Advantage Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantage Solutions Bundle

Advantage Solutions faces a dynamic competitive landscape, with significant pressures from buyers and the threat of substitutes impacting its market position. Understanding the intensity of these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping Advantage Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Advantage Solutions' reliance on a substantial workforce for its core services, including merchandising and in-store sampling, places significant weight on labor market dynamics. The availability and cost of skilled personnel directly impact operational efficiency and service quality.

Recent trends highlight a tightening labor market, with reports suggesting difficulties in fully staffing events and projects. This scarcity can empower the workforce, potentially driving up wages and benefits as companies like Advantage Solutions compete for talent. For instance, the U.S. Bureau of Labor Statistics reported in early 2024 that the unemployment rate remained low, around 3.9%, indicating a competitive environment for employers seeking workers.

Advantage Solutions' increasing reliance on specialized technology, including AI and advanced data analytics for its omnichannel marketing efforts, directly impacts the bargaining power of its technology and data providers. While the market for general software might be crowded, niche platforms or unique data sets can significantly empower these suppliers.

The company's ongoing strategic investments, such as its ERP system implementation and the development of its core data platform, underscore the critical nature of these technology partnerships. For instance, the global market for AI in marketing was projected to reach $100 billion by 2024, indicating the high value and potential leverage of AI solution providers.

Suppliers of specialized marketing technologies, like those offering advanced retail media platforms or sophisticated digital commerce tools, possess a degree of bargaining power. This power stems from their unique solutions that directly contribute to Advantage Solutions' ability to deliver enhanced services to its clients.

Advantage Solutions' strategic partnerships, such as its collaboration with Swiftly for retail technology, highlight the critical need to integrate specific vendor solutions. These integrations are essential for expanding omnichannel capabilities and executing comprehensive marketing campaigns, underscoring the value of these specialized suppliers.

The proprietary or highly specialized nature of these technologies often means Advantage Solutions has limited alternative options. This scarcity of substitutes naturally amplifies the influence these vendors can exert in negotiations.

Physical Resource Providers

Suppliers of physical resources like materials for displays, equipment, and logistics services hold some sway over Advantage Solutions. While not as specialized as tech, a shortage of specific materials or a concentration of logistics providers in certain areas can create challenges. For instance, a 2024 report indicated a 5% increase in raw material costs for retail display components across the industry, directly impacting companies like Advantage Solutions if not managed proactively. Maintaining strong relationships with these suppliers is key to keeping costs down and operations running smoothly.

The bargaining power of physical resource providers for Advantage Solutions is influenced by several factors:

- Availability of Substitutes: The ease with which Advantage Solutions can switch to alternative suppliers or materials impacts supplier power.

- Supplier Concentration: A limited number of suppliers for critical physical resources can increase their leverage.

- Importance of the Resource: If a physical resource is vital to Advantage Solutions' operations, suppliers have more power.

- Switching Costs: High costs associated with changing suppliers for physical resources bolster supplier bargaining power.

Limited Number of High-Quality Service Partners

For complex projects requiring specialized expertise, such as large-scale digital transformations or intricate market entry strategies, Advantage Solutions may face a limited pool of high-quality, reliable service partners. This scarcity grants these select suppliers increased bargaining power.

Advantage Solutions' commitment to delivering results with speed and precision means they rely on dependable partners capable of meeting stringent service level agreements. This often leads to a dependence on a smaller group of proven suppliers who deeply understand the nuances of the consumer goods and retail sectors.

- Limited Specialized Partners: In 2024, the market for highly specialized digital transformation services saw consolidation, with fewer independent firms possessing the deep industry knowledge and technological prowess required for complex projects in the consumer packaged goods (CPG) sector.

- High Switching Costs: For partners deeply integrated into Advantage Solutions' operational workflows, the cost and time associated with onboarding new, less experienced suppliers can be prohibitive, further strengthening the position of existing, trusted providers.

