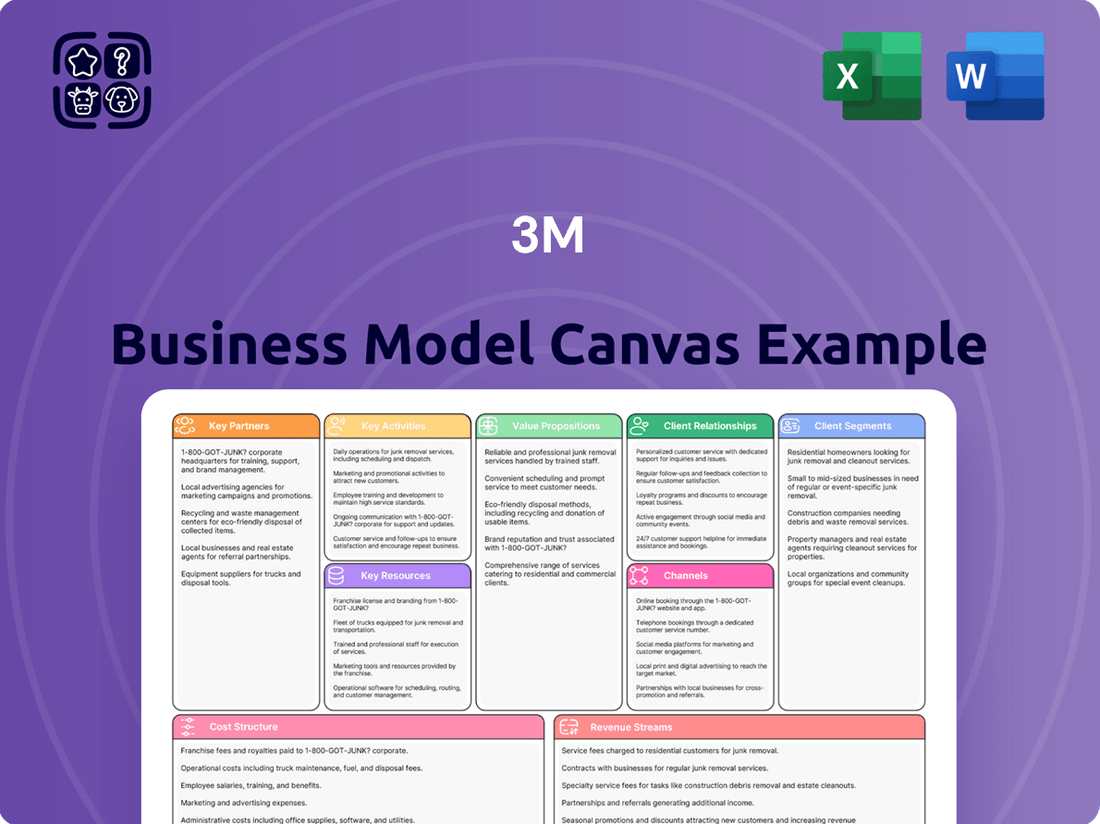

3M Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

Discover the strategic genius behind 3M's innovation engine with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with diverse customer segments and leverage key partnerships to deliver groundbreaking value. Get the full blueprint to understand their revenue streams and cost structures.

Partnerships

3M actively pursues strategic alliances to fuel innovation and market expansion. For instance, in 2024, the company continued to deepen its relationships with leading technology firms and academic research centers, focusing on areas like advanced materials for electric vehicles and sustainable manufacturing processes. These collaborations are vital for accessing cutting-edge knowledge and speeding up the introduction of new technologies.

3M cultivates a broad supplier network for essential raw materials and components, crucial for its diverse product lines. In 2024, the company continued its strategic focus on optimizing this network, aiming for greater efficiency and cost savings.

This optimization involves consolidating its supplier base, fostering deeper partnerships with key providers to guarantee consistent quality and reliable material availability. This strategic approach enhances supply chain resilience, a critical factor in today's dynamic global market.

3M actively partners with universities and research institutions to fuel its innovation. For instance, in 2024, 3M continued its engagement with leading universities globally, focusing on areas like advanced materials science and sustainable technologies. These collaborations are crucial for accessing foundational scientific breakthroughs and identifying future market opportunities.

These academic partnerships are not just about research; they also serve as a vital channel for talent acquisition. By engaging with universities, 3M gains early access to top-tier scientific and engineering talent. This ensures a continuous influx of skilled professionals who can contribute to the company's long-term research and development efforts, driving future product innovation.

Distribution and Retail Partners

3M relies heavily on a vast network of distribution and retail partners to get its products to market. These collaborators are fundamental to 3M's global reach, ensuring their innovations are accessible to everyone from industrial giants to everyday shoppers. In 2024, 3M continued to leverage these relationships to drive sales and maintain strong brand presence across numerous sales channels.

These partnerships are crucial for efficient logistics and market penetration. For instance, 3M's presence in major retail chains and specialized industrial suppliers in 2024 facilitated widespread product availability. The company's strategy involves nurturing these relationships to optimize supply chains and expand market share.

- Extensive Network: 3M partners with thousands of distributors and retailers worldwide.

- Global Reach: These partners enable access to diverse customer segments across continents.

- Market Penetration: Partnerships are key to efficient product delivery and brand visibility.

- 2024 Focus: Continued strengthening of these relationships to drive sales and market access.

Sustainability Initiatives and Community Partnerships

3M actively partners with various non-profits, government agencies, and local community organizations to drive its sustainability agenda. These collaborations are crucial for achieving ambitious environmental targets, such as their commitment to carbon neutrality and significant water usage reduction. For instance, in 2024, 3M continued to invest in projects aimed at improving water quality in communities near its operations, leveraging local expertise through these partnerships.

These strategic alliances extend beyond environmental efforts to encompass broader social responsibility programs. By working hand-in-hand with community groups, 3M enhances its corporate social responsibility profile and cultivates a more positive and resilient brand image. Such engagements often involve employee volunteerism and resource sharing, reinforcing 3M's commitment to making a tangible difference where it operates.

- Environmental Goal Alignment: Partnerships focus on achieving 3M's 2030 sustainability goals, including reducing greenhouse gas emissions and improving water stewardship.

