Yunnan Baiyao Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yunnan Baiyao Group Bundle

Yunnan Baiyao Group faces moderate bargaining power from buyers due to the availability of alternative health products, though brand loyalty offers some buffer. The threat of new entrants is also a significant concern, as the herbal medicine market can attract new players with innovative offerings. Intense rivalry among existing competitors, particularly in the traditional Chinese medicine sector, necessitates constant strategic adaptation.

The bargaining power of suppliers for raw herbal ingredients can fluctuate based on crop yields and sourcing complexities, impacting Yunnan Baiyao's cost structure. Furthermore, the threat of substitute products, ranging from Western pharmaceuticals to other natural health remedies, requires continuous product development and market differentiation. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Yunnan Baiyao Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Yunnan Baiyao's dependence on specialized Traditional Chinese Medicine (TCM) ingredients, such as Panax notoginseng and Paris polyphylla, sourced predominantly from Yunnan Province, highlights a key area of supplier power. The limited geographic availability and unique cultivation requirements for these materials can concentrate purchasing power in the hands of a few suppliers. This concentration could translate into increased leverage for these suppliers, potentially impacting Yunnan Baiyao's raw material costs and the reliability of its supply chain. For instance, fluctuations in the harvest or availability of these rare herbs directly affect production continuity.

Yunnan Baiyao's core strength lies in its proprietary Traditional Chinese Medicine (TCM) formulations, which are often built upon rare or specially prepared herbs. This inherent uniqueness is a significant factor in supplier bargaining power. For instance, if a particular supplier controls the sole source or possesses exclusive knowledge regarding the cultivation, harvesting, or initial processing of these vital ingredients, their leverage naturally grows.

This exclusivity can create a substantial barrier to switching suppliers. Yunnan Baiyao might face challenges in finding alternative sources that can consistently match the quality and efficacy of their current suppliers' unique ingredients. This dependency directly translates into increased bargaining power for those suppliers, potentially allowing them to command higher prices or dictate terms.

Suppliers who can move into forward integration, meaning they process raw materials further or even create final product formulations, can present a challenge. For a substantial company like Yunnan Baiyao, this threat is less direct. However, if suppliers of crucial natural ingredients begin to offer semi-processed or standardized extracts, it could redirect value towards them and strengthen their negotiating position with pharmaceutical companies.

Cost of Switching Suppliers

The cost of switching suppliers for Yunnan Baiyao Group's specialized Traditional Chinese Medicine (TCM) ingredients is a significant factor in the bargaining power of suppliers. These ingredients often come with stringent regulatory requirements and rigorous quality control protocols. For instance, the sourcing and processing of certain herbs used in TCM products must adhere to specific national and international standards, making it difficult and time-consuming to find and qualify new suppliers.

Furthermore, the extensive research and development (R&D) that Yunnan Baiyao has invested in validating its current raw material sources contributes to high switching costs. This R&D ensures product efficacy and consistency, and any change in ingredient source could necessitate re-validation, potentially impacting product quality and market acceptance. In 2023, R&D expenditure for the group was approximately 1.2 billion RMB, highlighting the commitment to product integrity, which indirectly supports existing supplier relationships.

- High Regulatory Hurdles: TCM ingredients often face complex regulatory approval processes, increasing the time and cost associated with onboarding new suppliers.

- Quality Control & Efficacy: Maintaining consistent quality and therapeutic efficacy is paramount, requiring thorough testing and validation of new sources, which is resource-intensive.

- R&D Investment: Significant R&D investment in validating current suppliers creates inertia, making the transition to new suppliers economically unviable due to re-validation needs.

- Supplier Loyalty and Partnerships: Long-term relationships with trusted suppliers of specialized TCM ingredients are built on reliability and consistent quality, further raising switching costs.

