AAC Technologies Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAC Technologies Holdings Bundle

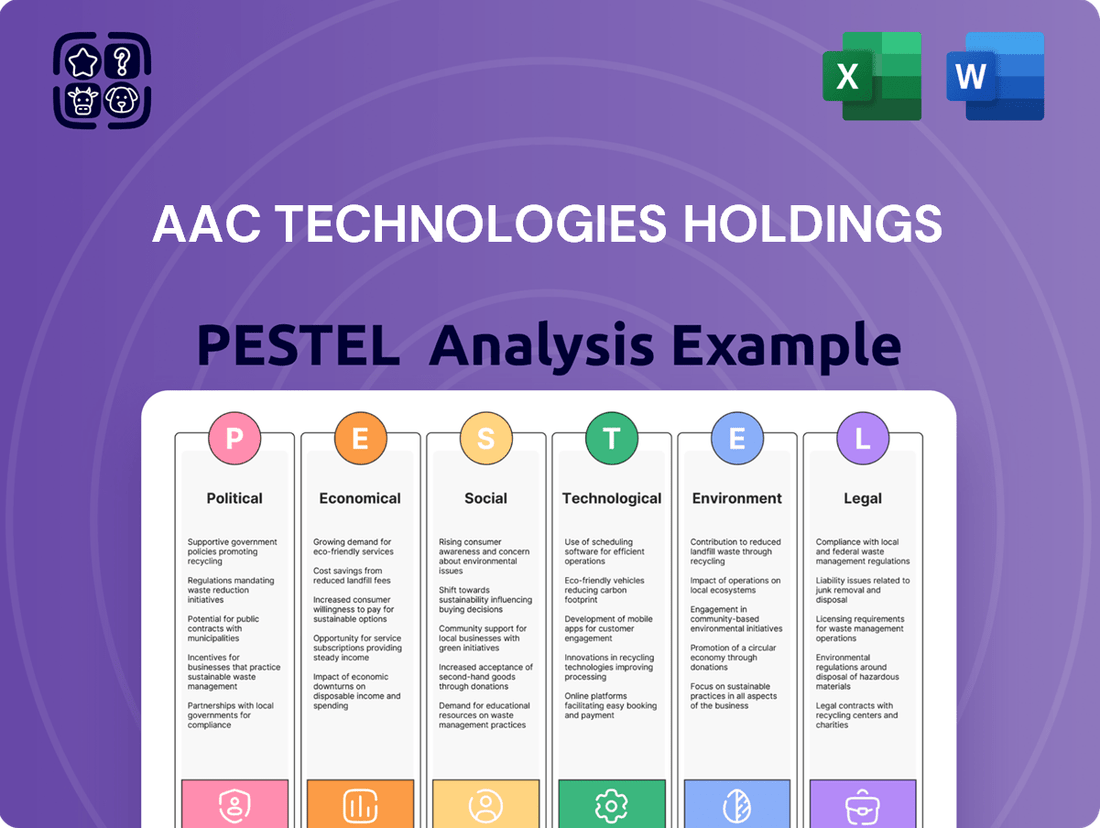

Navigate the complex external forces shaping AAC Technologies Holdings with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Our expert-crafted report provides actionable insights to inform your strategic decisions.

Uncover the critical social, environmental, and legal factors impacting AAC Technologies Holdings's market position. This detailed analysis is essential for investors, strategists, and anyone seeking a deeper understanding of the company's operating landscape. Download the full version now to gain a competitive edge.

Political factors

Geopolitical trade tensions, especially between major economies like the United States and China, create significant uncertainty for global component suppliers such as AAC Technologies. These disputes can manifest as tariffs on imported goods, restrictions on exporting critical technologies, or even outright bans, directly impacting the cost and availability of essential materials like semiconductors. For instance, the ongoing trade friction has previously led to increased costs for electronics manufacturers due to imposed tariffs, forcing them to re-evaluate their sourcing strategies.

The disruption to supply chains is a primary concern. When trade routes become complicated or key components face export controls, it can halt production lines and delay product launches. In response, many companies, including those in the electronics sector, are actively considering or implementing ‘friend-shoring’ or ‘reshoring’ strategies. This shift aims to build more resilient supply chains by relocating manufacturing to allied countries or back to domestic soil, potentially reshaping global manufacturing hubs in the coming years.

Governments globally are rolling out significant incentives to boost domestic semiconductor and electronics production. For instance, the US CHIPS Act provides substantial tax credits for domestic semiconductor manufacturing investments, a move aimed at reducing foreign supply chain dependence and enhancing national tech security. This policy landscape directly impacts where companies like AAC Technologies might strategically invest and expand their operations.

The technology sector, including companies like AAC Technologies, navigates an increasingly complex web of export control regulations, particularly for advanced and dual-use items. These rules, often updated in response to geopolitical shifts, can directly limit market access for high-performance products to designated nations or organizations, directly affecting revenue potential. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, which can restrict exports to specific companies, impacting global supply chains.

Intellectual Property Protection Policies

AAC Technologies' reliance on innovation makes robust intellectual property (IP) protection paramount. The company operates in regions with varying IP enforcement strengths, directly impacting its competitive edge. For instance, in 2023, the global value of IP rights in the technology sector continued to rise, highlighting the importance of safeguarding innovations.

Evolving patent laws, particularly those addressing AI-generated inventions and digital design protection, pose a significant consideration for AAC Technologies. Changes in these regulations can influence the company's ability to secure its research and development investments and maintain its market position. The World Intellectual Property Organization (WIPO) reported a notable increase in patent filings related to artificial intelligence in 2024.

- Global IP Landscape: Continued strengthening of IP frameworks in key markets is crucial for AAC Technologies to protect its technological advancements.

- AI and Design Protection: Adaptability to new regulations concerning AI-created inventions and digital designs is essential for maintaining a competitive advantage.

- R&D Investment Security: Effective IP laws ensure that AAC Technologies can recoup its substantial investments in research and development.

- Market Competitiveness: Strong IP protection safeguards AAC Technologies from infringement and maintains its unique selling propositions in a crowded market.

