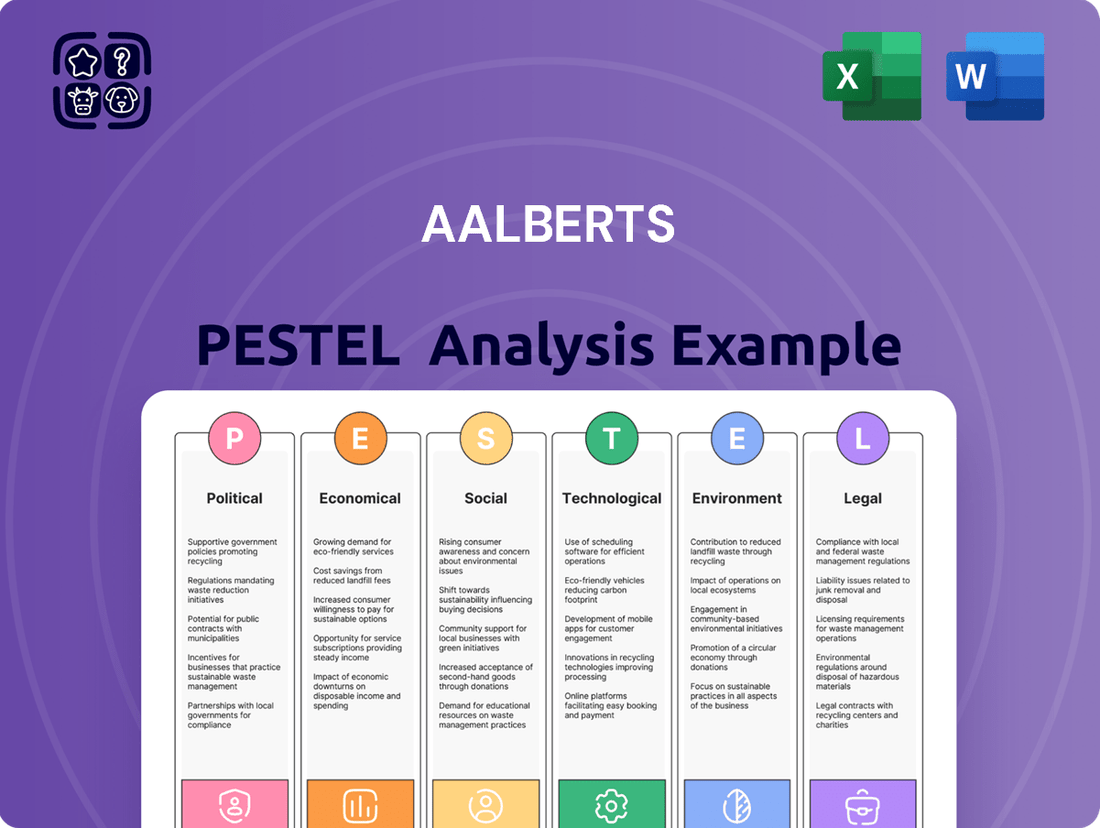

Aalberts PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aalberts Bundle

Navigate the complex external forces shaping Aalberts's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements present both challenges and opportunities for the company. This expertly crafted report provides the critical intelligence you need to inform your strategy and investment decisions. Download the full PESTLE analysis now for actionable insights.

Political factors

Global geopolitical tensions, including the ongoing conflict in Eastern Europe and the Middle East, alongside the persistent US-China rivalry, are profoundly reshaping global supply chains and trade dynamics. These complex relationships directly influence Aalberts' international operations by potentially disrupting established trade routes and impacting access to critical resources.

Such geopolitical instability often prompts the adoption of protectionist trade policies, such as tariffs and import/export restrictions. For instance, in 2024, the World Trade Organization (WTO) reported a notable increase in trade-restrictive measures globally, directly affecting companies like Aalberts that rely on cross-border sourcing and sales.

Governments globally are actively promoting green initiatives through financial backing. For instance, the European Union's Green Deal aims to mobilize at least €1 trillion in sustainable investments by 2030, with a significant portion directed towards energy efficiency and clean mobility. These incentives, including tax credits and grants for sustainable building materials and electric vehicle infrastructure, directly support Aalberts' strategic focus on efficiency and sustainability, potentially boosting demand for their solutions.

