3M SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

3M's diverse product portfolio is a significant strength, but its reliance on innovation presents a constant challenge. While their global reach offers substantial opportunities, potential regulatory hurdles and intense competition demand careful navigation. Want to understand how these factors shape 3M's future?

Discover the complete picture behind 3M's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

3M's strength lies in its incredibly diverse product catalog, encompassing approximately 60,000 items. This broad range spans critical sectors like Safety & Industrial, Transportation & Electronics, Health Care, and Consumer goods. Such diversification significantly lowers reliance on any single market, fostering robust financial stability and resilience.

This extensive product breadth, coupled with a significant global footprint, allows 3M to tap into a wide array of international markets. Consequently, the company is better positioned to navigate and mitigate risks associated with regional economic downturns or specific market challenges. For instance, in 2023, 3M reported net sales of $32.6 billion, with a substantial portion generated from its international operations, underscoring the importance of its global reach.

3M boasts a robust history of innovation, consistently deriving a substantial portion of its income from newly introduced products. This commitment is underscored by a planned investment of $3.5 billion in research and development between 2025 and 2027.

This significant R&D outlay is strategically aimed at launching approximately 1,000 new products. The company is focusing its innovation efforts on high-growth areas like aerospace, automotive, electronics, and energy to revitalize its product pipeline.

3M's brand recognition is a significant strength, built over a century of innovation and quality. Familiar names like Post-it and Scotch are household staples, contributing to substantial brand equity.

This strong brand equity allows 3M to leverage its reputation when entering new markets or launching product extensions. For instance, in 2023, 3M continued to invest in marketing its core brands, reinforcing their market presence.

Operational Efficiency and Financial Health

3M has showcased strong operational resilience, with its adjusted operating margins seeing an expansion in the first quarter of 2025. This improvement is largely attributed to successful productivity initiatives and stringent cost control measures implemented across the business.

The company is actively pursuing operational excellence, setting a clear target to achieve an operating margin of approximately 25% by the year 2027. This strategic focus on efficiency underpins its commitment to enhancing financial health and profitability.

- Improved Profitability: Adjusted operating margins expanded in Q1 2025.

- Productivity Gains: Operational improvements are driving margin expansion.

- Cost Controls: Effective management of expenses contributes to financial health.

- Future Margin Target: Aiming for approximately 25% operating margin by 2027.

Commitment to Sustainability

3M's commitment to sustainability is a significant strength, with the company actively pursuing initiatives to reduce its environmental impact. This includes a strong focus on lowering its carbon footprint, increasing its reliance on renewable energy sources, and enhancing its water stewardship practices.

The company is also in the process of reviewing and refining its sustainability targets related to carbon emissions, water usage, and plastic waste. These updated goals are being carefully aligned with 3M's broader business objectives, ensuring that sustainability efforts contribute to long-term value creation.

For instance, as of their 2023 reporting, 3M had achieved a 29% reduction in greenhouse gas emissions intensity compared to a 2019 baseline, demonstrating tangible progress in their carbon reduction goals. They also aim to source 100% of their purchased electricity from renewable sources by 2030, a target they are actively working towards.

- Reduced carbon footprint: 3M has set ambitious goals to decrease greenhouse gas emissions.

- Increased renewable energy use: The company is transitioning towards renewable electricity sources.

- Improved water stewardship: Efforts are focused on responsible water management across operations.

- Refined sustainability targets: Goals for carbon, water, and plastics are being updated and aligned with business strategy.

3M's diverse product portfolio, spanning roughly 60,000 items across key sectors like Safety & Industrial, Health Care, and Consumer goods, significantly reduces its dependence on any single market, ensuring financial stability and resilience.

This extensive product range, coupled with a substantial global presence, allows 3M to access a wide array of international markets, mitigating risks from regional economic downturns. In 2023, 3M reported net sales of $32.6 billion, with a significant portion originating from international operations, highlighting the value of its global reach.

A strong commitment to innovation is evident, with planned investments of $3.5 billion in R&D between 2025 and 2027 aimed at launching approximately 1,000 new products, focusing on high-growth areas like aerospace and electronics.

