3M Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

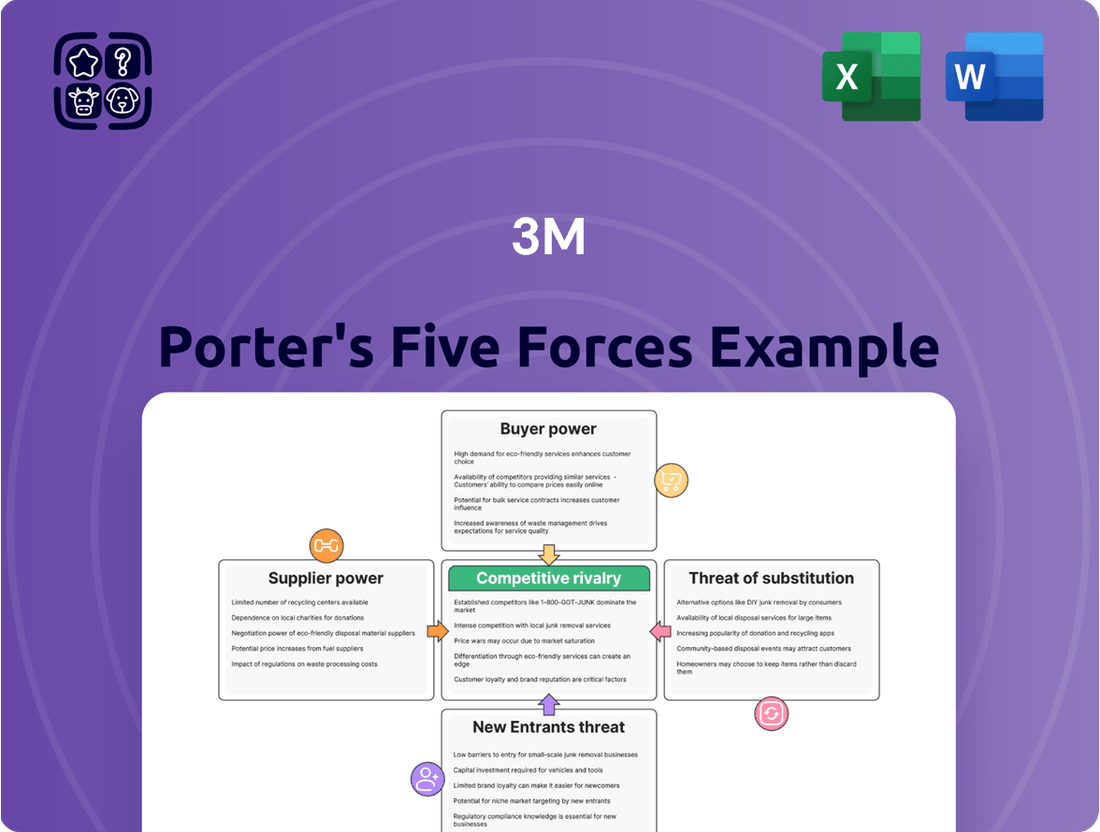

3M faces a dynamic competitive landscape shaped by the bargaining power of its buyers and the intense rivalry among existing players. Understanding these forces is crucial for navigating its diverse markets.

The threat of new entrants and the availability of substitute products also present significant challenges to 3M's market position. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore 3M’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

3M's reliance on a limited number of specialized raw material suppliers, particularly for advanced chemical compounds and nanotechnology materials, grants these suppliers significant bargaining power. As of 2024, 3M identifies approximately 17 critical suppliers for these specialized inputs. This concentration means that a few key players control access to essential components, potentially dictating terms and pricing.

The company's dependence on these select suppliers for roughly 62% of its critical raw materials underscores the potential impact of supplier actions. Unfavorable pricing changes or supply chain disruptions from even a small number of these specialized providers can directly affect 3M's manufacturing operations and overall cost structure.

