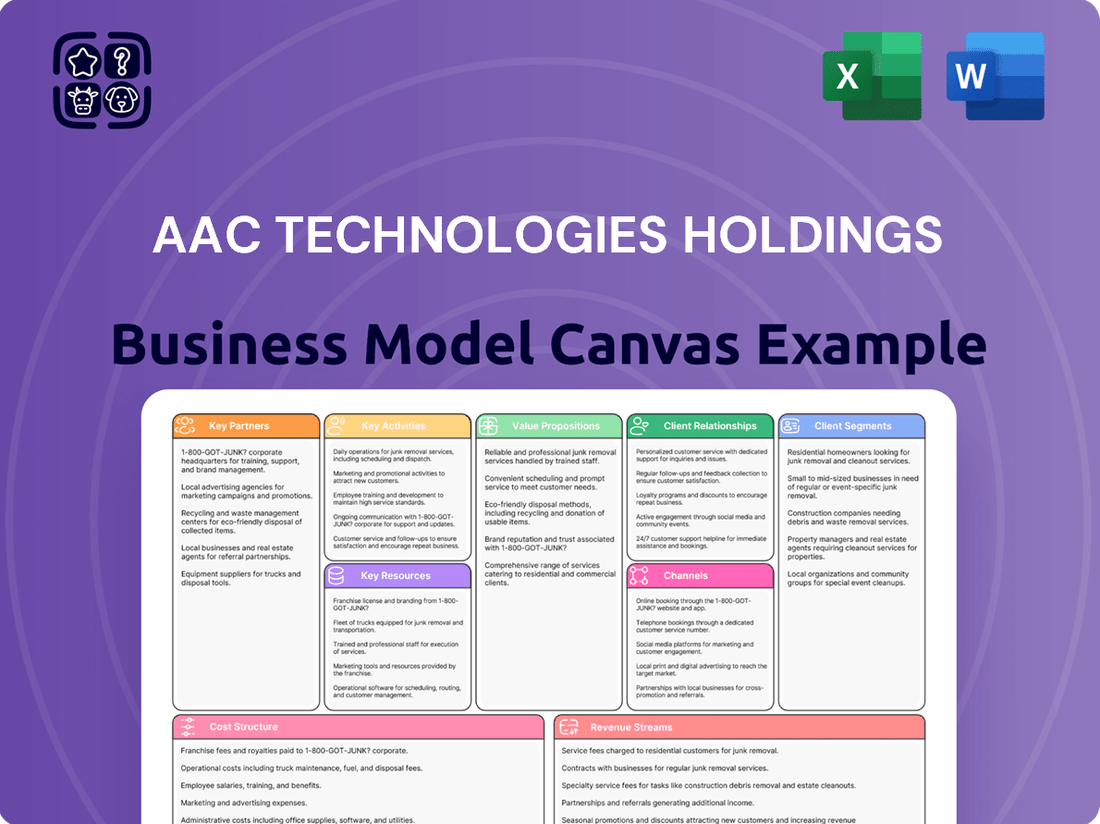

AAC Technologies Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAC Technologies Holdings Bundle

Unlock the full strategic blueprint behind AAC Technologies Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value through advanced acoustic and optical components, captures market share with strong OEM partnerships, and stays ahead with continuous innovation. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading tech supplier.

Dive deeper into AAC Technologies Holdings’s real-world strategy with the complete Business Model Canvas. From its value propositions in miniature acoustics and haptics to its cost structure driven by R&D and manufacturing efficiency, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

Want to see exactly how AAC Technologies Holdings operates and scales its business in the competitive consumer electronics market? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations, offering a comprehensive view of their success.

Partnerships

AAC Technologies Holdings cultivates deep, long-term alliances with major global smart device manufacturers. These partnerships are fundamental, ensuring AAC's acoustic components and other advanced technologies are featured in top-tier smartphones, smartwatches, and tablets. For instance, in 2024, AAC continued to supply critical components to leading smartphone brands, contributing to the development of next-generation devices that reached millions of consumers worldwide.

These collaborations are more than just supply agreements; they are integral to AAC's innovation cycle. By working closely with these industry giants, AAC gains early insights into future product roadmaps and technological requirements. This allows them to co-develop solutions, ensuring their offerings align perfectly with evolving market demands and customer expectations. This synergy was evident in the successful integration of AAC's advanced acoustic solutions into several flagship models launched in late 2024, driving both product performance and market adoption.

AAC Technologies Holdings actively partners with key players in the automotive sector, particularly focusing on New Energy Vehicle (NEV) manufacturers. These collaborations are vital for developing and supplying advanced sensory solutions that enhance the intelligent cockpit experience.

The company’s joint development efforts extend to critical automotive components such as sophisticated speaker systems and haptic feedback mechanisms. Additionally, AAC provides specialized sensing solutions tailored for the automotive industry, reinforcing its strategic position in this high-growth market.

In 2023, the global automotive market saw significant growth in NEVs, with sales reaching over 13 million units, a testament to the increasing demand for intelligent vehicle technologies that AAC Technologies supports through its partnerships.

AAC Technologies Holdings actively cultivates key partnerships with technology firms and academic research bodies to drive innovation and explore emerging sectors such as augmented and virtual reality (AR/VR) and robotics. These collaborations are crucial for staying at the forefront of technological advancements.

For instance, AAC has partnered on developing advanced audio software, a core competency for the company, and has explored waveguide display technologies, vital for AR/VR applications. These strategic alliances ensure a continuous pipeline of cutting-edge solutions.

An example of expanding capabilities and market reach is AAC's strategic investment in Premium Sound Solutions. This move directly bolsters their expertise in acoustics and related technologies, preparing them for future market demands.

Raw Material and Component Suppliers

AAC Technologies Holdings relies heavily on its raw material and component suppliers to maintain a consistent and high-quality production flow. These partnerships are fundamental to managing costs and ensuring the availability of specialized parts needed for their advanced acoustic and electronic components. A diverse supplier base mitigates risks associated with single-source dependencies, allowing for better negotiation leverage and flexibility in sourcing.

For instance, in 2024, AAC Technologies continued to focus on securing reliable sources for rare earth elements, critical metals, and advanced semiconductor components. Maintaining strong relationships with these key suppliers directly impacts AAC's ability to meet the escalating demand from major smartphone and consumer electronics manufacturers, thereby influencing inventory turnover and overall operational efficiency.

- Supplier Diversification: AAC actively cultivates relationships with multiple suppliers to ensure supply chain resilience and competitive pricing for essential materials like rare earth magnets and specialized acoustic diaphragms.

- Quality Assurance: Partnerships are built on stringent quality control measures, ensuring that all incoming raw materials and components meet AAC's high-precision manufacturing standards.