- Supplier Dependence: The need for consistent quality and adherence to strict timelines in the fast-paced CPG industry means Advantage Solutions is often reliant on a core set of suppliers who have demonstrated their capability to meet these demands.

Advantage Solutions' reliance on specialized technology, particularly for its omnichannel marketing and data analytics efforts, grants significant leverage to its technology and data providers. While the general software market is competitive, unique platforms and data sets empower these suppliers, especially as the global AI in marketing market was projected to reach $100 billion by 2024, highlighting the high value of these solutions.

The company's integration of specific vendor solutions, such as its partnership with Swiftly for retail technology, is crucial for its expanding omnichannel capabilities. This necessity, coupled with the proprietary nature of many advanced marketing technologies, means Advantage Solutions often faces limited alternatives, thereby increasing the bargaining power of these specialized suppliers.

Suppliers of essential physical resources like display materials, equipment, and logistics services also hold some influence. Industry-wide increases in raw material costs for retail display components, reported around 5% in early 2024, demonstrate how shortages or concentrated logistics providers can impact companies like Advantage Solutions, emphasizing the importance of strong supplier relationships.

Furthermore, for complex projects requiring niche expertise, such as large-scale digital transformations, Advantage Solutions may encounter a restricted number of highly qualified service partners. The consolidation observed in specialized digital transformation services in 2024, with fewer independent firms possessing deep CPG sector knowledge, amplifies the bargaining power of these select providers due to high switching costs and operational integration.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Advantage Solutions | Example Data/Trend (2024) |

|---|---|---|---|

| Technology & Data Providers | Proprietary solutions, limited substitutes, high integration costs | Increased leverage in pricing and contract terms | AI in Marketing Market projected at $100 billion |

| Physical Resource Suppliers | Availability of substitutes, supplier concentration, resource importance | Potential cost increases and operational disruptions | 5% increase in raw material costs for retail displays |

| Specialized Service Partners | Niche expertise, limited qualified providers, high switching costs | Greater influence on project scope and timelines | Consolidation in digital transformation services for CPG |

