Aalberts Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aalberts Bundle

Curious about Aalberts' strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture – purchase the complete report for actionable insights and a clear path to optimizing Aalberts' market performance.

Stars

Semiconductor Efficiency Technologies is a shining Star within Aalberts' portfolio. This segment thrives in a market with substantial long-term growth potential, even with temporary customer inventory adjustments. Aalberts is strategically investing in this area, evidenced by its 'thrive 2030' strategy, which prioritizes advancements in leading-edge semiconductor technologies.

The company's commitment to this segment is further demonstrated by its focus on expanding its presence in rapidly growing regions, such as Southeast Asia. Aalberts' intended acquisition of GVT is a prime example of this geographical expansion strategy. This proactive approach to innovation and market penetration in a strong, enduring market solidifies Semiconductor Efficiency's position as a Star.

The Aerospace and Defense sector within Aalberts' Industrial Productivity segment is a standout performer, fueled by sustained demand for air travel and a consistent need for new aircraft deliveries. This niche is experiencing robust growth, a positive trend for Aalberts.

While other industrial areas might face challenges, Aalberts' strategic emphasis on aerospace and defense highlights its positioning in a high-growth market. The company is actively expanding its footprint here, anticipating continued positive momentum in the coming periods.

Aalberts is making significant strides in advanced surface technologies and precision manufacturing, specifically targeting the burgeoning e-mobility and lightweight materials sectors. These sectors are experiencing robust growth, fueled by global decarbonization efforts and rapid technological advancements. For instance, the global electric vehicle market is projected to reach over $1.5 trillion by 2030, highlighting the immense opportunity.

The company's focus on these high-growth areas positions its specialized offerings as Stars within the BCG matrix. By developing innovative solutions for components like battery systems and lightweight structural parts, Aalberts is aligning itself with critical market trends. In 2023, the demand for lightweight materials in automotive applications alone saw a substantial increase, driven by the need to improve fuel efficiency and EV range.

Data Centre Solutions

Aalberts' data center solutions, a key component of its Sustainable Buildings segment, are demonstrating robust growth, positioning them as a Star in the BCG matrix. This sub-market is experiencing significant expansion due to the ever-increasing demand for digital infrastructure.

The company's specialized offerings, including prefabricated skids and integrated systems for critical functions like dynamic pressure maintenance, vacuum degassing, and side-stream filtration, are highly sought after. These solutions directly address the need for energy and resource efficiency within data centers, a crucial factor for operators.

The global data center market size was valued at approximately $200 billion in 2023 and is projected to grow significantly, with CAGR estimates often exceeding 15% through 2030. This high-growth environment, coupled with Aalberts' specialized and efficient solutions, solidifies its Star status.

- High Market Growth: The data center sector is a rapidly expanding market, driven by cloud computing, AI, and big data.

- Strong Competitive Position: Aalberts' specialized, efficient solutions for critical data center operations give it an edge.

- Resource Efficiency Focus: Their products cater to the increasing demand for sustainable and energy-efficient data center infrastructure.

- Revenue Contribution: While specific figures for data center solutions within Aalberts' reporting may be embedded, the overall Sustainable Buildings segment showed strong performance in recent years, indicating positive contributions from growth areas like data centers.

Strategic Acquisitions for Niche Market Dominance (e.g., Paulo Products Company)

Aalberts' acquisition of Paulo Products Company, a North American industrial heat treatment specialist, is a prime example of strategic growth within the BCG Matrix framework, likely positioning it as a Star. This move bolsters Aalberts' presence in a specialized, high-growth industrial sector, aligning perfectly with its Thrive 2030 strategy focused on niche market leadership. The integration of Paulo Products is expected to drive significant revenue growth and market share in this critical technology area.

This acquisition allows Aalberts to consolidate its position in a lucrative niche, potentially leading to increased profitability and competitive advantage. By acquiring Paulo Products, Aalberts is not just expanding its geographic reach but also enhancing its technological capabilities in a sector with strong demand drivers. The financial impact of such a strategic acquisition, particularly in 2024 and looking towards 2025, will be closely watched for its contribution to Aalberts' overall market performance and valuation.

- Niche Market Focus: Paulo Products operates in the specialized industrial heat treatment market, a segment Aalberts aims to dominate.

- Growth Potential: The acquisition is designed to capitalize on the growing demand for advanced heat treatment solutions, indicating strong future revenue streams.

- Strategic Alignment: This move directly supports Aalberts' Thrive 2030 strategy, emphasizing leadership in high-value niche markets.

- Competitive Advantage: By integrating Paulo Products, Aalberts enhances its technological expertise and market penetration, creating a stronger competitive stance.

