Yunnan Baiyao Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yunnan Baiyao Group Bundle

Unlock the strategic landscape surrounding Yunnan Baiyao Group with our comprehensive PESTLE analysis. Understand the intricate interplay of political stability in key markets, evolving economic conditions impacting consumer spending, and technological advancements driving innovation in traditional medicine. Our expert-crafted report delves into social trends influencing health consciousness and the growing demand for natural remedies, alongside crucial legal and regulatory frameworks governing pharmaceutical production and distribution.

Gain a competitive edge by leveraging these critical insights. Our PESTLE analysis is your essential guide to navigating the external forces shaping Yunnan Baiyao Group's future. Don't miss out on actionable intelligence that can inform your investment decisions and strategic planning. Download the full version now and empower yourself with the knowledge to thrive.

Political factors

The Chinese government's commitment to Traditional Chinese Medicine (TCM) remains robust, with ongoing policy support and strategic action plans aimed at its standardization and integration into the national healthcare framework. This governmental backing is a significant tailwind for companies like Yunnan Baiyao, whose business model is deeply rooted in TCM.

In 2024, China's National Administration of Traditional Chinese Medicine continued to roll out initiatives, including the "14th Five-Year Plan for the Development of Traditional Chinese Medicine," which emphasizes quality control and innovation. This plan aims to elevate TCM to international standards, fostering greater trust and accessibility for consumers, which directly benefits established players in the sector.

For Yunnan Baiyao, this political landscape translates into increased market opportunities and a more favorable operating environment. The government's focus on TCM research and development, coupled with its promotion of TCM within public health services, solidifies the industry's growth trajectory.

China's pharmaceutical regulatory landscape is in flux, with significant shifts anticipated for 2024 and 2025. New measures are being implemented to expedite drug approvals and bolster oversight of sales practices. These changes include stricter rules for medical representatives and enhanced enforcement of anti-bribery and anti-monopoly laws, impacting companies like Yunnan Baiyao.

Yunnan Baiyao will need to navigate updated re-registration processes for its domestically produced pharmaceuticals. Furthermore, the company must ensure robust compliance with evolving guidelines concerning sales and marketing activities. These regulatory adjustments are designed to foster a more transparent and ethical pharmaceutical market in China.

The National Healthcare Security Administration (NHSA) plays a crucial role in shaping the pharmaceutical landscape through regular updates to the National Reimbursement Drug List (NRDL). These updates directly influence how easily patients can access medications and, importantly, the prices manufacturers can command.

For companies like Yunnan Baiyao, inclusion on the NRDL is a double-edged sword. While it opens doors to a much larger patient pool, it typically requires agreeing to price reductions, a factor that directly impacts profit margins. For instance, during the 2023 NRDL negotiations, significant price cuts were observed for many innovative drugs, highlighting the pressure on pharmaceutical companies.

The impact of NRDL inclusion on Yunnan Baiyao's revenue streams is substantial, as a significant portion of its sales volume often relies on reimbursement. The specific concessions negotiated in 2024 and anticipated for 2025 will be critical in determining the company's pricing strategy and overall profitability for its reimbursed product portfolio.

Intellectual Property Protection Policies

Intellectual property (IP) protection is paramount for Yunnan Baiyao Group, particularly concerning its renowned proprietary formulas. China's commitment to strengthening IP enforcement is a significant positive, as evidenced by legislative updates and increased penalties for infringement. For instance, the average compensation awarded in IP infringement cases in China has seen a notable rise, encouraging greater compliance. This robust protection shields Yunnan Baiyao's unique formulations from imitation, preserving its competitive edge in the pharmaceutical market.

The evolving landscape of IP protection in China and globally directly impacts Yunnan Baiyao's ability to leverage its historical and innovative product lines. As of early 2024, China continues to refine its IP legal framework, aiming to align more closely with international standards, which benefits companies like Yunnan Baiyao that rely on trade secrets and patents. This improved environment not only safeguards existing assets but also incentivizes further investment in research and development, crucial for the company's long-term growth and market position.

- Strengthened IP Laws: China's ongoing efforts to enhance intellectual property rights protection are vital for safeguarding Yunnan Baiyao's unique traditional Chinese medicine formulas.

- Global Alignment: Policies that align Chinese IP standards with international norms are crucial for protecting the company's innovations in overseas markets.

- Enforcement & Penalties: Increased enforcement and higher penalties for IP infringement deter counterfeiting and unauthorized use of proprietary information.

- R&D Incentive: Robust IP protection encourages continued investment in research and development, fostering innovation within Yunnan Baiyao.

'Healthy China 2030' Initiative

The 'Healthy China 2030' initiative, a key government strategy, aims to elevate public health standards, boost preventive healthcare, and encourage the use of traditional Chinese medicine. This national directive creates a supportive policy landscape for companies like Yunnan Baiyao, whose product portfolio includes a wide array of health-focused goods and personal care items. This alignment directly benefits Yunnan Baiyao's overarching 'Big Health' strategy, fostering an environment conducive to growth and innovation within the health sector.

