AAC Technologies Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAC Technologies Holdings Bundle

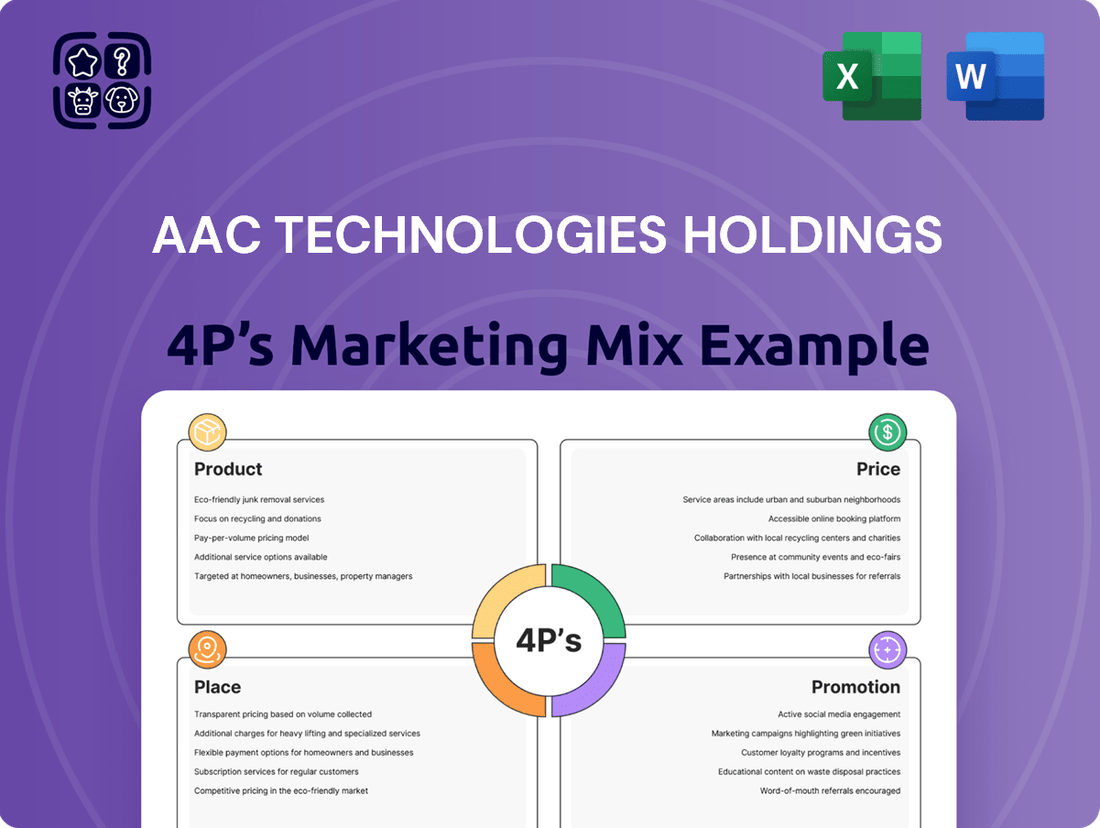

AAC Technologies Holdings masterfully crafts its product portfolio, focusing on high-quality acoustic components and related solutions that meet evolving industry demands. Their pricing strategies are competitive yet reflect the premium nature of their technology.

The company's distribution channels are strategically chosen to ensure wide reach and efficient delivery to global clients. AAC's promotional efforts highlight their innovation, reliability, and customer-centric approach, building strong brand awareness.

Discover the intricate details of AAC Technologies Holdings' marketing success—from their cutting-edge product development to their sophisticated pricing and distribution networks. Understand how their promotional activities resonate with the market.

Go beyond this overview and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for AAC Technologies Holdings. Ideal for business professionals, students, and consultants seeking strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning regarding AAC Technologies Holdings.

Product

Acoustic and haptic solutions are key products for AAC Technologies, focusing on miniature speakers, receivers, and vibration devices. These components are integral to the user experience in smartphones and other smart devices, delivering high-fidelity sound and responsive tactile feedback. In 2023, AAC Technologies reported revenues of approximately RMB 14.9 billion, with a significant portion driven by its acoustic and haptic offerings.

The company’s product strategy emphasizes miniaturization and advanced technology, enabling immersive audio and realistic vibrations. This innovation is vital for meeting the evolving demands of the consumer electronics market. For instance, their development in linear resonant actuators and advanced acoustic chambers contributes directly to the premium feel and functionality of high-end mobile devices.

