Yamada Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yamada Holdings Bundle

Gain a strategic advantage with our comprehensive PESTLE analysis of Yamada Holdings. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its operational landscape and future growth. Our expertly crafted report offers actionable insights to inform your investment decisions and market strategies. Don't miss out on crucial intelligence; download the full version now and unlock a deeper understanding of Yamada Holdings's external environment.

Political factors

Government policies directly influence Yamada Holdings' retail and e-commerce operations. Regulations concerning consumer data privacy, such as the General Data Protection Regulation (GDPR) in Europe and similar initiatives globally, can significantly impact how Yamada Holdings collects, stores, and uses customer information, potentially increasing compliance costs.

New licensing requirements for specific product categories, for example, in electronics or pharmaceuticals, could also add to operational expenses and create compliance hurdles. In Japan, the Act on Specified Commercial Transactions and the Personal Information Protection Act are key regulations affecting e-commerce businesses.

Conversely, government incentives aimed at promoting digital transformation within the retail sector could benefit Yamada Holdings. For instance, subsidies for adopting new technologies or tax breaks for e-commerce expansion might foster growth and innovation, as seen in various initiatives supporting small and medium-sized enterprises in Japan's digital economy.

The evolving landscape of online sales tax regulations, both domestically and internationally, also presents a dynamic factor. Changes in how online transactions are taxed can directly affect Yamada Holdings' pricing strategies and overall revenue streams, requiring constant adaptation to fiscal policies.

Consumer protection laws in Japan, covering product safety, warranties, and advertising, significantly impact Yamada Holdings' operations as an electronics retailer. Strict adherence is essential for building consumer trust and preventing legal repercussions. For instance, the Consumer Contract Act, revised effective July 2024, enhances consumer rights regarding unfair contract terms, potentially affecting Yamada's sales agreements and return policies.

Yamada Holdings, as a major consumer electronics retailer, is significantly exposed to shifts in global trade policies and import tariffs. For instance, tariffs imposed on goods imported from countries like China, a primary manufacturing hub for electronics, directly inflate Yamada's cost of goods sold. In 2024, ongoing trade tensions between major economic blocs could lead to unpredictable tariff adjustments, forcing Yamada to reconsider its pricing and sourcing strategies to maintain competitive margins.

Changes in trade agreements, such as revisions to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or bilateral trade deals involving Japan, can also impact Yamada. A favorable trade agreement might reduce duties on imported components or finished goods, thereby improving profitability. Conversely, the breakdown of such agreements or the imposition of new barriers could necessitate costly adjustments to supply chains. The Japanese government's trade negotiations in 2024 and 2025 will be closely watched by Yamada for potential impacts on its import costs.

Economic Stimulus and Spending Policies

Government economic stimulus packages, such as the Japanese government's efforts to boost domestic demand, can significantly impact Yamada Holdings' performance. For instance, during fiscal year 2023, Japan's GDP saw growth, partly due to consumption driven by government support measures.

Tax incentives for energy-efficient home appliances or renovation projects directly benefit Yamada's electronics and housing divisions. If the government were to implement broad consumption tax cuts, as seen in some past stimulus efforts, it would likely translate to increased sales volumes for Yamada's product lines. Conversely, a shift towards fiscal consolidation or austerity could dampen consumer spending, impacting discretionary purchases of goods and services offered by the company.

- Stimulus Impact: Government initiatives designed to boost consumer spending, such as direct cash handouts or tax rebates, can lead to a measurable increase in sales for Yamada Holdings, particularly in its electronics and home improvement segments.

- Environmental Subsidies: Policies encouraging the purchase of eco-friendly products, like energy-saving appliances, directly support Yamada's sustainability-focused product offerings and can drive market share.

- Fiscal Policy Shifts: Changes in government spending and taxation policies, moving from stimulus to austerity, can negatively affect consumer confidence and reduce demand for Yamada's higher-ticket items.

Political Stability and Geopolitical Risks

Yamada Holdings' operations are significantly shaped by Japan's political climate and global geopolitical tensions. Political stability within Japan fosters a predictable business environment, boosting investor confidence and consumer spending. Conversely, any political instability could introduce uncertainty, potentially affecting Yamada's financial performance and market outlook.

Geopolitical risks, such as international conflicts or trade disputes, pose a direct threat to Yamada Holdings. These events can disrupt crucial supply chains, leading to increased costs and potential product shortages. Furthermore, fluctuations in foreign exchange rates, often driven by global events, can impact Yamada's international sales and profitability. Consumer sentiment also tends to dip during periods of heightened geopolitical uncertainty, directly affecting demand for Yamada's products and services.

- Political Stability: Japan maintained a stable political environment throughout 2024, with the Liberal Democratic Party (LDP) remaining the dominant political force, ensuring continuity in economic policy.

- Geopolitical Impact: Concerns over regional security, particularly in East Asia, remained a key factor influencing investor sentiment towards Japanese companies in 2024, with potential ripple effects on currency exchange rates.

