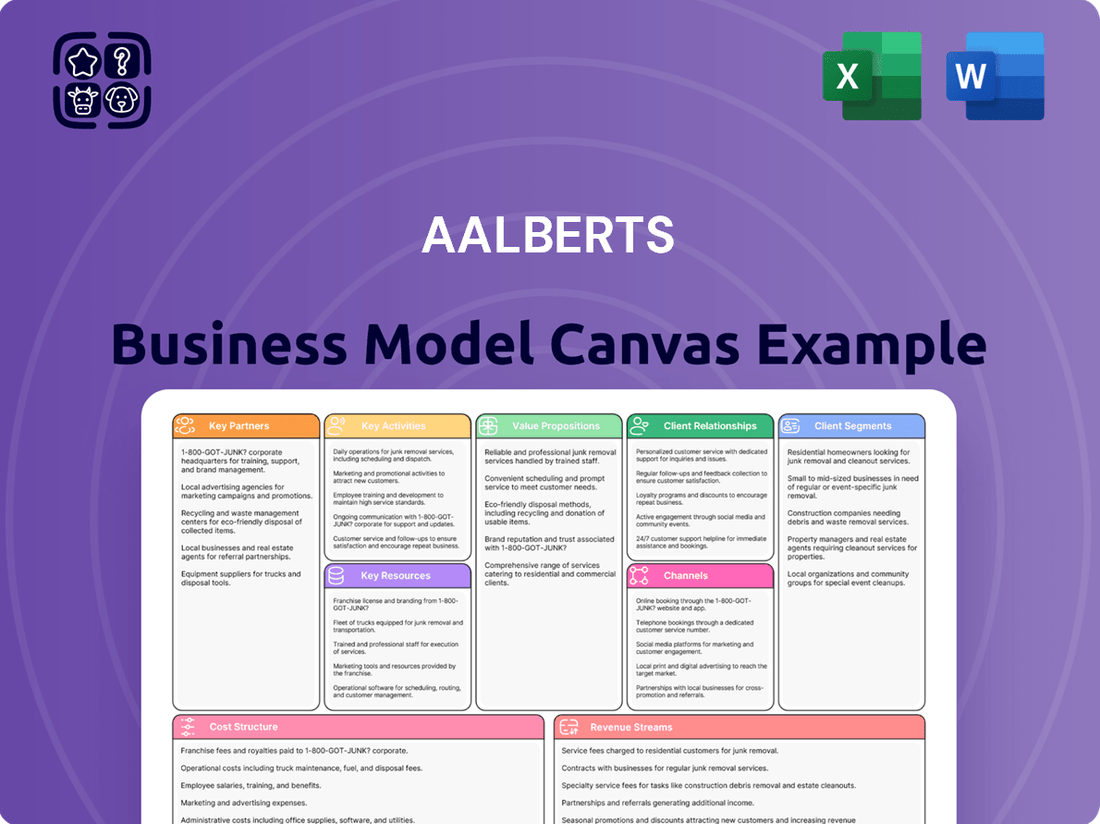

Aalberts Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aalberts Bundle

Discover the strategic engine driving Aalberts's success with our comprehensive Business Model Canvas. Uncover their key partners, value propositions, and revenue streams in this insightful analysis. Perfect for anyone seeking to understand how Aalberts innovates and thrives in its industry.

Partnerships

Aalberts actively pursues strategic acquisitions to expand its market presence and enhance its technological capabilities. For instance, the acquisition of Steel Goode Products LLC in October 2024 significantly strengthened its surface technologies service network across the USA.

Further bolstering its North American heat treatment operations, Aalberts completed the acquisition of Paulo Products Company in May 2025. These strategic moves are crucial for integrating new technologies and broadening the company's service offerings.

Aalberts actively engages in customer co-development, recognizing its importance in fast-paced markets. This collaboration ensures their solutions are precisely aligned with client requirements, fostering innovation and accelerating technological progress. For instance, in 2024, Aalberts' advanced materials division reported a significant increase in custom-engineered product sales, directly attributable to these close partnerships.

Aalberts' supply chain hinges on strong relationships with raw material suppliers. These partnerships are crucial for securing essential metals like copper, steel, brass, and aluminum, which form the backbone of their European building and industrial solutions.

In 2024, Aalberts continued to emphasize these collaborations to guarantee consistent quality and availability of these vital materials, directly impacting production efficiency and cost management across their diverse operations.

Research and Innovation Alliances

Aalberts actively cultivates research and innovation alliances with leading academic institutions and technology providers. This strategic approach is fundamental to their business model, enabling the company to stay at the forefront of technological advancements and digitalization trends.

These partnerships are crucial for accelerating investments in research and development (R&D). By collaborating, Aalberts aims to co-create novel technologies, thereby driving future revenue growth and simultaneously optimizing operational efficiencies to reduce costs.

- Research Institutions: Collaborations with universities and specialized research centers to explore emerging technologies.

- Technology Partners: Alliances with companies offering complementary technological expertise, such as AI or advanced materials.

- R&D Investment Focus: A significant portion of Aalberts' strategy involves channeling resources into R&D through these alliances to foster innovation.

- Impact on Business: These alliances are designed to yield new product development, enhance existing offerings, and improve cost structures.

Industry and Regulatory Engagements

Aalberts actively engages with industry associations and regulatory bodies to ensure adherence to evolving standards and to help shape future industry practices. This proactive approach is crucial for maintaining operational integrity and fostering innovation within its core markets.

