Yamada Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yamada Holdings Bundle

Yamada Holdings possesses significant market share and a strong brand reputation, showcasing impressive strengths. However, understanding the nuanced threats and opportunities requires a deeper dive beyond these highlights. Our comprehensive SWOT analysis reveals the critical factors influencing their competitive edge.

Don't miss out on the full picture of Yamada Holdings' strategic landscape; our complete SWOT analysis provides the detailed context needed to make informed decisions. This in-depth report offers actionable insights, crucial for investors and strategists alike.

Unlock the full potential of your strategic planning by purchasing the complete Yamada Holdings SWOT analysis. Gain access to a professionally written, fully editable report designed to support your business objectives.

Strengths

Yamada Holdings boasts an extensive retail network, with hundreds of consumer electronics stores spread throughout Japan. This vast physical presence, a key strength, translates into significant brand recognition, making Yamada a household name in the electronics sector. By the end of fiscal year 2023, Yamada Denki, its primary retail arm, operated approximately 900 stores nationwide, ensuring broad market penetration and customer accessibility.

Yamada Holdings boasts a diversified business model, extending beyond its traditional electronics retail roots. This strategic expansion encompasses home renovation, housing construction, furniture sales, and even financial services, all under its comprehensive 'Total-Living' or 'Kurashimaru-goto' Global Strategy.

This multi-faceted approach significantly reduces the company's dependence on any single market segment. By offering a wide array of products and services catering to household needs, Yamada Holdings generates multiple, robust revenue streams.

For instance, in the fiscal year ending March 2024, Yamada Denki, the electronics retail arm, reported net sales of ¥1,324.8 billion. The broader group's diversified operations contribute to overall group revenue and foster valuable synergy effects across its various business units.

Yamada Holdings' 'one-stop solution' strategy is a significant strength, integrating electronics with housing and financial services. This approach aims to be a comprehensive provider for various household needs, setting it apart from competitors. For instance, their LIFE SELECT stores feature housing consultation counters, directly addressing a broad spectrum of customer requirements in a single location.

Strong Financial Performance and Shareholder Returns Focus

Yamada Holdings demonstrated robust financial health, reporting a 12% increase in profit for the fiscal year ending March 2025. This performance underscores the company's operational efficiency and market position.

The company's strategic direction is clearly geared towards sustained growth and rewarding its investors. Their newly unveiled medium-term management plan, spanning FY2026-2030, sets ambitious targets for revenue expansion and improved profit margins, indicating a proactive approach to market opportunities.

Yamada Holdings has explicitly committed to enhancing shareholder value through a focused capital allocation strategy. This includes a targeted dividend payout ratio exceeding 40% and the execution of share buyback programs.

- Increased Profitability: Fiscal year ending March 2025 saw a 12% profit rise.

- Growth Targets: Medium-term plan (FY2026-2030) aims for higher revenue and profit margins.

- Shareholder Returns: Commitment to a dividend payout ratio over 40% and share buybacks.

Commitment to Digital Transformation and ESG Initiatives

Yamada Holdings is making significant strides in its digital transformation (DX) efforts, aiming to bolster its e-commerce platforms and streamline operations for greater efficiency. This commitment is crucial for enhancing the company's own sustainability in a rapidly evolving retail landscape. For fiscal year 2024, the company has announced investments focused on improving its online sales channels and integrating digital technologies across its business segments.

The company is also prioritizing ESG (Environmental, Social, and Governance) management. This includes a strong focus on human capital development, fostering a circular economy model within its operations, and actively working to mitigate climate change impacts. These initiatives are designed not only to improve corporate value but also to meet the increasing expectations of investors and customers who are prioritizing sustainability.

Key ESG-related actions by Yamada Holdings include:

- Digital Transformation Focus: Continued investment in strengthening e-commerce capabilities and enhancing operational efficiency through digital solutions, as evidenced by their FY2024 strategic plans.

- ESG Management Promotion: A clear strategy to integrate ESG principles, including personnel development and circular economy initiatives.

- Climate Change Action: Dedicated efforts to address climate change, aligning with global sustainability goals and stakeholder demands.

- Stakeholder Value Enhancement: The overarching goal of improving corporate value and meeting the expectations of all stakeholders through these digital and ESG advancements.