3M's brand recognition, bolstered by iconic names like Post-it and Scotch, represents a significant asset, allowing for easier market entry and product extensions, as demonstrated by continued marketing investments in its core brands throughout 2023.

Operational resilience is a key strength, with Q1 2025 seeing expanded adjusted operating margins due to productivity initiatives and cost controls, supporting a target of approximately 25% operating margin by 2027.

Sustainability efforts are a growing strength, with 3M actively working to reduce its environmental impact. By 2023, the company achieved a 29% reduction in greenhouse gas emissions intensity from a 2019 baseline and aims for 100% renewable electricity sourcing by 2030.

| Metric | 2023 Data | 2025 Target/Progress | 2027 Target |

|---|---|---|---|

| Net Sales | $32.6 billion | N/A | N/A |

| R&D Investment (Planned) | N/A | $3.5 billion (2025-2027) | N/A |

| New Products (Target) | N/A | ~1,000 | N/A |

| Adjusted Operating Margin | N/A | Expanded in Q1 2025 | ~25% |

| GHG Emissions Intensity Reduction | 29% (vs 2019) | N/A | N/A |

| Renewable Electricity Sourcing | N/A | Progressing | 100% by 2030 |

What is included in the product

Delivers a strategic overview of 3M’s internal and external business factors, detailing its strong brand and innovation capabilities alongside potential challenges in market diversification and litigation.

Identifies key competitive advantages and areas for improvement, enabling targeted resource allocation and risk mitigation.

Highlights potential growth opportunities and emerging threats, guiding strategic adjustments for sustained market leadership.

Weaknesses

While 3M boasts a broad product range, a significant portion of its revenue still stems from more traditional, mature categories. This can present a hurdle for overall growth, especially when compared to nimbler companies focused on niche, high-growth markets. For instance, in 2023, while specific segment data is still being analyzed for full year impact, the company has acknowledged the need to innovate within its established segments to counter this potential drag.

Despite diversification efforts, 3M's performance remains tethered to global economic cycles, influencing consumer spending and industrial capital. This sensitivity was evident in Q1 2025, where the company reported a modest dip in GAAP sales, signaling continued revenue challenges stemming from subdued market demand and fierce competition.

3M has experienced a higher attrition rate than many competitors in its sectors. This trend, evident in recent years, means the company must dedicate more resources to recruiting, onboarding, and training new employees. For instance, in 2023, the company reported a voluntary separation rate that impacted operational continuity.

This elevated turnover directly translates into increased operational costs, not only for recruitment and training but also for the potential loss of valuable institutional knowledge. Losing experienced staff can slow down innovation and project execution, requiring significant effort to rebuild expertise within teams.

Challenges in Innovation Competitiveness

Despite substantial research and development spending, 3M has faced challenges keeping pace with the innovation speed of key rivals in specific markets. This indicates a potential lag in converting research breakthroughs into dominant market offerings, a critical area for improvement.

To counter this, 3M is strategically shifting its focus towards sectors with higher growth potential and prioritizing the introduction of new products. For instance, in 2023, 3M reported $1.9 billion in R&D expenses, a significant investment aimed at fueling future innovation and maintaining competitiveness.

- Innovation Lag: Difficulty translating R&D into market-leading products compared to competitors.

- Strategic Realignment: Focus on high-growth sectors and accelerating new product introductions.

- R&D Investment: $1.9 billion allocated to R&D in 2023 to drive innovation.

Supply Chain Complexity and Vulnerability

3M's intricate global supply chain, a hallmark of its diverse product portfolio, presents a significant weakness. The company's reliance on a vast network of international suppliers, estimated in the tens of thousands, makes it susceptible to disruptions. For instance, geopolitical tensions or natural disasters in key manufacturing regions can impede the flow of raw materials and finished goods, impacting production schedules and delivery times. In 2023, 3M continued to invest in supply chain visibility and diversification, aiming to mitigate risks associated with its extensive global footprint.

This complexity also translates to vulnerability. Trade disputes or sudden changes in import/export regulations can create unforeseen hurdles, affecting cost structures and market access. While 3M is actively working to enhance its supply chain resilience through strategies like dual sourcing and regionalization, the sheer scale of its operations means that external shocks can still pose a considerable challenge to its operational efficiency and ability to meet customer demand promptly.