What is included in the product

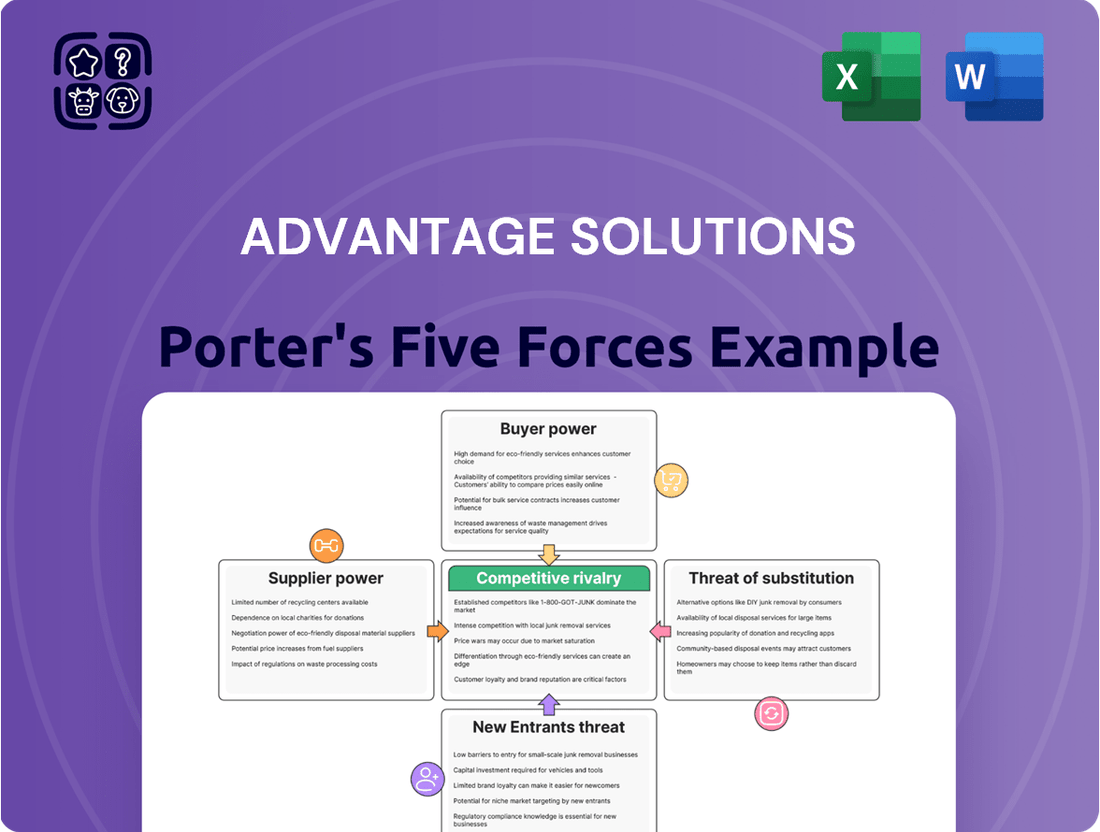

This analysis delves into the competitive forces shaping Advantage Solutions' market, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Gain immediate clarity on competitive pressures with a visual representation of each force, simplifying complex market dynamics.

Customers Bargaining Power

Advantage Solutions works with a vast array of consumer goods manufacturers, serving over 4,000 CPG brands. This broad client base includes major players across grocery, mass, big box, drug, and convenience retail sectors.

The sheer scale of some of these retail and manufacturing clients means they possess considerable market clout. This can translate into a concentrated customer base for specific services Advantage Solutions offers, giving these large clients significant bargaining power.

The substantial volume and revenue generated by these major clients allow them to negotiate favorable terms, pricing, and service level agreements. For instance, large retailers often demand specific promotional support and data analytics, which can put pressure on Advantage Solutions' margins.

For standardized outsourced sales and marketing services, customers often face low switching costs. This means they can readily move to a competitor if Advantage Solutions' pricing or performance doesn't meet their expectations. For instance, if a client is only using basic lead generation services, they might find it simple to switch providers if another company offers a slightly better rate or a more appealing initial pitch. This situation puts pressure on Advantage Solutions to constantly prove its unique value proposition.

Large consumer goods companies and major retailers have the financial muscle and operational know-how to handle tasks like sales, marketing, and digital commerce internally. This capability acts as a significant check on the pricing power of service providers like Advantage Solutions.

For instance, a major CPG brand might analyze its marketing spend in 2024 and find that bringing a portion of its digital campaign management in-house could save a projected 15% on agency fees, putting pressure on outsourcing partners to demonstrate superior ROI.

This threat of backward integration by customers means Advantage Solutions must continually highlight its specialized expertise and cost-effectiveness to justify its services and prevent clients from taking functions in-house.

Demand for Measurable ROI and Performance-Based Models

Customers are increasingly focused on quantifiable results, pushing for clear return on investment (ROI) from their partnerships. This demand is a significant factor in their bargaining power, as they can directly link service outcomes to their own financial performance.

The rise of performance-based compensation models further amplifies customer leverage. Advantage Solutions, like its competitors, faces pressure to tie its fees to tangible achievements such as increased sales, improved customer acquisition costs, or enhanced brand engagement metrics. For example, a recent industry survey indicated that over 65% of B2B service buyers now prioritize vendors who offer flexible, results-oriented payment structures.

- Increased Scrutiny of Performance Metrics: Clients are more adept at tracking and demanding evidence of improved KPIs.

- Shift Towards Value-Based Pricing: Customers are moving away from fixed retainers towards models where fees are directly correlated with achieved outcomes.

- Data-Driven Accountability: Advantage Solutions must continually prove its effectiveness through robust data analytics and reporting.