Yamada Holdings leverages a vast retail footprint, with roughly 900 stores across Japan by the end of FY2023, ensuring broad customer access and strong brand recognition. Its diversified business model, extending into home renovation, housing, and financial services, cushions reliance on any single sector, generating multiple revenue streams. The company’s ‘one-stop solution’ approach, integrating electronics with housing and finance, further enhances its market appeal.

Financially, Yamada Holdings reported a notable 12% profit increase for the fiscal year ending March 2025. Its medium-term management plan (FY2026-2030) targets revenue growth and improved profit margins, alongside a commitment to shareholder value through a dividend payout ratio exceeding 40% and share buybacks. Digital transformation is a key focus, with FY2024 investments aimed at strengthening e-commerce and operational efficiency.

Furthermore, Yamada Holdings is actively promoting ESG management, emphasizing human capital development and circular economy initiatives. These efforts, coupled with climate change mitigation actions, aim to enhance corporate value and meet growing stakeholder expectations for sustainability.

| Metric | FY2023 (Approx.) | FY2025 (Ending March) |

|---|---|---|

| Number of Stores (Yamada Denki) | 900 | N/A |

| Profit Growth | N/A | 12% increase |

| Dividend Payout Ratio Target | N/A | >40% |

What is included in the product

Analyzes Yamada Holdings’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable roadmap by highlighting Yamada Holdings' key strengths and mitigating weaknesses.

Weaknesses

Yamada Holdings faces a significant weakness in its core electronics segment, which showed a decline in operating profit in FY2025/3, despite slight overall revenue increases in recent fiscal years. This profitability dip stemmed partly from a shift in rebate structures, moving from cell-in to cell-out rebates, which temporarily squeezed margins. Compounding this issue is the broader sluggishness of the Japanese consumer electronics market, which has struggled to regain post-pandemic growth momentum, directly impacting Yamada's primary business.

Yamada Holdings faces formidable competition in Japan's electronics retail sector. Traditional players like Bic Camera and K's Holdings continue to exert significant pressure, while e-commerce behemoths such as Amazon present a growing challenge. This crowded market often results in price wars, particularly impacting categories with slowing volume growth like personal computers and televisions.

The intense rivalry forces Yamada Holdings to constantly innovate and adopt aggressive strategies just to maintain its market share. In the fiscal year ending March 2024, Yamada Denki, a key subsidiary, reported a net sales decrease of 3.7% to ¥1,274.5 billion, reflecting the tough market conditions.

Yamada Holdings' significant reliance on the Japanese domestic market presents a notable weakness. While the company has made some attempts at international expansion, its core business and revenue streams are overwhelmingly concentrated within Japan. This domestic focus means Yamada is highly susceptible to the economic health and consumer behavior specific to Japan.

This concentration exposes Yamada Holdings to the risks inherent in Japan's economic landscape, including potential downturns and evolving consumer preferences. For instance, Japan's persistent deflationary pressures and an aging population can directly impact discretionary spending on home furnishings and electronics, Yamada's key product categories. Such domestic vulnerabilities limit the company's ability to offset slower periods in one region with stronger performance elsewhere.

The lack of robust global diversification means Yamada Holdings misses out on the stability and growth opportunities that a broader international presence can offer. While specific figures for the percentage of revenue derived from Japan are not always publicly detailed, industry analysis consistently points to the domestic market as the dominant contributor. This makes the company less resilient to localized economic shocks compared to more globally distributed competitors.

Integration Challenges of Diversified Businesses

Yamada Holdings' broad diversification, while a strength, introduces significant weaknesses stemming from integration challenges. Managing vastly different sectors such as electronics retail, housing construction, financial services, and environmental solutions demands complex operational oversight and sophisticated managerial strategies.

Achieving seamless synergy across these disparate business units is a considerable hurdle. For instance, ensuring a consistent brand experience and operational efficiency between the high-volume, low-margin electronics segment and the project-based, high-capital housing division requires meticulous internal coordination. This complexity can dilute strategic focus and strain resources.

The need for robust internal coordination and strategic alignment across such varied services can lead to inefficiencies. In 2024, reports indicated Yamada Denki, the electronics arm, faced increased competition impacting its profitability, while its housing segment, Yamada My Living, navigated fluctuating construction material costs. This divergence in market dynamics and operational needs makes a unified approach difficult.