Labor Laws and Regulations in Manufacturing Hubs

AAC Technologies operates manufacturing facilities in diverse locations like China, Vietnam, Czechia, and Malaysia, each with its own complex labor laws. Navigating these regulations, which cover everything from working hours and minimum wages to the right to unionize, presents a significant challenge. For instance, China's Labor Contract Law, updated in 2023, mandates specific probation periods and severance pay, potentially increasing labor costs for manufacturers.

The imposition of stricter labor regulations or enhanced enforcement in these key manufacturing hubs directly impacts AAC Technologies' operational expenses. For example, a rise in minimum wage in Vietnam, as seen in recent years with increases aiming to improve worker livelihoods, can directly translate to higher payroll costs. Similarly, more stringent safety regulations could require investment in updated equipment or training, further adding to the cost base.

These labor dynamics can necessitate significant adjustments to AAC Technologies' established labor practices. Companies may need to invest more in worker training and welfare programs to comply with evolving standards, or re-evaluate their workforce composition and compensation structures. For example, if unionization efforts gain traction in a particular region, it could lead to collective bargaining agreements that influence wage levels and working conditions across the facility.

- China's Labor Contract Law (2023 update): Sets specific guidelines for employment contracts, probation, and termination, impacting hiring and firing costs.

- Vietnam's Minimum Wage Adjustments: Regular increases in minimum wages across different regions directly affect payroll expenses for manufacturing operations.

- Czech Republic's Working Time Directive: Adherence to EU directives on working hours and rest periods requires careful scheduling and potentially overtime management.

- Malaysia's Employment Act Amendments (effective 2023): Introduced changes related to working hours, overtime pay, and employee benefits, requiring compliance updates.

Government policies aimed at fostering domestic technological advancement, such as those incentivizing semiconductor manufacturing, directly influence AAC Technologies' strategic investment decisions and global operational footprint. Trade tensions and tariffs between major economic powers create supply chain vulnerabilities and cost pressures, prompting companies to explore diversification and regionalization strategies. Evolving export control regulations, particularly concerning advanced technologies, can limit market access and revenue potential for companies like AAC Technologies.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting AAC Technologies Holdings, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, helping stakeholders identify and navigate emerging threats and opportunities within the company's operating landscape.

A PESTLE analysis for AAC Technologies Holdings provides a clear, summarized version of external factors impacting their business, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during meetings and strategic planning.

Economic factors

The global consumer electronics market is a significant driver for AAC Technologies, impacting its financial performance. Despite past volatility, the market is showing resilience, with projections indicating sales could reach approximately $977 billion in 2025. This upward trend is expected to continue, with forecasts suggesting a market size of $1.25 trillion by 2034.

Key segments fueling this expansion are smartphones, gaming equipment, and TV peripheral devices. These areas represent crucial application domains for the acoustic components and modules that AAC Technologies specializes in, directly correlating market growth with AAC's potential revenue streams.

Inflationary pressures and economic uncertainty have notably altered consumer spending habits, particularly impacting the consumer electronics sector. This has led to a slowdown in demand for the components AAC Technologies Holdings supplies. For instance, in early 2024, inflation rates in major consumer markets remained elevated, although showing signs of moderation, which continues to affect how much consumers can spend on non-essential items like new gadgets.

While a recovery in consumer spending is anticipated, its pace is proving to be more gradual than initially projected. This slower rebound directly influences the volume of components AAC Technologies can sell and affects their pricing power. For example, reports from late 2024 indicated that consumer confidence, a key driver of discretionary spending on electronics, was still recovering from earlier dips, suggesting a cautious spending environment.

Disposable income levels and overall consumer confidence are critical factors for discretionary purchases of new electronic devices. When consumers feel financially secure and have more disposable income, they are more likely to upgrade their smartphones, laptops, and other electronics, thereby boosting demand for components like those produced by AAC Technologies. As of mid-2025, while employment figures remained strong in many developed economies, wage growth has, in some instances, lagged behind inflation, creating a mixed picture for consumer spending power.

Fluctuations in the cost of raw materials and global supply chain disruptions significantly impact AAC Technologies' manufacturing expenses and profit margins. For example, the price of key components like rare earth elements, essential for acoustic components and MEMS, can be highly volatile.

Geopolitical tensions, such as those experienced in 2023-2024 impacting semiconductor supply chains, can lead to export restrictions or increased shipping costs for critical materials. This directly affects production costs for AAC Technologies, potentially squeezing profit margins.

Efficient supply chain management and the diversification of sourcing are therefore crucial for AAC Technologies to mitigate these economic pressures. By exploring alternative suppliers and optimizing logistics, the company can build resilience against price shocks and availability issues.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for AAC Technologies Holdings, a company with extensive global operations. Fluctuations in major currencies like the US Dollar (USD), Chinese Yuan (RMB), and Euro directly impact its reported financial results by altering the value of foreign currency transactions when converted to its reporting currency. For instance, a stronger USD could reduce the reported revenue from US sales when translated into RMB.

These currency swings also affect the competitiveness of AAC Technologies' products across different international markets. A depreciating RMB, for example, could make its products more expensive for buyers in countries with stronger currencies, potentially dampening demand. Conversely, a strengthening RMB could make imports more affordable, potentially increasing the cost of raw materials sourced from abroad.

As of early 2024, the global currency markets have shown notable volatility. The USD experienced fluctuations against major trading partners, influenced by interest rate differentials and geopolitical events. Similarly, the RMB's performance has been a key consideration for companies with significant China-based operations and sales.

- USD/RMB Exchange Rate: The USD/RMB exchange rate has seen considerable movement, with analysts closely monitoring its trajectory for its impact on trade and corporate earnings. For example, in the first half of 2024, the USD generally strengthened against the RMB, which could pressure companies like AAC Technologies with significant RMB-denominated costs.

- Euro Volatility: The Euro also experienced significant fluctuations in 2024, driven by economic performance in the Eurozone and monetary policy decisions by the European Central Bank. This impacts AAC Technologies' sales and costs within European markets.

