Aalberts Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aalberts Bundle

Aalberts faces significant competitive pressures, from the bargaining power of its buyers and suppliers to the constant threat of new market entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate its complex industrial landscape.

The complete report reveals the real forces shaping Aalberts’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aalberts' diverse operations across niche markets like Sustainable Buildings and Semiconductor Efficiency mean supplier concentration isn't uniform. For instance, a unique, specialized component crucial for their semiconductor equipment might be sourced from a single, dominant supplier, granting that supplier significant leverage. This concentration directly impacts Aalberts' cost structure and supply chain reliability.

Aalberts faces significant switching costs when changing suppliers, particularly for specialized components. These costs include product redesign, retooling manufacturing lines, and the lengthy process of qualifying new vendors, which can disrupt production timelines. For instance, in 2024, many industrial manufacturers reported that the average time to onboard a new critical supplier could extend up to six months, impacting operational continuity.

Aalberts' emphasis on mission-critical technologies suggests that certain inputs may be highly specialized. When suppliers provide unique, differentiated, or patented components essential for Aalberts' advanced systems, their bargaining power increases significantly. This is especially true for inputs related to semiconductor efficiency and advanced materials, where innovation is key.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to Aalberts' bargaining power. If a supplier were to realistically move into producing the systems or products that Aalberts currently manufactures, their leverage would substantially increase. This scenario becomes more plausible for suppliers of less complex components where they might possess the necessary expertise and resources to replicate Aalberts' operations.

While a full integration into Aalberts' highly complex, integrated systems is less probable, the potential for component suppliers to vertically integrate is a tangible concern. For instance, if a key supplier of specialized valves or advanced fluid control components were to develop their own assembly or system integration capabilities, they could bypass Aalberts and directly serve end customers. This would fundamentally alter the supplier-customer dynamic, giving the supplier greater control over pricing and terms.

Consider the implications for Aalberts' HVAC and flow control segments. If a supplier of high-precision actuators or smart sensors were to integrate forward, they could potentially offer complete control modules, thereby diminishing Aalberts' role in the value chain. For example, a supplier with strong R&D in IoT integration for building management systems could leverage their component expertise to offer a competing packaged solution. This would necessitate Aalberts to either innovate faster or potentially face increased costs from a more powerful supplier.

- Potential for component suppliers to enter Aalberts' core markets.

- Increased supplier control over pricing and terms if forward integration occurs.

- Risk is higher for suppliers of less complex, standardized components.

- Aalberts must maintain technological and integration advantages to mitigate this threat.

Importance of Aalberts to Suppliers

Aalberts' substantial global footprint and significant revenue, reaching EUR 3,149 million in 2024, position it as a key customer for numerous suppliers. This scale can diminish a supplier's leverage if Aalberts constitutes a substantial portion of their overall sales, creating a dependency that reduces their bargaining power.

Conversely, the dynamic shifts if Aalberts represents a minor segment of a supplier's business. In such scenarios, Aalberts' ability to influence terms is considerably constrained, as the supplier is less reliant on their patronage.

- Aalberts' 2024 revenue: EUR 3,149 million.

- Impact of Aalberts' size on supplier dependency.

- Supplier reliance as a determinant of bargaining power.

The bargaining power of Aalberts' suppliers varies significantly based on the uniqueness of the components they provide and the concentration within specific supply chains. For highly specialized inputs critical to Aalberts' advanced technologies, like those in semiconductor efficiency, suppliers can wield considerable influence due to limited alternatives.

Aalberts' substantial revenue, reported at EUR 3,149 million in 2024, can be a double-edged sword; it enhances leverage with suppliers who depend heavily on their business, but diminishes it with those for whom Aalberts is a minor client.

The threat of forward integration by suppliers, particularly for less complex components, presents a notable risk, potentially allowing them to capture more value and dictate terms. This risk is amplified when suppliers possess the R&D capabilities to offer integrated solutions that bypass Aalberts.