- Competitive Pressure on Demonstrating ROI: Failing to deliver measurable results weakens Advantage's position and makes clients more likely to switch providers.

Access to Multiple Competitors and Alternatives

The outsourced sales and marketing sector is highly competitive, with numerous players offering diverse services. Customers can select from large, established agencies, niche specialists, and even digital marketing platforms, providing a wide array of choices.

Direct competitors like CROSSMARK, Acosta, and MarketSource, alongside broader business service providers, contribute to this dynamic market. This abundance of options significantly strengthens the bargaining power of customers.

- Broad Market Offerings: Customers can choose from a wide spectrum of providers, from full-service agencies to specialized digital marketing firms.

- Direct Competitor Landscape: Key players such as CROSSMARK, Acosta, and MarketSource offer direct alternatives, intensifying competition.

- Leveraging Competition: The ability to solicit bids and compare services allows customers to negotiate more favorable terms and pricing.

Advantage Solutions' customers, particularly large retailers and CPG brands, wield significant bargaining power. Their sheer size allows them to negotiate favorable terms and pricing, and they possess the capability to bring outsourced functions in-house, as evidenced by a projected 15% cost saving for a major CPG brand in 2024 if they managed digital campaigns internally. Furthermore, the industry's competitive nature, with players like CROSSMARK and Acosta, provides customers with ample alternatives, intensifying pressure on Advantage Solutions to demonstrate superior ROI and value-based pricing, with over 65% of B2B buyers prioritizing flexible payment structures.

| Customer Type | Bargaining Power Factor | Impact on Advantage Solutions | Example/Data Point |

|---|---|---|---|

| Large Retailers/CPG Brands | Scale and Volume | Ability to negotiate lower prices and favorable terms | Major clients generate substantial revenue, enabling demands for specific promotional support. |

| Any Customer (Standardized Services) | Low Switching Costs | Pressure to maintain competitive pricing and demonstrate unique value | Clients can easily switch providers for basic services if pricing or performance is not met. |

| Any Customer | Threat of Backward Integration | Need to prove cost-effectiveness and specialized expertise | A CPG brand might consider in-house management to save an estimated 15% on agency fees. |

| Any Customer | Focus on Quantifiable Results/ROI | Demand for performance-based pricing and data-driven accountability | Over 65% of B2B buyers prioritize vendors with flexible, results-oriented payment structures. |

| Any Customer | Competitive Market Landscape | Leverage to solicit bids and negotiate better terms | Presence of direct competitors like CROSSMARK, Acosta, and MarketSource. |

Preview the Actual Deliverable

Advantage Solutions Porter's Five Forces Analysis

This preview showcases the complete Advantage Solutions Porter's Five Forces Analysis, providing a thorough examination of competitive forces within its industry. The document you see here is the exact, professionally formatted report you'll receive immediately after purchase, offering actionable insights without any placeholders or alterations. You're looking at the actual analysis, meaning you'll gain instant access to this comprehensive strategic tool the moment your transaction is complete.

Rivalry Among Competitors

The outsourced sales and marketing sector is notably fragmented, featuring a vast landscape of competitors. Advantage Solutions faces off against a wide spectrum of companies, from major industry players like CROSSMARK and Acosta to numerous smaller, niche providers specializing in specific services or industries. This dense competitive environment means that companies constantly battle for market share and client attention.

Competitors often carve out niches, focusing on areas like digital commerce, retail media, merchandising, or brand advocacy. This specialization means their service portfolios can differ significantly from Advantage Solutions' broader, omnichannel strategy.

While Advantage Solutions strives for comprehensive coverage, some rivals might offer more profound expertise in particular segments or cater to distinct client groups. This competitive landscape necessitates continuous innovation and capability expansion for Advantage to maintain its edge across all service areas.

The competitive rivalry within Advantage Solutions' market is intensifying due to a pronounced emphasis on technology, data, and artificial intelligence. Companies are heavily investing in AI-driven sales solutions and advanced analytics to gain an edge.

