XTB Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

XTB Bundle

XTB's competitive landscape is shaped by powerful forces. Understanding the bargaining power of buyers and suppliers is crucial to navigating XTB's market. The threat of new entrants and the intensity of rivalry among existing players significantly impact XTB's strategic positioning.

Furthermore, the availability of substitute products or services presents a constant challenge for XTB. This brief snapshot only scratches the surface of these dynamics. Unlock the full Porter's Five Forces Analysis to explore XTB’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

XTB's reliance on external data feeds for real-time market prices, news, and analytical tools means data providers can wield considerable influence. If a provider's data is unique or becomes an industry benchmark, XTB may face higher costs due to limited alternatives. For instance, in 2023, the global financial data market was valued at approximately $35 billion, indicating the significant revenue streams for key players, which translates to their bargaining strength.

Similarly, companies supplying critical technology infrastructure, robust cybersecurity solutions, and specialized trading software components possess substantial bargaining power. This is particularly true when their services are indispensable to XTB's operations and lack readily available substitutes. The increasing complexity of financial technology and the growing threat landscape in 2024 further amplify the importance of these specialized providers.

For its Contracts for Difference (CFD) and forex trading services, XTB relies heavily on prime brokers and major financial institutions to ensure deep liquidity and attractive pricing. These liquidity providers wield considerable influence, directly impacting the spreads and the quality of trade execution that XTB can extend to its customers. In 2023, the global forex market saw daily trading volumes averaging around $6.8 trillion, underscoring the immense scale and importance of these liquidity sources.

The concentrated nature of top-tier liquidity providers means they possess significant bargaining power over brokers like XTB. A restricted pool of these essential partners can allow them to dictate terms, potentially increasing their leverage and influencing XTB's operational costs and profitability. This dependency is a critical factor in XTB's ability to maintain competitive offerings in the fast-paced financial markets.

XTB relies on a network of payment processors and banks for its global operations, handling client deposits and withdrawals. The bargaining power of these suppliers stems from their ability to offer secure, rapid, and competitively priced international payment solutions across various currencies.

While many payment providers exist, those with robust infrastructure and specialized services for financial transactions can command some leverage. For instance, a provider specializing in instant cross-border settlements could be a crucial partner.

However, XTB actively mitigates supplier power by diversifying its payment partners. This strategy prevents over-reliance on any single provider and allows for negotiation leverage. In 2024, the global fintech payment market saw significant growth, with companies like Adyen and Stripe processing billions in transactions, demonstrating the scale and importance of these services.

Marketing and Advertising Channels

Suppliers of marketing and advertising services, like Google Ads, Meta platforms, and major media outlets, wield significant influence over XTB. Their ability to reach and target specific customer segments is crucial for XTB's growth. For instance, in 2024, digital advertising spend globally was projected to reach over $600 billion, highlighting the sheer scale and importance of these channels.

XTB's dependence on these suppliers for client acquisition means they can impact customer acquisition costs. Premium placements and competitive bidding on platforms like Google Search can drive up expenses, directly affecting XTB's profitability. The effectiveness of these channels is directly tied to their reach and targeting capabilities, giving them leverage.

The bargaining power of these suppliers is further amplified by the data they possess. Their ability to provide detailed analytics and audience insights allows them to justify higher pricing and demonstrate value. For example, in 2024, it's estimated that over 50% of all digital ad spending goes to just a few major platforms, concentrating power.

- Digital Ad Platforms: Dominant players like Google and Meta control vast user bases and sophisticated targeting tools, enabling them to command premium pricing.

- Affiliate Networks: These networks connect XTB with a wide array of publishers, but their commission structures can be a significant cost factor.

- Media Outlets: Traditional and online media outlets offer reach, but their pricing is often influenced by audience size and engagement metrics.

- Data Providers: Companies supplying market and consumer data used in targeted advertising can also influence campaign costs.

Regulatory Compliance and Legal Services

As a company operating in the highly regulated financial sector, XTB relies heavily on specialized legal and compliance services. These experts, including lawyers, compliance officers, and auditors, possess unique knowledge essential for navigating complex international financial regulations, such as those set by the European Securities and Markets Authority (ESMA) or the UK's Financial Conduct Authority (FCA). Their specialized skills and accreditations mean they hold significant bargaining power, as their services are critical for XTB to maintain its operational licenses and avoid substantial penalties.