- Impact on Profitability: Currency headwinds or tailwinds can materially affect AAC Technologies' reported net income. A stronger home currency (RMB) can erode profits from overseas sales, while a weaker home currency can boost them.

Investment in R&D and Capital Expenditure Trends

Industry-wide investments in research and development (R&D) and capital expenditure are strong indicators of expected future growth and technological progress. A significant majority, over 65% of electronics companies globally, boosted their R&D spending in both 2023 and 2024. This increased investment is primarily directed towards key areas like artificial intelligence (AI), the Internet of Things (IoT), and the development of more sustainable products.

These trends present considerable opportunities for AAC Technologies to drive innovation and broaden its market reach. The company itself demonstrates a commitment to advancement by allocating over 7% of its annual revenue to R&D initiatives. This strategic focus positions AAC Technologies to capitalize on emerging technologies and evolving consumer demands.

- Increased R&D Spending: Over 65% of global electronics firms raised R&D budgets in 2023-2024.

- Focus Areas: Key investment areas include AI, IoT, and sustainable product development.

- AAC Technologies' Commitment: The company invests more than 7% of its annual revenue in R&D.

- Opportunity for Growth: These trends signal potential for AAC Technologies to innovate and expand its offerings.

Economic factors significantly influence AAC Technologies' performance, with consumer spending on electronics, a key market driver, projected to reach $977 billion in 2025 and $1.25 trillion by 2034. However, persistent inflation and economic uncertainty, with inflation rates remaining elevated in early 2024, have tempered consumer demand for components. While a gradual recovery in consumer spending is anticipated, it directly impacts sales volumes and pricing power, as seen in cautious consumer confidence levels in late 2024.

Fluctuations in raw material costs and supply chain disruptions also pose challenges, with volatile prices for rare earth elements impacting manufacturing expenses. Geopolitical tensions, such as those affecting semiconductor supply chains in 2023-2024, can further increase costs through export restrictions or higher shipping fees. Currency exchange rate volatility, particularly concerning the USD, RMB, and Euro, directly affects AAC Technologies' reported financial results and product competitiveness in global markets, with the USD generally strengthening against the RMB in the first half of 2024.

Industry-wide R&D spending has increased, with over 65% of electronics companies boosting their budgets in 2023-2024 to focus on AI, IoT, and sustainability. AAC Technologies' commitment to innovation is evident in its allocation of over 7% of annual revenue to R&D, positioning it to capitalize on these technological advancements and evolving consumer demands.

| Economic Factor | 2024/2025 Data/Projection | Impact on AAC Technologies |

|---|---|---|

| Global Consumer Electronics Market Size | Projected $977 billion (2025) | Directly drives demand for AAC's components. |

| Inflation Rates (Major Markets) | Elevated in early 2024, moderating but still a concern. | Reduces consumer disposable income, impacting electronics purchases. |

| Consumer Confidence | Recovering gradually from earlier dips (late 2024). | Affects discretionary spending on new gadgets. |

| Key Material Costs (e.g., Rare Earth Elements) | Volatile pricing. | Impacts manufacturing expenses and profit margins. |

| USD/RMB Exchange Rate | USD generally strengthened vs. RMB (H1 2024). | Affects reported revenue and cost of goods sold. |

| R&D Investment (Electronics Industry) | Over 65% of firms increased spending (2023-2024). | Creates opportunities for innovation and new product development. |

Same Document Delivered

AAC Technologies Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of AAC Technologies Holdings. This includes detailed insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. You'll gain a clear understanding of the external forces shaping AAC Technologies' market landscape.

Sociological factors

Consumer preferences are increasingly leaning towards sophisticated smart devices and interconnected ecosystems, which directly fuels the demand for advanced components like those manufactured by AAC Technologies. This shift signifies a move towards integrated digital experiences, where performance and functionality are paramount.

The widespread adoption of 5G technology in smartphones, a trend accelerating into 2024 and 2025, coupled with the integration of AI-powered features, is creating a significant need for higher-performance components. For instance, the global 5G smartphone shipments are projected to exceed 1.5 billion units by the end of 2024, a substantial increase that requires more capable internal hardware.

AAC Technologies' strategic focus on acoustics, haptics, and optical solutions is well-aligned with these evolving consumer demands. The company's expertise in areas like advanced speaker systems and sophisticated haptic feedback mechanisms directly addresses the desire for richer, more immersive user experiences in the latest mobile devices.

Consumers are increasingly prioritizing personal health and wellness, driving a strong demand for sophisticated health-tracking technology. This sociological shift is evident in the booming market for wearables equipped with advanced sensors and functionalities, a trend that accelerated significantly through 2024 and is projected to continue its upward trajectory into 2025.

AAC Technologies Holdings, with its core competency in micro-electromechanical systems (MEMS) and sensor technology, is ideally positioned to benefit from this growing market. The company's ability to produce high-quality, miniaturized sensors directly addresses the need for components in smartwatches, fitness trackers, and other health-monitoring devices, which saw global sales surge past 100 million units in 2024.

This demand isn't confined to consumer gadgets; it's expanding into the specialized healthcare sector. The integration of advanced sensors into medical devices for remote patient monitoring and diagnostics represents a key growth area. For instance, the market for remote patient monitoring devices alone was valued at over $25 billion in 2024, with wearable sensor technology being a critical enabler.

Social media and online reviews significantly shape consumer choices in the electronics market. Platforms like TikTok and Instagram set trends, driving demand for specific features, which in turn affects component suppliers like AAC Technologies. For instance, the growing popularity of foldable phones, heavily promoted on social media, necessitates advanced hinge and display components, a market AAC is positioned to serve.

A company's online reputation, built on product quality and innovation, directly impacts sales. Positive reviews and influencer endorsements for devices using AAC's acoustic solutions, like advanced speaker modules in flagship smartphones, can boost demand. Conversely, negative feedback about audio quality or durability can indirectly harm AAC's standing with its OEM clients, impacting future orders.

