XTB Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

XTB Bundle

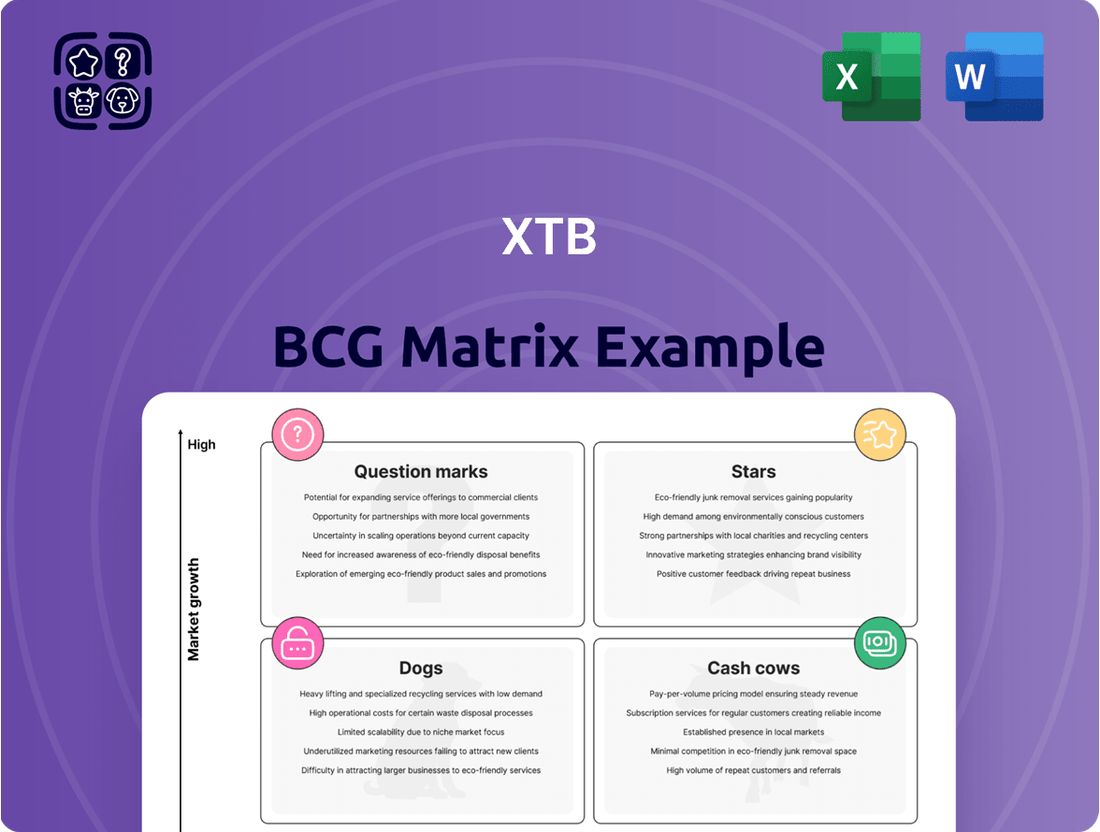

The Boston Consulting Group (BCG) Matrix is a powerful tool for analyzing a company's product portfolio. It categorizes products into four quadrants: Stars, Cash Cows, Dogs, and Question Marks, based on market growth rate and relative market share.

Understanding where your products fall within this matrix is crucial for making informed strategic decisions about resource allocation and future investments. Are your products poised for growth, or are they draining valuable resources?

This preview offers a glimpse into the strategic positioning of key products. However, to truly unlock the potential of this analysis and gain a comprehensive understanding of your competitive landscape, you need the full BCG Matrix.

Purchase the complete BCG Matrix report to receive detailed quadrant placements, data-backed recommendations, and a clear roadmap for smart investment and product development. Don't miss out on actionable insights that can drive your business forward.

Stars

XTB has achieved remarkable client acquisition, welcoming close to 500,000 new clients in 2024. This momentum continued into Q1 2025, with an additional 194,000 clients joining, a testament to their expanding market presence.

This surge in new clients has directly translated into substantial growth in XTB's active client base, significantly bolstering their overall market share within the dynamic online brokerage sector.

The company's strategic and robust investment in marketing efforts is clearly a key factor, directly fueling this impressive client onboarding rate and reinforcing their position as an industry leader.

Index CFDs have solidified their position as XTB's primary revenue driver. In the first quarter of 2025, they contributed a significant 52.3% to the company's total revenue. This impressive figure represents a notable jump from the prior year, underscoring their growing importance.