High switching costs for specialized components, which can involve extensive redesign and qualification processes, further solidify the bargaining power of incumbent suppliers, impacting Aalberts' operational flexibility and cost management.

| Factor | Impact on Aalberts' Supplier Bargaining Power | Key Considerations for Aalberts |

| Supplier Concentration & Uniqueness of Inputs | High for specialized components (e.g., semiconductor equipment parts) | Mitigate by diversifying suppliers for critical, non-unique items; foster strong relationships for unique ones. |

| Switching Costs | High, especially for technologically advanced or integrated components | Factor in potential disruption and cost when evaluating supplier changes. |

| Threat of Forward Integration | Moderate to High for less complex components; lower for highly integrated systems | Maintain a technological edge and value-added services to deter supplier integration. |

| Aalberts' Size & Supplier Dependence | Leverage with suppliers where Aalberts is a major customer; limited leverage otherwise | Strategic sourcing to ensure key suppliers are reliant on Aalberts' volume. |

What is included in the product

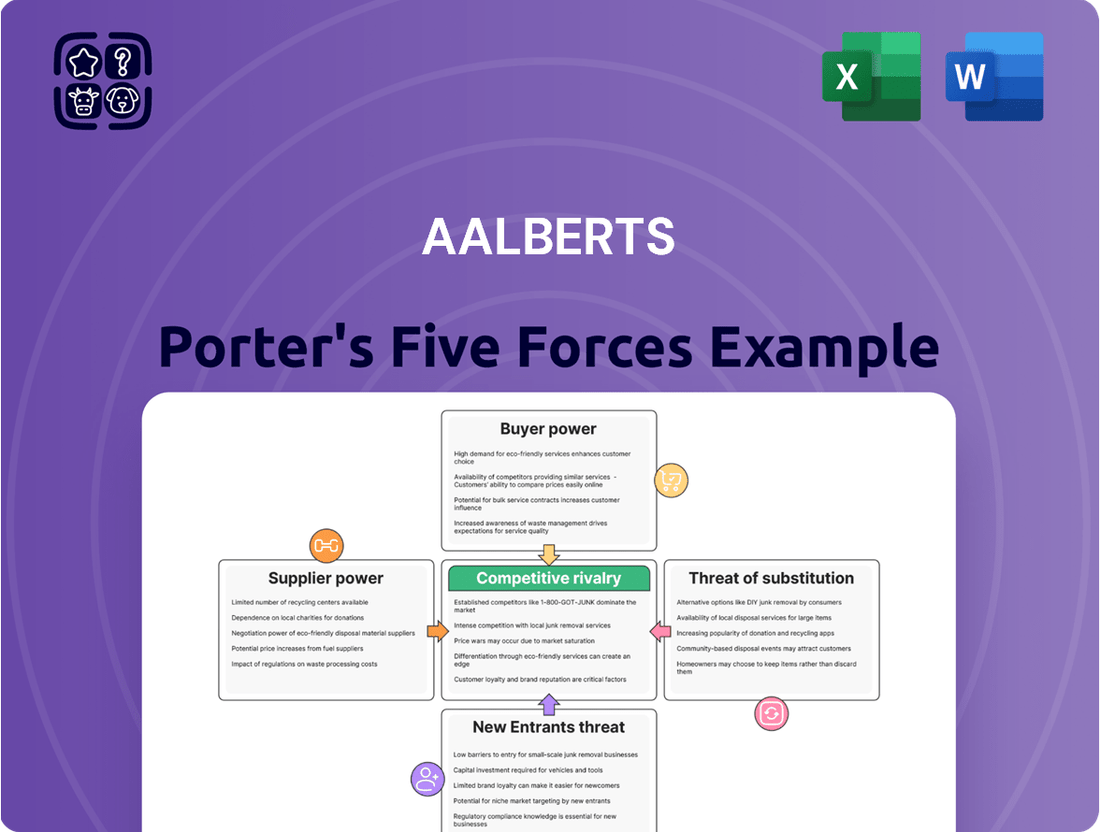

Aalberts' Porter's Five Forces analysis dissects the competitive intensity within its operating industries, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors to understand its strategic positioning.

Effortlessly identify and mitigate competitive threats with a visual representation of market dynamics, enabling proactive strategy adjustments.

Customers Bargaining Power

While Aalberts operates across many sectors, some niche markets exhibit higher customer concentration. This means a few key clients might represent a substantial portion of sales in those specific areas. For example, in the highly specialized semiconductor sector, Aalberts could rely on a smaller pool of very large buyers.

When a few major customers contribute a significant percentage to Aalberts' overall revenue, their individual bargaining power naturally grows. These large clients can leverage their substantial business volume to negotiate more favorable terms, potentially impacting Aalberts' pricing and profit margins in those segments.

