3M PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

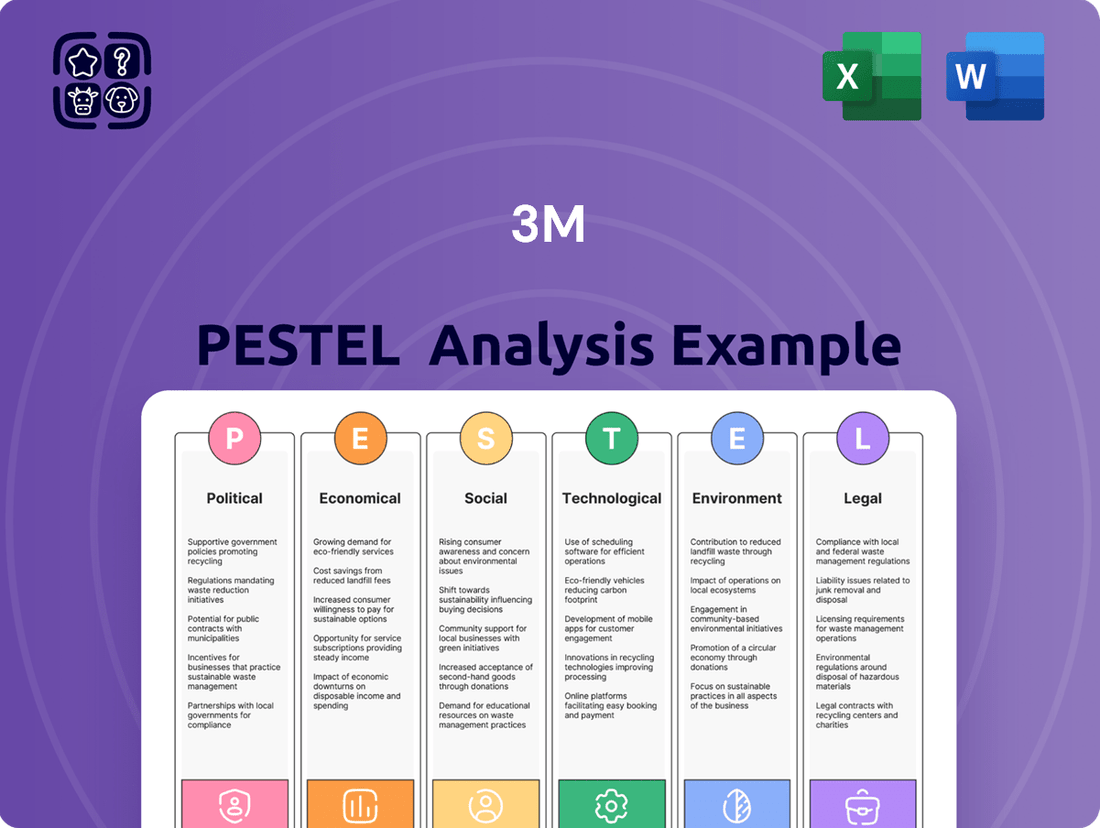

Navigate the complex external forces shaping 3M's future with our expert PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, environmental regulations, and legal frameworks are impacting this global innovator. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for a comprehensive understanding.

Political factors

3M navigates a complex global regulatory landscape, facing stringent rules on product safety, manufacturing processes, and environmental impact. For instance, in 2023, the company continued to address significant legal settlements, including those related to per- and polyfluoroalkyl substances (PFAS) and combat earplug litigation, which collectively represent billions of dollars in potential liabilities. These regulatory and legal challenges underscore the substantial financial and operational risks associated with non-compliance, impacting everything from supply chains to market access.

Global trade policies and tariffs are a significant political factor impacting 3M's operations. These policies directly affect the cost of raw materials, components, and finished goods, influencing 3M's production expenses and pricing strategies. For instance, in early 2025, ongoing US-China trade tensions were a concern, with analysts projecting potential earnings impacts due to tariffs.

3M is actively managing these risks by optimizing its extensive global manufacturing and distribution footprint. This strategy allows the company to shift production or sourcing to mitigate the financial effects of specific tariffs, ensuring greater resilience in its supply chain and maintaining market access across various regions.

3M's vast global presence, spanning operations in 87 countries with 200 manufacturing facilities, inherently ties its performance to political stability and geopolitical risks. Instability in key markets, such as ongoing trade tensions or regional conflicts, can directly impact 3M's supply chain reliability and access to raw materials, as seen in disruptions affecting global manufacturing in 2024.

