Yunnan Baiyao Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yunnan Baiyao Group Bundle

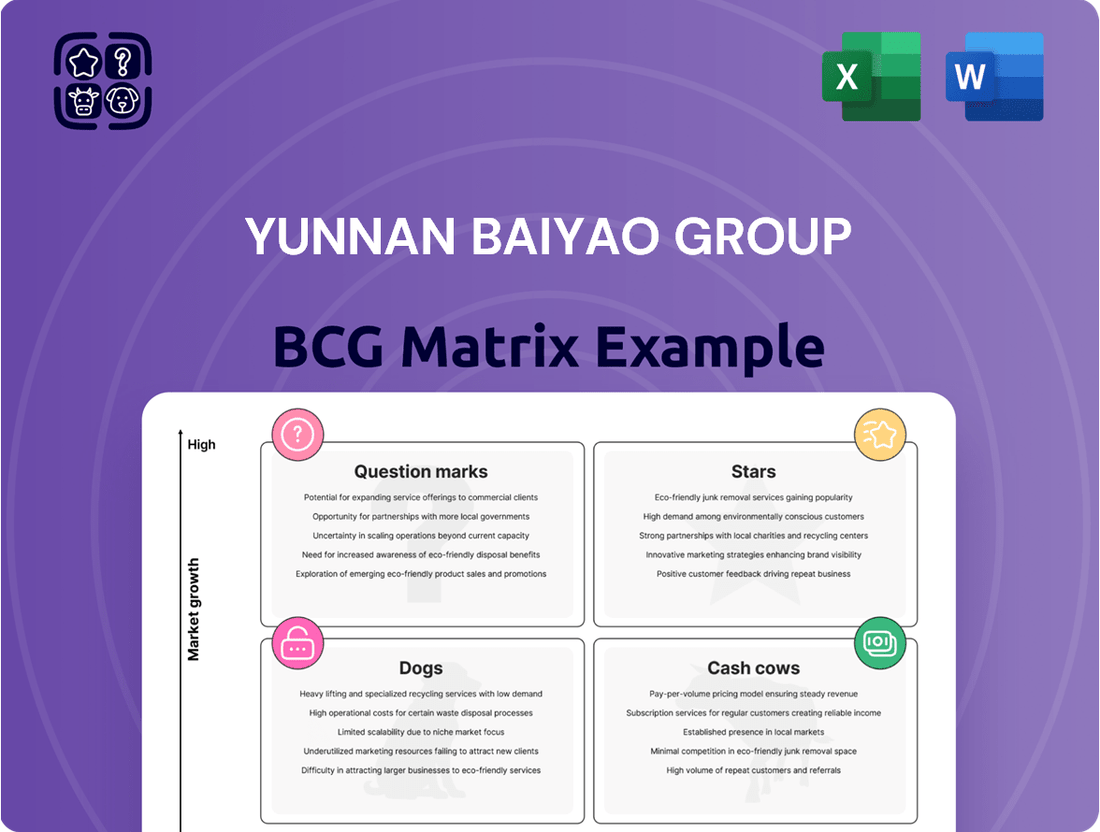

Yunnan Baiyao Group's BCG Matrix paints a compelling picture of its diverse product portfolio. Understanding whether its flagship products are Stars or Cash Cows, and identifying potential Dogs or Question Marks, is crucial for strategic resource allocation. This initial glimpse highlights the complexity of their market position.

To truly grasp the strategic implications and unlock actionable insights for growth, a deeper dive is essential. The full BCG Matrix report will reveal the precise quadrant placement for each of Yunnan Baiyao's key offerings, providing a clear roadmap for investment decisions.

Don't miss out on the opportunity to gain a competitive edge. Purchase the complete BCG Matrix to access detailed analysis, data-backed recommendations, and a comprehensive understanding of where Yunnan Baiyao Group is headed.

This report is your shortcut to strategic clarity, offering a quadrant-by-quadrant breakdown that empowers you to make informed decisions about product development and market focus.

Invest in the full BCG Matrix today and transform your understanding of Yunnan Baiyao Group's strategic landscape. It's time to move beyond the surface and harness the power of data-driven strategy.