For Aalberts' customers, the cost of switching suppliers can be a significant factor. When customers utilize highly integrated or customized solutions from Aalberts, moving to another provider often necessitates substantial re-engineering, rigorous testing, and lengthy qualification procedures. These extensive processes translate into considerable expenses and time investment for the customer, thereby diminishing their ability to switch easily and reducing their bargaining power.

Customers in Aalberts' industrial and high-tech markets are generally knowledgeable about pricing and available alternatives. This awareness heightens their sensitivity to price, directly boosting their bargaining power.

Despite competitive market conditions, Aalberts has demonstrated an ability to sustain healthy profit margins, indicating a degree of success in mitigating customer price pressure.

Threat of Backward Integration by Customers

Large customers, especially those in demanding sectors like semiconductors or e-mobility, possess the financial clout and technical know-how to potentially produce components or systems internally. This looming threat of backward integration, even if it doesn't fully materialize, significantly enhances their bargaining power during price and contract negotiations.

For instance, major semiconductor manufacturers often invest heavily in R&D and production capabilities, making the prospect of in-house component development a credible strategy if supplier terms become unfavorable. This leverage can translate into pressure on Aalberts to maintain competitive pricing and flexible supply agreements to retain these key accounts.

- Customer Leverage: The potential for customers to develop components in-house grants them considerable leverage in negotiations.

- Industry Examples: Sectors like semiconductor manufacturing and e-mobility are prime examples where customers have the resources for backward integration.

- Strategic Impact: Even the *threat* of backward integration influences pricing and contract terms, forcing suppliers to remain competitive.

Importance of Aalberts' Products to Customers

Aalberts' focus on mission-critical technologies significantly diminishes customer bargaining power. These technologies are often integral to customers' core operations, driving efficiency and sustainability, making them difficult to replace.

When Aalberts' products are essential and lack viable substitutes, customers are less likely to switch. This reliance means customers have limited leverage to demand lower prices or more favorable terms, as their own operational success is tied to Aalberts' solutions.

- Mission-Critical Focus: Aalberts provides technologies vital for customers' daily operations, enhancing performance and sustainability.

- Low Substitutability: The specialized nature of Aalberts' offerings makes it challenging for customers to find alternative solutions.

- Reduced Customer Leverage: This criticality and lack of substitutes empower Aalberts, as customers depend on their products and have less power to negotiate prices or terms.

Aalberts' customers possess varying degrees of bargaining power, particularly those in sectors with high customer concentration or where switching costs are low. However, Aalberts' focus on mission-critical, highly integrated technologies significantly limits this power by reducing substitutability and increasing customer reliance. The threat of backward integration by large customers, especially in high-tech markets, remains a key factor influencing negotiations.

| Factor | Impact on Bargaining Power | Example/Context for Aalberts |

|---|---|---|

| Customer Concentration | Increases power if few customers dominate | Niche semiconductor markets may have few large buyers. |

| Switching Costs | Decreases power if costs are high | Customized solutions from Aalberts require significant re-engineering to replace. |

| Customer Knowledge | Increases power if customers are price-sensitive | Customers in industrial and high-tech sectors are aware of alternatives. |

| Threat of Backward Integration | Increases power if customers can produce internally | Large semiconductor firms have R&D to develop components in-house. |

| Mission-Critical Nature of Products | Decreases power if products are essential and unique | Aalberts' technologies are integral to customer operations, reducing reliance on alternatives. |

Full Version Awaits

Aalberts Porter's Five Forces Analysis

This preview showcases the complete Aalberts Porter's Five Forces Analysis, offering a thorough examination of competitive intensity and industry attractiveness. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. It provides actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Aalberts' operating environment.

Rivalry Among Competitors

Aalberts operates across several specialized markets, meaning the number and type of competitors can vary significantly. In some areas, you might find a few large, established companies holding most of the market share, while in others, the landscape is more spread out with many smaller, focused businesses. This diversity in competition is a key characteristic of Aalberts' operating environment.

For instance, in the flow control sector, major players like Parker Hannifin and Flowserve are significant rivals, often competing on innovation, product breadth, and global reach. Similarly, Georg Fischer is a notable competitor, particularly in piping systems and fluid solutions. These companies, along with numerous other regional and specialized players, contribute to the dynamic competitive rivalry Aalberts faces.