The bargaining power of these suppliers is amplified by the high cost and time involved in finding and onboarding new qualified professionals. For instance, the average annual salary for a compliance officer in the financial services industry in the EU can range from €50,000 to €80,000, and finding individuals with specific expertise in fintech regulations can be even more challenging. This reliance makes XTB susceptible to price increases or unfavorable contract terms from these essential service providers.

- High Demand for Specialized Expertise: The global financial industry's increasing complexity and regulatory scrutiny create a constant demand for skilled compliance and legal professionals.

- Barriers to Entry: The need for specific accreditations, licenses, and years of experience in financial law creates significant barriers to entry for new service providers, limiting the pool of available talent.

- Criticality of Services: Failure to comply with regulations can result in severe financial penalties, reputational damage, and even the loss of operating licenses, underscoring the indispensable nature of these suppliers' services for XTB.

Suppliers of critical technological infrastructure, cybersecurity solutions, and specialized trading software components hold significant bargaining power, especially when their services are indispensable and lack readily available substitutes. The increasing complexity of financial technology and the growing threat landscape in 2024 further amplify the importance of these specialized providers for XTB's operations.

XTB's reliance on prime brokers and major financial institutions for liquidity directly impacts its ability to offer competitive spreads and execution quality. The immense daily trading volumes in the global forex market, around $6.8 trillion in 2023, highlight the leverage these liquidity providers possess.

Payment processors and banks are crucial for XTB's global operations. While many exist, those with specialized services for financial transactions, like instant cross-border settlements, can command leverage, although XTB mitigates this by diversifying its payment partners. The global fintech payment market's growth in 2024, with major players processing billions, underscores the significance of these services.

Data providers are essential for XTB's real-time market prices and analytical tools. The global financial data market, valued at approximately $35 billion in 2023, shows the substantial revenue streams for key players, granting them considerable bargaining strength, particularly if their data is unique or an industry benchmark.

| Supplier Category | Bargaining Power Factors | Impact on XTB | 2023/2024 Data Point |

|---|---|---|---|

| Technology Infrastructure & Software | Indispensable services, lack of substitutes, increasing complexity | Potential for higher costs, operational reliance | Growing threat landscape in 2024 |

| Liquidity Providers (Prime Brokers) | Concentrated market, deep liquidity provision | Influence on spreads, trade execution quality | Global forex daily trading volume ~$6.8 trillion (2023) |

| Payment Processors & Banks | Specialized financial transaction services, global reach | Negotiation leverage, cost of services | Fintech payment market growth in 2024 |

| Data Providers | Unique data, industry benchmark status, limited alternatives | Increased costs, reliance on specific data sources | Global financial data market ~$35 billion (2023) |