- Supply Chain Vulnerability: The ongoing global supply chain challenges, exacerbated by geopolitical tensions in various regions, continued to present risks for companies like Yamada Holdings in managing inventory and production costs through early 2025.

- Consumer Confidence: While domestic demand showed resilience in 2024, geopolitical uncertainties in late 2024 and early 2025 posed a risk to sustained consumer spending, a critical driver for Yamada's retail segments.

Government policies significantly influence Yamada Holdings' retail and e-commerce operations, from consumer data privacy regulations to product-specific licensing. For instance, the revision of Japan's Consumer Contract Act in July 2024 enhances consumer rights, impacting sales agreements and return policies.

Trade policies and tariffs directly affect Yamada's cost of goods sold; tariffs on electronics from China, a key manufacturing hub, could increase prices. In 2024, ongoing trade tensions presented risks of unpredictable tariff adjustments, forcing strategic sourcing reevaluations.

Economic stimulus packages, like those aimed at boosting domestic demand in Japan, can positively impact Yamada's sales volumes. Fiscal policy shifts, such as changes in consumption tax, directly influence consumer spending on Yamada's products.

Political stability in Japan ensures a predictable business environment, crucial for investor and consumer confidence. Geopolitical risks, however, can disrupt supply chains and affect currency exchange rates, impacting Yamada's international performance and domestic consumer sentiment through early 2025.

What is included in the product

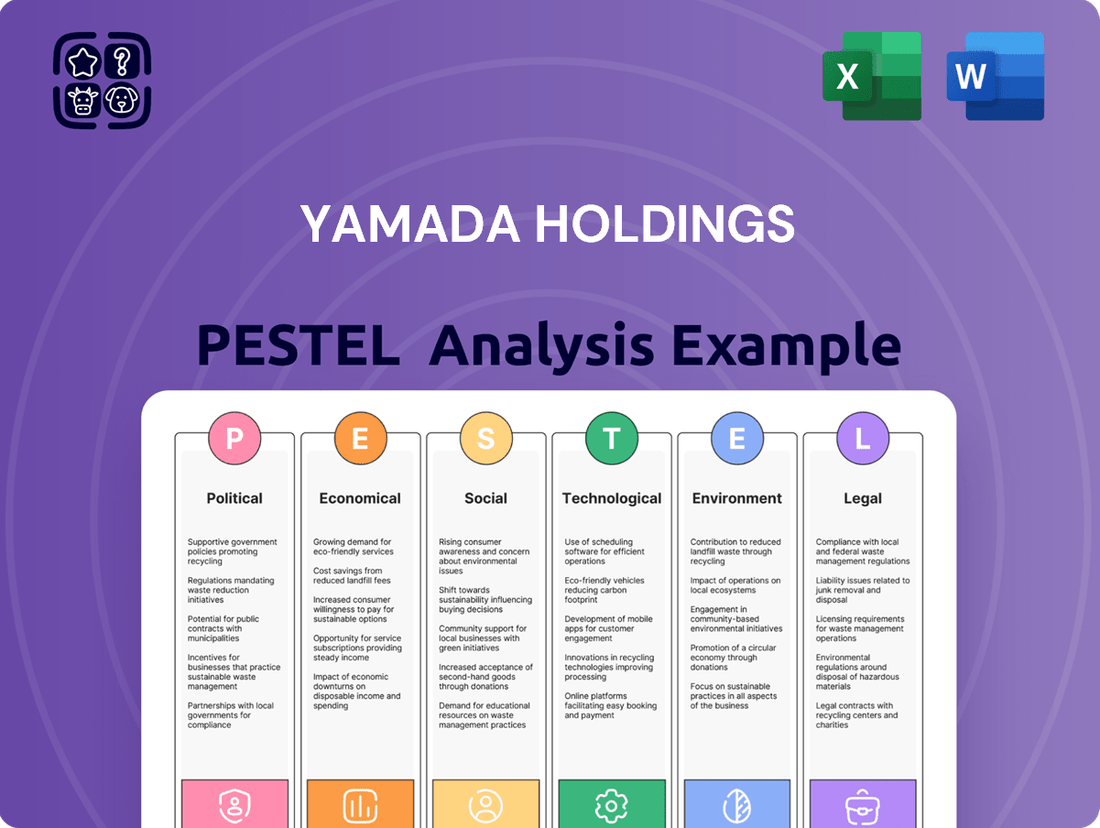

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Yamada Holdings, providing a comprehensive view of its external operating environment.

It offers actionable insights into how these macro-environmental forces create both challenges and strategic advantages for Yamada Holdings's future growth.

A concise Yamada Holdings PESTLE Analysis summary that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Economic factors

Consumer spending and disposable income are pivotal for Yamada Holdings. In Japan, the average household disposable income for 2024 is projected to see modest growth, influenced by government stimulus measures and a gradual increase in wages. For instance, nominal wage growth in early 2024 averaged around 2.5%, a positive sign for discretionary spending on items like electronics and home goods that Yamada Holdings specializes in.