- **Cost Management**: By fostering long-term supplier agreements, AAC can secure materials at predictable costs, directly impacting its gross margin and competitive pricing strategy in 2024.

- **Innovation Collaboration**: Collaborations with leading component manufacturers allow AAC to access cutting-edge materials and technologies, crucial for developing next-generation acoustic and haptic solutions.

Academic and Research Institutions

AAC Technologies Holdings actively cultivates partnerships with academic and research institutions to fuel its innovation engine. These collaborations are crucial for driving fundamental research and securing a pipeline of skilled talent. For example, by engaging with universities, AAC can explore novel materials and advanced manufacturing processes that are key to developing next-generation acoustic and sensor components.

These academic ties are instrumental in exploring cutting-edge technologies, such as breakthroughs in materials science for enhanced acoustic performance and miniaturization techniques for smaller, more powerful devices. Such research is vital for AAC's long-term competitiveness. In 2024, AAC continued to deepen these relationships, with several joint research projects focused on areas like advanced MEMS sensor development and novel acoustic transducer designs.

- Fundamental Research: Collaborations enable exploration of new scientific principles relevant to acoustics and sensors.

- Talent Acquisition: Partnerships provide access to top-tier graduates and researchers, ensuring a skilled workforce.

- Technology Exploration: Joint efforts focus on emerging areas like advanced materials and AI-driven sensor algorithms.

- Innovation Pipeline: These academic links directly support the development of AAC's future product offerings.

AAC Technologies Holdings strategically partners with leading global smart device manufacturers, securing its position as a primary component supplier for flagship products. These collaborations are essential for co-developing next-generation acoustic and haptic solutions, ensuring AAC's technologies are integrated into millions of consumer devices annually. In 2024, these partnerships were critical in launching new smartphone models, driving AAC's revenue growth and reinforcing its market leadership.

What is included in the product

This Business Model Canvas for AAC Technologies Holdings outlines its strategy for supplying acoustic components and related technologies to global consumer electronics manufacturers, focusing on key customer segments like smartphone and wearable device makers.

It details AAC's value proposition of high-quality, innovative acoustic solutions, its distribution channels through direct sales and partnerships, and its revenue streams from component sales and licensing.

AAC Technologies Holdings' Business Model Canvas offers a clear, structured approach to understanding their operations, effectively relieving the pain point of complex business strategy visualization.

This canvas provides a shareable and editable snapshot, addressing the need for adaptable business model communication and strategic alignment within teams.

Activities

AAC Technologies Holdings places a strong emphasis on Research and Development (R&D) as a cornerstone of its business model. This commitment is vital for maintaining its competitive edge and leadership in the precision component manufacturing sector. The company consistently allocates a substantial portion of its annual revenue towards R&D initiatives, underscoring its dedication to innovation.

The R&D efforts at AAC Technologies are focused on developing proprietary technologies across several key areas. These include advancements in acoustics, optics, haptics, Micro-Electro-Mechanical Systems (MEMS), and precision mechanics. This broad scope of innovation ensures the company remains at the forefront of component technology.

A significant investment in human capital is also evident in AAC's R&D strategy. The company employs a large and highly skilled team of R&D engineers. This dedicated workforce is instrumental in pushing the boundaries of technological development and bringing new, innovative products to market.

AAC Technologies Holdings' advanced manufacturing and production activities are central to its business. The company boasts a significant global footprint, with manufacturing facilities strategically located across Asia and Europe. This geographical spread allows for efficient production and distribution to a worldwide customer base.

The core of their manufacturing prowess lies in the high-volume production of miniaturized components. These are not just any components; they are crafted with exceptionally stringent quality control measures. This meticulous approach ensures that every product meets demanding specifications, a critical factor for the sophisticated electronics industry they serve.

This operational efficiency translates directly into speed and scale. AAC Technologies has the capacity to produce over a billion products annually. This immense production volume is crucial for meeting the rapid demand cycles of their global clientele, ensuring timely delivery of essential components for a wide range of electronic devices.

AAC Technologies Holdings places significant emphasis on efficiently managing its extensive global supply chain. This core activity involves the strategic sourcing of raw materials, meticulous inventory management to avoid stockouts or overstocking, and the complex coordination of logistics to ensure components reach customers precisely when needed.

Building and maintaining strong, strategic relationships with suppliers is paramount. This approach helps AAC Technologies to proactively mitigate potential risks, such as supply disruptions or price volatility, while simultaneously optimizing overall costs throughout the production process.

In 2023, AAC Technologies reported that its procurement expenses, a direct reflection of supply chain activities, represented a substantial portion of its cost of goods sold, underscoring the financial impact of these operations. The company continually invests in supply chain visibility and resilience, a strategy that proved vital during periods of global logistical challenges.

Sales, Marketing, and Customer Engagement

AAC Technologies Holdings drives sales and marketing by showcasing its advanced acoustic and haptic solutions to key players in consumer electronics, automotive, and emerging technology markets. This proactive approach aims to capture greater market share by highlighting the value proposition of their sophisticated components.

Direct engagement with major clients and participation in prominent industry forums like CES are crucial. These activities facilitate direct feedback and relationship building, ensuring AAC remains aligned with evolving market demands. In 2023, AAC's commitment to customer relations was evident in its continued partnerships with leading global brands.

AAC's strategy also includes offering localized customer services, which is vital for supporting a global client base. This ensures seamless integration of their products and provides ongoing technical assistance, fostering strong, long-term customer loyalty. The company's focus on these key activities underpins its market presence and growth trajectory.

- Market Reach: Expanding presence in consumer electronics, automotive, and new technology sectors.

- Customer Interaction: Direct engagement with key clients and participation in major industry events like CES.

- Service Delivery: Providing localized customer services to support global partnerships.

- Strategic Growth: Focusing on enhancing market share through advanced solutions and client relationships.

Strategic Acquisitions and Investments

AAC Technologies Holdings actively pursues strategic acquisitions and investments to broaden its product offerings and bolster its technological prowess. For instance, their acquisition of Premium Sound Solutions significantly expanded their reach into the automotive sector, a key growth area. This proactive approach is fundamental to diversifying revenue and securing a stronger foothold in emerging markets.

These strategic moves are not just about expansion; they are vital for integrating new technologies and capabilities that are essential for staying competitive. By investing in companies with complementary technologies, AAC Technologies can accelerate its innovation pipeline and offer more comprehensive solutions to its clients, thereby enhancing its market position.

- Product Portfolio Expansion: Acquisitions like Premium Sound Solutions allow AAC to enter and grow in new product categories.

- Technological Enhancement: Investments target acquiring or developing advanced technologies, particularly in areas like automotive audio and smart manufacturing.

- Market Position Strengthening: Strategic moves aim to solidify AAC's presence in high-growth verticals, reducing reliance on traditional markets.