Stars

Yunnan Baiyao's investment in innovative biopharmaceuticals and AI-driven Traditional Chinese Medicine (TCM) solutions, like their work with Huawei Cloud on a TCM industry large model, signals a strong push into potential . This strategic direction aims to capture market share in burgeoning segments, diversifying beyond their established product base.

Yunnan Baiyao Aerosol and Plasters are firmly positioned as Stars within the Yunnan Baiyao Group's BCG Matrix. In 2024, the aerosol product line alone achieved sales revenue surpassing RMB 2.1 billion, marking an impressive year-on-year growth of over 26%.

This robust performance underscores a dominant market share within the expanding pain management and trauma care segments of the pharmaceutical industry.

The sustained high growth trajectory of both the aerosol and plaster formulations of their flagship product validates their Star status.

Yangyuanqing Hair Care Products, a key player in Yunnan Baiyao Group's personal care division, is demonstrating significant momentum. In 2024, these products generated 0.422 billion yuan in sales revenue, marking an impressive 30.3% increase compared to the previous year. This robust growth trajectory highlights Yangyuanqing's strong market positioning and its potential for continued expansion, particularly within the burgeoning scalp health care niche.

The brand's strategic focus on online sales channels has proven highly effective, indicating a keen understanding of current consumer purchasing habits and a successful adaptation to the digital retail landscape. This online concentration not only drives sales but also provides valuable data for future marketing and product development efforts, reinforcing its status as a promising segment for Yunnan Baiyao.

Modernized Herbal Patch Line for Pain Management

Yunnan Baiyao's modernized herbal patch line for pain management represents a significant strategic move. This innovative product targets a high-demand therapeutic area, and its recent distribution across 28 countries underscores its global ambition and potential for substantial market share growth.

The expansion into numerous international markets highlights a burgeoning global demand for effective pain relief solutions, positioning this relatively new product line for rapid development. Yunnan Baiyao's investment in modernizing traditional herbal remedies taps into a growing consumer preference for natural wellness products.

- Global Reach: Distributed in 28 countries, demonstrating significant international market penetration.

- Market Potential: Addresses a high-demand therapeutic area for pain and joint management.

- Growth Trajectory: Poised for substantial market share gains due to product innovation and global distribution.

- Strategic Focus: Leverages traditional herbal knowledge with modern product development.

New Oral Care Product Extensions (beyond toothpaste)

Yunnan Baiyao Group is strategically diversifying its oral care portfolio beyond its established toothpaste brand, which functions as a Cash Cow. The company is introducing new product lines such as mouthwash and toothbrushes, designed to cater to increasingly specific consumer demands and preferences within the oral hygiene market. These new offerings are positioned to capitalize on the growth of the oral care sector, with a focus on innovative formulations and solutions for particular oral health concerns.

The introduction of these extensions, particularly those featuring advanced ingredients or addressing niche oral health issues, signifies their potential to become Stars in the BCG matrix. The global oral care market, valued at approximately USD 47.6 billion in 2023 and projected to grow at a CAGR of 4.9% from 2024 to 2030, provides a fertile ground for these new ventures. Yunnan Baiyao's investment in these areas reflects a clear strategy to capture a larger share of this expanding market.

- Market Expansion: Yunnan Baiyao is extending its oral care offerings to include mouthwash and toothbrushes, moving beyond its successful toothpaste product.

- Consumer Needs: These new products are developed to meet personalized consumer needs and address specific oral care issues.

- Market Growth: The global oral care market is experiencing robust growth, with projections indicating continued expansion in the coming years.

- Star Potential: Innovative formulations and targeted solutions within these new product extensions position them as potential Stars within Yunnan Baiyao's BCG matrix.

Yunnan Baiyao's aerosol and plaster products are clear Stars in the BCG matrix. In 2024, the aerosol line alone generated over RMB 2.1 billion in sales, showing more than a 26% year-on-year increase. This indicates their dominance in growing pain management markets.

Yangyuanqing Hair Care Products are also performing exceptionally well, with 2024 sales reaching 0.422 billion yuan, a significant 30.3% jump from the previous year. Their success in online channels highlights strong market positioning and adaptability.