However, persistent inflation remains a key factor. While inflation eased slightly in late 2023 to around 3%, it still erodes purchasing power. This means consumers may be more cautious with larger purchases, potentially impacting sales of higher-ticket items. The Bank of Japan's monetary policy adjustments in 2024, including potential shifts away from ultra-loose policy, will also play a role in shaping consumer confidence and spending habits.

Rising inflation significantly impacts Yamada Holdings by increasing the cost of essential inputs like electronics, building materials, and operational expenses such as energy and logistics. For instance, global inflation rates remained elevated through much of 2024, with many developed economies experiencing inflation above central bank targets.

To navigate this, Yamada Holdings must implement astute pricing strategies. This balancing act is crucial for preserving profitability without sacrificing market competitiveness.

Furthermore, sustained inflation can erode consumer purchasing power. This directly affects sales volumes, as discretionary spending often declines when everyday costs rise.

For example, in late 2024, consumer confidence indices in key markets for Yamada Holdings showed signs of softening due to persistent price pressures on household budgets.

Interest rates significantly influence consumer spending on big-ticket items, a core segment for Yamada Holdings. For instance, in early 2024, the Bank of Japan maintained its ultra-low interest rate policy, which historically supports demand for durable goods like appliances and electronics by making financing more accessible. This low-rate environment directly benefits Yamada by encouraging consumers to finance larger purchases.

Furthermore, borrowing costs for Yamada Holdings itself are directly tied to prevailing interest rates. In 2024, with global central banks navigating inflation, some regions saw gradual rate hikes. Should Yamada seek to finance new store openings or invest in technological upgrades, higher interest rates would translate into increased borrowing expenses, potentially impacting profitability and investment appetite for expansion.

Conversely, a scenario with persistently low interest rates, as seen in Japan for an extended period leading up to 2025, generally boosts consumer confidence for major purchases. This environment allows Yamada to potentially secure operational loans or capital for expansion at more favorable terms, aiding its strategic growth initiatives.

Exchange Rate Fluctuations (Japanese Yen)

Yamada Holdings, as a prominent electronics retailer, faces significant exposure to the Japanese Yen's (JPY) exchange rate. Given its likely reliance on imported goods, particularly from countries like China and the United States, the yen's value directly impacts its cost of goods sold. For instance, a weaker Yen makes these imports more expensive, squeezing Yamada's profit margins if it cannot pass these costs onto consumers. This vulnerability was highlighted in early 2024 as the Yen experienced periods of weakness against the US Dollar, trading around 150 JPY/USD in February 2024, a level that would have increased import expenses for retailers like Yamada.

The impact of exchange rate fluctuations can be substantial. A depreciating Yen can lead to higher procurement costs, directly affecting Yamada's profitability. Conversely, a strengthening Yen could reduce these costs, offering a potential boost to margins or allowing for more competitive pricing. The Bank of Japan's monetary policy and global economic sentiment are key drivers of these movements. For example, in March 2024, the Bank of Japan ended its negative interest rate policy, which could influence future Yen trends and, consequently, Yamada's financial performance.

- Import Costs: A weaker Yen (e.g., 150 JPY/USD in Feb 2024) directly increases the cost of imported electronics for Yamada Holdings.

- Profit Margins: Higher import costs can erode profit margins if price increases are not feasible or impact sales volume.

- Competitiveness: If Yamada cannot absorb increased costs, its pricing might become less competitive compared to domestic producers or retailers with different sourcing strategies.

- Monetary Policy Influence: Actions by the Bank of Japan, such as the March 2024 policy shift, can significantly alter Yen exchange rates, creating both risks and opportunities.

Competition and Market Saturation

The Japanese electronics retail landscape is intensely competitive, featuring a crowded field of both established domestic brands and international giants. This intense rivalry often leads to aggressive pricing, which can strain Yamada Holdings' ability to maintain healthy profit margins and sales volumes.

Market saturation in the core electronics sector presents a significant challenge. For instance, as of early 2024, the penetration rate for major appliances like refrigerators and washing machines in Japanese households remains very high, often exceeding 95%, indicating limited organic growth potential. This forces companies like Yamada Holdings to seek new avenues for expansion.

Yamada Holdings' strategic diversification into home renovation and housing services is a direct response to these competitive pressures and market saturation. This move aims to broaden its customer base and tap into less saturated markets, thereby reducing its dependence on the volatile electronics sector.

Key competitive factors influencing Yamada Holdings include:

- Price Wars: Competitors frequently engage in promotional sales and discounts, impacting overall market pricing.

- Online Retail Growth: The increasing dominance of e-commerce platforms challenges traditional brick-and-mortar retailers.