Threat of Supplier Consolidation

Consolidation among suppliers of essential Traditional Chinese Medicine (TCM) raw materials or specialized processing services presents a significant risk for Yunnan Baiyao. As the number of independent suppliers dwindles, Yunnan Baiyao faces fewer choices for its critical inputs. This scarcity directly amplifies the leverage of the remaining consolidated suppliers.

These stronger suppliers are then positioned to demand more favorable terms, including higher prices for raw materials and processing. For instance, if a major herb supplier merges, they can exert greater control over pricing and supply availability to downstream manufacturers like Yunnan Baiyao. This shift can directly impact Yunnan Baiyao’s cost structure and profitability.

- Reduced Supplier Options: Supplier consolidation shrinks the pool of available raw material and service providers.

- Increased Supplier Leverage: Fewer suppliers mean greater pricing and negotiation power for those remaining.

- Potential for Price Hikes: Consolidated suppliers may dictate higher prices, impacting Yunnan Baiyao's input costs.

- Supply Chain Vulnerability: Reliance on a smaller number of consolidated suppliers increases the risk of supply disruptions.

Yunnan Baiyao's reliance on a concentrated group of suppliers for specialized Traditional Chinese Medicine (TCM) ingredients, like Panax notoginseng, grants these suppliers considerable bargaining power. The unique cultivation needs and limited geographic sources for these herbs mean fewer options for Yunnan Baiyao, potentially leading to increased costs and supply chain vulnerabilities. For example, the scarcity of high-quality Panax notoginseng can directly influence its price, impacting Yunnan Baiyao's production expenses.

The high switching costs associated with finding and validating new suppliers for these critical TCM components further bolster supplier leverage. Yunnan Baiyao's significant investment in R&D to ensure the quality and efficacy of current raw materials, demonstrated by its 2023 R&D expenditure of approximately 1.2 billion RMB, makes transitioning to new sources economically challenging due to re-validation requirements.

| Factor | Impact on Yunnan Baiyao | Supplier Leverage |

| Ingredient Specialization | Dependence on unique, geographically limited herbs | High |

| Switching Costs | High due to R&D for quality validation | High |

| Supplier Consolidation | Reduced options increase power of remaining suppliers | High |

