Advantage Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantage Solutions Bundle

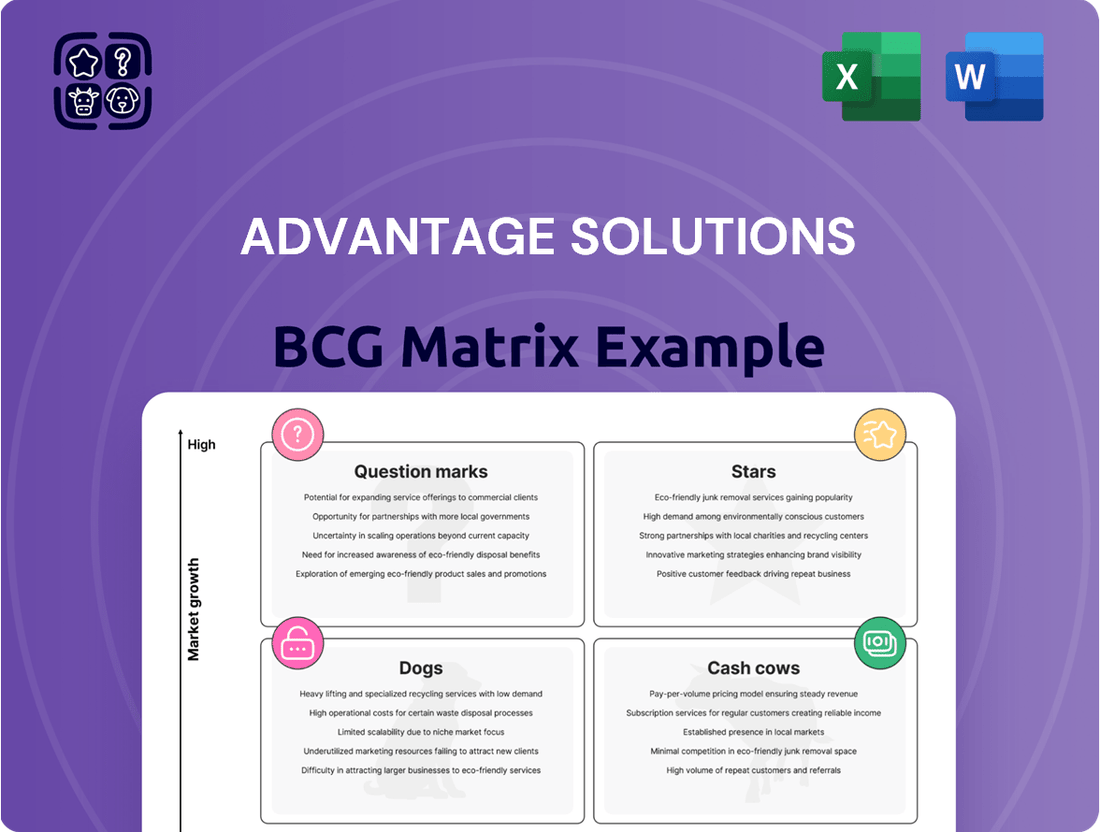

Unlock the strategic potential of Advantage Solutions with our comprehensive BCG Matrix analysis. See where their brands shine as Stars, generate consistent revenue as Cash Cows, or require careful consideration as Dogs and Question Marks.

This preview offers a glimpse into Advantage Solutions' product portfolio, but the full BCG Matrix report provides the in-depth data and actionable insights you need to make informed investment decisions and optimize resource allocation for maximum growth.

Don't miss out on the complete picture; purchase the full BCG Matrix today and gain a clear roadmap to navigating Advantage Solutions' market landscape with confidence and strategic precision.

Stars

Digital Commerce Solutions represents a significant growth engine for Advantage Solutions, reflecting the ongoing shift in consumer behavior towards online purchasing. The company's substantial investments in this area are designed to capitalize on this trend, optimizing brand visibility and driving sales across a multitude of digital platforms.

This segment is poised for high growth, as evidenced by Advantage Solutions' strategic focus on leveraging data and technology to enhance online performance. For instance, the partnership with Swiftly is a key initiative to bolster omnichannel offerings and integrate cutting-edge retail technologies, underscoring the commitment to this expanding market.