The European Union's Corporate Sustainability Reporting Directive (CSRD), fully applicable from the 2024 financial year for many companies, mandates extensive disclosure on environmental, social, and governance (ESG) matters. Similarly, the revised Energy Performance of Buildings Directive (EPBD), with key provisions coming into effect in 2025, will elevate energy efficiency standards for buildings across member states. These regulatory shifts necessitate significant adaptation in Aalberts' product design and manufacturing processes to meet enhanced performance benchmarks and reporting obligations, potentially impacting capital expenditure and operational costs.

Stability of Political Regimes

The stability of political regimes in countries where Aalberts operates is a significant consideration. Political uncertainty can directly impact economic conditions, leading to unpredictable shifts in regulations and potential disruptions in manufacturing and supply chains, affecting the company's international operations.

For instance, Aalberts' presence in regions experiencing political transitions or unrest could face challenges. In 2023, the World Bank's Ease of Doing Business report, while not updated for 2024, historically highlighted how regulatory environments, often influenced by political stability, affect business operations. Aalberts' reliance on global sourcing and sales means it must monitor geopolitical landscapes closely.

- Geopolitical Risk: Aalberts operates in over 50 countries, increasing exposure to varied political stability levels.

- Regulatory Impact: Political shifts can alter trade policies, tax laws, and environmental regulations affecting Aalberts' cost structure and market access.

- Supply Chain Vulnerability: Instability in key sourcing or manufacturing countries, such as those in parts of Asia or Eastern Europe where Aalberts has a presence, can disrupt material flow and production schedules.

Government Support for Industrial Development

Governments worldwide are increasingly prioritizing industrial development and automation, a trend that directly benefits Aalberts. For instance, in 2024, many European nations continued to roll out programs aimed at modernizing manufacturing sectors, often with substantial R&D funding. This translates into increased demand for Aalberts' advanced industrial solutions.

These governmental pushes often manifest as tangible support mechanisms. Consider the following:

- Tax Incentives: Many countries offer reduced corporate tax rates or specific tax credits for investments in automation and advanced manufacturing technologies, making it more attractive for businesses to adopt Aalberts' products and services.

- R&D Funding: Direct grants and subsidies for research and development in areas like robotics, AI-driven manufacturing, and smart factory solutions are becoming more common, fostering innovation that Aalberts can leverage.

- Infrastructure Improvements: Investments in digital infrastructure, such as high-speed internet and smart grids, are crucial for the widespread adoption of connected industrial solutions, a core offering of Aalberts.

- Skills Development Programs: Governments are also investing in training and upskilling the workforce to meet the demands of automated industries, ensuring a talent pool ready to utilize advanced manufacturing technologies.

Geopolitical shifts and trade tensions continue to influence global markets, potentially impacting Aalberts' supply chains and market access. For example, the ongoing restructuring of global trade alliances in 2024 and 2025 necessitates careful navigation of international regulations and tariffs.

Governmental support for green initiatives, such as the EU's €1 trillion sustainable investment target by 2030, directly aligns with Aalberts' focus on efficiency and sustainability. Furthermore, regulations like the EU's CSRD (fully applicable from 2024) and the revised EPBD (effective 2025) are driving demand for Aalberts' energy-efficient building solutions and requiring adaptations in product development.

Many governments are actively promoting industrial automation and advanced manufacturing through tax incentives and R&D funding. This trend, evident in numerous European nations in 2024, boosts demand for Aalberts' industrial solutions and supports their innovation pipeline.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Aalberts across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential influence on Aalberts's operations and future growth.

Aalberts' PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of wading through complex data for quick referencing during meetings or presentations.

Economic factors

Aalberts observed a downturn in its organic revenue during 2024 and the first half of 2025. This was largely driven by weaker performance in key markets like building technology in Europe and the automotive sector.

The persistent global economic slowdown presents a significant risk. A prolonged downturn could further dampen customer demand and curtail investment in new projects, directly impacting Aalberts' top and bottom lines.

Aalberts, like many industrial companies, has been navigating significant inflationary pressures throughout 2024 and into 2025. These pressures are particularly evident in the costs of essential raw materials, energy, and the labor force, all of which directly impact the company's bottom line and profitability.