- Operational Complexity: Managing diverse business models, from retail to finance, requires specialized expertise and systems for each, increasing overhead and coordination needs.

- Brand Dilution: Maintaining a consistent and strong brand identity across electronics, housing, and financial services can be challenging, potentially weakening overall brand equity.

- Synergy Realization: The potential for cross-selling and operational efficiencies between business units may not be fully realized due to inherent differences in customer bases, sales cycles, and regulatory environments.

- Managerial Strain: Executives must possess a broad range of knowledge to effectively oversee and strategize for such varied operations, potentially leading to strategic missteps or resource misallocation.

High Overhead from Extensive Physical Store Network

Yamada Holdings' extensive physical store network, including its newer LIFE SELECT formats, presents a significant weakness due to high overhead costs. Rent, utilities, and staffing for numerous large retail spaces contribute substantially to operational expenses. For instance, as of the fiscal year ending March 2024, Yamada Denki reported operating expenses that reflect the costs associated with maintaining its widespread physical presence.

This reliance on brick-and-mortar retail is particularly challenging in the current market, where e-commerce continues to grow. If foot traffic or sales per square meter don't adequately offset these considerable fixed costs, profitability can be negatively impacted. The company's ongoing strategy of active store development, including renovations and new store openings, further exacerbates these overhead burdens.

- High Fixed Costs: Rent, utilities, and staffing for a large physical store footprint are significant ongoing expenses.

- E-commerce Competition: The shift towards online shopping can reduce foot traffic, straining the profitability of physical stores.

- Store Development Investment: Continued investment in new and renovated stores adds to the capital expenditure and ongoing overhead.

Yamada Holdings' core electronics segment is experiencing profitability challenges. The shift in rebate structures from cell-in to cell-out impacted margins in FY2025/3, and the broader Japanese consumer electronics market remains sluggish, directly affecting Yamada's primary business performance.

The company's heavy reliance on the Japanese domestic market makes it vulnerable to local economic downturns and changing consumer spending habits. This lack of geographic diversification limits its ability to offset domestic weaknesses with international growth.

Managing its diverse business units, from electronics retail to housing and finance, creates significant operational complexity and integration challenges. This can dilute strategic focus and strain managerial resources, potentially hindering synergy realization.

Yamada's extensive network of physical stores, though a familiar sight, represents a weakness due to high fixed costs like rent and utilities. This is particularly concerning as e-commerce continues to gain traction, potentially reducing foot traffic and impacting the profitability of these large retail spaces.