What is included in the product

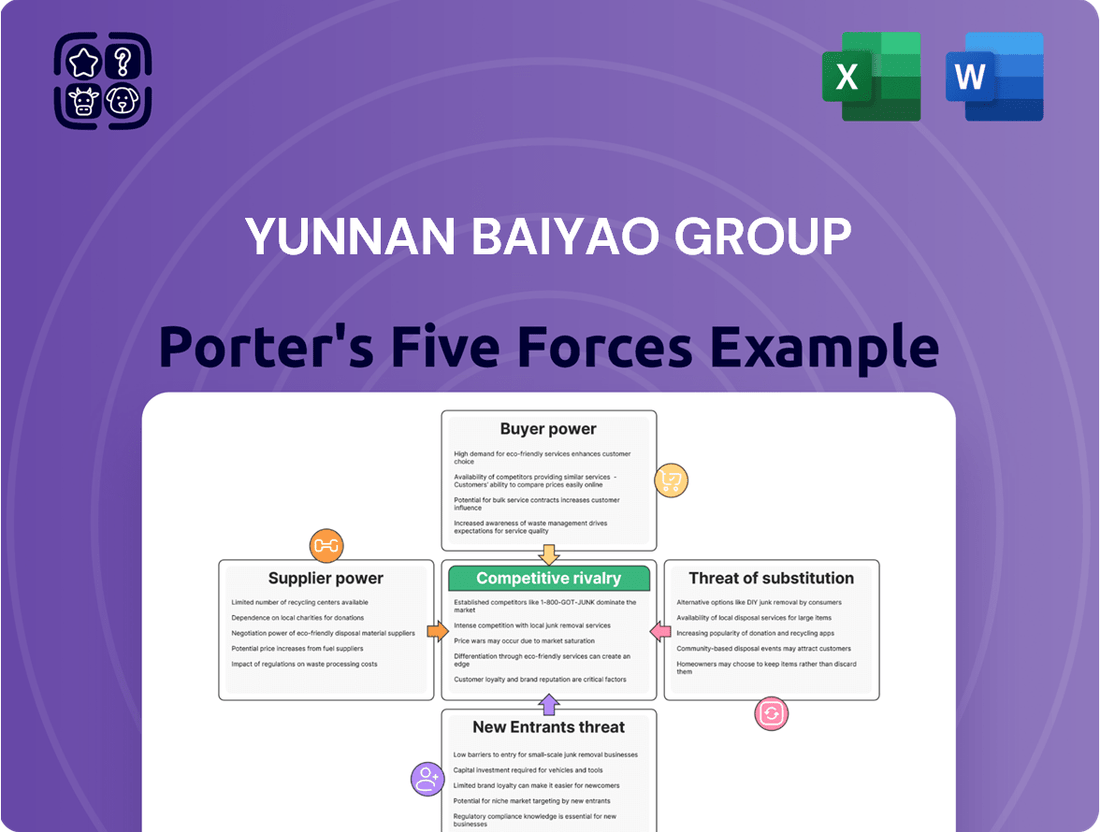

This analysis dissects the competitive landscape for Yunnan Baiyao Group, examining the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes.

Understand the competitive landscape of Yunnan Baiyao Group with a clear, one-sheet Porter's Five Forces analysis—perfect for quickly identifying and addressing pain points.

Customers Bargaining Power

Yunnan Baiyao's core products, particularly its famous hemostatic powder, have built a formidable reputation for effectiveness in addressing critical health needs. This long-standing trust translates directly into high brand loyalty, making consumers less likely to seek out or switch to competing products, even if those are priced lower. This reduced customer sensitivity to price and product variations significantly lowers their bargaining power.

Yunnan Baiyao Group's diversified product portfolio, spanning pharmaceuticals, personal care like toothpaste, and health foods, caters to a wide array of consumer needs. This broad reach means that while customers in high-competition categories, such as toothpaste, may exert significant price pressure due to readily available alternatives, those seeking specialized Yunnan Baiyao pharmaceuticals often face fewer direct substitutes, thus moderating their bargaining power.

Yunnan Baiyao's strong presence across traditional retail and newer direct-to-consumer (DTC) channels, including significant growth in on-demand retail and e-commerce in 2024, diversifies its customer base. This wide distribution network, with numerous touchpoints, inherently limits the bargaining power of any individual customer or small customer groups.

Price Sensitivity Across Product Segments

Customers for over-the-counter (OTC) products, such as Yunnan Baiyao's popular toothpaste or general health foods, tend to be more sensitive to price changes. This is because these items are often considered non-essential and have readily available substitutes in the market. For instance, the toothpaste market is highly competitive, with numerous brands vying for consumer attention, making price a significant factor in purchasing decisions.

Conversely, customers seeking specialized prescription pharmaceuticals or advanced health products exhibit lower price sensitivity. These consumers are often driven by efficacy, brand trust, and the need for specific medical solutions, making them less inclined to switch brands based on minor price differences. Yunnan Baiyao's engagement in both segments means it navigates a spectrum of price sensitivities, directly impacting its pricing strategies and profitability across its diverse product portfolio.

- Price Sensitivity Variation: Consumers of Yunnan Baiyao's OTC products, like toothpaste, are more price-sensitive than those buying prescription drugs.

- Market Dynamics: The competitive OTC market, especially for oral care, means price is a key driver for consumers.

- Strategic Pricing: Yunnan Baiyao must adapt its pricing strategies to account for varying customer price sensitivity across its product lines.

- Profit Margin Impact: Differences in price sensitivity directly influence profit margins for different product segments within the group.