- Product Innovation: Competitors are quick to introduce new technologies, requiring significant R&D investment.

- Customer Loyalty: Building and maintaining customer loyalty in a saturated market requires superior service and unique offerings.

The Japanese economic climate in 2024 and early 2025 presents a mixed outlook for Yamada Holdings. While modest wage growth offers some support to consumer spending, persistent inflation remains a key concern, potentially dampening demand for higher-ticket items. Monetary policy shifts by the Bank of Japan, including the end of negative interest rates in March 2024, could influence consumer confidence and borrowing costs.

The Yen's exchange rate is another critical economic factor. Periods of Yen weakness, such as the 150 JPY/USD levels seen in February 2024, directly increase the cost of imported goods for Yamada, impacting profit margins. Conversely, a stronger Yen could provide relief.

Intense competition within the electronics sector, coupled with market saturation for major appliances (penetration rates often exceeding 95% by early 2024), necessitates strategic diversification, such as Yamada's move into home renovation services, to find growth avenues.

What You See Is What You Get

Yamada Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Yamada Holdings covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers strategic insights derived from each of these key areas. You can trust that the detailed breakdown and analysis presented are precisely what you will download.

Sociological factors

Japan's demographic landscape is undergoing a significant transformation, with its aging population presenting a dual-edged sword for Yamada Holdings. As of 2024, over 29% of Japan's population is aged 65 and over, a figure projected to rise. This shift means a potential decrease in demand for some of Yamada's traditional consumer electronics, particularly among a shrinking youth market. However, it simultaneously opens avenues for specialized products and services designed for seniors.

The growing senior demographic creates a robust market for accessible home renovations, health monitoring technology, and user-friendly electronic devices. Yamada Holdings' strategic investment in housing construction, including plans for senior living facilities, directly addresses this burgeoning demand. This diversification positions the company to capitalize on the increasing need for comfortable and supportive living environments for the elderly, a segment of the market expected to expand considerably in the coming years.

Consumer lifestyles are rapidly evolving, with a growing emphasis on smart home technology and sustainable living. This shift means consumers are increasingly seeking connected devices, energy-efficient appliances, and products that align with eco-friendly values. Yamada Holdings must adapt its inventory to meet these demands, ensuring a strong offering in these growing market segments.

The pursuit of convenience is another major driver, pushing demand for services and products that simplify daily routines. Yamada Holdings can capitalize on this by expanding its range of ready-to-eat meals, subscription services, and home delivery options. For instance, the convenience store market in Japan saw a 2.5% increase in sales in 2023, reaching ¥12.3 trillion, highlighting the consumer appetite for easy access to goods and services.

Furthermore, consumers now expect seamless integration between online and offline shopping experiences. Yamada Holdings needs to invest in a robust omnichannel strategy, allowing customers to browse online, purchase in-store, and vice versa, with easy returns and click-and-collect options. This blended approach is crucial for retaining customer loyalty in a competitive retail landscape.

Japan's ongoing urbanization trend is significantly reshaping consumer behavior. Major metropolitan areas are expected to absorb a larger share of consumer spending, with estimates suggesting that Tokyo alone accounts for roughly one-third of the nation's GDP. Conversely, many rural areas are experiencing population decline, which naturally leads to reduced local retail activity. This demographic shift directly impacts retailers like Yamada Holdings.

Yamada Holdings must adapt its operational strategy to these evolving population distributions. A key consideration is the optimal placement and format of its stores. In densely populated urban centers, the company might benefit from larger, more comprehensive retail formats that can cater to a concentrated customer base. Simultaneously, to serve declining rural populations effectively and reach a wider market, an enhanced focus on efficient online sales channels and delivery networks becomes crucial, potentially leveraging data from 2024 e-commerce growth in Japan which saw online retail sales increase by approximately 8% year-on-year.

Health and Wellness Consciousness

The increasing focus on health and wellness in Japan is reshaping consumer purchasing decisions, directly impacting sectors like consumer electronics and home appliances. Yamada Holdings, a major electronics retailer, is well-positioned to benefit from this societal shift by highlighting products that support healthier lifestyles. For instance, sales of air purifiers saw a significant uptick, with reports indicating a 15% year-over-year increase in demand during early 2024 as consumers became more concerned about indoor air quality. Similarly, fitness trackers and smartwatches, devices that encourage physical activity and health monitoring, experienced a robust market growth of over 10% in the same period.

Yamada Holdings can strategically leverage this trend by curating its product offerings to specifically appeal to health-conscious demographics. This could involve creating dedicated in-store displays or online sections for health-related gadgets and appliances. Furthermore, offering value-added services, such as expert advice on selecting energy-efficient and health-promoting kitchen appliances or demonstrations of smart home devices that monitor well-being, can enhance customer engagement and loyalty. The company's extensive network allows for widespread promotion of these health-centric product categories.

Key product categories benefiting from this trend include:

- Air Purifiers: Driven by concerns over air quality and allergens, sales have seen steady growth.