To counter these rising expenses, Aalberts has strategically implemented robust cost-saving initiatives. Furthermore, the company has maintained strong pricing power, enabling it to sustain its added value margin and protect its EBITA margin. For instance, in the first half of fiscal year 2024, Aalberts reported a revenue growth of 5% to €1,896 million, with a strong operational performance that allowed for margin resilience despite the challenging cost environment.

As a global player, Aalberts is significantly impacted by currency exchange rate fluctuations. For instance, a stronger US Dollar against the Euro could boost reported earnings when converting US-based profits back to Euros, while a weaker Dollar would have the opposite effect.

In 2024, the Euro experienced volatility against the US Dollar, trading in a range that saw it weaken at times, impacting companies with substantial cross-border transactions. This dynamic directly affects Aalberts’ reported revenue and profitability in its consolidated financial statements.

The Polish Zloty also presents a key currency for Aalberts, given its operations in Poland. Shifts in the Zloty's value relative to the Euro can alter the cost of imported components or the repatriated value of sales generated within Poland, influencing overall financial performance.

Investment in Semiconductor and E-mobility Sectors

The semiconductor and e-mobility sectors are poised for sustained long-term expansion, fueled by rapid AI development and the global drive towards greener transport. Despite occasional market fluctuations, these trends create substantial avenues for Aalberts' advanced technological offerings.

Global semiconductor revenue is projected to reach $687.2 billion in 2024, according to the Semiconductor Industry Association (SIA), underscoring the sector's robust growth. Simultaneously, the electric vehicle market is accelerating; by the end of 2023, electric car sales accounted for approximately 15% of all new car sales globally, a figure anticipated to climb significantly in the coming years.

- Semiconductor Market Growth: Expected to continue its upward trajectory, driven by AI, IoT, and high-performance computing needs.

- E-mobility Expansion: Government incentives and consumer demand are propelling EV adoption, creating a vast market for related components and infrastructure.

- Aalberts' Opportunity: The company's expertise in precision engineering and material science aligns well with the high-quality components required by both sectors.

Interest Rate Environment and Capital Expenditure

The current interest rate landscape significantly shapes Aalberts' capital expenditure decisions. As central banks navigate inflation, borrowing costs for new projects, such as capacity expansions and R&D, become more sensitive to prevailing rates. For instance, if interest rates rise, the cost of financing new manufacturing facilities or acquiring advanced technologies will increase, potentially impacting the return on investment for these ventures.

Higher interest rates can also indirectly affect Aalberts by influencing customer demand. When borrowing becomes more expensive for Aalberts' clients, their own investment plans may be scaled back, leading to reduced demand for Aalberts' engineered solutions. This creates a dual challenge: increased cost of capital for Aalberts and potentially softer demand from their customer base.

Aalberts' commitment to ongoing investment in capacity, geographical reach, and innovation remains a strategic priority. However, the economic backdrop of 2024 and into 2025 presents a dynamic environment where the cost-effectiveness of these investments is closely scrutinized against evolving interest rate scenarios. For example, the European Central Bank's key interest rates, which influence borrowing costs across the Eurozone where Aalberts has significant operations, have seen adjustments, directly impacting the cost of capital for future projects.

- Impact on Financing Costs: Rising benchmark interest rates directly increase the cost of debt financing for Aalberts' capital projects.

- Customer Demand Sensitivity: Higher interest rates can dampen capital spending by Aalberts' clients, potentially reducing order volumes.

- Investment Prioritization: Aalberts must weigh the increased cost of capital against the strategic benefits of ongoing investments in capacity and innovation.

- Geopolitical and Monetary Policy Influence: Central bank decisions on interest rates, influenced by inflation and economic growth, are critical factors in Aalberts' long-term capital planning.

Aalberts navigated a challenging economic climate in 2024 and early 2025, marked by a slowdown in organic revenue, particularly in European building technology and the automotive sector. Persistent global inflation drove up costs for raw materials, energy, and labor, impacting profitability. However, the company demonstrated pricing power and cost-saving measures to maintain its margins, reporting a 5% revenue increase to €1,896 million in H1 2024.

Currency fluctuations, especially between the Euro and the US Dollar and Polish Zloty, significantly affected Aalberts' reported earnings and the value of international transactions. The company also faced the impact of rising interest rates, which increased financing costs for capital expenditures and could potentially dampen customer demand.