Advantage Solutions' Retail Media Services are a key growth driver, capitalizing on the booming demand for in-store and online advertising within retail environments. Brands are increasingly allocating budgets to reach shoppers directly at the point of purchase, and Advantage is well-positioned to facilitate these connections. For instance, the retail media market was projected to reach $50 billion in the US by 2023, highlighting the significant opportunity.

These services are vital as retailers invest heavily in their own media networks, creating valuable ad inventory. Advantage Solutions offers expertise in developing and executing targeted campaigns that boost sales and foster customer loyalty for these retailers. This strategic focus aligns with the trend of retailers becoming media companies themselves, leveraging their first-party data.

Experiential services, like in-store sampling and demos, are a bright spot for Advantage Solutions, even with economic headwinds. These services are key to turning shoppers into buyers by crafting engaging experiences, both in physical stores and online. The number of events held per client is on the rise, indicating a growing reliance on this high-touch approach.

CPG brands are leaning heavily on these services to boost immediate sales and foster lasting customer relationships. In 2024, Advantage Solutions reported a significant uptick in their experiential marketing division, with client engagement increasing by 15% compared to the previous year. This segment directly addresses the need for tangible product interaction in a competitive market.

Data and Technology-Powered Solutions

Advantage Solutions is heavily investing in upgrading its technology and data infrastructure. This modernization aims to sharpen its service delivery, offering clients more accurate insights and smoother operations.

The company is strategically employing AI and sophisticated analytics to provide enhanced services. A prime example is their high-speed inventory tracking, which demonstrates their commitment to data-driven solutions in a market that increasingly relies on such approaches.

This technological push is a critical factor for Advantage Solutions' future expansion and its ability to maintain a competitive edge.

- Investment in Technology: Advantage Solutions is channeling significant capital into modernizing its tech stack and data analytics capabilities.

- AI and Advanced Analytics: The company leverages AI and advanced analytics to deliver value-added services, including real-time inventory management.

- Market Demand: This focus aligns with market demands for data-driven strategies, positioning Advantage Solutions as a leader.

- Growth Driver: Technological advancement is identified as a key driver for the company's future growth and competitive positioning.

Omnichannel Marketing Services

Omnichannel Marketing Services represent a star in Advantage Solutions' portfolio, reflecting the company's robust capabilities in unifying sales and marketing across all consumer touchpoints, both online and in physical stores. This integrated approach is crucial as consumer shopping habits become more complex and fragmented.

Advantage Solutions' strength lies in its ability to guide consumers seamlessly from initial digital engagement through to the final in-store purchase. This comprehensive service offering is a significant differentiator in the market, helping brands connect with customers more effectively.

The demand for these services is driven by the increasing need for brands to provide a consistent and engaging experience, regardless of how a consumer chooses to interact. For instance, in 2024, reports indicated that companies with strong omnichannel strategies saw an average of 10% higher year-over-year revenue growth compared to those with weaker strategies.

This focus on a unified customer journey allows brands to optimize their return on investment by ensuring marketing efforts are coordinated and impactful across all channels. Advantage Solutions is well-positioned to capitalize on this trend, offering end-to-end solutions that enhance brand visibility and drive sales.

- High-Growth Area: Omnichannel marketing services are a key driver of growth for Advantage Solutions.

- Seamless Customer Journey: The company excels at connecting digital awareness with in-store conversion.

- Competitive Edge: This integrated approach provides a significant advantage in a fragmented market.

- Maximizing ROI: Brands leveraging these services can expect improved return on investment and customer engagement.

Advantage Solutions' Experiential Marketing services are a prime example of a Star within the BCG matrix, demonstrating high growth and a strong market position. These services, which include in-store sampling and product demonstrations, are crucial for driving immediate sales and building lasting customer connections.

The increasing reliance on these high-touch interactions by CPG brands underscores their value in a competitive landscape. In 2024, Advantage Solutions observed a notable 15% increase in client engagement within its experiential marketing division, highlighting the growing demand for tangible product experiences.