- Global Reach, Global Risk: 3M's operations span over 70 countries, creating a complex web of suppliers and logistics that can be easily disrupted by geopolitical events or trade policy shifts.

- Supplier Dependence: The company's reliance on a broad supplier base, while offering diversification, also means that issues with a few critical suppliers can have a cascading effect on production.

- Logistical Challenges: Managing the transportation and warehousing of diverse products across continents is inherently complex and prone to delays, especially in the face of rising shipping costs and port congestion, which impacted global trade throughout 2023 and into early 2024.

3M faces challenges in converting its significant R&D investments into market-leading products, often lagging behind competitors in innovation speed. This was highlighted in 2023 when, despite $1.9 billion in R&D spending, the company acknowledged the need to accelerate new product introductions, particularly in high-growth sectors.

The company's broad product portfolio, while a strength, also means a substantial portion of revenue comes from mature markets, potentially limiting overall growth compared to more specialized firms. This reliance on established categories necessitates continuous innovation to offset slower growth trajectories.

3M's extensive global supply chain, while enabling worldwide reach, creates significant vulnerability to disruptions. Geopolitical events, trade policy shifts, and logistical challenges, as seen with global shipping issues in 2023-2024, can impact production and timely delivery.

Furthermore, the company has experienced higher employee attrition rates, leading to increased costs for recruitment and training, and a potential loss of institutional knowledge that can slow down innovation and project execution.

| Weakness | Description | Impact | Example/Data |

| Innovation Lag | Difficulty translating R&D into market-leading products compared to competitors. | Slower market penetration, reduced competitive advantage. | 2023 R&D spend: $1.9 billion, yet strategic focus on accelerating new product introductions. |

| Mature Market Dependence | Significant revenue from traditional, mature product categories. | Limited overall growth potential, vulnerability to market saturation. | Acknowledged need to innovate within established segments to counter growth drag. |

| Supply Chain Vulnerability | Complex global network susceptible to disruptions. | Production delays, increased costs, inability to meet demand. | Operations in over 70 countries; impacted by global shipping issues in 2023-2024. |

| Employee Attrition | Higher than average employee turnover. | Increased operational costs, loss of expertise, slower project execution. | Reported voluntary separation rate impacting operational continuity in 2023. |