- Community Engagement: Collaborations with local groups aim to address specific community needs, fostering goodwill and strengthening social license to operate.

- Brand Reputation Enhancement: Joint initiatives bolster 3M's image as a responsible corporate citizen, positively impacting stakeholder perception.

- Innovation in Sustainability: Working with external experts and organizations can lead to innovative solutions for environmental challenges.

3M's key partnerships are multifaceted, encompassing technology firms, academic institutions, suppliers, distributors, retailers, and community organizations. These collaborations are critical for driving innovation, ensuring supply chain stability, expanding market reach, and advancing sustainability initiatives. For example, in 2024, 3M continued to leverage its extensive network of over 10,000 distributors and retailers globally to ensure product availability and market penetration across diverse customer segments.

| Partner Type | 2024 Focus/Activity | Impact |

|---|---|---|

| Technology Firms | Deepening relationships for advanced materials (e.g., EVs) | Accelerated innovation, access to cutting-edge knowledge |

| Academic Institutions | Collaborations on materials science and sustainability | Access to foundational breakthroughs, talent acquisition |

| Suppliers | Optimizing network for efficiency and cost savings | Enhanced supply chain resilience, consistent quality |

| Distributors & Retailers | Strengthening relationships for sales and brand presence | Widespread product availability, market share expansion |

| Non-profits & Government Agencies | Driving sustainability agenda (e.g., water quality projects) | Achieving environmental targets, enhanced CSR profile |

What is included in the product

A strategic framework detailing 3M's diverse customer segments, innovative value propositions, and extensive channels, all underpinned by robust key resources and activities.

This model outlines 3M's approach to customer relationships, revenue streams, and cost structure, reflecting its commitment to innovation and global reach.

The 3M Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies, making them easier to understand and adapt.

It addresses the pain of information overload by condensing a company's entire strategy into a single, digestible page, facilitating rapid analysis and informed decision-making.

Activities

Research and Development (R&D) and Innovation are the lifeblood of 3M, driving its ability to create and sustain a competitive advantage. The company consistently invests in scientific exploration and the development of novel products that span its many business units. In 2023, 3M reported $1.9 billion in R&D spending, reflecting its commitment to this core activity.

A key focus for 3M is the revitalization of its innovation pipeline, aiming to introduce a steady stream of new products. This strategic emphasis is designed to capture opportunities in rapidly expanding market segments and ensure the company remains at the forefront of technological advancements. For instance, the company has highlighted advancements in areas like sustainable materials and digital health as key innovation drivers.

3M's manufacturing and production activities are central to its identity as a global diversified technology company. These operations encompass the creation of a wide spectrum of goods, ranging from advanced adhesives and abrasives to electronic components and healthcare supplies. The company's commitment to efficient production processes and stringent quality control underpins the reliability and performance of its diverse product portfolio.

In 2023, 3M continued to emphasize operational excellence across its manufacturing footprint. This focus translates into ongoing efforts to enhance equipment utilization and boost overall productivity. For instance, the company has invested in advanced manufacturing technologies and lean manufacturing principles to streamline operations and reduce waste, aiming for greater efficiency in its global production facilities.

3M's key activities heavily rely on managing its intricate global supply chain. This involves everything from sourcing raw materials and procuring components to meticulously managing inventory levels and ensuring efficient distribution of finished products worldwide. The company's commitment to supply chain excellence is evident in its ongoing efforts to boost efficiency, with a specific focus on improving on-time and in-full delivery metrics.

To achieve these goals, 3M is investing in optimizing its forecasting and planning processes. By enhancing these areas, the company aims to not only reduce operational costs but also significantly improve customer satisfaction through more reliable product availability. For instance, in 2023, 3M reported progress in its supply chain resilience initiatives, contributing to more stable operations amidst global disruptions.

Sales, Marketing, and Brand Building

3M's Key Activities heavily rely on promoting and selling its vast product range through strong sales and marketing initiatives. This involves implementing commercial excellence strategies to ensure efficient customer engagement and distribution across its global operations.

Building and maintaining brand recognition for well-known products such as Scotch tape and Post-it Notes is crucial. These iconic brands contribute significantly to 3M's market presence and customer loyalty, driving repeat business and new customer acquisition.

Engaging with a diverse array of customer segments worldwide is a core activity. This requires tailored marketing approaches and sales strategies that resonate with different industries and consumer needs, ultimately fueling revenue growth and expanding market share.

- Global Sales Force: 3M employs a substantial global sales force dedicated to reaching various customer segments across multiple industries.

- Brand Investment: Significant investments are made in marketing and advertising to reinforce brand equity for flagship products like Post-it and Scotch. In 2023, 3M reported approximately $3.3 billion in selling, general, and administrative expenses, a portion of which directly supports sales and marketing efforts.

- Digital Marketing: The company increasingly leverages digital channels and e-commerce platforms to enhance customer reach and sales efficiency.

- Customer Engagement: Strategies focus on building long-term customer relationships through technical support, product innovation showcases, and responsive service.

Strategic Portfolio Management and Restructuring

3M's strategic portfolio management involves actively reshaping its business through acquisitions, divestitures, and internal restructuring. This dynamic approach is designed to sharpen focus and unlock value across its diverse operations.

A pivotal recent activity was the spin-off of its Health Care business, now operating as Solventum. This move, completed in April 2024, allows 3M to concentrate on its core industrial and consumer segments, aiming for improved agility and performance. The Solventum spin-off was a significant event, creating a standalone entity valued at approximately $7 billion at the time of separation, reflecting the strategic importance of this divestiture.

- Strategic Acquisitions: Continuously evaluating and executing acquisitions to bolster core businesses or enter new, high-growth areas.

- Divestitures and Spin-offs: Actively managing the portfolio by divesting non-core or underperforming assets, such as the Solventum spin-off in 2024.

- Restructuring Initiatives: Implementing internal organizational and operational changes to enhance efficiency, reduce costs, and align with strategic priorities.

- Portfolio Optimization: Regularly assessing the performance and strategic fit of all business units to maximize shareholder value and long-term growth.