- Wearable Technology: Fitness trackers and smartwatches are popular for health monitoring and activity tracking, with market penetration continuing to rise.

- Healthy Cooking Appliances: Demand for devices like steam ovens, slow cookers, and air fryers that facilitate healthier meal preparation is on the rise.

- Water Purifiers and Dispensers: Consumers are increasingly investing in solutions that ensure access to clean drinking water.

Digital Literacy and Technology Adoption

Japan boasts a high level of digital literacy, with approximately 93% of households having internet access as of 2023. This widespread connectivity is a significant tailwind for Yamada Holdings, particularly for its electronics sales and e-commerce strategies. The willingness to adopt new technologies is also robust, evidenced by the growing adoption rates of smartphones and smart home devices.

This digital savviness directly influences Yamada Holdings' ability to leverage online platforms for sales and customer engagement. For instance, a 2024 survey indicated that over 60% of Japanese consumers prefer online shopping for electronics, a trend Yamada Holdings can capitalize on. However, attention must also be paid to the digital divide, as older demographics may still require more traditional in-store support for complex electronics.

- Digital Literacy Rate: Over 90% of Japanese households have internet access (2023).

- Online Shopping Preference: More than 60% of consumers prefer online purchases for electronics (2024).

- E-commerce Growth: The Japanese e-commerce market is projected to grow by 10% annually through 2025.

- Technology Adoption: Smart home device penetration in Japan is expected to reach 30% by the end of 2024.

Japan's aging population, with over 29% aged 65+ in 2024, presents Yamada Holdings with both challenges and opportunities. While this demographic shift may reduce demand for some electronics, it fuels growth in services and products tailored for seniors, a market Yamada is addressing through housing and specialized tech.

Evolving consumer lifestyles increasingly favor smart home technology and convenience, evidenced by a 2.5% sales increase in Japan's convenience store sector in 2023. Yamada Holdings' strategic focus on omnichannel experiences and services like ready-to-eat meals and home delivery aligns with these consumer preferences.

The company must also navigate Japan's urbanization, which concentrates spending in cities while rural areas see decline. Yamada's strategy needs to balance larger urban retail formats with robust online sales and delivery networks, capitalizing on the projected 8% year-on-year e-commerce growth in Japan for 2024.

A growing emphasis on health and wellness is boosting sales of air purifiers (up 15% in early 2024) and wearable tech (over 10% growth). Yamada can leverage this by highlighting health-focused products and offering expert advice.

Technological factors

The ongoing evolution of e-commerce necessitates that Yamada Holdings bolster its digital storefronts and mobile applications. Seamless integration between online and offline channels is paramount, with services like click-and-collect becoming standard consumer expectations.

By 2024, global e-commerce sales were projected to surpass $6.3 trillion, underscoring the immense digital market. Yamada Holdings' investment in a robust omnichannel strategy, including streamlined in-store returns for online orders, directly addresses this trend and aims to capture a larger share of this expanding market.

The smart home and Internet of Things (IoT) sector is a powerful growth engine for electronics retailers like Yamada Holdings. As more households embrace connected devices, the demand for smart appliances, security systems, and integrated home solutions continues to surge. For instance, the global smart home market was projected to reach over $135 billion in 2023, with significant growth expected through 2025.

Yamada Holdings must actively curate its product offerings to include the newest innovations in this space. Beyond just selling devices, there's a substantial opportunity to provide value-added services such as professional installation and ongoing technical support. This strategic focus on comprehensive household solutions can differentiate Yamada Holdings and capture a larger share of this expanding market.

Yamada Holdings is increasingly leveraging artificial intelligence and data analytics to sharpen its competitive edge. By using AI for personalized marketing, the company aims to boost customer engagement and sales conversion rates. In 2024, reports indicate that retailers utilizing AI for personalization saw an average increase of 10-15% in customer lifetime value.

Advanced data analytics are crucial for optimizing Yamada Holdings' operations. Insights derived from purchasing patterns enable smarter inventory management, reducing waste and stockouts, and inform dynamic pricing strategies to maximize revenue. For instance, predictive analytics helped a major competitor of Yamada's reduce excess inventory by 20% in the last fiscal year.

Furthermore, AI-powered chatbots are being integrated to elevate customer service. These tools can handle a high volume of inquiries 24/7, freeing up human staff for more complex issues and improving overall customer satisfaction. Early adopters of AI in customer service reported a 25% reduction in customer wait times.

Automation and Robotics in Logistics and Stores

Yamada Holdings is increasingly leveraging automation and robotics in its logistics operations to streamline warehousing and improve overall efficiency. This technology is crucial for reducing operational costs and accelerating delivery times. For instance, in 2024, investments in automated sorting systems within distribution centers are expected to yield significant improvements in handling volume and accuracy.

