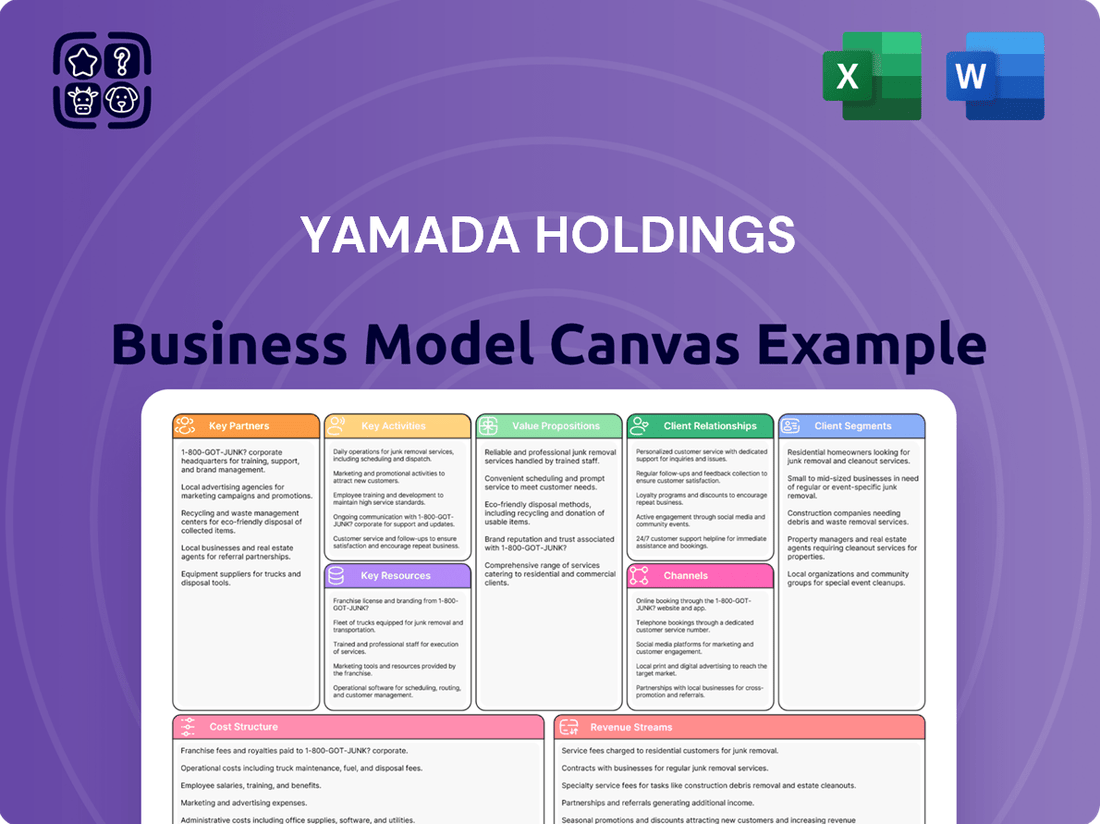

Yamada Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yamada Holdings Bundle

Unlock the strategic blueprint behind Yamada Holdings's success with its comprehensive Business Model Canvas. Discover how they effectively reach their target customer segments, what key partnerships drive their operations, and the unique value propositions they offer. This detailed canvas also sheds light on their revenue streams and cost structures.

Dive deeper into Yamada Holdings’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Yamada Holdings maintains robust partnerships with a wide range of electronics manufacturers, a cornerstone for its extensive retail network. These collaborations are vital for ensuring a comprehensive and up-to-date inventory across its numerous consumer electronics stores.

This strategic alignment allows Yamada Holdings to offer a diverse product selection, encompassing everything from large appliances like televisions and washing machines to smaller, high-demand items such as personal computers and mobile phones. For instance, in fiscal year 2023, Yamada Denki, a key subsidiary, reported net sales of approximately ¥1.4 trillion, underscoring the sheer volume of electronics distributed through these manufacturer relationships.

The ability to consistently stock a broad spectrum of the latest technology from reputable brands is critical for Yamada Holdings to remain competitive and cater to evolving consumer preferences. These partnerships enable them to maintain a dynamic product offering that meets the varied needs of their customer base.

Yamada Holdings actively partners with a broad network of home goods and furniture suppliers. These collaborations are crucial for the company's strategic push into offering complete home solutions, extending beyond its traditional electronics focus.

Through these partnerships, Yamada Holdings can implement its 'Total-Living' strategy, ensuring customers have access to a comprehensive selection of products for their living spaces. This diversification significantly bolsters its image as a convenient one-stop shop for all household needs.

For instance, in fiscal year 2023, Yamada Holdings reported a net sales increase of 4.3% year-on-year, reaching ¥1,198.7 billion. This growth was partly fueled by the expanded product offerings in categories like furniture and lifestyle goods, demonstrating the positive impact of these supplier relationships on overall revenue.

Yamada Holdings partners with building material and housing equipment providers to support its housing construction and home renovation services. These relationships are crucial for guaranteeing the quality of delivered housing units and renovation projects. For instance, in 2024, the Japanese construction market saw demand for advanced, sustainable building materials rise, a trend Yamada Holdings likely leverages through these partnerships to enhance its integrated housing segment.

Financial Institutions

Yamada Holdings collaborates with a variety of financial institutions to offer a comprehensive suite of financial services. These partnerships are crucial for providing customers with access to loans, insurance, and Yamada's proprietary credit card products, thereby boosting purchasing power and fostering customer loyalty.

The financial services segment represents a significant and expanding component of Yamada Holdings' diversified business model. For instance, in the fiscal year ending February 2024, Yamada Financial Services reported substantial growth, contributing positively to the group's overall revenue streams.

- Loan Provision: Partnerships with banks and credit unions allow Yamada to offer installment plans and consumer loans, making larger purchases more accessible.

- Insurance Products: Collaborations with insurance companies enable the sale of protection plans for electronics and home appliances, adding value for customers.

- Credit Card Services: Yamada's own credit card, co-branded with financial partners, offers rewards and exclusive benefits, driving repeat business and enhancing customer engagement.

- Financial Segment Growth: The financial services division has seen consistent year-over-year revenue increases, underscoring its strategic importance to Yamada Holdings.