What is included in the product

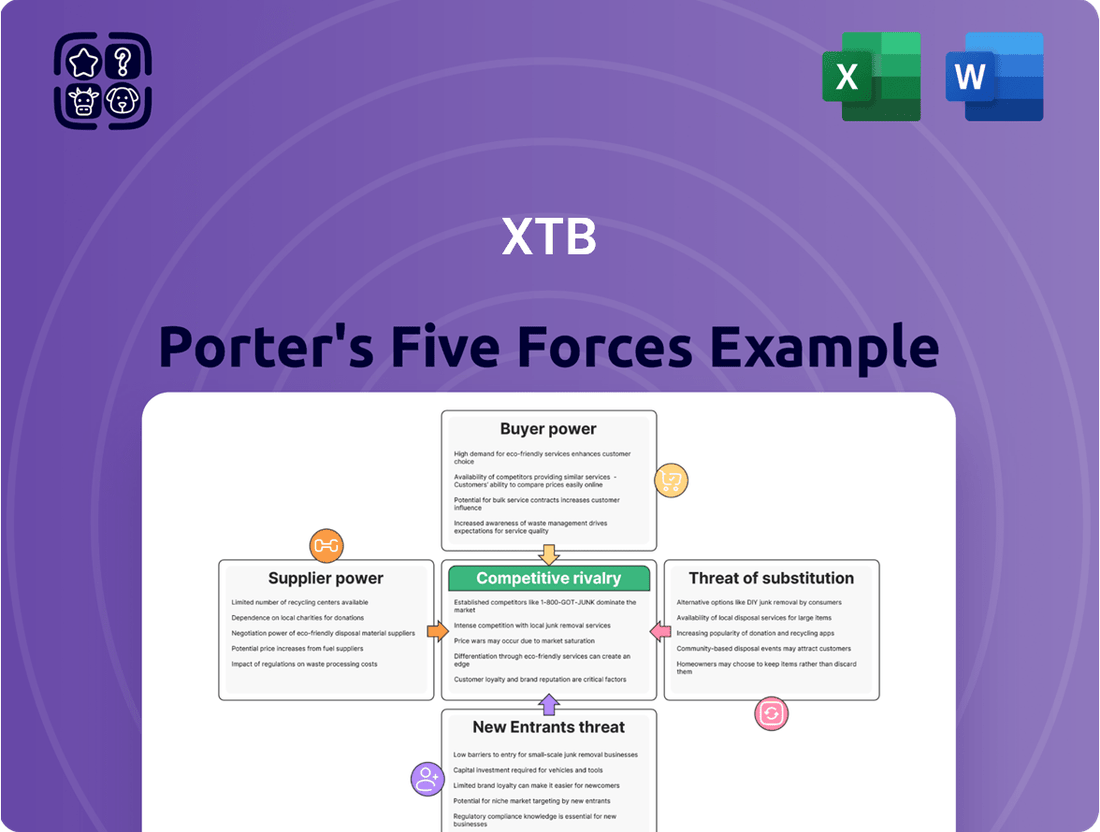

Uncovers the competitive landscape for XTB by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the danger of substitute products.

Visualize competitive intensity with an intuitive spider chart, instantly highlighting areas of strategic pressure.

Customers Bargaining Power

Individual retail investors today have it quite easy when it comes to switching online brokers. The barriers to entry are low, meaning you can often move your investments from one platform to another without much hassle or significant expense. This is largely because many brokers offer a similar range of financial products and the technology platforms are becoming increasingly standardized. For instance, in 2023, the average time for a full account transfer between brokers was reported to be around 3-5 business days, highlighting the relative ease of switching.

This ease of movement gives customers a significant advantage. They can readily shop around for the best deals, whether that means tighter spreads on trades, lower commission fees, a more intuitive trading platform, or even just better customer support. If a broker isn't meeting their expectations, clients can simply move their assets elsewhere, putting pressure on brokers like XTB to consistently offer competitive pricing and superior service to keep them engaged.

To combat this customer power, XTB needs to focus on what makes it stand out. This isn't just about price; it's about the overall client experience. Think about innovative features, educational resources, or a particularly user-friendly mobile app. For example, XTB’s investment in its proprietary xStation platform, which offers advanced charting tools and a streamlined trading experience, is a key differentiator. In 2023, XTB reported a significant increase in active clients, suggesting their efforts to enhance platform features and client service are resonating in a competitive market.

Customers, especially active traders, are very sensitive to the costs associated with trading, such as spreads, commissions, and overnight fees. This means that if XTB's pricing isn't competitive, clients can easily switch to another broker. For instance, in 2024, the average spread for major currency pairs on many platforms remained a key consideration for traders, with many seeking out brokers offering spreads as low as 0.1 pips.

The high degree of transparency in the brokerage market allows clients to readily compare pricing structures across different providers. This easy comparison puts significant pressure on XTB to maintain competitive rates to retain and attract customers. Many platforms in 2024 highlighted their zero-commission policies on certain asset classes, further intensifying this price competition.

This customer price sensitivity directly fuels aggressive price competition within the online brokerage industry. Brokers are constantly vying to offer the lowest fees and best value to capture market share. Reports from late 2023 and early 2024 indicated that a significant percentage of retail traders cited fees as a primary factor when choosing a broker.

The internet has fundamentally shifted the balance of power towards customers, particularly in the financial services sector. With readily available access to information, clients can easily research broker reviews, utilize comparison websites, and engage in online forums to gather insights. This wealth of data empowers them to make more informed decisions, comparing offerings and choosing providers that best align with their investment goals and risk tolerance.

This transparency means that brokers like XTB must actively cultivate a positive reputation. Client feedback, both positive and negative, is highly visible and can significantly influence potential customers. For instance, a study by Deloitte in 2024 found that 72% of consumers consider online reviews a crucial factor when choosing a financial service provider, highlighting the direct impact of sentiment on customer acquisition.