Brand perception, often curated through digital channels, plays a crucial role. As of Q1 2024, consumer electronics brands that consistently receive high ratings for user experience, often tied to audio and haptic feedback provided by components, see an average 15% higher market share in their respective segments. This highlights the indirect but vital influence of customer satisfaction with the end product on component manufacturers.

Ethical Consumerism and Brand Image

Growing consumer awareness about ethical sourcing and fair labor practices significantly impacts brand loyalty. For example, a 2024 survey indicated that 65% of consumers consider a company's ethical practices when making purchasing decisions, a notable increase from previous years. This trend directly affects component suppliers like AAC Technologies, as their clients increasingly scrutinize the entire supply chain for ethical compliance.

Companies are under immense pressure to showcase robust Environmental, Social, and Governance (ESG) performance to attract and retain ethically conscious consumers and maintain a positive brand image. By 2025, it’s projected that ESG investing will account for over $30 trillion in assets under management globally, highlighting the financial imperative behind ethical operations. For AAC Technologies, demonstrating strong ESG credentials is not just about corporate responsibility but also a critical business strategy for market competitiveness.

The emphasis on ethical consumerism means that brands must be transparent about their supply chains. This includes how components are manufactured and the conditions under which workers operate. Companies that fail to meet these expectations risk significant reputational damage and loss of market share. For instance, in early 2024, several major electronics brands faced consumer backlash due to unverified labor practices within their component supply chains, leading to immediate drops in stock value.

- Consumer Demand: A 2024 report found that 70% of millennials and Gen Z prioritize sustainability and ethical production when choosing brands, directly influencing demand for ethically sourced components.

- Supply Chain Scrutiny: Major electronics manufacturers are increasing their audits of suppliers, with a focus on labor rights and environmental impact, making ESG compliance a prerequisite for partnerships.

- Brand Reputation: Companies with strong ESG ratings, like those recognized by the Dow Jones Sustainability Index, often exhibit higher stock performance and greater consumer trust.

- Regulatory Trends: Emerging legislation in regions like the EU is mandating greater supply chain transparency regarding human rights and environmental due diligence, pushing companies to adopt more ethical practices.

Remote Work and Education Driven Device Demand

The enduring shift towards remote work and online learning has undeniably boosted demand for personal computing devices. This trend has translated into substantial sales increases for laptops, tablets, and essential peripherals like webcams. For instance, global tablet shipments saw a notable increase in late 2023 and early 2024, with IDC reporting a 1.7% year-over-year growth in Q4 2023, reaching 47.1 million units, indicating a sustained, albeit moderated, interest in these devices.

This persistent demand for devices used for productivity and communication directly benefits companies like AAC Technologies, which supply crucial components. The market for these devices remains strong as hybrid work models become more ingrained in corporate culture and educational institutions continue to offer flexible learning options. As of early 2024, the global PC market, encompassing laptops, continued to show signs of recovery, with shipments increasing by 3.4% in the first quarter of 2024 compared to the same period in 2023, according to Canalys, underscoring the ongoing need for these devices.

The sociological acceptance and integration of remote and hybrid arrangements mean that the need for reliable and efficient personal technology is not a fleeting trend but a long-term societal adaptation. This creates a stable and growing market for AAC Technologies' offerings, particularly in areas such as acoustic components for laptops and tablets.

Key implications for AAC Technologies include:

- Sustained demand for acoustic components: As more people rely on laptops and tablets for work and education, the need for high-quality speakers and microphones within these devices remains consistent.

- Growth in webcam and audio accessory markets: The ongoing need for clear communication in virtual settings drives demand for integrated and external webcams and audio solutions.

- Hybrid work model normalization: The widespread adoption of hybrid and remote work means that the device upgrade cycle for employees working from home is likely to continue.

- Educational technology investment: Schools and universities continue to invest in technology to support online and blended learning, further bolstering demand for educational devices.

Consumer preferences are increasingly leaning towards sophisticated smart devices and interconnected ecosystems, which directly fuels the demand for advanced components like those manufactured by AAC Technologies. This shift signifies a move towards integrated digital experiences, where performance and functionality are paramount.

The widespread adoption of 5G technology in smartphones, a trend accelerating into 2024 and 2025, coupled with the integration of AI-powered features, is creating a significant need for higher-performance components. For instance, the global 5G smartphone shipments are projected to exceed 1.5 billion units by the end of 2024, a substantial increase that requires more capable internal hardware.

AAC Technologies' strategic focus on acoustics, haptics, and optical solutions is well-aligned with these evolving consumer demands. The company's expertise in areas like advanced speaker systems and sophisticated haptic feedback mechanisms directly addresses the desire for richer, more immersive user experiences in the latest mobile devices.

Consumers are increasingly prioritizing personal health and wellness, driving a strong demand for sophisticated health-tracking technology. This sociological shift is evident in the booming market for wearables equipped with advanced sensors and functionalities, a trend that accelerated significantly through 2024 and is projected to continue its upward trajectory into 2025.

AAC Technologies Holdings, with its core competency in micro-electromechanical systems (MEMS) and sensor technology, is ideally positioned to benefit from this growing market. The company's ability to produce high-quality, miniaturized sensors directly addresses the need for components in smartwatches, fitness trackers, and other health-monitoring devices, which saw global sales surge past 100 million units in 2024.

This demand isn't confined to consumer gadgets; it's expanding into the specialized healthcare sector. The integration of advanced sensors into medical devices for remote patient monitoring and diagnostics represents a key growth area. For instance, the market for remote patient monitoring devices alone was valued at over $25 billion in 2024, with wearable sensor technology being a critical enabler.

Social media and online reviews significantly shape consumer choices in the electronics market. Platforms like TikTok and Instagram set trends, driving demand for specific features, which in turn affects component suppliers like AAC Technologies. For instance, the growing popularity of foldable phones, heavily promoted on social media, necessitates advanced hinge and display components, a market AAC is positioned to serve.

