Advantage Solutions Bundle

What is Advantage Solutions' Growth Strategy?

Advantage Solutions, established in 1987, is a leader in retail solutions. It connects CPG brands with retailers, focusing on omnichannel strategies. The company's evolution from a sales and marketing service to a comprehensive agency highlights its adaptability.

The company's success stems from its ability to integrate data and technology, enhancing brand presence across all sales channels. This strategic approach supports clients from initial planning through to final execution, boosting brand visibility and overall performance.

Advantage Solutions' growth strategy is deeply rooted in its comprehensive approach to retail and consumer goods. The company focuses on leveraging its extensive network and data analytics to provide end-to-end solutions for its clients. This includes everything from in-store execution and merchandising to digital marketing and e-commerce support. By offering a full spectrum of services, Advantage Solutions aims to be an indispensable partner for brands looking to navigate the complex retail landscape. The company's commitment to innovation is evident in its continuous investment in technology to enhance consumer engagement and optimize supply chain efficiency. For a deeper understanding of its market positioning, one might consider an Advantage Solutions BCG Matrix analysis.

How Is Advantage Solutions Expanding Its Reach?

Advantage Solutions is actively pursuing a growth strategy centered on portfolio simplification and enhancing its core service offerings for CPG and retailer clients.

The company has strategically divested non-core assets to sharpen its focus. This includes the sale of its digital advertising platform, Jun Group, for approximately $185 million in July 2024, with proceeds earmarked for debt reduction and core business reinvestment.

Advantage Solutions is bolstering its foundational services through strategic alliances and internal realignments. Agreements with Genpact and Tata Consultancy Services (TCS) in early 2024 aim to streamline operations and modernize IT infrastructure as part of a broader growth acceleration plan.

The company has reorganized into three primary units: Branded Services, Experiential Services, and Retailer Services. This strategic alignment is designed to support business priorities and foster long-term, profitable expansion.

The Experiential Services segment, encompassing in-store and online sampling and live events, demonstrates continued strength. Average event counts for sampling and demonstration saw an 11% increase in Q2 2024, with further growth anticipated in the latter half of the year.

The company's expansion initiatives also highlight a commitment to key client relationships and operational excellence. Advantage Solutions continues to cultivate its partnership with Amazon, recently receiving Amazon's inaugural Gold Tier award for delivery excellence, underscoring its dedication to high-quality service delivery.

Advantage Solutions' growth strategy is multifaceted, focusing on streamlining operations and enhancing core service delivery. The company's future prospects are tied to its ability to leverage these strategic moves for sustained market presence.

- Divestiture of non-core assets to focus on CPG and retailer services.

- Strategic partnerships with Genpact and TCS for process optimization.

- Re-segmentation into Branded, Experiential, and Retailer Services units.

- Continued growth in Experiential Services, with an 11% rise in sampling/demonstration events in Q2 2024.

- Recognition from Amazon for delivery excellence, reinforcing client relationships.

These strategic initiatives are integral to understanding the Brief History of Advantage Solutions and its ongoing efforts to adapt and thrive in the market. The company's focus on core business enhancement and operational efficiency positions it for future success, contributing to its overall Advantage Solutions growth strategy.