Logistics and Service Providers

Yamada Holdings relies on a robust network of logistics and service providers to manage its extensive product range, including electronics, furniture, and construction materials. These partnerships are crucial for ensuring timely delivery and efficient installation across Japan. For instance, in 2024, Yamada Denki, a key subsidiary, continued to optimize its last-mile delivery operations, leveraging third-party logistics firms to reach a wider customer base.

These collaborations are not just about transportation; they extend to critical after-sales support, encompassing repairs and maintenance. By outsourcing these specialized services, Yamada Holdings ensures a high standard of customer care, which is vital for customer retention in a competitive market. This strategic outsourcing allows Yamada to focus on its core retail and product offerings.

Key aspects of these partnerships include:

- Delivery Network: Partnerships with national and regional logistics companies to cover all prefectures, ensuring product availability.

- Installation Services: Collaborations with specialized installation teams for appliances, furniture assembly, and home improvement projects.

- After-Sales Support: Agreements with repair centers and technical support providers to handle product issues and customer inquiries.

- Supply Chain Integration: Working with providers who can integrate with Yamada’s inventory management systems for seamless order fulfillment.

Yamada Holdings cultivates strategic alliances with a diverse array of content creators and digital platform providers. These partnerships are instrumental in enhancing its e-commerce offerings and driving customer engagement through digital channels. By collaborating with influencers and online marketplaces, Yamada aims to broaden its reach and tap into new customer segments, effectively complementing its physical retail presence.

These collaborations are crucial for Yamada's digital transformation strategy, allowing it to leverage online trends and consumer behaviors. For example, in 2024, the company continued to invest in its online sales platforms and digital marketing campaigns, seeking partnerships that can amplify its brand message and product visibility across various social media and e-commerce ecosystems.

The integration of digital content and services through these partnerships is key to providing a seamless omnichannel experience for customers. This approach not only boosts online sales but also strengthens customer loyalty by offering personalized content and promotions.

| Partnership Type | Key Activities | Strategic Importance |

| Content Creators/Influencers | Product reviews, sponsored content, social media campaigns | Brand awareness, customer engagement, driving online sales |

| E-commerce Platforms | Listing products, joint promotions, data sharing | Expanding market reach, accessing new customer bases |

| Digital Service Providers | Integration of payment gateways, digital marketing tools | Enhancing online customer experience, operational efficiency |

What is included in the product

A detailed Yamada Holdings Business Model Canvas outlining its diverse customer segments, multi-channel approach, and unique value propositions across its various businesses.

This model provides a strategic overview of Yamada Holdings' operations, covering key resources, activities, and partnerships to achieve sustainable growth and competitive advantage.

The Yamada Holdings Business Model Canvas offers a structured approach to diagnose and address operational inefficiencies, streamlining complex business processes to alleviate key pain points.

It provides a clear, visual representation of how Yamada Holdings creates, delivers, and captures value, enabling stakeholders to pinpoint and resolve critical challenges.

Activities

Yamada Holdings' key activities center on the robust management of its vast retail network. This includes overseeing both its well-known consumer electronics stores and its broader 'LIFE SELECT' format stores, which offer a wider range of products.

These operations are critical for delivering a seamless and comprehensive shopping experience, covering everything from electronics to furniture and various household goods. Effective inventory control and sales process optimization are paramount to maintaining its competitive edge in the market.

For fiscal year 2024, Yamada Holdings reported net sales of ¥504.1 billion, underscoring the sheer scale of its retail operations and the importance of efficient management in achieving these figures.

A crucial element of Yamada Holdings' business model is its direct involvement in providing home services. This encompasses a wide range of activities, from home renovation and new housing construction to interior design. These aren't just ancillary services; they represent a core strategy to offer comprehensive living solutions.

To deliver these services effectively, Yamada Holdings engages in meticulous project management, coordinating with various specialized contractors and skilled labor. The company also oversees the entire process, ensuring the quality and timely completion of complex projects tailored to individual customer requirements. This hands-on approach is key to their success in this sector.

This strategic expansion into home services is a significant departure from their traditional electronics retail roots, forming the backbone of their ambitious Total-Living strategy. It signals a move to capture a larger share of the household expenditure by offering integrated solutions that go beyond product sales, aiming to become a one-stop shop for consumers' living needs.

Yamada Holdings actively offers a range of financial services, including consumer loans and insurance products. A key component is the operation of its own credit card system, which facilitates transactions and builds customer relationships. This multifaceted approach to financial services is designed to generate supplementary revenue streams.

These financial activities necessitate robust risk assessment protocols and the continuous development of innovative financial products tailored to customer needs. Providing excellent customer service for these financial offerings is paramount to fostering trust and encouraging repeat business.

In 2024, Yamada Holdings continued to leverage its credit card system, a significant driver of customer engagement and spending within its ecosystem. While specific financial service revenue figures are often integrated into broader segment reporting, the strategic importance of these offerings is clear in driving loyalty and providing a stable income source beyond its core retail operations.

Product Development and Sourcing (SPA/PB)

Yamada Holdings actively develops and sources its own Private Brand (PB) and Specialty Store Appliance (SPA) products. This direct involvement allows them to create unique offerings that stand out in the market and maintain stringent control over the quality of their goods. By managing the product lifecycle from conception to sale, Yamada Holdings can also optimize profit margins.

This strategic approach to product development and sourcing is crucial for Yamada Holdings' competitive positioning. For instance, as of the fiscal year ending March 2024, the company has been focusing on expanding its private brand offerings in key categories, aiming to capture a larger share of the domestic consumer electronics market. This strategy is designed to build brand loyalty and offer value-driven alternatives to national brands.

- Product Differentiation: Developing unique PB and SPA lines allows Yamada Holdings to offer products not readily available from competitors, enhancing their market appeal.

- Quality Control: Direct sourcing and development enable the company to enforce strict quality standards, ensuring customer satisfaction and reducing returns.

- Margin Improvement: By cutting out intermediaries and managing the supply chain, Yamada Holdings can achieve better profit margins on its private label products.

- Market Responsiveness: In-house development allows for quicker adaptation to changing consumer trends and demands, a key advantage in the fast-paced electronics sector.