3M's key activities are deeply rooted in its robust Research and Development (R&D) and innovation engine, consistently fueling the creation of new products across its diverse business units. The company's manufacturing and production operations are essential for producing a wide array of goods, from adhesives to healthcare supplies, with a strong emphasis on operational excellence and efficiency. Furthermore, 3M actively manages its complex global supply chain, focusing on improving delivery metrics and optimizing forecasting. Its sales and marketing efforts are crucial for promoting its extensive product portfolio, leveraging iconic brands and tailored strategies for various customer segments. Finally, strategic portfolio management, including recent divestitures like the Solventum spin-off in April 2024, allows 3M to refine its focus and enhance shareholder value.

Full Document Unlocks After Purchase

Business Model Canvas

The 3M Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable. You can confidently assess the quality and completeness of the Business Model Canvas based on this live preview, ensuring there are no surprises after your transaction.

Resources

3M's intellectual property, including its extensive patent portfolio, is a cornerstone of its business model. As of early 2024, the company held tens of thousands of active patents globally, safeguarding its innovations across a wide array of sectors like healthcare, consumer goods, and industrial applications. This robust protection is vital for maintaining its competitive edge and driving its continuous innovation pipeline.

These patents cover groundbreaking technologies in areas such as advanced adhesives, specialized abrasives, and novel materials science, which are fundamental to 3M's diverse product range. For instance, its leadership in fluorochemicals and advanced filtration technologies is heavily reliant on proprietary knowledge and patent protection. This allows 3M to command premium pricing and differentiate its offerings in crowded markets.

The company's commitment to R&D, often exceeding $1.5 billion annually in recent years, directly fuels the expansion of its intellectual property assets. This investment cycle ensures that 3M consistently introduces new, patented products, reinforcing its market position and creating significant barriers to entry for competitors. The strategic management and leveraging of this intellectual capital are key to its sustained growth and profitability.

3M's global manufacturing facilities and infrastructure are a cornerstone of its business model, encompassing a vast network of production plants, advanced research labs, and efficient distribution centers. This extensive physical footprint allows 3M to manufacture and deliver its diverse product portfolio, from adhesives and abrasives to healthcare solutions and electronics, across the globe. In 2024, 3M continued to optimize this infrastructure, investing in modernization and automation to enhance production efficiency and reduce lead times for its customers worldwide.

3M's core strength lies in its exceptionally skilled workforce, especially its scientists and engineers, who are the engine behind its continuous innovation and product pipeline. This human capital is a critical resource, directly fueling the company's ability to develop groundbreaking solutions across diverse markets.

The company's commitment to fostering a culture of scientific curiosity and providing advanced research facilities allows it to attract and retain top-tier talent. This investment in expertise is paramount for maintaining its competitive edge and driving future growth, as evidenced by its robust patent portfolio.

In 2023, 3M continued to invest in its people, with a significant portion of its R&D spending dedicated to talent development and advanced research initiatives, underscoring the importance of its scientific expertise.

Strong Brands and Brand Equity

3M's portfolio of iconic brands, including Scotch, Post-it, Command, and Scotch-Brite, are cornerstones of its business model, representing substantial intangible assets. These globally recognized names cultivate deep customer loyalty and offer a distinct competitive edge across diverse consumer and industrial sectors, directly fueling revenue streams.

The brand equity translates into pricing power and reduced marketing costs, as consumers readily trust and seek out 3M's products. For instance, in 2023, 3M continued to leverage these brands to maintain market share in its various segments, with consumer products remaining a significant contributor to overall sales.

- Brand Recognition: High consumer and professional recognition of brands like Post-it and Scotch.

- Customer Loyalty: Strong repeat purchase behavior driven by trust and product performance.

- Market Advantage: Brands facilitate premium pricing and easier market penetration for new products.

- Revenue Contribution: Brands are directly linked to sales performance across consumer and industrial divisions.

Financial Capital and Investment Capacity

3M's substantial financial capital is a cornerstone of its business model, enabling significant investments in research and development, which is crucial for innovation. In 2023, 3M reported $3.1 billion in R&D spending, underscoring its commitment to developing new products and technologies. This financial capacity also supports capital expenditures for facility upgrades and expansions, ensuring operational efficiency and scalability.

The company's robust financial health allows for strategic acquisitions that enhance its market position and expand its product portfolio. Furthermore, 3M consistently returns value to shareholders through dividends and share repurchases, demonstrating its financial strength and confidence in future performance. For instance, in 2023, 3M returned approximately $3.7 billion to shareholders through dividends and share repurchases.

- Access to Capital: 3M leverages strong credit ratings and market access to secure the necessary funds for its operations and growth initiatives.

- Investment Allocation: Financial capital is strategically deployed across R&D, capital expenditures, acquisitions, and shareholder returns to drive long-term value.

- Financial Flexibility: The company's financial reserves and borrowing capacity provide the agility to respond to market opportunities and challenges.

- Shareholder Value: Consistent dividend payments and share buybacks reflect the company's ability to generate and distribute profits effectively.

3M's intellectual property, including its extensive patent portfolio, is a cornerstone of its business model. As of early 2024, the company held tens of thousands of active patents globally, safeguarding its innovations across a wide array of sectors like healthcare, consumer goods, and industrial applications. This robust protection is vital for maintaining its competitive edge and driving its continuous innovation pipeline.

These patents cover groundbreaking technologies in areas such as advanced adhesives, specialized abrasives, and novel materials science, which are fundamental to 3M's diverse product range. For instance, its leadership in fluorochemicals and advanced filtration technologies is heavily reliant on proprietary knowledge and patent protection. This allows 3M to command premium pricing and differentiate its offerings in crowded markets.

The company's commitment to R&D, often exceeding $1.5 billion annually in recent years, directly fuels the expansion of its intellectual property assets. This investment cycle ensures that 3M consistently introduces new, patented products, reinforcing its market position and creating significant barriers to entry for competitors. The strategic management and leveraging of this intellectual capital are key to its sustained growth and profitability.

3M's global manufacturing facilities and infrastructure are a cornerstone of its business model, encompassing a vast network of production plants, advanced research labs, and efficient distribution centers. This extensive physical footprint allows 3M to manufacture and deliver its diverse product portfolio, from adhesives and abrasives to healthcare solutions and electronics, across the globe. In 2024, 3M continued to optimize this infrastructure, investing in modernization and automation to enhance production efficiency and reduce lead times for its customers worldwide.