Political shifts, including changes in government policies or trade agreements, can significantly alter market access and demand for 3M's diverse product portfolio. For instance, new tariffs or regulatory changes in major economies like China or the European Union could necessitate strategic adjustments to pricing and market entry strategies, as businesses worldwide navigate evolving trade landscapes in 2024-2025.

Government Contracts and Public Sector Demand

3M's extensive reach into sectors like healthcare and safety positions it as a significant player in government contracts and public sector demand. The company's role as a major producer of N95 masks during the COVID-19 pandemic, for example, highlighted its critical function within public health supply chains. Government spending priorities, particularly in defense, infrastructure, and healthcare, directly influence 3M's revenue streams and strategic focus.

Government procurement policies and budget allocations can significantly impact 3M's various business segments. For instance, increased defense spending in 2024-2025 could boost demand for 3M's advanced materials and electronic solutions used in military applications. Conversely, shifts in healthcare policy or budget constraints could affect sales of its medical supplies and technologies.

- Government Contracts: 3M secured substantial contracts for personal protective equipment (PPE) during the pandemic, showcasing its capacity to meet large-scale public demand.

- Public Sector Demand: Fluctuations in government spending on infrastructure projects and healthcare initiatives directly correlate with demand for 3M's diverse product portfolio.

- Policy Influence: Changes in regulations concerning environmental standards or product safety can necessitate adjustments in 3M's manufacturing processes and product development, impacting costs and market access.

International Relations and Diplomacy

The global political climate significantly influences 3M's international operations. Strong diplomatic ties between nations can smooth the path for market entry and reduce trade friction, making it easier for 3M to expand its reach. Conversely, geopolitical instability or strained relations can introduce significant hurdles, including tariffs, sanctions, or supply chain disruptions.

For instance, the anticipated easing of US-China trade tensions in mid-2025 is projected to have a beneficial effect on 3M's profit outlook. This diplomatic shift could potentially lower import duties on key components and open up previously restricted market segments in China. Such developments are crucial for a company with a substantial global manufacturing and sales footprint like 3M.

- Facilitated Market Access: Positive international relations can lower tariffs and non-tariff barriers, improving 3M's access to new customer bases.

- Reduced Operational Risk: Stable diplomatic environments minimize the risk of supply chain interruptions and regulatory changes that could impact production and distribution.

- Enhanced Partnership Opportunities: Diplomatic goodwill can foster collaboration with foreign entities, leading to joint ventures or strategic alliances that drive innovation and growth.

- Impact on Profitability: Shifts in international relations, such as the expected improvement in US-China trade relations by mid-2025, directly influence 3M's revenue forecasts and overall financial performance.

Political factors significantly shape 3M's operational landscape, from navigating extensive regulatory frameworks to responding to global trade dynamics. The company's substantial global footprint, operating in 87 countries, makes it susceptible to geopolitical shifts and regional instabilities that can disrupt supply chains and market access, as observed in manufacturing disruptions during 2024.

Government policies, including trade agreements and procurement strategies, directly influence 3M's revenue streams. For instance, shifts in defense spending in 2024-2025 could boost demand for its advanced materials, while changes in healthcare policy might affect its medical supply sales. The potential easing of US-China trade tensions by mid-2025 is anticipated to positively impact 3M's profitability by potentially lowering import duties.

3M's engagement with government contracts, particularly in areas like personal protective equipment (PPE) and defense applications, highlights the critical link between public sector demand and company performance. Policy changes concerning environmental standards or product safety also necessitate strategic adjustments, impacting manufacturing processes and market access.

What is included in the product

This PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting 3M, providing a comprehensive understanding of the external forces shaping its business landscape.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats for 3M.

Provides a structured framework to identify and analyze external factors impacting 3M, thereby reducing the anxiety of unforeseen market shifts and strategic blind spots.

Economic factors

The global economic outlook for 2024 and early 2025 presents a mixed picture, with varying growth rates across regions. While some economies are showing resilience, others face persistent headwinds, creating a complex demand environment for 3M's diverse product lines.

Recession risks remain a significant concern, particularly in major developed markets. For instance, the IMF projected global growth to moderate in 2024, with potential for further slowdowns if geopolitical tensions or inflation persist, directly impacting industrial output and consumer discretionary spending that affects 3M's sales.

Conversely, emerging markets are anticipated to contribute more significantly to global growth, potentially offering pockets of opportunity for 3M. Navigating these regional disparities in economic health is crucial for forecasting demand and managing inventory effectively across 3M's extensive operations.