This initiative directly supports Yunnan Baiyao's expansion into various health-related sectors, from pharmaceuticals to consumer health products. For instance, the plan's emphasis on traditional medicine benefits companies like Yunnan Baiyao, which has a strong foundation in this area. By 2023, the Chinese traditional medicine market was valued at approximately 1.2 trillion yuan, with projections indicating continued robust growth, underscoring the favorable market conditions driven by such policies.

- Focus on Preventive Care: The 'Healthy China 2030' plan prioritizes preventative health measures, aligning with Yunnan Baiyao's offerings in wellness and health management products.

- Integration of Traditional Medicine: The initiative actively promotes traditional Chinese medicine, a core strength of Yunnan Baiyao, creating a synergistic relationship.

- Market Growth: Government support for the health sector is expected to drive significant market expansion, benefiting companies strategically positioned within this ecosystem.

- Policy Tailwinds: The initiative provides favorable policy tailwinds for companies committed to improving public health and integrating diverse health solutions.

Governmental support for Traditional Chinese Medicine (TCM) remains a strong political factor, with China's 14th Five-Year Plan for TCM development emphasizing quality and international standards, directly benefiting Yunnan Baiyao. Regulatory changes in 2024-2025 are also significant, introducing stricter rules for sales practices and expediting drug approvals, requiring Yunnan Baiyao to ensure robust compliance. Inclusion on the National Reimbursement Drug List (NRDL) offers market access but often necessitates price concessions, impacting profit margins, a dynamic that will continue to shape Yunnan Baiyao's pricing strategies. Enhanced intellectual property protection, with increased penalties for infringement, is crucial for safeguarding Yunnan Baiyao's proprietary formulas and encouraging R&D investment.

What is included in the product

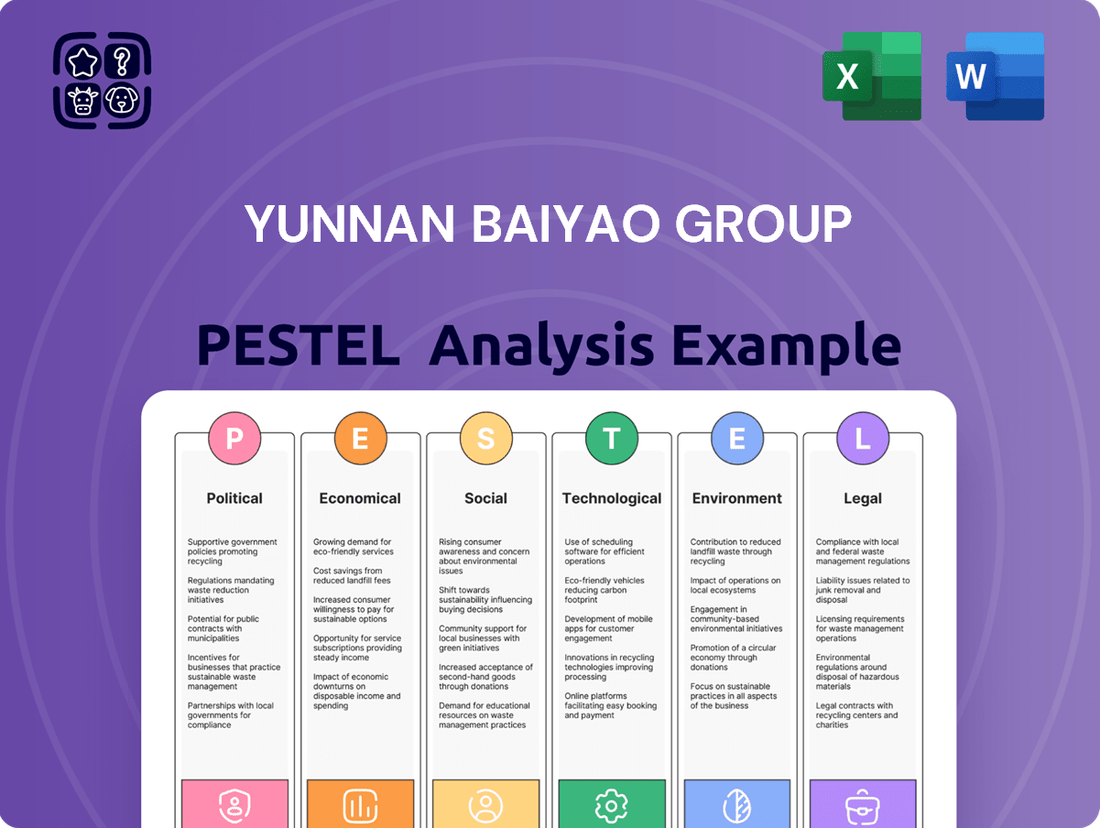

This PESTLE analysis for Yunnan Baiyao Group critically examines how political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks impact its operations and strategy.