Demand for Advanced Features and Support

Customers, both individual traders and larger institutions, are increasingly looking for more than just basic trading capabilities. They want advanced tools, a wide array of financial products to choose from, comprehensive educational materials, and customer support that’s quick and helpful. This rising demand directly impacts XTB, as clients can push the company to constantly improve its own trading platform and the services it offers. If XTB can't keep up with these growing expectations, it risks losing clients to competitors.

The expectation for sophisticated trading tools and diverse financial instruments means that XTB must continually invest in its technology. For instance, in 2024, the demand for AI-powered trading analytics and access to emerging asset classes like tokenized securities continued to grow. Clients are also prioritizing platforms that offer seamless integration with other financial tools and personalized insights.

Here’s how this impacts XTB:

- Sophisticated Trading Tools: Clients expect advanced charting, algorithmic trading capabilities, and real-time market data feeds.

- Diverse Financial Instruments: Demand spans traditional assets like stocks and forex to newer instruments such as cryptocurrencies and ETFs.

- Robust Educational Resources: Access to webinars, market analysis, and trading tutorials is a key differentiator for retaining clients.

- Responsive Customer Support: Fast and effective support across multiple channels is crucial for client satisfaction and loyalty.

Institutional Client Leverage

Institutional clients, like hedge funds and asset managers, wield considerable influence due to their substantial trading volumes. In 2024, these large players often require specialized execution, consistent liquidity, and detailed reporting, which XTB must accommodate.

This significant trading activity empowers institutional clients to negotiate better terms, including lower commission rates or tailored platform features. For instance, a large asset manager executing millions in trades annually can demand preferential pricing that smaller retail investors cannot access.

Their bargaining power translates into XTB potentially offering dedicated account management and advanced analytical tools to retain these high-value clients. In the competitive landscape of 2024, securing and maintaining institutional business is crucial for revenue generation and market presence.

- High Volume Trading: Institutional clients execute a disproportionately large share of total trading volume.

- Customized Needs: They often require bespoke solutions for execution, reporting, and risk management.

- Negotiation Power: Large trade sizes allow them to negotiate favorable pricing and service agreements.

- Market Influence: Their trading patterns can impact market liquidity, giving them leverage.

The bargaining power of customers in the online brokerage sector is substantial, driven by low switching costs and a transparent marketplace. This allows clients to easily compare fees, platform features, and customer service, forcing firms like XTB to remain highly competitive to retain business.

For instance, in 2024, the ease with which retail investors can switch brokers was further amplified by the standardization of trading platforms and the widespread availability of commission-free trading on many instruments. This environment puts significant pressure on brokers to offer superior value propositions, as clients can quickly move assets if expectations are not met.

Institutional clients, by virtue of their large trading volumes, possess even greater bargaining power. They can negotiate tailored services, preferential pricing, and specialized execution, making their retention a critical strategic imperative for brokers like XTB in the highly competitive 2024 market.

Same Document Delivered

XTB Porter's Five Forces Analysis

This preview showcases the comprehensive XTB Porter's Five Forces Analysis that you will receive instantly upon purchase, offering a detailed examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis, ready for immediate application in your strategic planning. You are viewing the complete file, ensuring no discrepancies or missing sections from the version you’ll download. This analysis meticulously breaks down the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Rest assured, what you preview is precisely what you get – a valuable tool for understanding market dynamics and formulating effective business strategies.

Rivalry Among Competitors

The online brokerage landscape is incredibly crowded, with a vast number of global and local companies all vying for customer attention. Think of giants like IG, Plus500, eToro, and Saxo Bank, but also a multitude of smaller, specialized brokers. This means XTB faces constant pressure from direct competitors offering very similar investment products and trading platforms.

This high level of fragmentation in the online brokerage market, evident in 2024, forces companies like XTB to differentiate themselves aggressively. The sheer volume of players means that market share gains are hard-won, often requiring significant investment in technology, marketing, and customer service to stand out from the crowd.

Competitive rivalry in the online brokerage space, particularly concerning price, is intense. XTB, like its peers, faces constant pressure to offer competitive pricing through tight spreads, low commissions, and favorable swap rates. For instance, in 2024, the average spread for major currency pairs on many platforms remained highly competitive, often just a few pips. This price sensitivity among clients means that even minor cost advantages can significantly sway customer acquisition and retention.

Maintaining these aggressive pricing structures while ensuring profitability is a delicate balancing act for XTB. The industry often sees a race to the bottom on pricing, which can compress profit margins across the board. A 2024 report indicated that the average revenue per user for retail brokers saw a slight decline due to increased promotional activities and competitive pricing strategies aimed at capturing market share.