Inflationary pressures continue to be a significant concern for manufacturers like 3M. In early 2024, global inflation rates, while moderating from their 2022 peaks, remained elevated in many regions, impacting the cost of essential inputs. For instance, the Producer Price Index (PPI) for manufactured goods saw fluctuations, directly affecting 3M's raw material and component expenses.

These rising costs for raw materials, energy, and labor directly squeeze 3M's profit margins if they cannot be effectively passed on. The company's pricing power is a key determinant of its ability to absorb or mitigate these inflationary impacts. In 2023, 3M did implement price increases across various product lines to counter these pressures, but the sensitivity of customer demand to these hikes remains a critical factor.

Consequently, managing supply chain efficiency is more vital than ever for 3M. Optimizing logistics, securing stable supplier relationships, and exploring alternative sourcing strategies are paramount to controlling manufacturing expenses and maintaining competitive pricing in an inflationary environment. This focus on operational resilience is a core strategy for navigating the ongoing cost pressures.

Currency exchange rate fluctuations significantly impact 3M, a global entity with extensive international operations. A strengthening U.S. dollar, for instance, can make 3M's products pricier for overseas customers, potentially dampening international sales volumes. Conversely, a weaker dollar can boost the competitiveness of its offerings abroad.

These currency movements also directly affect how 3M's overseas profits translate back into U.S. dollars. For example, if the Euro weakens against the dollar, 3M's earnings generated in Europe will be worth less when reported in its financial statements. In 2023, 3M reported that foreign currency translation negatively impacted its sales by approximately $700 million.

Interest Rates and Access to Capital

Changes in interest rates directly impact 3M's cost of capital. For instance, if the Federal Reserve maintains or increases its benchmark interest rate in 2024 or 2025, 3M's borrowing costs for new investments, research and development, and refinancing existing debt will likely rise. This increased expense can put pressure on profitability and potentially delay capital-intensive projects, such as expanding manufacturing facilities or acquiring new technologies.

Furthermore, access to favorable capital markets is crucial for 3M, especially given its ongoing need to fund strategic initiatives and manage significant legal settlements. In a high-interest-rate environment, securing affordable financing becomes more challenging. For example, if 3M needs to issue bonds to cover a portion of its environmental liabilities, higher prevailing yields would translate into greater interest payments over the life of the debt, impacting cash flow.

- Impact on Borrowing Costs: Rising interest rates in 2024-2025 directly increase 3M's expenses for new debt issuance and variable-rate loans.

- Project Financing: Higher financing costs can make capital-intensive projects, like factory upgrades or new product development, less attractive or require more robust internal funding.

- Debt Management: 3M's ability to manage its existing debt and fund large obligations, such as those stemming from legal settlements, is sensitive to prevailing interest rate levels and the availability of credit.

Consumer Spending and Market Demand

3M's consumer segment, encompassing household staples like Post-it Notes and Scotch tape, is intrinsically linked to consumer spending patterns and overall market demand. Economic confidence, a key driver of discretionary spending, directly impacts sales in this area. For instance, during periods of economic uncertainty, consumers may reduce purchases of non-essential household items, affecting 3M's revenue from these product lines.

Disposable income levels are a critical determinant of how much consumers can spend on 3M's consumer goods. As incomes rise, consumers tend to allocate more to household items and personal care products. Conversely, a decline in disposable income often leads to belt-tightening, with consumers prioritizing essential purchases. This dynamic was evident in 2023, where consumer spending growth, while present, was tempered by persistent inflation, influencing purchasing decisions for many households.

Shifting consumer preferences also significantly shape market demand for 3M's consumer offerings. There's a growing emphasis on sustainability, with consumers increasingly seeking eco-friendly and responsibly sourced products. 3M's ability to innovate and adapt its product portfolio to meet these evolving demands for sustainable alternatives, such as recycled or biodegradable materials in its consumer goods, will be crucial for maintaining market share and driving growth in this segment.

- Consumer Spending Trends: In Q1 2024, U.S. consumer spending saw a modest increase, though inflation continued to impact purchasing power for many goods.

- Disposable Income Impact: Higher disposable income generally correlates with increased sales of 3M's consumer products, as seen in periods of economic expansion.

- Sustainability Demand: A growing segment of consumers actively seeks sustainable product options, influencing demand for eco-conscious household items.

- 3M's Market Position: 3M's performance in the consumer segment directly reflects broader economic health and consumer sentiment.

The global economic landscape through 2024 and into early 2025 presents a complex environment for 3M. While some regions show resilience, others face persistent challenges, impacting demand for 3M's diverse product portfolio. Recession risks remain a concern in developed markets, potentially slowing industrial output and discretionary spending, which directly affects 3M's sales.