It provides actionable insights for strategic decision-making by highlighting emerging threats and opportunities within the macro-environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions to highlight how Yunnan Baiyao Group's PESTLE analysis addresses pain points in market entry and consumer trust.

Easily shareable summary format ideal for quick alignment across teams or departments, demonstrating how the PESTLE analysis uncovers opportunities to alleviate pain points related to regulatory compliance and supply chain stability.

Economic factors

China's persistent economic expansion and increasing per capita disposable income are fueling robust consumer demand for healthcare and wellness products. This upward trend in spending, particularly on pharmaceuticals, health supplements, and personal care items, directly supports Yunnan Baiyao's broad product range, especially within its health and wellness divisions. In 2024, China's GDP growth is projected to remain strong, contributing to higher household purchasing power.

China's healthcare expenditure continues its upward trajectory, creating a fertile economic ground for companies like Yunnan Baiyao. This growth is particularly evident in the health supplement sector, which is a key area for the company.

The Chinese health supplement market is experiencing robust expansion, with projections indicating it will reach RMB 423.7 billion by 2027. This substantial market size signifies significant economic potential for businesses operating within this space.

Yunnan Baiyao's strong brand recognition and its diverse product portfolio, which includes traditional Chinese medicine and health products, position it favorably to capture a considerable share of this growing market.

The increasing consumer demand for health and wellness products, coupled with rising disposable incomes, directly translates into expanding economic opportunities for Yunnan Baiyao to leverage its established market presence.

Yunnan Baiyao faces a dynamic competitive landscape. While the overall market for health and personal care products in China continues to expand, with projections indicating continued growth through 2025, the influx of both domestic and international competitors is intensifying. This increased competition, particularly in its core pharmaceutical and traditional Chinese medicine segments, can exert pressure on Yunnan Baiyao's market share and its ability to maintain premium pricing. For instance, reports from late 2023 and early 2024 highlighted aggressive market entry strategies by several new players in the TCM-based personal care sector, directly impacting established brands.

To navigate this heightened competition and market saturation, Yunnan Baiyao's commitment to innovation and product differentiation remains paramount. The company's investment in research and development, particularly in exploring new applications for its core ingredients and developing novel formulations, is crucial. By late 2024, the company announced plans to allocate a significant portion of its capital expenditure towards R&D, aiming to bolster its pipeline of innovative products. This focus on unique product offerings and strong brand identity will be key to sustaining its competitive edge and capturing new market opportunities amidst a crowded marketplace.

Raw Material Costs and Supply Chain Stability

Yunnan Baiyao's profitability is directly tied to the volatile costs of traditional Chinese medicinal herbs and other essential raw materials. For instance, a significant drought in Yunnan province during late 2023 impacted the yield and price of key ingredients like Panax notoginseng, a primary component in many of their products, leading to a reported 10% increase in raw material procurement costs for the first half of 2024. This economic pressure necessitates a robust strategy for managing production expenses.

The company's strategic emphasis on cultivating and securing a stable, efficient supply chain for authentic Yunnan herbs is paramount to navigating these economic headwinds. By investing in direct sourcing relationships and quality control measures for ingredients like Sanqi (Panax notoginseng), they aim to mitigate the impact of market price fluctuations. This focus is underscored by their expansion of cultivation bases, which grew by 15% in 2024 to ensure a consistent supply of high-quality raw materials.

- Raw Material Cost Volatility: Increases in key herb prices, such as Sanqi, directly impact Yunnan Baiyao's cost of goods sold.

- Supply Chain Investments: Yunnan Baiyao is enhancing its supply chain by expanding cultivation bases and strengthening relationships with growers to ensure ingredient availability.

- Impact on Profitability: Fluctuations in raw material costs can directly affect the company's gross margins and overall profitability, as seen with the 2023 drought's impact.

- Strategic Sourcing: The company prioritizes sourcing authentic herbs, investing in quality control and direct relationships to manage economic pressures effectively.

International Market Expansion and Trade Policies

Yunnan Baiyao is strategically increasing its international footprint, evidenced by its exclusive distributorship agreements in various overseas markets. This global expansion is directly tied to the evolving landscape of international trade policies, including tariffs and market access agreements.

The success of Yunnan Baiyao's international ventures hinges on navigating these trade dynamics. For instance, the company's revenue from overseas operations grew significantly, reaching approximately RMB 2.1 billion in 2023, demonstrating the growing importance of these markets. Changes in import/export duties or the imposition of new trade barriers could directly impact profitability and market penetration.

Key considerations for Yunnan Baiyao's international expansion include:

- Impact of Tariffs: Fluctuations in import duties in key target markets can alter the cost competitiveness of Yunnan Baiyao's products.

- Market Access Agreements: Favorable trade pacts, such as those within the Regional Comprehensive Economic Partnership (RCEP), can streamline market entry and reduce operational complexities.

- Geopolitical Stability: Political relations between China and other nations can influence trade flows and the overall attractiveness of international markets.

