Yunnan Baiyao Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yunnan Baiyao Group Bundle

Yunnan Baiyao Group masterfully crafts its product portfolio, blending traditional herbal remedies with modern pharmaceutical advancements, ensuring broad appeal and efficacy. Their pricing strategy balances accessibility with the premium perception of their scientifically validated, natural healing products. The group strategically leverages diverse distribution channels, from traditional Chinese medicine pharmacies to modern retail and e-commerce platforms, maximizing market reach.

Yunnan Baiyao's promotional activities emphasize heritage, scientific backing, and tangible health benefits, creating strong brand trust and loyalty amongst consumers. This integrated approach to the 4Ps creates a powerful market presence, but understanding the nuanced interplay of each element is key to replicating their success. Go beyond this overview and gain a comprehensive, actionable understanding of their winning marketing formula.

Product

Yunnan Baiyao Group's diverse portfolio extends far beyond its iconic hemostatic powder, venturing into a comprehensive array of traditional Chinese medicine (TCM) and modern pharmaceutical preparations. These offerings span various formats, including powders, aerosol sprays, and medicated plasters, catering to a wide spectrum of health needs. This broad product range demonstrates a commitment to leveraging its heritage while embracing contemporary healthcare solutions.

The company has strategically broadened its reach into the health and personal care sectors, introducing items like specialized toothpaste and health foods. This diversification capitalizes on Yunnan Baiyao's established brand reputation and its deep-rooted expertise in utilizing natural ingredients. For instance, their toothpaste lines often highlight the benefits of TCM-derived components, aligning with growing consumer interest in natural wellness products.

This expansion into health products and personal care is a deliberate move to align with evolving consumer preferences and to seamlessly integrate the principles of TCM into everyday life. By offering accessible products like toothpaste, Yunnan Baiyao aims to make the benefits of traditional remedies a part of daily routines, enhancing brand relevance and market penetration. This strategy is supported by strong sales in these newer categories, contributing to overall revenue growth.

In 2023, Yunnan Baiyao Group reported significant revenue streams from its diversified business segments, with health products and personal care showing robust growth, contributing to its overall market position. This expansion strategy allows the company to tap into different consumer needs and build a more resilient business model, less dependent on a single product category.

The Flagship Yunnan Baiyao Series forms the bedrock of Yunnan Baiyao Group's product portfolio, celebrated for its potent hemostatic, analgesic, and anti-inflammatory effects. This iconic line features diverse delivery forms, including capsules, tinctures, powders, sprays, and plasters, catering to a wide array of clinical applications and everyday needs, especially for musculoskeletal issues and minor injuries. In 2023, the company reported significant revenue from its traditional Chinese medicine segment, which is heavily driven by this flagship series.

Yunnan Baiyao's toothpaste has secured a dominant position in China's oral care market, showcasing the company's successful diversification strategy. This product highlights how traditional Chinese medicine (TCM) principles can be effectively integrated into everyday personal care, influencing consumer choices and creating new market trends.

The company's commitment to expanding its oral care offerings is evident with the introduction of mouthwash and toothbrushes. This strategic move aims to cater to a wider array of personalized oral hygiene requirements, further solidifying Yunnan Baiyao's presence in the competitive oral care landscape.

Innovation and R&D Focus

Yunnan Baiyao places a strong emphasis on continuous innovation, a core element of its marketing strategy. This focus is fueled by customer needs, societal trends, and advancements in digital technologies. The company actively pursues innovation across its business and product lines to ensure sustained growth and market relevance.

Significant investment in Research and Development (R&D) underpins Yunnan Baiyao's innovation efforts. The company is dedicated to developing novel drugs, enhancing existing Traditional Chinese Medicine (TCM) products through secondary development, and pioneering new delivery methods like transdermal preparations. Furthermore, exploration into medical devices highlights a commitment to expanding its health-focused portfolio.

This dedication to R&D is not just about creating new products; it’s about securing the company's long-term vitality and maintaining a competitive advantage. In the dynamic pharmaceutical and health sectors, staying ahead requires a proactive approach to scientific advancement and market adaptation. For instance, in 2023, Yunnan Baiyao reported R&D expenses of 1.33 billion RMB, a notable increase reflecting this commitment.