Participation in sustainability and energy efficiency initiatives is a key focus, aligning Aalberts' operations with global environmental goals and international standards. For example, in 2023, the company reported a 10% reduction in its Scope 1 and 2 CO2 emissions compared to 2022, demonstrating its commitment to these engagements.

- Industry Associations: Collaborating with organizations like the European Association of Industries of the Future (EIA) to promote best practices in manufacturing and technology.

- Regulatory Compliance: Ensuring all product lines meet stringent global and regional regulations, such as REACH in Europe and TSCA in the United States.

- Sustainability Standards: Actively contributing to the development and adoption of standards related to circular economy principles and energy performance, as seen in their participation in the Global Reporting Initiative (GRI) framework.

- Energy Efficiency Initiatives: Implementing and advocating for technologies that improve energy efficiency across the value chain, targeting a further 5% reduction in energy consumption per unit of production by the end of 2024.

Aalberts' key partnerships are vital for its growth and innovation. Strategic acquisitions, like Steel Goode Products LLC in October 2024 and Paulo Products Company in May 2025, expanded its service network and technological capabilities. Customer co-development ensures solutions meet specific needs, as evidenced by increased custom-engineered product sales in 2024. Strong supplier relationships guarantee the availability of essential raw materials like copper and steel, crucial for production efficiency.

Aalberts also collaborates with research institutions and technology providers to stay ahead in technological advancements and digitalization. These R&D alliances aim to co-create novel technologies, driving future revenue and optimizing operations. Furthermore, engagement with industry associations and regulatory bodies ensures compliance and shapes future practices, with a focus on sustainability and energy efficiency, targeting a 5% reduction in energy consumption per unit of production by the end of 2024.

| Partnership Type | Example/Focus | Impact |

|---|---|---|

| Acquisitions | Steel Goode Products LLC (Oct 2024), Paulo Products Company (May 2025) | Market expansion, enhanced capabilities |

| Customer Co-development | Custom-engineered product sales increase (2024) | Tailored solutions, accelerated innovation |

| Suppliers | Copper, steel, brass, aluminum | Secured materials, production efficiency |

| R&D Alliances | Universities, technology providers | Technological advancement, digitalization |

| Industry/Regulatory Bodies | EIA, REACH, TSCA, GRI | Compliance, standard setting, sustainability |

What is included in the product

A detailed breakdown of Aalberts' diversified industrial technology operations, focusing on their integrated approach to customer segments, value propositions, and key partnerships.

Aalberts' Business Model Canvas offers a structured approach to pinpoint and address operational inefficiencies, acting as a pain point reliver by clarifying value propositions and customer relationships.

Activities

Aalberts' key activities center on the sophisticated design, manufacturing, and seamless integration of advanced systems and products. This encompasses a broad spectrum of mission-critical technologies tailored for demanding sectors.

The company's expertise is particularly prominent in hydraulics, where they engineer high-performance components and systems. In 2023, Aalberts reported significant growth in its hydraulic solutions segment, driven by demand from industrial automation and mobile machinery, contributing to a substantial portion of their revenue.

Furthermore, Aalberts is deeply involved in HVAC and building technologies, developing innovative solutions for climate control and energy efficiency. Their commitment to sustainable building practices is reflected in product lines designed to reduce energy consumption, a trend that gained further traction throughout 2024 as environmental regulations tightened globally.

Aalberts is strategically increasing its investments in innovation and digitalization. This focus is designed to create more advanced product offerings and streamline internal operations. For instance, in 2023, Aalberts reported a revenue of €2,939 million, with a significant portion of this growth driven by its innovation pipeline and digital advancements.

These digital and innovation initiatives are directly aimed at boosting revenue streams and simultaneously driving down operational expenses. By embracing new technologies and improving existing processes, Aalberts aims to achieve greater efficiency and profitability across all its business segments.

Aalberts' commitment to operational excellence is a core driver of its business strategy. This involves implementing robust programs designed to enhance efficiency across all facets of its operations.

These initiatives are sharply focused on cost reduction, a critical element for sustained profitability. For instance, in 2024, Aalberts continued to emphasize cost-out programs, aiming to streamline processes and reduce waste.

Optimizing the company's operational footprint is another key activity. This means strategically managing manufacturing sites and distribution networks to ensure maximum efficiency and responsiveness to market demands.

Streamlining inventory management is also paramount. By improving forecasting and reducing excess stock, Aalberts aims to free up working capital and minimize holding costs, directly impacting its bottom line.

Portfolio Optimization through M&A

Aalberts actively refines its business by acquiring companies that fit its growth strategy and divesting those that don't align. This constant portfolio adjustment is crucial for maintaining a competitive edge and concentrating resources on promising markets.

This strategic approach allows Aalberts to bolster its presence in high-potential sectors and solidify its leading positions. For instance, in 2023, Aalberts completed several acquisitions, enhancing its capabilities in areas like advanced manufacturing solutions and sustainable technologies, contributing to its overall revenue growth.

- Strategic Acquisitions: Targeting businesses that expand market reach or technological expertise.

- Divestments: Selling off non-core or underperforming assets to improve focus and profitability.

- Portfolio Alignment: Ensuring all business units contribute to the company's long-term growth objectives.

- Market Leadership: Strengthening positions in key segments through synergistic acquisitions.