A company's online reputation, built on product quality and innovation, directly impacts sales. Positive reviews and influencer endorsements for devices using AAC's acoustic solutions, like advanced speaker modules in flagship smartphones, can boost demand. Conversely, negative feedback about audio quality or durability can indirectly harm AAC's standing with its OEM clients, impacting future orders.

Brand perception, often curated through digital channels, plays a crucial role. As of Q1 2024, consumer electronics brands that consistently receive high ratings for user experience, often tied to audio and haptic feedback provided by components, see an average 15% higher market share in their respective segments. This highlights the indirect but vital influence of customer satisfaction with the end product on component manufacturers.

Growing consumer awareness about ethical sourcing and fair labor practices significantly impacts brand loyalty. For example, a 2024 survey indicated that 65% of consumers consider a company's ethical practices when making purchasing decisions, a notable increase from previous years. This trend directly affects component suppliers like AAC Technologies, as their clients increasingly scrutinize the entire supply chain for ethical compliance.

Companies are under immense pressure to showcase robust Environmental, Social, and Governance (ESG) performance to attract and retain ethically conscious consumers and maintain a positive brand image. By 2025, it’s projected that ESG investing will account for over $30 trillion in assets under management globally, highlighting the financial imperative behind ethical operations. For AAC Technologies, demonstrating strong ESG credentials is not just about corporate responsibility but also a critical business strategy for market competitiveness.

The emphasis on ethical consumerism means that brands must be transparent about their supply chains. This includes how components are manufactured and the conditions under which workers operate. Companies that fail to meet these expectations risk significant reputational damage and loss of market share. For instance, in early 2024, several major electronics brands faced consumer backlash due to unverified labor practices within their component supply chains, leading to immediate drops in stock value.

- Consumer Demand: A 2024 report found that 70% of millennials and Gen Z prioritize sustainability and ethical production when choosing brands, directly influencing demand for ethically sourced components.

- Supply Chain Scrutiny: Major electronics manufacturers are increasing their audits of suppliers, with a focus on labor rights and environmental impact, making ESG compliance a prerequisite for partnerships.

- Brand Reputation: Companies with strong ESG ratings, like those recognized by the Dow Jones Sustainability Index, often exhibit higher stock performance and greater consumer trust.

- Regulatory Trends: Emerging legislation in regions like the EU is mandating greater supply chain transparency regarding human rights and environmental due diligence, pushing companies to adopt more ethical practices.

The enduring shift towards remote work and online learning has undeniably boosted demand for personal computing devices. This trend has translated into substantial sales increases for laptops, tablets, and essential peripherals like webcams. For instance, global tablet shipments saw a notable increase in late 2023 and early 2024, with IDC reporting a 1.7% year-over-year growth in Q4 2023, reaching 47.1 million units, indicating a sustained, albeit moderated, interest in these devices.

This persistent demand for devices used for productivity and communication directly benefits companies like AAC Technologies, which supply crucial components. The market for these devices remains strong as hybrid work models become more ingrained in corporate culture and educational institutions continue to offer flexible learning options. As of early 2024, the global PC market, encompassing laptops, continued to show signs of recovery, with shipments increasing by 3.4% in the first quarter of 2024 compared to the same period in 2023, according to Canalys, underscoring the ongoing need for these devices.

The sociological acceptance and integration of remote and hybrid arrangements mean that the need for reliable and efficient personal technology is not a fleeting trend but a long-term societal adaptation. This creates a stable and growing market for AAC Technologies' offerings, particularly in areas such as acoustic components for laptops and tablets.

Key implications for AAC Technologies include:

- Sustained demand for acoustic components: As more people rely on laptops and tablets for work and education, the need for high-quality speakers and microphones within these devices remains consistent.

- Growth in webcam and audio accessory markets: The ongoing need for clear communication in virtual settings drives demand for integrated and external webcams and audio solutions.

- Hybrid work model normalization: The widespread adoption of hybrid and remote work means that the device upgrade cycle for employees working from home is likely to continue.

- Educational technology investment: Schools and universities continue to invest in technology to support online and blended learning, further bolstering demand for educational devices.

The increasing importance of social responsibility and sustainability among consumers directly impacts the electronics industry. By 2025, it is estimated that over 70% of consumers will consider a brand's environmental and social impact when making purchasing decisions, a significant rise from previous years. This societal shift compels manufacturers, and by extension their component suppliers like AAC Technologies, to adopt more ethical and sustainable practices throughout their operations.

For AAC Technologies, this translates to a need for greater transparency in their supply chain and a commitment to responsible manufacturing. Brands are increasingly scrutinizing their partners for adherence to labor standards and environmental regulations. For example, in 2024, several major tech companies publicly committed to achieving carbon neutrality in their supply chains by 2030, setting a clear expectation for their component providers.

The growing emphasis on ethical consumerism means that companies with strong ESG credentials can gain a competitive advantage. A 2024 report by Morningstar indicated that ESG-focused funds outperformed their conventional counterparts by an average of 1.5% in the preceding year. This financial incentive underscores the business imperative for AAC Technologies to align its operations with societal values, enhancing brand reputation and market appeal.

The evolving societal attitude towards mental well-being and digital detox is also shaping consumer electronics. While demand for connected devices remains high, there is a growing segment of consumers seeking technology that supports mindfulness and reduces screen time. This could indirectly influence the types of components and features that are prioritized in future device designs.

| Sociological Factor | Description | Impact on AAC Technologies | Supporting Data (2024-2025) |

|---|---|---|---|

| Consumer Demand for Sophistication | Preference for advanced smart devices and integrated digital experiences. | Drives demand for high-performance acoustic, haptic, and optical components. | Global 5G smartphone shipments projected to exceed 1.5 billion units by end of 2024. |

| Health and Wellness Trends | Increased focus on personal health tracking and wearable technology. | Boosts demand for MEMS and sensor technology for health-monitoring devices. | Global wearable sensor market valued over $25 billion in 2024; wearable sales surpassed 100 million units in 2024. |

| Social Media Influence | Platforms shaping consumer choices and driving demand for new features. | Influences demand for components supporting trending device types like foldables. | Foldable phone popularity, heavily promoted on social media, requires advanced components. |

| Ethical Consumerism & ESG | Consumer prioritization of sustainability, fair labor, and ethical sourcing. | Requires transparent supply chains and ethical manufacturing practices; impacts client partnerships. | 65% of consumers consider ethical practices in 2024; ESG investing projected to exceed $30 trillion globally by 2025. |

| Remote Work Normalization | Shift towards hybrid and remote work models. | Sustains demand for reliable personal computing devices and their components. | Global PC market shipments increased 3.4% in Q1 2024 YoY; tablet shipments grew 1.7% in Q4 2023 YoY. |

Technological factors

AAC Technologies Holdings is deeply influenced by the relentless miniaturization trend in consumer electronics. This push for slimmer, more powerful devices is a core driver for their business, demanding constant innovation in component design.