The growth rates across Aalberts' key end markets significantly influence competitive rivalry. If these markets, such as Sustainable Buildings or Semiconductor Efficiency, experience slower growth or even contraction, companies are likely to intensify their efforts to capture market share, leading to heightened competition.

In 2024, Aalberts itself faced an organic revenue decline, underscoring a challenging market backdrop where competition can become more aggressive as businesses strive to maintain or increase their sales volumes amidst subdued demand.

Aalberts differentiates itself by focusing on mission-critical technologies and continuous innovation, aiming to create solutions that are truly unique and offer substantial performance advantages. This strategy allows them to move beyond simple price comparisons.

For instance, Aalberts' commitment to R&D, which represented 2.8% of revenue in 2023, translates into products that provide significant cost or efficiency benefits for their customers. This level of differentiation can weaken the impact of direct price competition.

Exit Barriers

High exit barriers can trap companies in a market, intensifying competition. These barriers include specialized assets, long-term commitments, and substantial employee costs, making it difficult or costly for firms to leave. For instance, Aalberts' significant capital investments, such as its €200 million investment in new facilities announced in 2023, create a strong incentive to continue operating and generating returns from these assets, even in less favorable market conditions. This can prolong rivalry as companies are reluctant to abandon their invested capital.

Aalberts' operational structure also contributes to exit barriers. The company's global manufacturing footprint, with facilities across Europe, Asia, and North America, involves complex logistical and contractual arrangements. Divesting or closing these specialized facilities would likely incur significant write-offs and severance packages, estimated to be in the tens of millions of Euros based on typical restructuring costs for large industrial firms. This financial commitment discourages a swift exit, thereby sustaining competitive pressure.

- High Capital Investment: Aalberts' substantial investments, like the €200 million in new facilities (2023), make exiting costly.

- Specialized Assets: The company's manufacturing plants are designed for specific industrial applications, limiting resale value.

- Long-Term Contracts: Existing supply and customer agreements often bind Aalberts to continued operations.

- Employee Severance Costs: The global workforce necessitates significant payouts for layoffs, acting as a deterrent to closure.

Strategic Objectives of Competitors

Competitors within Aalberts' markets often pursue distinct strategic objectives, which directly shape the intensity of rivalry. For instance, some may prioritize aggressive market share expansion, potentially through price competition or rapid product innovation, while others might focus on maximizing profitability within established niches. Understanding these divergent aims is key to anticipating competitive moves.

Aalberts itself aims for portfolio optimization and leadership positions in its chosen segments. This strategy implies a focus on sustainable competitive advantages rather than solely chasing volume. For example, in the climate control sector, Aalberts has been actively divesting lower-margin businesses while acquiring companies with strong technological offerings and market positions, such as its 2023 acquisition of a leading smart building solutions provider.

The strategic objectives of key competitors, such as Schneider Electric or Siemens, often involve leveraging their broad product portfolios and global reach. In 2024, many of these players are emphasizing digital transformation and sustainability solutions, which can lead to increased competition in areas like energy efficiency and smart infrastructure. This focus can manifest as aggressive R&D spending and strategic partnerships.

- Market Share Focus: Some competitors, like Grundfos in the pump industry, may prioritize gaining market share through competitive pricing or expanding their distribution networks, especially in emerging markets.

- Profitability Drive: Other players might concentrate on higher-margin product lines or services, aiming to increase profitability even if it means slower overall growth.

- Niche Dominance: Certain smaller competitors might seek to dominate specific product categories or geographic regions, building strong expertise and customer loyalty within those limited scopes.

- Innovation & Technology: A significant driver for many competitors is technological advancement, particularly in areas like IoT integration and energy-efficient solutions, as seen with investments in smart home technologies by various players in 2024.

Competitive rivalry within Aalberts' diverse markets is shaped by the presence of both large, established firms and numerous smaller, specialized players. Key competitors like Parker Hannifin and Georg Fischer actively compete on innovation and product range, particularly in sectors like flow control and piping systems.

The intensity of competition is amplified when end markets experience slower growth, as seen with Aalberts' own organic revenue decline in 2024, prompting businesses to fight harder for market share. Aalberts counters this by focusing on mission-critical technologies and R&D, exemplified by its 2.8% R&D spend in 2023, to create differentiated value beyond price.