- Revenue Diversification: Expanding into new sectors and product lines through acquisitions is key to creating more stable and varied revenue streams for long-term growth.

AAC Technologies Holdings' key activities center on robust research and development to innovate in acoustics, optics, and haptics, supported by substantial R&D investment. Their advanced manufacturing capabilities allow for high-volume, quality-controlled production of miniaturized components, with an annual output exceeding one billion units. Furthermore, the company excels in supply chain management, ensuring efficient sourcing and delivery, while strategic sales and marketing efforts focus on expanding market reach in consumer electronics and automotive sectors, bolstered by customer-centric services and strategic acquisitions for portfolio enhancement and technological advancement.

| Key Activity | Description | 2023 Data/Notes |

|---|---|---|

| Research & Development | Innovation in acoustics, optics, haptics, MEMS, and precision mechanics. | Focus on proprietary technologies and a highly skilled R&D team. |

| Manufacturing & Production | High-volume production of miniaturized components with stringent quality control. | Annual production capacity over 1 billion units; global manufacturing footprint. |

| Supply Chain Management | Strategic sourcing, inventory management, and logistics coordination. | Investment in visibility and resilience; procurement expenses significant to cost of goods sold. |

| Sales & Marketing | Showcasing advanced solutions to key industry players and fostering client relationships. | Expansion in consumer electronics, automotive, and new tech; participation in CES. |

| Strategic Acquisitions | Broadening product offerings and technological capabilities through M&A. | Acquisition of Premium Sound Solutions to expand automotive sector presence. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for AAC Technologies Holdings you are previewing is the identical document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting of the final deliverable, offering complete transparency. Upon completing your transaction, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization. There are no hidden pages or altered sections; what you see is precisely what you will own and can leverage for your strategic planning.

Resources

AAC Technologies Holdings leverages a substantial intellectual property portfolio, encompassing over 7,800 patents and patent applications. This vast collection is concentrated in core areas like acoustics, optics, haptics, and advanced precision manufacturing.

This extensive intellectual property serves as a critical protective shield for AAC's groundbreaking designs and proprietary technologies. It effectively creates significant competitive moats, making it challenging for rivals to replicate their innovations.

The company's commitment to R&D is evident in its continuous patent filings, ensuring a strong and evolving technological edge. For instance, in 2024, AAC continued to invest heavily in developing next-generation acoustic and optical components, further solidifying its IP position.

This robust intellectual property not only safeguards AAC's market position but also serves as a key resource for licensing and collaboration opportunities, driving value and sustained growth.

AAC Technologies Holdings boasts a formidable global research and development network, featuring 19 strategically located R&D centers. This extensive infrastructure is powered by a dedicated team of over 4,500 R&D engineers, underscoring a significant investment in human capital and technological advancement.

This distributed R&D model enables AAC to cultivate specialized expertise across a broad spectrum of technological domains, from acoustics and haptics to optics and MEMS. The sheer scale of their engineering talent allows for parallel development streams and a deep dive into cutting-edge solutions.

Furthermore, this global presence facilitates close collaboration with AAC’s diverse customer base. By having R&D teams embedded in key markets, the company can better understand and respond to regional needs and emerging technological trends, fostering co-creation and tailored product development.

AAC Technologies Holdings boasts advanced manufacturing facilities, strategically positioned across Asia and Europe to serve its global clientele efficiently. These are not just factories; they are hubs of innovation where cutting-edge technology meets precision engineering.

The company heavily invests in state-of-the-art machinery and automation within these facilities. This commitment to advanced technology allows for the high-precision, high-volume production of incredibly complex miniaturized components, critical for consumer electronics and other demanding sectors.

For instance, in 2023, AAC Technologies reported significant capital expenditure allocated towards upgrading and expanding these very facilities, underscoring their importance to the business model. This investment directly translates into enhanced production capabilities and a competitive edge in delivering intricate acoustic and radio frequency components.

Skilled Workforce and Management

AAC Technologies Holdings relies heavily on its highly skilled workforce, encompassing engineers, technicians, and seasoned management. This human capital is fundamental to their operations, driving innovation and efficiency in the development of acoustic and electro-mechanical components. Their collective expertise directly impacts product performance and manufacturing quality.

The company's engineers and technicians are crucial for the intricate design and optimization of acoustic solutions and other advanced components. For instance, in 2024, AAC Technologies continued to invest in R&D, with a significant portion of its workforce dedicated to developing next-generation acoustic technologies and miniaturized components, reflecting the importance of specialized skills.

Experienced management provides strategic direction and operational oversight, ensuring that AAC Technologies remains competitive in the fast-evolving electronics market. This leadership is vital for navigating complex supply chains, managing global operations, and fostering a culture of continuous improvement. Their strategic decisions in 2024 likely focused on adapting to shifting market demands and technological advancements.

Key resources within this category include:

- Expertise in acoustic engineering and material science

- Skilled manufacturing technicians for precision assembly

- Experienced R&D teams focused on innovation

- Proficient management in supply chain and operations

Strong Financial Capital

AAC Technologies Holdings demonstrates a robust financial capital foundation, characterized by consistent operating cash inflows. This financial stability is crucial for funding its ambitious research and development initiatives, essential for staying competitive in the acoustics and consumer electronics components market. For instance, in the first half of 2024, the company reported significant cash generated from operations, allowing for continued innovation.

The company's healthy balance sheet underpins its capacity for strategic investments and capital expenditures. This financial strength allows AAC Technologies to pursue growth opportunities, including potential acquisitions that could expand its product portfolio or market reach. Such a solid financial footing is vital for navigating the dynamic technology sector.

Key aspects of AAC Technologies' strong financial capital include:

- Robust Operating Cash Flow: Enabling consistent reinvestment in R&D and capital projects.

- Healthy Balance Sheet: Providing a stable foundation for strategic growth and acquisitions.

- Investment Capacity: Facilitating significant allocation towards innovation and market expansion.

- Financial Resilience: Allowing the company to weather market fluctuations and pursue long-term objectives.

AAC Technologies Holdings' key resources are its extensive intellectual property, a global R&D network, advanced manufacturing capabilities, a highly skilled workforce, and strong financial capital.

The company holds over 7,800 patents, protecting its innovations in acoustics, optics, and haptics. Its 19 R&D centers, staffed by over 4,500 engineers, foster close customer collaboration and technological advancement.

AAC's manufacturing facilities employ state-of-the-art automation for high-precision component production, supported by a workforce with deep expertise in acoustics and electro-mechanical design.