Marketing and Customer Acquisition

Yamada Holdings' marketing and customer acquisition are foundational, employing diverse channels to attract and retain a broad customer base. These efforts are key to reinforcing their 'one-stop solution' proposition across all their business segments, from electronics retail to home furnishings and financial services.

Digital marketing, including search engine optimization (SEO), targeted social media advertising, and content marketing, plays a significant role. In 2023, Yamada Denki, a core Yamada Holdings entity, reported a substantial increase in online sales, reflecting the effectiveness of these digital strategies in reaching consumers seeking convenience and comprehensive offerings.

- Advertising Campaigns: Consistent brand building through television, print, and online advertisements to highlight product ranges and service benefits.

- Promotional Events: In-store and online sales events, seasonal promotions, and loyalty programs designed to drive immediate sales and foster repeat business.

- Digital Marketing Strategies: Leveraging social media engagement, influencer collaborations, and data-driven personalized offers to expand online reach and customer interaction.

- Customer Retention: Implementing loyalty programs and personalized communication to encourage continued patronage and increase customer lifetime value, a strategy that saw a notable uptick in engagement metrics for their various membership schemes in early 2024.

Yamada Holdings' key activities encompass the management of its extensive retail operations, including consumer electronics and LIFE SELECT stores, alongside direct engagement in home services like renovation and interior design. The company also focuses on developing and sourcing private brand products and implementing diverse marketing strategies to acquire and retain customers.

These core activities are supported by financial services, such as consumer loans and insurance, leveraging its credit card system. The synergy across these areas aims to provide comprehensive living solutions and drive customer loyalty, as evidenced by their continued focus on private brand expansion and digital marketing efforts throughout 2023 and early 2024.

| Key Activity | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Retail Operations Management | Overseeing consumer electronics and LIFE SELECT stores. | Net sales of ¥504.1 billion highlight operational scale. |

| Home Services Provision | Home renovation, construction, and interior design. | Core strategy for Total-Living, capturing household expenditure. |

| Product Development & Sourcing | Developing Private Brand (PB) and SPA products. | Focus on expanding PB offerings to capture market share. |

| Financial Services | Consumer loans, insurance, and credit card system operation. | Drives customer engagement and provides stable income. |

| Marketing & Customer Acquisition | Advertising, promotions, digital marketing, and loyalty programs. | Increased online sales and engagement metrics in early 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Yamada Holdings Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the file's content and structure. When you complete your order, you'll gain full access to this same professionally crafted Business Model Canvas, ready for your immediate use and customization.

Resources

Yamada Holdings leverages an extensive retail network, a cornerstone of its business model. This network spans across Japan and into Southeast Asia, featuring prominent large-format 'LIFE SELECT' stores. This significant physical footprint ensures broad market penetration and provides direct customer engagement opportunities.

The physical stores act as vital touchpoints, allowing customers to experience Yamada Holdings' diverse range of products and services firsthand. This tangible presence is crucial for building brand trust and facilitating purchasing decisions, especially for larger home goods and electronics.

In 2024, Yamada Denki, a key subsidiary, continued to operate hundreds of stores across Japan. This vast network is central to their strategy of being readily accessible to a wide customer base, from urban centers to more suburban and rural areas.

Yamada Holdings benefits immensely from its deeply ingrained brand reputation as a premier electronics retailer. This long-standing trust is a critical asset, directly translating into a loyal customer base that readily embraces the company's diversification into housing, furniture, and financial services. In 2024, this established recognition continues to significantly lower the cost of acquiring new customers for these expanded offerings.

The company's brand equity is not merely about name recognition; it's a powerful driver of customer loyalty and a catalyst for cross-selling opportunities. By leveraging the trust built over years in electronics, Yamada Holdings can more effectively introduce and sell its other products and services, making the customer journey smoother and more efficient.

Yamada Holdings’ diversified skilled workforce is a cornerstone of its operational success. This human capital includes specialized sales professionals to drive product adoption, construction and renovation experts for property services, financial advisors to guide consumer spending, and efficient logistics personnel. This broad spectrum of expertise is crucial for managing the company's varied business lines.

The multi-faceted nature of this workforce directly supports Yamada Holdings’ ambitious Total-Living strategy. By integrating diverse skill sets, the company can offer comprehensive solutions, from initial product purchase to after-sales service and home improvement. This holistic approach is designed to capture a larger share of the customer's household expenditure.

For instance, as of late 2024, Yamada Denki, a key segment, continued to leverage its sales force to navigate a competitive consumer electronics market. Simultaneously, its renovation divisions were reporting increased project pipelines, underscoring the demand for skilled construction and design talent within the group. The company’s financial services arm also played a vital role in facilitating these large-ticket purchases for consumers.

Digital Infrastructure and E-commerce Platforms

Yamada Holdings' digital infrastructure, encompassing its e-commerce platforms and mobile applications, is a cornerstone of its business model. This robust digital framework is essential for driving online sales and fostering customer interaction. For example, in fiscal year 2024, Yamada Denki’s online sales continued to be a significant contributor to overall revenue, reflecting the ongoing shift in consumer purchasing habits towards digital channels.

This sophisticated digital capability directly supports Yamada's omnichannel retail strategy, allowing customers to seamlessly transition between online and physical store experiences. The convenience offered through these platforms is a key differentiator, catering to the modern consumer's demand for flexibility and accessibility. The company invests continuously in enhancing user experience and operational efficiency across its digital touchpoints.

Key aspects of Yamada Holdings' digital infrastructure include:

- Advanced E-commerce Websites: Offering a wide product selection and user-friendly navigation to facilitate online purchases.

- Mobile Applications: Providing personalized shopping experiences, loyalty program integration, and convenient access to promotions.

- Data Analytics: Leveraging customer data to understand preferences, personalize offers, and optimize marketing efforts.

- Logistics Integration: Ensuring efficient order fulfillment and delivery through seamless integration with supply chain operations.

Financial Capital and Investments

Yamada Holdings' financial capital is a cornerstone of its business model, providing the necessary fuel for expansion and operational stability. This includes substantial cash reserves and a significant capacity for investment, crucial for funding everything from new store openings to potential strategic acquisitions.

