XTB Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

XTB Bundle

Unlock the strategic DNA of XTB with our comprehensive Business Model Canvas. This detailed breakdown reveals their core customer segments, key revenue streams, and unique value propositions that drive their success in the competitive financial markets. Understand how XTB leverages its partnerships and cost structure to deliver exceptional trading experiences.

Dive deeper and discover the actionable insights within XTB's complete Business Model Canvas, perfect for entrepreneurs, investors, and analysts looking to learn from a market leader.

Partnerships

XTB collaborates with leading financial institutions and banks to secure robust liquidity. This ensures clients benefit from deep liquidity pools and competitive pricing across a diverse range of Contracts for Difference (CFDs). These partnerships are essential for swift and efficient order execution, maintaining tight spreads on forex, indices, commodities, stocks, ETFs, and cryptocurrencies.

XTB collaborates with a diverse range of payment processors, both globally recognized and regionally specific, to ensure clients can deposit and withdraw funds effortlessly across different geographies. These partnerships are critical for providing secure, swift, and convenient financial transactions, accommodating a variety of payment methods including bank transfers, credit/debit cards, and popular e-wallets.

In 2024, the fintech landscape continues to emphasize streamlined digital payments. For instance, the global digital payments market was projected to reach over $10 trillion in transaction value by 2025, highlighting the increasing reliance on efficient payment infrastructure. XTB's strategic alliances in this space directly contribute to a positive client experience and robust operational flow, as evidenced by the continued growth in online trading volumes, which saw significant upticks in 2023 and are expected to maintain momentum.

XTB partners with leading technology and data providers to ensure its trading platform remains cutting-edge and reliable. These collaborations grant access to high-quality, real-time market data crucial for informed trading decisions, alongside advanced charting capabilities. For instance, in 2024, XTB continued to leverage sophisticated data feeds to offer its clients a competitive edge in volatile markets.

These strategic alliances are fundamental to XTB's operational strength, providing the backbone for its proprietary trading infrastructure. By integrating specialized software solutions, XTB enhances platform performance, security, and user experience. This focus on robust technological partnerships allows XTB to deliver a seamless and efficient trading environment, crucial for its global client base.

Marketing and Affiliate Networks

XTB leverages strategic alliances with marketing agencies and affiliate networks to significantly broaden its client base and enhance global brand recognition. These collaborations are instrumental in driving lead generation and client acquisition through targeted digital campaigns and content. For instance, in 2023, XTB reported a substantial increase in new clients, partly attributable to its expanded marketing partnerships.

Collaborations with prominent financial portals and influencers amplify XTB's market presence, offering access to diverse investor communities. This synergy is vital for navigating the dynamic online brokerage landscape and maintaining a competitive edge. XTB's commitment to these partnerships underscores its strategy for sustained growth.

Key aspects of these partnerships include:

- Affiliate Marketing Programs: XTB's affiliate programs incentivize partners to refer new clients, creating a performance-based growth channel.

- Content Collaborations: Partnering with financial media outlets and influencers for co-branded content increases visibility and educational reach.

- Digital Advertising Networks: Strategic placement of advertisements across various online platforms ensures consistent lead flow.

- Performance Tracking: Robust analytics monitor the effectiveness of each partnership, allowing for optimization and resource allocation.

Regulatory Bodies and Compliance Consultancies

XTB's relationship with regulatory bodies like the UK's Financial Conduct Authority (FCA) and Poland's Komisja Nadzoru Finansowego (KNF) is critical, even if not a commercial partnership. Adherence to their directives, such as those concerning client fund segregation and capital adequacy ratios, underpins operational legitimacy and client confidence across its global markets. For instance, in 2023, XTB reported a capital adequacy ratio well above regulatory minimums, demonstrating robust financial health and compliance capacity.

Engaging with compliance consultancies further bolsters XTB's ability to navigate the complex and ever-evolving global regulatory landscape. These experts help ensure that XTB's operations, from trading platforms to client onboarding, meet stringent requirements across different jurisdictions, thereby mitigating legal risks and fostering trust.

- Regulatory Adherence: Maintaining compliance with entities like the FCA and KNF ensures legal operation and client trust.

- Capital Requirements: Meeting and exceeding stipulated capital adequacy ratios, such as XTB's robust position in 2023, is a key aspect of this relationship.

- Client Fund Protection: Strict adherence to regulations regarding the segregation of client funds is paramount.

