AAC Technologies Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAC Technologies Holdings Bundle

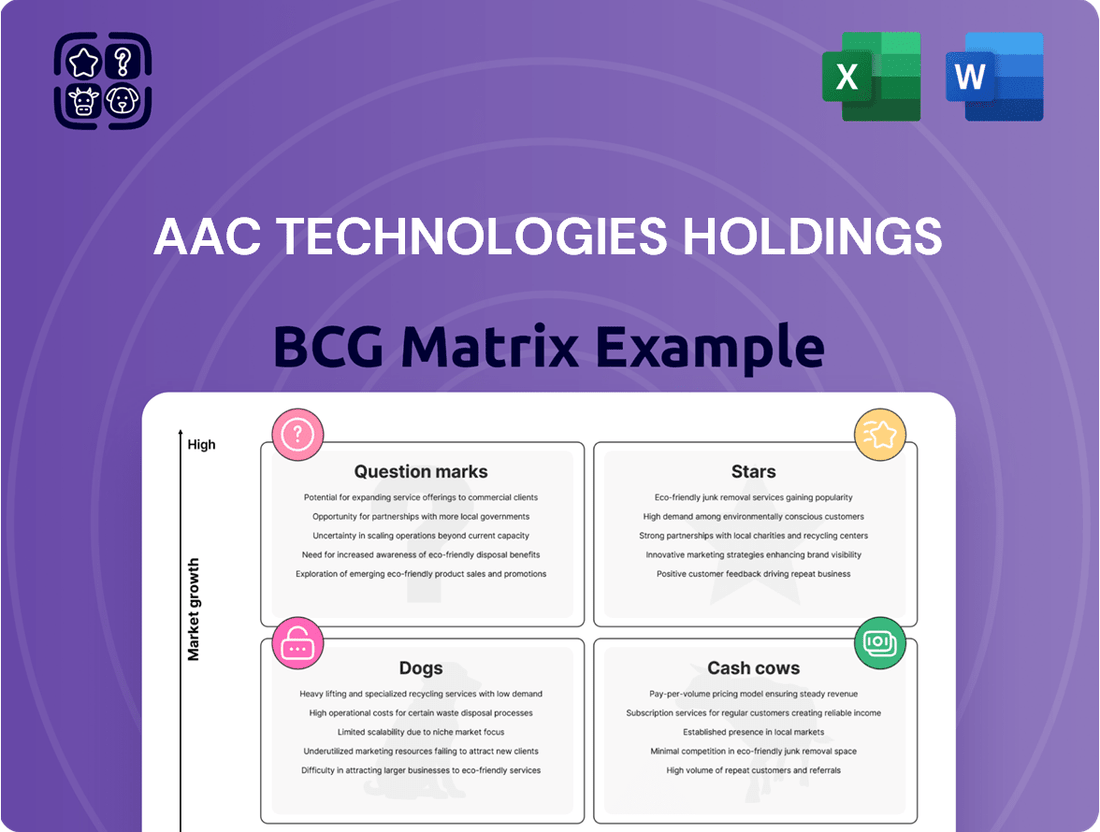

Unlock the strategic potential of AAC Technologies Holdings with a comprehensive BCG Matrix analysis. Understand precisely where each of their product lines fits – are they market-leading Stars, reliable Cash Cows, underperforming Dogs, or promising but uncertain Question Marks?

This preview offers a glimpse into the critical strategic positioning of AAC Technologies Holdings. To truly grasp their competitive landscape and identify actionable growth opportunities, you need the full picture.

Purchase the complete BCG Matrix to gain detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investment and product development strategies for AAC Technologies Holdings.

Don't just guess about AAC Technologies Holdings' market performance; know it. The full report provides an in-depth breakdown, enabling you to make informed decisions and gain a decisive edge.

Stars

AAC Technologies' Automotive Acoustics and Haptics segment, bolstered by the FY24 acquisition of Premium Sound Solutions, is a key growth driver. This strategic move injected significant revenue, underscoring the company's commitment to the automotive sector. The focus on advanced audio and haptic seat solutions for next-generation cockpits aligns perfectly with the industry's trend towards intelligent and immersive in-car experiences.