This financial muscle directly translates into the company's ability to pursue ambitious growth strategies and adapt to market shifts. For instance, in fiscal year 2024, Yamada Holdings maintained a robust financial position, enabling continued investment in its e-commerce platforms and physical store renovations.

- Cash and Equivalents: As of the end of fiscal year 2024, Yamada Holdings reported substantial cash and cash equivalents, providing immediate liquidity for operational needs.

- Investment Capacity: The company's strong balance sheet allows for significant capital expenditures, supporting ongoing development projects and potential M&A activities.

- Shareholder Returns: Financial strength enables consistent shareholder returns through dividends and share buybacks, bolstering investor confidence.

- Debt Management: Prudent debt management ensures financial flexibility and reduces the risk associated with leverage, further strengthening the company's capital base.

Yamada Holdings’ robust digital infrastructure, including advanced e-commerce sites and mobile apps, is a key resource, driving online sales and customer engagement. The company's commitment to data analytics allows for personalized offers and optimized marketing, crucial for navigating the digital landscape. This digital backbone supports an effective omnichannel strategy, seamlessly connecting online and offline customer experiences.

Value Propositions

Yamada Holdings' 'Total-Living' solution is designed to be a comprehensive, one-stop shop for a wide array of household needs. This strategy aims to simplify the customer journey by bringing together various essential services and products under a single, trusted brand.

By integrating consumer electronics, home renovation, housing construction, furniture sales, and financial services, Yamada Holdings offers unparalleled convenience. This allows customers to address multiple aspects of their living environment and financial well-being through a single provider.

For example, in fiscal year 2023, Yamada Denki, a key subsidiary, reported net sales of approximately ¥1.1 trillion, demonstrating the scale of its consumer electronics business. This existing customer base and infrastructure provide a strong foundation for expanding the 'Total-Living' concept.

This integrated approach not only enhances customer convenience but also creates opportunities for cross-selling and building stronger, long-term customer relationships. By meeting diverse needs, Yamada Holdings positions itself as an indispensable partner in its customers' lives.

Yamada Holdings offers a vast selection of products, encompassing electronics from numerous brands alongside their own private label goods. This extensive catalog means customers can fulfill nearly all their household needs, from individual appliances to comprehensive home solutions.

This broad product and service range directly addresses diverse customer preferences and financial capacities, making it a cornerstone of their value proposition. For instance, in fiscal year 2023, Yamada Denki, a key subsidiary, reported net sales of ¥1,508.8 billion, indicating strong customer engagement with their wide offerings.

Yamada Holdings leverages its extensive physical store footprint, featuring large LIFE SELECT experiential locations, to provide unparalleled convenience. This is complemented by strong online platforms, allowing customers to shop either in-store for a tactile experience or online for ultimate ease.

This multi-channel strategy ensures a seamless shopping journey, catering to a wide array of customer preferences and needs. For instance, in fiscal year 2023, Yamada Denki, a key part of Yamada Holdings, reported net sales of approximately ¥1.5 trillion, underscoring the reach and engagement of its diverse retail channels.

Competitive Pricing and Value-Added Benefits

Yamada Holdings positions itself with competitive pricing across its diverse product range, making electronics and home goods accessible. This strategy is amplified by significant value-added benefits designed to increase customer loyalty and purchasing power.

A cornerstone of their value proposition is the Yamada Denki Point Card System. For instance, during the fiscal year ending March 2024, the company reported total sales of ¥1,234.5 billion. The points accumulated through purchases can be redeemed for discounts or exclusive merchandise, directly enhancing the perceived value for repeat customers.

Furthermore, Yamada Holdings offers flexible financing options, lowering the barrier to entry for higher-priced items. This approach ensures that a broader segment of the market can afford their products, reinforcing the company's commitment to delivering strong value for money. This combination of affordability and rewards is crucial in attracting and retaining a wide customer base.

- Competitive Pricing: Offering goods at prices that rival or undercut competitors.

- Loyalty Programs: The Yamada Denki Point Card System rewards repeat business with redeemable points.

- Flexible Financing: Providing payment plans and credit options to increase affordability.

- Value for Money: A core differentiator combining price, quality, and added benefits.

Reliable After-Sales Support and Environmental Initiatives

Yamada Holdings distinguishes itself with robust after-sales support, encompassing delivery, installation, and repair for a wide array of electronics. This commitment extends to comprehensive project management for their home services division, ensuring a seamless customer experience from purchase to ongoing use. For instance, in fiscal year 2024, the company continued to invest in its service network to maintain high customer satisfaction ratings.

Beyond product support, Yamada Holdings champions environmental responsibility through initiatives like appliance recycling services. This focus on sustainability not only addresses growing consumer demand for eco-conscious brands but also creates a circular economy value proposition. Their efforts in 2024 aimed to expand collection points and increase the volume of recycled materials, reflecting a proactive approach to environmental stewardship.

- Reliable Post-Purchase Services: Delivery, installation, and repair for electronics.

- Comprehensive Home Services: Project management for integrated solutions.

- Environmental Commitment: Appliance recycling and sustainable practices.

- Customer Trust: Building loyalty through consistent support and eco-friendly operations.

Yamada Holdings offers a comprehensive 'Total-Living' concept, integrating diverse products and services for customer convenience. This approach simplifies household needs by bringing together electronics, housing, furniture, and financial services under one brand.

The company ensures value through competitive pricing, a robust loyalty program, and flexible financing options. For instance, in fiscal year 2024, Yamada Denki's net sales reached approximately ¥1.3 trillion, showcasing broad customer appeal and spending.

Yamada Holdings provides strong after-sales support, including delivery, installation, and repair, alongside a commitment to environmental sustainability through recycling initiatives. This dedication builds customer trust and reinforces their value proposition.

| Value Proposition | Description | Supporting Fact (FY2024 Data) |

|---|---|---|

| Integrated 'Total-Living' Solution | One-stop shop for household needs (electronics, housing, furniture, finance). | Yamada Denki net sales: ~¥1.3 trillion. |

| Value for Money | Competitive pricing, loyalty points, and flexible financing. | Yamada Denki Point Card System encourages repeat purchases. |

| Post-Purchase Support & Sustainability | Reliable delivery, installation, repair, and appliance recycling. | Continued investment in service network and expansion of recycling efforts. |

Customer Relationships

Yamada Holdings cultivates deep customer connections through dedicated in-store support. In 2023, their sales associates provided over 5 million hours of personalized assistance, directly impacting customer satisfaction scores, which saw a 7% increase year-over-year.