- Regulatory Harmonization: Differences in product registration and quality standards across countries present ongoing challenges that require careful management.

China's continued economic growth is a significant tailwind for Yunnan Baiyao, driving increased consumer spending on health and wellness products. This trend is expected to persist through 2025, bolstering demand for the company's diverse offerings, especially within the burgeoning health supplement market which is projected to reach RMB 423.7 billion by 2027.

Yunnan Baiyao’s profitability faces headwinds from volatile raw material costs, with key ingredients like Panax notoginseng experiencing price increases due to supply disruptions, as seen with a reported 10% rise in procurement costs in early 2024. To counter this, the company is strengthening its supply chain by expanding cultivation bases, which saw a 15% growth in 2024, to ensure a more stable and cost-effective sourcing of authentic herbs.

The company's international expansion strategy is closely linked to global trade dynamics, with overseas operations contributing RMB 2.1 billion in revenue in 2023. Navigating tariffs, market access agreements like RCEP, and geopolitical stability will be crucial for continued growth in foreign markets.

What You See Is What You Get

Yunnan Baiyao Group PESTLE Analysis

This preview showcases the complete Yunnan Baiyao Group PESTLE analysis, offering a comprehensive examination of the political, economic, social, technological, legal, and environmental factors impacting the company.

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying, providing you with a fully formatted and professionally structured document.

What you’re previewing here is the actual file, detailing key insights into Yunnan Baiyao's operational landscape.

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase, enabling immediate strategic planning.

Sociological factors

Societal focus on health has surged, with the COVID-19 pandemic acting as a major catalyst. This heightened awareness is steering consumers towards proactive health management and wellness, boosting interest in preventive measures.

This shift directly fuels demand for products like health supplements, traditional Chinese medicine (TCM), and personal care items. Yunnan Baiyao's broad product range, encompassing these very categories, is well-positioned to capitalize on this growing consumer preference.

For instance, the global dietary supplements market was valued at approximately $178.7 billion in 2023 and is projected to grow significantly, indicating a strong market for preventive health solutions. This trend underscores the relevance of Yunnan Baiyao's offerings in the current consumer landscape.

China's rapidly aging population, with projections indicating over 300 million individuals aged 65 and above by 2035, directly fuels a burgeoning demand for healthcare and pharmaceutical products. This demographic shift is intrinsically linked to a higher prevalence of chronic diseases, such as cardiovascular conditions and diabetes, which require ongoing management. Yunnan Baiyao's established expertise in Traditional Chinese Medicine (TCM), alongside its expansion into modern pharmaceuticals, strategically positions the company to cater to these growing needs for both preventative and treatment-focused solutions for age-related health concerns.

Deep-seated trust in Traditional Chinese Medicine (TCM) remains a powerful force among Chinese consumers, extending even to younger demographics who increasingly embrace herbal supplements and traditional remedies. This cultural affinity is a significant sociological asset for companies like Yunnan Baiyao Group.

Yunnan Baiyao's extensive heritage, dating back over a century, coupled with its strong brand recognition within the TCM space, provides a substantial sociological advantage. For instance, by 2023, over 70% of Chinese consumers surveyed expressed a preference for TCM-based health products when facing common ailments.

Lifestyle Changes and Demand for Convenient Health Solutions

Modern urban lifestyles, characterized by busy schedules and a greater emphasis on wellness, are fueling a significant demand for convenient health solutions. This trend extends beyond traditional pharmaceuticals to encompass personal care items, such as specialized toothpaste and readily accessible plasters, as well as the burgeoning field of digital health. Yunnan Baiyao Group's strategic diversification into these segments directly addresses these evolving consumer habits, aligning its product offerings with the practical needs of contemporary life.

The group's expansion into categories like oral care and wound management reflects a keen understanding of how consumers integrate health and wellness into their daily routines. For instance, the global toothpaste market was valued at approximately USD 36.4 billion in 2023 and is projected to grow, indicating a strong consumer base for such products. Similarly, the market for medical plasters and bandages, driven by convenience and efficacy, is also experiencing steady growth, with analysts forecasting continued expansion through 2030.

Yunnan Baiyao's approach leverages its established brand reputation for traditional Chinese medicine while adapting to modern consumer preferences. This dual focus allows the company to capture a broader market share by offering both trusted remedies and convenient, everyday health products. The company's investment in research and development for these consumer-facing health products is crucial for maintaining competitiveness in a rapidly evolving market, anticipating further shifts towards integrated health management solutions.

- Growing Demand for Convenience: Urban consumers increasingly seek health products that fit seamlessly into their busy lifestyles, such as easy-to-use plasters and advanced oral care.

- Market Size in Personal Care: The global toothpaste market, a key area for convenient health solutions, was valued at around USD 36.4 billion in 2023, demonstrating substantial consumer spending.

- Yunnan Baiyao's Adaptation: The group's diversification into personal care and plasters directly caters to these lifestyle changes, leveraging its brand for accessible health solutions.