Preview Before You Purchase

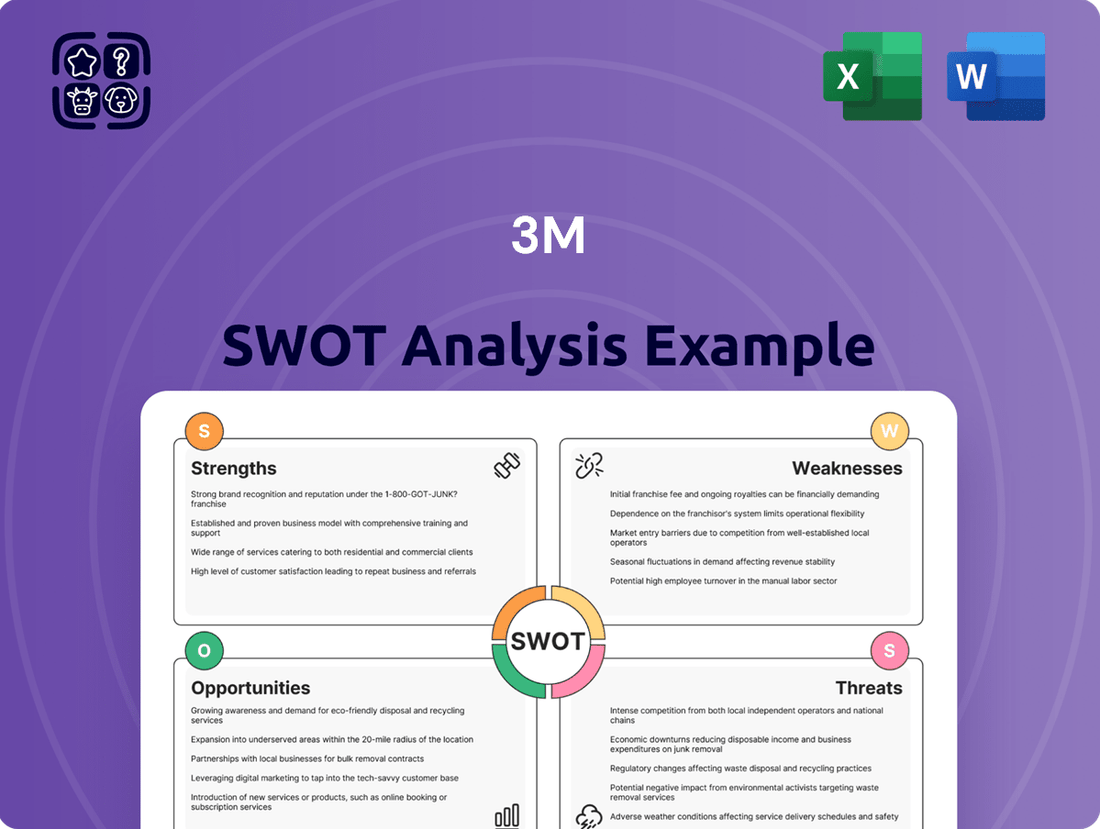

3M SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for 3M. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

This is the same SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and in-depth insights into 3M's strategic position.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail, allowing you to leverage its strategic insights.

Opportunities

3M is actively pursuing growth by concentrating on dynamic sectors like aerospace, automotive, electronics, industrial automation, AR/VR, energy, data centers, and semiconductors. This strategic alignment allows the company to capitalize on its unique technological capabilities in markets poised for significant expansion.

For instance, in the semiconductor industry, 3M's advanced materials are crucial for next-generation chip manufacturing, a sector projected to see robust growth through 2025 and beyond, driven by increasing demand for AI and high-performance computing. Similarly, the automotive sector's shift towards electric vehicles and advanced driver-assistance systems (ADAS) presents substantial opportunities for 3M's specialized adhesives, films, and electronic components, with the global EV market expected to reach hundreds of billions in value by 2025.

The spin-off of its healthcare business into Solventum Corporation, completed in April 2024, allows 3M to sharpen its operational focus on its industrial and consumer core. This strategic realignment is expected to unlock distinct value propositions for both entities. For instance, Solventum's initial market capitalization was approximately $13 billion, highlighting the significant value attributed to the separated healthcare assets.

This move enables 3M to pursue its industrial and advanced materials roots more effectively, potentially leading to improved resource allocation and innovation within these core segments. By shedding the complexities of the healthcare division, 3M can concentrate on areas where it holds a more dominant market position and can drive greater operational efficiencies.

Growing global environmental consciousness is a significant tailwind, driving consumer and business demand for sustainable and eco-friendly products. This trend positions 3M favorably, given its established expertise in materials science and innovation, to develop and market solutions that align with these evolving preferences.

3M is actively investing in sustainable product design, the utilization of eco-friendly materials, and the implementation of energy-efficient production processes. For instance, in 2023, the company reported a 10% increase in sales from its sustainability-focused product portfolio compared to 2022, demonstrating tangible market traction.

Digitalization and AI in R&D and Operations

3M is leveraging digitalization and AI to significantly boost its R&D processes, aiming for faster innovation cycles and more efficient product design. This strategic move is exemplified by the development of their Cubitron 3 brand abrasive product, showcasing how AI can streamline research and bring new solutions to market more effectively.

The company's investment in these advanced technologies is expected to yield tangible benefits, potentially leading to improved operational efficiency and a stronger competitive edge. For instance, AI-driven simulations can reduce the time and cost associated with physical prototyping.

- AI-powered R&D: Accelerating discovery and development of new materials and products.

- Operational Optimization: Enhancing manufacturing processes and supply chain management through data analytics.

- Cubitron 3 Example: Demonstrating AI's role in creating high-performance products with enhanced precision.

- Future Growth: Positioning 3M for continued innovation and market leadership in a digital-first environment.

Strategic Acquisitions and Portfolio Optimization

3M's history of successfully integrating acquired companies offers a significant opportunity for new revenue streams and market penetration. For instance, its 2021 acquisition of Food Safety business from Neogen Corporation for $5.3 billion aimed to bolster its presence in the food safety sector, a market showing consistent growth.