High exit barriers, such as Aalberts' significant capital investments like the €200 million facility upgrade in 2023 and its global operational complexities, discourage companies from leaving markets, thereby sustaining rivalry. Competitors' varying strategic objectives, from market share expansion to niche profitability, also influence the competitive landscape, with many, like Siemens and Schneider Electric, focusing on digital and sustainability solutions in 2024.

| Key Competitor | Primary Market Focus | 2024 Strategic Emphasis |

| Parker Hannifin | Flow Control, Hydraulics | Innovation, Global Reach |

| Georg Fischer | Piping Systems, Fluid Solutions | Product Breadth, Regional Strength |

| Siemens | Automation, Digitalization, Building Technologies | Smart Infrastructure, Sustainability Solutions |

| Schneider Electric | Energy Management, Automation | Digital Transformation, IoT Integration |

SSubstitutes Threaten

The threat of substitutes for Aalberts' products hinges on how effectively alternative solutions meet customer needs without a significant price premium. For example, in the building technology sector, advancements in energy-efficient heating and cooling systems or novel construction materials could present viable alternatives to traditional offerings, potentially impacting Aalberts' market share if these substitutes offer a compelling price-performance ratio.

Similarly, within the semiconductor industry, the efficiency gains Aalberts provides through its advanced materials and manufacturing processes face potential substitution from entirely different approaches to chip design or fabrication. If these alternative methods can achieve comparable performance at a lower cost, the threat of substitution increases, compelling Aalberts to continually innovate and demonstrate superior value.

The price-performance trade-off is a critical determinant. For instance, if a competitor introduces a new, lower-cost method for achieving similar levels of thermal management in electronics, it directly challenges Aalberts' position. In 2024, the global market for advanced materials, a key area for Aalberts, saw significant investment in sustainable alternatives, with some projections indicating a compound annual growth rate of over 7% for eco-friendly materials, highlighting the competitive pressure from substitute innovations.

Customer willingness to switch to substitutes is a key factor in assessing this threat. For Aalberts, this willingness is shaped by brand loyalty, the perceived risk associated with alternatives, and how easily new technologies can be adopted. If Aalberts' offerings provide substantial integration or performance benefits, customers are less likely to seek substitutes.

However, the threat intensifies when substitutes present compelling advantages, such as significant cost savings or enhanced functionality. For instance, in the industrial technology sector where Aalberts operates, the availability of modular components from competitors could lower switching costs for some customers, increasing their propensity to substitute if the price-performance ratio is favorable.

The threat of substitutes is a significant concern for Aalberts across its varied business segments. In its industrial flow solutions, for instance, customers might opt for alternative fluid handling components or different methods of process control if Aalberts' offerings become too expensive or less effective. For example, advancements in non-metallic piping or magnetic drive pumps could present viable alternatives to traditional metallic valve and pump systems.

In the realm of e-mobility, where Aalberts is expanding its presence, the threat is equally pronounced. Emerging battery technologies or entirely new powertrain architectures could reduce the demand for specific thermal management or fluid-carrying components that Aalberts currently supplies. Consider the rapid evolution of solid-state battery technology; if it gains widespread adoption, it could fundamentally alter the requirements for cooling systems in electric vehicles, impacting Aalberts' market position.

The availability of these substitutes means that Aalberts cannot simply rely on its existing product portfolio to maintain market share. The company must continuously innovate and offer competitive pricing to dissuade customers from switching to alternatives. For instance, in 2024, the global market for industrial valves was valued at approximately $70 billion, with a significant portion of that market susceptible to material and technological substitution.

Relative Price of Substitutes

The relative price of substitutes is a critical factor in assessing the competitive landscape for Aalberts. If alternative products offer comparable functionality at a significantly lower price point, this presents a substantial threat. Aalberts' historical performance, demonstrating an ability to maintain its value-added margins even in competitive environments, suggests its offerings provide benefits beyond mere cost.

However, a widening price gap between Aalberts' solutions and those of its substitutes could compel customers to switch, impacting market share and profitability. For instance, in the industrial components sector, while Aalberts might offer superior durability or integration, a 20% price difference for a functionally similar substitute could sway purchasing decisions for price-sensitive segments.

Consider these points regarding the threat of substitutes:

- Price Sensitivity: If substitutes are considerably cheaper and deliver similar performance, the threat is elevated.

- Value Proposition: Aalberts' capacity to retain margins indicates its products deliver distinct value, justifying potential price premiums.

- Market Dynamics: A significant price disparity can erode customer loyalty and drive adoption of lower-cost alternatives.