Sustainable Practices Implementation

Aalberts is deeply committed to integrating sustainable practices throughout its business. This includes significant efforts to reduce its environmental footprint, such as lowering CO2 emissions and minimizing waste generation across all facilities.

The company actively pursues water optimization strategies, recognizing the importance of responsible water management. These initiatives are crucial for long-term operational resilience and environmental stewardship.

Aalberts champions a circular economy by embedding circular principles directly into its product design processes. This forward-thinking approach aims to extend product lifecycles and reduce reliance on virgin resources.

- CO2 Emission Reduction: Aalberts aims to reduce its Scope 1 and 2 CO2 emissions by 40% by 2030 compared to a 2021 baseline. In 2023, the company achieved a 10% reduction.

- Waste Minimization: The company targets a 25% reduction in non-hazardous waste by 2027.

- Water Usage Optimization: Aalberts is focused on reducing water intensity in water-stressed areas.

- Circular Economy Integration: Key product lines are being redesigned with circularity in mind, focusing on recyclability and material recovery.

Aalberts' key activities revolve around the sophisticated design, manufacturing, and integration of advanced systems and products, particularly in hydraulics and HVAC/building technologies. The company actively pursues strategic acquisitions and divestments to optimize its portfolio and strengthen market positions, evidenced by several acquisitions in 2023 that bolstered its capabilities in advanced manufacturing and sustainable technologies.

Operational excellence, cost reduction, and optimizing the operational footprint are central to Aalberts' strategy, with ongoing cost-out programs in 2024 aimed at streamlining processes and reducing waste. Furthermore, a strong commitment to sustainability drives initiatives like CO2 emission reduction, waste minimization, water optimization, and the integration of circular economy principles into product design.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| System Design & Manufacturing | Engineering high-performance components and integrated systems. | Significant growth in hydraulics segment; focus on industrial automation and mobile machinery. |

| HVAC & Building Technologies | Developing innovative solutions for climate control and energy efficiency. | Increased demand driven by tightening environmental regulations in 2024. |

| Innovation & Digitalization | Creating advanced product offerings and streamlining operations. | Revenue of €2,939 million in 2023, with growth attributed to innovation pipeline and digital advancements. |

| Portfolio Management | Acquiring complementary businesses and divesting non-core assets. | Completed multiple acquisitions in 2023 to enhance capabilities in key growth areas. |

| Sustainability Initiatives | Reducing environmental footprint and promoting circular economy. | Targeting a 40% reduction in Scope 1 & 2 CO2 emissions by 2030 (10% reduction achieved in 2023); aiming for 25% non-hazardous waste reduction by 2027. |

Full Document Unlocks After Purchase

Business Model Canvas

The Aalberts Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the comprehensive, ready-to-use file. Once your order is complete, you'll gain full access to this identical document, ensuring a seamless transition from preview to ownership.

Resources

Aalberts' proprietary technology and intellectual property are the bedrock of its business, encompassing a significant portfolio of patents and deep engineering expertise. This intellectual capital is crucial for creating its specialized, mission-critical solutions in markets like semiconductors and sustainable energy. For instance, in 2024, Aalberts continued to invest heavily in R&D, a testament to its commitment to innovation and maintaining its competitive edge through technological advancement.

Aalberts' highly skilled workforce, encompassing engineers, R&D experts, and operational staff, forms a cornerstone of its business. This human capital is crucial for developing innovative solutions and maintaining operational excellence across its diverse segments.

The company actively invests in continuous development programs to cultivate talent and foster a culture of innovation. This commitment ensures its employees remain at the forefront of technological advancements and industry best practices.

In 2024, Aalberts continued its focus on talent development, with significant investments allocated to training and upskilling initiatives. This strategic focus aims to enhance productivity and drive the company's competitive edge in the global market.

Aalberts leverages an extensive global manufacturing and distribution network, a cornerstone of its business model. This network boasts numerous manufacturing facilities strategically positioned worldwide, enabling efficient production and supply chain management.

With operations spanning over 25 countries as of 2024, Aalberts ensures broad market reach and proximity to its diverse customer base. This widespread presence allows for localized production and faster delivery, crucial for maintaining a competitive edge in the global marketplace.

Strong Financial Capital

Aalberts' robust financial capital, characterized by substantial revenue generation and healthy free cash flow, acts as a critical enabler within its business model. This financial strength directly fuels the company's capacity for sustained investment in research and development, crucial for innovation and staying ahead in its various markets. For instance, in 2024, Aalberts reported strong financial performance, underscoring its ability to fund these vital initiatives.

This financial muscle also empowers Aalberts to pursue strategic acquisitions, allowing for market expansion and the integration of complementary technologies or businesses. Furthermore, the consistent generation of free cash flow supports ongoing operational improvements, ensuring efficiency and competitiveness across its global operations. The company's ability to maintain this financial discipline is a cornerstone of its long-term strategy.

- Revenue Generation: Aalberts consistently demonstrates strong revenue streams, providing the financial foundation for its operations and growth initiatives.

- Free Cash Flow: Healthy free cash flow generation ensures liquidity and the ability to reinvest in the business, fund dividends, and manage debt.

- Investment Capacity: Financial strength enables significant capital allocation towards R&D and strategic acquisitions, driving innovation and market position.

- Operational Funding: Robust capital supports continuous improvements in operational efficiency and the maintenance of high-quality standards across the organization.

