XTB SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

XTB Bundle

XTB's robust technology platform and diverse product offering are clear strengths, but understanding their market positioning requires a deeper dive. While their global expansion presents opportunities, potential regulatory shifts pose a significant threat.

Want the full story behind XTB's competitive edge, potential pitfalls, and strategic advantages? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and market research.

Strengths

XTB's proprietary trading platform, xStation 5, stands out as a significant strength, lauded for its intuitive design and robust functionality. This in-house technology provides a seamless trading experience, incorporating advanced charting capabilities and rapid execution speeds, crucial for active traders. As of Q1 2024, XTB reported a substantial increase in active clients, underscoring the platform's appeal and effectiveness in attracting and retaining users.

XTB operates under the watchful eyes of multiple top-tier financial regulators, including the UK's Financial Conduct Authority (FCA), Cyprus's Securities and Exchange Commission (CySEC), and Poland's Financial Supervision Authority (KNF). This extensive regulatory coverage is a cornerstone of XTB's strength, creating a secure and trustworthy environment for traders worldwide.

This robust, multi-jurisdictional regulatory structure significantly bolsters client confidence and ensures strong investor protection measures are in place. It's a key reason why XTB enjoys a high trust score within the competitive financial services sector.

Further solidifying its standing, XTB is a publicly traded entity on the Warsaw Stock Exchange. This public listing inherently promotes transparency in its operations and financial dealings, underscoring the company's commitment to financial stability and accountability to its stakeholders.

XTB distinguishes itself with an exceptionally broad spectrum of financial instruments. Clients gain access to contracts for difference (CFDs) across major asset classes like forex, indices, commodities, stocks, ETFs, and cryptocurrencies. This extensive selection caters to a wide range of investment preferences and trading styles, enabling users to diversify their portfolios effectively.

Beyond CFDs, XTB also provides direct trading in real stocks and ETFs, further broadening its appeal. This dual approach allows both leveraged trading for those seeking short-term opportunities and direct ownership for long-term investors. The company has demonstrated a commitment to expanding this offering, with future plans including spot cryptocurrencies and options, indicating continued growth in product diversity.

Robust Client Growth and Financial Performance

XTB has shown impressive client growth, adding a significant number of new clients throughout 2024 and into Q1 2025. This expansion is reflected in their financial performance, with the company reporting record consolidated revenues and net profits. The company's strategic marketing efforts and dedication to broadening its international client base are clearly paying off, indicating a strong ability to capture market share.

Key performance indicators highlight this robust growth:

- Client Acquisition: XTB reported a substantial increase in active clients, reaching over 1 million by the end of 2024.

- Revenue Growth: Consolidated revenues for 2024 surpassed PLN 2.5 billion, a year-on-year increase of over 70%.

- Profitability: Net profit for 2024 reached approximately PLN 1.2 billion, marking a new record for the company.

- Market Expansion: The company has successfully expanded its presence in key European markets, contributing to its overall client base growth.

Comprehensive Educational Resources and Customer Support

XTB offers a robust suite of educational tools, including a comprehensive Trading Academy. This resource features a wealth of video tutorials, live webinars, and informative articles designed to cater to traders of all experience levels, from beginners to seasoned professionals.

The company's commitment extends to exceptional customer support, readily available to assist clients with their queries and trading needs. This dual focus on education and support significantly enhances the client experience, making XTB a compelling choice for individuals looking to refine their trading strategies.

By providing these extensive learning materials and accessible support channels, XTB actively empowers its clients. This dedication to knowledge transfer and assistance is a key strength, attracting a broad spectrum of investors who value continuous learning and reliable guidance in their financial endeavors.

XTB's proprietary trading platform, xStation 5, is a major asset, praised for its user-friendly interface and powerful features, facilitating a smooth trading experience with advanced charting and fast execution. The company's impressive client growth, exceeding 1 million active clients by the end of 2024, demonstrates the platform's effectiveness in attracting and keeping users. This user-centric technology is a significant draw for traders.

XTB's strong regulatory standing, with oversight from top-tier bodies like the FCA and CySEC, builds substantial client trust and ensures a secure trading environment. This multi-jurisdictional compliance is a critical factor in its high reputation within the financial services sector.

The firm's public listing on the Warsaw Stock Exchange enhances operational transparency and financial accountability, reinforcing its image of stability and trustworthiness among investors and stakeholders.