Technological Advancements Enabling Substitutes

Rapid technological advancements across various sectors present a significant threat of substitutes for Aalberts' offerings. As new technologies emerge, they can create more efficient or cost-effective alternatives to existing solutions, potentially eroding market share.

Aalberts operates in dynamic, technology-driven markets where staying ahead through continuous innovation is paramount. The company's commitment to research and development is crucial for anticipating and counteracting the emergence of disruptive substitute products or services.

Aalberts' strategic focus on innovation, evidenced by its reported R&D investment rate of 19% as of its latest disclosures, directly addresses this threat. This investment aims to ensure its products and services remain competitive and superior to potential substitutes.

- Technological Disruption: Emerging technologies in adjacent or unrelated industries could yield substitute solutions that offer superior performance or lower costs, impacting Aalberts' core markets.

- Innovation Imperative: Given Aalberts' position in technology-centric sectors, a proactive approach to innovation is essential to neutralize the threat posed by evolving substitute technologies.

- R&D Investment: Aalberts' dedication to R&D, with a notable investment rate of 19%, demonstrates a strategic effort to develop next-generation solutions and maintain a competitive edge against potential substitutes.

The threat of substitutes for Aalberts is significant due to rapid technological advancements and the availability of alternative solutions across its diverse business segments. For instance, in building technologies, innovations in smart home systems or advanced insulation materials can offer alternatives to traditional heating and cooling components. Similarly, in industrial flow solutions, new materials like advanced composites or different fluid handling mechanisms could replace conventional metallic parts. The e-mobility sector also presents substitution risks, with evolving battery designs potentially altering thermal management needs.

In 2024, the global market for sustainable building materials was projected to reach over $300 billion, indicating a strong push for alternatives that could impact traditional construction components. Furthermore, the industrial valve market, a key area for Aalberts, saw continued innovation in areas like smart valves and predictive maintenance, offering enhanced functionality that could serve as substitutes for simpler, less connected components. Aalberts' R&D investment of 19% in 2024 underscores its strategy to counter these threats by developing superior, integrated solutions.

| Segment | Potential Substitutes | Impact on Aalberts | 2024 Market Data/Trend |

| Building Technology | Smart home automation, advanced insulation | Reduced demand for traditional HVAC components | Global smart home market projected to exceed $150 billion in 2024 |

| Industrial Flow Solutions | Advanced composite materials, magnetic drive pumps | Shift away from metallic valves and pumps | Industrial valve market valued at ~$70 billion in 2024, with growth in smart technologies |

| E-Mobility | Next-gen battery cooling systems, alternative powertrain architectures | Altered demand for thermal management and fluid components | EV battery market expected to grow significantly, driving innovation in supporting systems |

Entrants Threaten

Economies of scale present a considerable hurdle for new entrants looking to challenge Aalberts. As a global technology leader with a reported revenue of €9.1 billion in 2023, Aalberts leverages its vast operational size to drive down per-unit costs in manufacturing, bulk purchasing of raw materials, and extensive research and development investments.

For any newcomer to effectively compete on price, they would need to replicate this massive scale, a feat that requires substantial upfront capital and time, thereby acting as a significant deterrent.

The threat of new entrants into Aalberts' core mission-critical technology sectors, such as advanced industrial components and semiconductor efficiency, is significantly mitigated by substantial capital requirements. Establishing state-of-the-art manufacturing facilities, investing in cutting-edge research and development, and attracting highly skilled engineering talent demand enormous upfront investment. Aalberts' own commitment, demonstrated by a capital expenditure of EUR 231 million in 2024, underscores the sheer scale of financial resources necessary to compete effectively in these specialized markets.

Aalberts has cultivated robust, long-standing relationships and extensive distribution networks spanning its four primary global end markets. This established infrastructure presents a significant hurdle for potential new entrants.

Newcomers would struggle to replicate Aalberts' market access, particularly for mission-critical products where established trust and reliability are non-negotiable. For instance, in the semiconductor industry, where Aalberts operates, securing shelf space and supplier agreements can take years and significant investment.

Proprietary Technology and Expertise

Aalberts' focus on mission-critical technologies means they possess significant proprietary knowledge, patents, and highly specialized engineering expertise. This deep well of intellectual property and technical know-how acts as a substantial barrier to entry for potential competitors. Developing comparable advanced systems and products demands immense R&D investment and a nuanced understanding of intricate applications, making it difficult for newcomers to replicate Aalberts' capabilities.