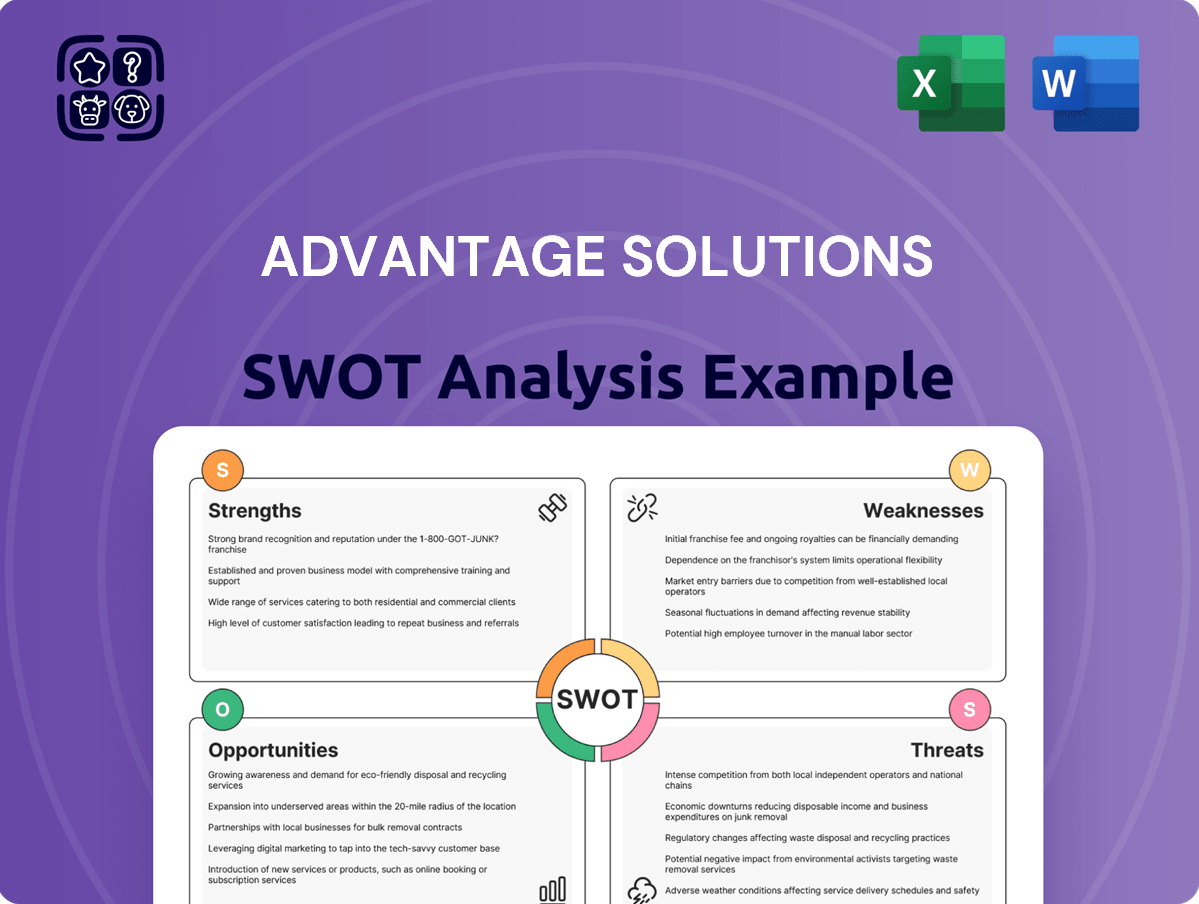

Advantage Solutions SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Advantage Solutions Invest in Innovation?

Advantage Solutions is actively investing in technology and innovation to fuel its growth strategy and enhance its service offerings. The company is focusing on significant advancements in information technology and data management to improve operational efficiencies and expand its capabilities.

The company is embracing digital transformation by integrating cutting-edge technologies into its operations. This focus aims to modernize its infrastructure and service delivery.

In early 2024, a partnership with Genpact was formed to develop an innovative market entry model. This collaboration leverages Genpact's advanced AI technologies for more efficient back-office services.

A strategic partnership with Tata Consultancy Services (TCS) is underway to modernize the company's IT infrastructure. This includes support, device provisioning, and application management.

These technological investments are designed to boost Advantage's ability to serve its CPG partners. The goal is to deliver results with increased speed, precision, and deeper insights.

The company's strategy aligns with major trends identified in the Ad Age Agency Report 2025, such as AI reshaping creativity and evolving client expectations for precision and agility.

Advantage Solutions offers a comprehensive suite of omnichannel services. This includes retail media, marketing technology, and digital commerce, showcasing its commitment to technology across the entire path to purchase.

The company is actively pursuing innovation, evidenced by its filing of 27 patents. These patents cover key areas such as AI automation, execution, and trade logic, underscoring its dedication to developing proprietary technological solutions.

- Infusing 'high-tech, high-touch, high-value solutions'

- Leveraging AI for operational efficiency

- Modernizing IT infrastructure for better service

- Enhancing precision and agility in client delivery

- Integrating omnichannel capabilities

- Protecting intellectual property through patents

Advantage Solutions PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Advantage Solutions’s Growth Forecast?

Advantage Solutions experienced a challenging start to 2025, with a 5% revenue decrease to $822 million in the first quarter compared to the previous year. This financial performance reflects ongoing strategic adjustments and market dynamics impacting the company's operations.

The company reported a net loss of $56 million in Q1 2025, an increase from the $50 million loss in Q1 2024. This was attributed to deliberate client exits, transformation costs, labor shortages, and reduced retail inventory affecting order volumes.

For the full year 2024, revenues were $3.57 billion, a decrease from $3.90 billion in 2023, though Adjusted EBITDA saw a slight increase of 1.1% to $356 million. The company has revised its 2025 guidance downward, anticipating revenues and adjusted EBITDA to be flat to down low single digits, reflecting heightened market uncertainty.