3M encounters significant hurdles when it comes to switching suppliers, largely due to the intricate nature of its manufacturing processes. These complex operations mean that moving to a new supplier isn't a simple task.

The estimated costs for 3M to switch suppliers are substantial, potentially falling between $4.2 million and $7.6 million for each product line. This figure encompasses various expenses, such as obtaining new certifications, re-engineering existing product components, and going through rigorous qualification processes for new materials.

Consequently, these elevated switching costs diminish 3M's agility in the market. This situation can embolden suppliers, allowing them to negotiate for more advantageous terms, as the financial and operational disruption for 3M to change its supply chain would be considerable.

Supplier concentration is a significant factor impacting 3M, especially in niche technological and chemical markets. For example, in the advanced chemicals sector, a mere four suppliers control 38% of the market share, indicating a substantial reliance on a small group of providers. Similarly, the nanotechnology materials segment sees three suppliers holding 24% of the market. This limited supplier base for critical inputs grants these specialized companies considerable bargaining power.

Large Scale of Operations and Global Sourcing

3M's sheer size as a global manufacturer grants it considerable leverage over its suppliers. The vast quantities of materials and components it procures allow 3M to negotiate highly favorable pricing and terms, effectively diminishing the suppliers' ability to dictate conditions. This scale of operations is a cornerstone of its cost management strategy.

By maintaining a broad and diversified global supplier network, 3M actively reduces its dependence on any single source. This strategy inherently limits the bargaining power of individual suppliers, as 3M can readily shift its business to alternatives if terms are not met. In 2023, 3M reported over $32 billion in revenue, underscoring the significant volume of its purchasing power.

Leveraging global sourcing enables 3M to foster competition among potential suppliers worldwide. This competitive environment drives down costs for raw materials and essential components, further strengthening 3M's position. For instance, its advanced materials division relies on a complex supply chain that benefits from this global competition.

- Significant Purchasing Power: 3M's substantial order volumes allow for advantageous price negotiations, reducing input costs.

- Reduced Supplier Dependence: A diverse global supplier base minimizes reliance on any one entity, weakening individual supplier leverage.

- Competitive Sourcing Strategy: Global sourcing fosters competition among suppliers, leading to more favorable pricing for 3M.

Vertical Integration Strategy

3M's vertical integration strategy is a key factor in managing supplier bargaining power. By developing its own production capabilities for critical raw materials, 3M significantly reduces its reliance on external suppliers.

As of 2024, 3M produces approximately 43% of its essential raw materials internally. This internal production, supported by a substantial $624 million investment, effectively lowers its dependence on outside suppliers by 37%.

- Internal Production: 3M manufactures 43% of its critical raw materials in-house as of 2024.

- Investment: The company has invested $624 million to bolster its internal manufacturing capabilities.

- Reduced Dependency: This strategy has decreased supplier dependency by 37%, enhancing self-sufficiency.

- Strategic Advantage: Vertical integration strengthens 3M's competitive position by lessening reliance on external sources for vital components.

Despite 3M's considerable purchasing power and diversified supplier base, the bargaining power of suppliers remains a significant consideration, particularly for specialized inputs. The company's reliance on a limited number of providers for advanced materials, coupled with high switching costs, creates a dynamic where certain suppliers can exert notable influence.

| Supplier Characteristic | Impact on 3M | Supporting Data (2024) |

|---|---|---|

| Supplier Concentration (Specialized Materials) | High bargaining power for key suppliers | 4 suppliers control 38% of advanced chemicals market; 3 suppliers control 24% of nanotechnology materials market. |

| Switching Costs | Reduces 3M's agility, emboldens suppliers | Estimated $4.2M - $7.6M per product line to switch suppliers. |

| Internal Production of Raw Materials | Mitigates supplier power | 3M produces 43% of critical raw materials internally. |

| Overall Revenue (Purchasing Power) | Weakens supplier power | Over $32 billion in revenue (2023) allows for strong price negotiations. |

What is included in the product

This analysis dissects the competitive forces impacting 3M, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its diverse markets.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

3M's extensive reach across more than 70 industries globally, from healthcare to electronics, significantly fragments its customer base. This inherent diversity means that no single customer or industry segment holds substantial sway over 3M's pricing or terms. For instance, while a major automotive manufacturer might represent a sizable account, it's just one piece of 3M's vast customer mosaic.