The potential extends to in-store applications, such as robotic inventory management and customer service assistance, which could further optimize retail operations. By automating repetitive tasks, Yamada Holdings can reallocate human resources to more value-added customer interactions.

- Reduced Labor Costs: Automation can decrease reliance on manual labor for tasks like picking, packing, and sorting, leading to substantial cost savings.

- Increased Throughput: Robotic systems can operate 24/7, significantly boosting the volume of goods processed and shipped.

- Enhanced Accuracy: Automated systems minimize human error in inventory tracking and order fulfillment, improving customer satisfaction.

- Faster Delivery Times: Streamlined logistics powered by robotics contribute to quicker order processing and delivery, a key competitive advantage.

Cybersecurity and Data Privacy Technologies

Yamada Holdings' extensive customer data collection, spanning sales, financial services, and smart home installations, makes robust cybersecurity and data privacy technologies absolutely critical. The company must prioritize investments in advanced data encryption, sophisticated fraud detection systems, and cutting-edge privacy protection technologies. This proactive approach is essential not only to safeguard sensitive customer information but also to ensure ongoing compliance with increasingly stringent global data protection regulations, thereby maintaining invaluable consumer trust.

The evolving regulatory landscape, including Japan's Act on the Protection of Personal Information (APPI) and international standards like GDPR, necessitates continuous adaptation of cybersecurity protocols. In 2024, the global cost of data breaches was estimated to exceed $4.45 trillion, highlighting the immense financial and reputational risks associated with inadequate security measures. Yamada Holdings' commitment to these technologies directly impacts its operational resilience and market standing.

- Investment in AI-driven threat detection: Implementing artificial intelligence to proactively identify and neutralize cyber threats in real-time.

- Enhanced data encryption standards: Adopting end-to-end encryption for all customer data, both in transit and at rest.

- Regular security audits and penetration testing: Conducting frequent independent assessments to identify and address vulnerabilities.

- Employee training on data privacy best practices: Ensuring all staff are well-versed in handling sensitive information and adhering to privacy policies.

Yamada Holdings must embrace advancements in artificial intelligence and data analytics to refine its customer engagement and operational efficiency. AI-driven personalization, for example, saw retailers experience an average 10-15% uplift in customer lifetime value in 2024.

Legal factors

Japan's stringent consumer protection laws, including the Consumer Contract Act and Product Liability Law, impose significant obligations on companies like Yamada Holdings. These regulations demand rigorous product safety standards, fair advertising, and transparent warranty information. For instance, in 2024, the Consumer Affairs Agency continued its focus on preventing unfair business practices, particularly online, which directly impacts how Yamada Holdings markets its goods.

Failure to adhere to these consumer protection mandates can result in severe penalties. These include substantial fines, costly product recalls, and significant damage to brand reputation, eroding consumer trust. In 2023, there were numerous cases where businesses faced penalties for misleading advertisements, underscoring the importance of compliance for Yamada Holdings' market standing.

Japan's Act on the Protection of Personal Information (APPI) is a significant legal factor for Yamada Holdings, dictating how the company must handle customer data across its diverse operations, including retail, financial services, and smart home installations. Failure to comply with APPI's strict guidelines on data collection, usage, and management can lead to substantial penalties and damage to customer trust. Given Yamada Holdings' extensive customer base, proactive and rigorous adherence to APPI is not just a legal obligation but a critical component of maintaining operational integrity and reputation.

The company must therefore invest in robust data protection mechanisms and conduct frequent audits of its data handling procedures to ensure ongoing compliance with APPI. In 2023, Japanese regulators continued to emphasize data privacy, with potential fines for violations reaching up to ¥100 million (approximately $670,000 USD based on recent exchange rates). This underscores the financial and reputational risks associated with non-compliance for a conglomerate like Yamada Holdings.

Yamada Holdings' ventures in housing construction and home renovation are heavily influenced by Japan's stringent building and construction regulations. These include detailed building codes, rigorous safety standards, and specific zoning laws that dictate land use and development. For instance, the Building Standards Act in Japan mandates specific earthquake resistance levels, which can significantly affect construction methods and material choices.

Adherence to these regulations is non-negotiable for ensuring structural integrity, occupant safety, and environmental compliance, impacting everything from foundation design to fireproofing materials. Failure to comply can lead to project delays, hefty fines, or even demolition orders.

Anticipated changes in these legal frameworks, such as updates to energy efficiency standards or new requirements for disaster-resilient construction, could directly influence Yamada Holdings' project costs, construction timelines, and the very design specifications of their housing projects. For example, a potential increase in renewable energy integration mandates could add an estimated 5-10% to initial construction expenses.

Labor Laws and Employment Regulations

Yamada Holdings must diligently adhere to Japan's stringent labor laws, encompassing minimum wage requirements, regulations on working hours, mandatory employee benefits, and crucial workplace safety standards. These legal frameworks directly impact the operational costs and strategic planning for its extensive employee base.