Despite these headwinds, Aalberts is strategically positioned to benefit from long-term growth in the semiconductor and e-mobility sectors, with global semiconductor revenue projected to reach $687.2 billion in 2024 and electric vehicle sales climbing rapidly.

| Economic Factor | Impact on Aalberts | Data/Trend (2024/2025) |

| Global Economic Slowdown | Reduced customer demand, dampened investment | Observed downturn in organic revenue (H1 2024) |

| Inflationary Pressures | Increased costs (raw materials, energy, labor) | Significant cost increases impacting profitability |

| Pricing Power & Cost Savings | Margin resilience, protected EBITA | H1 2024 revenue growth of 5% to €1,896 million |

| Currency Fluctuations | Impact on reported earnings and transaction values | Euro volatility against USD, Zloty shifts |

| Interest Rates | Higher financing costs, potential demand reduction | Influenced by ECB key rate adjustments |

| Growth Sectors (Semiconductors, E-mobility) | Opportunities for technological offerings | Semiconductor revenue: $687.2B (2024 proj.); EV sales ~15% of new cars (end 2023) |

Same Document Delivered

Aalberts PESTLE Analysis

The preview shown here is the exact Aalberts PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the factors influencing Aalberts.

The content and structure shown in the preview is the same Aalberts PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Societal awareness regarding environmental impact is surging, creating a significant push for sustainable and eco-friendly solutions across industries. This growing demand directly benefits companies like Aalberts, whose strategic direction emphasizes efficiency and sustainability in areas such as buildings and transportation.

In 2024, the global sustainable building materials market was valued at approximately $250 billion and is projected to grow robustly, indicating a strong market appetite for Aalberts' offerings. This trend supports their focus on developing products that reduce energy consumption and environmental footprints, aligning with consumer and regulatory preferences.

Global urbanization continues its upward trajectory, fueling consistent demand for enhanced infrastructure. This trend directly benefits Aalberts, as cities expand and existing structures require modernization, driving sales for their essential technologies in areas like Sustainable Buildings.

The International Energy Agency reported in 2024 that urban areas are projected to house 60% of the world's population by 2030, underscoring the ongoing need for robust building and industrial facility upgrades, a key market for Aalberts' solutions.

Aalberts' success hinges on a skilled workforce adept at handling advanced technologies. In 2024, the global demand for engineers and technicians specializing in areas like mechatronics and automation, crucial for Aalberts' operations, remained high, with reports indicating a persistent shortage in many developed economies. This scarcity directly impacts operational efficiency and the pace of innovation.

Consumer Preferences for Energy Efficiency

Consumer and business demand for energy efficiency is a significant sociological trend, directly impacting markets where Aalberts operates. This growing awareness is motivated by both the desire to lower operational costs and a heightened concern for environmental sustainability. For instance, in 2024, the global green building market was valued at over $1.3 trillion, demonstrating substantial consumer and corporate investment in eco-friendly solutions.

This preference fuels the adoption of advanced systems and products that align with Aalberts' strategic focus. Specifically, Aalberts' offerings in its Sustainable Buildings and Industrial Productivity segments directly cater to this demand. The International Energy Agency reported in 2024 that energy efficiency measures could deliver over 40% of the emissions reductions needed to meet 2030 climate goals, highlighting the substantial market opportunity.

Key drivers for this consumer preference include:

- Cost Savings: Reduced energy bills are a primary motivator for both residential and commercial consumers.

- Environmental Consciousness: Growing awareness of climate change encourages choices that minimize carbon footprints.

- Regulatory Push: Government incentives and regulations often promote or mandate energy-efficient technologies.

- Technological Advancements: The availability of more sophisticated and effective energy-saving products makes adoption easier.

Safety and Health Standards

Societal expectations for enhanced safety and health standards are increasingly shaping industrial and building environments. This growing awareness directly impacts how products are designed and manufactured, pushing for greater reliability and risk mitigation. Aalberts' product portfolio, which often focuses on advanced flow control and precision engineering, directly addresses these concerns by providing solutions that improve operational safety and control within critical infrastructure and industrial processes.

For instance, in the construction sector, stricter building codes mandating fire safety and structural integrity, which are prevalent across Europe and North America, necessitate high-performance components. Aalberts' contributions to fluid handling and climate control systems play a vital role in meeting these stringent regulatory requirements. The company's commitment to quality and innovation in these areas positions it favorably to capitalize on the ongoing demand for safer and more resilient built environments.