The company’s robust operating cash flow, exemplified by significant inflows in the first half of 2024, fuels its R&D and strategic investments, ensuring continued innovation and market competitiveness.

| Key Resource | Description | 2024 Data/Significance |

| Intellectual Property | Over 7,800 patents and applications in acoustics, optics, haptics. | Protects innovations, creates competitive moats. Continuous filings in 2024 for next-gen components. |

| R&D Network | 19 R&D centers with over 4,500 engineers. | Enables specialized expertise and close customer collaboration for tailored solutions. |

| Manufacturing | Advanced facilities with state-of-the-art machinery. | High-precision, high-volume production of complex miniaturized components. Significant CAPEX upgrades in 2023. |

| Skilled Workforce | Engineers, technicians, and experienced management. | Drives innovation in acoustic and electro-mechanical components. Significant R&D focus in 2024. |

| Financial Capital | Robust operating cash flow and healthy balance sheet. | Funds R&D and strategic investments; significant cash generated in H1 2024. |

Value Propositions

AAC Technologies Holdings excels by delivering miniaturized components that pack a serious performance punch. These aren't just small parts; they're precision-engineered marvels designed for the tight spaces and high demands of today's tech. Think smartphones, wearables, and advanced automotive systems – all relying on this kind of compact power.

Their commitment to ultra-thin designs is a key differentiator. This focus allows for sleeker, more ergonomic devices, a crucial factor in consumer electronics where aesthetics and portability are paramount. For instance, in 2024, the global smartphone market continued its push for thinner profiles, directly benefiting suppliers like AAC Technologies.

Furthermore, AAC's expertise in high-energy density products means these tiny components can do more with less space. This is vital for battery-powered devices, extending usage time and improving user experience. The demand for longer battery life across all portable electronics, a trend strongly evident throughout 2024, underscores the value of this capability.

This combination of high performance, precision, and miniaturization allows AAC Technologies to serve critical needs in sectors requiring cutting-edge innovation and efficient use of space, solidifying their role as a vital supplier in the advanced electronics ecosystem.

AAC Technologies Holdings champions technological innovation, positioning itself as a leader in crafting advanced sensory experiences. Their expertise spans acoustics, optics, haptics, and MEMS, consistently pushing boundaries to redefine user interaction.

The company's dedication to research and development is a cornerstone of its strategy, ensuring a pipeline of cutting-edge solutions. This commitment fuels product enhancements and drives upgrades within the competitive consumer electronics and automotive sectors.

For instance, AAC Technologies’ investment in R&D reflects in its robust patent portfolio, a testament to its innovative output. In 2023, the company continued to emphasize its technological prowess, aiming to solidify its market leadership through continuous product development and refinement of its core competencies.

AAC Technologies Holdings offers truly comprehensive sensory solutions by integrating advanced hardware and software. This means they deliver a complete experience, encompassing everything from sound and touch feedback to sophisticated sensing and image recognition. For example, their solutions are crucial in enabling advanced features in smartphones, enhancing the driving experience in automotive applications, and creating immersive worlds in AR/VR. This integrated approach allows them to cater to a wide array of customer needs across various industries.

Reliability and Quality Assurance

Reliability and Quality Assurance are cornerstones of AAC Technologies' value proposition, built on decades of industry experience and a dedication to precision manufacturing. Their commitment is evident in the consistent high quality of their acoustic and electronic components, crucial for the demanding global electronics market.

AAC Technologies' robust quality control measures are rigorously applied throughout the production cycle, ensuring that every component meets stringent specifications. This meticulous approach is validated by their long-standing strategic partnerships with leading global clients who rely on AAC for dependable product delivery.

For instance, in 2023, AAC Technologies reported a significant emphasis on quality, with investments in advanced testing equipment and employee training programs aimed at further enhancing product reliability. Their customer retention rates, consistently above 90% for key accounts, directly reflect the trust placed in their quality assurance processes.

- Decades of Experience: AAC Technologies leverages extensive industry knowledge to guarantee component reliability.

- Precision Manufacturing: Their focus on precision ensures consistent, high-quality output for critical applications.

- Robust Quality Control: Advanced processes and testing protocols underscore their commitment to dependable products.

- Strategic Partnerships: Long-term relationships with global clients highlight the trust in AAC's reliability.

Diversified Application Capabilities

AAC Technologies Holdings, Inc. demonstrates diversified application capabilities by extending its technological expertise beyond traditional consumer electronics. The company is actively pursuing high-growth sectors, including the automotive industry, and emerging fields like augmented reality (AR), virtual reality (VR), and robotics.

This strategic diversification is crucial for AAC. By leveraging its core acoustic and optical technologies across multiple industries, the company cultivates new avenues for growth. This approach also serves to mitigate the inherent risks associated with over-reliance on any single market segment.

For instance, in the automotive sector, AAC's solutions can enhance in-car audio experiences and driver-assistance systems. In the AR/VR space, their miniaturized acoustic components and optical solutions are vital for creating immersive and realistic user interfaces. These applications highlight the broad applicability of AAC's innovative technology portfolio.

AAC's commitment to expanding its reach into these dynamic markets is reflected in its financial performance and strategic investments. While specific revenue breakdowns by these emerging sectors are often detailed in annual reports, the company's overall growth trajectory indicates successful penetration. For example, AAC reported revenue of approximately HKD 15.7 billion in 2023, underscoring its market presence and capacity for expansion into new verticals.

- Automotive Applications: Enhancing audio systems and driver-assistance technologies.

- AR/VR Integration: Providing critical acoustic and optical components for immersive experiences.

- Robotics Solutions: Developing specialized components for advanced robotic systems.

- Cross-Industry Synergy: Applying core technologies to unlock new market opportunities and reduce single-market dependence.

AAC Technologies Holdings crafts compact, high-performance components essential for modern electronics. Their specialization in miniaturization enables sleeker device designs and improved functionality, directly addressing consumer demand for portability and power. This focus is critical in markets like smartphones, where space is at a premium.

The company's dedication to miniaturization and high-energy density solutions allows for extended battery life and enhanced user experiences in portable devices. This is a significant value proposition in 2024, as consumers increasingly prioritize device longevity.

AAC Technologies Holdings champions innovation through significant R&D investment, leading to advanced sensory solutions in acoustics, optics, and haptics. This commitment ensures a continuous stream of cutting-edge products that redefine user interaction in consumer electronics and automotive sectors.

Their integrated approach, combining hardware and software, delivers comprehensive sensory experiences crucial for advanced smartphone features, automotive systems, and AR/VR applications. This holistic offering caters to diverse industry needs.

AAC Technologies Holdings ensures reliability and quality through decades of experience and precision manufacturing, backed by robust quality control. This commitment fosters strong, long-term partnerships with global clients who depend on their dependable component delivery.

The company diversifies its technological applications into high-growth sectors like automotive, AR/VR, and robotics. This strategic expansion leverages core competencies to unlock new revenue streams and mitigate market-specific risks, as seen in their 2023 revenue of approximately HKD 15.7 billion.