Emerging markets are expected to drive a larger portion of global growth, offering potential opportunities for 3M. Navigating these regional economic disparities is key for effective demand forecasting and inventory management across 3M's global operations.

Inflationary pressures continue to affect manufacturers like 3M, increasing the cost of raw materials, energy, and labor. While global inflation has moderated from its 2022 peaks, it remained elevated in many areas in early 2024. For instance, the US Producer Price Index (PPI) for finished goods saw increases, directly impacting 3M's input expenses.

Currency fluctuations significantly influence 3M's international operations. A strong U.S. dollar can make 3M's products more expensive for overseas buyers, potentially reducing sales volumes abroad. Conversely, a weaker dollar can enhance the competitiveness of its offerings internationally. In 2023, foreign currency translation had a negative impact on 3M's sales, reducing them by approximately $700 million.

Interest rate changes directly affect 3M's cost of capital. For example, if interest rates remain high in 2024-2025, 3M's borrowing costs for new investments and debt refinancing will likely increase, potentially impacting profitability and project timelines.

| Economic Factor | 2024/2025 Outlook | Impact on 3M |

| Global GDP Growth | Moderate, with regional variations. IMF projected 3.2% for 2024. | Influences overall demand for 3M's products. |

| Inflation | Moderating but remains elevated in many regions. | Increases input costs, squeezing profit margins. |

| Interest Rates | Expected to remain elevated or increase in some economies. | Raises borrowing costs for capital investments and debt. |

| Currency Exchange Rates | Volatile, with a strengthening USD impacting international sales. | Affects international revenue translation and product pricing. |

Preview the Actual Deliverable

3M PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of 3M covers all key political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the strategic landscape 3M operates within.

Sociological factors

Global consumers are increasingly prioritizing environmentally friendly and sustainably produced goods, a trend that significantly influences market dynamics. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact.

3M's Consumer Business Group is actively adapting to this shift by emphasizing eco-friendly materials in its product development. This includes a concerted effort to reduce plastic usage in packaging, a common concern for environmentally conscious shoppers. Furthermore, the company is focusing on designing products with waste reduction and recyclability in mind, directly addressing consumer demand for more responsible consumption.

This growing preference for sustainability acts as a powerful catalyst for innovation within 3M, driving the development of new solutions and strengthening its market positioning. Companies that successfully integrate sustainable practices into their offerings are better poised to capture market share and build brand loyalty in the coming years.

Societal emphasis on health and safety has significantly boosted demand for 3M's offerings. This is particularly evident in their Safety & Industrial and Health Care divisions, where products like personal protective equipment (PPE) and medical supplies are crucial. The heightened global awareness around health, especially post-2020, has solidified the need for these items, presenting ongoing opportunities for 3M to innovate and meet market needs.

3M faces a dynamic workforce landscape shaped by an aging population and the distinct expectations of younger generations, impacting how it attracts and keeps talent. For instance, in 2024, the global labor force continues to see a significant portion of experienced workers nearing retirement age, while Gen Z is increasingly entering the workforce with a strong emphasis on purpose-driven work and work-life balance.

Adapting to new labor trends is crucial for 3M's competitive edge. The widespread adoption of remote and hybrid work models, a trend that accelerated in recent years and remains strong in 2024, demands flexible policies. Furthermore, the growing demand for diversity, equity, and inclusion (DEI) in the workplace requires proactive strategies to foster an environment where all employees feel valued and can contribute fully.

Societal Expectations for Corporate Responsibility

Societies today have heightened expectations for corporate responsibility, pushing companies like 3M to go beyond mere profit. This means actively engaging in ethical sourcing, ensuring fair labor practices throughout their supply chains, and contributing positively to the communities where they operate. For instance, in 2023, 3M reported investing over $40 million in community and social impact programs globally, underscoring this commitment.

These societal demands directly influence a company's reputation and financial performance. A strong stance on corporate social responsibility (CSR) is no longer optional; it's a critical component for maintaining a positive brand image. This is particularly true for attracting socially conscious investors and top talent, who increasingly prioritize companies with demonstrable ethical and sustainable practices.

3M's dedication to sustainability, as evidenced by their goal to reduce greenhouse gas emissions by 50% by 2030 compared to a 2019 baseline, is a direct response to these evolving societal expectations. Such initiatives are vital for building trust and long-term value.

Key aspects of societal expectations for 3M include:

- Environmental Stewardship: Demonstrating a commitment to reducing environmental impact and promoting sustainable practices in product development and operations.

- Ethical Labor Practices: Ensuring fair wages, safe working conditions, and respect for human rights across all global operations and supply chains.