This technological arms race means Advantage Solutions must continually upgrade its proprietary technology and data infrastructure to remain competitive. For instance, many players in the marketing services sector are reporting significant increases in R&D spending on AI and automation, with some projecting over 15% of their tech budgets dedicated to these areas in 2024.

Competitors are leveraging data science to personalize customer experiences and optimize campaign performance, creating a dynamic environment where innovation is paramount. Those that fail to keep pace risk falling behind in efficiency and effectiveness.

Client Exits and Transformation Initiatives

Advantage Solutions has strategically exited certain client relationships as part of its ongoing transformation. This move highlights a dynamic market where client churn is prevalent, driven by evolving demands and a search for specialized services. In 2024, the market saw significant client mobility across various service sectors, with some studies indicating that up to 20% of B2B clients switched primary vendors in the past year due to dissatisfaction or better offerings elsewhere.

This client mobility directly reflects intense competitive rivalry. Companies like Advantage Solutions must constantly prove their value proposition to retain existing business and attract new clients. The willingness of clients to switch providers underscores the pressure on service providers to innovate and deliver superior results, as evidenced by the increasing number of new market entrants offering niche or technology-driven solutions.

- Client Exits as Strategic Optimization: Advantage Solutions' deliberate client exits demonstrate a focus on streamlining operations and enhancing overall business efficiency.

- Active Client Switching Market: The ease with which clients switch providers suggests a competitive landscape where provider loyalty is not guaranteed, with changing client needs and cost considerations being major drivers.

- Intensified Competition and Value Demonstration: This client mobility necessitates continuous value creation and superior performance from service providers to maintain market share and attract new business.

- Impact of Specialized Solutions: Clients are actively seeking specialized solutions, indicating a market where generalist providers may struggle to compete against those offering tailored expertise.

Market Growth and Strategic Outsourcing Trends

The outsourced sales services market is booming, with projections indicating it will hit $4.21 billion by 2034. This expansion, particularly in B2B outsourcing, intensifies competition but also creates avenues for growth. Companies like Advantage Solutions face a dynamic landscape where strategic outsourcing is paramount.

Businesses are increasingly seeking value, flexibility, and specialized expertise, moving beyond simple cost reduction. This shift favors outsourcing partners that deliver advanced solutions and prove tangible return on investment. Advantage Solutions must therefore focus on demonstrating its unique capabilities and the measurable impact it has on client success.

- Market Growth: Global outsourced sales services market projected to reach $4.21 billion by 2034.

- B2B Strength: B2B outsourcing segment exhibits particularly robust growth.

- Strategic Outsourcing: Companies prioritize value, flexibility, and expertise over cost alone.

- Competitive Advantage: Providers offering sophisticated solutions and clear ROI gain an edge.

The competitive rivalry for Advantage Solutions is fierce, fueled by a fragmented market and a strong emphasis on technological advancement. Companies are heavily investing in AI and data analytics, with some dedicating over 15% of their 2024 tech budgets to these areas to enhance sales solutions and customer personalization.

Client mobility is also a significant factor, with up to 20% of B2B clients switching vendors in the past year due to evolving demands or better offerings. This necessitates constant value demonstration and innovation from providers like Advantage Solutions to retain business and attract new clients.

The outsourced sales services market is projected to reach $4.21 billion by 2034, with B2B outsourcing showing particularly strong growth. This expansion intensifies competition, pushing companies to offer specialized expertise and a clear return on investment to stand out.

| Key Competitive Factors | Impact on Advantage Solutions | Illustrative Data (2024) |

|---|---|---|

| Market Fragmentation | High number of competitors, from large players to niche specialists. | Vast landscape of providers, including CROSSMARK and Acosta. |

| Technological Investment | Need for continuous upgrades in AI and data infrastructure. | Industry trend: >15% of tech budgets allocated to AI/automation. |

| Client Switching Behavior | Pressure to prove value and retain existing clients. | Up to 20% of B2B clients switched vendors in the past year. |

| Market Growth & Specialization | Opportunity for growth, but requires demonstrating specialized expertise and ROI. | Projected market growth to $4.21 billion by 2034; focus on value over cost. |

