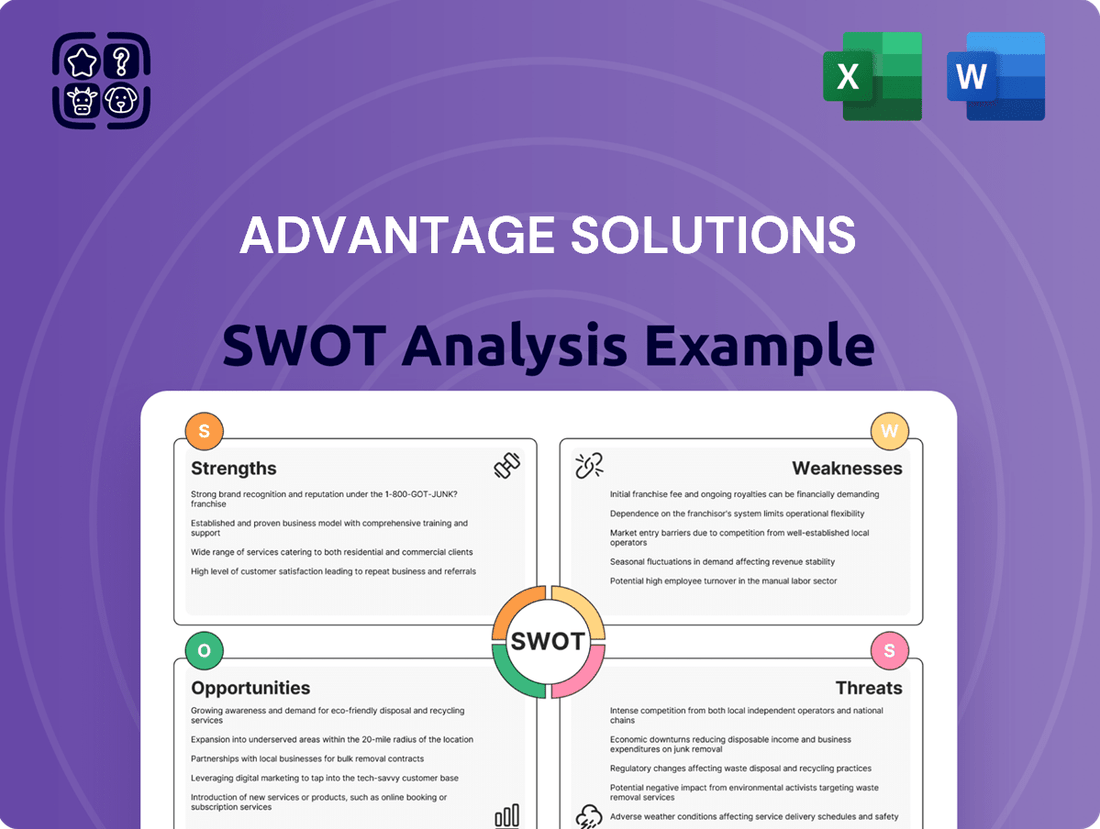

Advantage Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantage Solutions Bundle

Advantage Solutions leverages its extensive retail and brand partnerships, a key strength, but faces challenges in adapting to evolving consumer preferences and digital disruption. Understand the full strategic landscape, including potential threats and opportunities, to make informed decisions.

Want the full story behind Advantage Solutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Advantage Solutions boasts a comprehensive service portfolio, covering everything from outsourced sales and marketing to crucial business solutions like merchandising and brand advocacy. This broad spectrum allows them to offer a complete package to consumer goods manufacturers and retailers, guiding them from initial strategy to final execution.

Their capabilities extend into exciting areas like retail media and digital commerce, reflecting a forward-thinking approach. In 2023, Advantage Solutions reported net sales of $3.2 billion, showcasing their significant market presence and the demand for their integrated services.

Advantage Solutions boasts a dominant position as North America's foremost omnichannel retail solutions provider, a testament to its significant market scale and deep industry expertise. This extensive reach allows them to serve a vast array of clients effectively.

The company's strength lies in its robust, long-standing relationships with key clients across its core markets and diverse sales channels. This stability is further underscored by their significant market share, with reports indicating Advantage Solutions' services being utilized by approximately 80% of the top 50 CPG manufacturers in the US.

Advantage Solutions leverages advanced data and technology to connect brands with consumers, optimizing their presence across diverse sales channels. This focus on data-driven strategies allows for more precise targeting and effective campaign execution. The company's commitment to integrating cutting-edge technologies enhances its ability to deliver measurable results for clients.