3M's iconic brands like Post-it Notes and Scotch Tape are highly differentiated, fostering strong customer loyalty. This brand recognition and perceived quality make it difficult for customers to find direct substitutes, significantly reducing their power to demand lower prices. For instance, in 2023, 3M reported strong performance in its Consumer segment, partly driven by the enduring appeal of its differentiated offerings.

3M faces considerable bargaining power from its large corporate and government buyers. These entities often procure substantial volumes, granting them significant leverage in negotiations. In 2023, 3M reported that large enterprise customers constituted 65% of its total revenue, with its top ten customers alone contributing around 12% of annual sales.

This concentration of business with major clients means that 3M must remain competitive on price and value. These large buyers frequently push for cost reductions, a trend that intensifies during periods of economic uncertainty, further amplifying their negotiation strength.

Availability of Alternatives and Low Switching Costs in Some Segments

While 3M boasts highly differentiated products, certain market segments present customers with low switching costs. This means buyers can readily shift to competing brands if price, quality, or service offerings are more attractive. For instance, in the adhesives market, while 3M has premium options, a significant portion of the market can utilize readily available alternatives, impacting their bargaining power.

The presence of numerous alternative products, even if not perfect substitutes, further amplifies customer leverage. This dynamic compels 3M to maintain a relentless focus on innovation and consistently prove its value proposition to secure customer loyalty. In 2024, the global adhesives and sealants market, a key area for 3M, was valued at approximately $70 billion, indicating a substantial competitive landscape where customer choice is paramount.

- Low Switching Costs: In segments like consumer tapes or certain industrial abrasives, customers can easily switch to competitors without significant disruption or cost.

- Availability of Alternatives: The market offers numerous brands and product types that can fulfill similar needs, even if not identical to 3M's offerings.

- Price Sensitivity: In less differentiated product categories, price becomes a significant factor, empowering customers to negotiate or seek lower-cost options.

- Impact on Innovation: This customer power necessitates continuous R&D and value demonstration by 3M to maintain market share and pricing power.

Increased Buyer Information and Market Knowledge

Consumers today have unprecedented access to market information, allowing them to easily compare prices, features, and reviews across a multitude of products. This enhanced buyer knowledge significantly bolsters their bargaining power, especially when dealing with standardized goods where differentiation is less pronounced. For a company like 3M, this means customers are more empowered to seek out the best value, putting pressure on the company to maintain competitive pricing and continuously improve its product offerings.

This transparency forces 3M to be highly responsive to customer needs and market shifts. Buyers can readily identify alternatives and negotiate terms more effectively, making it crucial for 3M to demonstrate clear value and superior performance. The ability for customers to quickly gather data means 3M must remain agile, adapting its strategies to meet evolving consumer expectations and preferences.

- Informed Consumers: Buyers can easily access product specifications and pricing from competitors.

- Price Sensitivity: Increased information leads to greater price sensitivity among customers.

- Value Proposition: 3M must clearly articulate its value to justify pricing.

- Market Responsiveness: Agility in product development and pricing is essential.