Competitive rivalry in the online brokerage space is fierce, extending well beyond just offering the lowest fees. Companies are locked in a battle to attract and retain clients by differentiating through superior platform technology, intuitive user interfaces, and a broad selection of tradable assets. This means constantly investing in innovation and expanding product offerings.

Brokers are actively developing proprietary trading platforms, like XTB's xStation, to provide a unique and seamless trading experience. They also compete by offering advanced analytical tools, a wider array of asset classes including more exchange-traded funds (ETFs) and emerging cryptocurrencies, and comprehensive educational resources to empower their user base. For example, as of early 2024, major brokers were significantly enhancing their mobile app functionalities and integrating AI-driven insights.

Aggressive Marketing and Brand Building

Competitors in the financial brokerage sector, including XTB's rivals, are heavily invested in aggressive marketing and brand building to capture market share and attract new clients. This intense competition means significant financial resources are channeled into online advertising, strategic sponsorships, and leveraging influencer marketing to enhance brand visibility and client acquisition. For instance, in 2024, the global digital advertising market for financial services saw substantial growth, with many firms allocating a large portion of their budgets to these channels to cut through the noise.

XTB must contend with this high level of marketing expenditure from its competitors, which consequently pressures XTB to make considerable investments in its own brand-building initiatives and client acquisition strategies. To effectively compete and stand out in an increasingly saturated market, XTB needs to continuously innovate its marketing approaches and ensure its brand message resonates with target audiences. The sheer volume of marketing activity by rivals necessitates a robust and well-funded strategy for XTB to maintain and grow its client base.

- Intense Marketing Spend: Competitors allocate substantial budgets to online advertising, sponsorships, and influencer campaigns.

- Brand Recognition Drive: The primary goal of these campaigns is to build strong brand recognition and attract new clients.

- Client Acquisition Costs: High marketing activity by rivals increases client acquisition costs for all players, including XTB.

- Need for Differentiation: XTB must invest in its own brand building to differentiate itself in a crowded and competitive landscape.

Regulatory Compliance and Trust

The financial services industry, particularly online brokerage, operates under intense regulatory scrutiny, creating a significant competitive dynamic. Brokers vie for client trust by demonstrating robust compliance with regulations and maintaining high standards of transparency and security. For instance, in 2023, regulatory bodies like the FCA in the UK and ESMA in Europe continued to enforce strict capital requirements and client asset protection rules, influencing how brokers operate and market themselves.

This focus on regulatory adherence and trust isn't just about avoiding penalties; it's a direct competitive advantage. Brokers that can clearly communicate their compliance measures and build a reputation for reliability attract and retain more clients. A notable example is how firms with a strong track record of regulatory compliance often outperform those facing sanctions or investigations, as seen in market share shifts following regulatory actions against specific entities.

- Regulatory Compliance as a Differentiator: Brokers emphasize their adherence to global standards (e.g., MiFID II, SEC regulations) to build client confidence.

- Trust and Reputation: A broker's perceived trustworthiness, often linked to its regulatory history and transparency, is a key factor in client acquisition and retention.

- Market Share Impact: Lapses in regulatory compliance or trust can lead to significant client attrition, with funds moving to more reputable platforms. For example, reports in late 2023 indicated that brokers with a history of regulatory issues experienced higher client outflow compared to their compliant peers.

- Operational Costs: Maintaining compliance involves substantial investment in technology, legal, and risk management, impacting profitability and creating barriers to entry for new, less capitalized firms.

The competitive rivalry within the online brokerage sector is exceptionally intense, characterized by a large number of players, including global powerhouses and niche providers, all vying for market share. This crowded environment, clearly visible in 2024, necessitates aggressive differentiation strategies from companies like XTB, as gaining and retaining clients is a constant battle. The pressure to offer competitive pricing, such as tight spreads and low commissions, is a defining feature, with even minor cost advantages influencing client decisions.

Beyond pricing, brokers are heavily investing in technology, user experience, and asset diversification to stand out. This includes developing proprietary platforms, enhancing mobile capabilities, and expanding offerings to include more ETFs and cryptocurrencies, as observed with advancements in AI-driven insights in early 2024. Furthermore, significant marketing expenditure is a common tactic, with companies pouring resources into digital advertising and brand building, which in turn raises client acquisition costs for everyone in the market.