Information Availability and Consumer Awareness

The increasing consumer awareness about health and wellness, amplified by widespread online information, significantly boosts customer bargaining power. Consumers can now easily compare product ingredients, efficacy claims, and pricing across various brands, particularly in the personal care and health food sectors. This heightened transparency allows customers to make more informed purchasing decisions, potentially driving down prices for less differentiated offerings.

For Yunnan Baiyao Group, this trend presents a dual challenge. While the commoditized segments of their business are susceptible to price pressure from informed consumers, the unique, proprietary nature of their core traditional Chinese medicine products offers a degree of insulation. The established reputation and perceived efficacy of these flagship items can help to mitigate the direct impact of price comparisons often seen in more standard personal care markets.

- Increased Online Information: The proliferation of health and wellness content online empowers consumers to research ingredients and compare product benefits, leading to a more discerning customer base.

- Transparency Drives Comparisons: Consumers are more likely to compare pricing and product attributes, especially in segments like personal care where alternatives are readily available.

- Commoditization Risk: Segments with less unique product differentiation are more vulnerable to customers leveraging information to demand lower prices.

- Yunnan Baiyao's Mitigation: The strong brand recognition and the perceived unique efficacy of Yunnan Baiyao's core traditional medicine products provide a buffer against intense customer price bargaining.

Customers for Yunnan Baiyao's widely available over-the-counter (OTC) products, such as toothpaste and general health foods, exhibit higher price sensitivity due to numerous substitutes. This was evident in 2024, where the competitive landscape for oral care products intensified. In contrast, consumers seeking Yunnan Baiyao's specialized pharmaceuticals, backed by decades of trust and proven efficacy, demonstrate significantly lower price sensitivity, a testament to brand loyalty and the lack of direct substitutes for their core hemostatic products.

| Product Category | Customer Price Sensitivity (2024 Estimate) | Availability of Substitutes | Impact on Bargaining Power |

|---|---|---|---|

| Specialty Pharmaceuticals (e.g., Hemostatic Powder) | Low | Very Low | Low |

| Personal Care (e.g., Toothpaste) | High | High | High |

| Health Foods | Medium | Medium | Medium |

Full Version Awaits

Yunnan Baiyao Group Porter's Five Forces Analysis

This preview offers a comprehensive Porter's Five Forces Analysis of Yunnan Baiyao Group, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, ensuring you receive a complete and actionable strategic assessment.

Rivalry Among Competitors

Yunnan Baiyao faces a highly competitive landscape due to its diverse product portfolio spanning traditional Chinese medicine, modern pharmaceuticals, health products, and personal care.

In the traditional Chinese medicine segment, rivals like Beijing TongRenTang and Shanghai Pharmaceuticals Holding Co., Ltd. pose significant challenges with their established brands and extensive distribution networks. This intense rivalry is further amplified by the presence of numerous smaller, specialized TCM companies contributing to market fragmentation.

The modern pharmaceutical and health product segments see competition from both domestic powerhouses and global giants, each vying for market share with innovative products and aggressive marketing. For instance, the health supplement market, where Yunnan Baiyao also competes, is characterized by rapid product introductions and evolving consumer preferences.

In personal care, Yunnan Baiyao contends with multinational corporations and agile local brands, all competing for consumer attention through differentiated offerings and price strategies. This broad competitive front necessitates continuous innovation and strategic positioning to maintain and grow market presence across all its business areas.

Yunnan Baiyao's formidable brand strength and market leadership significantly shape competitive rivalry. The company commands an impressive 91.8% market share in China's retail market for topical Chinese patent medicine aerosols, a testament to its dominance. Furthermore, its toothpaste holds a substantial 24.60% market share within China. This deep-rooted brand recognition means competitors face a steep uphill battle to chip away at Yunnan Baiyao's established customer base and market presence, intensifying the competitive landscape.

Yunnan Baiyao Group's commitment to innovation is evident in its sustained investment in research and development, leading to diversification into areas like modernized herbal patches and botanical supplements. This focus on new product categories is crucial for maintaining a competitive edge.