XTB boasts an extensive product offering, providing access to a wide array of CFDs across forex, indices, commodities, stocks, ETFs, and cryptocurrencies, alongside direct trading in real stocks and ETFs, catering to diverse investment strategies. This broad selection, with plans to add spot cryptocurrencies and options, highlights a commitment to continuous product expansion.

XTB's financial performance in 2024 was exceptional, with consolidated revenues exceeding PLN 2.5 billion, a 70% year-on-year increase, and net profits reaching approximately PLN 1.2 billion, setting new company records. This growth is fueled by strategic marketing and a focus on expanding its international client base.

The company's commitment to client education through its Trading Academy, featuring video tutorials, webinars, and articles, coupled with accessible customer support, significantly enhances the user experience and attracts a broad range of investors seeking continuous learning and reliable guidance.

| Key Metric | 2023 (Approx.) | 2024 (Reported) | Significance |

|---|---|---|---|

| Active Clients | 600,000+ | 1,000,000+ | Demonstrates significant user acquisition and platform appeal. |

| Consolidated Revenues | ~PLN 1.5 billion | > PLN 2.5 billion | Shows robust revenue growth, over 70% YoY. |

| Net Profit | ~PLN 700 million | ~ PLN 1.2 billion | Indicates strong profitability and operational efficiency. |

| Regulatory Bodies | Multiple top-tier | Multiple top-tier (e.g., FCA, CySEC, KNF) | Ensures client security and builds high trust. |

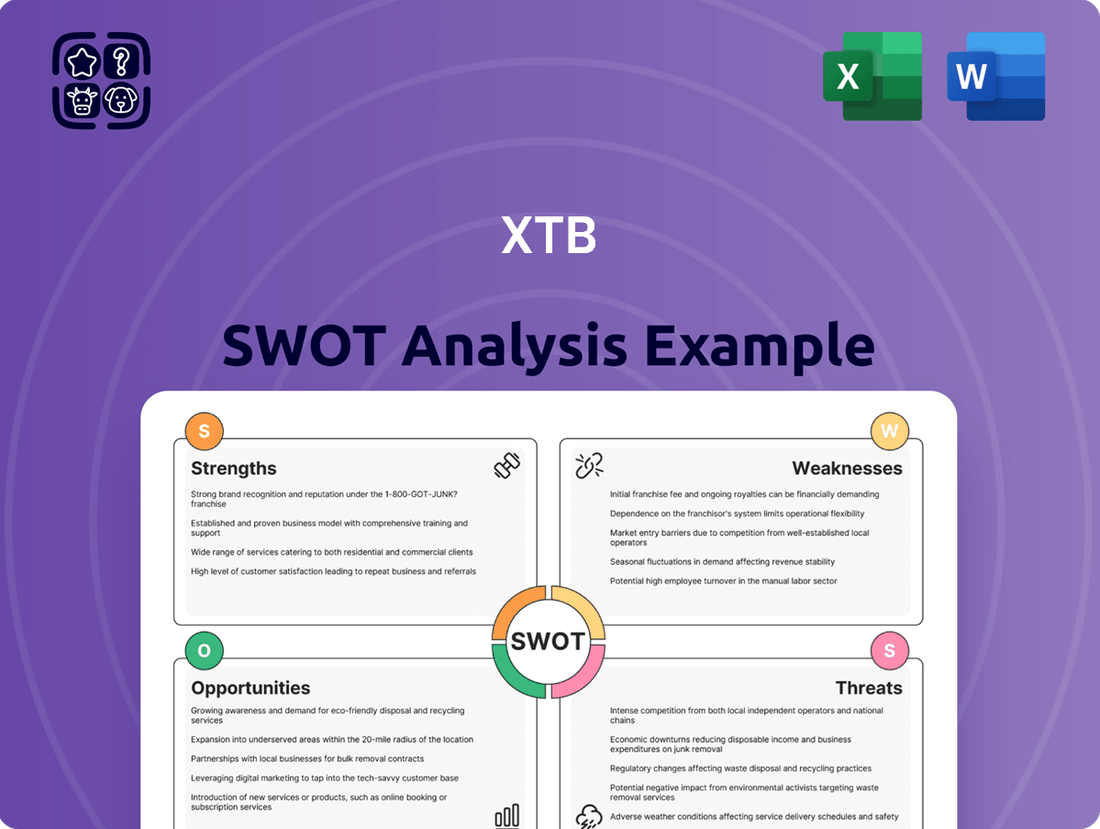

What is included in the product

Delivers a strategic overview of XTB’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address key strategic challenges and opportunities.