The company’s strength lies in its ability to create compact acoustic components, haptic feedback systems, and MEMS, enabling the integration of more features into ever-smaller device footprints. This expertise is crucial for staying competitive.

For instance, the smartphone market, a key sector for AAC, saw average thickness reduction trends from around 8.5mm in 2020 to closer to 7.5mm by early 2024, showcasing the practical impact of miniaturization.

This ongoing miniaturization directly translates to AAC's product development cycles, where achieving greater functionality within smaller volumes is paramount for maintaining market leadership and meeting evolving consumer expectations for sleeker gadgets.

AAC Technologies is at the forefront of technological innovation, particularly in acoustic and haptic solutions. The company is developing advanced microphones designed to significantly improve the performance of AI assistants, boasting higher signal-to-noise ratios for clearer voice capture. This focus on superior audio quality is crucial as AI integration becomes more pervasive across devices.

Furthermore, AAC is pushing the boundaries of haptic feedback technology. Their work on sophisticated actuators and rendering technologies aims to create more realistic and immersive sensory experiences for users. This is particularly relevant for the burgeoning markets of smartphones, wearables, and automotive interiors, where nuanced physical feedback enhances user interaction.

The demand for enhanced sensory experiences is growing, with the global haptics market projected to reach approximately $20.8 billion by 2027, according to some industry analyses. AAC's investment in these areas positions them to capitalize on this trend, offering differentiated product features that appeal to consumers seeking more engaging and intuitive device interactions.

AAC Technologies is pushing forward with its optical solutions, particularly in plastic and hybrid lenses, and sophisticated camera modules for smartphones, with a clear emphasis on premium market segments. This focus is evident as the smartphone industry continues to demand higher resolution and more advanced imaging capabilities.

The company is also heavily investing in sensing solutions and MEMS microphones, which are crucial for emerging markets like automotive advancements and AI-driven technologies. For instance, the automotive sector's increasing reliance on advanced driver-assistance systems (ADAS) directly fuels the demand for these sophisticated sensing components.

Emergence of AI and IoT-Enabled Devices

The rapid expansion of artificial intelligence (AI) and Internet of Things (IoT) enabled devices presents a significant technological driver for AAC Technologies. AI's growing integration into everyday products, from smartphones to smart appliances, necessitates advanced acoustic components and sensors, directly benefiting AAC's core competencies. For instance, the demand for sophisticated microphones capable of clear voice command recognition in AI-powered devices is surging, a key area for AAC. This trend is further amplified by the increasing complexity of IoT ecosystems, where devices communicate and interact, requiring precise and reliable electro-acoustic and mechatronic solutions that AAC is well-positioned to supply.

The market for AI and IoT devices is experiencing substantial growth, creating a robust demand pipeline for AAC's offerings. By 2024, the global IoT market was projected to reach over $1.6 trillion, with AI playing a pivotal role in its functionality and adoption. This growth translates into a direct need for the high-quality acoustic components, sensors, and precision-engineered parts that AAC Technologies specializes in producing. The company's ability to adapt and innovate within these rapidly evolving technological landscapes is crucial for capturing this expanding market opportunity.

- AI in Smartphones: Enhanced microphones and audio processing capabilities are essential for AI-driven features like voice assistants and noise cancellation, driving demand for AAC's acoustic solutions.

- Smart Home Devices: The proliferation of smart speakers, thermostats, and security systems relies heavily on advanced sensors and acoustic components, aligning with AAC's product portfolio.

- Robotics and Automation: AI-powered robots require sophisticated sensors for navigation, object recognition, and human interaction, creating opportunities for AAC's precision mechanics and sensor integration.

- IoT Connectivity: The interconnected nature of IoT devices necessitates reliable and high-performance components, including micro-speakers and actuators, which are key product categories for AAC.

Investments in R&D and Patent Portfolio Expansion

AAC Technologies Holdings shows a serious dedication to staying ahead technologically. They consistently put more than 7% of their yearly income back into research and development. This focus has helped them build an impressive portfolio, boasting over 7,800 patents and pending patent applications.

This ongoing investment in R&D is crucial for AAC Technologies to innovate and broaden its technological reach. By fostering collaborations and making strategic acquisitions, such as the one with Premium Sound Solutions, the company strengthens its capabilities. These efforts are particularly important for developing advanced solutions in rapidly evolving sectors like automotive technology and robotics.

- R&D Investment: Over 7% of annual revenue dedicated to research and development.

- Patent Portfolio: Holds more than 7,800 patents and patent applications.

- Strategic Acquisitions: Includes Premium Sound Solutions to enhance technological offerings.

- Application Expansion: Focus on automotive and robotics sectors.

AAC Technologies Holdings is heavily invested in advancing acoustic and haptic technologies, critical for the burgeoning AI and IoT markets. The company's commitment to R&D, dedicating over 7% of annual revenue, is key to developing sophisticated components like high-performance microphones for AI assistants and advanced actuators for immersive haptic feedback.

This technological focus is evident in their substantial patent portfolio, exceeding 7,800 patents and applications, underscoring their innovation in areas like miniaturization and precision engineering. For instance, the smartphone industry's push towards thinner devices, with average thicknesses decreasing to around 7.5mm by early 2024, highlights the practical demand for AAC's compact solutions.