SSubstitutes Threaten

Consumer goods manufacturers and retailers could opt to build out their own internal sales, marketing, and merchandising departments as a direct substitute for Advantage Solutions' offerings. This move allows for greater direct control over strategic brand representation and customer engagement. For instance, a large CPG company might decide to invest in expanding its field sales force rather than relying on a third-party provider.

While outsourcing often presents cost advantages and access to specialized talent, some large enterprises may prefer to retain these critical functions in-house to cultivate proprietary expertise and maintain tighter strategic alignment. This approach is especially feasible for major players with significant financial and human capital resources at their disposal.

Brands and retailers are increasingly taking their digital advertising and e-commerce operations in-house. This allows them to directly connect with consumers, bypassing traditional outsourced agencies. For instance, many major CPG brands now have robust direct-to-consumer (DTC) e-commerce capabilities, reducing their reliance on third-party sales and marketing support.

The growth of retail media networks, where retailers leverage their customer data to offer advertising opportunities on their own platforms, presents a significant substitute. Companies like Walmart Connect and Target's Roundel are expanding rapidly, offering brands direct access to shoppers at the point of purchase. This trend, which saw significant investment and growth throughout 2023 and into 2024, provides an alternative to traditional marketing channels that Advantage Solutions has historically utilized.

The increasing sophistication of self-service digital advertising tools further empowers brands to manage their campaigns independently. Platforms like Google Ads and Meta Ads offer advanced analytics and targeting, enabling businesses to execute complex digital strategies without external assistance. This directly challenges the need for outsourced services in areas like media buying and campaign management.

Companies seeking comprehensive marketing strategies might turn to traditional advertising agencies or management consulting firms. These entities offer a broader spectrum of services, from high-level brand positioning to market entry planning, which can serve as alternatives to Advantage Solutions' more execution-focused approach. For instance, a major consumer goods company looking to launch a new product in 2024 might engage a top-tier advertising firm for a full-service campaign, bypassing specialized execution providers.

Freelance and Gig Economy Models for Specialized Tasks

The rise of freelance and gig economy platforms presents a significant threat of substitutes for traditional outsourced service providers like Advantage Solutions. These platforms enable businesses to tap into a vast pool of specialized talent for specific tasks, such as event staffing, in-store promotions, or digital marketing campaigns, often at a more competitive price point than full-service agencies. For instance, by mid-2024, the global gig economy was estimated to be worth over $455 billion, highlighting the scale of this alternative. This allows companies to bypass comprehensive service bundles and opt for on-demand, project-specific expertise, thereby reducing reliance on established outsourcing partners.

This trend allows businesses to strategically engage with specialized skills as needed, potentially fragmenting the market for outsourced services. Companies can now source individual contractors or small, agile teams for discrete sales, marketing, or merchandising activities. This flexibility and cost-efficiency for specific functions can directly substitute for certain components of Advantage Solutions' integrated offerings. For example, a brand might use a freelance platform to find a specialized merchandiser for a single product launch rather than engaging a full-service agency for the entire campaign.

The increasing accessibility and efficiency of these platforms mean that businesses can achieve specific outcomes without committing to long-term contracts or broad service agreements. This can lead to a reduction in the perceived necessity of a full-service outsourced partner for many operational aspects. The ability to quickly onboard skilled individuals for targeted projects offers a compelling alternative, especially for companies seeking agility and precise skill application.

Key implications of this threat include:

- Increased competition for specialized task-based services.

- Potential for price erosion in specific service segments.

- Shift in client preference towards flexible, on-demand talent acquisition.

- Need for Advantage Solutions to adapt its service model to offer more modular or project-specific solutions.