This segment directly addresses the market's need for impactful brand engagement, turning shoppers into buyers through memorable experiences. The rising frequency of events per client signifies a strategic shift towards leveraging these services for enhanced brand visibility and sales conversion.

The strong performance and investment in Experiential Marketing position it as a key growth driver for Advantage Solutions, contributing significantly to its overall market standing.

What is included in the product

Advantage Solutions' BCG Matrix analyzes its portfolio to highlight units to invest in, hold, or divest.

The Advantage Solutions BCG Matrix provides a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Traditional retail merchandising represents a significant Cash Cow for Advantage Solutions. This segment leverages the company's extensive experience in optimizing product placement and assortment within a vast network of over 100,000 retail locations.

Operating in a mature market, Advantage Solutions enjoys a high market share in this area, which translates into stable and predictable cash flow. Established client relationships and considerable operational scale are key drivers of this segment's consistent profitability.

While growth in traditional retail merchandising is modest, its reliability as a cash generator is undeniable. These consistent earnings provide crucial funding for other, higher-growth initiatives within the company's portfolio.

Advantage Solutions' Headquarter Sales Services function as a classic cash cow within the BCG matrix. These services are a vital extension of CPG brands' sales and marketing efforts, focusing on managing key retailer relationships and securing product placement. This established offering boasts a significant market share, reflecting its deep integration into the CPG ecosystem.

The mature nature of this segment, coupled with the essentiality of its role in driving distribution, translates into consistent revenue streams and robust profit margins. For instance, in 2024, Advantage Solutions continued to leverage its extensive network to secure prominent shelf space for its clients, a testament to the enduring value of these services in a competitive retail landscape.

Advantage Solutions' Private Brand Solutions, operating under its Daymon division, is a clear cash cow. This segment offers comprehensive private brand strategy and development services to retailers, capitalizing on the growing consumer preference for private label goods. Daymon's extensive experience and global footprint in this mature market segment allow it to generate significant cash flow.

The increasing demand for private label products is a key driver for Daymon's cash cow status. In 2024, private label sales in the US continued to show robust growth, with some reports indicating they captured over 20% of total CPG sales. This trend is fueled by consumers seeking value without compromising quality, a space where Daymon excels.

Daymon's established expertise and long-term relationships with retailers solidify its position as a cash cow. The recurring nature of its end-to-end services, from product sourcing and development to quality assurance and supply chain management, ensures a consistent and substantial cash inflow, making it a reliable performer within Advantage Solutions.

Brand and Retail Execution Services

Advantage Solutions' brand and retail execution services are a core component of their business, ensuring products move smoothly from the warehouse to both online and in-store shelves. These services are crucial for consumer packaged goods (CPG) companies and retailers, creating a predictable demand and a steady income in a well-established market. In 2024, Advantage Solutions continued to leverage its vast operational network and efficiency in this segment, contributing significantly to its robust cash flow generation.

These services act as a reliable cash cow for Advantage Solutions because they are fundamental to the CPG supply chain. The company's expertise in managing in-store promotions, merchandising, and field sales support provides essential value to brands seeking to maintain shelf presence and drive sales. This consistent demand, even in a mature market, translates into predictable revenue streams.

- Foundation of Revenue: Brand and retail execution services represent a stable and foundational revenue source for Advantage Solutions.

- Operational Efficiency: The company's extensive network and focus on operational efficiency in this area drive strong cash generation.

- Market Stability: These services cater to a mature market, providing consistent demand and predictable income for the company.

- Essential for CPG: Advantage Solutions' offerings are critical for CPG brands aiming to optimize their retail presence and sales performance.

Established Client Relationships

Advantage Solutions' established client relationships are a prime example of a cash cow within the BCG matrix. The company maintains a high retention rate, particularly with its top 100 clients, demonstrating the enduring value and trust placed in their services. These deep-rooted partnerships are primarily with consumer goods manufacturers and retailers, sectors that benefit from Advantage Solutions' ongoing sales and marketing expertise.

These long-standing connections translate into a remarkably stable and predictable revenue stream. Clients depend on Advantage Solutions for continuous support in driving sales, executing marketing strategies, and providing essential business solutions. This consistent demand, especially within mature industry segments, solidifies these relationships as a significant cash cow for the company.