Semiconductor Efficiency Technologies, Aerospace and Defense, and Data Center Solutions are all identified as Stars within Aalberts' portfolio. These segments benefit from high market growth and Aalberts' strong competitive positioning, driven by specialized and efficient solutions. The company's strategic investments and acquisitions, such as Paulo Products, further solidify these areas as key growth drivers, aligning with its Thrive 2030 strategy.

| Segment | Market Growth Drivers | Aalberts' Strategic Advantage | Key Data/Outlook (2023-2025) |

|---|---|---|---|

| Semiconductor Efficiency Technologies | Long-term growth in leading-edge tech, regional expansion (Southeast Asia) | Strategic investment, focus on innovation | Customer inventory adjustments are temporary; continued investment in advanced technologies. |

| Aerospace and Defense | Sustained demand for air travel, new aircraft deliveries | Strategic emphasis on high-growth niche | Robust growth expected to continue; company expanding footprint. |

| Data Center Solutions | Increasing demand for digital infrastructure, cloud computing, AI | Specialized, efficient solutions for critical operations | Global data center market valued ~ $200 billion in 2023, projected CAGR > 15% through 2030. |

| Industrial Heat Treatment (e.g., Paulo Products) | Growing demand for advanced solutions in e-mobility, lightweight materials | Niche market leadership, technological enhancement | Acquisition of Paulo Products expected to drive significant revenue growth and market share in 2024-2025. |

What is included in the product

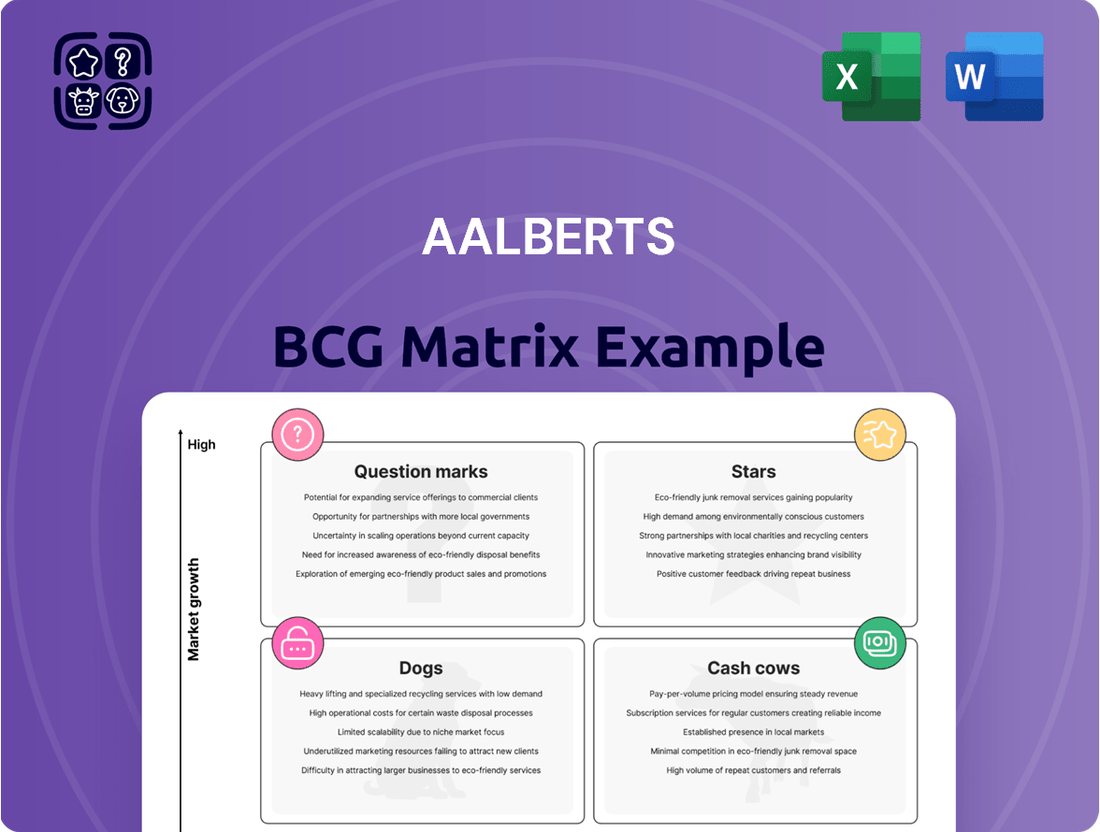

Aalberts BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Aalberts BCG Matrix offers a clear, visual overview of business unit performance, simplifying complex strategic decisions.