Advantage Solutions is committed to disciplined capital allocation, including voluntary debt repurchases and share buybacks. In 2024, the company repurchased approximately $158 million in debt and $34 million in shares, aiming to reduce its net leverage to below 3.5x from the current 4.2x as of March 31, 2025.

Analysts project Q2 2025 earnings per share of $0.12 and revenue of $792.51 million. The average twelve-month stock price forecast is $2.25, with a high of $2.50 and a low of $2.00, indicating a potential upside of 64.23% from the July 25, 2025 price of $1.37.

Understanding the Competitors Landscape of Advantage Solutions is crucial when evaluating its financial trajectory. The company's strategic initiatives, including client portfolio adjustments and operational efficiencies, are key to navigating the current economic climate and achieving its long-term growth objectives. The focus on deleveraging and prudent capital deployment signals a commitment to strengthening its financial foundation for future success.

Revenues declined by 5% to $822 million in Q1 2025, following a full-year 2024 revenue of $3.57 billion.

A net loss of $56 million was reported in Q1 2025, with Adjusted EBITDA down 18% to $58 million for the same period.

The 2025 outlook was lowered to flat to down low single digits for revenues and adjusted EBITDA due to market uncertainty.

The company repurchased $158 million in debt in 2024 and aims for a net leverage ratio below 3.5x.

Analysts forecast a potential 64.23% upside for the stock, with an average price target of $2.25.

Q2 2025 projections include earnings per share of $0.12 and revenue of $792.51 million.

Advantage Solutions Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Advantage Solutions’s Growth?

Advantage Solutions faces significant headwinds that could impact its Advantage Solutions growth strategy and future prospects. Market competition is intensifying, with clients demanding greater precision and agility from agencies. Macroeconomic factors, such as declining consumer confidence and tariff uncertainties, are also affecting consumer purchasing behavior and order volumes, as evidenced by the company's Q1 2025 results which showed a 5% revenue decline and an increased net loss.

The landscape of client expectations is constantly shifting, requiring agencies to deliver more sophisticated and responsive services. This dynamic environment presents a continuous challenge for maintaining market share and driving growth.

Waning consumer confidence and concerns over tariffs are directly impacting consumer spending and, consequently, order volumes for businesses. These external economic pressures create an uncertain operating environment.

Staffing difficulties and shortages in specific regions are hindering the company's execution capabilities. This is particularly noticeable in segments like Experiential Services and Retailer Services, impacting service delivery.

The Q1 2025 financial results indicated a 5% revenue decline and a widening net loss, partly due to market uncertainties and transformation expenses. S&P Global Ratings revised the outlook to negative in June 2025, citing weaker-than-expected Q1 performance.

The company's S&P Global Ratings-adjusted leverage is projected to remain high, around 6x in fiscal year 2025. This elevated leverage level poses a risk to financial flexibility and future investment capacity.

While transformation initiatives aim to improve efficiency, there is an inherent execution risk associated with these complex changes. The company also remains vulnerable to economic downturns impacting its business model.

Management is actively pursuing transformation initiatives designed to enhance efficiency and bolster cash flow. These efforts include streamlining operations, improving operating efficiencies, and strategically investing in advanced technologies and talent. The company is also prioritizing disciplined capital allocation, such as voluntary debt repurchases, to strengthen its balance sheet and reduce its net leverage ratio. Despite these proactive measures, the business acknowledges the near-term risks posed by macroeconomic uncertainty and is implementing cost reduction programs to mitigate these impacts. Understanding the Growth Strategy of Advantage Solutions is crucial in light of these challenges.

Streamlining operations and enhancing efficiencies are key components of the company's strategy to navigate current market conditions and improve financial performance.

Investments in leading-edge technologies and talent development are intended to bolster the company's competitive advantage and adapt to evolving client needs.

Disciplined capital allocation, including voluntary debt repurchases, is a focus area to improve the company's financial health and reduce its leverage ratio.

Proactive implementation of cost reduction programs is underway to address the impact of macroeconomic uncertainties and support profitability.

Advantage Solutions Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

- What is Brief History of Advantage Solutions Company?

- What is Competitive Landscape of Advantage Solutions Company?

- How Does Advantage Solutions Company Work?

- What is Sales and Marketing Strategy of Advantage Solutions Company?

- What are Mission Vision & Core Values of Advantage Solutions Company?

- Who Owns Advantage Solutions Company?

- What is Customer Demographics and Target Market of Advantage Solutions Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.