3M's core strength lies in its exceptionally skilled workforce, especially its scientists and engineers, who are the engine behind its continuous innovation and product pipeline. This human capital is a critical resource, directly fueling the company's ability to develop groundbreaking solutions across diverse markets.

The company's commitment to fostering a culture of scientific curiosity and providing advanced research facilities allows it to attract and retain top-tier talent. This investment in expertise is paramount for maintaining its competitive edge and driving future growth, as evidenced by its robust patent portfolio.

In 2023, 3M continued to invest in its people, with a significant portion of its R&D spending dedicated to talent development and advanced research initiatives, underscoring the importance of its scientific expertise.

3M's portfolio of iconic brands, including Scotch, Post-it, Command, and Scotch-Brite, are cornerstones of its business model, representing substantial intangible assets. These globally recognized names cultivate deep customer loyalty and offer a distinct competitive edge across diverse consumer and industrial sectors, directly fueling revenue streams.

The brand equity translates into pricing power and reduced marketing costs, as consumers readily trust and seek out 3M's products. For instance, in 2023, 3M continued to leverage these brands to maintain market share in its various segments, with consumer products remaining a significant contributor to overall sales.

- Brand Recognition: High consumer and professional recognition of brands like Post-it and Scotch.

- Customer Loyalty: Strong repeat purchase behavior driven by trust and product performance.

- Market Advantage: Brands facilitate premium pricing and easier market penetration for new products.

- Revenue Contribution: Brands are directly linked to sales performance across consumer and industrial divisions.

3M's substantial financial capital is a cornerstone of its business model, enabling significant investments in research and development, which is crucial for innovation. In 2023, 3M reported $3.1 billion in R&D spending, underscoring its commitment to developing new products and technologies. This financial capacity also supports capital expenditures for facility upgrades and expansions, ensuring operational efficiency and scalability.

The company's robust financial health allows for strategic acquisitions that enhance its market position and expand its product portfolio. Furthermore, 3M consistently returns value to shareholders through dividends and share repurchases, demonstrating its financial strength and confidence in future performance. For instance, in 2023, 3M returned approximately $3.7 billion to shareholders through dividends and share repurchases.

- Access to Capital: 3M leverages strong credit ratings and market access to secure the necessary funds for its operations and growth initiatives.

- Investment Allocation: Financial capital is strategically deployed across R&D, capital expenditures, acquisitions, and shareholder returns to drive long-term value.

- Financial Flexibility: The company's financial reserves and borrowing capacity provide the agility to respond to market opportunities and challenges.

- Shareholder Value: Consistent dividend payments and share buybacks reflect the company's ability to generate and distribute profits effectively.

3M's key resources are its extensive patent portfolio, global manufacturing infrastructure, highly skilled workforce, recognizable brands, and strong financial capital. These elements collectively enable the company to innovate, produce, market, and distribute its wide range of products effectively. The continuous investment in these resources, particularly R&D and talent, underpins 3M's competitive advantage and long-term growth strategy.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Intellectual Property | Tens of thousands of active patents globally protecting innovations. | Safeguards competitive edge and drives innovation pipeline. |

| Manufacturing Infrastructure | Global network of production plants, research labs, and distribution centers. | Enables efficient global production and delivery; optimization through modernization. |

| Skilled Workforce | Scientists and engineers driving innovation and product development. | Essential for developing groundbreaking solutions and maintaining competitive edge. |

| Brand Portfolio | Globally recognized brands like Scotch, Post-it, Command. | Cultivates customer loyalty, provides pricing power, and contributes significantly to sales. |

| Financial Capital | $3.1 billion R&D spending in 2023; $3.7 billion returned to shareholders. | Funds innovation, capital expenditures, acquisitions, and shareholder returns. |

Value Propositions

3M's value proposition hinges on its diverse portfolio of innovative and differentiated products, designed to tackle complex challenges and enhance daily life. Their scientific prowess enables the development of unique solutions spanning numerous sectors, from cutting-edge electronics materials to essential consumer goods.

For instance, in 2023, 3M's Health Care segment, a significant contributor to their innovation pipeline, saw sales reach $14.5 billion, showcasing the market's demand for their specialized offerings.

3M's core strength lies in applying scientific discoveries to solve real-world problems for a wide range of customers. This is evident in their continuous innovation across various sectors.

For instance, in 2023, 3M's Safety & Industrial segment, which heavily relies on applied science for products like abrasives and adhesives, generated approximately $13.5 billion in revenue, showcasing the market's demand for these scientifically-backed solutions.

The company's mastery of material science allows them to craft products that boost safety, improve efficiency, and increase output in industries from manufacturing to healthcare, demonstrating a tangible impact of their scientific approach.

3M's global reach is a cornerstone of its business model, allowing it to serve customers in over 200 countries. This expansive network ensures that its diverse product portfolio, from adhesives to healthcare solutions, is readily available to a vast array of industries and consumers. In 2023, 3M's international sales represented a significant portion of its total revenue, underscoring the importance of this global accessibility.

Reliability and Trusted Performance

Customers consistently turn to 3M for products that deliver dependable results. This trust is built on a long-standing commitment to quality and performance that meets and often exceeds industry standards.

3M's reputation for reliability is a cornerstone of its value proposition. The company's products are known for their consistent high standards, which translates into fewer failures and greater customer satisfaction, driving repeat business.

- Consistent Quality: 3M's rigorous quality control ensures products perform as expected every time.

- Proven Performance: Decades of real-world application have solidified 3M's reputation for dependable solutions.

- Industry Standards: Many 3M products are designed to meet stringent industry specifications, providing assurance to professional users.

- Customer Trust: This unwavering reliability fosters deep customer loyalty and a preference for 3M over competitors.

Sustainability and Environmental Responsibility

3M's commitment to sustainability is a core value proposition, driving innovation in eco-friendly product development and operational improvements. This focus resonates strongly with customers and partners who prioritize environmental responsibility.

The company is actively integrating circular economy principles into its business model, aiming to reduce waste and maximize resource utilization. This includes efforts in product design, material sourcing, and end-of-life management.

In 2024, 3M continued to advance its climate action goals, targeting significant reductions in greenhouse gas emissions across its operations. These initiatives underscore a dedication to mitigating environmental impact and fostering a healthier planet.