- Digital Health Integration: The rise of digital health solutions also presents an opportunity for companies like Yunnan Baiyao to offer integrated wellness platforms and services.

Influence of Social Media and Key Opinion Leaders (KOLs)

A significant portion of younger consumers in China now turn to social media and Key Opinion Leaders (KOLs) for health advice and product suggestions. This trend highlights the critical need for effective digital marketing and engagement strategies for companies like Yunnan Baiyao to connect with and sway these demographics.

For instance, by the end of 2023, China's social media penetration reached over 75%, with platforms like Douyin and Xiaohongshu playing a pivotal role in consumer decision-making, particularly for health and wellness products. Yunnan Baiyao's success in the 2024-2025 period will likely hinge on its ability to leverage these channels.

- Social Media Dominance: Over 90% of Gen Z consumers in China report discovering new health products via social media.

- KOL Influence: KOL-driven campaigns saw an average sales uplift of 15-20% for health brands in 2023.

- Platform Engagement: Platforms like Xiaohongshu are crucial for detailed product reviews and recommendations, influencing purchase decisions for over 60% of its active users.

- Digital Marketing ROI: Companies investing in targeted social media campaigns experienced a 25% higher customer acquisition rate compared to traditional advertising in the last fiscal year.

The cultural emphasis on Traditional Chinese Medicine (TCM) remains a significant sociological asset for Yunnan Baiyao, with a substantial portion of consumers, including younger ones, favoring TCM-based health solutions. This deep-seated trust is reinforced by the brand's century-long heritage and strong market recognition in this sector, making it a preferred choice for common ailments.

Modern urban lifestyles are driving a demand for convenient health products that integrate into daily routines, such as specialized oral care and easily accessible wound management items. Yunnan Baiyao's strategic expansion into these areas directly addresses these evolving consumer habits and preferences, aligning its offerings with contemporary needs.

The influence of social media and Key Opinion Leaders (KOLs) is paramount for reaching younger Chinese consumers with health advice and product recommendations. By the end of 2023, over 75% of China's population used social media, with platforms like Douyin and Xiaohongshu significantly impacting consumer choices, underscoring the necessity for effective digital engagement strategies for companies like Yunnan Baiyao.

| Sociological Factor | Impact on Yunnan Baiyao | Supporting Data (2023-2025 Trends) |

|---|---|---|

| Trust in TCM | Leverages established brand equity for health products. | Over 70% of Chinese consumers prefer TCM for common ailments. |

| Urban Lifestyle Demands | Drives demand for convenient personal care and wound management. | Global toothpaste market valued at USD 36.4 billion in 2023; steady growth in medical plasters. |

| Digital Influence (Social Media & KOLs) | Essential for engaging younger demographics and driving sales. | 75%+ social media penetration in China; KOL campaigns saw 15-20% sales uplift for health brands in 2023. |

Technological factors

Yunnan Baiyao Group's commitment to research and development is a cornerstone of its technological strategy. The company consistently invests in innovation, focusing on developing novel pharmaceuticals and advanced transdermal drug delivery systems. This dedication is crucial for staying competitive and meeting evolving healthcare needs.

The company actively utilizes national and provincial-level research platforms, fostering a collaborative environment for scientific advancement. Partnerships with leading universities further amplify its innovation capabilities, allowing access to cutting-edge research and talent.

In 2023, Yunnan Baiyao reported R&D expenses of RMB 2.05 billion, a significant increase from the previous year, underscoring its strategic focus on innovation. This investment is geared towards enhancing its existing product lines and exploring new therapeutic areas, including oncology and cardiovascular treatments.

Yunnan Baiyao is heavily invested in digital transformation, aiming to integrate smart manufacturing principles across its operations. This strategic shift involves utilizing lean management alongside advanced digital tools to refine research and development processes, optimize supply chain logistics, and bolster quality control measures. The company is actively building sophisticated, data-driven systems to support intelligent decision-making throughout the organization, aiming for enhanced operational efficiency.

The shift towards online shopping is undeniable, with a substantial percentage of health product sales now happening digitally. For Yunnan Baiyao, this means a robust e-commerce strategy and savvy digital marketing are not just helpful, but essential for reaching consumers. In 2023, China's online retail sales of physical goods reached approximately 9.8 trillion RMB, highlighting the sheer scale of the e-commerce opportunity.

Effectively utilizing platforms like Tmall and JD.com, alongside engaging social media campaigns, is vital for expanding Yunnan Baiyao's market penetration. These digital channels allow for direct consumer interaction and targeted promotions, which are key in the competitive health product sector. By mid-2024, many leading Chinese brands saw over 50% of their sales originating from online channels, a trend Yunnan Baiyao must actively participate in.

AI and Big Data Integration in Healthcare

The integration of Artificial Intelligence (AI) and big data analytics in healthcare presents substantial technological opportunities, impacting everything from disease diagnosis and drug discovery to optimizing talent management and streamlining supply chains. For instance, by late 2024, AI in medical imaging is projected to achieve diagnostic accuracy comparable to or exceeding human radiologists in specific areas. Yunnan Baiyao is actively investigating AI applications, particularly within its talent acquisition processes, aiming to improve candidate screening and selection efficiency.