The robust performance is largely fueled by demand for major indices such as the German DAX, US 100, and US 500. This suggests XTB holds a strong market share within this dynamic and lucrative sector of the financial markets.

The consistent profitability generated by Index CFDs highlights their role as a crucial engine for XTB's ongoing growth and expansion. Their popularity indicates a healthy appetite for these instruments among traders seeking exposure to broader market movements.

XTB's shares and ETFs trading segment is a significant growth driver, demonstrating impressive performance. In the first quarter of 2025, turnover in this area surged by 121.3%, reaching an impressive USD 4.1 billion.

This segment is also a key gateway for new clientele. Approximately 80% of new European clients initiate their investment journey with XTB by trading shares and ETFs, highlighting the platform's appeal to emerging investors.

This strong client adoption in shares and ETFs indicates XTB's successful penetration into the long-term investment market. It underscores the company's growing market share in a space that continues to gain popularity among investors.

Proprietary xStation Platform

The xStation platform is XTB's proprietary technological backbone, a key driver of its competitive edge. This platform’s ongoing development is central to XTB's strategy. Its intuitive design and robust features are instrumental in attracting and retaining a significant base of active users within the dynamic fintech landscape. In 2023, XTB reported over 400,000 active clients, a testament to the platform's appeal and utility.

- Technological Core: xStation is XTB's primary technological asset, continuously enhanced to maintain a competitive advantage.

- Client Acquisition & Retention: Its user-friendly interface and comprehensive tools are crucial for attracting and keeping a large active client base.

- Fintech Sector Growth: The platform's success is closely tied to its ability to cater to the demands of the high-growth fintech sector.

- Market Leadership: Innovation and reliability in the xStation platform are vital for XTB's market position and ongoing expansion efforts.

Strategic Push for 'Universal Investment Application'

XTB's strategic push to become a universal investment application is a significant move, integrating a wider array of financial products and services. This aligns with the growing demand for comprehensive financial management platforms. The company's commitment to this vision is evidenced by substantial investments in client acquisition and product innovation, targeting robust growth by serving a broader spectrum of investor requirements beyond their established CFD offerings.

This transformation positions XTB to capitalize on the evolving fintech landscape, aiming for market leadership. For instance, by the end of 2023, XTB reported a record-breaking net profit of 1.43 billion PLN, a substantial increase from 758 million PLN in 2022. This financial strength underpins their ambitious expansion plans.

- Expanded Product Offering: Introduction of new asset classes and investment instruments.

- Client Acquisition Focus: Significant investment in marketing and onboarding to attract a diverse user base.

- Technological Advancement: Enhancing the platform to support integrated financial management and trading.

- Market Positioning: Aiming to be a one-stop-shop for retail investors.

Stars represent the highest growth potential and high market share within the BCG Matrix. These are typically market leaders in rapidly expanding industries. XTB's Index CFDs, contributing 52.3% of revenue in Q1 2025, and its Shares & ETFs segment, with a 121.3% turnover increase to USD 4.1 billion in Q1 2025, exemplify Star characteristics due to their strong performance and significant market impact.

The substantial client acquisition, with nearly 500,000 new clients in 2024 and an additional 194,000 in Q1 2025, fuels the growth of these segments. The platform's ability to attract new users, particularly in Shares & ETFs where 80% of new European clients begin, further solidifies their Star status. XTB's strategic vision to become a universal investment application supports the continued expansion and dominance of these product categories.

| Category | Market Share | Market Growth | XTB Performance |

| Index CFDs | High | High | 52.3% of Q1 2025 revenue |

| Shares & ETFs | Growing rapidly | High | 121.3% turnover growth in Q1 2025 |

| Overall Client Acquisition | Increasing | High | ~500,000 new clients in 2024; 194,000 in Q1 2025 |

What is included in the product

The XTB BCG Matrix categorizes XTB's financial products based on market growth and share.

It helps identify which products to invest in, hold, or divest.

XTB BCG Matrix provides clarity on business unit performance, alleviating the pain of unclear strategic direction.

Cash Cows

Commodity CFDs were the standout performers for XTB in 2024, accounting for an impressive 48% of the company's total revenue. This significant contribution was largely fueled by the robust trading activity in key commodities such as gold and natural gas, underscoring their importance to XTB's financial health.

While the market share of commodity CFDs saw a slight dip in the first quarter of 2025, they continue to represent a vital and highly profitable segment for XTB. This suggests a mature product line with a strong market presence, reliably generating substantial cash flow for the organization.