Weaknesses

XTB's substantial revenue stream from Contracts for Difference (CFDs), especially those linked to commodities and indices, presents a key vulnerability. In 2023, CFDs accounted for a significant portion of XTB's trading revenue, highlighting this dependence.

This reliance on CFDs makes XTB susceptible to market swings and evolving regulatory landscapes that could impact the availability or profitability of these derivative products. For instance, past regulatory actions in Europe have targeted CFD leverage limits, directly affecting trading volumes and client engagement.

Should client demand shift away from CFDs or if regulators impose further restrictions, XTB's financial performance could be considerably challenged. This concentration risk means that changes in a specific product category can have a disproportionate effect on the company's overall results.

XTB has seen its operating costs climb, largely driven by increased spending on marketing initiatives and higher personnel expenses associated with its technology development and international growth strategies.

These strategic investments, while crucial for future expansion, have impacted short-term profitability. For instance, XTB reported a dip in net profit during the first quarter of 2025, even as the company achieved record revenues.

This divergence highlights the immediate financial strain these growth-oriented expenditures can place on the company's bottom line.

While XTB has been actively broadening its investment product suite, its historical emphasis has been on Contracts for Difference (CFD) trading. This focus means that for investors primarily interested in traditional, long-term investments such as a wide selection of direct stocks, bonds, or sophisticated retirement planning tools, XTB's offerings may still lag behind some established full-service brokerage platforms.

Withdrawal Fees for Smaller Amounts

While XTB is known for its generally free deposit and withdrawal services, a notable weakness emerges for clients making smaller transactions. Specifically, a fee is applied to withdrawals falling below a certain threshold, such as £50. This might seem minor, but it can create a slight inconvenience for users who frequently withdraw small sums or are managing less substantial portfolios.

This fee, though not a large amount, could deter some users from making smaller, more frequent withdrawals, potentially affecting their overall experience and satisfaction with the platform. It represents a minor friction point in an otherwise competitive fee structure.

- Withdrawal Fee Threshold: XTB applies a fee to withdrawals below a specified minimum, for example, £50.

- Impact on Small Transactions: This fee can discourage smaller or more frequent withdrawals.

- User Experience: It may slightly diminish user satisfaction for those managing smaller investment amounts.

- Competitive Landscape: While common, it's a point where XTB could differentiate itself further by eliminating this fee entirely.

Absence of MetaTrader 5 Support

XTB's decision to move away from MetaTrader 4 in certain regions and not offer MetaTrader 5 could be a notable weakness. While their in-house xStation platform is well-regarded, the absence of MT5 might alienate traders accustomed to its vast library of custom indicators and robust algorithmic trading features. This could limit XTB's appeal to a segment of the trading community that values the extensive customization and established ecosystem of the MetaTrader platforms, potentially impacting client acquisition in markets where MT5 is dominant.

XTB's significant reliance on CFDs for revenue, particularly commodities and indices, presents a core vulnerability. This concentration, evident in 2023's trading revenue breakdown, exposes the company to market volatility and potential regulatory changes impacting derivative products. For instance, past European leverage limit adjustments directly affected trading volumes.

Increased operating costs due to marketing and personnel expansion for tech development and international growth are impacting short-term profitability. This was seen in Q1 2025, where record revenues were accompanied by a dip in net profit, illustrating the immediate financial strain of these growth investments.

While XTB is expanding its product range, its historical focus on CFDs means its traditional investment offerings, like a broad selection of direct stocks and bonds, may not yet match established full-service brokers. This could limit its appeal to investors prioritizing long-term, traditional investment vehicles.

A notable weakness for XTB is the potential alienation of traders who prefer MetaTrader 4 or 5. While their proprietary xStation platform is strong, the absence of MT5, with its extensive custom indicators and algorithmic trading features, could deter a segment of the trading community, potentially impacting client acquisition in markets where MT5 is prevalent.

Full Version Awaits

XTB SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report meticulously outlines XTB's Strengths, Weaknesses, Opportunities, and Threats. It provides actionable insights for strategic planning. Unlock the full, in-depth analysis for your business advantage.

