3M Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

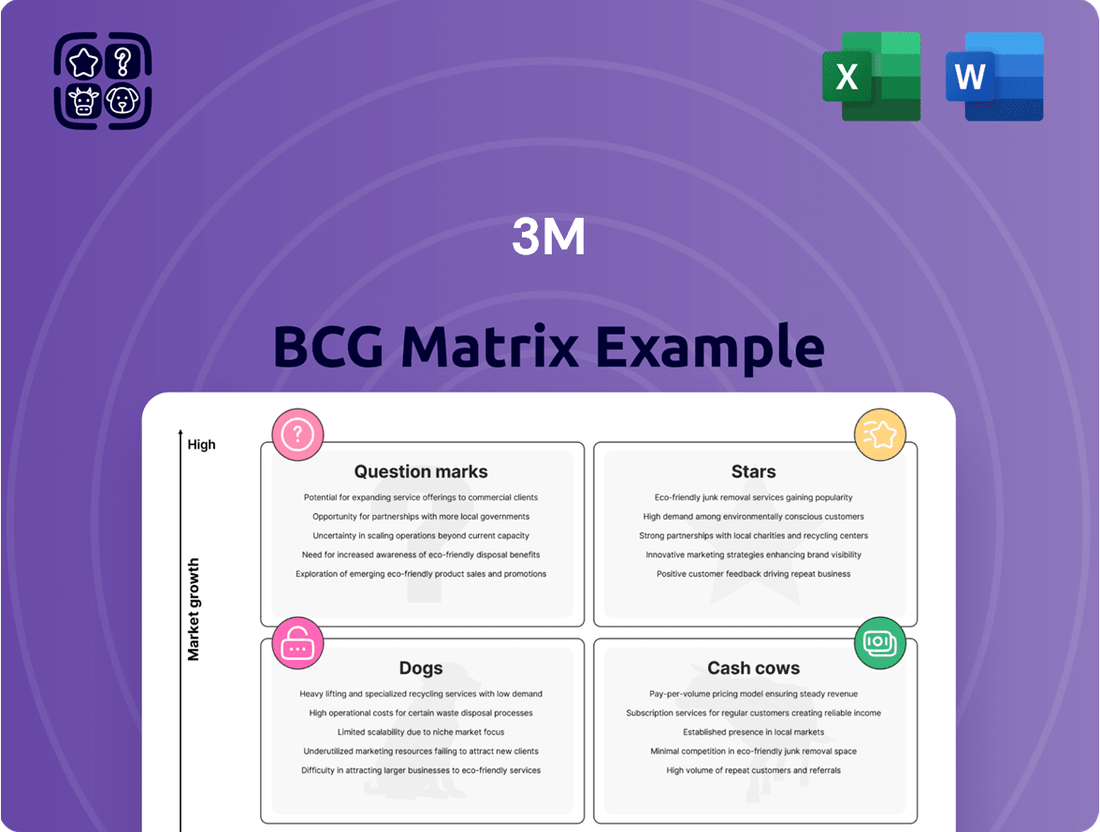

Understand the strategic positioning of a company's product portfolio with the 3M BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual representation of their market share and growth potential. Gain actionable insights to optimize resource allocation and drive future success.

Ready to transform your strategic planning? Purchase the full BCG Matrix report to unlock detailed quadrant analysis, identify growth opportunities, and make informed decisions about your product investments. Don't miss out on this essential tool for competitive advantage.

Stars

3M commands a substantial portion of the global Personal Protective Equipment (PPE) sector, especially in respiratory protection. This segment is seeing robust expansion, with the overall PPE market expected to reach USD 104.6 billion by 2035, growing from USD 60.92 billion in 2020 at a compound annual growth rate (CAGR) of 6.6% beyond 2025.

This growth is fueled by heightened safety awareness and stricter regulations worldwide. 3M's commitment to innovation in PPE, including advanced filtration technologies and comfortable designs, solidifies its leading position in this dynamic and growing market.

3M's Electronics Materials segment is a star in its BCG matrix, driven by a booming market. This sector is expected to climb from USD 69.87 billion in 2025 to USD 111.08 billion by 2033, showing a solid 5.9% compound annual growth rate.