- Increased regulatory scrutiny on workplace safety: Many jurisdictions have seen an uptick in safety-related legislation, impacting manufacturing and installation practices.

- Growing consumer demand for product safety: End-users are more informed and vocal about the safety features of products, especially in residential and public spaces.

- Aalberts' role in enhancing operational integrity: The company's solutions, such as advanced valve technology and pipe systems, are designed to prevent leaks and ensure reliable performance, contributing to safer operations.

- Alignment with sustainability and ESG goals: Safer operations often correlate with reduced environmental impact and better social outcomes, aligning with broader Environmental, Social, and Governance (ESG) initiatives favored by investors and stakeholders.

Societal demand for energy efficiency and sustainability continues to rise, directly benefiting Aalberts' focus on innovative solutions for buildings and industry. This trend is underscored by the global green building market's valuation exceeding $1.3 trillion in 2024, with energy efficiency measures projected to contribute significantly to emissions reductions needed for 2030 climate goals.

Urbanization remains a powerful sociological driver, increasing the need for modernized infrastructure and robust building solutions, areas where Aalberts' technologies are essential. By 2030, urban areas are expected to house 60% of the global population, highlighting the sustained demand for upgrades in both new and existing structures.

The increasing emphasis on safety and health standards across industries and public spaces also plays a crucial role. Aalberts' commitment to high-quality, reliable components in fluid handling and climate control systems directly addresses these growing expectations for operational integrity and risk mitigation.

The global demand for skilled engineers and technicians in specialized fields like automation and mechatronics, critical for Aalberts' advanced product development and manufacturing, remained strong in 2024, though a shortage persists in many developed economies, impacting innovation speed.

Technological factors

Breakthroughs in materials science are significantly impacting industries, offering Aalberts avenues to boost product performance and innovate. The development of advanced materials like metamaterials and nanotechnology promises lighter, more durable, and responsive components. For instance, the global advanced materials market was valued at approximately $270 billion in 2023 and is projected to grow substantially, providing a fertile ground for Aalberts' technological integration.

The accelerating integration of Industry 4.0 technologies like the Internet of Things (IoT), artificial intelligence (AI), and advanced robotics is fundamentally reshaping industrial operations, driving significant growth in automation adoption. This trend presents a substantial opportunity for companies like Aalberts, whose core business revolves around enhancing industrial productivity.

Aalberts is well-positioned to capitalize on this technological shift by offering solutions that directly address the increasing demand for improved operational efficiency, enhanced precision, and elevated productivity within manufacturing environments. For instance, the global industrial automation market was valued at approximately USD 223.9 billion in 2023 and is projected to reach USD 367.7 billion by 2030, growing at a CAGR of 7.3% during this period, according to various market research reports.

The escalating demand for Artificial Intelligence (AI) and high-performance computing (HPC) is fundamentally reshaping the semiconductor landscape. This surge directly translates into increased demand for the sophisticated equipment needed to manufacture these advanced chips, creating a robust growth environment for companies like Aalberts. The semiconductor equipment market, a key area for Aalberts' Semiconductor Efficiency segment, is projected to see substantial growth driven by these trends.

For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of over 30% through 2030, reaching well over $100 billion. This rapid expansion necessitates cutting-edge manufacturing processes and specialized equipment, areas where Aalberts' expertise in precision engineering and advanced materials provides a competitive edge. Aalberts' Semiconductor Efficiency segment is thus strategically positioned to capitalize on this technological wave, supplying critical components and solutions that enable the production of next-generation AI and HPC processors.

Innovations in E-mobility Charging Technology

Technological advancements in electric vehicle (EV) charging are rapidly enhancing convenience and practicality, directly fueling wider adoption. Innovations like ultra-fast charging, which can add hundreds of miles of range in minutes, and the emerging convenience of wireless charging are transforming the EV ownership experience. These developments are critical for overcoming range anxiety and making EVs a more accessible choice for a broader consumer base.

Aalberts' strategic positioning within the e-mobility transition market is significantly bolstered by these technological leaps. By integrating advanced solutions, Aalberts contributes to a more robust and user-friendly charging ecosystem. For instance, the global EV charging infrastructure market was valued at approximately $25 billion in 2023 and is projected to grow substantially, with advancements in charging speed being a key driver.

The company’s involvement benefits from and contributes to:

- Ultra-fast Charging: Technologies enabling charging speeds that rival gasoline refueling times, significantly reducing downtime for EV users.