The bargaining power of 3M's customers is generally moderate, influenced by product differentiation and switching costs. While many of 3M's iconic products enjoy strong brand loyalty, reducing customer power, certain segments face more price-sensitive buyers and readily available alternatives. In 2024, the company's diverse portfolio means customer leverage varies significantly across its 70+ served industries.

| Customer Segment Characteristic | Impact on 3M's Bargaining Power | Example/Data Point (2023/2024) |

|---|---|---|

| Product Differentiation & Brand Loyalty | Lowers customer power | Strong performance in Consumer segment driven by brands like Post-it and Scotch. |

| Switching Costs | Varies; lower in some industrial segments | Adhesives market features readily available alternatives, increasing customer leverage. |

| Customer Concentration | Increases power for large buyers | Top ten customers contributed ~12% of 2023 sales, indicating significant leverage for these entities. |

| Availability of Substitutes | Increases customer power | Global adhesives market valued at ~$70 billion in 2024, highlighting a competitive landscape with numerous choices. |

Full Version Awaits

3M Porter's Five Forces Analysis

This preview showcases the complete 3M Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

3M faces a fiercely competitive environment due to its presence in diverse sectors like healthcare, industrial, consumer goods, and electronics. This broad operational scope means 3M contends with numerous established global players in each segment. For instance, in the industrial sector, rivals such as Honeywell International and Emerson Electronics present significant competitive challenges.

The intensity of this rivalry is amplified by the global reach of its competitors. Companies like GE Aerospace and Corning Incorporated operate on a worldwide scale, forcing 3M to compete across multiple international markets simultaneously. This global competition necessitates continuous innovation and strategic agility to maintain market share and profitability.

Many of 3M's core markets, such as adhesives, abrasives, and personal safety equipment, are mature and exhibit high saturation. This means that growth opportunities are limited, and companies must fight harder for existing customers. For instance, the global adhesives market, a significant segment for 3M, was projected to reach approximately $70 billion in 2024, with growth rates moderating in developed regions.

This intense competition naturally leads to considerable pricing pressure. Companies often resort to price reductions to gain or maintain market share, especially in commoditized product lines. In 2023, 3M itself noted that pricing actions had a negative impact on sales growth in some of its divisions due to competitive pressures.

The constant battle over price can significantly erode profit margins. When multiple players are willing to accept lower prices for similar products, the overall profitability of the industry can be suppressed. This dynamic forces companies like 3M to focus on innovation and cost management to differentiate themselves beyond price.

3M faces intense competitive rivalry, largely fueled by continuous innovation and differentiation efforts across the industry. While 3M is a powerhouse in R&D, its rivals, such as DuPont and Avery Dennison, also pour significant resources into developing new products and technologies. This constant pursuit of novel solutions creates a dynamic marketplace where companies vie to stand out and capture market share.

The pressure to innovate is relentless. For instance, in the adhesives market, a key segment for 3M, competitors are continually introducing advanced formulations offering improved performance characteristics like higher bond strength or better temperature resistance. This necessitates that 3M maintain a robust innovation pipeline, as evidenced by its consistent investment in R&D, which stood at approximately $1.9 billion in 2023, to counter these pressures and safeguard its profitability.

Switching Costs and Product Offerings

In certain market segments, customers experience low switching costs. This means they can readily shift their business to a competitor based on factors like price, perceived quality, or the level of service offered. This ease of switching naturally heightens the competitive pressures 3M faces, as customers are less tethered to existing relationships.

However, 3M's extensive and diverse product portfolio often acts as a powerful retention tool. When customers integrate multiple 3M products into their operations, the interconnectedness and potential disruption of switching suppliers for even one component can significantly increase the practical switching costs. This integration fosters customer loyalty and creates a stickier customer base.

The sheer breadth of 3M's product offerings directly impacts the intensity of rivalry. A wider scope means 3M competes across more fronts, potentially locking in customers who rely on their comprehensive solutions rather than piecemeal offerings from competitors.

- Low Switching Costs: In some areas, customers can easily switch brands based on price or quality, intensifying competition.

- Integrated Solutions: 3M's broad product range and bundled offerings can create higher switching costs for customers using multiple 3M products.

- Customer Loyalty: The complexity of switching away from integrated 3M solutions can foster significant customer loyalty.

- Rivalry Intensity: The scope of 3M's product offerings influences how intensely it competes with rivals across different market segments.