3M is strategically positioning itself within this growth area by focusing on advanced solutions. Their investments in specialized adhesives for flexible displays, like those in foldable phones, and high-performance connectors for data centers directly address the escalating need for cutting-edge electronic components.

The company's commitment to innovation, particularly in materials supporting artificial intelligence and other emerging technologies, further solidifies this segment's star status. This forward-looking approach ensures 3M is well-placed to capitalize on the rapid advancements and increasing demand within the global electronics industry.

Industrial Adhesives is a strong performer within 3M's portfolio, positioned as a star in the BCG matrix. This sector is projected to expand significantly, with market size expected to grow from USD 58.8 billion in 2025 to USD 96.7 billion by 2035, demonstrating a healthy compound annual growth rate of 5.1%.

3M's leadership in this robust market is underpinned by the increasing demand for advanced bonding solutions across critical sectors such as automotive manufacturing, electronics assembly, and packaging innovation. The company's continuous investment in research and development, coupled with its extensive global distribution network, solidifies its star status in this dynamic industry.

Advanced Materials for Electric Vehicles (EVs) and Aerospace

Within its Transportation & Electronics segment, 3M is actively innovating in advanced materials for electric vehicles (EVs) and aerospace. These materials are designed to enhance efficiency and safety, particularly for the rapidly expanding EV market. The demand for high-performance adhesives in EVs represents a substantial growth avenue for companies like 3M.

3M's strategic investments and new product introductions in these specialized material sectors signal a strong potential for high growth and a concerted effort to expand its market presence. For instance, 3M reported its Transportation & Electronics segment revenue was approximately $10.5 billion in 2023, with a notable portion driven by automotive and aerospace solutions.

- Lightweight Materials: 3M is developing materials that reduce EV weight, improving range and performance.

- Adhesives for EVs: The company is capitalizing on the increasing need for specialized adhesives in EV battery packs and structural components.

- Aerospace Applications: 3M also provides advanced materials for aircraft, contributing to fuel efficiency and structural integrity.

- Market Growth: The global EV market is projected to reach over $1.5 trillion by 2030, presenting significant opportunities for material suppliers.

New Product Innovations in High-Growth Verticals

3M is strategically positioning itself for future growth by heavily investing in new product development. The company has outlined an ambitious plan to introduce more than 1,000 new products over the next three years, with a significant portion, 215, slated for launch in 2025. This aggressive innovation pipeline is specifically targeting high-growth sectors.

These targeted sectors include industrial automation, energy, and sustainable solutions. A prime example of this focus is the Padded Automatable Curbside Recyclable (PACR) product, designed to capitalize on the increasing demand for eco-friendly packaging. By concentrating on these dynamic markets, 3M aims to capture market leadership.

- Targeted Innovation: 3M's commitment to launching over 1,000 new products in three years, including 215 in 2025, showcases a robust R&D strategy.

- High-Growth Verticals: Focus areas like industrial automation, energy, and sustainable solutions are identified for their significant growth potential.

- Strategic Positioning: Innovations like the PACR product demonstrate 3M's intent to lead in emerging, high-demand markets.

- Star Potential: The company's renewed emphasis on R&D and commercialization aims to turn these new offerings into market-leading "stars."

Stars in 3M's BCG matrix represent business segments with high market share in high-growth industries. These are the primary drivers of future growth and profitability for the company. 3M's strategic focus on these areas, backed by significant R&D investment, positions them for continued market leadership.

The company's commitment to innovation is evident in its pipeline, with a significant number of new products slated for launch in high-growth sectors like electric vehicles and advanced electronics. These initiatives are designed to capture emerging market trends and solidify 3M's position as a leader.

3M's performance in Personal Protective Equipment (PPE) and Electronics Materials highlights its successful "star" positioning. The PPE market's projected growth to USD 104.6 billion by 2035 and the Electronics Materials market's expansion to USD 111.08 billion by 2033 underscore the strength of these segments.