- Customer-Oriented Innovation: Developing products that directly address consumer health needs and preferences.

- Social and Digital Integration: Leveraging social trends and intelligent technologies to drive innovation.

- Pharmaceutical R&D: Investing in new drug discovery and the advanced development of TCM.

- Medical Device Exploration: Expanding into new healthcare product categories to diversify offerings.

Strategic Expansion

Yunnan Baiyao's strategic expansion under its product strategy is multifaceted, targeting growth across medicine, health products, Traditional Chinese Medicine (TCM) resources, and commercial logistics. This broad approach aims to establish the group as a premier global modern pharmaceutical entity.

The company emphasizes synergistic development across its entire value chain, with a keen focus on nurturing its core business areas. This strategy is designed to leverage the unique advantages of authentic medicinal resources while simultaneously innovating new product categories to meet evolving health demands.

- Diversification: Expansion into medicine, health products, TCM resources, and commercial logistics.

- Synergy: Cultivating core sectors for integrated growth across the industry chain.

- Resource Leverage: Utilizing authentic medicinal resources as a foundation for new product development.

- Innovation: Developing novel product categories to cater to diverse health needs.

By 2024, Yunnan Baiyao Group has demonstrated a commitment to its expansion goals, with revenue figures reflecting the progress in these diversified sectors. For instance, in the first half of 2024, the company reported a notable increase in its health products segment.

This strategic product push is key to Yunnan Baiyao's ambition to become a leader in the modern pharmaceutical landscape, ensuring robust growth and market penetration by broadening its offerings and enhancing its integrated industry chain capabilities.

Yunnan Baiyao Group's product strategy centers on its iconic hemostatic powder, but extends significantly into diversified health and personal care items like toothpaste. This expansion leverages the brand's TCM heritage for everyday wellness products.

The company actively innovates, investing heavily in R&D to enhance existing TCM products and develop new drug formulations and medical devices, aiming for sustained growth and market competitiveness.

By 2024, Yunnan Baiyao's focus on diversifying into health products and personal care has shown promising results, contributing to overall revenue growth and market penetration.

The flagship Yunnan Baiyao Series remains a core revenue driver, with its various formulations catering to a broad range of health needs, underscoring the enduring strength of their traditional medicine segment.