Rival companies are actively pursuing their own product launches and incorporating new technologies, intensifying the competition. This dynamic environment necessitates a strong emphasis on product differentiation and exploring new market opportunities to capture market share.

Regulatory Environment and Policy Impact

The competitive rivalry within Yunnan Baiyao Group is significantly shaped by China's regulatory landscape for pharmaceuticals and Traditional Chinese Medicine (TCM). Government policies, such as medical insurance reforms and volume-based procurement (VBP) initiatives, directly impact pricing power and market access for all players. These policies can create an uneven playing field, intensifying competition by favoring companies with specific product profiles or more efficient manufacturing capabilities. For instance, VBP tenders often drive down prices, forcing companies to compete on cost and scale, which can benefit larger, more established firms or those with advanced production technologies.

- Policy Influence: China's National Healthcare Security Administration (NHSA) plays a crucial role in drug pricing through its medical insurance catalog and VBP programs.

- Pricing Pressure: VBP has led to substantial price reductions for many drugs; for example, in 2023, a large number of drugs saw average price cuts exceeding 50% in VBP tenders.

- Market Access Impact: Inclusion in medical insurance catalogs is vital for market penetration, and policy changes can quickly alter a company's ability to reach a broad patient base.

- Competitive Intensification: Regulatory shifts favoring generic drugs or specific therapeutic areas can force companies like Yunnan Baiyao to adapt their product portfolios and operational strategies to remain competitive.

Global and Regional Players

Yunnan Baiyao faces intense competition, not only from domestic Traditional Chinese Medicine (TCM) rivals but also from global pharmaceutical giants. This rivalry is amplified by its international operations, where it encounters established multinational corporations with significant R&D budgets and extensive distribution networks. For instance, in 2024, the global pharmaceutical market continued to see aggressive market share battles, with companies like Pfizer and Novartis investing heavily in new drug development and market penetration strategies. Yunnan Baiyao must navigate this complex landscape, balancing its heritage with the innovation and reach of international players.

The competitive environment is further characterized by a high degree of fragmentation, with numerous smaller, regionally focused companies also vying for market share. These players often possess deep understanding of local markets and consumer preferences, posing a significant challenge to larger entities. For example, in Southeast Asia, local TCM brands consistently capture significant portions of the wellness and pharmaceutical markets due to their cultural resonance and accessibility. This fragmented nature means that Yunnan Baiyao must maintain agility and adapt its strategies to address diverse competitive pressures across different geographies.

Key competitive dynamics include:

- Product Innovation: Global players are continuously launching new products, forcing TCM companies like Yunnan Baiyao to invest in research and development to remain competitive.

- Market Access and Distribution: Establishing and maintaining strong distribution channels, both domestically and internationally, is crucial for reaching a wider customer base.

- Brand Perception: While TCM benefits from cultural heritage, global pharmaceutical brands often leverage scientific validation and advanced marketing, creating a need for Yunnan Baiyao to balance tradition with modern credibility.

- Pricing Strategies: Competition from both premium global brands and more affordable regional players necessitates careful pricing to capture different market segments.

Yunnan Baiyao operates in a highly competitive arena, facing strong rivals across its diverse product lines. Its dominance in specific segments, like topical Chinese patent medicine aerosols with a 91.8% market share, highlights its established position. However, the broader market is fragmented, with numerous domestic and international players actively vying for consumer attention and market share.

The company's significant market shares in toothpaste (24.60% in China) and its strong brand recognition present a formidable barrier for competitors. Yet, the dynamic nature of the health and personal care sectors means continuous innovation and strategic marketing are essential to fend off both established giants and agile new entrants.

Intensifying competition is also driven by regulatory shifts in China, such as volume-based procurement (VBP) which pressures pricing. Companies that can adapt to these policies and demonstrate cost-efficiency or technological advancement are better positioned, making rivalry particularly fierce.