- Wireless Charging: The development of inductive charging pads for homes and public spaces, offering a seamless, plug-free charging solution.

- Smart Grid Integration: Innovations allowing charging stations to communicate with the power grid, optimizing energy usage and potentially reducing costs.

- Improved Battery Management Systems: Technological advancements that enhance charging efficiency and battery longevity, making EVs more sustainable.

Digitalization and Data Analytics

The increasing digitalization across various industries offers significant opportunities for Aalberts to streamline operations and improve customer engagement. For instance, the global digital transformation market was projected to reach over $1.5 trillion in 2024, highlighting the widespread adoption of digital technologies. This trend allows Aalberts to leverage data analytics for optimizing its supply chains and manufacturing processes, potentially leading to cost savings and increased efficiency.

The growing emphasis on data analytics is crucial for Aalberts to gain deeper insights into market trends and customer behavior. By analyzing vast datasets, the company can identify areas for innovation and product development. For example, in 2024, businesses are increasingly investing in AI-powered analytics to predict market shifts and personalize offerings, a capability that Aalberts can harness.

Specific applications like digital product passports and advanced monitoring systems, especially within the building sector, can significantly enhance transparency and operational efficiency for Aalberts. These tools allow for better tracking of materials, performance monitoring, and lifecycle management of products, contributing to sustainability goals and improved service delivery. The construction technology market, a key area for Aalberts, saw substantial growth in 2024, driven by demand for smart building solutions.

Key technological factors impacting Aalberts include:

- Digitalization Adoption: Continued growth in digital transformation initiatives across sectors where Aalberts operates, such as manufacturing and building technology.

- Data Analytics Investment: Increasing corporate spending on data analytics tools and expertise to drive informed decision-making and process optimization, with global spending on big data and business analytics software projected to exceed $300 billion in 2025.

- Smart Building Technologies: The rise of IoT and digital solutions in construction, enabling advanced monitoring and digital product passports for enhanced transparency and efficiency.

- AI Integration: The growing application of artificial intelligence in optimizing industrial processes, predictive maintenance, and customer relationship management.

Technological advancements are a significant driver for Aalberts, particularly in materials science and industrial automation. The global advanced materials market, valued at approximately $270 billion in 2023, offers avenues for product innovation. Furthermore, the industrial automation market, projected to reach $367.7 billion by 2030, highlights the demand for enhanced operational efficiency that Aalberts can address.

Legal factors

Aalberts, a significant European player, faces increasing scrutiny under new ESG reporting mandates. The Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy are key examples, demanding detailed disclosures on environmental and social impacts. For instance, the CSRD, fully applicable from fiscal year 2024 for many companies, requires extensive data on a company's sustainability performance, including climate change mitigation and adaptation efforts.

Meeting these regulatory requirements necessitates robust data collection and transparent reporting on how sustainability factors influence Aalberts' financial health and strategy. Failure to comply can lead to penalties and reputational damage, impacting investor confidence and market access. The company must integrate these reporting frameworks into its core business operations to ensure ongoing compliance and demonstrate its commitment to sustainable practices.

The European Union's updated Energy Performance of Buildings Directive (EPBD) is a significant legal factor for Aalberts, pushing for enhanced energy efficiency in both new and existing structures. This directive includes a planned phase-out of fossil fuel boilers, directly impacting the market for heating and cooling systems.

These stringent regulations are set to shape demand for Aalberts' sustainable building solutions, particularly in areas like heat pumps and advanced insulation. Companies like Aalberts must adapt their product portfolios to meet these evolving energy efficiency mandates, ensuring compliance and capitalizing on the growing market for green building technologies.

Aalberts operates under a complex web of product safety and quality regulations globally. For instance, in the European Union, directives like the General Product Safety Directive (GPSD) mandate that only safe products are placed on the market, with non-compliance potentially leading to significant fines and product recalls. Adherence to these standards is paramount for Aalberts to ensure the reliability of its advanced technologies, thereby minimizing potential liability and safeguarding its reputation with customers.

Intellectual Property Rights and Patents

Protecting its innovation through intellectual property rights, including patents, is paramount for Aalberts. This legal shield is essential for maintaining its competitive edge in the technology sector and safeguarding its unique designs and manufacturing processes from infringement. In 2023, Aalberts continued to invest in R&D, a key driver for patent applications, underscoring the importance of these legal protections.

