Advantage Solutions Bundle

Who Owns Advantage Solutions?

Understanding Advantage Solutions' ownership is key to its strategy. The company went public on January 1, 2020, after merging with Conyers Park II Acquisition Corp., a SPAC. This move transitioned ownership from private equity.

Advantage Solutions, founded in 1987, is a major player in North American retail solutions, using data and tech to boost brand sales. As of July 31, 2025, its market cap stood at $444 million with 324 million shares outstanding, employing around 70,000 people.

In 2024, Advantage Solutions reported $3.57 billion in revenue and $356 million in adjusted EBITDA. The company was recognized as the 9th largest agency in North America and 18th worldwide in the Ad Age Agency Report 2025, with agency revenue of $1.2 billion in 2024. This evolution traces from its founder's initial stake to current public shareholders, influencing its governance and strategy. For a deeper dive into its market positioning, consider an Advantage Solutions BCG Matrix analysis.

Who Founded Advantage Solutions?

Advantage Solutions traces its origins back to 1987 when Sonny King established the company as Advantage Sales & Marketing. Initially focused on brokerage services in Southern California, the company's early capital likely stemmed from founder investments. King's ambition from the outset was to build a national presence.

Sonny King founded Advantage Sales & Marketing in 1987. His initial vision was to create a company with national reach.

The company began by offering brokerage services in Southern California. Early funding was likely from the founder and initial investors.

Between 1997 and 2010, the company grew significantly through acquisitions. This strategy consolidated market share by acquiring regional brokers.

In 2004, Allied Capital provided crucial funding. This capital supported the consolidation of Advantage with 15 regional sales agencies.

The funding from Allied Capital was instrumental in achieving national scale. This allowed the company to become one of the largest sales and marketing agencies in the U.S.

By 2016, the company's aggressive growth strategy had propelled its revenues to over $2 billion. This marked a significant milestone in its early ownership evolution.

The early ownership structure of Advantage Solutions was primarily shaped by its founder, Sonny King, and the strategic capital infusions that enabled its rapid expansion. The company's growth trajectory, particularly between 1997 and 2010, was heavily reliant on an acquisition-driven strategy. A pivotal moment in its ownership evolution occurred in 2004 when Allied Capital provided funding to consolidate Advantage with fifteen regional sales agencies. This financial backing was critical in transforming the company into a national leader, achieving revenues exceeding $2 billion by 2016. While specific initial equity splits remain proprietary, the narrative of Advantage Solutions' early years highlights a combination of founder vision and strategic financial partnerships as key drivers of its ownership development and market position. Understanding this early history is crucial for grasping the subsequent Advantage Solutions ownership changes over time and its current Competitors Landscape of Advantage Solutions.

The early ownership of Advantage Solutions was significantly influenced by its founder and key financial partners who facilitated its expansion.

- Founded by Sonny King in 1987 as Advantage Sales & Marketing.

- Initial focus on brokerage services in Southern California.

- Aggressive acquisition strategy from 1997 to 2010 to consolidate market share.

- Allied Capital provided significant funding in 2004 for consolidation.

- Achieved national scale and over $2 billion in revenues by 2016.