The modernized herbal pain relief patches are demonstrating Star potential due to their global reach, now distributed in 28 countries. This expansion targets a high-demand therapeutic area, leveraging traditional knowledge for modern wellness.

New oral care products like mouthwash and toothbrushes are also positioned as potential Stars, aiming to capture share in the growing global oral care market, valued at approximately USD 47.6 billion in 2023.

| Product Category | 2024 Sales (RMB) | Year-on-Year Growth | Market Position |

|---|---|---|---|

| Aerosol & Plasters | > 2.1 Billion | > 26% | Dominant Star |

| Yangyuanqing Hair Care | 0.422 Billion | 30.3% | Growing Star |

| Herbal Pain Patches | N/A (New Launch) | N/A (Global Expansion) | Emerging Star |

| New Oral Care Products | N/A (New Launch) | N/A (Market Entry) | Potential Star |

What is included in the product

Yunnan Baiyao's BCG Matrix analysis identifies core products as Cash Cows, while new ventures are positioned as Stars or Question Marks requiring strategic investment.

Yunnan Baiyao Group's BCG Matrix offers a pain point reliever by visually categorizing its business units, clarifying strategic focus.

Cash Cows

Yunnan Baiyao's original powder and capsule formulations are true cash cows within the group's portfolio. These products, steeped in history and widely recognized for their efficacy in stopping bleeding and relieving pain, dominate a mature segment of the Traditional Chinese Medicine market.

Their consistent generation of substantial cash flow is a testament to deep-seated brand loyalty and their indispensable role for consumers. In 2023, Yunnan Baiyao Group reported total revenue of approximately 34.7 billion RMB, with its pharmaceutical segment, heavily influenced by these core products, remaining a significant contributor.

These established offerings require minimal promotional expenditure to retain their leading market positions, further enhancing their profitability. The enduring demand for their hemostatic and analgesic properties ensures a steady, reliable income stream for Yunnan Baiyao Group.

Yunnan Baiyao Toothpaste, a cornerstone of the Yunnan Baiyao Group, exemplifies a classic Cash Cow within the company's portfolio. It commands the largest market share in China's highly competitive oral care sector, demonstrating robust brand penetration and consumer loyalty.

Despite operating within a mature market, the toothpaste product consistently delivers top-tier financial performance. This stability is a direct result of its strong brand recognition, which minimizes the need for extensive growth-oriented investments, allowing it to generate significant and reliable cash flow for the group.

In 2023, the oral care segment of Yunnan Baiyao Group reported approximately 3.4 billion CNY in revenue, with toothpaste being a primary contributor, highlighting its role as a dependable cash generator. This consistent revenue stream is crucial for funding other ventures within the conglomerate.

Beyond its flagship Yunnan Baiyao series, the company boasts a robust portfolio of established Traditional Chinese Medicine (TCM) products like Pudilan Anti-inflammatory Tablets. These mature offerings are consistent revenue generators, exhibiting stable growth and benefiting from Yunnan Baiyao Group's strong brand equity in the TCM market. In 2023, these core TCM products represented a significant portion of the group's overall profitability, demonstrating their reliable contribution to cash flow with limited need for substantial investment.

Pharmaceutical Distribution and Commercial Logistics

Yunnan Baiyao's pharmaceutical distribution and commercial logistics segment operates as a classic Cash Cow. The company commands a dominant market share in its home province of Yunnan, with distribution networks extending effectively across major retail pharmacy chains.

This business unit, characterized by its low-growth environment, is a consistent generator of stable and predictable cash flow. It achieves this by reliably providing critical supply chain services to a wide array of medical institutions and end consumers.

The segment's robust performance is underscored by its role as a foundational pillar for Yunnan Baiyao's overall business strategy, underpinning other ventures with its dependable financial contributions.

- Market Dominance: Yunnan Baiyao holds a leading position in pharmaceutical distribution within Yunnan Province.

- Stable Cash Generation: Despite low market growth, this segment provides consistent and predictable cash flow.

- Essential Services: It supplies vital supply chain services to medical institutions and customers.

- Strategic Importance: This unit serves as a foundational business that supports the company's broader operational and strategic initiatives.