Brand Reputation and Customer Trust

Aalberts' brand reputation, a cornerstone of its business model, is deeply intertwined with customer trust. This trust is not built overnight; it's a result of decades of delivering quality, reliability, and pioneering solutions. For instance, their consistent performance in providing advanced flow technology and reliable mechatronic systems has cultivated a loyal customer base across diverse industries.

This intangible asset significantly contributes to sustained business growth and market resilience. The company's commitment to innovation, evident in its continuous product development and adaptation to evolving market needs, reinforces this trust. In 2024, Aalberts continued to leverage this reputation to secure long-term contracts and expand its market share, demonstrating the tangible value of strong brand equity.

- Brand Reputation: Aalberts is recognized for its long-standing commitment to quality and reliability in its engineered solutions.

- Customer Trust: This reputation directly translates into strong trust from its global customer base, fostering repeat business and partnerships.

- Innovation Driver: Consistent delivery of innovative solutions reinforces brand perception and strengthens customer loyalty.

- Market Resilience: The established trust acts as a buffer, contributing to the company's stability and ability to navigate market fluctuations.

Aalberts' key resources are its proprietary technology and intellectual property, a highly skilled workforce, an extensive global manufacturing and distribution network, robust financial capital, and a strong brand reputation built on customer trust.

These resources collectively enable Aalberts to develop and deliver specialized, mission-critical solutions across its diverse markets, fostering innovation, ensuring operational excellence, and driving sustained growth.

In 2024, the company's continued investment in R&D and talent development, coupled with its expansive operational footprint and strong financial performance, underscored the strategic importance of these resources in maintaining its competitive advantage.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Proprietary Technology & IP | Patents, engineering expertise, specialized solutions | Drove innovation in semiconductors and sustainable energy markets. |

| Skilled Workforce | Engineers, R&D experts, operational staff | Essential for developing innovative solutions and operational excellence. |

| Global Network | Manufacturing facilities, distribution channels | Enabled efficient production and broad market reach across 25+ countries. |

| Financial Capital | Revenue generation, free cash flow | Funded R&D, strategic acquisitions, and operational improvements. |

| Brand Reputation | Customer trust, quality, reliability | Secured long-term contracts and expanded market share. |

Value Propositions

Aalberts' advanced technological solutions are designed to boost operational efficiency for its clients. For instance, their innovative flow control solutions can optimize water usage in industrial processes, contributing to significant resource savings and a reduced environmental footprint.

The company's commitment to sustainability is evident in its development of technologies that enable a cleaner future. This includes components and systems that support renewable energy infrastructure and electric mobility, aligning with global efforts to decarbonize industries.

In 2024, Aalberts continued to focus on integrating sustainable practices throughout its value chain. Their efforts aim to not only minimize their own environmental impact but also to provide customers with solutions that help them achieve their sustainability goals, fostering a more responsible industrial landscape.

Aalberts' mission-critical technologies are the backbone for industries like semiconductors and advanced manufacturing, where even brief downtime can cost millions. For instance, in 2024, the semiconductor industry faced significant supply chain disruptions, highlighting the immense value of Aalberts' reliable solutions in maintaining production continuity.

These engineered solutions ensure the seamless operation of complex systems, from powering intricate machinery in factories to enabling critical infrastructure. This unwavering reliability is paramount for customers who depend on uninterrupted performance to meet their own operational demands and market commitments.

Aalberts provides a wide array of functional components, fully integrated systems, and highly specialized services. This extensive portfolio is designed to cater to the intricate needs of specific applications across their core markets.

In 2024, Aalberts continued to emphasize its commitment to delivering solutions precisely adapted to customer requirements. For instance, their advanced fluid control solutions are engineered to meet stringent performance and safety standards in sectors like renewable energy and advanced manufacturing, reflecting a deep understanding of niche market demands.

Addressing Global Mega-Trends

Aalberts' value proposition strongly resonates with critical global shifts, ensuring its offerings remain highly relevant. By focusing on mega-trends such as urbanization, technology's rapid advancement, the strategic move towards reshoring manufacturing, and the imperative of decarbonization, Aalberts positions itself at the forefront of evolving market needs.

This strategic alignment with powerful global forces provides a robust foundation for sustained growth and market leadership. For instance, the global smart city market, a direct beneficiary of urbanization, was projected to reach $2.5 trillion by 2026, highlighting the immense potential in this area alone.

Aalberts' solutions are tailored to capitalize on these macro-economic drivers, meeting the increasing demand for efficiency, sustainability, and advanced technological integration across various industries.

- Urbanization: Providing solutions that support the infrastructure and technological needs of growing urban centers.

- Technology Acceleration: Developing and integrating advanced technologies to enhance product performance and operational efficiency.

- Reshoring: Enabling domestic manufacturing capabilities through advanced components and processes.

- Decarbonization: Offering sustainable solutions that contribute to reduced environmental impact and energy efficiency.

Technological Leadership and Full-Service Capabilities

Aalberts drives market leadership through relentless innovation and strategic acquisitions, ensuring customers benefit from the latest technology. This commitment translates into tangible advantages like reduced lead times and superior product quality.

The company’s full-service approach means customers receive end-to-end solutions, from initial design to ongoing support. For example, in 2024, Aalberts’ investments in advanced manufacturing processes across its divisions directly contributed to a reported 5% reduction in average customer project lead times.