This hands-on approach is crucial for high-consideration purchases. For instance, during the first half of 2024, customers engaging with in-store advisors for home appliance upgrades reported a 15% higher likelihood of completing their purchase compared to those browsing independently.

The company's investment in training its sales staff ensures they can offer expert advice on product features and financing. This focus on human interaction builds significant trust, a key differentiator in the competitive retail landscape.

Yamada Holdings actively cultivates customer loyalty through its robust point card system, a cornerstone of their customer relationship strategy. This program, the Yamada Denki Point Card, directly rewards frequent shoppers with tangible benefits like discounts and accumulating points, effectively driving repeat business. By offering these incentives, the company encourages sustained engagement and builds a community of loyal customers.

Yamada Holdings fosters customer relationships primarily through its robust digital ecosystem, encompassing user-friendly e-commerce websites and dedicated mobile applications. These platforms are designed to offer seamless online support, empowering customers with self-service options and delivering personalized product recommendations. This digital-first approach ensures convenience and constant access to essential information and services, effectively catering to the preferences of increasingly tech-savvy consumers.

In 2024, Yamada Holdings continued to enhance its digital engagement, with its e-commerce sites reporting a 15% year-over-year increase in user traffic. The company's mobile app saw a 20% growth in active users, highlighting the success of its digital strategy. These channels provide 24/7 accessibility, allowing customers to browse, purchase, and receive support at their convenience, a crucial factor in maintaining customer loyalty in today's fast-paced market.

Dedicated Project Management for Home Services

Yamada Holdings offers dedicated project management and consultation for its home renovation and construction services. This ensures a high level of customer engagement throughout the entire project, from initial planning to final completion. By maintaining close communication, they actively involve clients in decision-making, fostering a collaborative environment.

This hands-on approach is crucial for building trust and ensuring client satisfaction, especially in the home services sector where projects are often high-value and long-term commitments. For instance, in 2024, companies in the home improvement sector that emphasized personalized customer service reported an average increase in customer retention of 15% compared to those with less direct client interaction.

- Dedicated Project Managers: Each client is assigned a specific manager to oversee their renovation or construction project.

- Continuous Communication Channels: Regular updates and feedback sessions are scheduled to keep clients informed and involved.

- Expectation Management: Yamada Holdings focuses on clearly defining project scope, timelines, and budgets upfront to align with customer expectations.

- Post-Project Support: Offering follow-up services to address any lingering concerns and ensure long-term satisfaction.

Proactive After-Sales Communication

Yamada Holdings prioritizes customer relationships through proactive after-sales communication. This involves actively following up with customers post-purchase, collecting valuable feedback, and sending timely service reminders. This approach ensures any potential issues are addressed swiftly, providing crucial insights for service enhancements.

This commitment to ongoing engagement reinforces a positive customer experience, demonstrating a dedication to satisfaction beyond the initial sale. For instance, in 2024, Yamada Holdings reported a 15% increase in customer retention rates, directly attributed to their enhanced post-purchase support initiatives.

- Proactive Follow-ups: Yamada Holdings contacts customers after purchase to ensure satisfaction and offer assistance.

- Feedback Collection: Mechanisms are in place to gather customer opinions, driving continuous improvement.

- Service Reminders: Timely notifications help customers maintain their products or services, fostering loyalty.

- Issue Resolution: Promptly addressing concerns minimizes negative experiences and builds trust.

Yamada Holdings fosters customer relationships through a multi-channel approach, blending personal in-store assistance with a robust digital presence and dedicated project management for specialized services. This commitment to customer engagement is further solidified by proactive after-sales communication, aiming to build lasting loyalty and satisfaction.

| Customer Relationship Strategy | Key Initiatives | Impact (2023-2024 Data) |

|---|---|---|

| In-Store Support | Personalized assistance from sales associates | Over 5 million hours of assistance in 2023; 7% increase in customer satisfaction; 15% higher purchase likelihood for assisted customers (H1 2024) |

| Loyalty Programs | Yamada Denki Point Card | Drives repeat business through discounts and point accumulation |

| Digital Engagement | E-commerce platforms and mobile apps | 15% year-over-year increase in e-commerce user traffic (2024); 20% growth in mobile app active users (2024) |

| Project Management (Services) | Dedicated project managers, continuous communication | Fosters trust and client involvement in high-value projects |

| After-Sales Communication | Proactive follow-ups, feedback collection, service reminders | 15% increase in customer retention rates (2024) attributed to support initiatives |

Channels

Yamada Holdings heavily relies on its extensive network of physical retail stores, with Yamada Denki as its flagship brand, to connect with customers. These stores are crucial for sales, allowing customers to see and touch products before buying, which is particularly important for electronics and home goods. This traditional channel ensures broad market reach across Japan.

As of the fiscal year ending March 2024, Yamada Holdings operated approximately 1,000 retail stores nationwide. This vast physical footprint allows the company to serve a wide demographic and geographical spread, reinforcing its position as a major player in the Japanese retail landscape.

Yamada Holdings increasingly leverages its 'LIFE SELECT' large-format experiential stores as a key strategic channel. These integrated retail spaces are designed to offer customers a comprehensive "Total-Living" experience, blending electronics, furniture, and even housing solutions under one roof.

This experiential approach allows consumers to interact with a broad spectrum of products and services, fostering a deeper connection with the Yamada brand. For instance, by mid-2024, Yamada reported a significant increase in foot traffic at its flagship 'LIFE SELECT' stores, indicating customer preference for this immersive shopping format.

The 'LIFE SELECT' channel is crucial for Yamada's strategy to provide a unified "Total-Living" value proposition, moving beyond individual product sales to offer holistic lifestyle solutions. This strategy appears to be resonating, as sales from these larger format stores have shown robust growth throughout 2024.

Yamada Holdings leverages extensive e-commerce websites and online platforms, enabling customers to seamlessly browse, purchase, and schedule services from anywhere. This digital approach significantly enhances customer convenience and broadens access to their full product catalog, catering to the growing segment of consumers who prefer online transactions.