Operational Excellence and Cost Management

The competitive landscape for 3M is significantly shaped by rivals' relentless pursuit of operational excellence and rigorous cost management. Companies across various sectors are investing heavily in streamlining processes and optimizing supply chains to gain a cost advantage. This focus is not unique to 3M's competitors; 3M itself has implemented initiatives like the '3M eXcellence' operating model, aimed at enhancing efficiency and reducing operational expenditures. For instance, in 2023, 3M reported cost of goods sold as a percentage of sales at 56.8%, highlighting the ongoing importance of managing these expenses.

Effective cost management and continuous productivity improvements are paramount for companies to thrive in this intensely competitive environment. These factors directly influence financial health, enabling competitive pricing strategies and the ability to invest in innovation. In 2023, 3M's total operating expenses were $25.4 billion, a figure that underscores the scale of operations and the potential impact of efficiency gains. Such efforts are crucial for sustaining long-term growth and ensuring stability amidst market fluctuations.

- Competitors' emphasis on operational efficiency and cost control directly fuels intense rivalry.

- 3M's own '3M eXcellence' program reflects the industry-wide drive for improved operational performance.

- In 2023, 3M's cost of goods sold represented 56.8% of its sales, illustrating the critical nature of cost management.

- Maintaining financial health and competitive pricing hinges on efficient cost management and productivity enhancements.

3M operates in highly competitive markets, facing numerous global rivals across its diverse business segments. This rivalry is intensified by competitors' consistent innovation and the mature nature of many of 3M's core product categories, leading to significant pricing pressures and a constant need for differentiation beyond cost.

While some customers have low switching costs, 3M's integrated solutions and broad product portfolio can foster customer loyalty and increase the practical costs of switching. The company's own focus on operational efficiency, as seen in its 2023 cost of goods sold at 56.8% of sales, highlights the industry-wide imperative to manage expenses effectively to remain competitive.

| Key Competitors (Examples) | Industry Segments | Notes on Rivalry |

| Honeywell International | Industrial | Global competitor with broad industrial offerings. |

| Emerson Electric | Industrial | Strong presence in automation and industrial solutions. |

| GE Aerospace | Industrial (Aerospace) | Major player in a high-tech, competitive sector. |

| Corning Incorporated | Industrial (Specialty Materials) | Innovator in glass and ceramics, competing in advanced materials. |

| DuPont | Diversified (Chemicals, Materials) | Significant R&D investment, direct competitor in many material science areas. |

| Avery Dennison | Industrial (Adhesives, Labels) | Key player in adhesives and labeling, focusing on innovation. |

SSubstitutes Threaten

The threat of substitutes for 3M is significant due to its broad product portfolio, with alternatives constantly emerging across various segments. For instance, in the abrasives sector, advancements in composite materials and novel manufacturing processes present viable substitutes for traditional grinding and finishing products. 3M's 2023 annual report highlighted ongoing investments in research and development to counter such threats.

Customers often evaluate substitutes based on their performance-price trade-off. If an alternative product, even if not a direct competitor, offers comparable or superior functionality at a lower cost, it presents a significant threat. For instance, in the adhesives market, a new, lower-cost industrial adhesive that meets 90% of a specific application's performance requirements could lure customers away from 3M's premium offerings if the price difference is substantial.

This dynamic is especially pronounced in sectors where cost optimization is paramount. Businesses scrutinize every expense, and a slight improvement in the performance-to-price ratio of a substitute can lead to significant savings. For example, a manufacturing firm might switch from a specialized 3M tape to a generic equivalent if the latter provides adequate adhesion for a less critical component, saving thousands annually.

To counter this, 3M must continuously innovate and clearly articulate the unique value proposition of its products. Demonstrating superior durability, specialized functionality, or enhanced efficiency that justifies a higher price point is crucial. In 2024, many industrial sectors are facing margin pressures, making the performance-price calculation even more critical for purchasing decisions.