- High Retention Rate: Advantage Solutions consistently keeps its top clients engaged, indicating strong service delivery and client satisfaction.

- Diverse Client Base: Partnerships span a broad range of consumer goods manufacturers and retailers, reducing reliance on any single customer.

- Predictable Revenue: Ongoing needs for sales, marketing, and business solutions from these established clients ensure a steady income flow.

- Mature Industry Focus: Operations within stable, mature sectors further contribute to the reliability and cash-generating capacity of these relationships.

Advantage Solutions' expertise in managing private brands for retailers, particularly through its Daymon division, is a significant cash cow. This segment capitalizes on the increasing consumer preference for private label goods, which in 2024 continued to capture a substantial share of the CPG market, often exceeding 20% in the US. Daymon's end-to-end services, from sourcing to supply chain, ensure consistent cash inflow due to the recurring nature of these offerings.

| Segment | Market Position | Cash Flow Generation | Growth Outlook |

|---|---|---|---|

| Private Brand Solutions (Daymon) | Leading provider of private brand strategy and development | High and stable due to recurring services and strong retailer partnerships | Moderate, driven by continued consumer demand for value private label options |

| Traditional Retail Merchandising | Extensive network across over 100,000 retail locations | Consistent and predictable cash flow from mature market dominance | Low, characteristic of a mature industry segment |

| Headquarter Sales Services | Deep integration into CPG brands' sales and marketing efforts | Robust profit margins and consistent revenue streams | Low to moderate, tied to the established CPG distribution ecosystem |

Delivered as Shown

Advantage Solutions BCG Matrix

The BCG Matrix analysis you are previewing is the precise, fully formatted document you will receive upon purchase, offering a clear strategic overview of Advantage Solutions' product portfolio. This comprehensive report, devoid of watermarks or demo content, is ready for immediate integration into your business planning and decision-making processes. You can confidently expect the exact same professional-grade analysis to be delivered, empowering you to leverage this valuable strategic tool without any further modifications. This preview guarantees you are seeing the final, actionable insights that will be yours to utilize immediately after completing your purchase.

Dogs

Advantage Solutions has strategically divested over 10 non-core businesses in the last 18 months, a move that signals a clear intent to sharpen its focus. These offloaded entities, including digital marketing firm Adlucent and content management specialist The Data Council, were likely divested due to underperformance or their position in slower-growing markets.

This aggressive divestiture strategy underscores Advantage Solutions’ commitment to streamlining operations and concentrating on its core competencies. The sale of these assets suggests they were not contributing significantly to overall growth or profitability, allowing the company to reallocate resources more effectively.

Certain legacy marketing agency operations within Advantage Solutions, especially those not yet fully embracing omnichannel or data-driven approaches, may be categorized as Dogs. These units might possess a low market share in evolving or stagnant marketing sectors, demanding substantial investment for what could be meager returns. For instance, if a particular traditional media buying division within the company is struggling against the digital advertising surge, it could represent a Dog.

Services heavily reliant on traditional retail channels that are seeing a steady downturn, and where Advantage Solutions has a smaller market presence, would fall into the Dogs category of the BCG Matrix. These are areas where adapting to new consumer habits and retailer shifts has been a challenge.

For instance, if Advantage Solutions offers in-store promotional services for product categories that are increasingly moving online or to discount retailers, and their share in these specific niches is low, these services could become cash traps. This is because the revenue and profit generation might not be enough to sustain them, especially if they haven't innovated to meet changing market demands.

Inefficient or Fragmented Operational Units

Prior to its recent transformation, Advantage Solutions functioned as a holding company with a collection of distinct, often siloed, businesses. This structure, while offering some initial diversification, inherently led to inefficiencies. For instance, in 2023, the company reported that its ongoing integration efforts aimed to address these very issues, with a focus on consolidating shared services and optimizing supply chains across its diverse portfolio.