The strength and enforcement of intellectual property laws directly impact Aalberts' ability to monetize its technological advancements. Robust patent frameworks allow the company to secure exclusive rights, preventing competitors from replicating its innovations without licensing agreements. This legal recourse is critical for recouping substantial R&D expenditures and fostering continued investment in future technologies.

- Patent Portfolio Growth: Aalberts actively manages and expands its patent portfolio, a strategy directly linked to its innovation pipeline.

- Global IP Enforcement: The company navigates varying international IP laws to protect its inventions across key markets.

- Licensing Opportunities: Strong patent protection can open avenues for lucrative licensing agreements, generating additional revenue streams.

- R&D Investment Link: Expenditures on research and development are intrinsically tied to the generation of new intellectual property.

Anti-Trust and Competition Laws

Aalberts, with its extensive global operations, must navigate a complex web of anti-trust and competition laws across numerous countries. These regulations are critical as they directly impact the company's ability to pursue mergers, acquisitions, and even its day-to-day market conduct. For instance, the European Union's Directorate-General for Competition actively scrutinizes market concentration, potentially affecting Aalberts' expansion strategies in key European markets.

These legal frameworks shape Aalberts' strategic growth initiatives by dictating permissible market share and preventing monopolistic practices. Failure to comply can result in significant fines and operational restrictions. In 2024, regulatory bodies worldwide continued to focus on digital markets and supply chain consolidation, areas where Aalberts might encounter heightened scrutiny.

- Merger Control: Aalberts' acquisition plans are subject to review by competition authorities to prevent undue market dominance.

- Market Conduct: Laws prohibit anti-competitive agreements, such as price-fixing or market sharing, impacting Aalberts' sales and distribution practices.

- Regulatory Fines: Non-compliance can lead to substantial penalties; for example, the European Commission imposed billions in fines on various companies for competition violations in recent years.

- Global Compliance: Aalberts must maintain awareness of differing competition law interpretations in regions like North America, Asia, and Europe to ensure consistent adherence.

Aalberts must navigate evolving environmental regulations, including the EU's Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy, which demand detailed sustainability disclosures. These mandates, with CSRD fully applicable from fiscal year 2024 for many, require robust data collection on environmental and social impacts, influencing investor confidence and market access.

The EU's updated Energy Performance of Buildings Directive (EPBD) is a key legal factor, pushing for enhanced energy efficiency and a phase-out of fossil fuel boilers, directly impacting Aalberts' heating and cooling solutions market.

Global product safety and quality regulations, such as the EU's General Product Safety Directive (GPSD), necessitate strict adherence to ensure Aalberts' advanced technologies are safe, minimizing liability and safeguarding its reputation.

Intellectual property laws are crucial for Aalberts to protect its innovations, with R&D investment in 2023 directly fueling patent applications and securing its competitive edge through exclusive rights.

Competition laws globally, including EU scrutiny of market concentration, shape Aalberts' strategic growth, with regulatory bodies in 2024 focusing on digital markets and supply chain consolidation.

Environmental factors

Global initiatives to tackle climate change, such as the European Union's ambitious target of achieving climate neutrality by 2050, are significantly boosting the market for energy-efficient and sustainable technologies. This presents a substantial opportunity for companies like Aalberts.

Aalberts' core technologies, including advanced flow control and thermal management solutions, directly support these environmental objectives by enabling reduced carbon emissions and improved resource efficiency across various industries.

For instance, in 2023, the renewable energy sector saw record investments, with global clean energy capacity additions reaching approximately 510 GW, highlighting the growing demand for the very solutions Aalberts provides to facilitate this transition.

Growing global awareness of resource scarcity is driving a significant shift towards circular economy principles, emphasizing efficient material use and waste minimization. This trend directly impacts industries reliant on raw materials, pushing for innovative solutions that reduce environmental footprints.

Aalberts' strategic commitment to circularity, including the development of products designed for easier dismantling and reuse, aligns perfectly with these environmental imperatives. This focus not only offers ecological advantages but also positions the company to capitalize on emerging markets for sustainable and reusable components.

For instance, the global market for circular economy solutions was projected to reach over $4.5 trillion by 2030, highlighting the substantial economic potential of adopting these practices. Aalberts' investments in sustainable production, such as their advanced manufacturing techniques, contribute to this growing sector.