Established Forex CFD trading is a cornerstone of XTB's business, acting as a reliable cash cow. This segment has historically provided a consistent revenue stream, underscoring its maturity and XTB's established position in this high-volume market. While its share of revenue saw a slight decline in Q1 2025, as newer asset classes gained traction, it remains a vital and steady income generator for the company. This maturity means it requires less aggressive investment for growth, allowing it to continue contributing significantly to XTB's overall financial health.

Central and Eastern Europe (CEE) continues to be XTB's powerhouse, generating a significant 63.9% of its total revenue in 2024. This strong performance is particularly noticeable in Poland, where revenue saw substantial increases.

XTB's commanding market share in this mature CEE region translates into a reliable and considerable cash flow. This established leadership allows the company to consistently generate profits from a market where it holds a dominant position.

Educational Materials and Customer Support

XTB's commitment to extensive educational materials and dedicated customer support acts as a powerful "Cash Cow" within its business model, particularly in the context of the BCG Matrix. These services, while not direct revenue drivers, are instrumental in fostering client loyalty and trust, which is crucial given XTB's substantial client base. By offering robust educational content and responsive support, XTB effectively reduces client churn in a highly competitive online trading environment.

These foundational services ensure a stable and engaged customer base, indirectly contributing to overall profitability by minimizing acquisition costs associated with replacing lost clients. For instance, XTB reported a significant increase in active clients throughout 2023 and into early 2024, a testament to the sticky nature of their value-added services. The company's educational platform, including webinars and analytical tools, is designed to empower traders of all levels, thereby enhancing client retention.

- Client Retention: Educational resources and customer support directly contribute to higher client retention rates.

- Trust Building: These services are key in building long-term trust with a large and diverse client base.

- Reduced Churn: Offering strong support helps mitigate client attrition in a competitive market.

- Indirect Profitability: While not a direct revenue source, they support overall profitability by fostering loyalty and reducing acquisition costs.

Existing Active Client Base

XTB's existing active client base functions as a classic Cash Cow within the BCG Matrix. The significant and ever-increasing number of active clients, exceeding 735,000 as of Q1 2025, signifies a reliable and predictable revenue source. These clients, having already been acquired, generate consistent income through trading activity, spreads, and commissions, ensuring a steady cash flow even in a competitive brokerage landscape.

This substantial, engaged client pool is crucial for XTB's financial stability. It provides a foundation of recurring revenue that can be leveraged to fund other strategic initiatives.

- Stable Revenue Stream: Over 735,000 active clients as of Q1 2025.

- Recurring Income: Generated through transaction fees, spreads, and commissions.

- Market Stability: Provides consistent cash flow in a mature brokerage sector.

- Foundation for Growth: Supports investment in high-growth areas like new client acquisition.

XTB's established Forex CFD trading segment acts as a reliable cash cow, historically providing a consistent revenue stream. While its share of revenue saw a slight decline in Q1 2025, it remains a vital and steady income generator for the company, requiring less aggressive investment for growth.

The company's extensive educational materials and dedicated customer support are instrumental in fostering client loyalty and trust, effectively reducing client churn and indirectly contributing to profitability by minimizing acquisition costs.

XTB's substantial and growing active client base, exceeding 735,000 as of Q1 2025, provides a stable and predictable revenue source through trading activity, spreads, and commissions, ensuring consistent cash flow.

| Business Segment | 2024 Revenue Contribution | BCG Category |

|---|---|---|

| Commodity CFDs | 48% | Cash Cow |

| Forex CFDs | Mature, Steady Contributor | Cash Cow |

| Central & Eastern Europe (CEE) Operations | 63.9% | Cash Cow |

| Educational & Support Services | Indirect Revenue Driver | Cash Cow |

| Active Client Base (>735,000 as of Q1 2025) | Foundation of Recurring Income | Cash Cow |

Full Transparency, Always

XTB BCG Matrix

The BCG Matrix report you are currently previewing is the identical, fully-formatted document you will receive immediately after your purchase. This comprehensive analysis, meticulously crafted by strategic planning experts, is designed to provide actionable insights into your business portfolio. You can trust that no watermarks or demo content will be present in the final downloadable file, ensuring immediate usability for your strategic decision-making.

Dogs

XTB's decision to freeze its bond offering project in August 2024 places it firmly in the 'dog' category of the BCG Matrix. This move signals a strategic shift, likely due to anticipated low market share growth or substantial hurdles in implementation, making it a less attractive investment compared to other potential ventures.