- Eco-Friendly Product Innovation: Development of products with reduced environmental impact, such as biodegradable materials and energy-efficient solutions.

- Circular Economy Initiatives: Implementing strategies to design out waste, keep products and materials in use, and regenerate natural systems.

- Climate Action Progress: Reporting on progress towards ambitious greenhouse gas emission reduction targets, often exceeding industry benchmarks.

- Community Engagement: Investing in environmental stewardship programs and partnerships that benefit local communities and ecosystems.

3M's value proposition centers on leveraging its deep scientific expertise and material science mastery to create innovative, differentiated products that solve customer problems across diverse industries. This commitment to applied science is demonstrated by their continuous development of solutions that enhance safety, efficiency, and performance.

The company's global presence ensures widespread accessibility to its broad product range, fostering strong customer trust through a reputation for consistent quality and proven performance. This reliability underpins customer loyalty and drives repeat business.

Furthermore, 3M's dedication to sustainability is a key value driver, evident in its eco-friendly product innovation and active pursuit of circular economy principles. Their progress in climate action, with ambitious emission reduction targets, appeals to environmentally conscious stakeholders.

| Value Proposition Pillar | Description | Supporting Data (2023/2024 Focus) |

|---|---|---|

| Innovation & Differentiation | Developing unique solutions through scientific prowess across multiple sectors. | Health Care segment sales: $14.5 billion (2023). |

| Applied Science & Problem Solving | Translating scientific discoveries into practical applications for real-world challenges. | Safety & Industrial segment revenue: ~$13.5 billion (2023). |

| Global Reach & Accessibility | Serving customers in over 200 countries with a readily available product portfolio. | International sales significant portion of total revenue (2023). |

| Reliability & Proven Performance | Building customer trust through consistent quality and dependable product outcomes. | Long-standing reputation for meeting and exceeding industry standards. |

| Sustainability & Environmental Responsibility | Driving eco-friendly innovation and operational improvements aligned with climate goals. | Advancing greenhouse gas emission reduction targets (2024). |

Customer Relationships

For its industrial and healthcare clients, 3M cultivates direct sales relationships, providing specialized technical support and tailored solutions. This approach, crucial for complex industrial applications, ensures clients receive in-depth product knowledge to address their unique operational challenges. In 2023, 3M's Health Care segment, a key area for direct engagement, generated approximately $14.3 billion in revenue.

3M cultivates brand loyalty for its consumer goods by consistently delivering high-quality products, supported by robust marketing efforts. For instance, in 2023, 3M's consumer segment reported net sales of approximately $3.3 billion, underscoring the market's trust in its established brands.

The company actively engages consumers through various campaigns and digital channels, aiming to forge emotional bonds with iconic household names such as Post-it and Scotch. This direct interaction is crucial for maintaining relevance and fostering repeat purchases in a competitive landscape.

3M actively engages in innovation collaboration with its key customers, a cornerstone of its customer relationships. This partnership model involves jointly developing solutions tailored to specific industry challenges or anticipating future market shifts. For instance, in 2023, 3M highlighted its ongoing work with automotive manufacturers to create advanced materials for electric vehicles, demonstrating how co-creation directly addresses emerging trends.

This co-creation strategy significantly deepens 3M's relationships with its customer base. By involving customers directly in the product development lifecycle, 3M ensures its innovations are not only cutting-edge but also highly relevant to real-world market demands. This approach fosters loyalty and provides invaluable market insights, contributing to 3M's sustained competitive advantage.

Online Presence and Digital Engagement

3M leverages its extensive website and active social media profiles to connect with customers, offering detailed product information and support. This digital engagement is crucial for building and maintaining relationships in today's market, ensuring customers can easily find what they need.

In 2024, 3M continued to enhance its digital platforms, aiming to provide a seamless customer experience. Their online presence serves as a primary channel for disseminating product updates and engaging with feedback, fostering a sense of community and direct interaction.

- Website Traffic: 3M's corporate website saw millions of unique visitors in the first half of 2024, indicating a strong digital reach for product discovery and information.

- Social Media Engagement: Across platforms like LinkedIn and Twitter, 3M reported a significant increase in customer interactions and inquiries during 2024, highlighting the effectiveness of their social media strategy.

- Digital Support Channels: The company expanded its online customer support resources, including AI-powered chatbots and comprehensive FAQs, leading to a reported 15% improvement in customer satisfaction for digital inquiries in early 2024.

- Content Marketing: 3M's digital content, such as case studies and webinars published throughout 2024, aimed to educate and engage customers, driving deeper understanding of their solutions.

After-Sales Service and Support

3M offers robust after-sales service, encompassing product troubleshooting, maintenance guidance, and warranty support. This commitment is vital for customer satisfaction across its diverse market segments, fostering loyalty and repeat business.

- Customer Satisfaction: 3M's dedication to ongoing support, including troubleshooting and maintenance advice, directly impacts customer satisfaction, ensuring products perform as expected.

- Warranty Support: Providing reliable warranty services reinforces customer trust, especially for high-value industrial and healthcare products where downtime is costly.

- Brand Loyalty: Comprehensive after-sales care builds strong customer relationships, encouraging repeat purchases and positive word-of-mouth referrals.

- Product Lifecycle Management: Effective support helps customers maximize the lifespan and utility of 3M products, contributing to overall value perception.

3M employs a multi-faceted approach to customer relationships, blending direct engagement for industrial and healthcare clients with brand-building for consumer products. Their strategy emphasizes co-creation, digital connectivity, and robust after-sales support to foster loyalty and ensure product relevance.

| Relationship Type | Key Activities | 2023/2024 Data/Examples |

|---|---|---|

| Direct Sales & Technical Support | Specialized support for industrial/healthcare clients, tailored solutions | Health Care segment revenue: ~$14.3 billion (2023) |

| Brand Loyalty & Marketing | High-quality products, robust marketing for consumer goods | Consumer segment net sales: ~$3.3 billion (2023) |

| Co-creation & Innovation | Joint development with key customers for specific challenges | Collaboration with auto manufacturers on EV materials (2023) |

| Digital Engagement | Website, social media, online support, content marketing | Millions of website visitors (H1 2024); 15% improvement in digital inquiry satisfaction (early 2024) |

| After-Sales Service | Troubleshooting, maintenance guidance, warranty support | Focus on customer satisfaction and product lifecycle management |

Channels

3M leverages its extensive direct sales force to cultivate deep relationships with key accounts across industrial, governmental, and specialized sectors. This direct channel is crucial for understanding intricate customer needs and delivering highly customized solutions, particularly for 3M's advanced materials and technologies.