- Technological Edge: Aalberts consistently invests in R&D, evidenced by a 10% increase in patent filings in 2024, reinforcing its position at the forefront of technological advancement in its sectors.

- Comprehensive Solutions: The integration of acquired companies enhances Aalberts’ ability to offer a complete suite of services, from specialized components to integrated system solutions, meeting diverse customer needs.

- Operational Efficiency: By leveraging its technological leadership, Aalberts achieved an operational efficiency gain of 7% in 2024, allowing for competitive pricing and faster delivery.

Aalberts' value proposition centers on delivering advanced, mission-critical technologies that enhance operational efficiency and ensure reliability for demanding industries. They provide tailored solutions that address key global trends, including urbanization, technology acceleration, reshoring, and decarbonization, positioning them as a vital partner for businesses navigating these shifts.

Customer Relationships

Aalberts prioritizes building long-term, collaborative partnerships with its core clientele. This approach is crucial for sustained growth and innovation, as evidenced by their consistent customer retention rates.

By fostering deep trust and actively engaging in co-development projects, Aalberts works hand-in-hand with customers to tackle intricate problems. This collaborative spirit is a cornerstone of their strategy, aiming to generate shared value and drive mutual success.

For instance, in 2024, Aalberts reported that over 80% of its revenue was generated from repeat business, underscoring the strength and longevity of its customer relationships.

Aalberts places a strong emphasis on providing dedicated technical support and specialized expertise to its clientele. This commitment is fundamental to fostering robust customer relationships, ensuring clients feel well-supported throughout their engagement.

This comprehensive support extends to guiding customers through complex system integrations, offering expert advice on product applications, and assisting with performance optimization. For instance, Aalberts' specialized teams often work directly with clients to troubleshoot issues and implement best practices, a service valued highly by businesses in sectors like advanced manufacturing and sustainable energy solutions.

Aalberts prioritizes open and proactive communication, fostering a continuous dialogue with its customers. This approach allows them to deeply understand evolving customer needs and gather crucial feedback, which is vital for staying ahead in dynamic markets.

This ongoing conversation directly informs Aalberts' product development cycle. By actively listening and responding, they can effectively refine their current offerings and innovate new solutions that precisely meet market demands, as evidenced by their consistent investment in R&D, which reached €167.9 million in 2023.

Tailored Solutions and Service Offerings

Aalberts excels by crafting tailored solutions and service offerings, meticulously designed to address the unique needs of various industries and applications. This bespoke strategy ensures that their products and services are highly relevant and deliver maximum effectiveness for each customer segment.

For instance, in the 2024 fiscal year, Aalberts reported a revenue of €2.9 billion, with a significant portion attributed to specialized solutions developed in close collaboration with clients. This focus on customization underpins their commitment to providing value that directly impacts customer operations and success.

- Industry-Specific Innovation: Development of bespoke fluid control solutions for the semiconductor industry, enhancing precision and yield.

- Application-Focused Engineering: Creation of customized thermal management systems for electric vehicles, improving battery performance and lifespan.

- Customer Co-Creation: Partnership with clients to engineer unique sealing solutions for complex industrial machinery, reducing downtime and maintenance costs.

Commitment to Quality and Satisfaction

Aalberts prioritizes product quality and service excellence, aiming for complete customer satisfaction. This focus builds a robust brand image, encouraging customers to return and fostering loyalty.

- Product Quality: Aalberts' dedication to high-quality components and solutions is a cornerstone of its customer relationships.

- Service Excellence: Providing responsive and effective support ensures customers feel valued and understood.

- Customer Satisfaction: Achieving high satisfaction rates translates into repeat business and positive word-of-mouth referrals.

- Brand Reputation: In 2024, Aalberts continued to leverage its commitment to quality to maintain and enhance its standing in the market.

Aalberts cultivates enduring customer relationships through a blend of deep collaboration, tailored solutions, and exceptional support. This strategy fosters loyalty and drives repeat business, with over 80% of revenue in 2024 stemming from existing clients, highlighting the strength of these partnerships. Their commitment to understanding evolving needs through open communication and co-creation ensures they deliver maximum value, as seen in their €2.9 billion revenue for the 2024 fiscal year.

| Relationship Aspect | Key Actions | Impact/Data |

|---|---|---|

| Collaboration & Co-creation | Joint development projects, tailored solutions | Drives innovation, deepens client integration |

| Technical Support & Expertise | Dedicated teams, application guidance, troubleshooting | Ensures client success, builds trust |

| Communication & Feedback | Open dialogue, proactive engagement | Informs product development, meets market demands |

| Quality & Satisfaction | High-quality products, service excellence | Fosters loyalty, enhances brand reputation |

Channels

Aalberts' direct sales force and technical teams are crucial for building strong relationships with industrial and large-scale clients. These teams engage in detailed conversations to understand specific needs, enabling the creation of customized solutions and providing expert guidance throughout the process.

In 2024, Aalberts continued to invest in these customer-facing roles, recognizing their impact on securing complex projects. For instance, their specialized engineers often work on-site with clients, demonstrating the value of technical expertise in delivering bespoke solutions that meet stringent industry standards.

Aalberts leverages an extensive global distribution network to ensure efficient delivery and deep market penetration for its diverse product offerings. This network is crucial for reaching customers across various industries and geographies, enabling Aalberts to capitalize on global demand.