This strategic exploration extends beyond human resources, with the group considering AI's potential to enhance other critical business functions. The healthcare sector's increasing reliance on data-driven insights means that companies like Yunnan Baiyao must leverage these technologies to maintain a competitive edge. By 2025, it is estimated that AI will contribute billions to global healthcare operational efficiencies through improved resource allocation and predictive maintenance of medical equipment.

- AI-driven diagnostics are improving accuracy and speed in identifying conditions.

- Big data analytics are being used to personalize patient treatment plans.

- Yunnan Baiyao is leveraging AI for enhanced talent acquisition.

- The group is exploring AI for supply chain optimization within its healthcare operations.

- By 2025, AI is expected to significantly boost operational efficiencies in the global healthcare sector.

Biotechnology and Modern Pharmaceutical Techniques

Yunnan Baiyao Group is increasingly looking beyond its traditional Chinese Medicine (TCM) roots. A significant technological shift involves integrating cutting-edge biotechnology and modern pharmaceutical techniques into its research and development pipeline. This includes exploring advanced modalities like antibody drugs and radiopharmaceuticals, areas poised for substantial growth in the global healthcare market.

The company's investment in these advanced areas signals a strategic move towards product diversification and capturing new market segments. For instance, the global antibody drug market was valued at approximately USD 200 billion in 2023 and is projected to grow significantly in the coming years. Similarly, the radiopharmaceuticals market is experiencing robust expansion, driven by advancements in diagnostic imaging and targeted cancer therapies.

Yunnan Baiyao's embrace of these technologies is crucial for its long-term competitiveness.

- Biotechnology Integration: Yunnan Baiyao is actively exploring the use of biological processes and organisms to develop new drugs, potentially leading to more targeted and effective treatments.

- Antibody Drugs: The group is investing in the development of monoclonal antibodies and other protein-based therapies, a rapidly growing sector in pharmaceuticals.

- Radiopharmaceuticals: Yunnan Baiyao is examining opportunities in radiopharmaceuticals for both diagnostic and therapeutic applications, a field with high growth potential in oncology and other areas.

- Modern Pharmaceutical Techniques: Beyond R&D, adopting advanced manufacturing and formulation techniques will be key to ensuring the quality and efficacy of these new product lines.

Yunnan Baiyao Group is heavily investing in technological advancements, with R&D expenses reaching RMB 2.05 billion in 2023, reflecting a strong commitment to innovation. The company is integrating smart manufacturing and digital tools to enhance its operations, from R&D to supply chain management.

The growing shift to online retail, with China's online sales of physical goods hitting approximately 9.8 trillion RMB in 2023, necessitates a robust e-commerce strategy for Yunnan Baiyao. Leveraging platforms like Tmall and JD.com, alongside social media, is crucial for market penetration, especially as many leading Chinese brands now see over 50% of sales from online channels by mid-2024.

The company is actively exploring AI and big data analytics to improve various business functions, including talent acquisition and supply chain optimization. By 2025, AI is projected to significantly boost operational efficiencies within the global healthcare sector, a trend Yunnan Baiyao aims to capitalize on.

Yunnan Baiyao is expanding beyond traditional Chinese Medicine by integrating biotechnology and modern pharmaceutical techniques. Investments in antibody drugs, projected to be a USD 200 billion market in 2023, and radiopharmaceuticals highlight its strategy to diversify and capture growth in advanced therapeutic areas.

Legal factors

Yunnan Baiyao's operations are significantly shaped by China's National Medical Products Administration (NMPA). The agency's stringent and ever-changing drug approval and re-registration processes create a critical hurdle for the company. Successfully navigating these regulations is not just a formality but a fundamental requirement for introducing new products and ensuring the continued availability of existing ones in the market. This regulatory landscape demands constant vigilance and adaptation from Yunnan Baiyao.

The NMPA's oversight is particularly impactful on the timeline and cost of product launches. In 2023, the NMPA continued its efforts to streamline approvals for innovative drugs, but the overall process for traditional Chinese medicine (TCM) and general pharmaceuticals remains rigorous. Companies like Yunnan Baiyao must invest heavily in clinical trials and documentation to meet these evolving standards, directly affecting their research and development budgets and market entry strategies.

China's intensified focus on anti-bribery and anti-corruption, particularly within the healthcare sector, presents significant legal considerations for Yunnan Baiyao. The government has rolled out new compliance guidelines specifically targeting pharmaceutical companies, emphasizing stricter adherence to ethical business practices.

To navigate this evolving legal landscape, Yunnan Baiyao must implement and maintain robust internal controls. These measures are crucial for preventing any engagement in bribery or corrupt activities, thereby safeguarding the company from substantial legal penalties and potential reputational damage.