Water stress is a significant global challenge, with projections indicating that by 2030, 40% of the world's population could face water scarcity. This escalating concern highlights the critical need for efficient water management and conservation strategies across industries.

Aalberts' expertise in fluid control and treatment technologies positions it to address these environmental pressures. For instance, their solutions can optimize water usage in industrial processes, reduce wastewater discharge, and improve the quality of water for reuse, contributing to responsible water stewardship.

In 2023, Aalberts' Industrial Companies segment, which includes many of their fluid technology solutions, generated €1,517 million in revenue, demonstrating the scale of their operations and the potential impact of their water-related innovations.

Waste Management and Pollution Control

Stricter environmental regulations concerning waste management and pollution control directly influence Aalberts' manufacturing processes and the entire product lifecycle. Compliance necessitates ongoing investment in cleaner technologies and efficient waste reduction strategies.

Aalberts must prioritize minimizing its environmental footprint by adhering to stringent waste reduction targets and actively managing pollution across its global operations. For instance, the company's commitment to sustainability is reflected in its efforts to reduce CO2 emissions, with targets aligned with global climate goals.

- Regulatory Pressure: Increasing global and regional regulations on emissions, hazardous waste disposal, and water pollution require continuous adaptation and investment in compliance technologies.

- Operational Impact: Changes in manufacturing processes to reduce waste and pollution can affect production costs and efficiency, demanding innovative solutions.

- Product Lifecycle: Environmental considerations now extend to product design, material sourcing, and end-of-life management to ensure recyclability and minimize environmental impact.

- Sustainability Reporting: Companies like Aalberts are increasingly expected to report on their environmental performance, including waste generation and pollution control metrics, with stakeholders scrutinizing these figures closely.

Renewable Energy Transition

The global push towards renewable energy is significantly shaping the demand for specialized infrastructure and components. As countries and corporations prioritize decarbonization, the market for technologies supporting solar, wind, and other green energy sources is expanding. For instance, the International Energy Agency (IEA) reported in early 2024 that renewable energy capacity additions are projected to grow by over 50% by 2028 compared to the previous five years, reaching nearly 7,300 gigawatts globally.

Aalberts' strategic focus on technologies that enhance energy efficiency and promote sustainable building practices places it in a strong position to capitalize on this environmental transformation. Their solutions, often incorporating advanced materials and precision engineering, are crucial for developing the infrastructure needed for this energy transition. For example, the building sector accounts for a substantial portion of global energy consumption, and Aalberts' contributions to efficient heating, cooling, and water management systems directly address this environmental factor.

- Growing Demand: The global renewable energy market is expected to see substantial growth, driven by climate targets and technological advancements.

- Infrastructure Needs: This transition necessitates significant investment in new infrastructure, creating opportunities for companies supplying essential components.

- Aalberts' Position: Aalberts' expertise in energy efficiency and sustainable building technologies aligns well with the demands of this evolving market.

- Market Impact: The increasing focus on reducing carbon footprints in buildings and infrastructure directly benefits companies offering relevant solutions.

Global efforts to achieve climate neutrality, like the EU's 2050 goal, are driving demand for sustainable technologies, benefiting companies like Aalberts. Their flow control and thermal management solutions directly support reduced emissions and resource efficiency, aligning with the growing renewable energy sector, which saw approximately 510 GW of clean energy capacity additions in 2023.

The increasing global awareness of resource scarcity is pushing for circular economy principles, emphasizing efficient material use and waste reduction, a trend Aalberts addresses with products designed for easier dismantling and reuse. This focus taps into a market for sustainable components, with circular economy solutions projected to exceed $4.5 trillion by 2030.

Water scarcity, projected to affect 40% of the world's population by 2030, highlights the need for efficient water management, an area where Aalberts' fluid control and treatment technologies offer solutions. Their systems optimize water usage and reduce wastewater discharge, contributing to responsible water stewardship, as evidenced by the €1,517 million revenue from Aalberts' Industrial Companies segment in 2023.

Stricter environmental regulations on waste and pollution necessitate continuous investment in cleaner technologies and waste reduction strategies for companies like Aalberts. This includes managing pollution across operations and reducing CO2 emissions, with targets aligned with global climate goals.

PESTLE Analysis Data Sources

Our PESTLE analysis for Aalberts is built on a comprehensive review of data from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.