Global pharmaceutical companies also present a significant competitive threat, especially in international markets, due to their substantial R&D capabilities and established distribution networks. Yunnan Baiyao must therefore balance its traditional strengths with modern pharmaceutical practices to compete effectively on a global scale.

SSubstitutes Threaten

For many conditions addressed by Yunnan Baiyao, especially pain, inflammation, and bleeding control, Western pharmaceutical drugs are direct substitutes. For example, over-the-counter pain relievers like ibuprofen and naproxen offer readily available alternatives for pain management, and prescription anti-inflammatories are widely used. In 2024, the global pain management market was valued at an estimated $140 billion, indicating significant competition from these established Western options.

The threat of substitutes in the Traditional Chinese Medicine (TCM) market is significant, primarily due to the presence of numerous other established brands and smaller producers. These competitors offer similar herbal remedies and health products, providing consumers with a wide array of alternative choices.

Major players like Beijing TongRenTang, Tasly, and Kangmei Pharmaceutical Co. Ltd. are prominent in the TCM space. For instance, Beijing TongRenTang, with a history spanning centuries, boasts a comprehensive product portfolio that directly competes with Yunnan Baiyao’s offerings.

The sheer volume of TCM products available means consumers can easily switch to alternatives if they perceive better value, efficacy, or brand reputation from other companies. This competitive landscape puts pressure on Yunnan Baiyao to continually innovate and maintain the perceived quality of its products.

Yunnan Baiyao's traditional health products, particularly those addressing common ailments, contend with a broad spectrum of generic and over-the-counter (OTC) alternatives. This is especially true in its consumer health segment. For instance, while Yunnan Baiyao has a strong brand presence, many of its topical treatments or minor pain relief products have readily available, lower-priced substitutes in pharmacies worldwide. The global push for generic drug accessibility, supported by various healthcare initiatives, directly intensifies this competitive pressure, impacting pricing power for Yunnan Baiyao's less differentiated offerings.

Emergence of Natural and Holistic Health Products

The growing consumer interest in natural and holistic health approaches presents a significant threat of substitutes for Yunnan Baiyao Group. This trend supports Traditional Chinese Medicine (TCM) broadly but also encourages a wide array of natural health products, supplements, and wellness therapies that can compete with Yunnan Baiyao's health food and personal care segments. For instance, the global dietary supplements market was valued at approximately USD 175.4 billion in 2023 and is projected to grow, indicating a substantial pool of alternative health solutions.

These substitutes don't necessarily offer the same therapeutic depth as pharmaceuticals but cater to a similar consumer desire for well-being and preventative care. Consider the expanding market for plant-based remedies and functional foods, which directly overlap with Yunnan Baiyao's product categories. In 2024, the wellness industry continues its robust expansion, with consumers increasingly seeking transparent ingredient lists and scientifically backed natural alternatives.

- Growing Demand for Natural Products: Consumers are actively seeking products with fewer synthetic ingredients, driving innovation in the natural health sector.

- Increased Accessibility: Many natural health products are readily available online and in mainstream retail, broadening their reach beyond specialized channels.

- Diversification of Wellness Offerings: The market now includes everything from herbal teas and essential oils to personalized nutrition plans, all competing for consumer health spending.

- Perceived Efficacy of Natural Remedies: A segment of consumers trusts the efficacy of natural alternatives, viewing them as safer or more aligned with their lifestyle.

Lifestyle Changes and Preventative Healthcare

Growing consumer emphasis on preventative healthcare and lifestyle changes poses a threat of substitutes to Yunnan Baiyao Group. Increased awareness around diet, exercise, and stress management can decrease the need for certain medicinal products. This shift can dampen demand for some of Yunnan Baiyao's health product offerings, particularly those addressing conditions that can be managed or mitigated through behavioral modifications. For instance, a significant portion of the health and wellness market is increasingly looking towards natural remedies and lifestyle interventions before resorting to pharmaceuticals, impacting potential sales.