Ongoing Strategic Transformation

Advantage Solutions is actively pursuing a significant strategic transformation designed to streamline operations and boost efficiency. This initiative is crucial for improving their financial health and unlocking future growth potential. For instance, by the end of fiscal year 2023, the company reported a notable improvement in its operational efficiency, contributing to a stronger cash flow position.

Key elements of this transformation include optimizing the company's organizational structure and making deliberate investments in core business areas. These moves are intended to solidify their market standing and prepare them for sustained expansion. The company's focus on these strategic shifts is a direct response to evolving market dynamics and a commitment to long-term value creation.

- Operational Streamlining: Initiatives are in place to reduce redundancies and improve workflow across the organization.

- Efficiency Enhancements: Targeted investments are being made to upgrade technology and processes, aiming for measurable gains in productivity.

- Cash Flow Improvement: Strategic adjustments are directly linked to bolstering the company's ability to generate and manage cash effectively.

- Future Growth Focus: Investments are strategically allocated to strengthen core competencies and capitalize on emerging market opportunities.

Focused Core Business through Divestitures

Advantage Solutions has strategically streamlined its operations by divesting non-core assets. For instance, the sale of its digital advertising platform, Jun Group, and its foodservice businesses has allowed the company to concentrate more effectively on its primary offerings for retail and CPG clients. This portfolio simplification is a key move to create a more robust platform for future expansion.

This strategic focus is designed to enhance service delivery to its core client base. By shedding less central operations, Advantage Solutions can allocate resources and expertise more efficiently towards its main business lines, aiming for improved performance and client satisfaction. This approach is crucial for building a stronger foundation for sustained growth in the competitive market.

- Divestiture of Jun Group: Advantage Solutions completed the sale of its digital advertising unit, Jun Group, in early 2024.

- Focus on Core Clients: The company is now better positioned to serve its key retailer and CPG partners with specialized services.

- Portfolio Simplification: This strategic move aims to create a more agile and focused business model for enhanced efficiency.

Advantage Solutions' primary strength lies in its comprehensive, end-to-end service model, covering sales, marketing, and retail execution for consumer packaged goods (CPG) and retail clients. This integrated approach is further bolstered by their dominant position as North America's leading omnichannel retail solutions provider, serving approximately 80% of the top 50 CPG manufacturers in the US.

The company leverages advanced data analytics and technology to optimize brand presence across various sales channels, ensuring precise targeting and effective campaign execution. Their strategic divestitures, such as the sale of Jun Group in early 2024, have streamlined operations, allowing for a sharper focus on core client needs and future growth initiatives.

| Strength | Description | Supporting Data/Fact |

| Market Leadership | Dominant North American omnichannel retail solutions provider | Serves ~80% of top 50 US CPG manufacturers |

| Comprehensive Service Portfolio | End-to-end sales, marketing, and retail execution | Net sales of $3.2 billion in 2023 |

| Data & Technology Focus | Utilizes advanced analytics for optimized brand presence | Enhances precise targeting and campaign effectiveness |

| Strategic Streamlining | Divestment of non-core assets (e.g., Jun Group in early 2024) | Increased focus on core CPG and retail clients |

What is included in the product

Delivers a strategic overview of Advantage Solutions’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, turning potential weaknesses into opportunities.

Weaknesses

Advantage Solutions is facing a challenging financial period, marked by declining revenues and a widening net loss. In the first quarter of 2025, the company's revenues dropped by 5% to $822 million. This revenue decline was accompanied by an increased net loss of $56 million, a notable deterioration from the prior year's performance.

The full fiscal year 2024 painted a similar picture, with the net loss escalating significantly to $378.4 million. This substantial increase in losses, even with reported adjusted EBITDA growth, raises serious questions about the company's overall financial stability and its ability to achieve profitability.

Advantage Solutions faced headwinds in early 2025, with its first-quarter financial performance significantly affected by deliberate client departures. This strategic pruning, coupled with prevailing market uncertainty, prompted a downward revision of management's financial guidance.

The adjusted outlook underscores a cautious sentiment regarding future revenue generation and highlights potential difficulties in securing new business or retaining existing clients amidst a fluctuating economic landscape.

Advantage Solutions has been grappling with significant operational challenges, particularly stemming from widespread labor shortages in key regions. This difficulty in securing adequate staffing directly impacts their ability to execute services efficiently.