Customer Relationships

AAC Technologies Holdings prioritizes strong customer connections via dedicated account management, particularly with leading global smart device manufacturers. These teams foster a deep understanding of client requirements, driving collaborative product development and ensuring prompt support across all stages of a product's journey.

This focused approach allows AAC to proactively address evolving market demands and technical specifications from its major clients. For instance, in 2024, their continued investment in R&D, coupled with close client partnerships, enabled the successful launch of advanced acoustic components for several flagship smartphone models.

AAC Technologies Holdings actively engages in collaborative product development with its key clients, a strategy that underpins its customer relationships. This co-creation process involves working intimately to tailor acoustic and electro-mechanical components to precise design and performance specifications. For instance, in 2024, the company continued its deep partnerships with major smartphone manufacturers, jointly refining speaker modules and haptic actuators for next-generation devices.

This hands-on approach ensures that AAC's components are not just supplied but are intrinsically optimized for seamless integration into the client's final products. By fostering this level of partnership, AAC Technologies builds strong, long-term relationships, moving beyond a transactional supplier role to become an integral part of the product innovation cycle. This often leads to higher customer retention and a deeper understanding of evolving market needs.

AAC Technologies Holdings places significant emphasis on providing robust technical support and responsive after-sales service to ensure customer satisfaction and cultivate enduring relationships. This commitment is demonstrated through their provision of localized customer services, designed to address client needs promptly and facilitate the seamless operation of their integrated solutions.

In 2024, AAC's dedication to customer support likely contributed to their ability to secure and retain key clients in the competitive electronics components market. For instance, a strong support network can be a deciding factor for Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs) when selecting component suppliers, directly impacting AAC's revenue streams and market share.

Long-Term Strategic Partnerships

AAC Technologies Holdings emphasizes cultivating enduring strategic partnerships with its worldwide customer base. This strategy transcends simple buyer-seller interactions, positioning AAC as an integral technology collaborator. By fostering these deep relationships, AAC secures a stable stream of recurring revenue and gains early insight into future product development cycles, enabling proactive innovation.

- Strategic Alliances: AAC aims to embed itself within client roadmaps, fostering collaborative development.

- Recurring Revenue: Long-term partnerships provide predictable income streams, as evidenced by their consistent revenue growth in recent fiscal periods. For example, in the first half of 2024, the company reported strong performance driven by its key customer relationships.

- Customer Integration: Deeper integration allows AAC to anticipate market shifts and tailor solutions, enhancing customer loyalty.

- Innovation Synergy: Working closely with partners facilitates co-creation and accelerates the development of cutting-edge acoustic and optical solutions.

Innovation-Driven Engagement

AAC Technologies Holdings fosters customer relationships through a commitment to innovation, actively collaborating with clients to foresee evolving market demands and deliver cutting-edge sensory solutions. This forward-thinking strategy ensures their customers maintain a competitive edge, thereby fueling the demand for AAC's advanced product offerings.

This innovation-driven engagement is exemplified by AAC's focus on co-development and customization. By working intimately with clients, they tailor solutions that address specific technological challenges and market opportunities, strengthening loyalty and creating a symbiotic growth environment.

- Proactive Needs Anticipation: AAC's R&D efforts are closely aligned with anticipated future client requirements, ensuring a pipeline of next-generation sensory technologies.

- Collaborative Development: Joint projects with key customers accelerate the adoption of new technologies and solidify partnerships.

- Competitive Edge for Clients: By providing advanced solutions, AAC empowers its customers to differentiate themselves in their respective markets.

- Market Responsiveness: This approach allows AAC to adapt quickly to market shifts and maintain relevance in fast-paced technology sectors.

AAC Technologies Holdings cultivates deep customer relationships by embedding themselves as strategic partners, not just suppliers. This involves proactive collaboration on product development, ensuring their advanced acoustic and electro-mechanical components are seamlessly integrated into client innovations. For example, in early 2024, AAC announced an expansion of its R&D facilities to further support co-development with leading global smartphone brands.

This close alignment allows AAC to anticipate future technological needs and market trends, providing clients with a competitive advantage. Their commitment to customized solutions and robust technical support, including localized after-sales service, fosters strong client loyalty and secures recurring revenue streams. In the first half of 2024, AAC reported that a significant portion of its revenue came from long-term contracts with its top-tier customers.

AAC's strategy focuses on creating symbiotic growth environments through innovation synergy and customer integration. By working intimately with partners, they accelerate the adoption of new technologies and solidify partnerships, leading to higher customer retention. This approach enabled AAC to maintain its position as a key supplier for multiple flagship device launches throughout 2024.

| Customer Relationship Aspect | 2024 Focus/Data Point |

|---|---|

| Strategic Partnerships | Expansion of R&D facilities to support co-development with major smartphone manufacturers. |

| Collaborative Product Development | Joint refinement of components for next-generation devices. |

| Customer Support | Provision of localized, responsive after-sales service. |

| Revenue Source | Significant portion of H1 2024 revenue derived from long-term contracts with key clients. |

Channels

Direct sales to Original Equipment Manufacturers (OEMs) represent the cornerstone of AAC Technologies' business model. This channel directly targets leading global players in the consumer electronics, automotive, and other industrial sectors, ensuring a deep understanding of their evolving needs.

This direct engagement facilitates the development and delivery of highly customized acoustic and optical solutions, precisely tailored to each OEM's specifications. It also enables seamless integration into their complex manufacturing supply chains, a critical factor for efficiency and speed to market.

For instance, in 2024, AAC Technologies continued its strong partnerships with major smartphone manufacturers, supplying key acoustic components. The company reported that its revenue from direct sales to the consumer electronics segment remained robust, underscoring the channel's importance in maintaining market leadership.

The automotive sector also saw significant growth in direct sales for AAC, with the company providing advanced acoustic solutions for in-car entertainment systems and driver assistance technologies, reflecting a strategic expansion beyond traditional consumer electronics.

AAC Technologies Holdings utilizes a robust global distribution network to complement its direct sales efforts, ensuring its acoustic components and other offerings reach a diverse international clientele. This network is crucial for maintaining their extensive global presence and facilitating the swift delivery of products to manufacturers worldwide. For instance, in 2024, AAC's commitment to this network was evident in their continued investment in logistics and warehousing to support their expanding product lines and customer base across key markets in Asia, Europe, and North America.

Participation in major industry trade shows, such as CES, is crucial for AAC Technologies Holdings. These events act as a prime channel for unveiling cutting-edge products and technologies, solidifying their position as an innovator in the market.

These exhibitions are instrumental in generating qualified leads and fostering direct engagement with both prospective and established clients. The visibility gained at these high-profile gatherings directly translates into enhanced brand recognition and market penetration.