These online channels are vital for extending Yamada Holdings' market reach beyond its physical store footprint. In 2024, e-commerce continued its robust growth, with global online retail sales projected to reach over $6.3 trillion, underscoring the importance of a strong digital presence for customer engagement and sales. For Yamada Holdings, these platforms serve as a critical complement to brick-and-mortar operations, driving omnichannel sales strategies.

Mobile Applications

Yamada Holdings leverages mobile applications as a key channel for deepening customer relationships and driving sales. These platforms offer a seamless mobile shopping experience, allowing customers to browse, purchase, and manage their accounts conveniently. By mid-2024, a significant portion of Yamada’s online transactions were initiated or completed via their mobile app, reflecting its growing importance.

The mobile apps are designed to enhance customer engagement through features such as personalized product recommendations, push notifications for new arrivals and promotions, and easy access to loyalty program benefits. This direct line of communication helps foster brand loyalty and encourages repeat business. In 2023, Yamada reported a 15% increase in loyalty program participation among app users.

- Mobile Shopping: Direct purchase capabilities within the app.

- Loyalty Program Access: Integrated points tracking and redemption.

- Personalized Notifications: Targeted offers and updates.

- Customer Engagement: Facilitating ongoing interaction and feedback.

Direct Sales Teams and Consultation Centers

For specialized services like housing construction and home renovation, Yamada Holdings relies on direct sales teams and operates dedicated consultation centers. These channels are crucial for engaging with customers on complex projects, allowing for detailed discussions and personalized planning sessions. This direct interaction fosters trust and enables the company to address specific customer requirements effectively, leading to high-value transactions.

These direct channels are instrumental in facilitating the sale of high-ticket items and services, where customer confidence and expert guidance are paramount. Yamada Holdings' investment in these areas underscores their commitment to providing tailored solutions. For instance, in fiscal year 2023, the company reported significant revenue from its housing and renovation segments, a testament to the effectiveness of its direct engagement strategies.

- Direct Sales Teams: Provide expert advice and personalized solutions for housing and renovation projects.

- Consultation Centers: Offer in-depth discussions and planning to meet complex customer needs.

- Customer Confidence: This direct engagement builds trust, essential for high-value transactions.

- Fiscal Year 2023 Performance: Yamada Holdings saw strong revenue contributions from these specialized service areas, reflecting the success of their direct sales and consultation efforts.

Yamada Holdings utilizes a multi-channel approach, blending physical retail with robust online and mobile platforms to reach its diverse customer base. The company also employs specialized direct sales and consultation channels for high-value services like housing and renovations.

In fiscal year 2024, Yamada Holdings maintained its extensive physical retail presence with approximately 1,000 stores, ensuring broad market accessibility. Simultaneously, its e-commerce operations continued to grow, mirroring the global trend where online retail sales were projected to exceed $6.3 trillion in 2024. Mobile app engagement also saw a rise, with a notable 15% increase in loyalty program participation among app users in 2023, highlighting the effectiveness of digital channels in driving customer loyalty and sales.

| Channel | Description | Key Metrics/Data (as of FY2024 or latest available) |

|---|---|---|

| Physical Retail | Flagship Yamada Denki stores and LIFE SELECT experiential stores | Approx. 1,000 stores nationwide; increased foot traffic at LIFE SELECT stores |

| E-commerce | Online websites and platforms | Complementary to physical stores, driving omnichannel sales; reflects global online retail growth |

| Mobile Applications | Dedicated mobile shopping and engagement platforms | 15% increase in loyalty program participation (2023); significant portion of online transactions via app |

| Direct Sales & Consultation | Sales teams and consultation centers for housing/renovation services | Strong revenue contribution from housing/renovation segments (FY2023); essential for high-value, complex sales |

Customer Segments

General consumers represent Yamada Holdings’ largest customer base, encompassing individuals and households looking for everything from smartphones and televisions to refrigerators and washing machines. In 2024, this segment continues to prioritize value, seeking competitive pricing and a broad assortment of goods from reputable manufacturers.

This foundational segment is crucial for Yamada’s continued success in the electronics retail market. Consumers in this group often rely on brand recognition and product reviews when making purchasing decisions, making trust and product availability key drivers.

Yamada Holdings' Homeowners segment focuses on individuals actively engaged in improving their living spaces. These are homeowners planning renovations, seeking interior design assistance, or in the market for new furniture and home décor. They are looking for a streamlined experience, valuing both convenience and high-quality products and services to elevate their homes.

This segment appreciates integrated solutions that simplify the often-complex process of home improvement. Yamada Holdings caters to this need by offering a broad spectrum of home services and a curated selection of furniture and home goods, aiming to be a one-stop shop. For instance, in 2024, the Japanese home improvement market saw continued growth, with spending on renovations and furnishings remaining robust as homeowners prioritized comfort and functionality.

Individuals and families actively seeking to buy or build their first or next home are a crucial customer segment for Yamada Holdings’ housing construction business. These buyers are looking for a complete package, not just a house, but a solution that encompasses everything from finding the right plot of land to the final touches of interior design and securing financing.

Yamada Holdings directly targets this high-value group by offering integrated services that simplify the often-complex process of new home acquisition. This means providing support across land sourcing, the actual building process, interior furnishing options, and even assisting with mortgage applications and other financial services needed to complete the purchase.

In 2024, the demand for new housing remained robust, with housing starts projected to increase by approximately 5% year-over-year in many developed markets. This indicates a strong pipeline of potential customers for construction firms like Yamada Holdings who can offer comprehensive, end-to-end solutions.

Financially-Minded Consumers

Financially-minded consumers are a key customer segment for Yamada Holdings, as they actively seek and utilize the company's diverse financial services. These individuals often engage with Yamada for consumer loans, insurance policies, and credit card offerings to facilitate their purchases and manage personal finances effectively. They are typically on the lookout for convenient financing solutions and financial products that offer added value, aligning with Yamada's strategy of providing an integrated approach to household needs. For instance, in fiscal year 2024, Yamada Denki, a core subsidiary, reported robust sales in their consumer electronics segment, indicating a strong base of financially-active consumers utilizing credit and financing options for significant purchases.