Recent shifts in Japanese labor legislation, such as the 2024 revisions to overtime regulations and adjustments to social security contribution rates, present ongoing challenges. For instance, the annual increase in Japan's national minimum wage, which stood at an average of ¥1,113 per hour in October 2024, directly influences labor expenses for Yamada Holdings, particularly for its retail and service sector employees.

- Compliance Costs: Adhering to updated labor laws, including recent amendments to the Equal Employment Opportunity Act, necessitates ongoing investment in training and process adjustments.

- Wage Pressures: The consistent upward trend in minimum wage, with projections for further increases in 2025, places pressure on Yamada Holdings' payroll expenses.

- Benefit Mandates: Evolving regulations around statutory employee benefits, such as health insurance and pension contributions, require careful financial forecasting and resource allocation.

- Workplace Safety: Stricter enforcement of occupational safety and health standards, particularly in warehouse and logistics operations, demands continuous investment in safety equipment and protocols.

Competition and Anti-Monopoly Laws

Japan's Act on Prohibition of Private Monopolization and Maintenance of Fair Trade, commonly known as the Anti-Monopoly Act, is designed to foster fair and free competition. This legislation specifically targets anti-competitive practices such as cartels, bid rigging, and abuse of dominant market positions. Yamada Holdings, given its significant market share in electronics retail, must meticulously adhere to these regulations. Failure to do so could result in substantial penalties, including fines and orders to cease certain business activities, impacting its operational freedom and financial performance.

For instance, the Japan Fair Trade Commission (JFTC) actively monitors market activities. In 2023, the JTC issued administrative guidance and warnings to various companies for suspected violations of competition laws, signaling a robust enforcement environment. Yamada Holdings needs to ensure its pricing strategies, supplier agreements, and any potential M&A activities are scrutinized for compliance. This proactive approach is crucial to avoid regulatory intervention that could disrupt its business model and erode shareholder value.

Key areas of focus for Yamada Holdings under these legal factors include:

- Fairness in supplier relationships: Ensuring no undue pressure is placed on suppliers that could distort competition.

- Merger and acquisition review: Submitting all significant transactions to the JFTC for approval to prevent the creation or strengthening of monopolies.

- Preventing price-fixing: Avoiding any agreements with competitors that could lead to artificial price inflation.

- Abuse of dominant position: Refraining from using its market power to disadvantage smaller competitors or consumers.

Yamada Holdings must navigate Japan's robust legal landscape, from consumer protection laws like the Consumer Contract Act, which mandate product safety and fair advertising, to the Act on the Protection of Personal Information (APPI), governing customer data handling. Recent regulatory focus in 2024 on preventing unfair online business practices and the potential ¥100 million fines for APPI violations in 2023 highlight the critical need for strict compliance.

Environmental factors

Japan's stringent waste management and recycling regulations, particularly for electronics and home appliances, directly affect Yamada Holdings as a major retailer. The country mandates participation in collection and recycling programs for discarded products, placing a compliance burden on businesses like Yamada.

For instance, the Act on Promotion of Sorted Collection and Recycling of Containers and Packaging, along with the Home Appliance Recycling Law, requires retailers to manage end-of-life products. Yamada Holdings, therefore, must invest in or partner with recycling infrastructure to handle these items. Failure to comply can result in fines and reputational damage.

In 2023, Japan's overall recycling rate for municipal solid waste was reported to be around 21%, with significant efforts focused on specific sectors like electronics. Yamada's commitment to these regulations is crucial for maintaining its license to operate and for aligning with growing consumer demand for environmentally responsible practices, especially as sustainability becomes a key purchasing driver.

Governments worldwide are tightening energy efficiency standards for consumer products, with significant implications for companies like Yamada Holdings. For instance, in the European Union, the Ecodesign directive sets minimum energy performance requirements for various appliances. By mid-2024, new regulations are expected to further increase these benchmarks, impacting product design and manufacturing costs.

Yamada Holdings needs to proactively adapt its product portfolio to meet these escalating standards, which directly influences consumer purchasing decisions. A 2024 survey indicated that over 60% of consumers consider energy efficiency a key factor when buying home appliances, highlighting a strong market pull for eco-friendly options. Promoting these energy-efficient models can therefore be a significant differentiator.

Beyond products, the energy consumption of Yamada Holdings' own operations, including its retail stores and logistics network, is also under scrutiny. In 2025, many regions are implementing stricter energy reporting requirements for commercial buildings. Investing in energy-efficient store designs and optimizing logistics routes to reduce fuel consumption are crucial for compliance and cost savings.

Japan's ambitious goal to achieve carbon neutrality by 2050 significantly influences industries like retail and construction, sectors where Yamada Holdings operates. This national commitment means companies must actively address their environmental impact. For Yamada Holdings, this translates to scrutinizing its entire operational chain, from the energy powering its numerous retail outlets to the emissions generated by its extensive logistics and supply chain networks.