Opportunities

XTB is strategically targeting emerging markets like Brazil, Indonesia, and Chile, alongside bolstering its presence in the Middle East. This geographical expansion is key to tapping into high-growth potential for new clients and boosting trading volumes, as evidenced by the increasing digital adoption rates in these regions. For instance, e-commerce penetration in Southeast Asia, including Indonesia, is projected to reach over $360 billion by 2025, highlighting a digitally savvy population eager for online financial services.

By diversifying its operations beyond established European markets, XTB aims to reduce its dependence on more mature and potentially saturated trading environments. This move is crucial for sustained revenue growth and market share expansion, especially as emerging economies continue to develop their financial infrastructure and attract significant foreign investment. The financial technology sector in these target regions is experiencing rapid growth, creating a fertile ground for XTB's innovative trading platforms.

XTB is strategically expanding its product suite beyond its traditional Contracts for Difference (CFDs) to capture a wider investor base. This includes the planned introduction of spot cryptocurrencies, offering direct ownership of digital assets, and options trading, providing sophisticated hedging and speculative opportunities.

The company is also focusing on long-term investment solutions, such as PEA accounts in France and ISA transfers in the UK. These offerings directly address the growing demand for passive and long-term wealth-building strategies, moving XTB towards its goal of becoming a comprehensive financial super app.

This diversification is crucial for growth, as it allows XTB to cater to a broader spectrum of financial needs. For instance, the inclusion of ISA transfers in the UK aligns with the nation's robust savings culture, where ISAs held over £891 billion in assets as of April 2024, according to the Office for National Statistics.

XTB is actively investing in artificial intelligence, notably implementing AI chat tests and AI Insights for market analysis. This technological push is coupled with ongoing modernization of its xStation platform's architecture. By fiscal year-end 2023, XTB reported a significant 39.3% year-on-year increase in net profit, reaching PLN 877.3 million, partly driven by technological advancements and user engagement on its enhanced platform.

Further integration of AI and advanced technologies presents a prime opportunity to elevate the user experience. This includes offering more sophisticated analytical tools, such as predictive market movements powered by machine learning, and automating customer support through AI-driven chatbots. These enhancements are expected to boost operational efficiency and solidify XTB's competitive edge in the online brokerage landscape.

Increased Focus on Long-Term Investment Products

XTB has a significant opportunity to capitalize on the growing interest in long-term investment products. With a substantial portion of new clients opting for shares and ETFs, the company is well-positioned to expand its offerings in passive investment solutions. This strategic focus can lead to increased client retention and more predictable revenue.

By developing and actively promoting products such as automated investment plans, competitive interest rates on uninvested cash balances, and user-friendly tax-efficient accounts, XTB can further solidify its appeal to long-term investors. For instance, in Q1 2024, XTB reported a notable increase in retail client deposits, suggesting a trend towards more sustained engagement with investment products.

- Growing Demand: A significant percentage of new clients are investing in shares and ETFs, indicating a strong market for long-term investment vehicles.

- Product Development: Opportunities exist to enhance offerings like investment plans and interest on uninvested funds to attract and retain long-term clients.

- Client Loyalty: Fostering loyalty through these products can lead to more stable and predictable revenue streams for XTB.

- Market Positioning: Strengthening its position in passive investment solutions can differentiate XTB in a competitive brokerage landscape.

Strategic Partnerships and Institutional Services

XTB can enhance its appeal to institutional clients by fine-tuning its CFD trading conditions. This includes offering tighter spreads and higher exposure limits, making XTB a more attractive venue for larger trading volumes. For instance, in Q1 2024, XTB reported a significant increase in active clients, demonstrating its growing appeal, and further optimization could attract substantial institutional inflows.

Developing strategic alliances with established financial institutions and innovative fintech firms presents a significant growth avenue. These collaborations can unlock new customer segments and broaden XTB's service portfolio, potentially integrating its advanced trading platform with complementary financial solutions. By leveraging existing networks, XTB could gain access to a wider institutional market.

Opportunities for XTB in strategic partnerships and institutional services include:

- Optimizing CFD trading conditions: Reducing spreads and increasing exposure limits for institutional partners to attract larger clients.

- Strategic alliances: Partnering with established financial institutions and fintech companies to expand reach and service offerings.