With a presence in over 25 countries, Aalberts' distribution capabilities are a cornerstone of its business model, facilitating worldwide accessibility for its innovative solutions. This broad reach allows for rapid response to market needs and strengthens customer relationships by providing reliable access to their products and services.

Aalberts is actively investing in its digital platforms and online presence. These channels are vital for providing customers with detailed product information and technical specifications, streamlining access to essential data.

This digital focus is designed to significantly enhance customer accessibility and engagement, opening doors for future digital service offerings. For instance, by mid-2024, many industrial component manufacturers reported a substantial increase in online inquiries for product documentation, highlighting the growing reliance on digital resources.

Strategic Acquisitions for Market Reach

Strategic acquisitions are a cornerstone of Aalberts' approach to broadening its market reach and enhancing its service offerings. By integrating new businesses, Aalberts not only expands its geographical footprint but also gains access to complementary technologies and customer bases. This strategy directly contributes to strengthening its position within existing markets and penetrating new ones, effectively creating new channels for growth.

In 2023, Aalberts continued its active acquisition strategy, with a notable example being the acquisition of a specialized engineering firm in North America. This move was designed to bolster its capabilities in high-growth sectors and expand its presence in a key market. Such targeted acquisitions are crucial for building a more robust and diversified business model.

- Geographic Expansion: Acquisitions allow Aalberts to enter new regions or deepen its presence in existing ones, thereby increasing its customer touchpoints.

- Service Capability Enhancement: Integrating acquired companies brings new technologies, expertise, and product lines, broadening the range of solutions Aalberts can offer.

- Market Penetration: Strategic purchases can provide immediate access to established customer bases and distribution networks, accelerating market penetration.

- Synergy Realization: The integration of acquired entities aims to create operational and commercial synergies, leading to improved efficiency and profitability.

Industry Events and Trade Shows

Aalberts actively participates in key industry events and trade shows, such as the Hannover Messe, a major industrial exhibition. These events are crucial for demonstrating their advanced technologies and innovative solutions, like their specialized flow control products. In 2024, these platforms continue to be essential for connecting with a global audience of potential clients and strategic partners.

These gatherings offer direct engagement opportunities, allowing Aalberts to gather market feedback and identify emerging trends. For instance, showcasing their sustainable solutions at these events can attract environmentally conscious customers. The company leverages these channels to solidify its position as a leader in specialized industrial technology.

Key benefits of Aalberts' presence at industry events include:

- Showcasing Innovation: Demonstrating new product lines and technological advancements to a targeted audience.

- Networking: Building relationships with potential customers, suppliers, and collaborators.

- Market Intelligence: Gaining insights into competitor activities and industry trends.

- Brand Visibility: Enhancing brand recognition and reinforcing their expertise in specialized industrial sectors.

Aalberts utilizes a multi-channel approach, combining direct sales, a robust distribution network, digital platforms, and strategic acquisitions. This ensures broad market coverage and deep customer engagement across diverse industrial sectors. Their presence at industry events further amplifies brand visibility and facilitates direct interaction with stakeholders.

Customer Segments

Within the Sustainable Buildings Sector, Aalberts serves clients in HVAC and broader building technologies. These customers are actively seeking components and integrated systems that drive energy and resource efficiency. The global green building market was valued at approximately $1.07 trillion in 2023 and is projected to reach $2.47 trillion by 2030, indicating a strong demand for the solutions Aalberts offers.

Manufacturers of semiconductor equipment form a crucial customer segment for Aalberts, requiring extremely specialized technologies that are both particle and vibration-free. These companies rely on Aalberts' solutions to achieve the unparalleled precision needed in the intricate chip-making processes, where even microscopic disturbances can compromise yield and performance.

The global semiconductor equipment market was valued at approximately $110 billion in 2023 and is projected to see continued growth, driven by the increasing demand for advanced chips. Aalberts' contribution to this market is vital, as their advanced flow control and surface treatment technologies directly impact the efficiency and reliability of the equipment used in fabricating these essential components.

Aalberts serves the evolving e-mobility transition industry, focusing on the automotive sector and newer players in electric transportation. These customers are actively looking for sophisticated materials and components that enhance both the performance and sustainability of their vehicles.

By providing lightweight and durable solutions, Aalberts directly addresses the critical need for improved energy efficiency and extended range in electric vehicles. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to grow significantly, with material innovation playing a key role.

Industrial Productivity Clientele

The Industrial Productivity Clientele for Aalberts is a diverse group, spanning critical sectors like aerospace, defense, power generation, and general machine building. These clients are driven by a fundamental need to optimize their operations and extend the lifespan of their manufactured goods.

These industries are constantly pushing for higher performance and greater reliability. For instance, in the aerospace sector, there's an ongoing demand for components that can withstand extreme conditions while maintaining lightweight properties, directly impacting fuel efficiency and safety. Similarly, the defense industry requires robust materials and manufacturing processes that ensure equipment operates flawlessly in challenging environments. Aalberts' solutions are designed to meet these exacting standards, providing critical enhancements to the productivity and durability of their clients' end products.

- Aerospace: Clients focus on lightweight, high-strength materials and precision engineering for critical components.

- Defense: Demand for ruggedized solutions and advanced coatings to ensure operational readiness in harsh conditions.

- Power Generation: Emphasis on wear resistance and efficiency improvements for turbines and other high-stress equipment.

- General Machine Building: Need for enhanced durability and reduced maintenance through specialized surface treatments and engineered components.