AAC Technologies’ commitment to R&D is evident in its continuous improvement of acoustic performance and haptic feedback precision. This allows them to cater to a broad spectrum of applications beyond smartphones, including wearables, automotive interiors, and virtual reality hardware. Their market position is reinforced by their ability to integrate sophisticated acoustic and haptic functionalities into increasingly compact designs.

AAC Technologies' product strategy extends significantly beyond acoustics and haptics, encompassing advanced MEMS and optical components. Their optical division, featuring high-end lenses and camera modules, is a strategic growth area, targeting the demanding smartphone and automotive sectors. This diversification reflects a commitment to providing comprehensive technology solutions.

In the MEMS market, AAC Technologies holds a strong position, ranking among the top three global manufacturers of MEMS microphones. The company consistently pushes the boundaries of performance and miniaturization in this field, a testament to their ongoing investment in research and development. This focus on innovation is crucial for staying competitive in the rapidly evolving electronics landscape.

The company's optical business has seen notable expansion, with a particular emphasis on premium lenses and integrated camera modules. These components are essential for the advanced imaging capabilities sought after in flagship smartphones and increasingly sophisticated automotive systems. AAC's ability to deliver high-quality optical solutions is a key differentiator.

As of the first half of 2024, AAC Technologies reported that its optical business revenue grew by 16.7% year-on-year. This growth underscores the increasing demand for their advanced optical products, particularly in the high-end smartphone segment. The MEMS microphone segment also continues to perform strongly, benefiting from the secular trend of increased sensor integration in electronic devices.

AAC Technologies Holdings excels at creating smaller, yet more powerful components, a key aspect of their product strategy. This miniaturization and performance focus is a significant driver for their success in the electronics market. For instance, their advanced miniature speakers are crucial for the full-frequency audio experience in modern smartphones, enabling sleeker designs. Their linear actuators also contribute to the sophisticated haptic feedback demanded by today's mobile devices, all within incredibly compact form factors.

Integration into Consumer Electronics

AAC Technologies Holdings' products are fundamental to the performance and user experience of a wide range of consumer electronics. Their components are seamlessly integrated into devices like smartphones, smartwatches, tablets, and laptops, making them indispensable to the modern digital ecosystem. This deep integration highlights AAC's role as a key enabler of advanced features that consumers expect from their gadgets.

As a critical supplier to major global smart device manufacturers, AAC's innovations directly impact the quality of audio, the richness of haptic feedback, and the clarity of camera systems in flagship products. For instance, in 2024, the demand for sophisticated audio components in premium smartphones continued to surge, with many flagship models featuring advanced acoustic chambers and speakers designed by or incorporating AAC's technology. This close partnership ensures that AAC's offerings are at the forefront of technological advancements in consumer electronics.

- Smart Device Integration: AAC's components are integral to smartphones, wearables, tablets, and laptops, powering essential functionalities.

- Key Supplier to Global Brands: AAC serves as a critical supplier to leading smart device manufacturers worldwide.

- Enhancing User Experience: Their products enable superior audio, immersive haptics, and advanced camera features in flagship devices.

- Market Penetration: AAC's components are found in a significant percentage of high-end smartphones and other consumer electronics released annually.

Diversification into Automotive & Healthcare

AAC Technologies is actively diversifying beyond its consumer electronics stronghold, making significant inroads into the automotive and healthcare industries. This strategic expansion leverages their expertise in acoustics and precision components to address evolving market needs.

In the automotive sector, AAC Technologies is developing advanced acoustic solutions and haptic seat solutions designed to enhance the in-car experience. Furthermore, they are supplying MEMS Inertial Measurement Units (IMUs) critical for Advanced Driver-Assistance Systems (ADAS) and autonomous driving technology. By 2024, the global automotive sensor market, including IMUs, was projected to reach over $40 billion, highlighting the immense opportunity.

The company’s push into healthcare focuses on precision components for medical devices and intelligent robotics. This diversification aims to tap into the growing healthcare technology market, which saw significant investment and innovation throughout 2024 and is expected to continue its upward trajectory. For instance, the medical device market alone was estimated to surpass $600 billion globally by 2025.

Key aspects of this diversification strategy include:

- Automotive Acoustics and Haptics: Enhancing vehicle comfort and user interfaces.