Medical Devices and Industrial Products

Yunnan Baiyao Group's medical devices and industrial products, including pharmaceutical packaging, are firmly positioned as cash cows. This segment benefits from a high market share within a mature and stable market, ensuring consistent demand from the essential healthcare sector.

These established products generate reliable cash flow, allowing the company to maintain its position without the need for substantial investment in rapid expansion. In 2023, Yunnan Baiyao Group reported revenue from their medical devices segment reaching approximately RMB 4.1 billion, showcasing its significant contribution.

- Established Market Presence: High market share in a stable sector.

- Consistent Demand: Steady revenue from healthcare sector needs.

- Cash Generation: Reliable cash flow without aggressive growth investment.

- Strategic Support: Funds and supports the core pharmaceutical business.

Yunnan Baiyao's original powder and capsule formulations, along with its toothpaste, are strong cash cows. These products, deeply entrenched in their respective markets, consistently generate substantial cash flow with minimal need for new investment. Their established brand loyalty and mature market positions ensure reliable revenue streams.

The company's pharmaceutical distribution and medical devices segments also function as cash cows, benefiting from stable demand and established market shares. These units provide predictable income, crucial for funding other business areas.

| Product Category | 2023 Revenue (RMB billions) | Market Position | Cash Flow Contribution |

|---|---|---|---|

| Original Powder/Capsules | (Part of Pharmaceutical Segment ~34.7 Bn total) | Dominant in mature TCM market | High, stable |

| Toothpaste | ~3.4 Bn CNY | Largest share in oral care | High, stable |

| Pharmaceutical Distribution | (Not separately disclosed, but significant) | Dominant in Yunnan Province | Consistent, predictable |

| Medical Devices | ~4.1 Bn | High share in stable healthcare sector | Reliable, supports core business |

Full Transparency, Always

Yunnan Baiyao Group BCG Matrix

The BCG Matrix analysis of Yunnan Baiyao Group you are currently previewing is the complete and final document you will receive upon purchase. This comprehensive report, free from watermarks or demo content, offers an in-depth strategic breakdown ready for immediate professional application.

Dogs

Certain niche modern pharmaceutical formulations within Yunnan Baiyao Group's portfolio may currently reside in the Dogs quadrant. These specialized products, perhaps targeting rare conditions or employing novel delivery systems, might be experiencing sluggish sales and limited market penetration, especially when compared to more established or widely adopted treatments.

For instance, if a particular bio-engineered formulation launched in 2023 has only secured a 0.5% market share in its intended therapeutic area by early 2024, and that market itself is only projected to grow by 2% annually, it would fit the Dogs profile. Such products often require significant ongoing investment in research, development, and marketing without a commensurate return, potentially hindering the group's overall profitability and resource allocation efficiency.

Some of Yunnan Baiyao Group's older, traditional herbal preparations might be categorized as Dogs. These are formulations that have seen their market share decline as newer, more effective, or commercially appealing alternatives have emerged. For instance, a specific liniment that was once popular but is now largely replaced by advanced topical analgesics could fall into this group.

Products in this category typically exhibit low growth prospects and a dwindling customer base. Their contribution to overall revenue is minimal, and they often require continued investment in production and distribution without generating significant returns. This can lead to them becoming cash traps, draining resources that could be better allocated to more promising ventures within the company's portfolio.

By mid-2024, it's likely that a portion of these legacy products would have seen their sales volumes drop considerably, potentially below 1% of the group's total revenue. Without a clear strategic plan for revitalization or a justifiable niche, these items represent a drag on profitability and operational efficiency, reflecting their status as Dogs in the BCG matrix.

Yunnan Baiyao's history includes diversification attempts that didn't fully pan out, such as certain health food products or specialized personal care items. These ventures, often characterized by low market share, represent potential 'Dogs' in a BCG analysis if they continue to require resources without generating substantial returns.

For instance, if a past health food line launched in the early 2020s, like a fortified herbal beverage, failed to gain traction against established competitors and only accounted for 0.5% of total group revenue by 2024, it would likely be classified as a Dog. Such initiatives can drain capital and management focus that could be better allocated to high-potential areas.