With a market capitalization of €1.4 billion as of early 2024, XTB's resource allocation becomes critical. Freezing the bond project suggests that the company's leadership believes capital is better deployed elsewhere, perhaps in areas with higher potential returns or more immediate strategic alignment, such as their existing forex and CFD offerings which have shown robust growth.

While XTB boasts robust performance across its primary CFD offerings, some highly specialized or less frequently traded niche instruments might be classified as underperforming. These could be instruments with consistently low trading volumes and limited revenue generation. For instance, a hypothetical scenario might see a specific commodity CFD, like palladium, experiencing a significant downturn in global demand during 2024, leading to reduced trading activity and profitability for XTB in that particular segment.

Segments of XTB's extensive knowledge base or older online courses that may no longer be highly relevant or engaging to the evolving client base could be considered 'dogs.' For instance, modules focusing on trading platforms or market analysis techniques from the early 2010s might not reflect the current technological landscape or the prevalence of new asset classes.

If these materials require maintenance but attract low user engagement or fail to drive new client acquisition and retention effectively, they represent inefficient resource allocation. Consider that in 2023, XTB reported a significant increase in active clients, reaching over 400,000, yet a portion of their educational content might not be contributing proportionally to this growth.

For example, if a particular webinar series on a now-less-popular derivative has only seen a few hundred views in the past year, despite being updated, it signals a potential 'dog' category. This is particularly true if the cost of maintaining and promoting these assets outweighs the tangible benefits they bring in terms of client engagement or conversion rates.

The key is to identify these underperforming educational assets and either revitalize them with current data and approaches or reallocate those resources to more promising areas. Failing to do so can lead to a diluted learning experience for clients and a drain on valuable operational capacity.

Specific Geographies with Stagnant Low Market Share

Within the XTB BCG Matrix, specific geographies with stagnant low market share represent the 'dogs'. These are typically mature markets where XTB's presence is minimal, and growth is unlikely to accelerate. Despite the company's overall expansion, these regions demand careful consideration regarding continued investment, as resources might be better allocated elsewhere.

For instance, consider emerging markets in regions like parts of Southeast Asia or certain African nations where XTB's brand awareness and client base are still developing. In these areas, regulatory hurdles or intense local competition can limit market penetration, resulting in a low market share and slow revenue growth. For example, a hypothetical scenario in a specific, smaller European country might show XTB holding only 0.5% market share in 2024, with projected growth rates of less than 2% annually for the next five years.

- Low Market Penetration: XTB might have less than 1% market share in certain niche or less developed financial markets.

- Limited Growth Prospects: Expected annual market growth in these geographies is projected to be below 3% in the coming years.

- High Competitive Intensity: Established local players often dominate these markets, making it difficult for XTB to gain significant traction.

- Resource Re-evaluation: Investment in these 'dog' markets should be critically assessed to determine if the capital could yield higher returns in other segments.

Non-Core Legacy Systems/Processes

Non-core legacy systems and outdated operational processes can be categorized as 'dogs' within the XTB BCG Matrix. These are systems or workflows that, while perhaps functional, no longer directly support the core xStation trading platform or strategic growth areas. Their continued existence often means ongoing costs for maintenance and updates, diverting resources that could be better allocated to innovation or core business improvements. For instance, XTB's continued investment in maintaining older customer relationship management (CRM) systems, which are separate from the core trading infrastructure and not slated for replacement or integration with newer strategic initiatives, would fall into this category. Such systems might consume an estimated 15-20% of IT operational budgets without yielding significant competitive advantage.

These 'dog' elements can indirectly impact efficiency. For example, if an older, non-integrated back-office system requires manual data transfer to newer platforms, it introduces potential for errors and delays. While XTB has focused heavily on its xStation platform, any legacy internal reporting tools or manual data reconciliation processes that are not core to the trading experience and do not feed into strategic decision-making represent resources tied up in activities that don't drive market share or revenue growth.

- Resource Drain: Legacy systems like older, non-integrated accounting software may consume significant IT resources for maintenance, potentially costing XTB millions annually without contributing to platform innovation.

- Efficiency Bottlenecks: Outdated manual data entry processes for non-core client onboarding can slow down operations, contrasting with the speed expected from a digital brokerage.

- Missed Opportunities: Funds spent on maintaining redundant internal databases could otherwise be invested in enhancing the xStation platform's features or expanding into new markets.

- Low ROI: These 'dog' assets provide minimal return on investment and do not align with XTB's strategic goal of being a technology-driven leader in online trading.