In 2024, AAC Technologies demonstrated its commitment to these channels by actively participating in key global tech events. This strategic presence allows them to gather market intelligence and directly assess competitor activities, informing their product development roadmap.

These trade shows not only facilitate sales but also serve as a platform for strategic partnerships and collaborations, essential for sustained growth in the competitive electronics component industry.

Online Presence and Investor Relations Portal

AAC Technologies Holdings leverages its official website and dedicated investor relations portal as key channels to communicate directly with stakeholders. This digital platform is crucial for disseminating financial reports, company news, and strategic updates, fostering transparency and accessibility.

The investor relations portal acts as a central hub, providing easy access to annual reports, interim results, and presentations, thereby facilitating informed decision-making for investors. In 2024, the company continued to update its portal with timely information, ensuring stakeholders had access to the latest performance metrics.

- Website and Investor Portal: AAC Technologies maintains a robust online presence through its official website and a dedicated investor relations portal.

- Information Dissemination: These channels are primary for sharing financial reports, corporate news, and strategic updates, enhancing transparency.

- Investor Engagement: The portal facilitates direct engagement with investors and the broader market, improving accessibility to critical information.

- Data Accessibility: In 2024, the company ensured continuous updates to its online platforms, providing stakeholders with real-time access to performance data and disclosures.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships are critical channels for AAC Technologies Holdings, enabling expansion and diversification. These moves aren't just about acquiring new technologies; they're about unlocking new customer bases and penetrating deeper into lucrative market segments, especially within the dynamic automotive sector. For instance, the acquisition of Premium Sound Solutions broadened AAC's reach into the high-fidelity audio market for vehicles.

These strategic alliances allow AAC to integrate complementary capabilities, thereby enhancing its product offerings and competitive positioning. By partnering with or acquiring companies that possess specialized expertise or established market presence, AAC can accelerate its growth trajectory and mitigate risks associated with organic development. This approach proved vital in 2024 as the company continued to solidify its standing in advanced acoustic and optical solutions.

- Acquisitions: Such as Premium Sound Solutions, provide access to new technologies and customer bases, particularly in the automotive sector.

- Partnerships: Foster collaboration for product development and market penetration, leveraging shared resources and expertise.

- Market Access: Strategic moves expand AAC's footprint into new geographical regions and industry verticals.

- Synergy Realization: Integrating acquired entities and partnerships aims to create operational efficiencies and enhanced value propositions.

AAC Technologies Holdings leverages a multi-faceted channel strategy, with direct sales to Original Equipment Manufacturers (OEMs) forming the core. This direct approach ensures deep customer understanding and tailored solutions, particularly evident in their strong relationships with major smartphone makers and growing presence in the automotive sector throughout 2024. Complementing this, a global distribution network ensures broad market reach and efficient product delivery worldwide.

Industry trade shows, such as CES, serve as vital channels for AAC to showcase innovation, generate leads, and gather market intelligence, reinforcing their position as a technology leader. Furthermore, their official website and investor relations portal provide transparent communication and accessibility to critical company information for stakeholders, with consistent updates in 2024. Finally, strategic acquisitions and partnerships, like the integration of Premium Sound Solutions, are key channels for market expansion and technological advancement, contributing to their solid performance in 2024.

Customer Segments

Global Consumer Electronics Brands represent AAC Technologies' foundational customer base. These are the titans of the tech world, the companies behind the smartphones, smartwatches, tablets, and laptops we use every day.

AAC Technologies serves these major manufacturers by providing the critical, high-performance, and incredibly small acoustic, haptic, optical, and MEMS components that power their flagship devices. Think of the tiny speakers that deliver rich sound, the subtle vibrations that confirm a touch, or the advanced sensors that enable new features.

In 2024, the global consumer electronics market continued its dynamic growth, with smartphone shipments alone projected to reach over 1.2 billion units. Brands within this segment are constantly pushing the boundaries of innovation, demanding increasingly sophisticated and miniaturized components to differentiate their offerings and meet consumer expectations for thinner, lighter, and more powerful devices.

The success of these brands hinges on the reliability and cutting-edge performance of their internal components. AAC Technologies' ability to deliver consistent quality and advanced solutions in acoustics, haptics, and optics makes them an indispensable partner for these global giants.

Automotive Manufacturers (OEMs) represent a rapidly expanding customer segment for AAC Technologies, particularly within the burgeoning New Energy Vehicle (NEV) market. These leading brands are actively seeking sophisticated acoustic, haptic, and sensing solutions to enhance their intelligent cockpits and in-car entertainment systems, driving demand for AAC's specialized technologies.

Augmented Reality (AR) and Virtual Reality (VR) companies represent a rapidly growing customer segment for AAC Technologies. These innovators are developing next-generation immersive experiences, demanding highly specialized miniature components for their headsets and other wearable devices. AAC's core competencies in optics, acoustics, and haptics are directly applicable to these emerging needs.

The AR/VR market is projected to reach significant figures. For instance, the global AR/VR market size was valued at approximately USD 28.46 billion in 2023 and is expected to grow substantially, with some forecasts suggesting it could exceed USD 200 billion by 2028. This expansion fuels demand for the precise, miniaturized solutions AAC provides.

Companies in this sector require advanced optical components for displays and sensors, sophisticated acoustic solutions for spatial audio, and innovative haptic feedback mechanisms to enhance realism. AAC's ability to deliver high-quality, integrated solutions positions it as a key partner for these forward-thinking businesses.

For example, the demand for high-resolution displays in VR headsets necessitates advanced micro-optics, an area where AAC has demonstrated significant expertise. Similarly, the pursuit of truly immersive audio experiences in both AR and VR applications relies on compact, high-fidelity acoustic transducers, a testament to AAC's manufacturing capabilities.

Robotics and AI-Driven Technology Developers

AAC Technologies Holdings is actively targeting the burgeoning robotics and AI-driven technology sector as a key customer segment. This involves supplying highly specialized components crucial for advanced robotics. For instance, their micro high-thrust stepper motors and high-precision hollow cup motors are finding application in sophisticated humanoid robots and other AI-powered systems.

This strategic focus on robotics and AI development positions AAC for significant future growth. By providing essential, precision-engineered parts, AAC enables the creation of more capable and sophisticated robotic solutions. The demand for such components is expected to surge as AI integration across industries accelerates.

- Target Market Focus: Humanoid robots and AI-driven applications.

- Key Components Provided: Micro high-thrust stepper motors, high-precision hollow cup motors.

- Growth Driver: Expanding reach into the robotics sector as a future growth engine.

- Market Trend Alignment: Catering to the increasing demand for advanced robotics driven by AI advancements.