High-end optical modules, specifically 6P/7P lenses and hybrid G+P solutions, represent a significant growth area for AAC Technologies. The optics business experienced a robust rebound in the latter half of 2024, fueled by a resurgence in smartphone upgrades and a notable increase in average selling prices for these advanced components. This upward trend underscores the market's demand for enhanced visual capabilities.

AAC's strategic investments in wafer-level glass (WLG) lenses and hybrid glass-plastic lens technology have proven prescient. Their industry-leading capabilities in mass-producing these sophisticated optical components place them in a prime position to capitalize on the expanding market for advanced smartphone photography and other visual technologies. This technological edge is crucial for maintaining competitiveness in the high-end segment.

Advanced Haptic Solutions, encompassing RichTap AI Vibration and Linear Actuators, represent a significant growth area for AAC Technologies. This segment is poised to capitalize on the burgeoning demand for immersive user experiences across mobile, wearable, and AR/VR markets. The global haptic technology market was projected to reach over $20 billion by 2024, with AAC well-positioned to capture a substantial share.

MEMS Microphones for AI-driven Devices

MEMS microphones are experiencing significant growth, driven by the increasing adoption of AI-powered voice assistants across various consumer electronics. AAC Technologies is capitalizing on this trend by focusing on advanced MEMS microphone offerings.

The company is making strides in developing high-performance analog and Windtalker digital microphones, crucial for enabling sophisticated voice interaction in devices like smartphones and smart speakers. These components are essential for meeting the demands of intelligent voice technology and are key to spec upgrades in the market.

- Market Growth: The global MEMS microphone market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, fueled by AI integration.

- AAC's Position: AAC Technologies is a leading supplier, with its high-performance analog and Windtalker digital microphones targeting the premium segment of this expanding market.

- Key Applications: Demand is particularly strong from smartphones, wearables, smart home devices, and automotive applications where voice control is becoming standard.

- Technological Advancement: AAC's focus on 70dB+ performance signifies a commitment to quality and advanced features that differentiate its products in a competitive landscape.

Integrated Solutions for XR Headsets and Robotics

AAC Technologies is strategically positioning itself within the burgeoning augmented reality (AR), virtual reality (VR), and robotics sectors. These markets are seen as prime opportunities for the company to offer integrated sensory experience solutions, leveraging its existing strengths.

The company's component offerings for XR headsets, such as advanced acoustics and haptic feedback systems, are crucial for immersive user experiences. Similarly, their contributions to humanoid robots, including precision micro-motors and mechanical parts, highlight a focus on high-growth, technologically advanced applications.

AAC's investment in these areas signifies a commitment to innovation and capturing market share in what are anticipated to be major growth industries. For instance, the global XR market was projected to reach over $100 billion by 2025, with robotics following a similar upward trajectory.

- XR Headset Components: AAC provides critical acoustic and haptic solutions that enhance user immersion in AR/VR environments.

- Robotics Components: The company supplies micro-motors and precision mechanics essential for the sophisticated movements of humanoid robots.

- Market Focus: These sectors represent high-growth potential where AAC can capitalize on its core technological competencies.

- Strategic Importance: AAC's expansion into XR and robotics underscores a forward-looking strategy to align with emerging technological trends and demand.

AAC Technologies' advanced haptic solutions and MEMS microphones are strong contenders in the market, exhibiting significant growth potential. The increasing demand for immersive experiences in consumer electronics and the widespread adoption of AI voice assistants are key drivers. AAC's focus on high-performance components positions them well to capture market share, with the MEMS microphone market alone projected for robust growth through 2030.

| Segment | Key Products | Growth Drivers | AAC's Strength | Market Outlook (2024/2025 Focus) |

|---|---|---|---|---|

| Advanced Haptics | RichTap AI Vibration, Linear Actuators | Immersive user experiences (mobile, AR/VR) | Leader in haptic technology | Global market projected over $20 billion by 2024 |

| MEMS Microphones | High-performance analog & Windtalker digital | AI voice assistants, smart devices | Premium segment supplier | Market valued at ~$2.5 billion in 2023, 7%+ CAGR |

What is included in the product

AAC Technologies' BCG Matrix shows products divided into Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment.

The AAC Technologies BCG Matrix clarifies business unit performance, relieving the pain of resource allocation uncertainty.