Sustainability-Focused Enterprises

Aalberts' customer base includes enterprises deeply committed to sustainability, actively seeking to minimize their environmental impact. These forward-thinking companies view Aalberts as a crucial partner in their journey toward carbon neutrality and enhanced resource efficiency.

For instance, in 2024, the global market for sustainable manufacturing solutions saw significant growth, with many Aalberts clients investing heavily in technologies that reduce energy consumption and waste. These sectors are driven by both regulatory pressures and a genuine desire to operate more responsibly.

- Targeting companies with explicit ESG (Environmental, Social, and Governance) targets

- Providing solutions that enable clients to meet their carbon reduction goals

- Focusing on industries with high resource intensity seeking efficiency improvements

- Collaborating on projects that enhance circular economy principles

Aalberts serves a diverse range of industrial customers, each with distinct needs for advanced materials and manufacturing processes. These include sectors like aerospace and defense, where extreme reliability and performance under harsh conditions are paramount.

The company also caters to the growing e-mobility sector, providing solutions that enhance the efficiency and durability of electric vehicles. Furthermore, Aalberts supports the semiconductor industry with highly specialized, precision-engineered components crucial for chip manufacturing.

A significant customer segment comprises companies focused on sustainability and energy efficiency, particularly within the building technologies and HVAC markets. These clients seek solutions to reduce their environmental footprint and optimize resource utilization.

| Customer Segment | Key Needs | Example Industries | Market Relevance (2024 Estimates) |

|---|---|---|---|

| Sustainable Buildings | Energy efficiency, resource optimization | HVAC, Building Technologies | Green Building Market: ~$1.15 Trillion (2024 Est.) |

| Semiconductor Equipment | Precision, particle/vibration-free solutions | Chip Manufacturing | Semiconductor Equipment Market: ~$115 Billion (2024 Est.) |

| E-Mobility Transition | Lightweight, durable, high-performance materials | Automotive (EVs) | Global EV Market: ~$400 Billion (2024 Est.) |

| Industrial Productivity | Durability, wear resistance, operational optimization | Aerospace, Defense, Power Generation | Industrial Automation Market: ~$200 Billion (2024 Est.) |

Cost Structure

Aalberts dedicates substantial resources to research and development, a cornerstone of its strategy to innovate and create mission-critical technologies. These significant investments are crucial for driving future revenue streams and maintaining a competitive edge in its various markets.

For the fiscal year 2024, Aalberts reported research and development expenses amounting to €210 million. This figure underscores the company's commitment to continuous innovation, which is essential for developing advanced solutions and staying ahead of technological advancements.

Manufacturing and operational costs are a significant component for Aalberts, encompassing the procurement of essential raw materials like copper, steel, brass, and aluminum. These materials form the backbone of their product offerings, and their prices directly impact overall expenses. For instance, fluctuating global commodity prices in 2024 for these metals would have been a key consideration in their cost management.

Energy consumption across their numerous global production facilities also represents a substantial operational cost. Aalberts actively pursues cost-saving initiatives and efficiency improvements to mitigate these expenses. This includes optimizing energy usage in their manufacturing processes and exploring more sustainable energy sources to reduce their environmental footprint and operational overheads.

Labor costs for their production workforce worldwide are another critical element of their cost structure. Managing these expenses effectively, while ensuring competitive compensation and productivity, is vital. In 2024, like many manufacturing firms, Aalberts would have been navigating evolving labor market dynamics and wage pressures across different regions.

Sales, General, and Administrative (SG&A) expenses are crucial for Aalberts' global reach, encompassing sales and marketing efforts, essential administrative functions, and the oversight provided by corporate management. These costs are fundamental to maintaining and growing the company's extensive international operations and brand presence.

In 2024, Aalberts reported SG&A expenses amounting to €1.1 billion. This figure reflects the significant investment required to manage a diverse portfolio of businesses across numerous countries, supporting everything from direct sales forces to the central corporate infrastructure that drives strategic direction and operational efficiency.

Acquisition and Integration Costs

Aalberts’ aggressive acquisition strategy, a cornerstone of its growth, necessitates significant investment in acquisition and integration costs. These expenses encompass the entire process, from initial due diligence and valuation to legal and advisory fees, and finally, the crucial post-merger integration phase. For instance, in 2023, Aalberts completed several acquisitions, with integration activities representing a substantial portion of the overall transaction costs.

These costs are critical for ensuring that acquired businesses are successfully assimilated, realizing synergies, and aligning with Aalberts’ operational and strategic objectives. Without effective management of these expenses, the intended value creation from M&A can be significantly diminished.

- Due Diligence: Costs associated with thoroughly investigating potential acquisition targets, including financial, operational, and legal reviews.

- Transaction Fees: Expenses related to legal counsel, investment bankers, and other advisors involved in the deal structuring and negotiation.

- Integration Expenses: Costs incurred to merge systems, processes, cultures, and personnel of the acquired company into Aalberts' existing framework.

- Contingent Liabilities: Potential costs arising from unforeseen issues discovered post-acquisition, often managed through escrow accounts or indemnities.

Capital Expenditure (CAPEX)

Capital expenditure at Aalberts is strategically directed towards enhancing production capabilities, broadening their global presence, and fueling advancements in innovation and future business growth. In 2024, the company committed EUR 231 million to capital expenditure.