Cash Cows

Aalberts' Core Sustainable Buildings Solutions segment is a classic cash cow. It's showing steady, moderate growth, with organic growth hitting 1.4% in the first half of 2025. This stability is backed by a solid EBITA margin of 12.9%, demonstrating its ability to consistently generate cash even in a mature market.

The segment's resilience is further highlighted by its performance across different regions. While some European markets faced challenges, growth in America, Asia, and the Middle East remained strong. This geographical diversification, coupled with the ongoing demand for energy and resource efficiency, solidifies its position as a reliable cash generator for Aalberts.

Aalberts' established hydronic flow control solutions are a prime example of a Cash Cow within the BCG matrix. These products, crucial for hygienic water distribution and energy efficiency in buildings, represent a mature segment with stable, predictable demand.

The company's ongoing focus on strengthening its market presence, especially in North America, ensures this segment continues to be a reliable source of significant cash flow. For instance, in 2023, Aalberts reported strong performance in its Building Technologies division, which encompasses these hydronic solutions, highlighting their consistent revenue generation.

General Industrial Niche Solutions, excluding areas facing headwinds, represent Aalberts' cash cows. These segments are characterized by their strong profitability, as evidenced by the Industrial Productivity segment's robust EBITA margin of 16.8% in the first half of 2025, despite a slight organic revenue dip.

This resilience points to Aalberts' ability to extract significant cash flow from its established niche markets. The operational excellence within these areas allows them to maintain healthy margins and generate consistent cash, underscoring their role as reliable cash generators for the company.

Water Treatment Offerings for Heating Systems

Aalberts' water treatment solutions for heating systems are a strong performer within the eco-friendly buildings sector. This segment taps into the ongoing demand for energy and resource efficiency in both homes and businesses, solidifying its position as a reliable contributor to the company's financial health.

The market for sustainable building solutions is expanding, and Aalberts is well-positioned to capitalize on this trend. Their water treatment offerings are designed to meet stringent environmental regulations and consumer preferences for greener infrastructure.

- Consistent Demand: The need for efficient heating systems is perpetual, ensuring a steady revenue stream for Aalberts' water treatment products.

- Market Growth: The eco-friendly buildings market saw significant investment in 2024, with a projected continued upward trajectory in the coming years.

- Profitability: These offerings represent a mature product line that generates substantial, stable profits, fitting the profile of a cash cow.

Mature Parts of Industrial Valves in America

Aalberts' mature industrial valves segment in America is a classic cash cow. The company consistently reports strong order intake in this region, signaling a stable market where Aalberts likely commands a significant market share. This robust demand translates directly into predictable and substantial cash flows, allowing the company to fund other strategic initiatives.

The industrial valves in America are characterized by their maturity, meaning they operate in a well-established market with less aggressive growth potential but high profitability. Aalberts' established customer relationships and strong brand reputation in this sector contribute to this steady cash generation. For instance, in their 2024 reports, Aalberts highlighted the resilience of their North American operations, with the industrial valve segment being a key contributor to overall financial stability.

- Strong Order Intake: Aalberts consistently sees robust order volumes for industrial valves in the American market.

- Stable Market Position: This indicates a mature market where Aalberts likely holds a high market share and benefits from established customer loyalty.

- Predictable Cash Flow: The consistent demand generates steady and reliable cash generation, characteristic of a cash cow.

- Contribution to Group: These cash flows are crucial for funding growth opportunities in other business segments.

Aalberts' established hydronic flow control solutions are a prime example of a Cash Cow within the BCG matrix. These products, crucial for hygienic water distribution and energy efficiency in buildings, represent a mature segment with stable, predictable demand.

The company's ongoing focus on strengthening its market presence, especially in North America, ensures this segment continues to be a reliable source of significant cash flow. For instance, in 2023, Aalberts reported strong performance in its Building Technologies division, which encompasses these hydronic solutions, highlighting their consistent revenue generation.

General Industrial Niche Solutions, excluding areas facing headwinds, represent Aalberts' cash cows. These segments are characterized by their strong profitability, as evidenced by the Industrial Productivity segment's robust EBITA margin of 16.8% in the first half of 2025, despite a slight organic revenue dip.