Products with Declining Market Share due to Intense Competition

Yunnan Baiyao Group's portfolio may include products facing intense competition, leading to a shrinking market share. These products, particularly if operating in mature or slow-growing market segments, could be classified as Dogs in the BCG Matrix. This means they generate just enough revenue to cover their costs but offer little potential for significant growth or profitability. For instance, some of their traditional herbal remedies might be seeing increased competition from modern pharmaceuticals or newer, more aggressively marketed natural health products.

The challenge for these "Dog" products lies in their inability to capture new customers or significantly increase sales volume in an environment where competitors are offering more innovative or cost-effective alternatives. This situation necessitates careful strategic consideration, as continued investment might not yield a substantial return.

- Declining Market Share: Products in this category have seen their share of the market diminish due to a heightened competitive landscape.

- Low Market Growth: They typically operate within industries experiencing minimal or no growth, limiting opportunities for expansion.

- Profitability Challenges: These items often struggle to maintain profitability, sometimes only breaking even.

- Strategic Re-evaluation: Management must decide whether to divest, harvest, or attempt a niche revitalization strategy for these products.

Non-core, Low-Volume Commodity Ingredients Trading

Yunnan Baiyao Group's involvement in non-core, low-volume commodity ingredient trading, particularly in certain traditional Chinese medicine (TCM) resources, could be categorized as a Dog in the BCG matrix. If these segments face intense competition or volatile pricing that erodes profitability, they might struggle to generate significant returns, potentially breaking even.

For instance, if a specific medicinal herb or raw ingredient segment has become oversupplied due to market saturation or experiences sharp price drops, its contribution to overall profitability would diminish. This contrasts with their core TCM resource development, which likely aims for higher growth and market share.

- Low Volume & Profitability: Segments trading niche or commoditized TCM ingredients might exhibit low sales volumes and thin profit margins.

- Market Saturation/Price Volatility: Intense competition or unpredictable commodity markets can depress earnings in these areas.

- Resource Allocation: Such "Dog" segments may tie up capital and management attention that could be better deployed in higher-potential business units.

- Strategic Re-evaluation: Yunnan Baiyao might consider divesting or restructuring these low-performing trading activities to optimize its portfolio.

Certain legacy product lines within Yunnan Baiyao Group's diverse portfolio may be classified as Dogs. These are typically items that have experienced declining sales and market share, often due to increased competition or shifting consumer preferences. For example, some older formulations of their topical analgesics or traditional herbal remedies might fall into this category if their market growth is minimal and their share is shrinking.

By early 2024, some of these products might have seen their sales contribution drop to below 1% of the group's total revenue, indicating low market attractiveness and potentially low profitability. These 'Dogs' often consume resources without generating substantial returns, necessitating a strategic decision regarding their future, such as divestment or a focused revitalization effort for a specific niche market.

Additionally, less successful diversification efforts, like certain health food or personal care items launched in the early 2020s that failed to gain traction against established brands, could be categorized as Dogs. If these ventures, for instance, only captured a 0.5% market share in their segment by 2024 with negligible growth prospects, they represent a drain on capital and management focus.

These products, characterized by low growth and low market share, often require continued investment in production and marketing without a commensurate return, potentially impacting overall resource allocation efficiency.

| Product Category Example | Market Share (Early 2024) | Market Growth (Projected Annual) | Revenue Contribution (Est. 2024) | Strategic Implication |

|---|---|---|---|---|

| Legacy Topical Analgesics | 1.5% | 2% | 0.8% | Consider divestment or niche marketing |

| Niche Health Food Line | 0.5% | 1% | 0.2% | Evaluate for discontinuation |

| Older Herbal Remedies | 1.0% | 1.5% | 0.6% | Harvest or explore revitalization |

Question Marks

Yunnan Baiyao Group is actively investing in emerging AI-powered diagnostic platforms within Traditional Chinese Medicine (TCM). These initiatives represent high-growth potential within the rapidly expanding healthcare technology sector. For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to reach $187.9 billion by 2030, showcasing the significant upside.

While these AI diagnostic systems are positioned for substantial future growth, Yunnan Baiyao's current market penetration in these specific nascent platforms is likely modest. The company is channeling considerable resources into the research, development, and commercialization of these smart TCM diagnosis systems, aiming to solidify its position in this innovative space.