The Industrial Adhesives segment also shines as a star, with a market expected to reach USD 96.7 billion by 2035, driven by demand in automotive and electronics. 3M's strategic investments in these high-growth areas are crucial for maintaining its competitive edge and driving future revenue.

| Segment | Market Growth Rate | 3M's Market Position | Key Drivers |

| Personal Protective Equipment (PPE) | 6.6% CAGR (2020-2035) | Leading | Safety awareness, regulations |

| Electronics Materials | 5.9% CAGR (2025-2033) | Strong | Flexible displays, data centers |

| Industrial Adhesives | 5.1% CAGR (2025-2035) | Leading | Automotive, electronics assembly |

| Transportation & Electronics (EVs) | High (Global EV market >$1.5T by 2030) | Growing | EV adoption, lightweight materials |

What is included in the product

The 3M BCG Matrix categorizes business units by market share and growth rate to guide strategic decisions.

It highlights which units to invest in, hold, or divest based on their position as Stars, Cash Cows, Question Marks, or Dogs.

Provides a clear, visual roadmap for strategic resource allocation, easing the pain of uncertain investment decisions.

Cash Cows

Post-it Notes and Scotch Tape are classic examples of 3M's Cash Cows. These brands dominate mature markets, meaning their sales growth isn't explosive, but they are incredibly reliable money-makers.

Their widespread brand recognition and established distribution channels mean 3M can count on consistent sales. In 2023, 3M's Consumer segment, which heavily features these products, reported approximately $3.2 billion in sales, highlighting their enduring revenue generation.

Scotch-Brite cleaning products are a classic example of a Cash Cow for 3M within its Consumer Business Group. This brand enjoys significant market penetration in the mature cleaning supplies sector, meaning it has a strong and consistent customer base.

The steady demand for Scotch-Brite items translates into reliable revenue streams and healthy profit margins for 3M. Because the brand is so well-recognized, it doesn't require substantial marketing expenditure to maintain its sales, allowing for efficient cash generation.

In 2024, 3M's consumer segment, which includes Scotch-Brite, continued to be a vital contributor to the company's overall financial performance. While specific segment breakdowns can vary, the stability of established brands like Scotch-Brite is crucial for funding innovation in other areas of 3M's diverse portfolio.

Command Brand Adhesives, a cornerstone of 3M's consumer division, exemplifies a classic Cash Cow within the BCG Matrix. Its dominance in the damage-free hanging solutions market, a segment characterized by stable demand, translates into consistent and substantial cash generation for 3M. In 2024, the consumer adhesives market continued to show resilience, with Command products maintaining a significant market share due to their perceived value and widespread availability in retail channels.

Filtrete Air Filters (Established Lines)

Filtrete air filters represent a classic example of a cash cow for 3M. This brand is well-established in the home air filtration market, a sector that sees consistent demand due to growing awareness of health and indoor air quality. The core Filtrete product lines hold a significant market share, reliably generating substantial and steady cash flow for the company.

These established products are the bedrock of 3M's filtration business. While the company might be investing in newer, potentially higher-growth filter technologies, the core Filtrete offerings continue to be a dependable source of revenue. For instance, in 2024, the home care segment, which includes air filtration, remained a stable contributor to 3M's overall revenue, demonstrating the enduring strength of these mature product lines.

- Brand Recognition: Filtrete is a household name synonymous with home air purification.

- Market Maturity: The home air filter market is established, with consistent consumer spending on health and wellness products.

- Consistent Cash Flow: The high market share of Filtrete's core products ensures a predictable and substantial cash inflow for 3M.

- Strategic Importance: These cash cows fund innovation and growth in other business segments within 3M.

Core Abrasives and Industrial Tapes

3M's Core Abrasives and Industrial Tapes are classic Cash Cows within the company's BCG matrix. These segments benefit from 3M's deep historical roots and substantial market share in mature industrial sectors. Their consistent performance and high margins are driven by established product efficacy and strong customer relationships.

These foundational product lines, despite facing slower market growth, remain critical for a wide array of industrial uses. They consistently deliver high-margin revenue, underscoring their role as reliable profit generators for 3M.