The rapid pace of technological advancements, especially in advanced manufacturing, digital solutions, and new materials, constantly creates new substitute products or services. For example, in the healthcare sector, innovative digital diagnostic tools could potentially replace some of 3M's traditional medical supplies. Similarly, advancements in material science might offer lighter, stronger, or more cost-effective alternatives to 3M's existing product lines.

Shifting Customer Preferences and Environmental Concerns

Evolving customer preferences, particularly a rising demand for sustainable and environmentally friendly products, significantly bolster the threat of substitutes. This shift can accelerate the adoption of alternatives that align with growing environmental consciousness.

For instance, 3M's strategic decision to exit PFAS manufacturing by the end of 2025 directly reflects the mounting pressure from environmental concerns and evolving regulations. Companies that successfully develop and market greener alternatives to 3M's traditional offerings could present a formidable competitive challenge.

- Growing consumer demand for eco-friendly products: A significant portion of consumers now prioritize sustainability in their purchasing decisions.

- Regulatory pressures on specific materials: Increasing scrutiny and potential bans on certain chemicals, like PFAS, create opportunities for substitute materials.

- Innovation in alternative materials: Advancements in material science are continuously yielding viable, often more sustainable, substitutes for established products.

- Impact of corporate sustainability initiatives: Companies actively promoting their environmental credentials can sway customer loyalty away from less sustainable options.

Cross-Industry Innovation Leading to New Solutions

Innovation from unexpected sectors poses a significant threat. For example, breakthroughs in additive manufacturing, like advanced 3D printing, could offer alternative methods for producing components previously reliant on 3M's traditional materials and processes. Similarly, advancements in materials science, such as novel composites developed by aerospace firms, might provide substitutes for 3M’s adhesives or abrasives.

These cross-industry innovations can disrupt established markets by offering comparable performance at potentially lower costs or with unique advantages. In 2024, the global 3D printing market was valued at approximately $20 billion, with significant growth projected, highlighting the increasing viability of these alternative manufacturing approaches.

- Cross-Industry Innovation: Developments in fields like nanotechnology and advanced materials science, often originating outside direct competitive circles, can yield substitute products or processes.

- Emergent Threats: Technologies such as sophisticated 3D printing or novel composite materials present new ways to achieve outcomes traditionally addressed by 3M's core offerings.

- 3M's Defense: Leveraging its diverse technological base and embracing open innovation are key strategies for 3M to anticipate and adapt to these evolving substitute threats.

The threat of substitutes for 3M remains a critical consideration, especially as technological advancements and evolving consumer preferences drive the emergence of alternatives across its diverse product lines. For instance, in 2024, the increasing adoption of digital solutions in healthcare could impact demand for some of 3M's traditional medical supplies, while innovations in advanced materials offer potential replacements for its adhesives and abrasives. The company's strategic focus on innovation and its exit from PFAS manufacturing by the end of 2025 underscore its efforts to proactively address these evolving substitute threats, particularly those driven by sustainability demands.

| Sector | Potential Substitutes | Impact Driver | 2024 Market Trend |

|---|---|---|---|

| Abrasives | Advanced composites, novel manufacturing processes | Performance-price ratio, cost optimization | Growth in additive manufacturing impacting traditional methods |

| Adhesives | Lower-cost industrial adhesives, novel bonding technologies | Cost savings, adequate performance for non-critical applications | Increased margin pressure on industrial buyers |

| Healthcare Supplies | Digital diagnostic tools, advanced wound care materials | Technological advancement, improved patient outcomes | Growing demand for telehealth and remote monitoring solutions |

| Materials (e.g., PFAS-related) | Environmentally friendly alternatives, PFAS-free materials | Sustainability demands, regulatory pressures | Increased consumer and regulatory scrutiny on chemical usage |

Entrants Threaten

The industries 3M operates in, such as advanced materials and healthcare, demand substantial upfront capital for research, development, and manufacturing facilities. For instance, establishing a new production line for specialized adhesives or medical devices can easily cost tens of millions of dollars, if not more.