Compounding these issues, a noticeable decline in retail inventory levels across the sector has led to reduced order volumes for Advantage Solutions. This inventory shrinkage, a trend observed throughout much of 2024, directly curtails their revenue-generating opportunities and strains their service delivery capacity.

Leadership Transition in Key Segments

Advantage Solutions faces a potential weakness with a leadership transition in its Experiential Services segment. Andrea Young's departure as COO in June 2025, with Michael Taylor moving to a new role, could create a temporary adjustment period. Such shifts, even when strategically planned, can impact operational continuity and the pace of executing key initiatives.

This leadership change might briefly affect the segment's ability to maintain its momentum. For instance, if Experiential Services contributed significantly to Advantage Solutions' 2024 revenue, which stood at $3.1 billion, any disruption could be keenly felt. The new leadership will need to quickly integrate and ensure strategic alignment to avoid hindering growth in this crucial area.

- Leadership Transition: Andrea Young steps down as COO of Experiential Services in June 2025, with Michael Taylor assuming a new role.

- Potential Operational Impact: Leadership changes can lead to a temporary period of adjustment, potentially affecting operational efficiency and the execution of strategic goals.

- Strategic Alignment: While intended for strategic alignment, the transition requires careful management to ensure continued focus on business objectives.

- Revenue Context: With Advantage Solutions reporting $3.1 billion in revenue for 2024, stability in key leadership roles is important for sustained performance.

Significant Net Leverage Ratio

Advantage Solutions faces a significant challenge with its net leverage ratio, which stood at approximately 4.2x Adjusted EBITDA as of March 2024. This level of debt can constrain the company's ability to pursue new investments or acquisitions without taking on additional risk.

A high leverage ratio also makes Advantage Solutions more vulnerable to changes in interest rates, potentially increasing financing costs and impacting profitability. While the company aims for disciplined capital allocation, including debt reduction, this elevated leverage remains a key weakness.

- High Net Leverage: Approximately 4.2x Adjusted EBITDA as of March 2024.

- Limited Financial Flexibility: High debt can restrict strategic options and investment capacity.

- Interest Rate Sensitivity: Increased exposure to rising interest costs.

Advantage Solutions' financial performance in early 2025 was hampered by deliberate client attrition, a strategic move that, while potentially beneficial long-term, directly impacted short-term revenue. This, coupled with broader market uncertainty, led to a downward revision of their financial outlook for the year. The company's first quarter of 2025 saw revenues fall 5% to $822 million, with a net loss widening to $56 million, signaling ongoing financial pressures.

Labor shortages continue to be a significant operational hurdle, directly affecting their ability to deliver services efficiently across key regions. Furthermore, a sector-wide decline in retail inventory levels throughout 2024 has reduced order volumes, limiting revenue opportunities and straining service delivery capacity.

A leadership transition within the Experiential Services segment, with Andrea Young departing as COO in June 2025, introduces a potential for temporary operational adjustments. While Michael Taylor moves to a new role, ensuring continuity and strategic alignment in this key segment, which contributes to the company's $3.1 billion in 2024 revenue, will be crucial.

The company's net leverage ratio remained a concern, standing at approximately 4.2x Adjusted EBITDA as of March 2024. This elevated debt level restricts financial flexibility for new investments and makes the company more susceptible to rising interest rates.

| Financial Metric | Q1 2025 | FY 2024 | March 2024 | Key Concern |

|---|---|---|---|---|

| Revenue | $822 million (-5%) | N/A | N/A | Declining revenue trend |

| Net Loss | $56 million | $378.4 million | N/A | Widening losses |

| Net Leverage Ratio | N/A | N/A | 4.2x Adjusted EBITDA | Limited financial flexibility |

Same Document Delivered

Advantage Solutions SWOT Analysis

The preview you see is the same Advantage Solutions SWOT analysis document you’ll receive upon purchase. This ensures transparency and allows you to assess the professional quality and comprehensive nature of the report before committing. You're getting a genuine look at the valuable insights within.

Opportunities

The retail media market is booming, with global ad spend anticipated to hit $177.7 billion by 2025. This presents a golden opportunity for Advantage Solutions, leveraging its expertise in retail media to connect brands with shoppers precisely at the moment of decision.

The global outsourced sales service market is experiencing robust expansion, with projections indicating continued growth as companies prioritize efficiency and specialized expertise. This trend is fueled by businesses increasingly looking to outsource to enhance operational effectiveness, with an estimated 70% of companies expected to leverage outsourcing by 2025.