- Expert Consultation: Working with compliance consultancies aids in navigating diverse and changing international financial regulations.

XTB's key partnerships are foundational to its business model, ensuring operational excellence and client satisfaction. These collaborations span critical areas from financial liquidity and payment processing to technology and marketing. For instance, in 2023, XTB’s focus on strengthening liquidity partnerships contributed to its ability to offer competitive pricing and rapid execution for its clients.

The company collaborates with leading banks for robust liquidity, ensuring deep pools and competitive pricing across various CFDs. Furthermore, partnerships with diverse payment processors facilitate seamless, secure, and swift financial transactions globally, accommodating various payment methods. In 2024, the trend towards digital payments continued to grow, with global digital payments projected to exceed $10 trillion by 2025, underscoring the importance of these financial infrastructure alliances.

XTB also partners with technology and data providers to maintain a cutting-edge trading platform, leveraging high-quality market data and advanced charting tools. These technological alliances are crucial for delivering a superior user experience and a reliable trading environment. Marketing and affiliate network partnerships are vital for expanding client reach and brand awareness, as demonstrated by XTB's client growth in 2023.

| Partnership Area | Key Partners | Impact on XTB | 2023/2024 Relevance |

|---|---|---|---|

| Liquidity Provision | Leading Financial Institutions, Banks | Deep liquidity pools, competitive pricing, swift order execution | Crucial for stable trading conditions in volatile markets. |

| Payment Processing | Global and Regional Payment Processors | Seamless, secure, and swift fund deposits/withdrawals | Supports increasing global client base and digital transaction trends. |

| Technology & Data | Technology Providers, Data Feed Suppliers | Cutting-edge platform, real-time data, advanced charting | Ensures competitive edge and enhanced client trading experience. |

| Marketing & Acquisition | Marketing Agencies, Affiliate Networks, Financial Influencers | Broadened client base, enhanced brand recognition, lead generation | Drove significant client growth in 2023 and continues to fuel expansion. |