- Community Engagement: Actively participating in and supporting local communities through various initiatives, volunteering, and philanthropic efforts.

- Product Safety and Transparency: Providing clear information about product ingredients, safety, and environmental impact to consumers and stakeholders.

Impact of Digital Lifestyles and Connectivity

The increasing integration of digital lifestyles and constant connectivity profoundly shapes 3M's product development and marketing strategies. Consumers and businesses alike demand advanced materials that enable new technologies, from cutting-edge electronics and smart home devices to the robust infrastructure supporting data centers. For instance, the global data center market was valued at approximately $275 billion in 2023 and is projected to grow significantly, driven by AI and cloud computing, creating a substantial market for 3M's specialized materials.

3M is strategically positioned to capitalize on these trends by offering solutions that enhance performance and efficiency in these digital ecosystems. This includes materials for advanced semiconductor manufacturing, thermal management solutions for high-performance computing, and components for reliable connectivity. The company's focus on supporting artificial intelligence and emerging technologies is evident in its development of energy-efficient solutions for data centers, a critical area as digital infrastructure expands.

The demand for higher bandwidth and faster data transmission directly translates into a need for innovative materials in telecommunications infrastructure and consumer electronics. 3M's portfolio, which includes advanced adhesives, films, and specialty chemicals, is crucial for miniaturization, durability, and performance in these rapidly evolving sectors. The company's commitment to sustainability also aligns with the growing emphasis on energy efficiency within the digital realm.

Key areas influenced by digital lifestyles include:

- Electronics: Demand for advanced materials in semiconductors, displays, and consumer gadgets.

- Smart Home: Growth in connected devices requiring reliable and efficient components.

- Data Centers: Need for high-performance materials supporting AI, cloud computing, and energy efficiency.

- Connectivity: Requirements for advanced materials in telecommunications and networking infrastructure.

Societal values significantly shape consumer preferences and corporate expectations, impacting 3M's operations and product development. A strong global emphasis on sustainability, for instance, means consumers increasingly favor eco-friendly products, a trend 3M addresses through its focus on sustainable materials and reduced plastic in packaging. Furthermore, heightened awareness around health and safety, particularly post-2020, has bolstered demand for 3M's protective equipment and medical supplies.

The evolving workforce, with an aging population and the distinct priorities of younger generations like Gen Z, presents both challenges and opportunities for talent acquisition and retention at 3M. The widespread adoption of flexible work models and a growing demand for diversity, equity, and inclusion (DEI) necessitate adaptive human resource strategies.

Societal expectations for corporate responsibility are also rising, pushing 3M to prioritize ethical sourcing, fair labor, and community engagement, as demonstrated by its $40 million investment in community programs in 2023. These commitments are crucial for maintaining brand reputation and attracting socially conscious investors and talent.

The increasing integration of digital lifestyles drives demand for 3M's advanced materials in sectors like electronics and data centers, with the global data center market valued at approximately $275 billion in 2023. 3M's solutions are vital for enhancing performance and efficiency in these digital ecosystems, supporting everything from semiconductor manufacturing to AI infrastructure.

Technological factors

3M places a significant emphasis on research and development, recognizing it as a cornerstone for innovation and sustained competitive advantage. This dedication is clearly demonstrated by its planned investment of $3.5 billion in R&D from 2025 through 2027.

This substantial financial commitment is strategically allocated to expedite the creation of new products and efficiently scale promising innovations from initial laboratory concepts to full-scale manufacturing. Such a focused approach is integral to 3M's overarching long-term growth objectives, ensuring a pipeline of future revenue streams.

3M's foundation is built on advanced materials science, making ongoing breakthroughs in areas like adhesives, abrasives, and specialized films absolutely crucial for its success. The company's presence at CES 2025 underscored this commitment, showcasing innovative material solutions tailored for a wide array of sectors, including the rapidly growing electric vehicle market and consumer electronics.

3M is actively pursuing digital transformation and automation across its operations. This strategy focuses on enhancing manufacturing efficiency and supply chain agility, incorporating technologies like artificial intelligence in production. For instance, in 2023, 3M reported a focus on digital initiatives as part of its ongoing operational improvements, aiming to streamline processes and reduce costs.

Emerging Technologies (AI, Nanotechnology, Immersive Tech)

3M is strategically investing in and integrating cutting-edge technologies like Artificial Intelligence (AI), nanotechnology, and immersive tech into its research and development. For instance, AI is being leveraged to accelerate the discovery of novel materials, including advanced nanocomposites, which are crucial for next-generation products. This focus positions 3M to capitalize on advancements shaping key sectors.