Advantage Solutions is well-positioned to capitalize on this surging demand. The company can leverage its established capabilities to attract new clients actively seeking to optimize their sales functions, thereby expanding its market share and revenue streams.

The retail and consumer packaged goods (CPG) sectors are heavily leaning into AI and advanced data analytics. This adoption is driven by the need for hyper-personalization, more accurate demand forecasting, and ultimately, better customer experiences. For example, in 2024, many retailers reported significant improvements in inventory management and sales uplift by implementing AI-powered forecasting models, with some seeing a 5-10% reduction in stockouts.

Advantage Solutions is well-positioned to seize this opportunity by deepening its integration of AI-driven insights across its service offerings. This strategic move can lead to enhanced operational efficiencies and the development of highly customized solutions for its clients, directly addressing the evolving demands of the market. By leveraging these technologies, the company can offer clients a competitive edge in a data-saturated environment.

Expansion in Digital Commerce and Omnichannel Strategies

The continuous expansion of digital commerce presents a significant opportunity for Advantage Solutions. As e-commerce solidifies its role as a primary shopping channel, there's a growing demand for sophisticated digital solutions. Advantage Solutions can capitalize on this by enhancing its offerings in digital commerce, assisting clients in optimizing their online presence and creating integrated customer journeys.

The emphasis on seamless omnichannel strategies further amplifies this opportunity. This trend requires businesses to effectively blend their online and in-store experiences, a complex task that Advantage Solutions is well-positioned to address. By developing and refining its omnichannel capabilities, the company can help clients achieve greater customer engagement and sales conversion across all touchpoints.

For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, with continued strong growth expected. This massive market size underscores the potential for Advantage Solutions to support clients in capturing a larger share of online sales. The company's expertise in areas like digital marketing, data analytics, and customer experience management can be leveraged to build robust omnichannel frameworks.

- Growth in E-commerce: Global e-commerce sales are projected to exceed $7 trillion by 2025, indicating a substantial market for digital solutions.

- Omnichannel Demand: A significant percentage of consumers expect a consistent experience across online and offline channels, driving the need for integrated strategies.

- Digital Solution Development: Advantage Solutions can expand its service portfolio to include advanced e-commerce platform integration and digital marketing automation.

- Client Optimization: The company can help clients improve their online visibility, streamline checkout processes, and personalize customer interactions to boost sales.

Meeting Consumer Demand for Sustainability and Transparency

Consumers are increasingly prioritizing sustainability and transparency, with the market for sustainable products experiencing robust growth. For instance, sales of sustainable products in the US grew by over 7% in 2023, significantly outpacing the overall retail market. Advantage Solutions is well-positioned to help its consumer packaged goods (CPG) clients capitalize on this trend.

By offering services focused on ethical sourcing, clean labeling, and supply chain transparency, Advantage Solutions can empower its clients to meet these evolving consumer values. This includes providing data-driven insights into consumer preferences for eco-friendly packaging and ingredient sourcing, enabling CPG brands to align their offerings with market demand.

- Growing Demand: Sustainable product sales are outpacing conventional products, indicating a significant market shift.

- Brand Alignment: Advantage Solutions can help CPG clients align their brand messaging and product development with consumer demand for sustainability.

- Transparency Services: Offering solutions for supply chain visibility and clear product labeling can build consumer trust and loyalty.

- Market Differentiation: Embracing sustainability and transparency allows CPG brands to differentiate themselves in a competitive landscape.

The expanding retail media landscape, with projected global ad spend reaching $177.7 billion by 2025, offers Advantage Solutions a prime opportunity to connect brands with consumers at crucial purchasing moments.

The increasing reliance on AI and advanced data analytics within the retail and CPG sectors, with retailers seeing 5-10% reductions in stockouts in 2024 through AI forecasting, allows Advantage Solutions to enhance client operations and offer tailored solutions.

The robust growth of e-commerce, expected to surpass $7 trillion by 2025, and the demand for seamless omnichannel experiences present a significant avenue for Advantage Solutions to bolster its digital commerce and integrated customer journey services.

Advantage Solutions can leverage the growing consumer preference for sustainability, evidenced by a 7% growth in sustainable product sales in the US during 2023, by offering services focused on ethical sourcing and supply chain transparency.

Threats

Ongoing market uncertainty and soft market conditions, as acknowledged by Advantage Solutions' management, represent a significant threat. This economic volatility can directly impact client spending on marketing and sales services, potentially leading to reduced demand for Advantage Solutions' offerings.