Aalberts' mature industrial valves segment in America is a classic cash cow. The company consistently reports strong order intake in this region, signaling a stable market where Aalberts likely commands a significant market share. This robust demand translates directly into predictable and substantial cash flows, allowing the company to fund other strategic initiatives.

| Segment | Market Growth | Market Share | Profitability | Cash Flow Generation |

| Sustainable Buildings Solutions (Hydronic Flow Control) | Moderate | Strong | Stable (EBITA 12.9% H1 2025) | High and Consistent |

| Industrial Productivity (Niche Solutions) | Low to Moderate | Leading in Niches | High (EBITA 16.8% H1 2025) | Strong and Reliable |

| Industrial Valves (North America) | Low | High | Very High | Significant and Predictable |

Delivered as Shown

Aalberts BCG Matrix

The Aalberts BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means the strategic insights and analysis presented are exactly what you'll be working with, offering immediate value without any hidden surprises or watermarks. You can confidently assess the report's quality and relevance, knowing the final version is ready for your immediate use in strategic decision-making. This ensures a seamless transition from preview to actionable business intelligence.

Dogs

The automotive and agriculture sectors within Aalberts' Industrial Productivity segment are currently exhibiting significant weakness. These areas have seen consistently low activity, especially in crucial European markets such as Germany and France, which are key indicators of broader industrial health.

With persistent headwinds and a lack of discernible recovery signals, these sub-segments are characterized by low growth potential. This suggests Aalberts may hold a low market share in these particular niches, positioning them as prime candidates for strategic minimization or even divestiture to reallocate resources more effectively.

The machine build sector in Germany and France, a key area for Aalberts, has seen a significant downturn. In 2024, industrial production in Germany, a vital indicator for this sector, contracted by 1.5% year-on-year, reflecting weakened global demand for capital goods. France experienced a similar trend, with its manufacturing PMI hovering below the expansionary 50-point mark for much of the year, signaling ongoing sluggishness.

This challenging environment strongly suggests that Aalberts' machine build segment in these regions likely operates with a low market share. Such a position, coupled with the sector's reduced activity and low growth prospects, means this business unit is probably a cash consumer rather than a generator. It fits the profile of a 'Dog' in the BCG matrix, requiring careful strategic consideration due to its low profitability and growth potential.

The European new build and renovation market within sustainable buildings is currently experiencing a slowdown. In 2023, Germany's construction sector contracted by 1.7%, and France saw a similar trend with a decline in new housing starts. This sluggishness directly affects Aalberts' Sustainable Buildings segment, positioning it within a low-growth environment.

This market dynamic presents challenges for Aalberts, as reduced construction and renovation activity can lead to increased competition for fewer projects. Consequently, the company may face pressure on its market share and profitability within this segment, as demand for sustainable building solutions softens in key European markets.

Divested Elkhart Products Corporation

Aalberts' divestment of Elkhart Products Corporation in August 2024, a manufacturer of copper solder fittings, strongly suggests this business unit was categorized as a Dog within their BCG Matrix. This strategic move implies Elkhart Products likely exhibited low growth prospects and a diminished market share within Aalberts' broader operations.

Such divestitures are typical for Dog business units, which often consume resources without generating significant returns. For instance, in 2023, Aalberts reported a total revenue of €2.9 billion, and the sale of a smaller, underperforming unit like Elkhart Products would have been a logical step to streamline their portfolio and focus on more promising ventures.

- Divestment Rationale: Elkhart Products Corporation, a copper solder fitting manufacturer, was divested by Aalberts in August 2024.

- BCG Matrix Classification: This action indicates Elkhart Products was likely a Dog, characterized by low market share and low market growth.

- Strategic Implication: The divestment suggests the business unit had limited future growth potential and was not a strategic fit for Aalberts' long-term objectives.

- Financial Context: Aalberts' overall revenue in 2023 was €2.9 billion, highlighting the company's scale and the potential impact of shedding less profitable segments.

Segments from Russia Operations (Divested)

Aalberts' divestment of its building and industry segments in Russia, completed in 2023, signals these were likely underperforming assets. For instance, in 2022, the company reported a €15 million loss from discontinued operations, a significant portion of which can be attributed to the Russian business. This move aligns with the characteristics of a Dog in the BCG matrix, indicating low market share and low growth potential.

The strategic decision to exit Russia suggests these operations were not contributing positively to Aalberts' overall financial health or future growth trajectory. Factors such as geopolitical instability and sanctions likely exacerbated existing challenges, making continued investment untenable. This aligns with the typical profile of Dog businesses, which often require significant resources without yielding commensurate returns.

- Divestment of Russian operations completed in 2023.

- €15 million loss from discontinued operations reported in 2022, partly due to Russia.

- Low market share and low growth potential are characteristic of Dog businesses.

Aalberts' divestment of Elkhart Products Corporation in August 2024 and its Russian building and industry segments in 2023 strongly indicate these were classified as Dogs in the BCG matrix. These businesses likely possessed low market share and faced limited growth prospects. The €15 million loss from discontinued operations in 2022, partly attributed to the Russian business, underscores their underperformance and resource drain.