The integration of these technologies is anticipated to significantly impact industries where 3M holds a strong presence, such as mobility and electronics. By harnessing AI for material science, 3M aims to unlock new performance characteristics and manufacturing efficiencies. This forward-looking approach is vital for maintaining a competitive edge in a rapidly evolving technological landscape.

The company's commitment to these emerging fields is evident in its ongoing projects and partnerships. For example, in 2024, 3M announced a significant expansion of its AI capabilities, projecting a 15% increase in R&D efficiency through AI-driven simulations. Furthermore, advancements in nanotechnology are enabling the development of thinner, stronger, and more sustainable materials, with applications expected to drive substantial revenue growth in the coming years.

- AI in Material Discovery: 3M utilizes AI algorithms to analyze vast datasets, predicting and identifying new material properties, potentially reducing material development cycles by up to 30% compared to traditional methods.

- Nanotechnology Applications: The company is developing advanced coatings and films using nanotechnology, aiming for a 10% improvement in energy efficiency for electronic devices and a 20% increase in durability for industrial applications by 2025.

- Immersive Technologies in R&D: 3M is exploring virtual and augmented reality for product design and testing, projecting a 25% reduction in prototyping costs and an accelerated time-to-market for new innovations.

- Market Impact: These technological advancements are expected to drive growth in 3M's key markets, with the global market for AI in manufacturing projected to reach $12.6 billion by 2025, and the nanotechnology market expected to surpass $120 billion in the same year.

Product Innovation and Commercialization Speed

Accelerating the launch of new products and improving commercialization speed are paramount technological objectives for 3M. The company's strategy involves introducing approximately 1,000 new products within the next three years, with a particular emphasis on rapidly expanding sectors such as automotive electrification, industrial automation, and safety solutions. This aggressive innovation cadence is essential for 3M to remain agile and responsive to evolving market demands and competitive pressures.

3M's commitment to faster commercialization is directly linked to its investment in advanced R&D capabilities and streamlined product development processes. For instance, in 2024, 3M reported a significant portion of its sales coming from products introduced within the last five years, underscoring the success of its innovation pipeline. This focus allows them to capitalize on emerging trends and maintain a competitive edge.

- Technological Priority: Accelerate new product launches and commercialization speed.

- Target: Introduce 1,000 new products in the next three years.

- Focus Areas: Automotive electrification, industrial automation, and safety.

- Strategic Importance: Enhance market responsiveness and competitive positioning.

3M's technological strategy centers on robust R&D investment, with a planned $3.5 billion allocation from 2025-2027 to drive new product development and scale innovations. This commitment fuels breakthroughs in materials science, crucial for sectors like electric vehicles and consumer electronics, as highlighted at CES 2025. The company is also embracing digital transformation, integrating AI and automation to boost manufacturing efficiency and supply chain agility, a focus evident in its 2023 operational improvement initiatives.

Further embedding advanced technologies like AI and nanotechnology into its R&D pipeline, 3M aims to accelerate material discovery and enhance product performance. For example, AI is projected to boost R&D efficiency by 15% through simulations in 2024, while nanotechnology advancements target a 10% energy efficiency improvement in electronics by 2025. These efforts are geared towards accelerating new product launches, with a goal of introducing 1,000 new products in the next three years, particularly in automotive electrification and industrial automation.

| Technological Focus | Key Initiatives | Projected Impact/Targets | Relevant Data/Timelines |

| R&D Investment | New product development, scaling innovations | Pipeline for future revenue streams | $3.5 billion planned (2025-2027) |

| Materials Science | Adhesives, abrasives, specialized films | Solutions for EVs, consumer electronics | Showcased at CES 2025 |

| Digital Transformation & Automation | AI in production, supply chain agility | Enhanced manufacturing efficiency, cost reduction | Focus in 2023 initiatives |

| Emerging Technologies Integration | AI, nanotechnology, immersive tech | Accelerated material discovery, improved product performance | AI to increase R&D efficiency by 15% (2024); Nanotech for 10% energy efficiency in electronics (by 2025) |

| Product Commercialization | Faster launch and market entry | 1,000 new products in three years | Focus on automotive electrification, industrial automation, safety |

Legal factors

3M's legal landscape is significantly shaped by the Combat Arms Earplugs litigation. In 2023, the company agreed to a substantial $6.01 billion settlement to address claims from roughly 260,000 military veterans.

Disbursements for this settlement commenced in 2024 and are scheduled to span through 2029, with a considerable amount already paid out. This extensive mass tort action has placed a considerable financial and reputational strain on 3M.