Regulatory compliance has also emerged as a critical differentiator, with brokers leveraging their adherence to global standards to build client trust and reputation. Firms with a strong compliance record, as highlighted by client outflow trends in late 2023, tend to outperform those facing regulatory scrutiny. This focus on trust, alongside technological innovation and competitive pricing, shapes the fierce competitive landscape XTB navigates daily.

SSubstitutes Threaten

Clients can choose traditional investment methods like buying stocks directly, mutual funds, ETFs held outside of trading platforms, or bonds through standard brokerage accounts or banks. These alternatives cater to investors focused on long-term growth and may present different risk-return profiles compared to leveraged trading.

For instance, in 2024, the global ETF market continued its robust growth, exceeding $10 trillion in assets under management, demonstrating a significant appetite for accessible, diversified investment vehicles outside of active trading platforms.

The appeal of direct ownership in assets, whether through traditional brokerage or direct company offerings, contrasts with XTB's Contracts for Difference (CFDs) which are derivative products not tied to actual asset ownership, offering leverage but also different risk considerations.

The proliferation of robo-advisors presents a significant threat of substitutes for traditional active trading and, by extension, for platforms offering complex instruments like CFDs. These automated platforms offer diversified portfolio management at substantially lower fees, attracting investors who prioritize a passive, hands-off approach to wealth accumulation. While robo-advisors and CFD trading platforms often cater to different investor profiles, they are ultimately competing for the same pool of investment capital.

By 2024, the assets under management in robo-advisory services globally are projected to reach over $2 trillion, demonstrating a clear and growing preference for automated investment solutions. This trend highlights the increasing accessibility and appeal of these substitutes, especially for retail investors seeking simplicity and cost-effectiveness over the higher-risk, higher-reward nature of leveraged products like CFDs.

Investors often consider physical assets like real estate and precious metals as alternatives to traditional financial markets. For instance, global real estate investment trusts (REITs) saw significant activity in 2024, with many investors seeking tangible assets. Similarly, gold prices in 2024 remained a key indicator for investors looking for safe-haven assets, often outperforming traditional equities during periods of uncertainty.

Direct Cryptocurrency Ownership

Clients can bypass XTB's cryptocurrency CFDs by directly purchasing and holding digital assets on specialized exchanges or personal digital wallets. This direct ownership model appeals to investors seeking control and potential yield generation through staking, opportunities often unavailable with leveraged CFD products. For example, by mid-2024, the total market capitalization of cryptocurrencies, including Bitcoin and Ethereum, reached over $2.5 trillion, indicating a significant market segment prioritizing direct asset acquisition over derivative trading.

This direct ownership offers several advantages that act as a substitute for CFD trading:

- Direct Control: Investors maintain full custody of their digital assets, reducing counterparty risk associated with brokers.

- Access to DeFi: Direct ownership often unlocks participation in decentralized finance (DeFi) protocols for lending and yield generation.

- Lower Fees for Long-Term Holders: While trading fees on exchanges can vary, direct holding can be more cost-effective for long-term investors compared to rollover fees in CFD trading.

- Broader Asset Availability: Many smaller, emerging cryptocurrencies are only available for direct purchase, not through CFD platforms.

Savings Accounts and Fixed Deposits

For individuals prioritizing capital preservation over aggressive growth, traditional savings accounts and fixed deposits present a significant threat of substitution to leveraged trading products like Contracts for Difference (CFDs). These instruments offer virtually no risk and a guaranteed, albeit modest, return. For instance, in early 2024, average interest rates on savings accounts in major economies remained relatively low, often below inflation, but still provided a predictable outcome. This stability attracts risk-averse capital that might otherwise be deployed in more volatile markets.

These alternatives are particularly compelling during economic downturns or periods of heightened market uncertainty. When investors fear substantial losses, the safety offered by a savings account, where principal is protected, becomes highly attractive. For example, in times of geopolitical instability, as seen in various global events throughout 2023 and early 2024, many investors shifted towards these secure options, reducing the pool of capital available for speculative trading.

- Low Risk: Savings accounts and fixed deposits offer principal protection, a stark contrast to the leveraged nature of CFDs.

- Guaranteed Returns: While often low, these returns are predictable, unlike the fluctuating market-driven profits from CFDs.

- Capital Preservation Focus: They appeal to a segment of the market that prioritizes keeping their initial investment safe.