The rapid growth of AI and IoT devices, with the global IoT market projected to surpass $1.6 trillion in 2024, directly fuels the need for AAC's specialized offerings. Their strategic acquisitions, such as Premium Sound Solutions, further bolster their capabilities in these high-growth sectors.

AAC's technological advancements are particularly relevant to the automotive sector's increasing adoption of advanced driver-assistance systems (ADAS), which rely on sophisticated sensing components. Their work on optical solutions, including premium camera modules for smartphones, also addresses the industry's demand for enhanced imaging capabilities.

Legal factors

Intellectual property (IP) is incredibly important for AAC Technologies, given its business in acoustics and electronics, where innovation is key. Protecting their vast patent portfolio, which boasts over 7,800 patents as of early 2024, is crucial for maintaining their competitive edge and preventing others from copying their designs and technologies. Legal battles over patent infringement can be costly and disruptive, impacting R&D investments and market share.

Recent trends in intellectual property law, particularly concerning advancements in artificial intelligence (AI) and sophisticated digital design processes, directly influence how AAC Technologies secures and defends its innovations. Staying ahead of evolving patent regulations and successfully navigating potential infringement claims is essential for their continued growth and ability to bring new products to market, especially as the tech landscape rapidly changes.

AAC Technologies Holdings must meticulously adhere to a complex web of international product safety and quality regulations. This is particularly critical given the sensitive nature of components supplied for consumer electronics, automotive systems, and healthcare devices. Failure to comply can lead to significant financial penalties and reputational damage.

Compliance ensures that AAC's products are reliable and free from defects, directly safeguarding end-users. For instance, the European Union's General Product Safety Regulation (GPSR), implemented in December 2024, imposes stricter requirements on manufacturers, including enhanced traceability and risk assessment for all products placed on the market. This necessitates robust internal testing protocols and adherence to various regional manufacturing standards across AAC's global operations.

Data privacy and cybersecurity laws are becoming increasingly critical as components like those from AAC Technologies are integrated into smart devices and connected ecosystems. Regulations such as the EU's General Data Protection Regulation (GDPR) and similar frameworks globally directly impact how data is handled. For AAC Technologies, this means their clients, who build the end-user devices, must adhere to these stringent rules.

While AAC Technologies is a component supplier, its customers' need to comply with these data privacy and cybersecurity mandates can significantly influence design specifications. For instance, there might be a growing demand for hardware features that inherently support secure data handling or encryption. Failing to meet these evolving regulatory demands could impact the marketability and adoption of their clients' products, indirectly affecting AAC's component sales.

The global cybersecurity market is projected to reach $345.2 billion by 2026, indicating a substantial focus on security measures. This trend suggests that component manufacturers like AAC Technologies will likely see increased pressure from their clients to incorporate security-by-design principles into their offerings, ensuring that the hardware itself contributes to robust data protection. This also extends to supply chain security, as breaches can originate at any point.

Supply Chain Due Diligence Directives

New legal frameworks, like the EU's Corporate Sustainability Due Diligence Directive (CSDDD), are increasingly mandating robust supply chain oversight. This directive, which came into effect in early 2024 and will be fully applicable by 2027, compels companies to actively identify and address human rights and environmental risks across their entire value chains. For AAC Technologies, with its extensive global manufacturing operations, compliance means a thorough review of supplier practices, impacting everything from raw material sourcing to product assembly.

Adherence to these directives necessitates a proactive approach to supplier selection and ongoing monitoring. AAC Technologies must implement rigorous vetting processes to ensure partners align with sustainability and ethical labor standards. This includes enhanced due diligence, audits, and potentially contractual obligations that reinforce responsible business conduct throughout the supply network. Failure to comply could result in significant penalties and reputational damage.

- EU CSDDD Enforcement: The CSDDD, applicable to large EU companies and certain non-EU firms operating within the EU, requires mandatory human rights and environmental due diligence.

- Supply Chain Transparency: Companies are expected to map their entire supply chain, identify potential adverse impacts, and implement measures to prevent or mitigate them.

- Supplier Audits and Certifications: AAC Technologies will likely need to increase the frequency and depth of supplier audits and may prioritize suppliers with recognized certifications for ethical and sustainable practices.

- Impact on Sourcing Decisions: The directives will influence sourcing strategies, potentially leading to higher costs for compliant materials or a shift towards suppliers located in regions with stronger regulatory frameworks.

Environmental Compliance and Reporting Laws

Environmental compliance is a significant legal factor for AAC Technologies. The company must navigate increasingly stringent regulations concerning hazardous substances, such as the EU's Restriction of Hazardous Substances (RoHS) directive and evolving restrictions on per- and polyfluoroalkyl substances (PFAS). Furthermore, laws governing electronic waste (e-waste) management require careful attention to product lifecycles and disposal practices. Failure to comply can result in substantial fines and reputational damage, impacting market access and investor confidence. For instance, in 2023, the EU continued to strengthen its PFAS regulations, impacting a wide range of industrial applications, including those in the electronics sector.

AAC Technologies is obligated to maintain transparency by reporting on its environmental performance. This includes detailed disclosures on emissions, water usage, and waste management strategies. Such reporting is not merely a legal requirement but also influences operational decisions, pushing the company to adopt more sustainable material sourcing and manufacturing processes. For example, the growing emphasis on circular economy principles within environmental legislation encourages manufacturers to design for recyclability and durability, directly affecting component selection and production techniques.

- RoHS Directive Compliance: Ensuring all products meet the substance restrictions set forth by the EU and similar global regulations.

- E-waste Management: Adhering to national and international laws regarding the collection, recycling, and disposal of electronic waste.

- PFAS Restrictions: Monitoring and adapting to new regulations limiting the use of specific PFAS chemicals in manufacturing processes.

- Environmental Reporting: Providing accurate and timely reports on emissions, waste generation, and overall environmental impact.

AAC Technologies must navigate a complex landscape of international trade laws and customs regulations. Compliance with export controls and sanctions, especially concerning advanced electronics, is paramount to avoid severe penalties. Changes in trade agreements or tariffs, such as those impacting global semiconductor supply chains, can directly influence procurement costs and market access for AAC's components.