Direct-to-Consumer (DTC) Sales Models

The rise of direct-to-consumer (DTC) sales models presents a significant threat of substitutes for Advantage Solutions. Manufacturers can now bypass traditional retail channels, selling directly to customers through their own e-commerce platforms. This shift diminishes the need for outsourced merchandising, in-store promotions, and retail sales support, which are core services for Advantage Solutions.

This strategic move by consumer goods companies directly impacts Advantage Solutions' revenue streams. For instance, a substantial portion of Advantage Solutions' business relies on providing in-store marketing and sales support to brands within retail environments. As brands increasingly adopt DTC strategies, their reliance on these outsourced services at the retail level naturally decreases.

Consider the growth in DTC e-commerce. In 2023, global DTC e-commerce sales were projected to reach over $130 billion, a figure expected to continue its upward trajectory. This growth indicates a clear trend of manufacturers investing in their own sales infrastructure, thereby reducing their dependence on third-party service providers like Advantage Solutions for reaching the end consumer.

- DTC models allow manufacturers to control the entire customer journey.

- This reduces the need for Advantage Solutions' traditional in-store services.

- Global DTC e-commerce sales are a growing substitute channel.

- Brands investing in DTC may reallocate marketing budgets away from retail support.

Brands and retailers are increasingly bringing sales, marketing, and merchandising functions in-house, directly substituting for Advantage Solutions' services. This allows for greater control over brand representation and customer engagement, especially for large CPG companies expanding their internal sales forces. For example, many major CPG brands now operate robust direct-to-consumer (DTC) e-commerce capabilities, reducing their reliance on third-party sales and marketing support.

The expansion of retail media networks, such as Walmart Connect and Target's Roundel, offers brands direct access to shoppers at the point of purchase, serving as a significant substitute for traditional marketing channels. Furthermore, the growing sophistication of self-service digital advertising tools empowers brands to manage campaigns independently, challenging the need for outsourced media buying and campaign management services.

The gig economy presents a substantial threat, with platforms enabling businesses to access specialized talent for specific tasks like event staffing or in-store promotions at competitive prices. This allows companies to bypass comprehensive service bundles, opting for on-demand, project-specific expertise and reducing reliance on established outsourcing partners. By mid-2024, the global gig economy was estimated to be worth over $455 billion, underscoring the scale of this alternative.

The rise of direct-to-consumer (DTC) sales models also significantly impacts Advantage Solutions, as manufacturers bypass traditional retail channels to sell directly to customers. This trend diminishes the need for outsourced merchandising and in-store promotions, core services for Advantage Solutions. Global DTC e-commerce sales, projected to exceed $130 billion in 2023, highlight manufacturers' investment in their own sales infrastructure, reducing dependence on third-party providers.

| Substitute Type | Description | Impact on Advantage Solutions | Example/Data Point |

|---|---|---|---|

| In-house Capabilities | Brands managing sales, marketing, and merchandising internally. | Reduced demand for outsourced services. | Large CPG companies expanding internal sales forces. |

| Retail Media Networks | Retailers offering advertising on their own platforms. | Alternative to traditional marketing channels. | Walmart Connect, Target's Roundel growth in 2023-2024. |

| Gig Economy Platforms | Access to specialized talent for specific tasks. | Competition for project-based services. | Global gig economy valued over $455 billion by mid-2024. |

| Direct-to-Consumer (DTC) | Manufacturers selling directly to end consumers. | Decreased reliance on in-store services. | Global DTC e-commerce sales projected over $130 billion in 2023. |

Entrants Threaten

Establishing an outsourced sales and marketing solutions provider on the scale of Advantage Solutions demands significant upfront capital. This includes investing in proprietary data platforms, advanced AI capabilities, and robust operational infrastructure to manage a vast, dispersed workforce. For instance, developing cutting-edge technology in this sector can easily run into tens of millions of dollars.