- Market Uncertainty Appeal: During volatile periods, these instruments act as a safe haven, drawing funds away from riskier assets.

The availability of direct asset ownership, such as buying physical gold or investing in real estate investment trusts (REITs), offers a tangible alternative to XTB's derivative products. In 2024, gold prices remained a significant draw for investors seeking safe-haven assets, with many actively acquiring physical bullion. Similarly, the global REITs market saw substantial investment flows, demonstrating a preference for real-world assets that provide rental income and potential appreciation, distinct from the leveraged nature of CFDs.

Robo-advisors, by offering automated, diversified portfolios at low costs, present a strong substitute for traditional and leveraged trading. By 2024, global robo-advisory assets were projected to exceed $2 trillion, indicating a significant shift towards passive investing for many retail clients. This trend directly competes for investment capital that might otherwise be allocated to platforms like XTB.

Directly owning cryptocurrencies on exchanges, rather than trading them via CFDs, provides investors with greater control and access to decentralized finance opportunities. The cryptocurrency market's total capitalization exceeding $2.5 trillion by mid-2024 underscores the significant investor interest in this direct acquisition model, bypassing derivative instruments.

Traditional savings accounts and fixed deposits offer capital preservation and guaranteed, albeit low, returns, appealing to risk-averse investors. Even with modest interest rates in early 2024, these instruments provide a stable, predictable outcome, drawing capital away from more volatile markets and leveraged trading products.

| Substitute Type | Description | 2024 Market Indicator/Fact | Investor Appeal | Impact on XTB (CFDs) |

|---|---|---|---|---|

| Direct Asset Ownership | Buying physical assets like gold or investing in REITs. | Global REITs market saw substantial investment; Gold prices remained a key safe-haven draw. | Tangible value, rental income, capital preservation. | Reduces demand for leveraged exposure to underlying assets. |

| Robo-Advisors | Automated, low-cost diversified portfolio management. | Global robo-advisory assets projected to exceed $2 trillion. | Simplicity, cost-effectiveness, passive approach. | Captures retail investment capital seeking simpler solutions. |

| Direct Cryptocurrency Ownership | Purchasing and holding digital assets on exchanges. | Total cryptocurrency market capitalization exceeded $2.5 trillion by mid-2024. | Full custody, DeFi access, potential yield generation. | Bypasses CFD trading for crypto exposure. |

| Savings Accounts & Fixed Deposits | Low-risk, guaranteed, modest return instruments. | Average savings account interest rates remained low but predictable. | Capital preservation, no risk, predictable outcome. | Attracts risk-averse capital, reducing funds for leveraged trading. |

Entrants Threaten

The online brokerage sector, particularly for Contracts for Difference (CFDs) and forex trading, faces significant global regulatory oversight. Entities aiming to operate in this space must secure numerous licenses from diverse financial authorities. For instance, operating in the EU requires authorization from bodies like the European Securities and Markets Authority (ESMA) and national regulators such as the UK's Financial Conduct Authority (FCA) or Poland's Komisja Nadzoru Finansowego (KNF).

Acquiring these necessary licenses is a notably intricate, lengthy, and costly undertaking. It necessitates substantial capital in reserve, the establishment of comprehensive compliance systems, and adherence to rigorous reporting standards. These demanding regulatory requirements effectively deter many aspiring new competitors from entering the market, thus reinforcing the position of established players like XTB.

Establishing an online brokerage, much like XTB, demands considerable upfront investment. This includes building robust technology platforms, extensive marketing campaigns to gain visibility, navigating complex regulatory hurdles, and ensuring adequate capital reserves for operational needs and client fund segregation.

Newcomers must possess significant financial resources to even enter the market. For instance, in 2023, the average cost to launch a fully compliant fintech platform in Europe, including brokerage services, could easily range from several million to tens of millions of euros, depending on the scope and ambition.

Established players benefit from existing economies of scale in technology and liquidity provision, creating a barrier for those just starting out. These incumbents can leverage their size to offer more competitive pricing and a wider range of services, making it challenging for new entrants to match their offerings without substantial backing.

The need for deep pockets to acquire customers and build brand recognition is paramount. In 2024, the cost of acquiring a new brokerage client can be upwards of $500, considering marketing spend, onboarding, and initial incentives, further amplifying the capital requirements for new entrants aiming for market share.