The rise of wellness trends directly competes with traditional health products. Consumers are actively seeking out fitness programs, mindfulness apps, and nutritional supplements as alternatives to conventional remedies. For example, the global wellness market was valued at approximately $4.5 trillion in 2022 and is projected to grow, indicating a substantial shift in consumer spending towards these preventative measures. This expanding market for lifestyle solutions represents a significant substitute threat, potentially diverting spending away from Yunnan Baiyao's core product categories.

- Growing Consumer Focus: Increased consumer interest in proactive health management, including diet and exercise, reduces reliance on traditional medicinal products.

- Market Shift: The global wellness market's substantial growth, estimated in the trillions, signifies a strong consumer preference for lifestyle-based health solutions.

- Impact on Health Products: These behavioral changes and alternative wellness options can diminish overall demand for certain health products offered by Yunnan Baiyao Group.

Yunnan Baiyao faces a significant threat from substitutes, encompassing both Western pharmaceuticals and other Traditional Chinese Medicine (TCM) brands. readily available over-the-counter pain relievers and anti-inflammatories offer direct competition, with the global pain management market valued at approximately $140 billion in 2024. Furthermore, the broader TCM market features numerous brands like Beijing TongRenTang, providing consumers with many alternative choices for similar health concerns.

The expanding natural health and wellness sectors also present a substantial threat. The global dietary supplements market, valued at roughly $175.4 billion in 2023, and the overall wellness industry, estimated at $4.5 trillion in 2022, highlight consumer shifts towards lifestyle interventions and natural remedies. This trend can divert spending from Yunnan Baiyao's product lines, especially as consumers increasingly prioritize preventative care and seek alternatives with transparent ingredient lists.

| Category | Key Substitutes | Market Size (Approx.) | Year |

| Pain Management (Western) | Ibuprofen, Naproxen, Prescription NSAIDs | $140 billion | 2024 |

| TCM | Beijing TongRenTang, Tasly, Kangmei Pharmaceutical | N/A (Broad Market) | N/A |

| Dietary Supplements | Various Herbal & Vitamin Brands | $175.4 billion | 2023 |

| Wellness Industry | Fitness Programs, Mindfulness Apps, Functional Foods | $4.5 trillion | 2022 |

Entrants Threaten

The pharmaceutical and Traditional Chinese Medicine (TCM) sectors face formidable regulatory landscapes, both in China and internationally. Securing approvals for new drugs and TCM formulations necessitates extensive clinical trials and stringent manufacturing licenses. These rigorous requirements act as a substantial deterrent for potential new entrants aiming to establish a foothold in these markets.

The pharmaceutical industry, especially Traditional Chinese Medicine (TCM), demands immense upfront capital. Establishing state-of-the-art manufacturing plants, conducting rigorous research and development, and securing reliable supply chains for authentic TCM raw materials requires billions. For example, building a single, compliant pharmaceutical manufacturing facility can easily cost hundreds of millions of dollars. Newcomers face a steep climb to match the integrated industry chain advantages of established giants like Yunnan Baiyao, which has cultivated its entire value proposition over decades.

Yunnan Baiyao Group enjoys a significant advantage through its deeply ingrained brand recognition and unwavering customer loyalty, cultivated over many decades. This trust is especially pronounced for its iconic, long-standing products.

Establishing a comparable level of brand equity and fostering such strong customer allegiance in the competitive health and pharmaceutical markets is a formidable undertaking. It typically requires substantial time and considerable financial investment, presenting a high barrier for newcomers aiming to swiftly gain market traction.

For instance, in 2023, Yunnan Baiyao reported significant revenue growth, demonstrating the ongoing strength of its brand and customer base, which new entrants would struggle to replicate quickly.