Cash Cows

AAC Technologies Holdings' standard acoustic components for smartphones are firmly established as cash cows within their business portfolio. As a global leader, AAC commands a substantial 20-30% market share in this mature segment of the smartphone industry.

Despite the slower growth typical of established markets, these essential components, including speakers and receivers, continue to be a reliable engine for substantial revenue and consistent cash flow generation for AAC. Their dominance in this foundational aspect of smartphone manufacturing underpins a significant portion of the company's financial stability.

Electromagnetic Drives and Precision Mechanics for Consumer Electronics represent AAC Technologies Holdings' Cash Cows. In fiscal year 2024, this segment, encompassing haptics and radio frequency mechanical components, was the company's leading revenue generator, accounting for 36% of its total revenue.

These products are well-established within the consumer electronics sector, particularly for devices like smartphones and tablets. Their strong market share in a mature industry ensures a steady and reliable stream of cash, even though growth is not expected to be explosive.

AAC Technologies' mid-range optical lenses and camera modules represent a significant cash cow within their portfolio. While the company invests in high-end innovations, this established segment reliably fuels revenue through consistent demand from the mainstream smartphone market. AAC's robust manufacturing expertise ensures efficient and high-volume production, solidifying its position as a stable cash generator. This segment's steady performance provides a crucial foundation for the company's growth initiatives.

Basic MEMS Sensors for Mass-Market Devices

AAC Technologies Holdings' basic MEMS sensors for mass-market devices, such as microphones, represent a significant Cash Cow for the company. These components are integral to a vast array of consumer electronics, ensuring a consistent and reliable revenue stream. While the growth rate for these mature technologies might not be explosive, their ubiquity in smartphones, wearables, and other connected devices guarantees sustained demand and profitability.

The company's established market position in this segment is a key advantage. For instance, in 2023, the global MEMS microphone market alone was valued at approximately USD 2.5 billion, with a projected compound annual growth rate (CAGR) of around 5-7% through 2028. AAC's ability to leverage its manufacturing scale and cost efficiencies within this market allows it to maintain strong margins.

- High Market Share: AAC holds a substantial share in the MEMS microphone market, a critical component in virtually all mobile devices.

- Steady Revenue: The widespread adoption of smartphones and other consumer electronics ensures a predictable and substantial inflow of revenue from these basic MEMS sensors.

- Mature but Essential Technology: While not cutting-edge, MEMS microphones are fundamental to device functionality, making them a consistent demand driver.

- Profitability through Scale: AAC's efficient manufacturing processes and economies of scale allow for healthy profit margins on these high-volume products.

Traditional Laptop and PC Audio Solutions

AAC Technologies Holdings' traditional laptop and PC audio solutions operate as a cash cow within its business portfolio. Beyond its dominant smartphone audio business, the company also provides high-quality speakers and acoustic components for laptops and personal computers. This diversification into the PC market, while less explosive than mobile, taps into a consistently stable demand for reliable audio hardware, ensuring a steady revenue stream.

This segment is characterized by its mature market status, where consistent demand for quality audio components underpins its cash-generating capabilities. AAC's innovations in this area, such as ultra-clear speakers, maintain its competitive edge. For example, in 2023, the global PC audio market, while not growing at the pace of mobile, still represented a substantial segment, with companies like AAC leveraging established relationships and product reliability to secure consistent orders.

- Stable Revenue: The laptop and PC audio market provides predictable revenue, acting as a reliable cash generator for AAC Technologies.

- Mature Market: Demand in this sector is consistent, driven by the ongoing need for audio components in a vast installed base of devices.

- Technological Integration: AAC's focus on innovations like ultra-clear speakers ensures continued relevance and market share in this established segment.

- Diversification Benefit: This business arm complements the more volatile smartphone market, contributing to overall financial stability.

AAC Technologies Holdings' Electromagnetic Drives and Precision Mechanics segment, including haptics and RF mechanical components, solidified its position as a prime cash cow in 2024, generating 36% of the company's total revenue. This established segment benefits from consistent demand in the mature consumer electronics market, particularly for smartphones and tablets, ensuring a steady and reliable cash inflow despite modest growth expectations.

The company's mid-range optical lenses and camera modules also function as a significant cash cow, consistently fueling revenue through high-volume demand in the mainstream smartphone sector. AAC's manufacturing prowess in this area allows for efficient production, reinforcing its role as a stable cash generator that supports broader growth initiatives.