The company is actively engaged in portfolio optimization, strategically assessing its business units for potential acquisitions or divestitures. This proactive approach allows 3M to align its operations with emerging market trends and future growth prospects, ensuring a more focused and profitable business structure.

Key opportunities arising from this strategy include:

- Market Expansion: Acquiring businesses in high-growth sectors can quickly expand 3M's market reach and customer base.

- Synergy Realization: Integrating complementary technologies and operations from acquired firms can lead to cost efficiencies and innovation.

- Strategic Divestitures: Selling underperforming or non-core assets frees up capital for investment in more promising areas.

- Enhanced Innovation: Accessing new intellectual property and talent through acquisitions can accelerate the development of next-generation products.

3M is strategically positioned to leverage growth in key sectors like aerospace, automotive, and electronics, with significant opportunities in the burgeoning semiconductor market. The company's focus on advanced materials for next-generation chip manufacturing aligns with projected industry expansion through 2025, driven by AI and high-performance computing demands. Furthermore, the automotive sector's transition to electric vehicles and advanced driver-assistance systems presents substantial avenues for 3M's specialized components, tapping into a global EV market expected to reach hundreds of billions in value by 2025.

The spin-off of its healthcare business in April 2024 allows 3M to concentrate on its core industrial and consumer segments, potentially unlocking greater value and operational efficiency. This strategic realignment, separating assets valued around $13 billion, enables a sharper focus on areas where 3M holds dominant market positions and can foster innovation more effectively.

Increasing global environmental awareness presents a significant tailwind, driving demand for sustainable products. 3M's expertise in materials science positions it well to develop and market eco-friendly solutions, evidenced by a reported 10% increase in sales from its sustainability-focused portfolio in 2023 compared to the previous year.

Leveraging digitalization and AI in R&D, as seen with the Cubitron 3 abrasive product, accelerates innovation cycles and enhances product design efficiency. This investment in advanced technologies is expected to improve operational efficiency and bolster the company's competitive edge.

3M's history of successful acquisitions, such as the $5.3 billion purchase of Neogen Corporation's Food Safety business in 2021, provides opportunities for new revenue streams and market penetration. Portfolio optimization through strategic acquisitions and divestitures further enhances market reach, synergy realization, and access to new intellectual property.

Threats

3M is navigating significant legal and regulatory headwinds, primarily stemming from its historical use of PFAS chemicals and the issue of defective combat earplugs. While the company has agreed to substantial settlements, such as the estimated $10.3 billion for PFAS-related litigation announced in mid-2023, the potential for further litigation and evolving regulatory landscapes presents an ongoing threat.

These persistent legal entanglements demand considerable financial resources and management attention, potentially diverting focus from innovation and growth initiatives. The company's ability to manage these liabilities effectively will be a key determinant of its future financial stability and operational capacity.

3M faces formidable competition across all its diverse business segments, creating a constant challenge to maintain and grow its market share and profitability. For example, in the consumer health sector, brands like Johnson & Johnson and Procter & Gamble are major rivals, while in industrial adhesives, companies such as Henkel and Avery Dennison are significant players.

The company's innovation cycle is directly challenged by competitors who are also heavily invested in research and development, pushing the boundaries in areas like advanced materials and filtration technologies. This continuous innovation from rivals means 3M must consistently invest in its own R&D to stay ahead, a significant operational cost.

In 2023, the global adhesives and sealants market, a key area for 3M, was valued at approximately $65 billion and is projected to grow, but this growth is shared among numerous established and emerging competitors, intensifying the fight for market dominance.

3M's extensive global operations expose it to significant macroeconomic volatility. For instance, persistent inflation in key markets like the United States and Europe throughout 2024 could dampen consumer demand for 3M's diverse product portfolio, from adhesives to healthcare supplies. Geopolitical tensions, such as ongoing trade disputes or regional conflicts, further introduce supply chain disruptions and cost uncertainties, impacting 3M's ability to maintain stable production and pricing.