3M faces significant legal challenges stemming from its involvement with Per- and Polyfluoroalkyl Substances (PFAS). These chemicals, known for their persistence in the environment, have led to extensive litigation.

A major development occurred in March 2024 when a federal court gave final approval to a substantial settlement. This agreement, ranging from $10.3 billion to $12.5 billion, is intended to address PFAS contamination impacting U.S. public water suppliers.

In response to these liabilities and public pressure, 3M has committed to a strategic exit from all PFAS manufacturing. This transition is slated to be completed by the end of 2025, marking a significant shift in its operational focus.

Beyond the widely publicized earplug and PFAS litigation, 3M navigates ongoing product liability risks inherent in its broad product range. The company's commitment to product safety and performance across diverse sectors, from healthcare to industrial applications, is paramount to mitigating potential future legal challenges and preserving its reputation.

Allegations of product defects can result in substantial financial burdens, encompassing legal defense costs, settlements, and substantial damage awards. For instance, while specific figures for 2024/2025 are still emerging, the company has historically faced significant settlements, such as the reported $6 billion PFAS settlement announced in mid-2023, underscoring the magnitude of such liabilities.

Intellectual Property Protection

Intellectual property protection is paramount for 3M, safeguarding its vast portfolio of patents, trademarks, and trade secrets. This legal framework is the bedrock of its innovation-centric business model, allowing it to leverage proprietary technologies effectively. In 2023, 3M continued to invest heavily in R&D, with expenses totaling $2.1 billion, underscoring the importance of protecting these advancements.

Legal challenges concerning IP infringement pose a significant risk, potentially draining resources and hindering 3M's capacity to maintain its competitive edge and market position. The company actively pursues legal avenues to defend its innovations, recognizing that robust IP protection is directly tied to its long-term profitability and brand integrity.

- Patent Strength: 3M holds tens of thousands of active patents globally, a testament to its ongoing innovation efforts.

- Trademark Value: The strong recognition of brands like Post-it and Scotch relies on vigilant trademark protection.

- Trade Secret Defense: Protecting manufacturing processes and proprietary formulations is crucial for maintaining cost advantages.

- Litigation Costs: IP disputes can lead to substantial legal fees and potential settlements, impacting financial performance.

Regulatory Enforcement and Fines

Adherence to a complex web of national and international regulations is critical for 3M. Failure to comply with environmental, health, safety, and consumer protection laws can result in substantial financial penalties. For instance, in 2023, 3M agreed to a significant settlement related to PFAS contamination, highlighting the substantial financial impact of regulatory non-compliance.

The company's legal department is instrumental in navigating these intricate regulatory environments. Their work focuses on proactive risk mitigation and ensuring the company operates within legal boundaries. This includes staying abreast of evolving standards in areas like chemical safety and product labeling, which directly impact 3M's diverse product portfolio.

- Regulatory Scrutiny: 3M operates in highly regulated sectors, facing oversight from agencies like the EPA and OSHA.

- PFAS Litigation: The company has faced significant legal challenges and settlements concerning per- and polyfluoroalkyl substances (PFAS), with estimated costs reaching billions of dollars.

- Compliance Costs: Maintaining compliance requires substantial investment in legal counsel, internal audits, and process improvements.

- Global Standards: Navigating differing regulations across the many countries where 3M operates adds another layer of complexity.

The Combat Arms Earplugs litigation continues to impact 3M, with settlement disbursements ongoing through 2029. The company's strategic exit from PFAS manufacturing by the end of 2025 aims to mitigate significant legal exposure from environmental contamination claims, with a major water supplier settlement approved in March 2024.

Environmental factors

3M is actively tackling climate change by aiming to cut its greenhouse gas (GHG) emissions substantially. The company has committed to a 50% reduction in Scope 1 and 2 GHG emissions by 2030, using 2019 as its baseline, and plans to achieve carbon neutrality in its operations by 2050. These ambitious goals have been officially recognized and validated by the Science Based Targets initiative (SBTi).

Water stewardship is a critical environmental focus for 3M. The company has set ambitious targets to decrease water consumption at its manufacturing sites, aiming for a 20% reduction by 2025 and a further 25% by 2030. This commitment reflects a growing awareness of water scarcity and the need for responsible resource management in industrial operations.

To support these goals, 3M is investing in advanced water purification systems. By 2024, the company plans to implement state-of-the-art technology at its facilities that are the largest consumers of water. The objective is to significantly improve the quality of water before it is returned to the environment, minimizing ecological impact.