Healthcare and Industrial Device Manufacturers

AAC Technologies Holdings serves niche segments within the healthcare and industrial device manufacturing sectors, leveraging its expertise in precision components. These markets, while smaller in volume compared to consumer electronics, demand exceptionally high standards for reliability and performance, areas where AAC's micro-electromechanical systems (MEMS) and optical solutions excel. For instance, their acoustic components can be integrated into advanced medical diagnostic equipment or specialized industrial sensors where precise sound capture or generation is critical.

The company's ability to deliver miniaturized and high-performance solutions makes them a valuable partner for manufacturers creating cutting-edge healthcare devices, such as implantable sensors or advanced audiology equipment. Similarly, in the industrial realm, AAC's offerings support applications in areas like precision measurement, environmental monitoring, and sophisticated control systems within manufacturing processes. This diversification showcases the broad applicability of AAC's core technological competencies beyond its primary consumer electronics focus.

- Healthcare Device Integration: AAC's components are utilized in medical devices requiring high precision, such as hearing aids, diagnostic equipment, and wearable health monitors.

- Industrial Equipment Applications: Their micro-acoustic and optical solutions are integrated into industrial sensors, automation systems, and communication devices for harsh environments.

- Technological Versatility: The company's core competencies in miniaturization and precision manufacturing are transferable across diverse and demanding industry applications.

- Focus on Niche Markets: While smaller, these segments represent high-value opportunities where performance and reliability are paramount, aligning with AAC's strengths.

AAC Technologies Holdings primarily targets global consumer electronics brands, providing essential acoustic, haptic, and optical components for their devices. The automotive sector, particularly new energy vehicles, is a growing area, with demand for advanced in-car systems. Additionally, the rapidly expanding Augmented Reality (AR) and Virtual Reality (VR) markets represent a key focus, requiring specialized miniature components for immersive experiences.

AAC also serves niche segments like healthcare and industrial devices, where precision and reliability are paramount. The company is strategically expanding into robotics and AI-driven technology, supplying critical motors for advanced systems.

| Customer Segment | Key Products/Services | 2024 Market Relevance |

|---|---|---|

| Global Consumer Electronics Brands | Acoustic, Haptic, Optical, MEMS components | Smartphones, wearables, laptops; demand for miniaturization and innovation. |

| Automotive Manufacturers (OEMs) | Acoustic, Haptic, Sensing solutions for intelligent cockpits | Growth in New Energy Vehicles (NEVs); enhanced in-car experiences. |

| AR/VR Companies | Miniature optics, acoustics, haptics for headsets | Rapid market growth, need for immersive and realistic components. |

| Robotics & AI | Micro high-thrust stepper motors, hollow cup motors | Enabling advanced humanoid robots and AI-powered systems. |

| Healthcare & Industrial Devices | MEMS, optical solutions, acoustic components | High-precision medical equipment, industrial sensors, automation. |

Cost Structure

Research and Development (R&D) costs represent a substantial investment for AAC Technologies Holdings, underscoring their dedication to staying at the forefront of technological advancement in their industry. These expenditures are crucial for maintaining their competitive edge and developing next-generation acoustic and optical components.

The R&D budget encompasses a wide array of activities, including the compensation of highly skilled engineers and scientists, the acquisition and maintenance of sophisticated laboratory equipment, and the extensive process of developing entirely new products and safeguarding their intellectual property through proprietary technologies. For instance, in 2024, AAC Technologies continued to invest heavily in areas like advanced miniaturization techniques for acoustic modules and enhancements in optical sensing technologies.

Manufacturing and production costs are a significant component for AAC Technologies, reflecting the expense of running their worldwide production sites. These costs encompass everything from acquiring the necessary raw materials and paying direct labor to covering utility bills and keeping sophisticated machinery in good repair.

The precision required for their high-tech components means these expenses are inherently substantial. For instance, in 2023, AAC Technologies reported that their cost of sales, which largely comprises manufacturing expenses, amounted to approximately RMB 18.08 billion, a notable increase from RMB 15.28 billion in 2022, highlighting the ongoing investment in their production capabilities.

AAC Technologies Holdings dedicates significant resources to sourcing specialized raw materials and components, a primary cost driver. The fluctuating nature of global commodity prices, such as for rare earth elements or advanced polymers essential for their acoustic and optical products, directly impacts this expenditure. For instance, in 2024, the volatility in certain metals used in micro-acoustic components saw price increases of up to 15% compared to the previous year, necessitating careful cost management.

Effective procurement strategies and robust inventory management are paramount to mitigating these raw material costs. By securing favorable long-term contracts and optimizing stock levels to avoid both shortages and excess, AAC aims to maintain cost efficiency. Their efforts in 2024 to diversify suppliers for key components, particularly those experiencing geopolitical supply chain disruptions, helped to stabilize procurement costs, preventing more substantial price hikes.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for AAC Technologies Holdings encompass the costs associated with selling their acoustic components and other products, managing their global operations, and supporting corporate functions. These are the essential costs of doing business that keep the company running and reaching its customers. For instance, in 2023, AAC Technologies reported SG&A expenses of RMB 2.89 billion. This figure reflects their investment in sales teams, marketing campaigns to promote their innovative products, and the administrative infrastructure needed to manage a large, international manufacturing enterprise.

These expenses are critical for maintaining AAC Technologies' market presence and driving future growth. They include salaries for sales and marketing personnel, advertising and promotional activities, and the operational costs of their administrative offices worldwide. The company's commitment to research and development, often housed within these SG&A figures, is also a significant driver of their competitive edge.

Key components within AAC Technologies' SG&A expenses typically include:

- Sales and Marketing: Costs related to promoting and selling products, including advertising, salaries for sales staff, and travel expenses.

- General and Administrative: Overhead costs such as executive salaries, accounting, legal fees, and office supplies.

- Research and Development (R&D): Investment in developing new technologies and products, crucial for maintaining a leading position in the acoustics market.

- Employee Benefits and Compensation: Costs associated with employee salaries, wages, and benefits across all departments.

Capital Expenditures (CapEx)

AAC Technologies Holdings' cost structure is heavily influenced by significant capital expenditures (CapEx). These investments are crucial for expanding and modernizing its manufacturing plants, acquiring cutting-edge production machinery, and building robust technology infrastructure. For instance, in 2023, AAC reported capital expenditures of approximately HKD 1.5 billion, reflecting ongoing investments in advanced manufacturing capabilities to meet market demand.

These CapEx outlays are fundamental to AAC's strategy of maintaining a competitive edge in production efficiency and supporting its long-term growth trajectory. By continuously upgrading its facilities and investing in new technologies, the company ensures it can deliver high-quality acoustic, haptic, and optical components.

- Manufacturing Facility Expansion: Continued investment in increasing production capacity.

- New Production Equipment: Acquisition of advanced machinery for enhanced product quality and efficiency.

- Technology Infrastructure: Investment in R&D and advanced manufacturing technologies.