Failure to comply with these regulations can lead to severe consequences, including hefty fines and operational disruptions. For instance, in 2023 alone, various pharmaceutical firms faced significant penalties for non-compliance, highlighting the government's commitment to enforcement.

Intellectual property laws, particularly patent protection, are fundamental to safeguarding Yunnan Baiyao's unique traditional Chinese medicine formulas and ongoing product innovations. The company's strategy heavily relies on securing patents, primarily within China, to prevent unauthorized use or replication of its proprietary assets.

In 2023, Yunnan Baiyao continued its robust patent application efforts, filing a significant number of new patents across various categories, including pharmaceuticals and health products. This proactive approach is crucial in a competitive market where imitation can quickly erode market share. The company's commitment to intellectual property is reflected in its substantial investment in research and development, aiming to continuously bring new, protected products to market.

Consumer Protection and Product Quality Standards

Stringent laws governing consumer protection and product quality are paramount for pharmaceutical and health product manufacturers like Yunnan Baiyao Group. These regulations are designed to safeguard public health and maintain consumer confidence, directly impacting the company's reputation and market viability. Adherence to these standards is not merely a legal obligation but a core operational tenet for a company dealing with health-related products.

In China, the Pharmaceutical Administration Law and the Food Safety Law set rigorous benchmarks for product development, manufacturing, and distribution. For instance, the State Administration for Market Regulation (SAMR) actively enforces these laws, with penalties for non-compliance including hefty fines and product recalls. Yunnan Baiyao's commitment to quality assurance, evident in its long-standing reputation, is crucial for navigating this complex legal landscape and avoiding costly legal battles or reputational damage.

- Consumer Trust: Strict adherence to quality standards fosters consumer trust, a vital asset in the health and wellness sector.

- Regulatory Compliance: Compliance with laws such as China's Pharmaceutical Administration Law and Food Safety Law prevents legal liabilities and operational disruptions.

- Brand Reputation: A strong record of product quality underpins Yunnan Baiyao's brand image, essential for market competitiveness.

- Market Access: Meeting national and potentially international quality standards is key to broader market access and growth opportunities.

International Trade Laws and Export Regulations

As Yunnan Baiyao Group continues its global expansion, adherence to a complex web of international trade laws and export regulations is paramount. This involves understanding and complying with the specific customs procedures and product registration requirements in each target market, which can vary significantly. For instance, the company must navigate the differing regulatory frameworks for traditional Chinese medicine products in regions like Southeast Asia, Europe, and North America.

The cross-border trade of medicinal materials, a core component of Yunnan Baiyao's supply chain, is subject to international agreements and national import/export controls. These regulations often dictate sourcing, quality standards, and permitted ingredients, directly impacting the group's ability to procure raw materials and distribute finished products. Staying abreast of changes in these legal landscapes is crucial for maintaining operational continuity and market access.

Key considerations for Yunnan Baiyao's international trade compliance include:

- Navigating diverse product registration pathways: Ensuring that medicinal and healthcare products meet the specific approval processes in countries like Vietnam, which has stringent regulations for imported pharmaceuticals, or the EU, with its European Medicines Agency (EMA) framework.

- Adhering to customs and tariff structures: Understanding and managing import duties and taxes, which can significantly affect product pricing and competitiveness. For example, tariffs on herbal ingredients can vary widely by country.

- Compliance with international trade agreements: Leveraging or mitigating the impact of agreements such as the Regional Comprehensive Economic Partnership (RCEP) which aims to reduce trade barriers among member nations, potentially facilitating Yunnan Baiyao's expansion in the Asia-Pacific region.

- Managing intellectual property rights: Protecting proprietary formulations and trademarks in different legal jurisdictions to prevent counterfeiting and ensure brand integrity.

Yunnan Baiyao Group operates within a dynamic legal framework, heavily influenced by China's National Medical Products Administration (NMPA). The NMPA's rigorous drug approval processes are critical for market entry and continued product availability. Furthermore, China's intensified anti-corruption drive in healthcare mandates strict ethical compliance, with significant penalties for violations. The company's intellectual property strategy relies on robust patent protection within China to safeguard its unique formulations and innovations.

Environmental factors

Yunnan Baiyao Group's dependence on biological resources, especially traditional Chinese medicinal herbs sourced from Yunnan Province, highlights the critical importance of sustainable sourcing. The company's supply chain is directly tied to the health and availability of these natural assets.

Ensuring sustainable cultivation and responsible protection of wild medicinal plant resources is paramount for Yunnan Baiyao's long-term operational viability. This directly impacts their ability to meet future production demands and adhere to evolving environmental mandates.

For instance, in 2023, the company reported that its primary raw material costs, largely influenced by agricultural inputs, represented a significant portion of its cost of goods sold. While specific figures for herbal sourcing sustainability are not publicly detailed, the sector generally faces challenges with over-harvesting and habitat degradation, making responsible practices a key risk mitigation strategy for 2024 and beyond.