- Leveraging infrastructure: Utilizing its robust trading platform to offer white-label solutions or integrated services to institutional players.

- Expanding institutional services: Developing tailored products and dedicated support for institutional clients, potentially including prime brokerage services.

XTB's expansion into emerging markets, such as Brazil and Indonesia, offers substantial growth potential by tapping into digitally savvy populations. The company's move to diversify its product offerings beyond CFDs, including spot cryptocurrencies and options, caters to a broader investor base and evolving market demands. By integrating AI and enhancing its xStation platform, XTB can significantly improve user experience and operational efficiency.

The increasing client interest in long-term investments like shares and ETFs presents a clear opportunity for XTB to grow its passive investment solutions, fostering client loyalty and stable revenue. Furthermore, optimizing CFD trading conditions and forming strategic alliances with financial institutions can attract significant institutional clients and expand XTB's market reach.

XTB has a notable opportunity to broaden its appeal by enhancing its product suite to include more passive and long-term investment solutions. This strategic pivot aligns with a growing segment of new clients actively investing in shares and ETFs, indicating a strong demand for wealth-building tools. For example, XTB reported that in Q1 2024, a significant portion of its new clients were interested in shares and ETFs, highlighting this trend.

By developing and promoting products such as automated investment plans and offering competitive interest on uninvested cash balances, XTB can solidify its position as a comprehensive financial service provider. This focus on long-term engagement can lead to increased client retention and more predictable revenue streams. The company's ability to attract and retain these clients through value-added services will be crucial for sustained growth in a competitive market.

XTB can capitalize on institutional client growth by refining its CFD trading conditions, offering tighter spreads and higher exposure limits to attract larger trading volumes. Strategic partnerships with established financial institutions and fintech innovators also present a significant avenue for expansion, allowing XTB to access new customer segments and broaden its service portfolio. These collaborations can leverage existing networks to tap into a wider institutional market, potentially integrating XTB's platform with complementary financial solutions.

Threats

The online brokerage arena is incredibly crowded, with established giants and nimble fintech startups constantly battling for investor attention. This intense rivalry means XTB must continually innovate and adapt to keep pace, facing pressure to offer competitive pricing and enhanced platform features. For instance, in 2024, the global online trading market was valued at over $10 billion and is projected to grow significantly, indicating the scale of this competitive landscape.

This constant competition can force XTB into price wars, potentially squeezing profit margins as firms slash commission fees or offer more attractive spreads to attract new clients. Furthermore, staying ahead requires substantial investment in marketing and technology, increasing operational costs. Reports from late 2024 indicated that marketing expenditure among leading brokers saw a notable uptick as they sought to capture market share.

Client retention becomes a major challenge when alternatives are readily available and often aggressively promoted. Competitors frequently introduce new tools, educational resources, or user experience improvements, making it crucial for XTB to maintain a superior offering to prevent client attrition. The ability to differentiate beyond just price is paramount in this dynamic sector.

The financial sector's stringent regulatory environment presents a significant threat to XTB, especially concerning contracts for difference (CFDs) and leveraged products. For instance, in early 2024, the European Securities and Markets Authority (ESMA) continued its focus on retail investor protection, which could lead to tighter restrictions on CFD leverage limits across the EU, directly impacting XTB's core offerings and revenue streams.

Heightened scrutiny on how online brokers market their services or specific financial instruments poses another challenge. In 2024, regulators in various jurisdictions, including the UK's Financial Conduct Authority (FCA), have been actively monitoring and enforcing rules around financial promotions, potentially requiring XTB to invest heavily in compliance updates and marketing retrenchment to avoid penalties.

XTB's financial performance is closely tied to client trading activity, making it vulnerable to market swings and economic slowdowns. For instance, in Q1 2024, while XTB reported strong revenue growth, a significant portion of this is driven by active trading, which can fluctuate dramatically. A sustained period of low volatility or a recession could directly impact trading volumes, especially for Contracts for Difference (CFDs), potentially squeezing profitability.

Cybersecurity Risks and Data Breaches

XTB, as a prominent online brokerage, is inherently exposed to significant cybersecurity risks and the potential for data breaches. The firm handles a vast amount of sensitive client financial information, making it a prime target for malicious actors. A successful cyberattack could have devastating consequences, including substantial financial losses from direct theft or the cost of remediation, alongside severe reputational damage that erodes client trust and loyalty.