The company's adherence to labor laws, including fair wages, working conditions, and anti-discrimination policies across its global operations, is a critical legal consideration. Increasingly, legislation like the UK's Modern Slavery Act and similar global initiatives demand robust due diligence in supply chains to prevent forced labor. Failure to comply can lead to significant legal repercussions, reputational damage, and loss of business opportunities.

Contract law forms the bedrock of AAC Technologies' business relationships, governing agreements with suppliers, customers, and partners. Ensuring all contracts are legally sound, clearly define terms, and are enforceable globally is vital. Disputes arising from contract breaches can be costly and time-consuming, potentially impacting project timelines and financial stability. For instance, in 2024, many businesses are reviewing their force majeure clauses due to geopolitical instability and supply chain disruptions.

Environmental factors

AAC Technologies is making significant strides in reducing its environmental footprint, aiming for 75% clean energy consumption at its main facilities by 2030. This aligns with broader global objectives, including China's 2060 carbon neutrality pledge and the EU's 2050 net-zero target, demonstrating a commitment to sustainable operations.

These ambitious decarbonization goals are a key driver for substantial investments in energy-efficient technologies and the increased integration of renewable energy sources throughout AAC Technologies' manufacturing plants. This strategic focus is crucial for meeting both regulatory expectations and growing market demand for environmentally conscious products.

The electronics sector is under growing pressure to embrace circular economy models, prioritizing waste reduction, recyclability, and product longevity. AAC Technologies is actively working towards high waste diversion rates at its major facilities, demonstrating a dedication to sustainable production processes.

This commitment is crucial as regulations like the EU's Ecodesign for Sustainable Products Regulation (ESPR) continue to shape industry expectations. For instance, the ESPR, which began its phased implementation in 2024, mandates stricter requirements for product durability, repairability, and recyclability, directly impacting how companies like AAC Technologies design and manage their product lifecycles.

The responsible sourcing of raw materials, particularly concerning conflict minerals and environmental impact, is a significant focus for AAC Technologies. In 2024, the company continued its commitment to evaluating suppliers against stringent environmental criteria, aiming for greater supply chain transparency. This proactive approach helps mitigate risks tied to unethical or environmentally detrimental sourcing practices, aligning with increasing global expectations for corporate environmental stewardship.

Water Resource Management

Water scarcity and the responsible use of water are paramount environmental concerns for manufacturing companies like AAC Technologies. The company is actively investigating and implementing reclaimed and reusable water systems across its facilities to significantly reduce its overall water consumption. This focus on efficient water management is a key aspect of its environmental stewardship strategy.

AAC Technologies' commitment to water resource management is reflected in its efforts to adopt innovative solutions. For example, in 2023, the company reported a reduction in freshwater withdrawal intensity by 5% compared to the previous year, a direct result of increased water recycling initiatives. This demonstrates a tangible step towards minimizing environmental impact.

- Water Scarcity Impact: Increasing global water stress, particularly in manufacturing hubs, poses operational risks and potential cost increases for water acquisition and treatment.

- Reclaimed Water Adoption: AAC Technologies is prioritizing the integration of advanced filtration and treatment technologies to enable higher rates of water reuse in production processes.

- Efficiency Metrics: The company aims to further decrease its water footprint by an additional 7% by the end of 2025, targeting specific high-usage processes for optimization.

- Regulatory Compliance: Adhering to stringent water discharge regulations and promoting water conservation aligns with evolving environmental policies and corporate social responsibility expectations.

Compliance with Environmental Regulations (e.g., RoHS, REACH)

AAC Technologies must strictly adhere to global environmental regulations like the EU's RoHS Directive and REACH. These rules limit hazardous substances in electronic components, directly influencing product design and material choices. For instance, RoHS restricts the use of lead, mercury, and cadmium, impacting the sourcing of components and manufacturing processes for AAC Technologies' acoustic and electro-mechanical products. Failure to comply can result in significant fines and market exclusion, especially in key export regions.

The impact of these regulations extends to the entire supply chain. AAC Technologies needs robust systems to track and verify the compliance of all raw materials and components. In 2024, the global electronics industry saw increased scrutiny on supply chain transparency, with reports highlighting challenges in fully mapping the chemical composition of complex electronic assemblies. By ensuring compliance, AAC Technologies safeguards its market access and strengthens its reputation as an environmentally responsible manufacturer.

- RoHS Compliance: Restricts the use of specific hazardous substances in electrical and electronic equipment.

- REACH Compliance: Requires registration, evaluation, authorization, and restriction of chemicals, impacting material sourcing.

- Market Access: Non-compliance can lead to exclusion from major international markets, particularly in Europe.

- Supply Chain Management: necessitates rigorous oversight of material sourcing and component manufacturing for adherence.

Environmental factors significantly influence AAC Technologies' operations, pushing for sustainable practices in energy, water, and waste management. The company's goal of 75% clean energy at main facilities by 2030 aligns with global climate targets like China's 2060 carbon neutrality pledge.

These environmental efforts are driven by regulations and market demand for eco-friendly products, requiring substantial investment in renewable energy and efficient technologies. The electronics sector's push towards circular economy models, emphasizing waste reduction and recyclability, directly impacts AAC Technologies' production processes.

The EU's Ecodesign for Sustainable Products Regulation (ESPR), implemented in phases from 2024, sets stricter standards for product durability and repairability, compelling companies like AAC Technologies to rethink product lifecycles.

Responsible raw material sourcing is also critical, with AAC Technologies evaluating suppliers on environmental criteria to ensure supply chain transparency and mitigate risks associated with unethical sourcing. This proactive stance is essential for meeting growing global expectations for corporate environmental stewardship.

PESTLE Analysis Data Sources

Our PESTLE analysis for AAC Technologies Holdings is built on a robust foundation of official government publications, reports from reputable financial institutions, and comprehensive industry research. We draw insights from global economic data, technological advancement trends, and relevant regulatory updates.