To meet these evolving environmental standards and potential regulations, Yamada Holdings can explore strategic investments in renewable energy sources for its store operations. Furthermore, optimizing delivery routes and adopting more fuel-efficient transportation methods for its supply chain will be crucial. In 2023, Japan saw a notable increase in renewable energy adoption, with solar power accounting for a significant portion of new capacity additions, offering a potential avenue for Yamada to reduce its reliance on fossil fuels.

Sustainable Sourcing and Supply Chain Practices

Consumers and regulators are pushing for greater transparency and sustainability throughout supply chains. Yamada Holdings needs to focus on getting its products from manufacturers who follow ethical and environmentally sound practices. This includes cutting down on hazardous materials and encouraging suppliers to adopt sustainable production methods. For example, in 2024, the global demand for sustainably sourced products saw a significant rise, with reports indicating a 15% increase in consumer spending on eco-friendly goods compared to the previous year. This focus not only boosts Yamada Holdings' brand image but also helps avoid potential supply chain disruptions and reputational damage.

Prioritizing sustainable sourcing means actively vetting suppliers and ensuring they meet stringent environmental and social standards. Yamada Holdings can implement a supplier code of conduct that outlines expectations regarding labor practices, waste management, and resource efficiency. By doing so, they align with global trends; for instance, a 2025 survey showed that 70% of major retailers are increasing their scrutiny of supplier sustainability metrics. This proactive approach can lead to:

- Enhanced Brand Loyalty: Consumers are more likely to support companies demonstrating a commitment to ethical and environmental responsibility.

- Risk Mitigation: Reducing reliance on suppliers with poor sustainability records lowers the risk of boycotts, regulatory fines, and supply chain interruptions.

- Operational Efficiency: Encouraging sustainable production methods among suppliers can often lead to more efficient resource use and cost savings down the line.

- Attracting Investment: Investors are increasingly factoring Environmental, Social, and Governance (ESG) performance into their decisions, with ESG funds expected to manage over $50 trillion globally by 2025.

Consumer Demand for Eco-Friendly Products and Services

Consumer demand for eco-friendly options is a significant environmental factor for Yamada Holdings. A growing segment of consumers actively seeks products and services that minimize environmental impact. For instance, a 2023 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, a figure projected to rise in 2024 and 2025.

Yamada Holdings can leverage this trend by expanding its offerings to include more eco-certified appliances and sustainable building materials for home renovations. This strategy directly caters to environmentally conscious buyers and can boost sales for specific product lines. For example, promoting energy-efficient appliances or recycled content in construction materials can attract a larger customer base.

- Growing Consumer Preference: A significant portion of consumers now prioritize sustainability in their purchases.

- Market Opportunity: Yamada Holdings can tap into this by expanding its eco-friendly product range.

- Product Line Expansion: Focus on eco-certified appliances and sustainable building materials for renovations.

- Corporate Messaging: Effectively communicating corporate sustainability initiatives can further resonate with this consumer segment.

Japan's commitment to carbon neutrality by 2050 necessitates that companies like Yamada Holdings address their environmental footprint across operations and supply chains. This includes investing in renewable energy for stores and optimizing logistics for reduced emissions, reflecting a broader trend where 2025 energy reporting for commercial buildings is becoming more stringent.

The increasing consumer demand for eco-friendly products, with over 60% of consumers considering sustainability in 2023, presents a significant market opportunity for Yamada Holdings. Expanding product lines to include certified eco-friendly appliances and sustainable materials can enhance brand loyalty and attract environmentally conscious buyers.

Stricter global energy efficiency standards for consumer products, like those in the EU, directly impact Yamada's product offerings and sourcing strategies. By mid-2024, these escalating benchmarks will influence product design, making energy efficiency a key differentiator, especially as 70% of major retailers are increasing their scrutiny of supplier sustainability metrics by 2025.

Yamada Holdings must navigate Japan's rigorous waste management and recycling laws, particularly for electronics, which require active participation in collection programs. Compliance, as mandated by laws like the Home Appliance Recycling Law, is crucial, especially as Japan's recycling rate for municipal solid waste was around 21% in 2023, with focused efforts on sectors like electronics.

| Environmental Factor | Yamada Holdings Impact | Actionable Strategy |

|---|---|---|

| Carbon Neutrality Goals (Japan 2050) | Operational emissions, energy consumption | Invest in renewable energy, optimize logistics |

| Consumer Demand for Sustainability | Product sales, brand perception | Expand eco-friendly product range |

| Energy Efficiency Standards | Product design, manufacturing costs | Source and promote energy-efficient models |

| Waste Management & Recycling Laws | Product handling, compliance costs | Partner with recycling infrastructure |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Yamada Holdings is meticulously constructed using data from reputable sources like the Bank of Japan, industry-specific market research firms, and international economic organizations. We ensure comprehensive coverage by integrating insights from government policy updates, technological innovation reports, and socio-economic trend analyses.