Supply Chain Disruptions and Cost Pressures

Despite ongoing efforts to bolster its global supply chain, 3M remains susceptible to disruptions. Events like geopolitical tensions, extreme weather, or shifts in trade policies can impact its operations. For instance, in early 2024, ongoing shipping route disruptions in the Red Sea continued to add costs and lead times for various industries, including those 3M serves.

Furthermore, the company faces persistent cost pressures. Fluctuations in the prices of key raw materials, such as petrochemicals and rare earth elements, directly affect 3M's manufacturing expenses. Global tariff adjustments also present a challenge, potentially increasing the cost of goods and impacting profit margins throughout 2024 and into 2025.

- Vulnerability to Geopolitical and Environmental Events: 3M's extensive global manufacturing footprint exposes it to risks from political instability and natural disasters impacting key sourcing regions.

- Rising Raw Material and Logistics Costs: The company experienced a notable increase in input costs in 2023, with projections for 2024 indicating continued volatility in commodity prices and elevated freight expenses.

- Impact of Trade Policies: Evolving trade agreements and tariffs can alter the cost structure of imported components and exported finished goods, creating uncertainty for financial planning.

Talent Acquisition and Retention

3M faces a significant threat from its higher attrition rate, particularly impacting its need for a highly skilled workforce in specialized areas. This makes it harder to maintain a competitive edge. In 2023, 3M reported a workforce of approximately 89,000 employees globally, and managing turnover within this large base, especially in critical R&D and manufacturing roles, is an ongoing challenge.

Attracting and retaining top talent, especially in rapidly evolving technological fields like advanced materials and digital innovation, is proving to be both challenging and costly for 3M. Companies in these sectors often compete fiercely for the same limited pool of highly qualified professionals, driving up recruitment expenses and potentially impacting project timelines if key personnel depart.

- High Attrition Rates: Increased employee turnover directly impacts operational efficiency and institutional knowledge.

- Specialized Skill Gaps: Difficulty in finding and keeping experts in fields like nanotechnology and AI hinders innovation.

- Competitive Talent Market: Rivals in advanced manufacturing and technology actively recruit from the same talent pools, increasing recruitment costs and time.

- Retention Costs: Implementing competitive compensation, benefits, and development programs to retain talent adds significant operational expenditure.

The ongoing legal battles, particularly concerning PFAS and combat earplugs, represent a substantial financial and reputational threat. The company's estimated $10.3 billion PFAS settlement in mid-2023 highlights the scale of these liabilities, with potential for further claims and evolving regulations creating persistent uncertainty.

Intense competition across its diverse segments, from consumer health to industrial adhesives, necessitates continuous innovation and significant R&D investment. Rivals like Johnson & Johnson and Henkel are formidable, demanding constant vigilance to maintain market share and profitability in areas like the $65 billion global adhesives market.

Macroeconomic volatility, including inflation and geopolitical tensions, poses risks to consumer demand and supply chain stability. For example, continued inflation in 2024 could impact sales, while disruptions like those seen in Red Sea shipping routes in early 2024 add costs and lead times.

3M faces challenges in retaining its skilled workforce, with high attrition rates impacting operational efficiency and innovation. The competitive talent market, especially in advanced materials and digital innovation, drives up recruitment costs and can delay critical projects.

| Threat Category | Specific Threat | 2023/2024 Impact/Projection |

|---|---|---|

| Legal & Regulatory | PFAS Litigation | $10.3 billion settlement (mid-2023); ongoing potential for claims. |

| Legal & Regulatory | Combat Earplugs Litigation | Ongoing legal proceedings; significant financial and reputational risk. |

| Competition | Market Share Erosion | Intense competition in adhesives, healthcare, and consumer goods sectors. |

| Competition | Innovation Lag | Competitors heavily investing in R&D for advanced materials and filtration. |

| Economic | Inflationary Pressures | Dampened consumer demand and increased operating costs in 2024. |

| Economic | Supply Chain Disruptions | Geopolitical tensions and shipping route issues impacting lead times and costs. |

| Operational | Talent Attrition | High turnover affecting specialized roles; increased recruitment costs. |

SWOT Analysis Data Sources

This 3M SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and insights from industry experts to ensure a well-rounded and actionable assessment.