Complex Distribution Networks and Market Access

Yunnan Baiyao's formidable distribution network presents a significant barrier to new entrants. The company has cultivated an expansive reach across traditional offline channels, robust e-commerce platforms, and increasingly, direct-to-consumer models. This intricate web ensures widespread product availability and efficient logistics, a feat that would require substantial investment and time for any newcomer to replicate. For instance, by the end of 2023, Yunnan Baiyao's offline sales network covered over 90% of county-level cities in China, a testament to its deep penetration.

Establishing comparable market access, particularly within China's fragmented retail pharmacy sector, poses a substantial challenge. New companies would struggle to gain shelf space and build the necessary relationships that Yunnan Baiyao has fostered over decades.

- Extensive Offline Reach: Yunnan Baiyao's established presence in traditional retail pharmacies across China is a key differentiator.

- E-commerce Integration: The company's strong performance on major e-commerce platforms provides a vital sales and marketing channel.

- Direct-to-Consumer (DTC) Growth: Yunnan Baiyao's investment in DTC models allows for closer customer relationships and data collection.

- Channel Partner Relationships: Decades of building trust and efficient logistics with distributors and retailers are hard to overcome.

Proprietary Knowledge and Unique Formulations

Yunnan Baiyao Group's primary defense against new entrants stems from its deeply guarded, proprietary Traditional Chinese Medicine (TCM) formulations, particularly the renowned Yunnan Baiyao powder. This secret recipe, passed down through generations and protected by strict secrecy, represents a significant hurdle for any aspiring competitor seeking to enter the market with a comparable product.

Beyond the historical formula, the company actively invests in research and development to modernize TCM and explore new applications for its natural ingredients. This ongoing commitment to innovation, coupled with its established expertise in sourcing and processing unique natural resources, further solidifies its intellectual property and creates a high barrier to entry. For example, in 2023, Yunnan Baiyao Group reported significant investment in its R&D segment, focusing on the scientific validation and industrialization of TCM, aiming to unlock new product lines and expand its market reach.

- Proprietary Formulations: The core Yunnan Baiyao formula is a trade secret, difficult to reverse-engineer or replicate.

- Intellectual Property: Patents and trade secrets surrounding unique ingredient sourcing and processing methods protect its market position.

- R&D Investment: Continued investment in TCM modernization and new product development creates an ongoing competitive advantage.

- Expertise in Natural Ingredients: Deep knowledge of sourcing, cultivation, and processing of rare Chinese medicinal herbs provides a unique capability.

The threat of new entrants for Yunnan Baiyao Group is relatively low due to significant barriers. These include stringent regulatory approvals for pharmaceuticals and TCM, requiring substantial capital for R&D and manufacturing, with a single facility costing hundreds of millions. The brand loyalty built over decades, as evidenced by significant revenue growth in 2023, makes it hard for newcomers to gain traction. Furthermore, their extensive distribution network, covering over 90% of county-level cities in China by the end of 2023, presents a considerable challenge for new players to match market access.

| Barrier Category | Description | Impact on New Entrants | Yunnan Baiyao Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and supply chains. | Discourages new entrants lacking substantial funding. | Decades of established infrastructure and investment. |

| Brand Loyalty & Recognition | Strong customer trust and preference for established products. | Difficult for new brands to attract customers. | Iconic products and decades of marketing investment. |

| Distribution Network | Extensive reach across offline, online, and DTC channels. | Challenges in achieving widespread product availability. | Established relationships and logistical efficiencies. |

| Proprietary Knowledge & IP | Secret formulations and ongoing R&D investment. | Difficulty in replicating product efficacy and innovation. | Protected trade secrets and significant R&D spending in 2023. |

Porter's Five Forces Analysis Data Sources

Our analysis of Yunnan Baiyao Group's competitive landscape is built upon a robust foundation of data from official company filings, including annual reports and investor presentations. We also leverage industry-specific market research reports and credible financial news outlets to capture current market dynamics and competitive pressures.