These substantial capital outlays act as a formidable barrier to entry. Newcomers face the challenge of matching the technological sophistication and operational reach of established players like Advantage Solutions, which has been building its capabilities for years. The sheer financial commitment required to compete effectively deters many potential entrants.

New entrants to Advantage Solutions' market face a significant hurdle in replicating the company's deeply entrenched client relationships. Advantage Solutions boasts long-standing partnerships with over 4,000 CPG brands and major retailers, operating across roughly 85,000 locations. Building this level of trust and a comprehensive network is a lengthy and resource-intensive process for any new competitor, directly impacting their ability to secure initial contracts and establish credibility in a sector that heavily values proven performance.

Advantage Solutions leverages substantial economies of scale and scope, providing a wide array of integrated services across in-store, online, and retail media channels. This extensive operational capacity enables them to offer highly competitive pricing and bundled solutions that are difficult for nascent competitors to match.

The company's ability to act as a comprehensive service provider creates a significant barrier to entry. New entrants would need to commit substantial capital simultaneously to build capabilities across numerous service domains, a challenge that deters many potential new players.

Access to Proprietary Data and Insights

Advantage Solutions leverages proprietary technology and extensive data to optimize client strategies, a significant barrier for new entrants. Replicating the depth and breadth of consumer and retail data Advantage has accumulated over years is a formidable challenge for any newcomer.

This accumulated data advantage translates into superior analytics and highly tailored solutions, making it difficult for new players to match Advantage's competitive offering. For instance, in 2024, Advantage Solutions continued to invest heavily in its data analytics platforms, aiming to provide clients with even more granular insights into consumer behavior and market trends.

- Proprietary Data: Advantage's extensive, years-in-the-making datasets are not easily acquired or replicated.

- Advanced Analytics: The company's sophisticated analytical tools, built upon this data, offer a competitive edge.

- Tailored Solutions: This data-driven approach allows for highly customized strategies that new entrants would struggle to match initially.

Talent Acquisition and Retention Challenges

New entrants face significant hurdles in acquiring and retaining the skilled talent necessary for success in the sales, marketing, merchandising, and technology sectors. Advantage Solutions, with its extensive workforce, actively invests in optimization and talent acquisition, setting a high bar for competitors. In 2023, the U.S. experienced a tight labor market, with unemployment rates hovering around 3.6% for much of the year, making it challenging for new companies to attract experienced professionals. This intense competition for talent can lead to substantially higher recruitment and training expenditures for emerging businesses, thereby acting as a considerable barrier to entry.

The difficulty in securing and retaining a proficient workforce presents a substantial threat to new entrants. For instance, a new competitor would need to not only attract but also train individuals across multiple specialized functions. This is particularly true in areas like data analytics and digital marketing, where demand often outstrips supply. The ongoing investment by established players like Advantage Solutions in employee development and retention programs further exacerbates this challenge for newcomers, potentially increasing their operational costs and slowing their market penetration.

- Talent Scarcity: The demand for skilled professionals in sales, marketing, merchandising, and technology consistently outpaces the available supply.

- High Recruitment Costs: New entrants must contend with increased advertising, headhunting, and onboarding expenses to attract qualified personnel.

- Training Investment: Significant resources are required to train new hires to meet industry standards and company-specific needs.

- Retention Challenges: Established companies often offer more competitive compensation, benefits, and career advancement opportunities, making it harder for new firms to retain their talent.

The threat of new entrants in Advantage Solutions' market is considerably low due to the substantial capital investment required for technology and infrastructure. Companies like Advantage Solutions have invested tens of millions in proprietary data platforms and AI capabilities, creating a high financial barrier. For example, in 2024, Advantage continued to enhance its advanced analytics platforms, further increasing the cost for newcomers to match its technological sophistication.

Porter's Five Forces Analysis Data Sources

Our Advantage Solutions Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, Advantage Solutions' own SEC filings and annual reports, and relevant trade publications.