Building brand recognition and trust in financial services, particularly with leveraged products, is a significant barrier. Years of industry scandals and the inherent risks mean clients are cautious. Newcomers face a steep climb against established players like XTB, who have cultivated a strong reputation and loyal customer base through consistent investment in their brand and security measures.

For instance, as of the first quarter of 2024, XTB reported a significant increase in its client base, reaching over 246,000 active clients. This growth underscores the trust and recognition the company has built, making it difficult for new entrants to attract a comparable following without substantial, long-term investment in brand building and a proven track record.

Access to Liquidity and Technology

New entrants in the brokerage sector face significant hurdles in accessing deep liquidity and advanced trading technology. Securing favorable terms with prime brokers, essential for competitive spreads and reliable execution, is a major challenge. For instance, in 2024, the cost of prime brokerage services can be substantial, requiring significant capital commitment.

Developing or acquiring cutting-edge, low-latency trading platforms is another formidable barrier. Proprietary platforms, like XTB's xStation, represent years of investment and refinement, offering a superior user experience and execution speed. New entrants must invest heavily in technology to even approach this level of sophistication.

- Liquidity Acquisition Costs: Prime brokerage fees and the capital required to access deep liquidity pools can easily run into millions of dollars for new entrants, impacting their ability to offer competitive pricing.

- Technology Development Investment: Building a robust, low-latency trading platform comparable to industry leaders can cost tens of millions of dollars, encompassing software development, infrastructure, and ongoing maintenance.

- Talent Acquisition: Attracting skilled developers, quantitative analysts, and trading technology experts is crucial but competitive, further increasing operational costs for newcomers.

Customer Acquisition Costs

Customer acquisition costs (CAC) in the online brokerage space are notably high, presenting a significant barrier for new entrants. This is driven by the fierce competition and substantial marketing expenditures by established firms. For instance, major online brokers often invest millions in advertising campaigns across various channels to attract and retain clients.

New players must be prepared for considerable upfront investment in marketing and promotional activities to even begin drawing customers away from trusted, well-known brands. This aggressive customer acquisition strategy directly impacts the speed at which a new brokerage can achieve profitability.

The substantial financial outlay required for marketing, coupled with the need for competitive pricing and robust platform development, creates a formidable financial barrier to entry. In 2024, the average CAC for a new client in the fintech and online trading sector can range from $200 to over $1,000, depending on the specific niche and marketing channels used.

- High Marketing Spend: Established online brokerages allocate significant budgets to advertising, content marketing, and performance marketing to capture market share.

- Brand Loyalty: Many investors stick with platforms they are familiar with, requiring new entrants to offer compelling incentives to switch.

- Regulatory Compliance: Meeting stringent regulatory requirements often necessitates additional investment in technology and legal resources, further increasing initial costs.

- Competitive Pricing: To attract clients, new entrants might offer lower fees or better trading conditions, which can squeeze profit margins and necessitate a larger client base to offset CAC.

The threat of new entrants into the online brokerage sector, particularly for platforms like XTB, is significantly mitigated by high capital requirements and substantial operational costs. These barriers ensure that only well-funded entities can realistically consider entering the market.

The need for extensive capital for technology, marketing, and regulatory compliance, coupled with the difficulty in acquiring customers and building trust against established players, creates a formidable entry barrier.

These factors combined mean that while the market is attractive, the practical hurdles prevent a flood of new competitors, thereby protecting the market position of incumbents.

| Barrier Category | Estimated Cost/Challenge (2024) | Impact on New Entrants |

|---|---|---|

| Regulatory Compliance & Licensing | Millions of Euros | Requires significant legal and financial resources, lengthy approval processes. |

| Technology Platform Development | Tens of Millions of Euros | Demands cutting-edge, low-latency systems; complex and costly to build or acquire. |

| Customer Acquisition Cost (CAC) | $200 - $1,000+ per client | High marketing spend needed to gain traction against established brands. |

| Brand Building & Trust | Years of consistent investment | Difficult to overcome existing brand loyalty and perceived security of incumbents. |

| Liquidity & Prime Brokerage Access | Millions of Dollars | Essential for competitive pricing; requires substantial capital commitment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for XTB leverages a robust data framework, drawing from XTB's annual reports, investor presentations, and regulatory filings. This internal data is complemented by independent industry research from financial data providers and brokerage reports to offer a comprehensive view of the competitive landscape.