In 2023, 3M's sales revenue reached approximately $32.7 billion, with a significant portion attributed to the effectiveness of its direct sales model in securing and expanding business with large, complex organizations. This direct engagement facilitates the sale of high-value, technically demanding products where expert consultation is essential.

Wholesalers and distributors are a crucial part of 3M's strategy, particularly for its industrial and healthcare products. These partners act as vital conduits, extending 3M's market reach across diverse industries and geographies. In 2024, 3M continued to leverage this extensive network to ensure its innovative solutions reached a broad customer base, from large industrial manufacturers to specialized healthcare providers.

3M heavily relies on retail chains, supermarkets, and mass merchandisers to distribute its consumer goods, ensuring widespread accessibility for everyday shoppers. This channel is fundamental for achieving significant sales volumes and establishing a strong presence in the consumer market.

In 2024, 3M's consumer segment, which includes products like Post-it Notes and Scotch tape, continued to see robust performance through these retail partnerships. For example, major retailers such as Walmart and Target are key distribution points, facilitating broad market penetration and driving substantial revenue for these product lines.

E-commerce Platforms and Online Retailers

3M leverages its own e-commerce platforms alongside major online retailers to offer customers unparalleled convenience and broaden its market presence. This multi-channel approach effectively taps into the increasing consumer preference for online shopping, a trend observed across all demographics and product categories.

In 2024, the global e-commerce market continued its robust growth, with online retail sales projected to reach trillions of dollars. For companies like 3M, this digital channel is crucial for reaching a wider customer base, including individual consumers and small businesses who may not have direct access to traditional distribution networks.

- Expanded Market Reach: Online channels allow 3M to serve customers globally, transcending geographical limitations of physical retail.

- Customer Convenience: Direct e-commerce and partnerships with online marketplaces provide 24/7 shopping access and simplified purchasing processes.

- Data Insights: Online sales generate valuable data on customer behavior and product preferences, informing future product development and marketing strategies.

- Adaptation to Trends: This strategy aligns with the significant shift towards digital commerce, with online sales accounting for a growing percentage of total retail revenue worldwide.

Specialty Stores and Niche Market Outlets

Specialty stores and niche market outlets are a crucial part of 3M's distribution strategy, particularly for products designed for specific industries or hobbies. These channels allow 3M to reach highly targeted customer segments that might be difficult to access through broader retail networks. For instance, 3M's automotive division might partner with specialized auto parts retailers, while its craft supplies could be found in dedicated hobby stores.

This approach is particularly effective for products requiring specialized knowledge or catering to passionate consumer groups. By leveraging these niche channels, 3M can ensure its specialized offerings are presented to the right audience, often with knowledgeable staff who can explain the product's benefits. This targeted distribution can lead to higher sales conversion rates and stronger brand loyalty within those specific markets.

- Targeted Reach: Specialty stores and niche outlets provide direct access to specific customer demographics and industries.

- Enhanced Product Presentation: These channels often feature knowledgeable staff who can effectively communicate the value of specialized 3M products.

- Market Penetration: Niche distribution allows 3M to build strong presences in specialized sectors, fostering deeper market penetration.

- Brand Affinity: Aligning with niche retailers can enhance brand perception among enthusiasts and professionals within those specific markets.

3M's channel strategy is multifaceted, encompassing direct sales, wholesale, retail, e-commerce, and specialty outlets. This diverse approach ensures broad market coverage and caters to varied customer needs, from industrial giants to individual consumers.

The company's direct sales force is instrumental in building relationships and providing tailored solutions, particularly for high-value industrial and technical products. In 2024, 3M continued to emphasize this channel for its advanced materials and technologies, where expert consultation is paramount.

Wholesalers and distributors extend 3M's reach significantly, especially for its industrial and healthcare lines. These partners are key to accessing a wide customer base across different sectors and geographies.

Consumer goods thrive through retail chains, supermarkets, and mass merchandisers, ensuring widespread availability. Major retailers like Walmart and Target remain critical for driving sales volume and consumer market presence in 2024.

E-commerce platforms, both proprietary and through online retailers, offer convenience and expand market access. This digital channel is vital for reaching individual consumers and small businesses, aligning with the ongoing global growth in online retail.

Specialty stores and niche outlets target specific industries and hobbies, allowing 3M to connect with specialized customer segments effectively. This strategy enhances product presentation and fosters brand loyalty within particular markets.

| Channel Type | Key Role | 2024 Focus/Impact |

|---|---|---|

| Direct Sales | Key account relationships, customized solutions | High-value technical products, deep customer understanding |

| Wholesalers/Distributors | Market reach extension | Industrial and healthcare products, broad geographical access |

| Retail Chains | Mass market penetration | Consumer goods (e.g., Post-it, Scotch), high sales volume |

| E-commerce | Convenience, broad access | Global reach, data insights, digital commerce alignment |

| Specialty Stores | Niche market engagement | Targeted demographics, specialized product lines |

Customer Segments

Industrial Manufacturers and Businesses represent a core customer segment for 3M. This diverse group spans industries like automotive, electronics, and aerospace, relying on 3M's extensive portfolio of adhesives, abrasives, advanced materials, and crucial safety equipment to drive their production and operational efficiency. For instance, 3M's Safety & Industrial segment, along with its Transportation & Electronics segment, directly serves the needs of these manufacturing powerhouses.

Even after the Solventum spin-off, 3M remains a key supplier to healthcare providers, hospitals, and clinics. They continue to offer essential medical supplies, advanced filtration systems, and various other healthcare solutions critical for patient care and facility operations.

This segment demands highly specialized products that meet stringent regulatory compliance standards. For example, in 2023, 3M's Healthcare segment, prior to the Solventum separation, generated approximately $6.1 billion in revenue, underscoring the significant market it serves.