What is included in the product

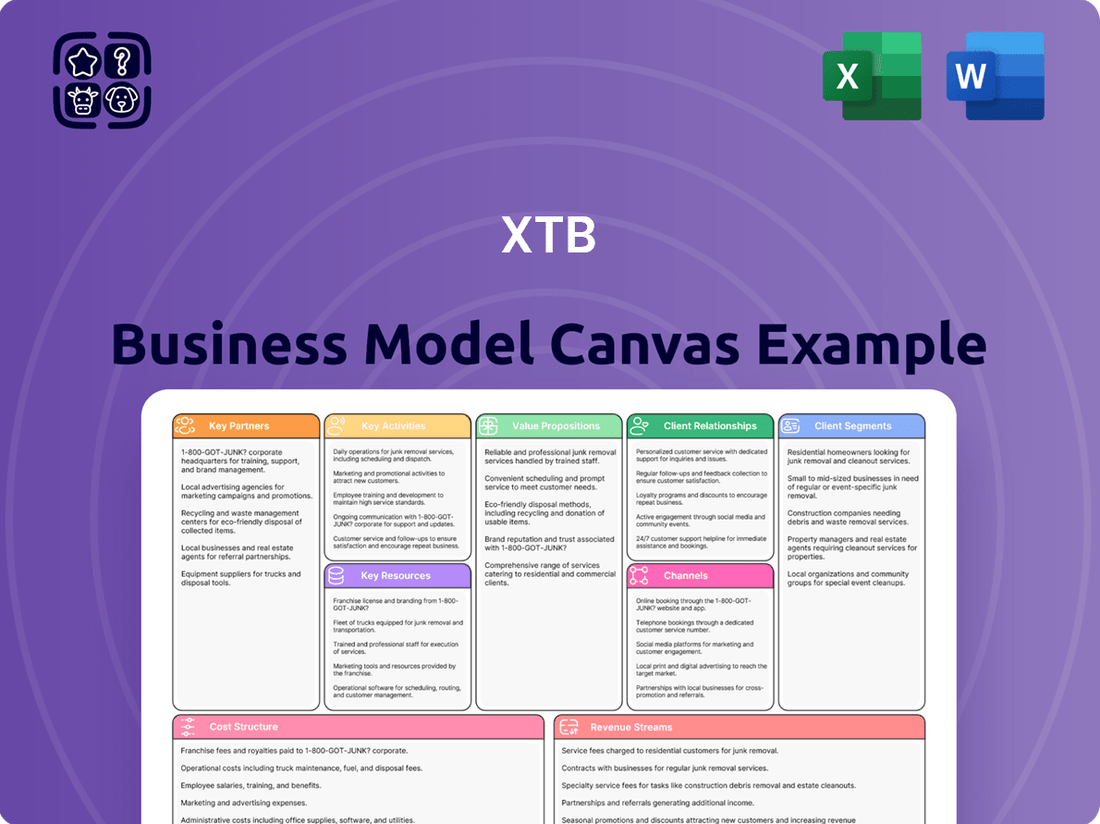

A detailed breakdown of XTB's operations, covering customer segments, value propositions, and revenue streams. It serves as a strategic blueprint for understanding their financial markets brokerage business.

Streamlines complex business strategy into a single, visual framework for clarity.

Simplifies the process of articulating and refining your business strategy, reducing confusion.

Activities

XTB's central focus lies in the ongoing creation, refinement, and upkeep of its xStation and xStation Mobile trading platforms. This commitment ensures a cutting-edge trading environment for its clients.

Key activities include introducing novel functionalities, optimizing the user interface for a seamless experience, guaranteeing platform robustness, and incorporating a wider array of financial instruments. For instance, in 2023, XTB reported a significant increase in active clients, directly attributable to its user-friendly and feature-rich platforms.

A sophisticated proprietary platform is a crucial element that sets XTB apart in a competitive market and is a primary factor in fostering client loyalty and sustained engagement.

This dedication to platform excellence underpins XTB's strategy to attract and retain a diverse client base, from novice traders to seasoned professionals.

XTB's key activities include attracting new clients globally, both individual and institutional, through robust marketing and lead generation efforts. In 2024, XTB continued to invest heavily in digital marketing and partnerships to broaden its reach. The onboarding process is designed for efficiency, encompassing identity verification (KYC) and swift account setup, crucial for rapid client base expansion and increasing market share.

XTB's core activities revolve around meticulously managing the financial risks inherent in Contract for Difference (CFD) trading. This includes actively monitoring market volatility and controlling client exposure to safeguard the company's capital and client investments. By implementing sophisticated hedging strategies, XTB aims to mitigate potential losses arising from adverse market movements.

Ensuring the seamless and equitable execution of client trades is paramount. XTB focuses on providing deep liquidity and maintaining highly competitive pricing, which directly impacts client trading success and overall satisfaction. This commitment to efficient execution is a critical component of their operational excellence.

In 2024, XTB reported a significant increase in trading volume, reaching 1.3 million active clients by the end of the third quarter. This growth underscores the importance of their robust risk management framework in handling the increased scale of operations and maintaining market integrity.

Customer Support and Educational Content Provision

XTB’s key activities center on robust customer support and the provision of extensive educational resources. This dual approach aims to empower clients and foster a deeper understanding of financial markets. By offering this support, XTB cultivates loyalty and encourages sustained engagement.

The company provides dedicated, multilingual customer assistance, ensuring clients worldwide receive timely and relevant help. Complementing this is a wealth of educational content designed to elevate trading proficiency. This includes a steady stream of market analysis, webinars, and tutorials.

- Multilingual Support: XTB offers customer service in numerous languages, catering to a global client base.

- Educational Resources: A comprehensive library of webinars, tutorials, articles, and market analysis is available.

- Skill Enhancement: The educational content is specifically designed to improve clients' trading knowledge and practical skills.

- Client Retention: High-quality support and education are crucial drivers of customer satisfaction and long-term retention, evident in XTB's consistent growth in active accounts. For instance, XTB reported a significant increase in active clients in early 2024, underscoring the effectiveness of these activities.

Regulatory Compliance and Reporting

Operating as a regulated broker across multiple jurisdictions means XTB must rigorously adhere to a complex web of financial regulations. This involves continuous monitoring of evolving regulatory landscapes, submitting timely and accurate reports to financial authorities, and establishing robust internal policies and procedures to guarantee ongoing compliance. A strong regulatory standing is absolutely vital for XTB’s credibility and its ability to maintain its operational licenses in key markets.