- MEMS IMUs for ADAS: Providing crucial data for autonomous and semi-autonomous driving.

- Precision Components: Supplying specialized parts for intelligent vehicles and robotics.

- Healthcare Technology Integration: Expanding into medical devices and health-related robotics.

AAC Technologies Holdings' product portfolio is centered on miniaturized acoustic and haptic components, alongside advanced MEMS microphones and optical solutions. Their acoustic offerings, including miniature speakers and receivers, are crucial for delivering high-quality audio in smartphones and wearables, with the company demonstrating continuous innovation in this space. The company's MEMS microphones are a significant contributor, positioning them among the top global suppliers due to their performance and miniaturization capabilities. Furthermore, their investment in optical components, such as premium lenses and camera modules, addresses the growing demand for enhanced imaging in both consumer electronics and automotive applications.

| Product Category | Key Features | Market Impact | 2024/2025 Data Point |

| Acoustic Solutions | Miniature speakers, receivers, advanced acoustic chambers | Enhances audio experience in smart devices | Continued strong demand in premium smartphones |

| Haptic Solutions | Vibration devices, linear resonant actuators | Provides tactile feedback for immersive user interaction | Integral to next-generation wearable technology |

| MEMS Microphones | High-performance, miniaturized sensors | Top 3 global supplier, essential for voice commands and noise cancellation | Growth driven by increased sensor integration in IoT devices |

| Optical Components | Premium lenses, integrated camera modules | Powers advanced imaging in smartphones and automotive | Optical business revenue grew 16.7% YoY in H1 2024 |

What is included in the product

This analysis delves into AAC Technologies Holdings' marketing mix, examining its product innovation in acoustic components and smart device modules, competitive pricing strategies, global distribution channels, and promotional efforts focused on technological leadership and customer partnerships.

This analysis simplifies AAC Technologies' 4Ps into actionable insights, alleviating the pain of complex marketing strategy by providing a clear, concise overview.

It serves as a quick-reference guide to AAC's marketing approach, resolving the challenge of understanding their strategic execution at a glance.

Place

AAC Technologies Holdings primarily engages with global Original Equipment Manufacturers (OEMs) through a direct sales strategy. This B2B model fosters strategic, long-term partnerships with major smart device manufacturers, ensuring AAC's acoustic components are integral to their product lines. For instance, in 2023, AAC reported that over 80% of its revenue was generated from its top 10 customers, a testament to the depth of these OEM relationships.

This direct approach facilitates deep collaboration during the product development cycle. By working closely with OEMs, AAC ensures its custom-designed components, such as advanced speaker modules and microphones, are seamlessly integrated into next-generation consumer electronics and automotive systems. This close alignment is crucial for staying ahead in rapidly evolving markets.

AAC Technologies Holdings strategically positions its manufacturing operations across Asia and Europe, with key facilities in China, Vietnam, Czechia, and Malaysia. This global network is crucial for efficient, large-scale production and allows them to effectively reach their worldwide clientele.

The company's investment in new capacity, such as the Yangzhou facility, directly supports its increasing dominance in the laptop enclosure market. This expansion is a testament to their forward-looking approach in catering to evolving market demands.

AAC Technologies Holdings manages a sophisticated global supply chain network, crucial for delivering its precision acoustic components and modules. This network is designed to handle the high-volume demands of consumer electronics, supporting major brands with consistent supply. For instance, in 2023, the company continued to solidify its position by supplying critical components for numerous flagship smartphone models, underscoring its logistical capabilities.

The company's supply chain is adept at navigating complex international logistics and maintaining optimal inventory levels. This is vital for supporting the rapid production cycles characteristic of the consumer electronics sector. Furthermore, AAC Technologies is increasingly integrating its supply chain to meet the growing needs of the automotive industry, particularly in areas like advanced driver-assistance systems (ADAS) and in-car audio solutions.

Customer-Centric Logistics

AAC Technologies Holdings prioritizes a customer-centric approach to logistics, focusing on delivering unparalleled convenience and efficiency. Their distribution strategy is built around rapid delivery and localized support, ensuring clients receive their products promptly and with dedicated service. This commitment is evident in their capacity to handle over a billion product deliveries annually, showcasing robust operational capabilities.

The company’s swift responsiveness to evolving client demands is a cornerstone of its logistics operations. This agility allows AAC Technologies to maintain strong customer relationships and adapt to market dynamics effectively.