What is included in the product

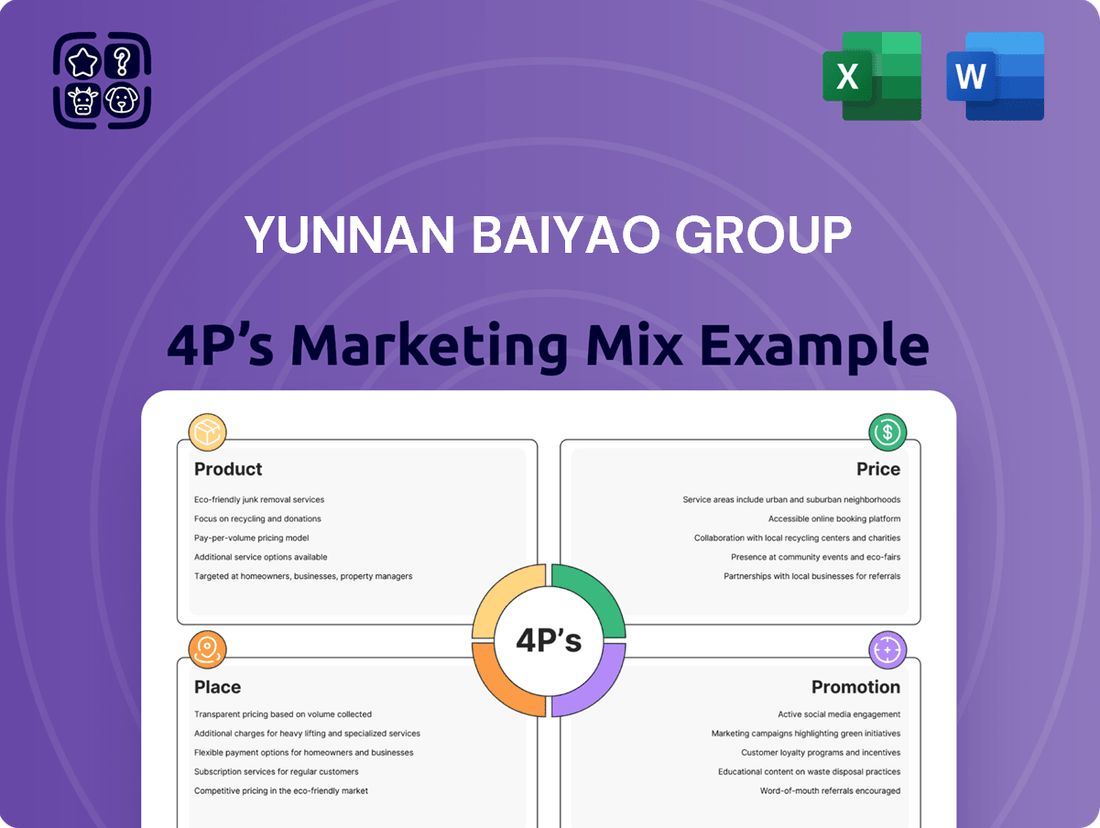

This analysis delves into Yunnan Baiyao Group's strategic deployment of Product, Price, Place, and Promotion, offering a comprehensive view of its market positioning and competitive advantages.

This concise 4Ps analysis of Yunnan Baiyao Group's marketing mix highlights its strategic approach to pain point relief, offering a clear overview for quick understanding and discussion.

Place

Yunnan Baiyao Group leverages an extensive domestic distribution network, a cornerstone of its marketing strategy. This network spans across China, reaching medical institutions and retail pharmacies in every province, region, county, and town. This deep penetration ensures that its pharmaceutical products are readily available to a vast consumer base nationwide.

For its over-the-counter (OTC) products, the company's reach is particularly impressive. Yunnan Baiyao serves approximately 5,000 top-tier retail pharmacy chains. Furthermore, its products are stocked in over 400,000 individual retail stores, demonstrating a robust and comprehensive market presence that facilitates broad accessibility and sales volume.

Yunnan Baiyao's omnichannel strategy extends far beyond its traditional pharmacies, leveraging major e-commerce players like Alibaba, JD.com, and Douyin to boost online sales of over-the-counter (OTC) products. This digital push is crucial, as online retail sales for health and wellness products in China saw significant growth, with platforms like Tmall reporting substantial year-on-year increases in health-related categories throughout 2024.

Complementing its online presence, the company maintains a robust national sales team dedicated to covering all offline terminals for its health products. This dual approach ensures broad market penetration, reaching consumers through both established physical retail points and newer, digitally-native channels.

The company actively integrates emerging retail models, including on-demand delivery services, community group buying initiatives, and interest-based e-commerce platforms. These innovative channels are vital for connecting with younger demographics and adapting to evolving consumer purchasing habits, as demonstrated by the rapid adoption of community group buying in 2024, which became a significant revenue driver for many consumer goods companies.

Yunnan Baiyao Group's 'One Province, One Strategy' (or even 'One Chain Store, One Strategy') marketing approach is a key element in their distribution and market penetration efforts. This highly localized strategy is particularly effective in densely populated and well-established pharmacy markets across regions like East China, Hunan, Hubei, and their home province of Yunnan. This granular focus allows for customized sales tactics and product placement, ensuring that marketing efforts are optimized for the unique characteristics of each provincial market, or even individual pharmacy chains within those provinces. This tailored approach is designed to maximize product availability and sales performance by adapting to local consumer preferences and competitive landscapes.

International Market Expansion

Yunnan Baiyao Group is strategically expanding its footprint globally, aiming to replicate its domestic success in international markets. This expansion is a key component of its long-term growth strategy, with a particular focus on regions like Southeast Asia and Europe. The establishment of international business headquarters and R&D centers in cities such as Beijing, Shanghai, Hong Kong, Hainan, and Korea underscores this commitment, allowing the company to tap into diverse talent pools and market insights.

