, impacting Aalberts' projected revenue growth of 5-7% for 2025.

Aalberts' reliance on acquisitions, while a growth strategy, introduces significant integration risks. The successful assimilation of acquired entities, like the €250 million Paulo Products Company acquisition in late 2024, is crucial. Failure to integrate effectively can lead to resource drain and hinder projected revenue growth of 5-7% for 2025.

Challenges such as cultural clashes, IT system incompatibility, and overestimation of synergies can impede value realization. These integration hurdles can divert management focus and capital from core operations, impacting overall financial performance.

The company's exposure to cyclical industries like automotive and machine building, alongside the volatile semiconductor market, presents ongoing demand-side risks. For example, the semiconductor segment saw a 13.4% organic revenue decline in H1 2025 due to inventory recalibrations and softened demand.

Geopolitical shifts and evolving trade policies create market uncertainties. While localized operations offer some buffer, indirect consequences like supply chain disruptions or demand shifts in key end markets remain a concern, as evidenced by trade disputes impacting volatility in 2024.

Preview Before You Purchase

Aalberts SWOT Analysis

This preview reflects the real Aalberts SWOT analysis document you'll receive. It's professionally structured and ready for your business insights. Purchase now to unlock the complete, in-depth report.

Opportunities

Global trends like decarbonization and energy efficiency are creating substantial opportunities for Aalberts. The company's focus on mission-critical technologies positions it well to capitalize on the growing demand for sustainable solutions.

With over 70% of its revenue already aligned with Sustainable Development Goals (SDGs) and a commitment to net-zero carbon by 2050, Aalberts is poised to expand its offerings in areas like eco-friendly HVAC systems and water management, tapping into a market increasingly prioritizing environmental impact.

The global electric vehicle market is projected to reach over $1.5 trillion by 2030, presenting a significant opportunity for Aalberts. Their advanced mechatronic solutions are well-positioned to support the increasing demand for components in electric powertrains and charging infrastructure.

Furthermore, the semiconductor industry, despite current inventory cycles, offers robust long-term growth driven by AI and advanced computing. Aalberts' expertise in particle- and vibration-free solutions for chip manufacturing equipment directly addresses critical needs in this high-growth sector.

Aalberts' 'thrive 2030' strategy highlights significant opportunities in strategic geographical expansion, with a keen focus on North America and Southeast Asia. This expansion aims to bolster its presence in key growth sectors, particularly building and industry segments in North America and the burgeoning semiconductor industry in Southeast Asia.

The company is actively pursuing this strategy through acquisitions, evidenced by recent successful ventures in the USA. Furthermore, an intended acquisition in Southeast Asia underscores its commitment to tapping into new markets and solidifying regional footholds, aligning with its global growth objectives.

Further Portfolio Optimization through Divestments and Acquisitions

Aalberts' strategic objective to divest up to €0.5 billion in revenue and acquire up to €1 billion by 2030 creates a significant opportunity for portfolio enhancement. This proactive approach allows the company to shed underperforming or non-core assets, thereby concentrating resources on higher-growth, higher-margin segments. This strategic rebalancing is crucial for driving future profitability and increasing shareholder value.

By actively managing its business portfolio, Aalberts can pivot towards markets with stronger secular growth trends and better profitability profiles. For instance, recent strategic acquisitions in areas like advanced automation or sustainable technologies could bolster its market position. This continuous optimization process aims to create a more resilient and value-generative company.

- Sharpened Strategic Focus: Divesting non-core assets allows for greater concentration on key growth areas.

- Enhanced Profitability: Targeting acquisitions in higher-margin sectors can improve overall financial performance.

- Increased Shareholder Value: A well-optimized portfolio is expected to yield better returns for investors.

- Market Agility: The ability to divest and acquire quickly allows Aalberts to adapt to evolving market demands and opportunities.

Leveraging Operational Excellence for Market Share Gains

Aalberts’ dedication to operational excellence, including cost reduction and smarter inventory management, presents a significant opportunity. Even when the market is tough, these strengths can set the company apart. By focusing on efficiency and keeping prices competitive, Aalberts can attract customers from rivals who aren't as streamlined. This strategy is particularly valuable as markets begin to rebound, allowing Aalberts to capture a larger share and boost its profits.

This focus on efficiency directly translates into tangible benefits. For instance, Aalberts has consistently demonstrated strong execution in its cost-out programs. In 2023, the company reported achieving significant cost savings through its operational improvements, contributing to a robust EBITDA margin of 18.3%. This ongoing commitment to optimization allows Aalberts to maintain pricing power and outperform competitors, especially during economic downturns.

- Enhanced Competitiveness: Operational excellence allows Aalberts to offer competitive pricing while maintaining healthy margins, a key differentiator in varied market conditions.

- Market Share Expansion: By outperforming less efficient competitors, Aalberts can attract new customers and increase its market share, particularly as economic conditions improve.

- Profitability Improvement: Continued focus on cost-out initiatives and inventory optimization directly supports improved profitability, especially during market recovery phases.

- Resilience in Challenging Markets: Strong operational capabilities provide a buffer against economic headwinds, enabling sustained performance and strategic positioning.

Aalberts is strategically positioned to benefit from global shifts towards sustainability and electrification. The company's mission-critical technologies are in high demand, with over 70% of its revenue already tied to Sustainable Development Goals. This alignment, coupled with a net-zero carbon commitment by 2050, opens doors for expanded offerings in eco-friendly HVAC and water management solutions.

The burgeoning electric vehicle market, projected to exceed $1.5 trillion by 2030, presents a substantial growth avenue for Aalberts. Their advanced mechatronic solutions are integral to electric powertrains and charging infrastructure. Similarly, the semiconductor industry, driven by AI, offers long-term potential, with Aalberts' expertise in particle- and vibration-free solutions for manufacturing equipment addressing critical industry needs.