Furthermore, basic MEMS sensors, such as microphones, are a vital cash cow for AAC, integral to a vast array of consumer electronics. Their ubiquity in smartphones, wearables, and other connected devices guarantees sustained demand and profitability, with the global MEMS microphone market valued at approximately USD 2.5 billion in 2023 and projected to grow steadily.

Traditional laptop and PC audio solutions represent another stable cash cow for AAC Technologies. This segment taps into consistent demand for reliable audio hardware, providing a predictable revenue stream from a mature market where quality and established relationships drive ongoing orders.

| Business Segment | Role in BCG Matrix | Key Financial Contribution (FY2024) | Market Characteristics | AAC's Competitive Advantage |

|---|---|---|---|---|

| Standard Acoustic Components (Smartphones) | Cash Cow | Significant Revenue Generator | Mature, High Volume | Global Market Leadership |

| Electromagnetic Drives & Precision Mechanics | Cash Cow | 36% of Total Revenue | Mature, Consistent Demand | Strong Market Share |

| Mid-Range Optical Lenses & Camera Modules | Cash Cow | Reliable Revenue Stream | Mainstream Smartphone Market | Efficient High-Volume Production |

| Basic MEMS Sensors (Microphones) | Cash Cow | Sustained Profitability | Ubiquitous in Consumer Electronics | Manufacturing Scale & Cost Efficiency |

| Laptop & PC Audio Solutions | Cash Cow | Stable Revenue | Mature, Consistent Demand | Product Reliability & Innovation |

Preview = Final Product

AAC Technologies Holdings BCG Matrix

The AAC Technologies Holdings BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase. This means no watermarks or sample data will be present; you'll get the fully formatted, professionally analyzed report ready for immediate strategic application.

Rest assured, the BCG Matrix report displayed here is an exact replica of the file you will download after completing your purchase. It has been meticulously crafted to provide clear insights into AAC Technologies Holdings' product portfolio, ensuring you receive a high-quality, actionable strategic tool.

What you see is precisely the AAC Technologies Holdings BCG Matrix document that will be yours after purchase, ready for immediate use. This comprehensive analysis is designed for professional integration into your business strategy, offering a clear roadmap without any hidden surprises.

Dogs

Legacy or commoditized acoustic components, like older speaker modules or basic microphones, often fall into the Dogs quadrant of the BCG Matrix. These products face intense price competition due to their undifferentiated nature, with demand shrinking as markets mature or shift to more advanced solutions. For example, in 2024, many basic audio components saw their average selling prices drop by over 10% year-over-year due to oversupply and the ubiquity of smartphones with integrated, higher-quality audio capabilities.

These offerings typically generate low profit margins and require minimal ongoing investment, as their development cycles are complete. AAC Technologies Holdings, like many in the electronics manufacturing sector, might find these products contribute little to overall growth or profitability. Their limited market share and stagnant or declining growth prospects make them prime candidates for strategic review, potentially leading to divestiture or a controlled phase-out to reallocate resources to more promising areas.

Niche or low-volume precision mechanical parts that don't fit AAC Technologies Holdings' main strategies, like those for automotive or AR/VR, would likely be classified as Dogs in the BCG Matrix. These are often items with small market shares and limited growth potential, possibly facing intense competition from smaller, specialized firms.

For instance, if AAC were to produce highly specialized components for legacy industrial equipment with declining demand, these would represent a Dog. Such products typically generate low revenue and profit, requiring minimal investment to maintain rather than grow.

In 2024, the precision mechanical parts market is robust, but specific segments focused on outdated technologies or very narrow industrial applications might be stagnant. Companies operating in these areas often see flat or declining sales, making them prime candidates for the Dog quadrant if they lack a clear path to revitalization or a strategic pivot.

Outdated haptic technologies, such as older vibration motors or basic linear resonant actuators, are likely to be found in the Dogs quadrant of the BCG Matrix for AAC Technologies. These technologies, once innovative, have been surpassed by more sophisticated solutions like advanced linear actuators offering nuanced feedback or even AI-driven haptic experiences. For instance, a shift away from simple eccentric rotating mass motors towards more precise piezoelectric actuators highlights this evolution.