- Market Share: 3M holds a leading position in the global abrasives and industrial tapes market, estimated to be worth billions of dollars annually.

- Revenue Contribution: While specific segment revenue figures fluctuate, these mature businesses typically contribute a significant portion of 3M's overall operating income due to their strong profitability.

- Profitability: High margins are a hallmark of these segments, often exceeding the company average, reflecting pricing power and operational efficiencies.

- Global Reach: 3M's extensive global manufacturing and distribution network ensures efficient production and delivery, further solidifying their cash-generating capabilities.

Cash Cows in 3M's portfolio, like their iconic Post-it Notes and Scotch Tape, represent products with strong market share in mature industries. These brands generate significant and consistent profits with relatively low investment needs, acting as reliable revenue engines for the company.

Their established presence means 3M can leverage brand loyalty and existing distribution networks to maintain sales. For instance, in 2023, 3M's Consumer segment, which heavily features these products, contributed approximately $3.2 billion in sales, underscoring their enduring revenue generation capabilities.

These mature products are vital for funding research and development in newer, high-growth areas. In 2024, the stability provided by these established brands remained a key factor in 3M's overall financial strategy, enabling continued investment in innovation.

Delivered as Shown

3M BCG Matrix

The 3M BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive strategic tool ready for your immediate use. You can confidently use this preview as a direct representation of the quality and content you'll be downloading.

Dogs

3M's planned exit from PFAS manufacturing by the end of 2025 firmly places these products in the 'dog' category of the BCG matrix. This strategic decision acknowledges the low-growth, high-risk nature of the PFAS market, driven by mounting environmental concerns and increasing regulatory scrutiny.

The company's commitment to ceasing production signifies that PFAS are viewed as a diminishing asset, likely experiencing declining market share and profitability. This divestment strategy aims to shed products that are becoming a significant drain on resources, including substantial litigation costs and environmental remediation expenses.

The Combat Arms Earplugs, while a past product, are a prime example of a 'dog' in the BCG matrix for 3M. Their association with extensive litigation, including settlements and legal fees, has turned them into a significant cash drain rather than a revenue generator.

These earplugs represent a substantial liability, consuming 3M's resources without any prospect of future market growth or share capture. The ongoing legal costs associated with these products firmly place them in the 'dog' category, characterized by low growth and low market share, but in this case, with a negative cash flow impact.

In December 2023, 3M divested its 50% equity stake in Combi Packaging Systems. This strategic move indicates a potential shift away from this specific market segment.

The divestiture of Combi Packaging Systems aligns with the characteristics of a 'dog' in the BCG Matrix. This suggests that the business likely experienced low market growth and held a relatively small market share for 3M, prompting the company to exit this area.

Certain Legacy, Niche Industrial Adhesives

Within 3M's extensive product range, there are likely legacy industrial adhesives designed for highly specialized applications. These might be older formulations serving very specific, mature markets with minimal expansion prospects. Such products often hold a small market share and may generate just enough revenue to cover their costs, representing a drain on company resources without substantial profit.

These niche adhesives, while perhaps critical for a select few customers, could be classified as Dogs in the BCG matrix. Their limited growth potential and low market share make them candidates for careful review. For instance, a specialized sealant used in a declining manufacturing sector might fall into this category. In 2024, companies are increasingly scrutinizing such product lines to optimize resource allocation.

- Low Market Growth: These adhesives operate in markets with little to no anticipated expansion.

- Small Market Share: They likely hold a minor position within their respective niche segments.

- Resource Drain: They may consume resources with minimal or break-even returns.

- Rationalization Potential: Companies often consider discontinuing or divesting such products to focus on more profitable areas.

Underperforming Smaller R&D Initiatives

In recent years, 3M has strategically reduced its investment in numerous smaller research and development projects. This move was a direct response to an identified imbalance in its R&D approach, where many initiatives failed to gain market traction or significant market share. These underperforming projects, often referred to as 'dogs' in portfolio analysis, consumed valuable resources without generating the anticipated high-growth products. For instance, in 2023, 3M reported a 2.4% decrease in its R&D spending compared to 2022, totaling $1.8 billion, reflecting a deliberate pruning of less promising ventures.