These strategic investments are geared towards transforming these early-stage ventures into future Stars within the BCG matrix. The company's commitment reflects a forward-looking strategy to leverage cutting-edge technology to enhance TCM efficacy and accessibility, potentially capturing significant market share in the coming years.

Yunnan Baiyao's international health product expansion, targeting markets beyond mainland China, falls into the question marks category of the BCG matrix. While international revenue is currently under 1%, the company is making strategic moves, such as producing and selling toothpaste in Thailand for non-mainland China consumers. These markets are considered high-growth potential but demand significant investment as Yunnan Baiyao works to establish its presence and build market share.

Yunnan Baiyao's introduction of new skincare lines, exemplified by the 'CAI ZHI JI - Paris fargesii' series featuring proprietary raw materials, signals a strategic move into the expanding beauty and personal care sector. This venture capitalizes on their established strength in natural ingredients, a trend that saw the global beauty and personal care market reach an estimated $511 billion in 2023, with skincare being a significant contributor.

While these innovative products tap into a promising market, their current market share is likely in its early stages, necessitating substantial investment in marketing and distribution to build brand recognition and capture significant market share. Companies often allocate 10-20% of revenue for marketing in competitive beauty markets, a figure Yunnan Baiyao might need to consider to effectively penetrate this segment.

Weight Loss Drugs/Solutions Development

Yunnan Baiyao's exploration into weight loss drugs positions this segment as a potential star in its BCG matrix. The global weight loss drug market is experiencing robust growth, projected to reach an estimated USD 100 billion by 2030, a significant increase from its 2023 valuation. This rapid expansion is fueled by rising obesity rates and increasing consumer demand for effective solutions.

Developing innovative weight loss medications requires substantial research and development investment. Yunnan Baiyao's commitment to this area signifies a strategic move to capture a share of this lucrative market. Early-stage R&D projects in this domain, while promising, necessitate considerable funding to navigate clinical trials and regulatory approvals, aiming for a strong competitive position.

- Market Growth: The weight loss drug market is a high-growth sector, with projections indicating substantial expansion in the coming years.

- Investment Needs: Developing novel weight loss solutions demands significant capital outlay for R&D, clinical trials, and market entry.

- Competitive Landscape: Entering this competitive arena requires innovative products and substantial investment to establish market presence.

- Strategic Importance: This segment represents a key strategic focus for Yunnan Baiyao, aiming to capitalize on a rapidly growing pharmaceutical avenue.

Integration of Western-TCM Hybrid Formulations and Innovative Drugs

Yunnan Baiyao's strategic focus on integrating Western and Traditional Chinese Medicine (TCM) hybrid formulations positions these ventures as potential stars within its BCG matrix. These innovative drug development efforts, often involving secondary innovation of existing products and the incorporation of international resources, target high-growth areas.

While these projects demonstrate significant promise for future market leadership, they are currently in a nascent stage with low market share. Consequently, they demand considerable investment in research and development, alongside robust commercialization strategies to establish market viability and capture growth.

- High R&D Investment: Significant capital is allocated to developing novel drug delivery systems and hybrid formulations, reflecting their experimental nature.

- Low Current Market Share: Despite future potential, these initiatives have a limited presence in the current market landscape.

- Focus on Innovation: The strategy emphasizes secondary innovation of existing products and the integration of global pharmaceutical advancements.

- Market Potential: These areas are identified as having substantial long-term growth prospects, aligning with the group's vision for future expansion.

Yunnan Baiyao's international health product expansion, particularly in markets outside mainland China, represents a classic "Question Mark" in the BCG matrix. Despite current international revenue being less than 1%, the company is actively investing in strategies like producing toothpaste in Thailand for non-mainland consumers. These ventures are in high-growth potential markets, but require substantial investment to build brand recognition and market share, much like the burgeoning AI in healthcare sector where the group is also investing.

BCG Matrix Data Sources

Our Yunnan Baiyao Group BCG Matrix is built on comprehensive market data, integrating company financial statements, industry growth rates, and competitor analysis for strategic insights.