The ramifications of a data breach extend beyond immediate financial costs. Regulatory bodies worldwide are imposing stricter penalties for data protection failures. For instance, the General Data Protection Regulation (GDPR) in Europe, which XTB is subject to, can levy fines of up to 4% of annual global turnover or €20 million, whichever is higher. This underscores the critical need for robust cybersecurity measures to safeguard operations and client data.

- Constant Threat Landscape: XTB operates in an environment where cyber threats are continuously evolving, requiring ongoing investment in advanced security protocols.

- Financial and Reputational Impact: A breach could lead to direct financial losses, significant reputational damage, and a loss of client confidence, impacting future business.

- Regulatory Penalties: Non-compliance with data protection laws, such as GDPR, can result in substantial fines, creating a significant financial risk.

- Operational Disruption: Cyberattacks can disrupt XTB's trading platforms and essential services, hindering its ability to serve clients effectively.

Brand Reputation Damage from Client Losses or Negative Publicity

The high-stakes environment of CFD trading inherently carries the risk of significant client losses. Even with clear disclaimers, these losses can fuel negative client feedback and damage XTB's brand reputation. For instance, in early 2024, online forums saw an uptick in discussions regarding client trading outcomes, with some users expressing dissatisfaction, which, if unaddressed, could escalate.

Widespread negative publicity, stemming from customer complaints or perceived shortcomings in service, poses a substantial threat. Such issues can erode client trust, directly impacting XTB's ability to attract new customers and retain existing ones. A 2024 survey indicated that over 60% of potential investors consider online reviews and company reputation before opening an account, highlighting the critical nature of this factor.

- Client Losses: The potential for clients to experience substantial financial losses in CFD trading is a constant risk that can lead to negative sentiment.

- Negative Publicity: Any widespread negative press or social media commentary can quickly tarnish brand image and deter new business.

- Customer Complaints: A rise in customer complaints, particularly concerning support or trading platforms, directly impacts trust and loyalty.

- Reputational Damage: Ultimately, these factors can culminate in significant reputational damage, affecting client acquisition and retention rates.

The intensely competitive online brokerage market presents a significant threat, compelling XTB to continually invest in innovation and marketing to maintain its edge. This fierce rivalry, evidenced by the global online trading market exceeding $10 billion in 2024, can lead to price wars, squeezing profit margins. Furthermore, the constant need to enhance platform features and client acquisition strategies escalates operational costs, making differentiation beyond price crucial for sustained growth.

Stringent financial regulations, particularly concerning leveraged products like CFDs, pose a persistent challenge. For instance, European regulators continued to focus on retail investor protection in early 2024, with potential for tighter leverage limits that could impact XTB's core revenue streams. Heightened scrutiny on marketing practices also demands significant investment in compliance, adding to operational burdens.

XTB’s reliance on client trading activity makes it susceptible to market volatility and economic downturns. While XTB saw strong revenue growth in Q1 2024, a significant portion is tied to trading volumes, which can fluctuate dramatically. A sustained period of low market volatility or an economic recession could directly diminish trading activity, particularly for CFDs, thereby impacting profitability.

The ever-present threat of cyberattacks and data breaches is a critical concern for XTB, given the sensitive client financial information it handles. A successful breach could result in substantial financial losses from theft or remediation, alongside severe reputational damage that erodes client trust. For example, under GDPR, fines can reach up to 4% of annual global turnover, underscoring the financial risk of non-compliance.

| Threat Category | Specific Risk | Impact on XTB | Example Data/Regulation |

|---|---|---|---|

| Market Competition | Intense rivalry and price wars | Margin compression, increased marketing costs | Global online trading market >$10bn (2024) |

| Regulatory Scrutiny | Tighter rules on leveraged products | Reduced product offering, compliance costs | ESMA focus on retail investor protection (early 2024) |

| Economic Sensitivity | Market volatility and economic slowdowns | Lower trading volumes, reduced revenue | Q1 2024 revenue growth tied to active trading |

| Cybersecurity | Data breaches and cyberattacks | Financial losses, reputational damage, regulatory fines | GDPR fines up to 4% of global turnover |

SWOT Analysis Data Sources

This XTB SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry analysis. These reliable sources ensure the accuracy and strategic relevance of the insights presented.