If these older haptic products haven't kept pace with market demands for richer sensory feedback or improved energy efficiency, their market share and growth potential would be low. AAC Technologies’ 2024 financial reports might indicate declining revenue or profitability from legacy haptic components, suggesting they are indeed cash traps, consuming resources without generating substantial returns.

Products with Declining ASPs and Low Differentiation

Products with declining Average Selling Prices (ASPs) and low differentiation fall into the 'Dogs' category of the BCG Matrix for AAC Technologies Holdings. This signifies a challenging market position where commoditization erodes pricing power, leading to reduced profitability and minimal cash flow generation for these product lines. For instance, if a specific acoustic component sees its ASP drop by 15% year-over-year due to intense competition and little unique technology, it would likely be classified here. This lack of competitive advantage means reinvestment yields diminishing returns.

These 'Dogs' typically exhibit slow or negative growth in market share and revenue. The company might face difficulties in allocating capital effectively to these segments, as the potential for future returns is limited. In 2024, a hypothetical product line within AAC Technologies, perhaps a standard speaker module with widespread adoption by multiple manufacturers, could see its ASP decrease by 10-12% as competitors offer similar functionalities at lower price points.

- Declining ASPs: Indicative of market saturation and price competition.

- Low Differentiation: Products are easily substitutable by competitors.

- Limited Pricing Power: Inability to command premium prices, squeezing margins.

- Minimal Cash Generation: Returns on investment are low, potentially requiring divestment or strategic repositioning.

Specific Sensor Products in Transition Cycles

Specific Sensor Products in Transition Cycles represent a segment that requires careful navigation within AAC Technologies Holdings' portfolio. The revenue in the Sensors and Semiconductor (SSE) segment experienced a notable decline, falling by 27.7% year-on-year in the second half of 2024.

This downturn is primarily attributed to a transition cycle occurring between the phasing out of older projects and the ramp-up of new ones. Certain older sensor products within this category are likely facing challenges such as declining market share and subdued growth prospects. These issues could stem from technological obsolescence, increased competition, or market saturation, impacting their overall performance.

- Revenue Decline: The SSE segment saw a 27.7% year-on-year revenue drop in 2H24.

- Causation: This decline is linked to the transition between older and newer project cycles.

- Underperforming Products: Older sensor products may be experiencing reduced market share and low growth.

- Contributing Factors: Technological shifts and market saturation are potential reasons for underperformance.

Legacy acoustic components, such as older speaker modules or basic microphones, often fall into the Dogs quadrant. These products face intense price competition due to their undifferentiated nature, with demand shrinking as markets mature or shift to more advanced solutions. For example, in 2024, many basic audio components saw their average selling prices drop by over 10% year-over-year due to oversupply and the ubiquity of smartphones with integrated, higher-quality audio capabilities.

These offerings typically generate low profit margins and require minimal ongoing investment, as their development cycles are complete. AAC Technologies Holdings, like many in the electronics manufacturing sector, might find these products contribute little to overall growth or profitability. Their limited market share and stagnant or declining growth prospects make them prime candidates for strategic review, potentially leading to divestiture or a controlled phase-out to reallocate resources to more promising areas.

Outdated haptic technologies, such as older vibration motors or basic linear resonant actuators, are likely to be found in the Dogs quadrant of the BCG Matrix for AAC Technologies. These technologies, once innovative, have been surpassed by more sophisticated solutions. AAC Technologies’ 2024 financial reports might indicate declining revenue or profitability from legacy haptic components, suggesting they are indeed cash traps, consuming resources without generating substantial returns.

| Product Category | BCG Quadrant | Market Trend (2024) | AAC Technologies Relevance | Strategic Implication |

| Legacy Acoustic Modules | Dogs | Declining ASPs (-10% YoY), High Competition | Low Profitability, Mature Market | Divest or Phase-out |

| Outdated Haptic Actuators | Dogs | Technological Obsolescence, Low Demand | Minimal Growth, Resource Drain | Reposition or Exit |

| Niche Precision Mechanical Parts (Legacy) | Dogs | Stagnant Market Share, Limited Growth | Low Revenue Contribution | Evaluate for Divestment |

Question Marks

AAC Technologies is venturing into advanced automotive motor solutions, moving beyond traditional audio and haptic applications. This includes brushless motors, crucial for the quiet and efficient operation demanded in modern electric vehicles, and micro-motors, which enable intricate movements in areas like robotic steering systems or adaptive seating. The automotive industry, particularly electric and autonomous segments, presents a robust growth trajectory, with the global automotive electric motor market projected to reach approximately $70 billion by 2028, growing at a CAGR of over 10%.