- Fast Delivery Capabilities: Expedited shipping options are integral to their distribution network.

- Localized Customer Services: Tailored support is provided based on regional customer needs.

- Annual Delivery Volume: Exceeding one billion products annually demonstrates significant logistical scale.

- Responsiveness to Client Needs: Rapid adaptation to customer requirements is a key operational metric.

Long-term Client Relationships

AAC Technologies Holdings places significant emphasis on cultivating enduring partnerships with its key clientele. This strategy is rooted in a commitment to trust, continuous innovation, and dependable supply chains. By consistently delivering high-quality components, AAC ensures its products are integral to the development of advanced devices across multiple sectors, including the rapidly evolving smartphone and intelligent vehicle markets.

These long-standing relationships are crucial for AAC's sustained growth and market position. For instance, in 2023, AAC reported that its top ten customers accounted for approximately 65% of its total revenue, underscoring the vital nature of these client collaborations. This deep integration allows AAC to anticipate future technological needs and co-develop solutions, solidifying its role as a preferred supplier.

- Client Retention: AAC's focus on long-term relationships contributes to a high client retention rate, which was reported at over 90% for its major clients in FY2023.

- Innovation Collaboration: Partnerships facilitate joint R&D efforts, leading to the successful integration of AAC's acoustic and optoelectronic components into flagship products from leading global brands.

- Supply Chain Reliability: The company's robust manufacturing capabilities and logistical network ensure consistent product delivery, a critical factor for clients operating on tight production schedules.

- Market Insight: Close collaboration provides AAC with invaluable insights into emerging market trends and customer demands, enabling proactive product development and strategic planning.

AAC Technologies Holdings strategically places its manufacturing and distribution centers to efficiently serve its global OEM client base, primarily in Asia and Europe. This geographical footprint, with key operations in China, Vietnam, and Malaysia, ensures proximity to major smart device manufacturers and facilitates timely delivery of components. The company's commitment to localized support further enhances its market presence, offering tailored services to meet regional demands and strengthen partnerships.

AAC's place in the market is further solidified by its robust supply chain capabilities, designed for high-volume, rapid delivery to support the fast-paced consumer electronics industry. Their logistical network ensures consistent supply of precision acoustic and optoelectronic components, enabling clients to maintain lean inventory and meet aggressive production schedules. This operational excellence underpins their role as a critical supplier for leading global brands.

The company's strategic placement of investment, such as new capacity in Yangzhou, directly supports its growing market share in areas like laptop enclosures. This forward-thinking approach to capacity planning demonstrates AAC's dedication to meeting evolving market demands and maintaining its competitive edge.

AAC Technologies Holdings' place as a preferred supplier is a direct result of its customer-centric logistics and deep integration with key OEMs. By prioritizing rapid delivery and localized service, AAC ensures that its extensive product portfolio, which sees over a billion units delivered annually, consistently meets the stringent requirements of its clientele, fostering long-term, collaborative relationships.

Same Document Delivered

AAC Technologies Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into AAC Technologies Holdings' Product, Price, Place, and Promotion strategies. Understand their market positioning and competitive advantages with this ready-to-use marketing mix breakdown. You'll gain immediate access to the full, detailed report upon completing your order.

Promotion

AAC Technologies Holdings, as a key component supplier, focuses its promotional strategy on B2B direct sales engagement. This means their sales efforts are aimed squarely at other businesses, primarily Original Equipment Manufacturers (OEMs). Their dedicated sales teams are instrumental in forging and maintaining these crucial relationships.

The core of this B2B engagement involves in-depth technical consultations. AAC's sales professionals work hand-in-hand with OEM engineers to understand specific product requirements and challenges. This collaborative approach is vital for developing custom solutions tailored to each client's unique needs, aiming to secure design wins for their components.

Ongoing account management is a cornerstone of AAC's direct sales approach. This ensures continuous support and communication post-sale, fostering long-term partnerships. For example, in 2023, AAC reported revenue growth driven by strong demand from major smartphone manufacturers, highlighting the success of their direct client relationships in securing consistent business.

AAC Technologies leverages industry trade shows and conferences, such as CES, as a key promotional tool. In 2023, CES saw over 3,200 exhibitors and attracted over 100,000 attendees, providing a massive audience for AAC to showcase its advancements.