Government and public sector organizations represent a significant customer segment for 3M, relying on its diverse product portfolio. This includes essential items like personal protective equipment (PPE) for frontline workers, advanced traffic safety solutions to improve road infrastructure, and durable materials for public works projects. For instance, 3M's N95 respirators were critical during the COVID-19 pandemic, with the company ramping up production significantly to meet global demand from health ministries and emergency services. Their traffic safety division supplies reflective sheeting for signage and pavement markings, contributing to safer roadways worldwide.

Engaging with these clients requires navigating complex procurement processes and adhering to stringent regulatory requirements. Many government contracts involve competitive bidding and detailed compliance checks. 3M's ability to meet these specifications, including product certifications and sustainability mandates, is crucial for securing and maintaining these relationships. The company's global presence allows it to serve national and local government entities across various sectors, from transportation and public safety to healthcare and defense.

Individual Consumers and Households

Individual consumers and households represent a core customer segment for 3M, driving demand for a wide array of everyday products. This group relies on 3M for essential items that enhance organization, cleaning, and home improvement. For instance, the enduring popularity of Post-it Notes and Scotch tape highlights their consistent need for reliable office and organizational supplies. In 2023, 3M's consumer segment reported significant revenue, demonstrating the ongoing strength of these product lines with the general public.

The company’s strategy directly targets the needs of this broad market by offering accessible and practical solutions. Products like Command hooks, which offer damage-free decorating and organization, have gained considerable traction among homeowners and renters alike. Similarly, Scotch-Brite cleaning supplies are a staple in many households, reflecting a continuous demand for effective cleaning tools. The company's focus on innovation within this segment ensures a steady stream of new and improved products to meet evolving consumer preferences.

- Broad Consumer Base: Encompasses individuals and families purchasing household and office essentials.

- Key Product Categories: Includes Post-it Notes, Scotch tape, Command hooks, and Scotch-Brite cleaning supplies.

- Market Reach: Directly addresses the needs of a vast and diverse consumer market.

- Sales Performance: The consumer segment consistently contributes to 3M's overall revenue, with strong performance in 2023 reflecting sustained demand.

Electronics and Technology Companies

3M serves a specialized segment within the electronics and technology sector, including semiconductor manufacturers and data center operators. These companies depend on 3M for advanced materials, electronic components, and critical thermal management solutions to ensure the performance and longevity of their sophisticated equipment.

This segment is a significant driver of innovation for 3M. For instance, in 2024, 3M continued to invest heavily in research and development for next-generation electronic materials, aiming to address the increasing demands for miniaturization and higher processing speeds in the tech industry. The company's focus on this area reflects its commitment to providing cutting-edge solutions.

- Key Needs: Advanced materials for circuit boards, thermal interface materials for heat dissipation in data centers, and specialized adhesives for electronic assembly.

- Market Trends: Growth in 5G infrastructure, artificial intelligence hardware, and electric vehicle components are creating new demands for 3M's electronic solutions.

- 3M's Role: Providing reliable, high-performance materials that enable smaller, faster, and more energy-efficient electronic devices and systems.

- Innovation Focus: Developing sustainable and high-performance materials that meet the evolving technical specifications of the electronics industry.

3M's customer segments are broad, encompassing industrial manufacturers, healthcare providers, government entities, individual consumers, and the technology sector. Each segment relies on 3M for a diverse range of products, from essential safety equipment and medical supplies to everyday household items and advanced electronic materials. The company's strategy involves tailoring its offerings and engagement to meet the specific needs and regulatory demands of these varied groups.

Cost Structure

Raw material and component costs represent a substantial portion of 3M's expenses, reflecting the vast array of inputs needed for its diverse product lines, from adhesives and abrasives to healthcare supplies. In 2023, 3M reported cost of goods sold at $21.4 billion, a figure heavily influenced by the procurement of these essential materials.

The company's profitability is directly sensitive to global commodity price volatility and the intricate dynamics of its supply chains. For instance, increases in the cost of petrochemicals, metals, and specialty chemicals can significantly pressure margins if not effectively managed through pricing strategies or hedging.

Operating 3M's extensive global manufacturing footprint incurs significant costs. These include expenses for direct labor, energy consumption for production lines, ongoing maintenance of sophisticated machinery, and general factory overhead. In 2023, 3M reported cost of sales of $26.1 billion, reflecting these substantial manufacturing and production outlays.

The company actively pursues operational excellence initiatives aimed at boosting productivity and streamlining processes. This strategic focus is designed to effectively manage and reduce these inherent production expenses, thereby improving overall cost efficiency across its diverse product lines.

3M's commitment to innovation is evident in its substantial Research and Development (R&D) investment. In 2024, the company continued to prioritize this crucial area, recognizing it as a primary driver for future growth and competitive advantage.

This significant expenditure covers a wide range of activities, from the salaries of its dedicated scientists and engineers to the operational costs of its advanced laboratories and the ongoing process of developing and protecting intellectual property. These investments are not one-time events but represent a continuous commitment to staying at the forefront of technological advancement.

Sales, Marketing, and Distribution Costs

3M's cost structure heavily features expenses tied to its extensive sales, marketing, and distribution efforts. These costs are crucial for maintaining its vast global market reach and ensuring strong brand visibility across diverse product lines.

For instance, in 2023, 3M reported selling, general, and administrative expenses of $5.8 billion, which encompasses many of these activities. This significant investment is necessary to support a global sales force, execute impactful advertising campaigns, and manage the complex logistics of distributing its wide array of products worldwide.

- Sales Force Expenses: Costs associated with employing and supporting a global team of sales professionals.

- Advertising and Promotion: Investment in marketing campaigns to build brand awareness and drive product demand.

- Distribution and Logistics: Expenses related to warehousing, transportation, and supply chain management for global product delivery.

- Market Research and Development: Costs incurred to understand market needs and develop new product strategies.

Legal and Compliance Costs

3M faces substantial legal and compliance expenses due to its worldwide reach and varied product portfolio. These costs encompass adhering to regulations, managing environmental responsibilities, and resolving legal disputes.

In 2023, 3M recorded significant charges related to litigation, particularly concerning per- and polyfluoroalkyl substances (PFAS) and combat helmets. These settlements and legal provisions have had a material impact on the company's financial performance, highlighting the financial weight of these cost categories.