- 2023 CapEx: Approximately HKD 1.5 billion spent on capital investments.

The cost structure of AAC Technologies Holdings is dominated by its manufacturing and production expenses, reflecting the capital-intensive nature of producing advanced acoustic and optical components. Research and development is another significant outlay, vital for maintaining their technological leadership and developing new products. Sales, General, and Administrative (SG&A) costs are also substantial, supporting global operations and market outreach.

In 2023, the company's cost of sales, largely manufacturing-related, was around RMB 18.08 billion. SG&A expenses for the same year stood at RMB 2.89 billion. Furthermore, capital expenditures were approximately HKD 1.5 billion in 2023, highlighting ongoing investments in facilities and equipment.

| Cost Category | 2023 (Approximate) | Significance |

| Cost of Sales (Manufacturing) | RMB 18.08 billion | Largest cost driver, covering raw materials, labor, and production overheads. |

| SG&A Expenses | RMB 2.89 billion | Supports global operations, sales, marketing, and administrative functions. |

| Capital Expenditures (CapEx) | HKD 1.5 billion | Investment in expanding and modernizing manufacturing capabilities and technology infrastructure. |

Revenue Streams

The sale of acoustic components, including speakers, receivers, and microphones, represents a primary revenue driver for AAC Technologies. These miniaturized parts are essential for a wide range of consumer electronics, notably smartphones and wearables. This segment was a significant contributor to AAC Technologies' revenue in 2024, underscoring its importance in the company's overall financial performance.

AAC Technologies Holdings generates significant revenue from the sale of electromagnetic drives and precision mechanics. This segment includes crucial components like linear motors for haptic feedback, essential for immersive user experiences in smartphones and other smart devices.

Revenue also flows from radio frequency (RF) mechanical solutions, which are vital for the seamless connectivity of modern electronics. These RF components ensure robust signal transmission and reception, a cornerstone of the smart device ecosystem.

Furthermore, the company profits from a range of other precision mechanical components. These parts contribute to the overall structural integrity and sophisticated functionality of high-tech consumer electronics, demonstrating a broad application of their manufacturing expertise.

For the fiscal year 2023, AAC Technologies reported that its acoustic and non-acoustic components business, which includes these electromagnetic drives and precision mechanics, achieved revenue of approximately RMB 12.05 billion (USD 1.68 billion). This highlights the substantial contribution of these product categories to the company's overall financial performance.

AAC Technologies Holdings generates substantial revenue through the sales of its optics products. This segment encompasses a wide array of optical solutions, including plastic lenses and advanced camera modules. These components are critical for a range of devices, from smartphones and augmented/virtual reality headsets to sophisticated automotive systems.

The optics business has been a significant growth driver for AAC Technologies, demonstrating notable expansion in recent periods. Furthermore, this segment has seen improvements in its profitability, indicating efficient operations and strong market positioning. For instance, in the first half of 2024, revenue from the optics segment saw a substantial year-on-year increase, reflecting strong demand across its target markets.

Sales of Premium Sound Solutions (PSS) for Automotive

Following its acquisition of PSS, AAC Technologies Holdings has established a robust revenue stream from premium sound solutions within the automotive sector. This segment now encompasses branded audio systems, high-fidelity speakers, and advanced amplifiers tailored for prominent automotive manufacturers.

The company’s commitment to integrating PSS has unlocked substantial growth, positioning automotive acoustics as a key contributor to its overall financial performance. This strategic move allows AAC Technologies to tap into the increasing demand for enhanced in-car audio experiences, a trend that continues to gain momentum in the automotive industry.

In 2024, the automotive sector has shown resilience, with many leading brands focusing on premium features to differentiate their offerings. This directly benefits AAC Technologies’ PSS division. For instance, the global automotive audio market is projected to reach significant figures, with specific segments related to premium sound systems experiencing notable expansion.

- Automotive Acoustics Revenue: A significant and growing segment for AAC Technologies, driven by the PSS acquisition.

- Product Offerings: Includes branded audio systems, speakers, and amplifiers for leading automotive brands.

- Market Trend: Capitalizes on the increasing consumer demand for premium in-car audio experiences.

- 2024 Outlook: Benefits from the automotive industry's focus on premium features and technological advancements in sound systems.

Sales of MEMS, Sensor, and Semiconductor Products

AAC Technologies Holdings generates revenue through the sale of sophisticated components like micro-electromechanical systems (MEMS), various sensors, and semiconductor products. These offerings are crucial for the functionality of many modern electronic devices.

While not the largest contributor to overall revenue at present, these product segments hold significant promise for future growth. The increasing integration of AI and robotics across industries is expected to drive demand for these advanced components.

- MEMS and Sensor Sales: Revenue derived from the sale of micro-electromechanical systems and a diverse range of sensors used in consumer electronics, automotive, and industrial applications.

- Semiconductor Products: Income generated from the sale of specialized semiconductor components, often integrated with their acoustic and other modules.

- Growth Potential: These areas are identified as high-growth segments, particularly as AI and robotics technologies continue to advance and require more sophisticated sensing and processing capabilities.

AAC Technologies' revenue streams are diverse, spanning acoustic components, electromagnetic drives, RF mechanical solutions, and other precision mechanics. The company also generates substantial income from its optics products, including plastic lenses and camera modules, which are crucial for smartphones, AR/VR headsets, and automotive systems. In the first half of 2024, the optics segment experienced a significant year-on-year revenue increase.

A key growth area is automotive acoustics, bolstered by the acquisition of PSS, contributing revenue from branded audio systems and advanced amplifiers. This segment benefits from the automotive industry's emphasis on premium features, with the global automotive audio market showing strong expansion. The company also earns revenue from MEMS, sensors, and semiconductor products, which are poised for future growth driven by advancements in AI and robotics.

| Revenue Stream | Key Products | 2023 Revenue (Approximate) | Growth Drivers |

|---|---|---|---|

| Acoustic & Non-Acoustic Components | Speakers, receivers, microphones, linear motors, haptic feedback components | RMB 12.05 billion (USD 1.68 billion) | Essential for smartphones, wearables, smart devices |

| Optics Products | Plastic lenses, camera modules | N/A (Significant H1 2024 growth) | Smartphones, AR/VR headsets, automotive systems |

| Automotive Acoustics | Branded audio systems, high-fidelity speakers, amplifiers | N/A (Key growth contributor post-PSS acquisition) | Premium in-car audio demand, automotive industry focus on features |

| MEMS, Sensors & Semiconductor Products | MEMS, various sensors, specialized semiconductor components | N/A (High future growth potential) | Advancements in AI, robotics, and IoT |

Business Model Canvas Data Sources

AAC Technologies Holdings' Business Model Canvas is meticulously constructed using a blend of financial disclosures, market research reports, and internal operational data. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework and market positioning.