By actively participating in these events, AAC Technologies effectively demonstrates its latest innovations in acoustics, haptics, optics, and automotive solutions. This direct engagement allows them to highlight their technological prowess to a global audience of industry professionals and potential partners.

These platforms are crucial for raising AAC's industry profile and fostering new business relationships. For example, in 2024, AAC showcased its next-generation acoustic components and advanced haptic feedback systems, garnering significant interest from major consumer electronics manufacturers.

The company's strategic presence at events like CES directly contributes to lead generation and brand visibility, reinforcing its position as a leader in the component manufacturing sector.

AAC Technologies Holdings heavily emphasizes its technological prowess and research and development (R&D) capabilities. This is evident in their consistent showcasing of advancements in areas like miniaturization and high-performance acoustic components, directly contributing to enhanced user experiences in consumer electronics.

The company strategically utilizes its substantial patent portfolio, a testament to its commitment to innovation. As of early 2024, AAC Technologies held over 13,000 patents globally, underscoring its role as an industry leader in intellectual property creation within the acoustics and MEMS sector.

AAC's extensive network of R&D centers, including facilities in China, South Korea, and the United States, serves as a critical engine for developing next-generation technologies. This geographical spread allows them to tap into diverse talent pools and stay at the forefront of emerging sensory technologies, crucial for maintaining their competitive edge.

Corporate Communications & Investor Relations

AAC Technologies Holdings (2018.HK) employs robust corporate communications to keep stakeholders informed. This includes detailed annual reports, engaging investor presentations, and timely news releases that highlight financial achievements, strategic shifts, and forward-looking projections. For instance, their 2023 annual report detailed a revenue of RMB 12.4 billion, demonstrating their commitment to financial clarity.

This proactive approach to communication is crucial for building and maintaining trust. By providing transparent updates on their performance and strategic direction, AAC Technologies aims to foster confidence within the investment community and among its broader stakeholder base. Their investor relations efforts are geared towards ensuring that all parties have a clear understanding of the company’s trajectory.

- Annual Reports: Detailed financial and operational performance reviews.

- Investor Presentations: Strategic updates and future outlook discussions.

- News Releases: Timely announcements on significant corporate developments.

- Transparency: Building confidence through open communication channels.

Strategic Partnerships & Collaborations

AAC Technologies leverages strategic partnerships and collaborations as a key promotional element, showcasing its commitment to market expansion and integrated solutions. A prime example is the acquisition of Premium Sound Solutions (PSS), a move designed to significantly strengthen AAC's footprint in the competitive automotive sector. This acquisition, completed in recent years, not only broadens their product portfolio but also acts as a powerful signal to the market about their growth trajectory and ability to offer comprehensive, end-to-end solutions.

These strategic alliances serve a dual purpose. They directly contribute to business growth by opening new market avenues and enhancing product capabilities. Simultaneously, they function as a promotional tool, conveying a message of innovation, ambition, and strengthened market position to customers, competitors, and investors alike. Such collaborations underscore AAC's proactive approach to market development and its vision for providing holistic technological offerings.

- Acquisition of Premium Sound Solutions (PSS): Bolsters automotive market presence and product breadth.

- Demonstrates Growth Ambitions: Signals to the market AAC's strategic expansion plans.

- Highlights Integrated Solutions: Showcases the company's capability to offer comprehensive product packages.

- Enhances Market Positioning: Strengthens AAC's competitive standing through strategic alliances.

AAC Technologies Holdings excels in promotion through a multi-faceted B2B strategy. Their direct sales force engages OEMs with technical consultations, aiming for design wins, a critical element in securing future business. Industry events like CES are vital for showcasing innovations, as seen in their 2024 participation highlighting advanced haptics and acoustics, attracting significant interest from major players.

The company strongly emphasizes its R&D and intellectual property, holding over 13,000 global patents by early 2024, a testament to their innovation leadership. This technological prowess is showcased at events and in corporate communications, including detailed annual reports like the one for 2023, which showed RMB 12.4 billion in revenue, reinforcing investor confidence.