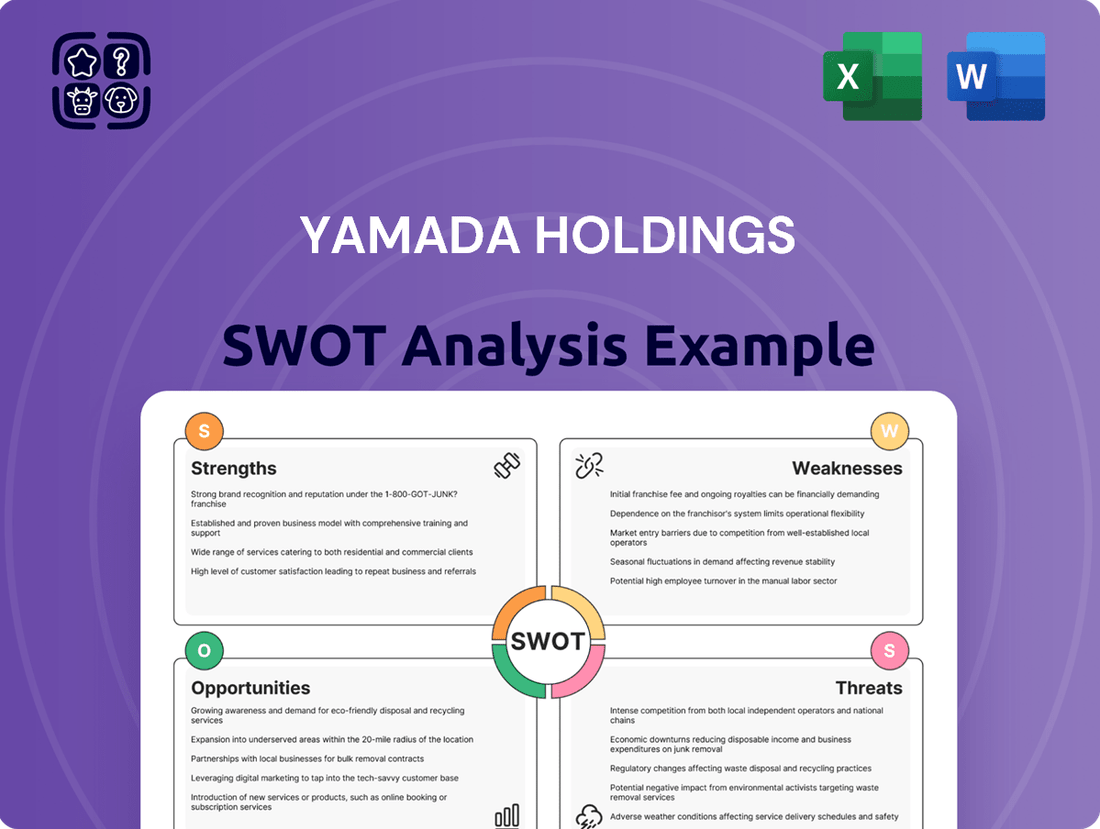

Preview Before You Purchase

Yamada Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're looking at the actual Yamada Holdings SWOT analysis, covering Strengths, Weaknesses, Opportunities, and Threats in detail. This is the same in-depth report you'll download after purchase, providing actionable insights for strategic planning.

Opportunities

Yamada Holdings' 'Total-Living' strategy, which combines housing, renovations, and smart home tech, offers substantial growth. This approach taps into Japan's aging demographic and changing housing demands.

The company can deepen its household penetration by integrating electronics and services, especially via the YAMADA Smart House initiative. This strategy is designed to capture customers across their entire housing journey.

For instance, in 2024, the Japanese housing renovation market alone was projected to reach over ¥8 trillion, indicating strong demand for services Yamada can offer.

By focusing on these interconnected services, Yamada Holdings can create a more comprehensive and sticky customer relationship, driving revenue across multiple touchpoints.

Yamada Holdings has a significant opportunity to capitalize on Japan's expanding e-commerce landscape, particularly within the consumer electronics sector. As online retail continues its upward trajectory, even in a market with historically slower overall growth, bolstering digital platforms presents a clear path to increased market share. This is crucial for Yamada Holdings to stay competitive and attract a growing demographic of online shoppers.

The company can leverage this by strengthening its e-commerce capabilities and enhancing its omnichannel integration. This strategy allows Yamada Holdings to not only reach a wider customer base but also to provide a more convenient and unified shopping experience. For instance, by seamlessly connecting online browsing with in-store pickup or returns, they can cater to diverse consumer preferences.

Data from 2024 indicates a continued shift towards online purchasing for electronics in Japan. While specific figures for Yamada Holdings' e-commerce growth are proprietary, the broader market trend shows that companies with robust online presences are outperforming those with a purely brick-and-mortar model. Optimizing their online platform for user experience and ensuring a smooth transition between digital and physical touchpoints are therefore critical for future revenue streams and market penetration.

Yamada Holdings, as a major electronics retailer with diverse services, has a significant opportunity to cultivate a distinct customer data foundation. This rich data can fuel highly personalized marketing campaigns, enhance existing customer loyalty initiatives, and pinpoint potential new service opportunities.

By becoming a dedicated data-utilizing company, Yamada Holdings aims to fundamentally reshape the retail landscape. In 2024, the company's focus on digital transformation, including data analytics, is a key strategy. This strategic pivot is designed to create a more customer-centric and efficient retail model.

Development of Private Brand (PB) and SPA Products

Yamada Holdings is strategically targeting 300 billion yen in revenue from its Private Brand (PB) and Specialty store retailer of Private label Apparel (SPA) products by the fiscal year 2030. This focus is a key opportunity for significant growth and profitability enhancement.