This recalibration of R&D spending is a common strategy for large corporations seeking to optimize their innovation pipeline and focus on areas with higher potential for return. By divesting from or scaling back these 'dog' initiatives, 3M aims to reallocate capital and human resources towards more promising avenues, thereby improving overall R&D efficiency and the likelihood of developing successful new products. This strategic pivot underscores a commitment to a more focused and results-oriented innovation process.

- Reduced R&D Investment: 3M's R&D spending decreased by 2.4% in 2023, reaching $1.8 billion, signaling a strategic pullback from less viable projects.

- Focus on High-Growth Areas: The company is reallocating resources from underperforming initiatives to those with greater potential for market success and profitability.

- Portfolio Optimization: This action aligns with a broader corporate strategy to streamline the innovation pipeline and enhance R&D efficiency.

- Addressing 'Out of Balance' R&D: The cutbacks are a direct consequence of acknowledging that past R&D efforts were not yielding the desired market impact or growth.

Products classified as 'dogs' in the BCG matrix for 3M represent business units or product lines with low market share in low-growth industries. These often require significant cash to maintain their current position but generate little return, acting as a drain on resources. The company's strategic decisions, such as divesting from certain segments or reducing investment in underperforming ventures, directly reflect an effort to manage and potentially eliminate these 'dog' assets.

3M's divestiture of its 50% stake in Combi Packaging Systems in December 2023 exemplifies a 'dog' scenario, indicating a market with limited growth and a small share for 3M. Similarly, the planned exit from PFAS manufacturing by the end of 2025, acknowledging the high-risk, low-growth nature of that market, places these products firmly in the 'dog' category. The extensive litigation surrounding Combat Arms Earplugs also highlights a past 'dog' product, characterized by significant liabilities and no future growth prospects.

| Product/Segment | BCG Category | Rationale | Financial Implication |

| PFAS Manufacturing | Dog | Planned exit by end of 2025 due to environmental concerns and regulatory scrutiny in a low-growth market. | Resource drain, potential litigation and remediation costs. |

| Combat Arms Earplugs | Dog | Significant litigation, settlements, and legal fees without future market growth. | Substantial liability, cash drain. |

| Combi Packaging Systems (50% stake) | Dog | Divested in December 2023, suggesting low market growth and small market share for 3M. | Exit from a segment deemed less profitable or strategic. |

| Legacy Niche Adhesives | Potential Dog | Specialized applications in mature, low-expansion markets with minimal market share. | May generate minimal returns, consuming resources without substantial profit. |

Question Marks

3M's investment in AI-leveraged material science platforms, like its digital materials hub, aims to speed up research and development and forecast material performance. These are areas poised for significant growth within advanced manufacturing and broader innovation sectors.

While these platforms hold substantial promise for future product creation, their current market share and direct revenue impact are likely minimal, reflecting an early, exploratory stage. The immense potential requires substantial investment to convert these AI capabilities into tangible, market-leading products.

3M's PACR (Paper-based, Curbside Recyclable) packaging is a classic example of a question mark in the BCG matrix. It operates within the rapidly expanding e-commerce packaging sector, a market projected to reach over $70 billion globally by 2027, fueled by increasing consumer and regulatory pressure for eco-friendly solutions. While PACR addresses this demand with its paper-based, recyclable design, its current market share is relatively small, facing stiff competition from entrenched plastic alternatives.

The success of PACR hinges on its ability to capture significant market share in this high-growth industry. This requires substantial investment in marketing and sales to educate consumers and businesses about its benefits and to encourage adoption. Without aggressive strategies to increase its market penetration, PACR risks remaining a question mark, unable to convert its potential into a strong market position, unlike established players.

3M is stepping into the robotics and automation sector, a move highlighted by their presence at CES 2025. This indicates a strategic push into supplying components for industrial automation, a market that experienced significant growth, with the global industrial robotics market valued at approximately $50 billion in 2023 and projected to reach over $100 billion by 2030.