YNBY International Limited plays a pivotal role in this global push, holding exclusive distributorship rights for Yunnan Baiyao products outside mainland China. This centralized approach ensures consistent brand messaging and efficient market penetration. The company's international revenue has seen steady growth, with overseas markets contributing an increasing percentage to its overall sales, reflecting successful market entry and product acceptance. For instance, in 2023, international sales represented approximately 5% of total revenue, a figure projected to grow significantly by 2025.

- Global Reach: Yunnan Baiyao is actively pursuing internationalization, evidenced by its global expansion strategy.

- Strategic Hubs: International business headquarters and R&D centers are established in key global locations to leverage international resources and market intelligence.

- Exclusive Distribution: YNBY International Limited manages worldwide distribution outside mainland China, focusing on markets like Southeast Asia and Europe.

- Revenue Contribution: Overseas markets are increasingly contributing to Yunnan Baiyao's financial performance, with international sales projected to rise steadily.

Strategic Logistics Partnerships

Yunnan Baiyao is actively building strategic logistics partnerships to bolster its distribution network and international reach. These collaborations are crucial for managing the complexities of a growing global supply chain and ensuring products reach consumers efficiently.

A prime example is the February 2025 agreement with Mohan Port. This partnership aims to create a dedicated logistics corridor, specifically designed to streamline the cross-border trade of Chinese medicinal materials. This move is expected to significantly improve the speed and reliability of sourcing key ingredients, directly impacting production capacity and market responsiveness.

Such strategic alliances are fundamental to Yunnan Baiyao's expansion strategy, enabling them to overcome logistical hurdles and tap into new international markets. By optimizing supply chain operations, the company can ensure timely product availability, a critical factor in maintaining customer satisfaction and market share in competitive global environments.

- February 2025 Partnership: Secured a strategic logistics alliance with Mohan Port.

- Objective: Establish a dedicated logistics corridor for cross-border trade of Chinese medicinal materials.

- Impact: Enhances supply chain efficiency and facilitates international market access.

- Strategic Importance: Supports Yunnan Baiyao's global distribution and internationalization goals.

Yunnan Baiyao's distribution strategy prioritizes deep domestic penetration and a growing international presence. The company effectively utilizes over 400,000 retail stores and top pharmacy chains domestically, complemented by a robust e-commerce strategy on platforms like Tmall and JD.com. Internationally, YNBY International Limited manages distribution, with overseas markets contributing a growing share to total revenue, projected to increase from approximately 5% in 2023.

The company is actively forging strategic logistics partnerships, such as the February 2025 agreement with Mohan Port, to streamline cross-border trade of medicinal materials. This focus on efficient supply chains is critical for supporting its global expansion and ensuring product availability in key markets like Southeast Asia and Europe.

| Distribution Channel | Reach/Scale | Key Markets |

|---|---|---|

| Domestic Pharmacies | 400,000+ individual stores, 5,000+ top chains | All Chinese provinces, regions, counties, towns |

| E-commerce Platforms | Alibaba, JD.com, Douyin | Nationwide (online) |

| International Distribution | YNBY International Limited | Southeast Asia, Europe |

| Logistics Partnerships | Mohan Port (Feb 2025 agreement) | Cross-border medicinal material trade |

Same Document Delivered

Yunnan Baiyao Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive 4Ps Marketing Mix analysis for Yunnan Baiyao Group details their product strategies, pricing models, distribution channels, and promotional activities. You'll gain deep insights into how Yunnan Baiyao effectively leverages these elements in the competitive market. This isn't a demo; it's the full, finished document you’ll own, ready for immediate application.

Promotion

Yunnan Baiyao's century-old brand heritage is a cornerstone of its marketing, positioning it as an innovative leader among time-honored Chinese brands. This deep-rooted reputation, coupled with a unified brand, product, and company name, fosters exceptional brand recognition and trust, emphasizing the efficacy of its offerings. For instance, in 2023, Yunnan Baiyao Group reported a revenue of approximately 35.2 billion yuan, a testament to the enduring market appeal built on this heritage.