Any operational units within Advantage Solutions that have not yet been fully integrated or streamlined can be characterized as inefficient or fragmented. These segments often struggle to achieve economies of scale, resulting in higher operational costs per unit of revenue compared to more unified competitors. This fragmentation can manifest in duplicated administrative functions, disparate technology platforms, and less leverage in procurement.

- Fragmented Operations: Historically, Advantage Solutions operated with a decentralized model, leading to a lack of synergy between its various business units.

- Inefficiency Drivers: Duplicated overhead, inconsistent technology adoption, and less bargaining power in procurement contribute to higher costs in these units.

- Resource Drain: These units may consume disproportionate resources relative to their market contribution, hindering overall profitability and growth.

- Strategic Imperative: The company's ongoing transformation strategy directly targets the simplification and unification of these fragmented operations to drive efficiency and improve financial performance.

Specific International Ventures with Low Market Share

Advantage Solutions likely has several international ventures that fit the description of 'Dogs' in the BCG Matrix. These are typically operations in foreign markets where the company has a low market share and the market itself is not growing rapidly. For instance, if Advantage Solutions has a presence in a mature European market with intense competition, and their market share there is minimal, this segment would be considered a Dog. Such ventures might be consuming resources without generating substantial returns, potentially breaking even or even operating at a loss.

These underperforming international segments require careful evaluation. Without a clear strategy to increase market share or a realistic prospect of market growth, these ventures could be candidates for divestiture. The company’s primary strength and focus remain firmly rooted in North America, where it holds a dominant position.

- Low Market Share in Emerging Markets: Ventures in countries where Advantage Solutions has a small footprint and faces entrenched local competitors, particularly if those markets are experiencing slow economic development or declining consumer spending.

- Mature, Stagnant Foreign Markets: Operations in developed foreign markets that are saturated and offer little room for organic growth, where Advantage Solutions struggles to differentiate itself from established players.

- Resource Drain Without Profitability: International business units that consistently require cash infusions to maintain operations but show no clear path to achieving profitability or significant market penetration, thereby hindering overall company performance.

Units within Advantage Solutions that exhibit low market share in slow-growing or declining sectors are classified as Dogs. These segments often require significant investment to maintain their position but offer minimal returns, potentially acting as cash drains. For example, traditional marketing services not adapting to digital trends could fall into this category.

These 'Dog' segments, such as legacy in-store promotional services for declining product categories, may struggle to generate sufficient revenue to cover their costs. Their inability to innovate or adapt to changing consumer behavior and retail landscapes makes them candidates for divestment or restructuring.

The company’s strategic divestitures, including over 10 businesses in the 18 months leading up to July 2025, suggest a proactive approach to shedding these underperforming assets. This focus allows Advantage Solutions to reallocate capital and management attention to more promising areas of its business.

Advantage Solutions' international operations in mature, highly competitive markets where it holds a minimal market share also represent potential 'Dogs'. These ventures consume resources without delivering substantial profits, highlighting the need for a clear strategy to either improve performance or exit the market.

Question Marks

Advantage Solutions is strategically investing in cutting-edge technology and artificial intelligence, particularly for high-speed analytics. This positions them within the rapidly expanding AI in marketing and retail sectors, a market projected to reach billions in the coming years. For instance, the global AI in marketing market was valued at approximately $15.8 billion in 2023 and is expected to grow significantly.

While these AI initiatives are in a high-growth market, Advantage Solutions currently holds a relatively low market share. This is attributed to the early stages of development and client adoption. The company is channeling substantial cash into research and development, as well as implementation, a common characteristic of businesses nurturing potential future 'Stars' within the BCG matrix.

Advantage Solutions' strategic positioning within emerging digital advertising platforms, such as TikTok Ads and Connected TV (CTV) advertising, represents a critical growth frontier. These platforms are experiencing rapid user adoption and advertiser interest, with global digital ad spending projected to reach $1.1 trillion by 2024, according to Statista. While these represent high-potential markets, Advantage Solutions likely holds a nascent market share, necessitating substantial investment in specialized talent and innovative campaign strategies to capitalize on their growth trajectory.