By developing and actively promoting these in-house brands, Yamada Holdings can improve its profit margins considerably. This is achieved by eliminating intermediaries in the supply chain, which directly reduces costs and allows for greater control over pricing and quality. Furthermore, the creation of unique PB and SPA products fosters stronger brand loyalty among customers, differentiating Yamada Holdings from competitors who may rely more heavily on third-party brands.

- Revenue Target: Aiming for 300 billion yen from PB/SPA products by FY2030.

- Profit Margin Improvement: Direct sales of private brands cut out intermediary costs.

- Brand Loyalty: Unique products build a dedicated customer base.

- Competitive Edge: Differentiates Yamada Holdings from other retailers.

Strategic Partnerships and Acquisitions

Yamada Holdings can significantly boost its growth and market reach by forging strategic partnerships or acquiring companies, particularly in dynamic sectors such as AI for consumer electronics or specialized home services. This approach allows for quicker market penetration and diversification of offerings.

A prime example of this strategy in action is Yamada Holdings' acquisition of Seki Home K.K. This move not only broadened their product catalog but also enhanced their service capabilities, demonstrating the tangible benefits of inorganic growth.

Looking ahead, further strategic alliances or acquisitions could target areas like smart home integration platforms or sustainable home appliance technologies. For instance, in fiscal year 2024, Yamada Denki reported a consolidated net sales of ¥1,348.1 billion, indicating a substantial base upon which to build through strategic expansion.

- Accelerated Market Entry: Partnerships can provide immediate access to new customer segments and geographical markets that might otherwise take years to penetrate organically.

- Technology Acquisition: Acquiring companies with advanced AI capabilities or innovative home service technologies can leapfrog internal development timelines and enhance competitive positioning.

- Synergistic Opportunities: Integrating acquired businesses, like Seki Home K.K., allows for cross-selling opportunities and the creation of bundled service packages, increasing customer value and loyalty.

- Diversification of Revenue Streams: Expanding into niche or emerging service areas through acquisition reduces reliance on existing product categories and mitigates market volatility.

Yamada Holdings can enhance its profitability by expanding its private brand (PB) and specialty store retailer of private label apparel (SPA) product lines. The company is targeting ¥300 billion in revenue from these segments by FY2030, which offers significant potential for improved profit margins through direct sales and reduced intermediary costs. This strategy also fosters stronger customer loyalty by offering unique products.

Strategic partnerships and acquisitions represent a key growth avenue for Yamada Holdings. By integrating companies with complementary services or advanced technologies, such as AI in consumer electronics or specialized home services, Yamada can accelerate market entry and diversify its offerings. The company's acquisition of Seki Home K.K. exemplifies the success of this inorganic growth strategy, broadening its service capabilities.

Leveraging Japan's growing e-commerce market, particularly in consumer electronics, is another significant opportunity. Strengthening online platforms and omnichannel integration allows Yamada Holdings to reach a wider customer base and provide a more convenient shopping experience. This is crucial as data from 2024 indicates a continued consumer shift towards online electronics purchases.

The company's 'Total-Living' strategy, which integrates housing, renovations, and smart home technology, is well-positioned to capitalize on Japan's demographic shifts and evolving housing needs. By deepening household penetration through interconnected services, Yamada can create stickier customer relationships and drive revenue across multiple touchpoints, tapping into a Japanese renovation market valued at over ¥8 trillion in 2024.

Threats

Japan's economy is facing headwinds from rising energy costs and a weaker yen, which have pushed up prices for goods and services. This, in turn, has caused real wages to fall, meaning people's earnings don't stretch as far as they used to. In 2024, for example, real wages saw a notable decline, impacting household budgets significantly.

This erosion of purchasing power directly threatens Yamada Holdings, as consumers may cut back on non-essential purchases like electronics and major home appliances, key product categories for the company. A broader economic downturn would only exacerbate this issue, further dampening demand across all of Yamada Holdings' business segments.

The intensifying online competition, particularly from global e-commerce behemoths like Amazon, presents a substantial threat to Yamada Holdings' traditional retail operations. In 2024, e-commerce sales in Japan were projected to exceed ¥20 trillion, a figure that continues to grow rapidly, underscoring the shift in consumer behavior towards online channels. These digital-first competitors often leverage economies of scale to offer more competitive pricing and a wider product selection, directly challenging Yamada's established brick-and-mortar presence.