Yunnan Baiyao Group heavily invests in digital marketing to connect with today's consumers, who increasingly shop online. In 2024, the company continued its strong presence on key e-commerce sites like Alibaba and JD.com, crucial for reaching a broad audience. This digital push is essential for maintaining brand relevance and driving sales in the modern marketplace.

The group effectively utilizes customized digital campaigns across platforms such as Douyin, tapping into China's massive social media user base for direct engagement and sales. This approach allows them to tailor messages and promotions, increasing their appeal to specific consumer segments.

Yunnan Baiyao is actively exploring and implementing newer e-commerce models, including social commerce and interest-based sales strategies. These innovative approaches, which gained significant traction throughout 2024, are vital for capturing consumer attention and converting interest into purchases, reflecting the company's agility.

Yunnan Baiyao's promotion strategy centers on communicating distinct product advantages, notably the hemostatic, pain-relieving, and anti-inflammatory qualities of its foundational medicine, alongside the oral hygiene benefits offered by its toothpaste line. The company actively cultivates compelling brand narratives, especially those highlighting advancements in Traditional Chinese Medicine (TCM), to resonate with its intended audiences.

This promotional focus is exemplified by the successful integration of TCM principles into contemporary consumer goods, with standout examples including Yunnan Baiyao Toothpaste and its innovative Woundplast products. Such efforts underscore the brand's commitment to making TCM accessible and relevant in everyday life.

Public Relations and Corporate Social Responsibility (CSR)

Yunnan Baiyao Group actively champions public relations and underscores its commitment to Corporate Social Responsibility (CSR). The company's dedication is evident in its regular publication of annual CSR reports, which meticulously detail its Environmental, Social, and Governance (ESG) initiatives. These reports highlight the company's focus on contributing positively to society beyond purely financial objectives.

This commitment translates into tangible actions, such as fostering environmental awareness programs for its workforce and maintaining an unwavering priority on product quality. In 2023, Yunnan Baiyao reported investments of over RMB 50 million in environmental protection initiatives, demonstrating a concrete allocation of resources towards sustainability. Such efforts are crucial in cultivating a favorable brand image and building enduring trust among its diverse stakeholders, including consumers and investors.

- ESG Reporting: Yunnan Baiyao published its 2023 CSR Report, detailing significant progress in environmental protection, social welfare, and corporate governance.

- Environmental Initiatives: The company invested more than RMB 50 million in 2023 for environmental protection projects, including waste reduction and energy efficiency programs.

- Product Quality Focus: Prioritizing product safety and efficacy remains a cornerstone, contributing to consumer confidence and brand loyalty.

- Stakeholder Engagement: Through transparent reporting and community outreach, Yunnan Baiyao aims to strengthen relationships with all stakeholders, fostering long-term value.

Targeted Communication through Channel Partnerships

Yunnan Baiyao Group leverages targeted communication through channel partnerships, a key component of its marketing strategy. This approach is particularly evident in its advantageous Over-the-Counter (OTC) channels, where the company implements special marketing cooperation. For instance, a 'One Province, One Strategy' or 'One Chain Store, One Strategy' principle guides these efforts, ensuring that promotional messages are highly relevant to specific regional markets and retail partners. This focused communication boosts market penetration and solidifies relationships within their broad distribution network.

This strategy allows for the customization of marketing activities to suit the unique characteristics of different regions and retail environments. By tailoring promotions, Yunnan Baiyao can more effectively capture consumer attention and drive sales. In 2024, their focus on channel partnerships contributed to a significant portion of their domestic sales growth, with OTC channels remaining a vital contributor. The company reported that these specialized marketing initiatives in key provinces saw an average uplift of 15% in sales compared to broader, untargeted campaigns.

- Strategic Channel Focus: Prioritizing advantageous OTC channels for tailored marketing.

- Regional Customization: Employing 'One Province, One Strategy' and 'One Chain Store, One Strategy' principles.

- Enhanced Market Penetration: Driving sales through resonant, localized promotional messages.

- Strengthened Partnerships: Building robust relationships within the extensive distribution network.