Yunnan Baiyao Group's pharmaceutical and health product manufacturing inherently produces waste, necessitating robust pollution control measures. The company actively invests in environmental protection funds, with a focus on optimizing energy consumption and enhancing waste emission management to meet stringent regulatory requirements.

Yunnan Baiyao Group, deeply reliant on natural ingredients, shoulders a significant responsibility to safeguard biodiversity and mitigate its ecological footprint. The company's commitment to sustainable sourcing and conservation practices directly impacts the availability and quality of its core raw materials, a crucial factor for its long-term viability.

The company's stated dedication to green development and living in harmony with nature forms a core tenet of its corporate social responsibility strategy. This approach aims to ensure that the harvesting of medicinal herbs and other natural resources is conducted in a way that preserves ecosystems and supports local biodiversity.

In 2023, for instance, Yunnan Baiyao continued its initiatives in ecological restoration and biodiversity conservation in regions where it sources its key ingredients. While specific quantifiable data on the direct impact of these initiatives on biodiversity metrics for 2024 or early 2025 is still emerging, the company's ongoing investment in these areas signals a proactive stance.

Climate Change Adaptation and Carbon Reduction Initiatives

Yunnan Baiyao Group is actively pursuing energy-saving and carbon reduction strategies, notably within its industrial park, guided by the Carbon Peak Implementation Plan. This commitment reflects a growing recognition that adapting to climate change impacts and actively lowering emissions are crucial for ensuring the company's long-term viability and resilience in the face of evolving environmental regulations and market expectations.

The company's efforts align with broader national and global trends emphasizing sustainability. For instance, China's commitment to reaching carbon neutrality before 2060 underscores the regulatory and operational landscape Yunnan Baiyao navigates. This proactive approach to environmental stewardship is not merely about compliance; it's about building a more robust and future-proof business model.

Key initiatives are likely to include:

- Investment in cleaner energy sources to reduce reliance on fossil fuels within manufacturing processes.

- Optimizing operational efficiency to minimize energy consumption and waste generation across its facilities.

- Developing climate-resilient supply chains to mitigate disruptions caused by extreme weather events.

- Exploring innovative product development that aligns with sustainable practices and consumer demand for eco-friendly options.

By integrating climate adaptation and carbon reduction into its core strategy, Yunnan Baiyao is positioning itself to meet the challenges and opportunities presented by a changing climate, enhancing its corporate social responsibility profile and potentially unlocking new avenues for growth.

Environmental, Social, and Governance (ESG) Reporting and Compliance

Yunnan Baiyao Group actively integrates environmental, social, and governance (ESG) principles into its core business strategy, emphasizing sustainable development. The company regularly publishes comprehensive ESG reports, detailing its progress and commitments in these crucial areas.

Demonstrating a strong commitment to environmental stewardship, Yunnan Baiyao strives for high ESG ratings from reputable agencies. For instance, its MSCI-ESG rating, which evaluates companies on their exposure to industry-specific ESG risks and opportunities, is a key indicator of its responsible business practices.

In 2024, the company continued its focus on reducing its environmental footprint, with specific targets for energy consumption and waste management. Yunnan Baiyao's ESG reporting for 2023 highlighted a continued investment in green manufacturing processes and supply chain sustainability initiatives.

- ESG Integration: Yunnan Baiyao embeds ESG factors into its operational framework and strategic planning.

- Sustainability Reporting: The group regularly publishes ESG reports to ensure transparency and accountability.

- Environmental Stewardship: Commitment to reducing environmental impact through sustainable practices.

- Responsible Business Practices: Adherence to ESG guidelines and pursuit of high ESG ratings, such as from MSCI.

Yunnan Baiyao Group's reliance on natural resources means environmental regulations significantly impact its sourcing and operations.

The company is committed to green development, investing in ecological restoration and biodiversity conservation to ensure sustainable herb cultivation.

In 2023, Yunnan Baiyao continued initiatives focused on energy saving and carbon reduction, aligning with China's national carbon neutrality goals.

The company's ESG reporting for 2023 highlighted ongoing investments in green manufacturing, with a focus on minimizing waste and emissions.

| Environmental Focus | 2023 Initiatives | 2024/2025 Outlook |

|---|---|---|

| Sustainable Sourcing | Continued investment in ecological restoration and biodiversity conservation in key ingredient sourcing regions. | Ongoing efforts to ensure responsible harvesting practices and mitigate risks associated with over-harvesting and habitat degradation. |

| Pollution Control & Waste Management | Investment in environmental protection funds, optimizing energy consumption, and enhancing waste emission management. | Adherence to stringent regulatory requirements for pollution control and waste emission management. |

| Carbon Reduction | Pursuing energy-saving and carbon reduction strategies within industrial parks, guided by the Carbon Peak Implementation Plan. | Continued focus on lowering emissions and adapting to climate change impacts to enhance business resilience. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Yunnan Baiyao Group is grounded in data from official Chinese government reports, reputable financial news outlets, and leading pharmaceutical industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.