Within this burgeoning automotive motor segment, AAC's current market share for these specialized motor types is still establishing itself. This positions these solutions as question marks in the BCG matrix – areas with high growth potential but requiring substantial investment to capture market share. For instance, the demand for advanced actuators in automotive applications, including those powered by micro-motors, is expected to see significant expansion as vehicle features become more sophisticated.

AAC Technologies' integrated cockpit monitoring systems, showcased at CES 2025, represent a significant move into the high-growth smart automotive sector, offering crucial data for ADAS and intelligent cockpit functionalities. These systems are positioned as potential Stars in the BCG Matrix, given the burgeoning demand for advanced driver-assistance and in-car experience features.

However, the company's market penetration and leadership in these complex, integrated solutions are likely still developing. This necessitates substantial ongoing investment to establish a strong foothold and capture market share, a characteristic of products transitioning from Question Marks towards Stars.

AAC Technologies Holdings' solid-state lidar components, including diffractive optical elements and AR-HUD light diffusers, are positioned within high-growth markets like automotive and XR. These micro-nano optical components represent advanced technologies, crucial for next-generation sensing and display systems. However, their placement in a BCG Matrix would likely be in the question mark category due to potentially low current market share, despite the significant market potential.

The investment in research and development for these cutting-edge optical solutions is substantial, reflecting the need to establish AAC's presence and gain traction. As these technologies mature and achieve wider market adoption, their position could shift. For instance, the automotive lidar market is projected to reach $15 billion by 2030, with solid-state lidar expected to capture a significant portion.

Medical and Healthcare Application Components

While AAC Technologies Holdings is primarily known for its work in consumer electronics and automotive sectors, its components are finding traction in the medical and healthcare space. Think of specialized microphones for hearing aids or the burgeoning market for medical wearables. These areas represent significant growth opportunities.

These medical and healthcare applications, though promising, likely represent a relatively small portion of AAC's current business. This positioning aligns with a company having a low market share in these emerging, high-potential markets. The global hearing aid market, for instance, was valued at approximately USD 8.1 billion in 2023 and is projected to grow significantly, offering substantial upside for component suppliers like AAC.

- Emerging High-Growth Market: The medical and healthcare sector, particularly in areas like audiology and wearable health devices, presents a strong growth trajectory.

- Low Current Market Share: AAC's involvement in these specialized medical applications likely means they have a small existing footprint, characteristic of a question mark in the BCG matrix.

- High Investment Potential: The significant growth forecasts for the hearing aid and medical wearable markets indicate substantial potential for increased investment and future market leadership.

- Component Versatility: AAC's core competencies in acoustic components and miniaturization are directly transferable to the demanding requirements of medical devices.

Liquid Cooling/Thermal Management Solutions for High-Performance Devices

AAC Technologies is strategically developing advanced thermal management solutions, such as Loop Heat Pipe (LHP) and Vapor Chamber (VC) cooling technology, specifically for high-performance devices. This move is in direct response to the escalating thermal challenges posed by increasingly powerful consumer electronics and computing hardware. For example, the global market for advanced cooling solutions, including liquid cooling, was projected to reach USD 3.5 billion in 2024, demonstrating a significant and growing demand.

- Market Need: As processors and GPUs push performance boundaries, effective heat dissipation becomes critical for device longevity and optimal function.

- AAC's Position: AAC's venture into this sector represents a strategic diversification, targeting a high-growth segment driven by technological advancements.

- Investment & Growth: While addressing a clear market need, AAC's market share in this nascent area would likely be small in 2024, necessitating substantial R&D and manufacturing investment to achieve scale and competitive positioning.

AAC Technologies' advanced automotive motor solutions and integrated cockpit monitoring systems are in their early stages within high-growth markets. These ventures, while promising significant future returns, currently represent question marks in the BCG matrix, requiring substantial investment to capture market share and establish leadership. This strategic investment aims to capitalize on the rapid expansion of the electric vehicle and smart automotive sectors.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.