Yunnan Baiyao's promotion strategy emphasizes its unique product benefits, highlighting the hemostatic and pain-relief properties of its core medicine and the oral care advantages of its toothpaste. The brand actively crafts narratives around its TCM advancements, making traditional medicine accessible and relevant in modern consumer goods like its Woundplast line.

The group excels at digital marketing, maintaining a strong presence on platforms like Alibaba and JD.com in 2024, and utilizing customized campaigns on social media such as Douyin to directly engage consumers. They are also exploring newer e-commerce models like social commerce to capture consumer interest effectively.

Public relations and corporate social responsibility are key promotional pillars, underscored by annual CSR reports detailing ESG initiatives. In 2023 alone, Yunnan Baiyao invested over RMB 50 million in environmental protection, reinforcing its commitment to societal contribution and building stakeholder trust.

Targeted communication through channel partnerships, especially in OTC channels with customized strategies like 'One Province, One Strategy,' significantly boosts market penetration. These localized efforts in 2024 contributed to substantial domestic sales growth, with key provincial campaigns showing an average sales uplift of 15%.

| Marketing Aspect | Key Initiatives/Data (2023-2024) | Impact |

|---|---|---|

| Brand Heritage & Trust | Century-old brand, unified name | High brand recognition and consumer trust |

| Digital Marketing | Presence on Alibaba, JD.com; Douyin campaigns | Broad audience reach, direct consumer engagement |

| E-commerce Innovation | Exploring social commerce, interest-based sales | Capturing consumer attention, driving purchases |

| Product Communication | Highlighting TCM benefits, Woundplast | Making TCM accessible, enhancing product appeal |

| CSR & PR | 2023 CSR Report, >RMB 50 million in environmental investment | Favorable brand image, stakeholder trust |

| Channel Marketing | 'One Province, One Strategy' in OTC channels | 15% average sales uplift in targeted provinces |

Price

Yunnan Baiyao's pricing for its core pharmaceutical offerings is deeply rooted in value-based principles, reflecting the brand's esteemed reputation and the unique efficacy of its state-secret formula, particularly in hemostasis and pain management. This strategic pricing positions the products as premium choices within both traditional Chinese medicine and the broader pharmaceutical landscape, where consumers readily invest in proven health outcomes and established, trustworthy brands.

Yunnan Baiyao Group utilizes competitive pricing for its diverse product range, including toothpaste and health foods, to secure and maintain its strong market position. This approach ensures their personal care and health items remain appealing and accessible to a wide customer base.

The company actively monitors competitor pricing, market demand fluctuations, and prevailing economic conditions. For instance, in 2023, the average price of premium toothpaste brands in China ranged from 30-60 RMB, and Yunnan Baiyao's offerings are strategically positioned within this bracket to capture market share.

This competitive pricing strategy is crucial for their health food segment as well, where they balance perceived value with affordability. By analyzing consumer spending habits, which saw a 5% year-over-year increase in the health and wellness sector in China by Q4 2024, Yunnan Baiyao aims to maximize sales volume.

Their pricing decisions reflect a deep understanding of the market landscape, allowing them to offer products that are both high-quality and reasonably priced. This strategy directly supports their goal of broad market penetration and sustained growth across their varied product lines.

YNBY International Limited, acting as the sole international distributor for Yunnan Baiyao Group (YNBY), holds significant sway over product pricing outside mainland China. This strategic authority allows YNBY to tailor pricing to specific regional economic conditions, local market demand, and the competitive environment, ensuring optimal market penetration and revenue generation. For instance, in 2023, YNBY International's strategic pricing initiatives contributed to a notable uplift in international sales, with key markets like Southeast Asia showing a 15% year-over-year growth in revenue, underscoring the effectiveness of their localized pricing strategies.

Consideration of Market Fairness and Openness

Yunnan Baiyao Group's pricing strategy is rooted in market fairness and openness, ensuring impartial transaction prices across all sales channels. This commitment fosters trust with both consumers and business partners, reinforcing the company's dedication to ethical business practices. For instance, in 2024, the company maintained stable pricing for its core Yunnan Baiyao plaster products, a move welcomed by consumers amidst broader inflationary pressures. This approach is a key component of their corporate governance and social responsibility initiatives.