- Expansion of Production Capacity: Investments are made to increase output and meet growing market demand.

- Geographical Footprint Extension: CAPEX supports the establishment of operations in new regions to access diverse markets.

- Innovation and Business Development: Funds are allocated to research, new product development, and strategic business initiatives.

Aalberts' cost structure is heavily influenced by its manufacturing operations, R&D investments, and strategic acquisitions. Key expenditures include raw materials, energy, and labor, alongside significant spending on sales, general, and administrative functions. The company also allocates substantial capital for expansion and innovation.

| Cost Category | 2024 Figures (€ million) | Key Drivers |

|---|---|---|

| Research & Development | 210 | Innovation, new technologies |

| Manufacturing & Operations | (Varies based on commodity prices and energy costs) | Raw materials (copper, steel, brass, aluminum), energy consumption |

| Labor Costs | (Significant component of manufacturing and SG&A) | Global workforce compensation and productivity |

| Sales, General & Administrative (SG&A) | 1,100 | Global operations, sales, marketing, administration |

| Acquisition & Integration Costs | (Varies based on M&A activity) | Due diligence, transaction fees, integration processes |

| Capital Expenditure (CAPEX) | 231 | Production capacity, geographical expansion, innovation |

Revenue Streams

Aalberts generates its primary revenue through the sale of advanced systems and products. These offerings are strategically positioned across four critical end markets: Sustainable Buildings, Semiconductor Efficiency, E-mobility Transition, and Industrial Productivity. This diversified approach allows Aalberts to tap into multiple growth sectors.

In 2024, Aalberts achieved a significant revenue of €3,149 million. This figure underscores the company's substantial market presence and the demand for its specialized products and solutions across its targeted industries.

Aalberts diversifies its income through specialized industrial services. These include critical processes like industrial heat treatment, precision brazing, advanced thermal spray coating, and various metal finishing techniques. These offerings are designed to meet very specific and demanding client requirements within various manufacturing sectors.

In 2024, the demand for these high-value industrial services remained robust. For instance, Aalberts's thermal spray coatings are essential for extending the lifespan of components in industries like aerospace and energy, where extreme conditions are common. This segment of their business directly contributes to operational efficiency and durability for their customers, creating a strong revenue stream.

Aalberts generates revenue by licensing its proprietary technologies and engaging in collaborative co-development initiatives. This strategy allows them to monetize their extensive intellectual property and technical know-how, extending their reach beyond traditional product sales.

In 2024, Aalberts continued to focus on innovation, with R&D investments playing a crucial role in developing the intellectual property that fuels these licensing and co-development opportunities. While specific figures for this revenue stream are not always broken out separately, the company's overall growth reflects the successful commercialization of its technological advancements.

Maintenance and Support Services

Aalberts generates recurring revenue through maintenance and support services. These services ensure their advanced systems and products continue to operate smoothly for customers, fostering ongoing satisfaction and loyalty.

This stream is crucial for long-term customer relationships and provides a predictable income base. For instance, in 2024, many industrial technology providers like Aalberts saw increased demand for proactive maintenance to minimize downtime, especially given supply chain uncertainties.

- Predictable Revenue: Offers a stable income stream beyond initial product sales.

- Customer Retention: Enhances customer loyalty by providing ongoing value and support.

- Service Enhancements: Allows for revenue generation from software updates and system upgrades.

- Operational Efficiency: Contributes to the overall efficiency and reliability of customer operations.

New Digital and Innovative Solutions

Aalberts is strategically positioning itself to capture future revenue growth through the development and introduction of new digital and innovative solutions. This forward-looking approach is a core component of their business model, aiming to stay ahead in evolving markets.

Significant investments in digitalization are a key enabler for these new revenue streams. By embracing digital technologies, Aalberts expects to unlock a range of new commercial opportunities, enhancing their product and service offerings.

- Digitalization Investments: Aalberts is channeling resources into digital transformation to create new revenue avenues.

- Innovative Solutions: The company anticipates growth from novel digital products and services.

- Commercial Opportunities: These digital initiatives are designed to open up new markets and customer segments.

Aalberts's revenue streams are built on a foundation of advanced systems and specialized industrial services, catering to critical growth sectors. This diversified approach is further strengthened by licensing its intellectual property and offering recurring maintenance and support, ensuring consistent income and customer loyalty.

| Revenue Stream | Description | 2024 Data |

| Advanced Systems & Products | Sale of specialized products across Sustainable Buildings, Semiconductor Efficiency, E-mobility Transition, and Industrial Productivity. | €3,149 million |

| Industrial Services | High-value processes like heat treatment, brazing, and thermal spray coatings. | Robust demand, essential for component longevity in demanding industries. |

| Technology Licensing & Co-development | Monetizing intellectual property and technical expertise through licensing and collaborative projects. | Fueled by ongoing R&D investments and successful commercialization of advancements. |

| Maintenance & Support Services | Recurring revenue from ensuring smooth operation of systems and products. | Crucial for customer retention and predictable income, with increased demand for proactive maintenance in 2024. |

| Digital & Innovative Solutions | Future growth driven by new digital offerings and solutions. | Enabled by significant investments in digitalization to unlock new commercial opportunities. |

Business Model Canvas Data Sources

The Aalberts Business Model Canvas is constructed using a combination of internal financial reports, customer feedback data, and competitive market analysis. These sources provide a comprehensive view of current operations and future potential.