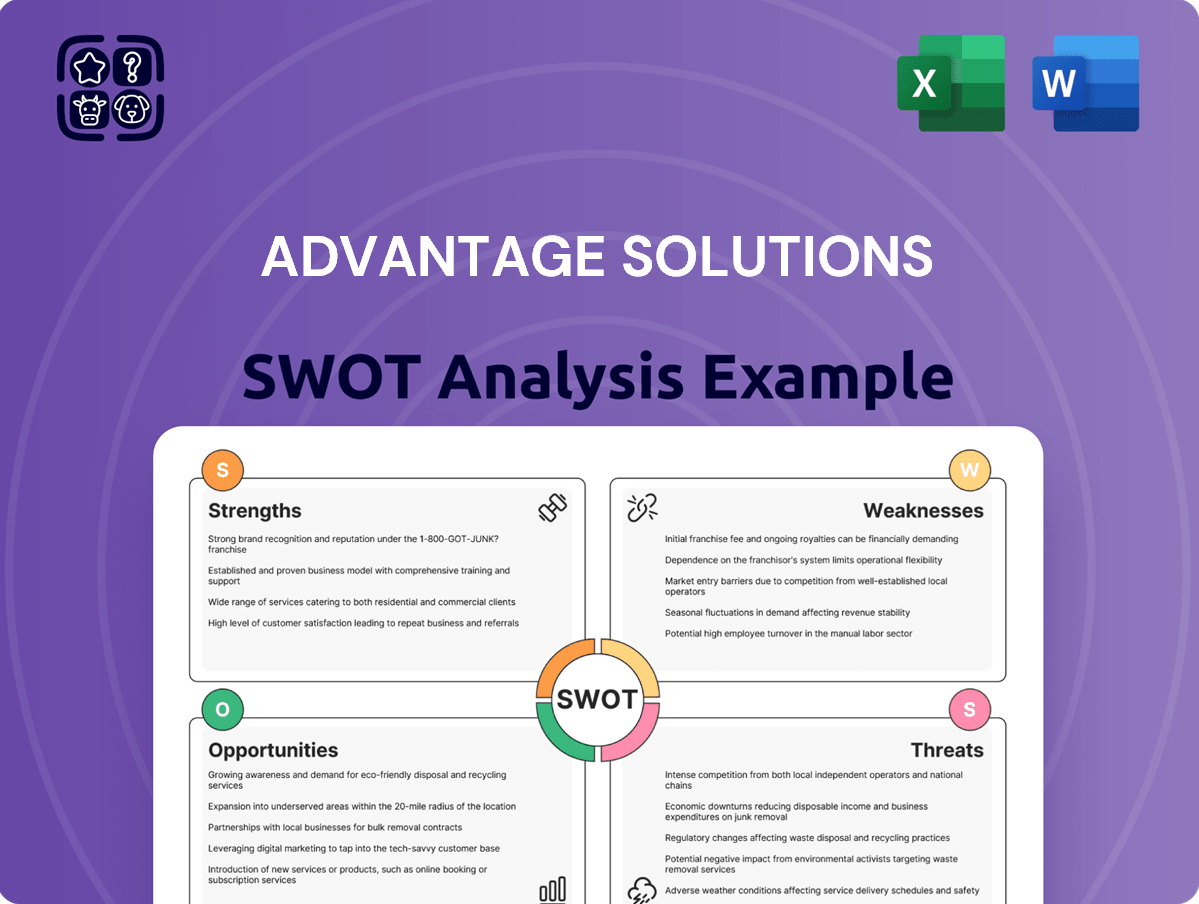

Advantage Solutions SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Advantage Solutions’s Ownership Changed Over Time?

Advantage Solutions' ownership journey has been marked by significant shifts, notably its public debut in 2020. This transition followed substantial private equity backing, reshaping its corporate structure and investor base.

| Shareholder Type | Key Stakeholders | Approximate Ownership (%) |

|---|---|---|

| Majority Owner | Karman Topco L.P. | 55.41% |

| Institutional Investors | T. Rowe Price Small Cap Value Fund, Inc., iShares, Bridgeway Funds, Inc., Dimensional Fund Advisors LP, CASTLEKNIGHT MANAGEMENT LP | Varies by quarter, with some increasing holdings significantly |

| Retail/Individual Investors | General public | Remaining percentage |

The path to Advantage Solutions' current ownership structure involved a pivotal merger with Conyers Park II Acquisition Corp. on January 1, 2020, which facilitated its public listing on the Nasdaq. This event was preceded by significant investments from private equity firms, including Leonard Green & Partners and CVC Capital Partners in 2014, and earlier involvement from Apax Partners. These investments were instrumental in the company's expansion and acquisition strategies, contributing to its Growth Strategy of Advantage Solutions.

Karman Topco L.P. stands as the primary majority owner, holding a substantial stake. The company's classification as a 'controlled company' under Nasdaq rules stems from this significant ownership concentration.

- Karman Topco L.P. beneficially owns 179,716,789 shares.

- Advantage Solutions became a public entity on January 1, 2020.

- The company's shares trade on the Nasdaq Global Select Market under the symbol 'ADV'.

- In Q4 2024, CASTLEKNIGHT MANAGEMENT LP notably increased its holdings by 61.7%.

Advantage Solutions PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Advantage Solutions’s Board?

As of the May 28, 2025, annual stockholders meeting, the board of directors for Advantage Solutions includes James M. Kilts, Jody L. Macedonio, Robin Manherz, Adam Nebesar, and Deborah Poole. James M. Kilts also holds the position of Independent Chairman of the Board. Additional directors include Christopher Baldwin, Cameron Breitner, Virginie Costa, Timothy Flynn, Tiffany Han, and Brian Ratzan. Dave Peacock, who became Chief Executive Officer in February 2023, also serves as a director.