In the XTB BCG Matrix, 'dogs' represent offerings with low market share and low growth potential. XTB's decision to freeze its bond offering project in August 2024 exemplifies this, suggesting it's a venture unlikely to gain significant traction or return substantial profits. Similarly, certain niche educational content or underperforming geographical markets with minimal penetration and stagnant growth also fall into this category, requiring careful resource allocation assessment.

| Category | XTB Example | Market Share | Growth Potential | Strategic Implication |

|---|---|---|---|---|

| Bonds Offering Project | Frozen Project (August 2024) | Low (projected) | Low (anticipated) | Capital reallocation to core strengths. |

| Niche Educational Content | Outdated Webinar Series | Low Engagement | Low (declining relevance) | Revitalization or resource diversion. |

| Underperforming Geographies | Specific Emerging Markets | <1% (hypothetical) | <2% annually (projected) | Re-evaluation of investment viability. |

Question Marks

XTB's strategy involves targeting emerging markets with high potential, such as Brazil and Indonesia, with initial entries planned for the first half of 2025. This aligns with a "question marks" approach in the BCG matrix, signifying low current market share but strong growth prospects.

Recent expansions into the Middle East and Chile also fall into this category. These regions represent significant growth opportunities for XTB, despite the inherent uncertainties associated with establishing a foothold in new territories.

The success of these ventures is not guaranteed, but the potential for substantial future returns drives XTB's investment. This calculated risk-taking is crucial for long-term portfolio diversification and market leadership.

XTB is currently exploring the introduction of options trading, a move that places it in the "Question Marks" category of the BCG Matrix. This signifies a high-growth market segment where XTB has no current market share, necessitating substantial investment for development and launch.

The potential for significant returns exists, but the path forward involves considerable risk and uncertainty. For instance, the global options market saw substantial activity in 2024, with trading volumes on major exchanges like the Cboe showing notable increases year-over-year, indicating a robust and expanding sector.

This strategic decision requires careful consideration of the capital investment needed for platform development, regulatory compliance, and marketing to capture a share of this competitive market. Success hinges on XTB's ability to effectively execute its strategy and differentiate its offering.

XTB is expanding its cryptocurrency offerings by planning to introduce spot cryptocurrencies, moving beyond its current Contracts for Difference (CFDs) model. This strategic shift positions XTB to tap into the burgeoning spot cryptocurrency market, where it anticipates beginning with a modest market share. The success of this new venture hinges significantly on securing necessary regulatory approvals and fostering widespread market adoption.

AI Chat and Advanced Technology Integration

XTB's integration of AI chat, initially rolled out to a select Polish client base in Q1 2025, represents a strategic move into advanced technology. This investment underscores a commitment to enhancing user experience and operational efficiency within the rapidly evolving, tech-centric financial sector.

- AI Chat Deployment: Launched for select clients in Poland during Q1 2025.

- Strategic Investment: Continuous investment in AI and technological enhancements for the platform.

- Objective: To improve user experience and operational efficiency.

- Market Impact: Broader market adoption and impact on market share are still developing.

eWallet and Multi-currency Card Service

XTB's eWallet and multi-currency card service, launched in 2024 and slated for expansion in 2025, represents a strategic move into the rapidly evolving digital payments sector. This initiative aims to position XTB as a comprehensive financial application, offering more than just investment tools.

The digital payments market is highly competitive, yet it presents significant growth opportunities. XTB's entry into this space, while currently holding a low market share for this specific service, signifies a calculated investment in a high-potential area of financial technology.

- Market Entry: Launched in 2024, targeting a broad user base.

- Strategic Goal: To become a universal investment and financial management application.

- Market Position: Currently low market share in digital payments, necessitating significant investment.

- Growth Potential: Operates in a high-growth sector with increasing demand for integrated financial solutions.

Question Marks represent XTB's ventures into high-growth markets where its current market share is minimal. These initiatives, like the planned introduction of options trading and expansion into spot cryptocurrencies, demand substantial investment. The success of these ventures is uncertain, but the potential for significant future returns is the driving force behind these strategic decisions.

| Initiative | Market Growth | XTB Market Share | Investment Need | Potential Return |

|---|---|---|---|---|

| Options Trading | High (e.g., Cboe volumes increased in 2024) | Low/None | High | High |

| Spot Cryptocurrencies | High (growing adoption) | Low/None | High | High |

| Emerging Markets (Brazil, Indonesia) | High | Low | High | High |

| eWallet/Multi-currency Card | High (digital payments sector) | Low | Moderate | Moderate to High |

BCG Matrix Data Sources

Our XTB BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive landscape analysis, to accurately position products.