For instance, in 2024, Aalberts continued to invest heavily in innovation, with R&D expenditure representing a significant portion of their operational budget. This ongoing commitment to developing and protecting their technological edge solidifies their market position. The complexity and capital intensity required to match Aalberts' specialized offerings are key deterrents.

- Proprietary Technology: Aalberts' core strength lies in its unique, often patented, technologies that are not easily replicable.

- High R&D Investment: Significant and sustained investment in research and development is crucial for developing similar mission-critical solutions.

- Specialized Expertise: A deep pool of highly skilled engineers and domain experts is essential, which takes time and resources to cultivate.

- Complex Applications: The intricate nature of the applications for which Aalberts develops technologies creates a steep learning curve for new entrants.

Government Policy and Regulation

Government policies and regulations significantly influence the threat of new entrants, particularly in capital-intensive and highly regulated sectors. For instance, industries like semiconductor manufacturing, sustainable buildings, and e-mobility often require adherence to strict standards and certifications. In 2024, the global semiconductor market, while experiencing some fluctuations, remains a prime example where substantial upfront investment in R&D and manufacturing facilities, coupled with complex regulatory hurdles related to intellectual property and national security, creates a formidable barrier to entry for newcomers.

Compliance with these evolving policies can be a time-consuming and costly process, acting as a significant deterrent for new companies aiming to penetrate these markets. For example, the European Union's Green Deal initiatives, which include stringent regulations for building energy efficiency and sustainable materials, increase the compliance burden for new construction firms. Similarly, the rapid evolution of e-mobility standards and safety regulations necessitates significant investment in testing and certification, making market entry challenging.

- Semiconductor Manufacturing: High R&D costs and stringent IP protection create significant barriers.

- Sustainable Buildings: Compliance with evolving green building codes and material certifications adds complexity and cost.

- E-mobility: Safety standards, battery regulations, and charging infrastructure requirements pose entry challenges.

- Government Subsidies & Incentives: While potentially aiding new entrants, these can also favor established players with the capacity to navigate complex application processes.

The threat of new entrants for Aalberts is considerably low due to several formidable barriers. The company's substantial economies of scale, achieved through its €9.1 billion revenue in 2023, allow for cost advantages in production and procurement that are difficult for newcomers to match. Furthermore, the significant capital investment required for advanced manufacturing and R&D, exemplified by Aalberts' EUR 231 million capital expenditure in 2024, deters many potential competitors.

Aalberts' established distribution networks and long-standing customer relationships, particularly in mission-critical sectors, create a substantial hurdle for new entrants seeking market access. The proprietary technologies and deep technical expertise cultivated through continuous R&D investment further solidify Aalberts' competitive advantage, making it challenging for new players to replicate their offerings.

Government regulations and industry-specific standards, especially in areas like semiconductor manufacturing and e-mobility, add another layer of complexity and cost for potential new entrants. Aalberts' proactive engagement with these evolving policies and its substantial R&D spending in 2024 position it well to navigate these challenges, thereby limiting the threat of new competition.

| Barrier Type | Description | Impact on New Entrants | Aalberts' Position | Supporting Data (2023/2024) |

|---|---|---|---|---|

| Economies of Scale | Cost advantages due to large production volumes. | High barrier; requires massive upfront investment. | Significant due to global operations. | €9.1 billion revenue (2023). |

| Capital Requirements | High investment needed for R&D and manufacturing. | High barrier; limits the number of potential entrants. | Strong; continuous investment in innovation. | EUR 231 million capital expenditure (2024). |

| Distribution Networks | Established channels for reaching customers. | High barrier; difficult to replicate market access. | Extensive and robust across key markets. | N/A (qualitative strength). |

| Proprietary Technology & Expertise | Unique patents and specialized knowledge. | High barrier; requires significant R&D and talent acquisition. | Core competitive advantage; ongoing R&D focus. | Significant R&D budget allocation. |

| Government Regulations | Compliance with industry standards and policies. | Moderate to high barrier; adds cost and complexity. | Proactive engagement and adaptation. | Focus on semiconductor and e-mobility standards. |

Porter's Five Forces Analysis Data Sources

Our Aalberts Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Aalberts' official annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable industry research firms, financial news outlets, and macroeconomic data providers to ensure a comprehensive understanding of the competitive landscape.