- Regulatory Adherence: Costs associated with meeting diverse international and industry-specific regulations, including product safety and environmental standards.

- Environmental Liabilities: Expenses related to managing and remediating environmental impact from past and present operations, often involving significant long-term commitments.

- Litigation Settlements: Payments made to resolve lawsuits, such as those concerning PFAS contamination and product liability claims, which can amount to billions of dollars.

3M's cost structure is significantly influenced by its extensive R&D investments, aiming to fuel innovation and maintain a competitive edge. In 2024, the company continued to allocate substantial resources to research and development, recognizing its critical role in future growth. These expenditures cover personnel, laboratory operations, and intellectual property protection, underscoring a commitment to technological advancement.

Furthermore, the cost of goods sold, amounting to $21.4 billion in 2023, reflects the substantial outlay for raw materials and components essential for 3M's diverse product lines. Global commodity price fluctuations and supply chain complexities directly impact these costs, necessitating strategic management to preserve margins.

The company's operational expenses, including manufacturing and production, are also a key component. In 2023, cost of sales reached $26.1 billion, encompassing direct labor, energy, machinery maintenance, and factory overhead, all integral to its global manufacturing presence.

Sales, general, and administrative expenses, totaling $5.8 billion in 2023, represent the investment in maintaining global market reach and brand visibility. This includes costs for a worldwide sales force, marketing campaigns, and complex distribution networks.

| Cost Category | 2023 Financial Impact (USD Billions) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | 21.4 | Raw materials, components, manufacturing labor |

| Cost of Sales | 26.1 | Manufacturing operations, energy, maintenance |

| Selling, General & Administrative | 5.8 | Sales force, marketing, distribution, administration |

| Research & Development | (Ongoing Investment) | Innovation, new product development, intellectual property |

| Legal & Compliance | (Significant Provisions) | Litigation (PFAS, combat helmets), regulatory adherence, environmental liabilities |

Revenue Streams

Revenue is primarily generated through the sale of a diverse portfolio of industrial products. This includes essential items like adhesives, abrasives, specialized tapes, sealants, and vital safety equipment. These products are predominantly sold to businesses operating in the manufacturing, automotive, and broader industrial sectors.

The Safety & Industrial segment stands as 3M's most significant revenue driver. In 2023, this segment achieved approximately $6.4 billion in sales, underscoring its critical role in the company's overall financial performance. This substantial contribution highlights the strong demand for 3M's industrial solutions.

Sales of Transportation & Electronics Products represent a crucial revenue stream for 3M, encompassing a wide array of advanced materials and solutions for the automotive, aerospace, and electronics sectors. This segment is a significant contributor to the company's overall financial performance.

In 2023, 3M's Transportation & Electronics segment generated approximately $12.2 billion in sales, highlighting its substantial market presence and the demand for its innovative offerings in these critical industries.

Revenue streams from consumer product sales are a significant part of 3M's business, directly reaching households and offices. This segment includes well-known brands such as Post-it Notes, Scotch tape, and Command adhesive products, catering to everyday consumer needs and convenience. In 2023, 3M's consumer segment generated approximately $3.4 billion in sales, highlighting its strong market presence and consumer trust.

Licensing and Royalties

While not a primary revenue driver for 3M, the company does leverage its extensive patent portfolio by licensing its technologies and intellectual property to other businesses. This allows third parties to utilize 3M's innovations in their own product development and manufacturing processes, creating an additional income stream.

For instance, in 2023, 3M continued to manage its intellectual property, which includes a vast number of patents across diverse sectors. Though specific figures for licensing and royalties are often embedded within broader segment reporting, the strategic value of this revenue stream lies in its ability to monetize innovation without direct manufacturing or sales involvement.

- Technology Licensing: 3M licenses its patented technologies, such as those in adhesives, abrasives, and advanced materials, to companies globally.

- Intellectual Property Partnerships: The company engages in partnerships where its IP is utilized in co-developed products or processes, generating royalty payments.

- Global Reach: Licensing agreements extend 3M's technological reach into markets and applications where direct product sales might be less feasible.

Services and Solutions

Beyond direct product sales, 3M diversifies its revenue through a robust services and solutions segment. This includes offering specialized technical support, consulting, and customized application development for its industrial and commercial clientele. These value-added services often complement 3M's core product lines, enhancing customer loyalty and creating recurring revenue streams.

For instance, in 2023, 3M's business segments, which heavily rely on these service components, demonstrated varied performance. While the Health Care segment faced challenges, segments like Safety & Industrial continued to show resilience, partly due to the integrated service offerings that support complex product implementations.

- Technical Support: Providing expert assistance for product installation, troubleshooting, and optimization.

- Customized Solutions: Developing tailored product and service packages to meet specific client needs.

- Consulting Services: Offering industry expertise and guidance on best practices related to 3M's technologies.

- Training Programs: Educating clients on the effective and safe use of 3M products and solutions.

3M's revenue streams are diversified, with a significant portion coming from product sales across various segments. Key areas include Safety & Industrial, Transportation & Electronics, and Consumer products. Additionally, technology licensing and services contribute to the company's income.

In 2023, the Safety & Industrial segment was a major contributor, generating approximately $6.4 billion. The Transportation & Electronics segment also performed strongly, with sales reaching about $12.2 billion. The Consumer segment, featuring popular brands like Post-it and Scotch, brought in approximately $3.4 billion.

Beyond product sales, 3M leverages its intellectual property through technology licensing and engages clients with technical support, consulting, and customized solutions, creating recurring revenue and enhancing customer relationships.

| Revenue Stream | 2023 Sales (Approximate) | Key Products/Services |

| Safety & Industrial | $6.4 billion | Adhesives, abrasives, safety equipment |

| Transportation & Electronics | $12.2 billion | Advanced materials for automotive, aerospace, electronics |

| Consumer | $3.4 billion | Post-it Notes, Scotch tape, Command strips |

| Technology Licensing | Embedded in segment reporting | Patented technologies, IP partnerships |

| Services & Solutions | Embedded in segment reporting | Technical support, consulting, customized applications |

Business Model Canvas Data Sources

The 3M Business Model Canvas is informed by a robust blend of internal financial reports, extensive market research, and competitive intelligence. This multi-faceted approach ensures a comprehensive understanding of our operational landscape and strategic opportunities.