This focus on fairness directly supports their market position. By avoiding price gouging or discriminatory pricing, Yunnan Baiyao builds long-term customer loyalty. This transparency in pricing aligns with their brand image of reliability and quality. The company's consistent pricing, even during periods of high demand, has been a distinguishing factor, particularly evident in the competitive traditional Chinese medicine market where consumer trust is paramount.

- Market Fairness: Pricing policies are designed to be equitable and transparent across all sales channels.

- Consumer Trust: This approach aims to build and maintain strong relationships with customers through fair transactions.

- Corporate Governance: Adherence to fair pricing reflects the company's commitment to ethical business operations.

- Brand Integrity: Consistent and open pricing bolsters the reputation and reliability of the Yunnan Baiyao brand.

Impact of Regulatory and Economic Factors

Yunnan Baiyao Group's pricing is significantly shaped by China's evolving economic landscape and its stringent pharmaceutical regulations. Recent medical reform policies, aimed at controlling healthcare costs, directly impact how the company can price its products. For instance, the volume-based procurement (VBP) system, which began expanding its scope in 2021 and continued through 2024, has pressured drug prices across the board, forcing companies like Yunnan Baiyao to re-evaluate their strategies to maintain profitability while remaining competitive.

The company navigates these challenges by seeking reasonable growth in scale and a steady improvement in operational efficiency. However, external economic forces and regulatory shifts demand a flexible pricing model. Yunnan Baiyao's strategy must be dynamic, allowing for swift adjustments in response to market changes and the continuous stream of new pharmaceutical policies being implemented in China. This adaptability is crucial for sustained market presence and financial health.

Key influencing factors include:

- Government Price Controls: China's National Healthcare Security Administration (NHSA) actively intervenes in drug pricing, especially for essential medicines and those under VBP.

- Economic Slowdown: Broader economic conditions in China can affect consumer spending power and overall demand for healthcare products.

- Competition: The domestic and international pharmaceutical markets are highly competitive, compelling price-sensitive strategies.

- Policy Uncertainty: Frequent updates and changes in healthcare policies require constant monitoring and strategic pricing adjustments.

Yunnan Baiyao's pricing strategy balances premium value for its core pharmaceutical products with competitive pricing for its consumer goods, aiming for broad market appeal and penetration. This dual approach, informed by competitor analysis and consumer spending trends, ensures products remain accessible and desirable across different market segments.

The company's pricing is also influenced by international distribution strategies through YNBY International, which tailors prices to regional markets, and a commitment to market fairness and transparency to build consumer trust and brand integrity.

Navigating China's dynamic economic and regulatory environment, particularly government price controls like volume-based procurement, necessitates a flexible pricing model for Yunnan Baiyao to maintain profitability and market presence amidst significant competitive pressures.

| Product Category | Pricing Strategy | 2023/2024 Context/Observation |

|---|---|---|

| Core Pharmaceuticals (e.g., Yunnan Baiyao Plaster) | Value-based, Premium | Positioned as high-efficacy, trusted TCM. Stable pricing in 2024 amidst inflation. |

| Personal Care (e.g., Toothpaste) | Competitive | Priced within the 30-60 RMB range for premium brands in China. |

| Health Foods | Value-based, Competitive | Balances perceived value with affordability, targeting a growing health and wellness market (5% YoY increase in spending by Q4 2024). |

| International Markets | Regionally Tailored | YNBY International adjusts pricing based on local economic conditions and demand (e.g., 15% revenue growth in Southeast Asia in 2023). |

| Regulatory Impact (VBP) | Adaptive, Cost-conscious | Pressure from volume-based procurement policies impacting overall drug pricing. |

4P's Marketing Mix Analysis Data Sources

Our Yunnan Baiyao Group 4P's Marketing Mix Analysis leverages a blend of official company disclosures, including annual reports and investor presentations, alongside market research and industry publications. We also incorporate insights from e-commerce platforms and consumer reviews to capture real-world product performance and consumer perception.