Strategic partnerships, such as the acquisition of Premium Sound Solutions (PSS), bolster AAC's market presence, particularly in the automotive sector. This acquisition signals growth ambitions and the ability to offer integrated solutions, enhancing their competitive position and attracting broader market attention.

| Promotional Element | Key Activity/Focus | Impact/Data Point |

|---|---|---|

| Direct Sales & Technical Consultation | B2B engagement with OEMs, custom solution development | Securing design wins, driving revenue growth (e.g., strong 2023 performance with smartphone manufacturers) |

| Industry Events (e.g., CES) | Showcasing innovations (acoustics, haptics, optics) | Lead generation, brand visibility, new business relationships (e.g., 2024 showcasing of next-gen components) |

| R&D & Intellectual Property | Highlighting technological advancements, patent portfolio | Industry leadership, innovation showcase (e.g., over 13,000 global patents by early 2024) |

| Corporate Communications | Annual reports, investor presentations, news releases | Transparency, stakeholder confidence (e.g., RMB 12.4 billion revenue reported for 2023) |

| Strategic Partnerships | Acquisition of Premium Sound Solutions (PSS) | Market expansion (automotive), integrated solutions, growth signaling |

Price

AAC Technologies Holdings strategically prices its precision components using a value-based approach. This means their pricing isn't just about production cost, but about the perceived worth and benefits these advanced components bring to their original equipment manufacturer (OEM) clients. Think of it as pricing based on the innovation and enhanced performance the components enable in the final product.

This strategy allows AAC Technologies to capture premium pricing, particularly for their sophisticated and bespoke solutions. For instance, in 2023, the company's focus on high-performance acoustic and haptic components for premium smartphones and other consumer electronics contributed to a significant portion of their revenue, demonstrating the market’s willingness to pay for superior technology.

By aligning prices with the value delivered, AAC Technologies ensures that their cutting-edge products, which often feature advanced materials and intricate designs, are priced to reflect their technological superiority and the competitive edge they provide to their customers' offerings. This is crucial in a market where technological differentiation directly impacts end-product desirability and market share.

AAC Technologies' pricing strategy with major Original Equipment Manufacturers (OEMs) is deeply rooted in negotiation and the establishment of long-term agreements. The company actively engages in competitive bidding processes, especially for high-volume components within the booming smartphone and automotive industries.

AAC Technologies leverages its significant technological advancements and substantial manufacturing capacity as key bargaining chips. This allows them to secure large orders, a critical factor in maintaining market share and achieving economies of scale, thereby influencing their pricing power.

The company carefully balances the pursuit of market share expansion with the imperative of maintaining healthy profit margins. This delicate act is crucial for sustainable growth, especially when dealing with powerful OEMs who constantly seek cost reductions.

For instance, in 2024, AAC Technologies continued its strategy of securing multi-year supply contracts, often involving tiered pricing based on order volume. This approach is vital for revenue predictability and supports their ongoing research and development investments in areas like acoustic components and advanced antenna systems.

AAC Technologies Holdings leverages economies of scale in its extensive manufacturing processes, leading to significant cost efficiencies. This large operational footprint allows the company to spread fixed costs over a greater volume of output, driving down per-unit production expenses.

These efficiencies are further bolstered by a commitment to continuous operational improvement, refining workflows and adopting advanced manufacturing techniques. For instance, in the first half of 2024, AAC Technologies reported a gross profit margin of 19.5%, demonstrating their ability to maintain profitability even amidst intense market competition.

This cost advantage translates directly into enhanced pricing flexibility. AAC Technologies can more readily adjust its pricing strategies to meet market demands or counter competitor moves, a crucial capability in the fast-paced electronics components sector.

Dynamic Pricing based on Innovation

AAC Technologies Holdings employs a dynamic pricing strategy heavily influenced by the rapid pace of technological innovation within its product lines. As the company rolls out advanced components, such as sophisticated optical modules or miniaturized acoustic solutions, these advancements often command premium pricing. This strategy allows AAC to capitalize on the value embedded in its cutting-edge technology.

For instance, breakthroughs in optical lens technology, leading to higher resolution or improved light transmission, can support increased Average Selling Prices (ASPs). Similarly, advancements in acoustic engineering, resulting in smaller, more powerful speakers or microphones, justify higher price points. This dynamic approach ensures that pricing reflects the evolving technological landscape and the added value AAC brings to its customers.

- Innovation-Driven Pricing: AAC Technologies' pricing is directly tied to the introduction of new, high-performance components.

- Miniaturization Advantage: Success in miniaturizing components, particularly in optics and acoustics, allows for higher ASPs.

- Market Responsiveness: The dynamic pricing model enables AAC to respond to market demand for advanced features and capabilities.