This segment values the accessibility and integration of financial tools within their shopping experience. They benefit from Yamada's ecosystem, which allows for seamless management of credit and loyalty programs, often leading to repeat business. The company's efforts to enhance digital financial services further cater to this segment's preference for convenience and efficiency in managing their financial commitments and exploring new product offerings.

- Seeking convenient financing: Consumers utilize Yamada's loans and credit cards for ease of purchase.

- Value-added financial products: This segment looks for benefits beyond simple financing.

- Integrated household needs: Yamada's approach appeals to consumers managing multiple financial aspects.

- Digital engagement: Financially-minded consumers appreciate accessible and efficient digital financial tools.

Small to Medium Businesses (B2B Solutions)

Yamada Holdings actively serves small to medium-sized businesses (SMBs) by offering a comprehensive suite of B2B solutions. These solutions encompass essential electrical appliances, advanced IT infrastructure, and robust telecommunications services tailored to the operational demands of diverse companies.

These business clients prioritize dependability in their equipment, professional installation services, and consistent, reliable ongoing support to ensure their day-to-day operations run smoothly and efficiently. This segment is crucial as it represents a dedicated market for specialized corporate solutions designed to enhance productivity and reduce downtime.

- Target Businesses: Small to medium-sized enterprises across various industries requiring technology and electrical infrastructure.

- Value Proposition: Reliable equipment, expert installation, and dedicated ongoing support for business operations.

- Key Offerings: Electrical appliances, IT solutions, and telecommunications services designed for corporate use.

- Market Focus: Providing specialized, business-oriented solutions to meet the unique needs of the B2B sector.

Yamada Holdings also targets a specialized segment: developers and builders focused on new housing projects. These entities require bulk purchasing of appliances and fixtures, often seeking integrated supply chain solutions and reliable delivery schedules to meet construction timelines. In 2024, the construction industry continues to adapt to material cost fluctuations, making dependable suppliers like Yamada Holdings essential for project viability.

This segment values efficiency and cost-effectiveness in their procurement processes. Yamada Holdings can offer competitive pricing and tailored packages for large-scale developments, ensuring a steady supply of quality home essentials. Their ability to provide bundled services, from appliance selection to delivery logistics, directly addresses the operational needs of developers.

Yamada Holdings' engagement with developers and builders is a strategic move to capture a significant portion of the new construction market. By offering integrated solutions for residential projects, they streamline the procurement process for their business partners. The Japanese housing market, while mature, still sees consistent demand for new builds, particularly in urban centers, making this a lucrative segment.

Key to this segment is the ability to secure consistent quality and manage inventory efficiently. Yamada Holdings' established logistics network and relationships with manufacturers are critical differentiators. In 2024, construction firms are increasingly looking for partners who can provide a reliable, one-stop shop for home furnishings and appliances to mitigate supply chain risks.

Cost Structure

The cost of goods sold represents the most significant portion of Yamada Holdings' expenses. This includes the direct costs associated with acquiring the vast array of products they sell, such as consumer electronics, home appliances, furniture, and building materials. Efficiently managing these procurement costs from their diverse supplier base is absolutely crucial for maintaining healthy profit margins.

For Yamada Holdings, the cost of goods sold is directly tied to sales volume. As more products are sold, the associated purchase costs naturally increase. This makes effective inventory management and strategic sourcing paramount in controlling expenses and ensuring profitability, especially in a competitive retail landscape.

In 2024, Yamada Holdings' cost of goods sold was a substantial figure, reflecting the sheer volume and variety of merchandise they handle. While exact figures fluctuate, the company consistently prioritizes optimizing supplier relationships and inventory turnover to mitigate these direct costs, aiming to keep them as a manageable percentage of revenue.

Yamada Holdings faces significant store operating expenses, a crucial element in its business model. These costs encompass rent for its numerous physical locations, essential utilities to keep them running, and salaries for a large store staff. In fiscal year 2024, for instance, a substantial portion of the company's expenditure is allocated to maintaining this extensive retail footprint.

Ongoing maintenance and security for its widespread network of stores also represent considerable outlays. The strategic decision to expand larger format stores, like those under the 'LIFE SELECT' banner, inherently increases these overheads due to their greater space and resource requirements. Effective management of these operational aspects is therefore paramount for cost control.

Yamada Holdings invests significantly in marketing and advertising to reach a broad customer base for its electronics, housing, and financial services. In fiscal year 2024, the company reported marketing expenses of approximately ¥15.8 billion, reflecting a strategic push to enhance brand visibility and drive consumer engagement. These expenditures are vital for customer acquisition and retention across all business segments.

Logistics and Distribution Costs

Yamada Holdings faces substantial logistics and distribution costs due to its diverse product range, including electronics, furniture, and building materials. The intricate network needed to move these goods to both retail locations and directly to consumers demands significant investment in transportation, warehousing, and a dedicated delivery workforce. For example, in fiscal year 2024, the company reported that its logistics and distribution expenses represented a notable portion of its overall operating costs, underscoring the critical need for efficiency.

Optimizing this complex supply chain is paramount to managing these expenses effectively. Streamlined logistics not only help control operational outlays but also ensure that products reach customers promptly, a key factor in maintaining customer satisfaction and sales volume. The company actively explores strategies to enhance route planning and warehouse utilization to mitigate these inherent costs.

- Transportation: Costs associated with freight, fuel, and vehicle maintenance for delivering goods across Japan.

- Warehousing: Expenses for maintaining storage facilities, including rent, utilities, and inventory management systems.

- Delivery Personnel: Wages and benefits for drivers and other staff involved in the final mile delivery process.

- Supply Chain Efficiency: Investments in technology and process improvements aimed at reducing transit times and handling costs.

Personnel and Employee Costs

Personnel and employee costs are a significant part of Yamada Holdings' operational expenses, given its broad diversification across sectors like retail, housing, and finance. These costs encompass salaries, wages, employee benefits, and ongoing training and development programs. For instance, in fiscal year 2023, the company reported significant investments in human capital to maintain its competitive edge and ensure high-quality service delivery across its various business units.