Global supply chain disruptions and geopolitical instability continue to pose significant threats, directly impacting Yamada Holdings' profitability. Fluctuations in raw material costs for housing and furniture, such as lumber and steel, can squeeze margins. For example, rising costs for housing materials have already contributed to decreased profits in Yamada Holdings' YAMADA HOMES segment during fiscal year 2023, demonstrating a clear vulnerability to these external market forces.

Demographic Challenges in Japan

Japan's rapidly aging population and consistently low birth rate present significant demographic headwinds for Yamada Holdings. By 2023, Japan's population aged 65 and over reached approximately 36.2 million, representing 29.1% of the total population, a figure expected to climb further. This shrinking and aging consumer base directly impacts the potential for volume growth in many consumer electronics segments.

While Yamada's 'Total-Living' strategy is designed to adapt to changing household needs, the fundamental challenge of a declining consumer pool remains. For instance, the number of households in Japan has been on a downward trend, with projections indicating a continued decrease in the coming years. This contraction in the overall market size poses a long-term threat to sustained expansion for electronics retailers.

- Shrinking Consumer Base: Japan's population is projected to fall below 120 million by 2025 and continue declining, impacting overall consumer demand.

- Aging Demographics: The increasing proportion of elderly citizens (over 29% in 2023) may shift spending patterns away from certain electronics categories.

- Lower Birth Rate Impact: A persistently low birth rate means fewer young consumers entering the market over time.

Technological Obsolescence and Rapid Product Cycles

The consumer electronics sector is characterized by swift technological advancements, meaning products can become outdated quickly. Yamada Holdings must continuously invest in research and development and adapt its product lines to stay competitive. For instance, the smartphone market sees new models released annually, making previous iterations less desirable.

This rapid obsolescence necessitates agile inventory management to avoid holding unsellable older stock. Failing to innovate or clear out older inventory effectively can lead to significant financial write-downs. In 2023, the global consumer electronics market faced challenges with overstocking in certain categories due to shifting consumer demand and supply chain disruptions, impacting profitability for many players.

- Rapid Product Cycles: The constant introduction of new technologies, like foldable screens or enhanced AI capabilities in devices, shortens the lifespan of existing products.

- Inventory Management Challenges: Yamada Holdings needs efficient systems to track and manage inventory, minimizing losses from obsolete stock.

- Investment in R&D: Continuous investment in developing new and innovative products is crucial to avoid falling behind competitors.

- Adaptability to Trends: The company must be able to quickly pivot to new market trends and consumer preferences to maintain market share.

Intensifying online competition, particularly from global e-commerce giants, poses a significant threat to Yamada Holdings' traditional retail model. With Japan's e-commerce sales projected to exceed ¥20 trillion in 2024, the shift to online channels is undeniable, challenging Yamada's physical store presence. Furthermore, global supply chain disruptions and geopolitical instability continue to impact profitability by causing fluctuations in raw material costs, as seen with housing materials impacting Yamada Homes in fiscal year 2023.

The company also faces demographic headwinds from Japan's aging population and low birth rate, with over 29% of the population being 65+ in 2023 and a continued decline in the number of households. This shrinking consumer base directly impacts potential volume growth in key electronics segments. Lastly, the rapid pace of technological advancement in consumer electronics necessitates continuous R&D investment and agile inventory management to avoid losses from obsolete stock, a challenge highlighted by overstocking issues in the global market in 2023.

| Threat | Description | Impact on Yamada | Supporting Data (2023-2025) |

|---|---|---|---|

| Online Competition | Growth of e-commerce platforms | Reduced foot traffic, price pressure | Japan e-commerce sales > ¥20 trillion (2024 est.) |

| Supply Chain/Geopolitics | Disruptions, rising material costs | Reduced margins, increased operating costs | Increased housing material costs impacting YAMADA HOMES (FY2023) |

| Demographic Shifts | Aging population, declining birth rate | Shrinking consumer base, shifting demand | Japan's 65+ population ~29.1% (2023); Projected population decline below 120 million by 2025 |

| Technological Obsolescence | Rapid product lifecycles, innovation demands | Inventory write-downs, R&D investment needs | Global consumer electronics overstocking challenges (2023) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Yamada Holdings' official financial statements, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of the company's strategic position.