XTB’s commitment to regulatory compliance directly impacts its operational framework and risk management. For instance, in 2023, XTB reported that its compliance department played a critical role in navigating the changing regulatory environment, ensuring all operations met the stringent requirements set by bodies such as the Polish Financial Supervision Authority (KNF) and the UK Financial Conduct Authority (FCA). This dedication is reflected in their financial performance and market trust.

- Adherence to Financial Regulations: XTB meticulously follows rules set by financial regulators in all operating regions, ensuring legal and ethical business practices.

- Regulatory Reporting: The company regularly submits comprehensive reports to supervisory bodies, detailing financial activities and compliance status.

- Internal Policy Implementation: Robust internal policies are developed and enforced to maintain high standards of compliance across all departments.

- Maintaining Licenses: Upholding regulatory standards is paramount for retaining operating licenses and ensuring business continuity.

XTB's key activities involve continuously enhancing its proprietary trading platforms, xStation and xStation Mobile, to provide a superior trading experience. This includes developing new features, optimizing user interface for ease of use, and ensuring platform stability. In early 2024, XTB reported a significant increase in active clients, directly linked to the appeal and functionality of these platforms.

What You See Is What You Get

Business Model Canvas

The XTB Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This isn't a sample; it's a direct representation of the comprehensive business tool you'll gain access to. Upon completing your transaction, you will download this exact file, preserving its structure, content, and professional formatting for immediate application.

Resources

XTB's proprietary trading platforms, xStation and xStation Mobile, are central to its business model, providing traders with advanced charting, robust analytical tools, and swift execution speeds. This self-developed technology is a significant differentiator, underpinning XTB's ability to attract and retain clients in a competitive market.

The innovation and reliability of xStation are critical for XTB's service delivery, directly impacting user experience and trading success. This technological backbone allows XTB to offer a seamless and efficient trading environment, fostering client loyalty. As of the first quarter of 2024, XTB reported a record net profit of PLN 235.8 million, partly driven by the strong performance and adoption of its advanced trading platforms.

XTB's success hinges on its human capital, a diverse team of skilled professionals. This includes adept software developers who fuel platform innovation, sharp financial analysts who guide investment strategies, and meticulous risk managers ensuring operational stability. In 2024, XTB continued to invest in its talent pool, recognizing that their expertise is the engine behind the company's technological advancements and market responsiveness.

The company's sales and marketing experts are crucial for client acquisition and brand building, while dedicated customer support teams ensure a seamless and positive client experience. These individuals are the face of XTB, translating complex financial services into accessible solutions. Their commitment to client satisfaction directly impacts retention and growth, vital for XTB's competitive edge.

The collective expertise of XTB’s employees is fundamental to executing its strategic vision and maintaining efficient daily operations. This human element drives the development of new trading tools and enhances the overall user journey, reinforcing XTB's position as a leading online brokerage. In the first half of 2024, XTB reported strong revenue growth, a testament to the effective deployment of its skilled workforce.

XTB relies on substantial financial capital to cover its operational costs, which include employee salaries, technology infrastructure, and office expenses. In 2023, XTB reported a net profit of PLN 813.7 million (approximately EUR 178 million), demonstrating its ability to generate revenue to support these ongoing needs. This financial strength is crucial for sustaining day-to-day operations.

Significant investment in marketing and client acquisition is a key use of XTB's financial resources. The company actively engages in promotional campaigns and partnerships to expand its client base. Adequate capital ensures XTB can continue these efforts, driving future growth and market presence.

Meeting stringent regulatory capital requirements is paramount for XTB as a financial institution. These requirements ensure the company has sufficient buffer to absorb potential losses and protect client funds. XTB's robust financial position allows it to comfortably adhere to these regulatory mandates, fostering trust and stability.

Maintaining sufficient liquidity for trading operations is a core function supported by XTB's financial capital. This allows the company to efficiently execute client trades and manage market exposures. Strong liquidity is essential for providing a seamless and reliable trading experience, especially during volatile market conditions.

Brand Reputation and Regulatory Licenses

XTB’s strong brand reputation, built on reliability and innovation, is a cornerstone of its business. This positive perception is reinforced by its numerous regulatory licenses, which are essential for operating legally and building client trust across diverse global markets. As of early 2024, XTB holds licenses from prominent financial authorities, including the UK's Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC), underscoring its commitment to regulatory compliance and client protection.