| Director Name | Role | Recent Activity (if applicable) |

|---|---|---|

| James M. Kilts | Independent Chairman of the Board | Multiple purchases in June 2025 |

| Jody L. Macedonio | Director | |

| Robin Manherz | Director | |

| Adam Nebesar | Director | |

| Deborah Poole | Director | |

| Christopher Baldwin | Director | |

| Cameron Breitner | Director | Board member of Topco |

| Virginie Costa | Director | |

| Timothy Flynn | Director | Board member of Topco |

| Tiffany Han | Director | Board member of Topco |

| Brian Ratzan | Director | |

| Dave Peacock | Chief Executive Officer & Director | Three purchases totaling 50,000 shares for ~$166,441 |

The voting power within Advantage Solutions is structured around a one-share-one-vote principle for its Class A common stock. This means each share grants its holder a single vote on matters presented to stockholders, with no provisions for cumulative voting. A significant aspect of the company's ownership structure is the beneficial ownership and voting power held by Karman Topco L.P. ('Topco'). As of March 31, 2021, Topco controlled 65.6% of the outstanding Class A common stock's voting power. This substantial stake classifies Advantage Solutions as a 'controlled company' under Nasdaq listing rules, allowing for exemptions from certain corporate governance requirements related to independent boards and specific committees. The board of directors of Topco, comprising Cameron Breitner, Tanya Domier, Timothy Flynn, Jonathan Sokoloff, Ryan Cotton, and Tiffany Han, collectively exercises voting and dispositive control over these shares, influencing the company's direction and strategic decisions. This level of concentrated ownership is a key factor in understanding Advantage Solutions ownership. In terms of recent insider transactions, CEO David A. Peacock has been active, making three share purchases. Director James M. Kilts also made multiple purchases in June 2025. In contrast, Andrea Young, COO Experiential Services, sold 66,000 shares in Q4 2024, valued at approximately $226,525. Understanding these transactions can offer insights into management's confidence and the Marketing Strategy of Advantage Solutions.

The ownership structure of Advantage Solutions is significantly influenced by Karman Topco L.P., which holds a majority of the voting power. This concentration impacts the company's corporate governance and strategic autonomy.

- Advantage Solutions is a controlled company due to Topco's voting power.

- Topco's board of directors oversees the voting and dispositive power of the majority shares.

- The company operates on a one-share-one-vote system for Class A common stock.

- Recent insider trading activity includes purchases by the CEO and a director.

Advantage Solutions Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Advantage Solutions’s Ownership Landscape?

Advantage Solutions has experienced significant shifts in its ownership landscape over the past few years, marked by strategic realignments and evolving investor sentiment. These changes reflect the company's ongoing transformation efforts and its response to market dynamics.

| Year | Revenue | Net Loss | Adjusted EBITDA |

|---|---|---|---|

| 2024 | $3.57 billion | $378.4 million | $356 million |

| Q4 2024 | $94.6 million |

The company's financial performance in 2024 showed a revenue decrease of 8.6% to $3.57 billion and a net loss of $378.4 million. However, Adjusted EBITDA saw a modest increase of 1.1% for the full year, reaching $356 million, and a more substantial 8.9% rise in the fourth quarter to $94.6 million. This suggests a focus on operational efficiency and cost management under CEO Dave Peacock, who has been steering the integration of previously fragmented business units. Over the 18 months leading up to August 2024, the divestiture of more than 10 non-core businesses was a key strategy, with proceeds primarily directed towards debt reduction and reinvestment in core operations. This strategic pivot aims to enhance growth and cash flow in the coming years, with anticipated benefits beginning in late 2024 and extending into 2026 and beyond. The Revenue Streams & Business Model of Advantage Solutions article provides further insight into these operational changes.

In 2024, the company repurchased approximately $158 million in debt and $34 million in shares. This trend continued into Q1 2025 with $20 million in debt repurchases and $1 million in share buybacks.

The institutional investor landscape is dynamic. In Q4 2024, some funds exited their positions, while others, like CASTLEKNIGHT MANAGEMENT LP, significantly increased their holdings by 61.7%.

CEO Dave Peacock's leadership has focused on unifying the company's diverse operations. This transformation, largely complete, involved divesting over 10 non-core businesses.

Management anticipates revenue and Adjusted EBITDA growth in 2025. These initiatives are expected to drive efficiency and enhance financial performance in the long term.

Advantage Solutions Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

- What is Brief History of Advantage Solutions Company?

- What is Competitive Landscape of Advantage Solutions Company?

- What is Growth Strategy and Future Prospects of Advantage Solutions Company?

- How Does Advantage Solutions Company Work?

- What is Sales and Marketing Strategy of Advantage Solutions Company?

- What are Mission Vision & Core Values of Advantage Solutions Company?

- What is Customer Demographics and Target Market of Advantage Solutions Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.