Within the BCG matrix, these cutting-edge robotics and automation components would likely be classified as Stars or Question Marks. While the industrial automation market is booming, 3M's specific market share in robotics components is probably nascent, demanding substantial investment for development and market penetration.

These ventures represent high-growth potential but carry inherent risks, with uncertain near-term returns, characteristic of Question Marks. Continued investment and innovation are crucial for 3M to establish a strong foothold and capitalize on the expanding opportunities in this technologically advanced field.

Sustainable Energy and Climate Tech Films

3M's sustainable energy and climate tech films fit into the Stars or Question Marks categories of the BCG Matrix, depending on their specific market penetration and growth trajectory. These energy-efficient films and recyclable filter technologies are directly addressing the burgeoning climate tech market, which is experiencing significant growth. For instance, the global climate tech market was projected to reach trillions of dollars by 2030, with significant investment flowing into sustainable materials and energy efficiency solutions.

These innovations represent high-growth opportunities due to increasing demand for eco-friendly industrial and consumer applications. However, 3M's market share within these specific, emerging sub-segments of climate tech films is likely still developing, placing them potentially in the Question Marks category. This means they are in a high-growth market but may not yet have a dominant position.

As new ventures, these sustainable energy and climate tech films require substantial investment to scale production, build market presence, and solidify their long-term viability. Without significant capital infusion and strategic market development, their potential to capture substantial market share and become established Stars remains uncertain. For example, companies in the advanced materials sector often see R&D and capital expenditure rise significantly in the early stages of market development.

- Market Growth: The climate tech sector is a rapidly expanding market, driven by global sustainability initiatives and regulatory pressures.

- 3M's Position: While 3M is contributing innovative solutions, its current market share in these niche climate tech film segments is likely nascent.

- Investment Needs: Significant investment is required to develop, manufacture, and market these new ventures effectively.

- Future Potential: These films represent potential Stars if they can successfully gain market share and establish a strong competitive advantage in the coming years.

Next-Generation Optical Films for Displays

3M's investment in next-generation optical films for displays, particularly low sparkle films for notebooks and foldable phones, positions them in a high-growth consumer electronics market. This segment is experiencing rapid expansion due to ongoing display technology advancements.

While the overall market for advanced display films is robust, 3M's penetration in these specific next-generation applications is likely in its nascent stages. This suggests a need for continued investment to capture significant market share and establish leadership.

- Market Focus: 3M is targeting the burgeoning market for low sparkle optical films, crucial for enhancing the viewing experience on devices like notebooks and foldable smartphones.

- Growth Potential: The consumer electronics display market is a high-growth sector, fueled by continuous technological innovation and increasing consumer demand for premium visual experiences.

- Market Share Trajectory: Despite the market's growth, 3M's current market share in these specific next-generation optical film applications is likely in the early phases, indicating a strategic imperative for further development and investment.

- Investment Imperative: To secure a dominant position, 3M must continue to invest in research, development, and market penetration strategies for these advanced optical films.

Question Marks represent business units or products in high-growth markets but with low market share. For 3M, these are often new technologies or emerging market segments where significant investment is needed to gain traction.

These ventures, like 3M's advancements in AI-driven material science or its new robotics components, operate in rapidly expanding industries but require substantial capital to achieve competitive market positions.

The success of these Question Marks hinges on 3M's ability to effectively invest in R&D, marketing, and production to convert their technological potential into market leadership.

Failure to gain market share in these high-growth areas could result in these ventures remaining underperformers, unable to transition into Stars.

| 3M Venture Area | Market Growth Rate | 3M Market Share (Estimated) | Investment Need | BCG Category |

| AI-Leveraged Material Science | High | Low/Nascent | High | Question Mark |

| Robotics & Automation Components | High | Low/Nascent | High | Question Mark |

| Sustainable Energy & Climate Tech Films | High | Low/Nascent | High | Question Mark |

| Next-Gen Optical Films (Foldable Displays) | High | Low/Nascent | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial data, comprehensive market research reports, and publicly available company performance metrics, ensuring a robust and accurate strategic overview.