These licenses are not just legal permissions; they are vital intangible assets that grant XTB access to key financial territories and foster a sense of security among its clientele. For instance, the ability to operate under the stringent regulations of the European Securities and Markets Authority (ESMA) provides a significant competitive advantage. This robust regulatory framework is crucial for maintaining market credibility and attracting a broad base of investors.

- Global Regulatory Compliance: XTB holds licenses from over 10 major regulatory bodies, including the FCA (UK), CySEC (Cyprus), and KNF (Poland), facilitating operations in key international markets.

- Brand Trust and Recognition: XTB has consistently invested in brand building, leading to high recognition among retail investors, with significant marketing campaigns contributing to increased client acquisition.

- Client Protection Measures: Regulatory adherence ensures adherence to strict client fund segregation and investor compensation schemes, bolstering confidence in XTB as a secure trading platform.

- Market Access and Credibility: Regulatory approvals unlock access to lucrative markets and validate XTB's operational integrity, enhancing its overall market standing and appeal.

Market Data and Advanced IT Infrastructure

Access to real-time, comprehensive market data feeds and a robust, secure IT infrastructure are fundamental. This encompasses high-speed data streams from global exchanges and the sophisticated hardware like servers and data centers that power our operations. For instance, by Q2 2024, XTB processed billions of data points daily, underscoring the sheer volume and speed required.

A resilient IT infrastructure ensures continuous and reliable platform operation, crucial for client trust and trading execution. This includes advanced network security systems to protect against cyber threats and maintain data integrity. In 2024, investments in IT infrastructure were a priority, with significant capital allocated to upgrading servers and enhancing cybersecurity protocols to support our growing user base and trading volumes.

- Real-time Market Data: Access to feeds from major global exchanges, providing up-to-the-minute pricing and economic indicators.

- Robust IT Infrastructure: Includes high-performance servers, secure data centers, and advanced networking capabilities.

- Network Security: State-of-the-art systems to protect client data and ensure platform integrity against evolving cyber threats.

- Scalability and Reliability: Infrastructure designed to handle peak trading volumes and ensure uninterrupted service availability.

XTB's key resources are its proprietary trading platforms, xStation and xStation Mobile, which offer advanced charting and swift execution, driving client acquisition and retention. The company's human capital, encompassing skilled developers, financial analysts, and marketing experts, is crucial for innovation and client engagement.

Financial capital is essential for operational costs, marketing investments, and meeting regulatory requirements, ensuring liquidity for trading. XTB's strong brand reputation, underpinned by over 10 major regulatory licenses including FCA and CySEC, fosters client trust and market access.

Access to real-time market data and a robust IT infrastructure, including secure servers and data centers, are fundamental for reliable platform operation and handling high trading volumes. By Q2 2024, XTB processed billions of data points daily, showcasing the scale of its operations.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Proprietary Platforms | xStation & xStation Mobile | Record net profit in Q1 2024 partly driven by platform performance. |

| Human Capital | Developers, Analysts, Sales, Support | Continued investment in talent pool to drive innovation and market responsiveness. |

| Financial Capital | Operational funding, Marketing, Regulatory reserves | Net profit of PLN 813.7 million in 2023 supported ongoing operations and growth. |

| Brand & Licenses | Reputation, FCA, CySEC, KNF licenses | Licenses from over 10 major regulatory bodies facilitate global operations. |

| IT Infrastructure & Data | Servers, Data Centers, Real-time feeds | Processed billions of data points daily by Q2 2024, highlighting infrastructure demands. |

Value Propositions

XTB provides clients with access to a vast selection of financial instruments through Contracts for Differences (CFDs). This includes major forex pairs, global stock indices, energy and metal commodities, individual company stocks, exchange-traded funds (ETFs), and various cryptocurrencies. This broad offering empowers traders to diversify their investments and seize opportunities across different asset classes from a single, integrated platform.

In 2024, XTB continued to expand its CFD offerings. For instance, the number of available stock CFDs grew significantly, allowing clients to trade on over 2,000 global stocks. This extensive product range caters to a wide spectrum of trading strategies and risk appetites, from short-term speculation to longer-term portfolio building.

XTB's proprietary xStation and xStation Mobile platforms offer traders a sophisticated yet easy-to-navigate space for both analyzing markets and executing trades. These platforms are designed to be intuitive, ensuring a smooth experience for users of all levels.

Key functionalities include advanced charting tools that allow for deep technical analysis, real-time market news to keep traders informed of crucial developments, and a suite of analytical tools to aid in decision-making. The emphasis is on providing a comprehensive environment for active trading.