Aalberts' 'thrive 2030' strategy emphasizes geographical expansion, particularly in North America and Southeast Asia, targeting key growth sectors like building and industry in North America and semiconductors in Southeast Asia. This is being actively pursued through acquisitions, with recent successful ventures in the USA and an intended acquisition in Southeast Asia underscoring this commitment.

The company's proactive portfolio management, aiming to divest up to €0.5 billion and acquire up to €1 billion in revenue by 2030, offers a significant opportunity for enhancement. This strategic rebalancing allows Aalberts to concentrate resources on higher-growth, higher-margin segments, thereby increasing shareholder value and market agility.

Threats

Continued macroeconomic uncertainties, especially in Europe, present a significant challenge for Aalberts. Germany and France, key markets for the company, are experiencing sluggish growth, impacting industrial sectors like automotive and agriculture.

A prolonged downturn in these vital end markets, characterized by low activity and diminished demand, could directly hinder Aalberts' organic revenue expansion and overall profitability. For instance, if industrial production in the Eurozone, which saw a contraction in early 2024, continues to decline, it will directly affect Aalberts' sales volumes.

The technology and industrial solutions sectors are inherently competitive. Aalberts faces intensified rivalry from both established companies and emerging players, which can translate into significant pricing pressure. This pressure is particularly acute when market demand softens, potentially impacting Aalberts' profit margins. For instance, in the first half of 2024, while Aalberts reported a revenue increase, the competitive landscape remains a key consideration for maintaining profitability.

Global supply chain hiccups and fluctuating raw material costs present a significant challenge for Aalberts, potentially driving up operational expenses and disrupting production timelines. For instance, the semiconductor shortage experienced through 2022 and into 2023 significantly impacted industries reliant on electronic components, a risk factor for many of Aalberts' product lines.

While Aalberts benefits from a geographically diverse operational base, which helps mitigate some risks, severe or extended supply chain breakdowns could still hinder its access to essential components or impede efficient product delivery, thereby affecting its bottom line.

Technological Obsolescence and Rapid Innovation Cycles

In sectors like semiconductor efficiency and e-mobility, where Aalberts operates, technological obsolescence is a serious threat. The pace of innovation means that even recently developed products can quickly become outdated if companies don't stay ahead. For instance, the semiconductor industry saw significant shifts in chip architectures and manufacturing processes throughout 2024, requiring substantial R&D investment to remain competitive.

Aalberts needs to consistently pour resources into research and development to keep pace with these rapid technological advancements. Failing to do so risks their offerings becoming irrelevant to customer needs and market demands. The company's strategic focus on innovation is therefore critical to avoid being left behind by competitors who are quicker to adopt new technologies.

- Technological Obsolescence: High risk in fast-evolving sectors like semiconductors and e-mobility.

- Innovation Investment: Continuous R&D is essential to match rapid advancements.

- Market Relevance: Failure to innovate can lead to products becoming outdated and losing market share.

- Competitive Pressure: Competitors’ rapid adoption of new technologies intensifies the threat.

Regulatory Changes and Environmental Compliance Costs

Increasingly stringent environmental regulations, particularly concerning emissions and waste management, pose a significant threat to Aalberts. While these align with sustainability objectives, they are projected to drive up operational costs and necessitate substantial capital investments in compliance technologies. For instance, the EU's Green Deal initiatives and evolving carbon pricing mechanisms could directly impact manufacturing processes and supply chains.

Failure to adapt proactively to these evolving regulatory landscapes could lead to substantial financial penalties, operational disruptions, and damage to Aalberts' reputation. The company's commitment to sustainability must be balanced with the financial implications of meeting these ever-tightening standards, especially as new legislation is anticipated to be introduced throughout 2024 and 2025.

- Increased Capital Expenditure: Investments in cleaner technologies and updated infrastructure to meet new environmental standards, such as those related to water discharge quality or hazardous material handling, could require significant upfront spending.

- Higher Operational Costs: Compliance may involve increased spending on energy efficiency, waste disposal, and the use of more sustainable, potentially costlier, raw materials.

- Risk of Fines and Penalties: Non-compliance with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) or specific national environmental laws can result in substantial fines, impacting profitability.

- Supply Chain Disruptions: Suppliers who fail to meet new environmental mandates could become unreliable partners, potentially disrupting Aalberts' production and delivery schedules.

Aalberts faces significant threats from intensifying competition, particularly in its core technology and industrial solutions markets. This rivalry can lead to pricing pressures, especially during periods of softer demand, potentially impacting profit margins. For instance, while Aalberts reported revenue growth in early 2024, the competitive environment remains a key factor for sustained profitability.

Macroeconomic headwinds, especially in key European markets like Germany and France, pose a substantial risk. Sluggish growth in these regions directly affects industrial sectors important to Aalberts, such as automotive and agriculture, potentially dampening sales volumes and overall profitability. The continued contraction in industrial production within the Eurozone in early 2024 highlights this vulnerability.

Supply chain disruptions and volatile raw material costs continue to be a threat, potentially increasing operational expenses and disrupting production. The lingering effects of past shortages, like the semiconductor scarcity through 2022-2023, underscore the risk to industries reliant on these components, impacting Aalberts' product lines.

Rapid technological obsolescence in sectors like semiconductors and e-mobility demands continuous, substantial R&D investment. Failure to keep pace with innovation, as seen with rapid chip architecture shifts in 2024, risks making Aalberts' offerings outdated and uncompetitive, leading to market share erosion.

SWOT Analysis Data Sources

This Aalberts SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.