Question Marks

Aalberts' proposed acquisition of Grand Venture Technology (GVT) signals a deliberate move into Southeast Asia's burgeoning semiconductor industry. This expansion targets a region experiencing robust growth, presenting a significant opportunity for Aalberts to establish or bolster its presence in a key global supply chain hub.

While Southeast Asia offers substantial growth potential in semiconductors, Aalberts' market share within this specific new geographical area is still nascent. This necessitates considerable investment to build capabilities and compete effectively, positioning this expansion as a Stars or Question Marks element within the BCG matrix, leaning towards the latter due to the developing market share.

Aalberts' acquisition of Geo-Flo, a US-based company specializing in pumping solutions for geothermal heat pump technology, represents a strategic move into a burgeoning sustainable building market. Geo-Flo contributes approximately USD 15 million in revenue, positioning it as a smaller player within Aalberts' broader portfolio.

While Geo-Flo operates in a high-growth sector, its current market share is relatively modest. This suggests that Geo-Flo would likely be categorized as a 'Question Mark' in the BCG matrix, requiring significant investment to foster integration and capitalize on its expansion potential within the growing sustainable building niche.

While Aalberts has a solid footing in specialized e-mobility areas, particularly those intersecting with aerospace and defense, its broader automotive e-mobility solutions in Europe and America have seen softer demand. This indicates that while the overall e-mobility market is expanding rapidly, some of Aalberts' product lines within this segment are still in their growth phase, needing further development to capture significant market share.

For instance, the European electric vehicle market, while growing, experienced a slowdown in new registrations in early 2024 compared to the previous year, with some analysts citing economic uncertainty as a factor. This environment means Aalberts’ automotive e-mobility components, though technologically advanced, are in a phase where they need focused investment and strategic marketing to transition from question marks to stars in the BCG matrix.

Innovation-driven initiatives (e.g., new processes for stainless steel hardening)

Aalberts Surface Technologies is pushing boundaries with innovations like new processes for hardening stainless steel, which crucially maintain corrosion resistance. These advancements target emerging applications with significant growth potential, positioning them as potential stars in the BCG matrix.

Despite their technological promise, these initiatives are likely in the early stages of market penetration. Their current market share and revenue generation are probably modest, requiring substantial investment in marketing and sales to scale effectively.

- Innovation Focus: Development of advanced processes for stainless steel hardening, preserving critical properties like corrosion resistance.

- Market Potential: Targeting high-growth application areas where these unique capabilities offer a competitive edge.

- Current Stage: Likely in the question mark phase due to nascent market adoption and the need for significant investment to capture market share.

- Strategic Need: Requires strategic marketing and capital allocation to transition from innovation to market leadership.

Underserved Niche Markets Targeted by Thrive 2030 Strategy

Aalberts' 'thrive 2030' strategy is designed to cultivate leadership in promising niche markets, often those where the company currently holds a smaller presence. These targeted segments are identified for their high growth potential, fitting the profile of question marks within the BCG matrix, requiring strategic investment to build market share.

The focus is on leveraging innovation to gain traction in these underserved areas. For instance, by 2024, Aalberts has been actively investing in advanced materials and sustainable solutions, which represent emerging niches with significant long-term upside. This strategic push aims to transform these question marks into stars.

- Focus on Emerging Technologies: Aalberts is targeting niches in areas like advanced thermal management solutions for electric vehicles and sustainable building technologies.

- Innovation-Driven Growth: The strategy emphasizes R&D investment to develop proprietary technologies that can establish a competitive advantage in these new markets.

- Portfolio Rebalancing: By acquiring or developing capabilities in these niches, Aalberts aims to diversify its revenue streams and reduce reliance on more mature markets.

Question Marks represent business units or markets where Aalberts is investing but has not yet established a strong market share. These are often new ventures or emerging markets that hold significant growth potential but also carry higher risk. The company is actively identifying and nurturing these areas, aiming to convert them into future stars.

For example, Aalberts' expansion into Southeast Asian semiconductor markets and its acquisition of Geo-Flo in the sustainable building sector are prime examples of Question Marks. These ventures require substantial capital and strategic focus to develop market presence and capitalize on anticipated growth trends.

The company's strategy explicitly targets developing leadership in promising niche markets, many of which currently represent Question Marks. By 2024, significant investment has been channeled into areas like advanced materials and sustainable solutions, underscoring the commitment to nurturing these nascent opportunities.

Aalberts' approach to its automotive e-mobility components in Europe and America also fits the Question Mark profile, especially given the fluctuating demand in early 2024. Focused investment and strategic marketing are crucial for these segments to climb the BCG matrix.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.