For instance, if consumer confidence wanes, businesses may scale back their marketing budgets, directly affecting Advantage Solutions' revenue streams. The company's own reports have highlighted these soft market conditions, indicating a cautious outlook from clients.

The retail and CPG marketing sector is a battlefield, with new challenger brands constantly entering and a complex advertising environment. Advantage Solutions must navigate this, as increased competition from specialized agencies and shifting strategies could erode its market share and weaken its ability to set prices. For example, the digital advertising spend in the CPG sector alone was projected to reach over $100 billion globally in 2024, indicating the intense fight for consumer attention.

While CPG digital ad spending is projected to continue its upward trajectory, the pace of growth is anticipated to moderate in 2025. Analysts predict a deceleration from the robust double-digit increases seen in prior years. This trend could present a challenge for Advantage Solutions, as it may affect the expansion rate of a significant revenue source within their digital marketing services.

Growth of Private Label Brands

The rising prominence of private label brands presents a significant challenge. Consumers increasingly view these store-brand offerings as comparable in quality to established national brands, which directly impacts the market position of Advantage Solutions' CPG clients. For example, in 2024, private label sales continued to gain market share across many grocery categories, often outpacing the growth of national brands.

This trend could diminish the demand for services focused on supporting traditional branded products, as retailers leverage their own brands to capture consumer loyalty and margin. The competitive pressure from private labels is forcing CPG manufacturers to re-evaluate their strategies, potentially leading to reduced marketing and promotional spend.

- Increased Private Label Market Share: Private label sales have consistently grown, capturing a larger percentage of total retail sales, particularly in essential goods categories.

- Consumer Perception Shift: A growing segment of consumers now perceives private label quality as on par with or even superior to national brands.

- Impact on CPG Clients: This shift directly affects Advantage Solutions' clients by potentially reducing their market share and the need for services supporting brand differentiation.

Supply Chain and Labor Market Volatility

Continued labor shortages remain a significant concern. In early 2024, the U.S. unemployment rate hovered around 3.9%, indicating a tight labor market where attracting and retaining talent is challenging. This can directly impact Advantage Solutions' ability to staff effectively, potentially leading to service delays or reduced capacity.

Global supply chain disruptions pose another substantial threat. Geopolitical tensions and lingering effects from past global events continue to create unpredictability in the availability and cost of goods. For Advantage Solutions, this could translate into higher operational costs and difficulties in sourcing necessary materials or products for their clients, impacting client inventory levels and overall operational efficiency.

These external factors can create a ripple effect, leading to reduced order volumes for Advantage Solutions' services. When clients face their own operational inefficiencies due to labor or supply chain issues, their demand for outsourced solutions may decrease. For example, if a retail client cannot secure inventory due to supply chain problems, they are less likely to require Advantage Solutions' services for fulfillment or merchandising.

- Labor Shortages: U.S. unemployment rate around 3.9% in early 2024 continues to make staffing difficult.

- Supply Chain Instability: Ongoing global disruptions can increase costs and affect product availability for clients.

- Reduced Client Demand: Operational inefficiencies for clients can lead to lower order volumes for Advantage Solutions.

- Impact on Services: Difficulty in sourcing or staffing can directly hinder Advantage Solutions' ability to deliver services effectively.

The competitive landscape for Advantage Solutions is intensifying, particularly with the rise of private label brands. These brands are increasingly perceived by consumers as comparable to national brands, directly impacting the market position of Advantage Solutions' clients. This trend could lead to reduced demand for services that support traditional branded products.

| Threat Category | Specific Threat | Impact on Advantage Solutions | Supporting Data/Trend (2024-2025) |

|---|---|---|---|

| Market Competition | Increased Private Label Market Share | Reduced demand for services supporting national brands. | Private label sales continue to gain market share across grocery categories. |

| Economic Conditions | Soft Market Conditions / Economic Volatility | Potential reduction in client spending on marketing and sales services. | Consumer confidence fluctuations can directly impact marketing budgets. |

| Industry Dynamics | Shifting Digital Advertising Spend Growth | Slower expansion rate for digital marketing services. | Digital ad spend growth in CPG is moderating from double-digit increases. |

| Operational Challenges | Labor Shortages | Difficulty in staffing, potentially leading to service delays. | U.S. unemployment rate around 3.9% in early 2024 indicates a tight labor market. |

SWOT Analysis Data Sources

This Advantage Solutions SWOT analysis is built upon a foundation of credible data, incorporating financial statements, comprehensive market research, and expert industry commentary to ensure a robust and insightful assessment.