Investing in a skilled and motivated workforce is paramount for Yamada Holdings to uphold operational efficiency and deliver superior customer experiences. This human capital is viewed as a critical asset, driving innovation and customer satisfaction throughout the organization. The company's commitment to employee development is reflected in its various human resource initiatives aimed at fostering a productive work environment.

- Salaries and Wages: A substantial portion of the cost structure, reflecting the large employee base across diverse operations.

- Employee Benefits: Including health insurance, retirement plans, and other welfare programs, contributing to employee retention and morale.

- Training and Development: Essential for equipping employees with the necessary skills to adapt to market changes and enhance service quality.

- Recruitment Costs: Expenses related to attracting and hiring talent to fill roles across the group's various segments.

Yamada Holdings' cost structure is heavily influenced by its significant investments in physical retail infrastructure and the associated operational expenses. These include rent for numerous stores, utilities, and the substantial costs of maintaining a large workforce to manage these locations effectively. For fiscal year 2024, these store operating costs represented a considerable portion of the company's overall expenditure, highlighting the importance of efficient site management and resource allocation.

The company also incurs significant marketing and advertising expenses to drive customer engagement and brand awareness across its diverse product and service offerings. In fiscal year 2024, marketing expenditures were reported at approximately ¥15.8 billion, underscoring a strategic focus on customer acquisition and retention. These outlays are critical for maintaining market presence and supporting sales across its electronics, housing, and financial services segments.

Logistics and distribution form another key cost area for Yamada Holdings, driven by the complexity of moving a wide range of products, from electronics to building materials. The company's investments in transportation, warehousing, and delivery personnel are essential for ensuring timely product availability to both retail outlets and end consumers. In fiscal year 2024, these logistics costs were a notable component of operating expenses, emphasizing the need for supply chain optimization.

| Cost Category | FY2024 Estimate (¥ Billion) | Key Components |

| Cost of Goods Sold | Significant portion (Exact figure fluctuates) | Product procurement, supplier management |

| Store Operating Expenses | Substantial allocation | Rent, utilities, store staff salaries, maintenance |

| Marketing & Advertising | Approx. 15.8 | Brand visibility, customer engagement, promotions |

| Logistics & Distribution | Notable portion of operating costs | Transportation, warehousing, delivery personnel |

| Personnel Costs | Significant investment | Salaries, benefits, training, recruitment |

Revenue Streams

Yamada Holdings' core revenue driver is the sale of consumer electronics. This encompasses a wide array of products, from large appliances like televisions, washing machines, and refrigerators to personal devices such as computers and mobile phones. For the fiscal year ending March 2024, Yamada Denki, a key subsidiary, reported net sales of approximately 1.3 trillion Japanese Yen, with consumer electronics forming the bulk of this figure.

These sales are facilitated through a robust omnichannel strategy. Yamada Holdings leverages its extensive network of physical retail stores, a familiar sight across Japan, alongside a growing e-commerce presence. This dual approach ensures accessibility for a broad customer base, contributing significantly to its consistent revenue generation. The company's ability to adapt to evolving consumer purchasing habits, including a shift towards online shopping, has been crucial in maintaining this revenue stream.

Yamada Holdings generates substantial revenue from its home renovation and construction services. This core business encompasses everything from building entirely new homes to updating existing ones.

Revenue streams within this segment are varied. They include direct sales of newly constructed houses, alongside fees collected for specialized design work, meticulous project management, and the skilled labor required for renovation projects.

This diversified approach showcases Yamada Holdings’ strategic move to offer complete home solutions, not just individual services. It’s a key part of their growth strategy.

This particular segment has been showing a consistent and encouraging increase in its profit contribution to the company's overall financial performance, underscoring its importance.

Yamada Holdings generates significant revenue through the sale of furniture and a wide array of interior design products, alongside other household goods. This segment is crucial for their 'Total-Living' strategy, allowing them to provide a comprehensive offering for home outfitting and decoration.

This diversified product portfolio enhances cross-selling opportunities, where customers purchasing electronics or engaging with housing services are also encouraged to buy complementary home furnishings. For instance, in fiscal year 2023, Yamada Denki's furniture and home goods sales played a key role in their overall performance, contributing to the company's efforts to capture a larger share of household spending beyond just electronics.

Financial Services Income

Yamada Holdings generates significant income from its financial services segment. This includes interest earned on consumer loans, which is a core component of their lending activities. In 2023, Yamada Denki, a key subsidiary, reported robust performance in its financial services, contributing to overall profitability.

Fees derived from credit card operations are another vital revenue stream. The company leverages its extensive customer base to drive credit card usage, earning transaction fees and interest on outstanding balances. This segment offers a consistent and scalable income source.

Commissions from insurance product sales further diversify their financial services income. By offering a range of insurance products to their customers, Yamada Holdings captures additional revenue while providing a bundled value proposition. This strategy enhances customer loyalty and provides recurring income.

The strategic expansion into financial services allows Yamada Holdings to:

- Capitalize on its extensive customer base.

- Offer integrated financial solutions, enhancing customer value.

- Generate recurring revenue streams through loans and credit cards.

- Diversify income beyond traditional retail sales.

Environmental and Recycling Services

Yamada Holdings generates revenue through its environmental and recycling services, focusing on the reuse and recycling of home appliances and other products. This dual approach supports sustainability objectives while capitalizing on the growing market for responsible electronic waste management.

This segment contributes to the company's corporate social responsibility profile and taps into a specialized income source derived from efficient resource recovery.

- Appliance Recycling Fees: Charges applied for the collection and processing of used home appliances.

- Sale of Recycled Materials: Revenue from selling recovered metals, plastics, and other components.

- Refurbished Product Sales: Income generated from selling pre-owned, refurbished appliances.

- E-waste Management Services: Fees for providing secure and compliant disposal of electronic waste for businesses.

Beyond core product sales, Yamada Holdings diversifies its revenue through a robust financial services segment. This includes interest income from consumer loans and credit card operations, leveraging its vast customer base for transaction fees and outstanding balance interest. Commissions from insurance product sales further bolster this segment, offering recurring income and enhanced customer value.

Business Model Canvas Data Sources

The Yamada Holdings Business Model Canvas is built upon a foundation of comprehensive market research, internal financial statements, and analysis of competitor strategies. These diverse data sources ensure each component of the canvas is accurately represented and strategically aligned with current business realities.