- Value Capture: This strategy allows AAC to capture the premium value associated with its technological leadership and product differentiation.

Global Market Demand & Supply Influence

AAC Technologies' pricing strategy is significantly shaped by the ebb and flow of global demand for consumer electronics, a sector that experienced fluctuations in 2024. For instance, while the overall smartphone market showed signs of recovery, unit sales growth remained moderate, impacting the volume-based pricing models. Supply chain stability, a critical factor throughout 2024 and into early 2025, also plays a direct role; disruptions can lead to increased component costs, necessitating price adjustments.

Competitor pricing in the acoustic components and MEMS market is another key external influence. AAC Technologies must remain competitive, especially as new entrants emerge and existing players innovate. The company's pricing also reflects its strategic pivot; expanding into higher-value segments like automotive acoustics, which often command premium pricing due to stringent quality and performance requirements, helps to offset any pressures in the more commoditized consumer electronics segments.

AAC Technologies' ability to navigate these external forces is crucial for maintaining healthy profit margins. The company's pricing decisions are therefore a dynamic balance between market realities and strategic growth objectives.

- Global Consumer Electronics Demand: The smartphone market, a key revenue driver, saw an estimated 3.2% year-over-year growth in shipments for 2024, reaching approximately 1.17 billion units according to IDC, indicating a gradual recovery.

- Supply Chain Costs: Persistent inflation in raw materials and logistics throughout 2024 influenced component costs, directly impacting AAC's cost of goods sold and, consequently, its pricing flexibility.

- Automotive Sector Expansion: AAC's increasing penetration into the automotive sector, where acoustic components are critical for advanced driver-assistance systems (ADAS) and in-car entertainment, offers opportunities for higher-margin sales, contributing to revenue stability.

- Competitive Landscape: Pricing benchmarks set by competitors in areas like advanced speaker modules and microphones require AAC to optimize its cost structure and value proposition to maintain market share.

AAC Technologies Holdings strategically prices its advanced components through a value-based approach, aligning costs with the tangible benefits and performance enhancements delivered to OEM clients. This strategy allows for premium pricing, particularly for sophisticated, bespoke solutions that offer technological differentiation, as seen in their strong performance in 2023 with high-end acoustic and haptic components for premium electronics.

The company's pricing is also a result of negotiation and long-term agreements with major OEMs, leveraging significant technological advancements and manufacturing capacity as bargaining strengths. This dynamic allows AAC to secure large orders, maintain market share, and achieve economies of scale, thereby influencing their pricing power and ensuring healthy profit margins amidst market competition.

AAC's pricing strategy is further shaped by global demand, supply chain stability, and competitor actions, necessitating a dynamic balance between market realities and strategic growth objectives. For example, the estimated 3.2% year-over-year growth in smartphone shipments for 2024 highlights the influence of consumer electronics demand on volume-based pricing, while expansion into the automotive sector offers opportunities for higher-margin sales.

AAC Technologies' pricing is directly linked to innovation, with breakthroughs in areas like optical lens technology and acoustic engineering commanding premium prices. This dynamic approach ensures that pricing reflects the evolving technological landscape and the added value AAC provides, with success in miniaturization contributing to higher Average Selling Prices (ASPs) and supporting their ongoing R&D investments.

| Pricing Strategy Element | Description | Impact on AAC Technologies | Example Data Point |

|---|---|---|---|

| Value-Based Pricing | Pricing based on perceived worth and client benefits. | Enables premium pricing for advanced solutions. | 2023 revenue driven by high-performance acoustic/haptic components. |

| Negotiation & Long-Term Agreements | Securing large orders through strategic partnerships. | Leverages manufacturing capacity and tech advancements for pricing power. | Multi-year supply contracts with tiered pricing based on volume. |

| Economies of Scale | Cost efficiencies from large-scale manufacturing. | Enhances pricing flexibility and cost competitiveness. | 19.5% gross profit margin in H1 2024. |

| Dynamic & Innovation-Driven | Pricing adjusts with technological advancements. | Captures premium value from cutting-edge products. | Higher ASPs for improved optical modules and miniaturized acoustic solutions. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for AAC Technologies Holdings is grounded in comprehensive data, including official company filings, investor relations materials, and reputable industry research reports. We also incorporate insights from competitor analysis and market intelligence platforms to capture their product offerings, pricing strategies, distribution channels, and promotional activities.