3M is actively engaged in waste reduction and promoting a circular economy, with a significant focus on lessening its reliance on virgin fossil-based plastics. This strategic shift is crucial for environmental sustainability and aligns with growing market demand for eco-friendly products.

A key target for 3M is to reduce its consumption of virgin fossil-based plastic by 125 million pounds by 2025. This ambitious goal is being pursued through innovative product redesigns and a concerted effort to incorporate more bio-based plastics and recyclable materials into its manufacturing processes.

PFAS Exit and Remediation Efforts

3M's commitment to environmental stewardship is highlighted by its decision to cease all PFAS manufacturing by the end of 2025. This strategic pivot is designed to mitigate the significant environmental risks and ongoing uncertainties linked to per- and polyfluoroalkyl substances, often referred to as 'forever chemicals.'

The company is also actively involved in substantial remediation initiatives. A key aspect of this is the multi-billion dollar settlement reached to address PFAS contamination in public water systems across the United States.

- PFAS Exit: 3M will stop all PFAS manufacturing by the end of 2025.

- Environmental Risk Reduction: This move aims to lessen the company's exposure to risks associated with 'forever chemicals.'

- Remediation Costs: 3M is undertaking significant remediation, including a multi-billion dollar settlement for PFAS contamination.

Sustainable Product Design and Innovation

3M is actively embedding sustainability into its product development, aiming to reduce environmental footprints from creation to disposal. This commitment is evident in their innovation pipeline, which includes advancements like energy-saving window films and materials designed for the burgeoning electric vehicle market, contributing to greater efficiency and reduced emissions.

The company's focus on eco-friendly solutions is a direct response to increasing consumer and regulatory pressure for greener alternatives. For instance, 3M's development of recyclable filter technologies addresses the growing global concern over waste management and resource depletion.

This strategic direction is not just about environmental responsibility; it's also a significant market opportunity. By 2024, the global market for sustainable products was projected to reach trillions, with consumers increasingly willing to pay a premium for environmentally conscious goods. 3M's investment in this area, including lightweight materials for EVs, positions them to capture a substantial share of this expanding market.

- Energy-Efficient Films: 3M's Thinsulate™ Window Films, for example, can reduce building energy consumption by up to 20% annually, leading to significant cost savings and reduced carbon emissions for commercial and residential properties.

- Recyclable Filter Technologies: The company is advancing filtration solutions that utilize more sustainable materials, aiming to reduce plastic waste associated with disposable filters.

- Lightweight EV Materials: 3M's advanced materials, such as structural adhesives and composites, are crucial for reducing the weight of electric vehicles, thereby extending battery range and improving overall energy efficiency.

3M is making significant strides in environmental stewardship, focusing on reducing its carbon footprint and managing resources responsibly. The company's commitment to sustainability is evident in its ambitious targets for greenhouse gas emission reductions and water conservation, reflecting a proactive approach to environmental challenges.

Key environmental initiatives include a 50% reduction in Scope 1 and 2 GHG emissions by 2030 (from a 2019 baseline) and achieving carbon neutrality by 2050, validated by the SBTi. Furthermore, 3M aims for a 20% reduction in water consumption by 2025 and a 25% reduction by 2030, implementing advanced water purification systems by 2024.

The company is also phasing out PFAS manufacturing by the end of 2025, a move to mitigate environmental risks, and has committed billions to address PFAS contamination, including a significant settlement for public water systems. This comprehensive strategy underscores 3M's dedication to minimizing its environmental impact and fostering a more sustainable future.

| Environmental Focus | Target/Action | Timeline | Impact |

|---|---|---|---|

| Greenhouse Gas Emissions | 50% reduction in Scope 1 & 2 GHG emissions | By 2030 (vs. 2019 baseline) | Climate change mitigation, operational efficiency |

| Carbon Neutrality | Achieve carbon neutrality in operations | By 2050 | Long-term environmental sustainability |

| Water Consumption | 20% reduction in water consumption at manufacturing sites | By 2025 | Resource conservation, water scarcity management |

| Water Quality | Implement advanced water purification systems | By 2024 (for high-consumption sites) | Reduced ecological impact, improved water return quality |

| PFAS Manufacturing | Cease all PFAS manufacturing | By end of 2025 | Environmental risk reduction, regulatory compliance |

| PFAS Remediation | Multi-billion dollar settlement for PFAS contamination | Ongoing | Addressing historical environmental impact, public health protection |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a comprehensive review of data from governmental bodies, reputable financial institutions, and leading market research firms. This ensures that every aspect of the political, economic, social, technological, legal, and environmental landscape is informed by credible and current information.