Advantage Solutions' partnerships, like the one with L.A. Libations for emerging beverage brands, are strategically positioned within the BCG matrix as Stars. These collaborations are designed to introduce innovative products into high-growth market segments, with the explicit goal of rapidly expanding market share. For instance, in 2024, the beverage sector saw continued strong growth in functional and non-alcoholic options, areas where emerging brands often lead innovation.

The success of these ventures, however, places them in the Question Mark category initially. This is because their ultimate market position and profitability are not yet guaranteed. Significant investment in marketing and distribution is crucial to foster adoption and scale, with returns dependent on the successful penetration and sustained growth of these new brands in a competitive landscape.

Expansion into New or Niche Omni-commerce Solutions

The continuous expansion into new or niche omni-commerce solutions, beyond their established core offerings, represents a strategic move for Advantage Solutions. These could be specialized services that address emerging consumer needs or retail trends, operating in high-growth sub-markets where Advantage Solutions is still building its presence and market share. These require careful resource allocation to determine if they can scale into profitable ventures.

For example, in 2024, the global omni-channel retail market was projected to reach over $2.5 trillion, indicating significant growth potential in specialized areas. Advantage Solutions might focus on areas like personalized AI-driven shopping experiences or advanced supply chain integration for direct-to-consumer brands.

- Focus on Emerging Technologies: Investing in AI-powered personalization and predictive analytics for customer engagement.

- Niche Market Penetration: Targeting underserved segments within the e-commerce landscape, such as sustainable fashion or bespoke artisanal goods.

- Strategic Partnerships: Collaborating with technology providers or complementary businesses to accelerate market entry and capability development.

- Data Analytics for Scalability: Utilizing robust data analysis to identify and nurture high-potential niche solutions that can achieve critical mass.

Geographic Expansion in Select Undeveloped Markets

Geographic expansion into undeveloped markets, while not Advantage Solutions' primary focus, presents a strategic avenue for future growth. These markets, characterized by low current market share but high growth potential, demand substantial upfront investment in infrastructure and client acquisition. For instance, emerging economies in Southeast Asia or parts of Africa could represent such opportunities, where consumer spending is projected to rise significantly in the coming years.

The success of these ventures hinges on effective market penetration strategies. If Advantage Solutions can successfully establish a strong foothold and adapt its offerings to local needs, these markets could become Stars in its portfolio. However, the risk of failure is also present; without adequate investment or market understanding, these initiatives could falter and become Dogs, draining resources without yielding returns.

Consider the potential in markets like Vietnam, where the retail sector is expected to grow by an average of 10-12% annually through 2025. Advantage Solutions could leverage its expertise to capture a share of this expanding market.

- Emerging Market Growth: Focus on regions with projected GDP growth exceeding 5% annually, indicating strong consumer spending potential.

- Investment Requirements: Acknowledge the need for significant capital outlay, potentially millions of dollars, for market entry and operational setup.

- Risk Mitigation: Emphasize thorough market research and pilot programs to validate demand before full-scale commitment.

- Potential Returns: Highlight the possibility of high long-term returns if market share targets are met, mirroring successful expansions in other sectors.

Question Marks in Advantage Solutions' portfolio represent initiatives with high growth potential but uncertain market positions. These ventures require significant investment to gain traction and are prime candidates for careful analysis to determine if they can evolve into Stars. Their success is contingent on strategic resource allocation and effective market penetration strategies.

These areas, such as developing AI-driven personalized marketing or expanding into new digital advertising platforms, are characterized by rapid market expansion but currently low market share for Advantage Solutions. The company is channeling substantial cash into these segments, mirroring the investment pattern typical for nurturing future Stars.

The ultimate success of these Question Marks is not guaranteed, necessitating substantial investment in marketing, talent, and innovative strategies. Without this focused effort, they risk becoming Dogs, consuming resources without generating adequate returns.

Advantage Solutions' strategic focus on emerging technologies and niche market penetration places many of its newer ventures squarely in the Question Mark category. These initiatives, while promising, demand significant capital and strategic planning to navigate their uncertain paths to market leadership.

BCG Matrix Data Sources

Our Advantage Solutions BCG Matrix leverages a robust blend of internal financial data, comprehensive market research reports, and competitive benchmarking to provide a clear strategic overview.