New competitors would find it incredibly challenging to replicate 3M's vast global manufacturing and distribution network, which has been built over decades. Without matching this scale, a new entrant would struggle to achieve cost efficiencies and market reach, making it difficult to compete on price or availability.

3M's iconic brands like Post-it and Scotch have cultivated deep customer loyalty over many years. This strong brand recognition makes it incredibly difficult for new companies to gain a foothold, as consumers already trust and prefer 3M's established products. For instance, in 2023, 3M reported over $32 billion in net sales, a testament to the enduring appeal and market penetration of its diverse product portfolio.

3M's extensive research and development capabilities are a formidable barrier to new entrants. The company boasts over 69,000 patents globally, a testament to its continuous innovation and broad product portfolio. This deep well of intellectual property makes it incredibly challenging for newcomers to replicate 3M's offerings or even to enter the market without infringing on existing patents.

Established Distribution Networks and Supply Chain Expertise

3M's established and intricate global distribution networks, spanning its diverse business segments, present a formidable barrier to new entrants. Building comparable channels and acquiring the requisite supply chain expertise to serve a worldwide customer base across various industries would incur substantial costs and significant time investment.

These deeply entrenched networks act as a crucial competitive moat for 3M, making it exceedingly difficult for newcomers to replicate the company's reach and efficiency. For instance, in 2023, 3M reported significant revenue generation through its extensive global sales operations, highlighting the effectiveness of its distribution infrastructure.

- Global Reach: 3M's distribution covers over 200 countries.

- Segment Diversity: Networks are tailored for industrial, healthcare, consumer, and safety markets.

- Supply Chain Mastery: Decades of experience in logistics and inventory management.

- Cost Barrier: Establishing a similar network could cost billions.

Regulatory and Compliance Hurdles

The threat of new entrants for 3M is significantly mitigated by substantial regulatory and compliance hurdles, particularly within its key healthcare and industrial sectors. These markets demand rigorous adherence to a complex web of regulations, including product certifications and stringent environmental standards. For instance, in the medical device industry, compliance with FDA regulations alone can involve extensive testing and documentation, a process that can cost millions and take years to navigate.

These regulatory complexities represent a significant barrier, necessitating considerable upfront investment in specialized legal and compliance infrastructure. New players must allocate substantial resources to understand and implement these requirements, making market entry a costly and time-consuming endeavor. This high cost of entry, coupled with the need for specialized expertise, deters many potential competitors from challenging established players like 3M, which has decades of experience managing these compliance landscapes.

- Regulatory Complexity: Markets like healthcare and industrial goods require adherence to strict standards, such as FDA approvals for medical products.

- High Compliance Costs: Meeting these standards can cost new entrants millions in testing, legal fees, and establishing compliance departments.

- Time-Intensive Processes: Obtaining necessary certifications and navigating regulatory frameworks can take years, delaying market entry.

- Deterrent to New Entrants: The combined cost and time investment acts as a significant barrier, protecting 3M's market position.

The threat of new entrants for 3M is generally low due to significant barriers. High capital requirements for R&D and manufacturing, coupled with established brand loyalty and extensive patent portfolios, make it difficult for newcomers to compete effectively. Furthermore, 3M's vast global distribution networks and the complex regulatory landscape in its key markets add substantial costs and time delays for potential entrants.

| Barrier Type | Impact on New Entrants | 3M's Advantage |

|---|---|---|

| Capital Requirements | High (R&D, Manufacturing) | Decades of investment and scale |

| Brand Loyalty | Significant | Strong recognition (e.g., Post-it, Scotch) |

| Intellectual Property | Formidable (69,000+ patents) | Broad product protection |

| Distribution Networks | Challenging to replicate (200+ countries) | Global reach and efficiency |

| Regulatory Hurdles | High (Healthcare, Industrial) | Established compliance expertise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, industry-specific market research, and economic databases to provide a comprehensive view of competitive dynamics.