Speed is paramount in trading, and xStation delivers fast order execution, a critical feature for capitalizing on market movements. This responsiveness is a significant advantage for traders aiming to optimize their entry and exit points.

As proprietary platforms, xStation and xStation Mobile are continuously developed and refined by XTB. This ensures a tailored trading experience that evolves with market demands and technological advancements. By controlling the technology in-house, XTB can implement specific features that directly benefit their client base, fostering a unique and competitive trading environment.

XTB offers a robust suite of educational resources, including comprehensive trading academies, live webinars, insightful articles, and detailed market analysis. These materials are designed to support traders at every stage, from beginners learning the basics to experienced investors seeking advanced strategies.

By providing accessible and high-quality educational content, XTB empowers its clients to develop the knowledge and skills necessary for making sound trading decisions. This focus on client education is a key differentiator, directly contributing to improved trading proficiency.

In 2024, XTB continued to expand its educational offerings, hosting over 100 webinars covering diverse topics from technical analysis to macroeconomic trends. Their trading academy modules saw a significant increase in engagement, with over 50,000 users accessing content throughout the year.

This commitment to empowering clients through education not only enhances their trading capabilities but also cultivates stronger client loyalty and retention, demonstrating the value XTB places on its user base's success.

Dedicated Customer Support and Local Presence

XTB prioritizes a strong client relationship through dedicated, multilingual customer support. This commitment is evident in their availability across multiple channels, ensuring clients receive timely and personalized assistance. This focus on accessible support helps build trust and boosts client satisfaction. For instance, in 2024, XTB reported a significant increase in customer engagement across their live chat and phone support lines, reflecting their investment in this crucial value proposition.

The company's strategy includes maintaining a local presence in key markets. This geographical reach allows XTB to offer support that is not only accessible but also culturally attuned to client needs. Having local offices facilitates a deeper understanding of regional market dynamics and client expectations. This localized approach is a key differentiator in the competitive financial services landscape.

This dedication to service is reflected in their operational focus. By offering responsive and accessible support, XTB aims to foster long-term client loyalty. The ability to resolve queries efficiently and effectively is paramount to this strategy. Data from 2024 indicates that clients who utilized XTB's direct support channels reported higher overall satisfaction rates compared to those who did not.

XTB's value proposition of dedicated customer support and local presence is designed to:

- Provide personalized assistance through multilingual support teams.

- Ensure timely resolution of client queries via various communication channels.

- Build trust and enhance client satisfaction through responsive service.

- Offer culturally relevant support by maintaining a local presence in key markets.

Transparency and Regulatory Compliance

XTB operates under stringent regulatory frameworks across various global markets, ensuring a high degree of transparency. This commitment to compliance means clients benefit from clear pricing structures and the segregation of their funds, fostering a secure trading environment. For instance, in 2023, XTB reported a significant increase in its regulatory capital ratios, demonstrating its financial robustness and adherence to capital adequacy requirements. This robust regulatory posture is a cornerstone of client trust.

The broker's adherence to regulations like MiFID II in Europe and similar directives elsewhere provides clients with essential protections. These regulations mandate clear disclosure of risks, fees, and investment products, allowing for informed decision-making. XTB's proactive approach to regulatory updates, including those expected to impact digital asset reporting in 2024, further solidifies its position as a dependable financial partner.

Key aspects of XTB's transparency and regulatory compliance include:

- Adherence to Global Regulations: Operating under licenses from top-tier regulators such as the UK's FCA and Poland's KNF.

- Client Fund Segregation: Keeping client funds separate from the company's operational capital.

- Transparent Fee Structures: Clearly outlining all trading costs and commissions.

- Regular Audits: Undergoing frequent independent audits to ensure compliance and financial health.

XTB's value proposition centers on providing a comprehensive and accessible trading experience. This includes a vast array of financial instruments, user-friendly proprietary trading platforms like xStation, and a strong emphasis on client education to foster informed decision-making.

In 2024, XTB significantly expanded its stock CFD offerings, surpassing 2,000 global stocks, and hosted over 100 educational webinars, demonstrating a commitment to client growth and market access.

The company also prioritizes robust customer support, leveraging local presence and multilingual teams to build trust and ensure client satisfaction, with reported increases in support channel engagement during 2024.

Furthermore, XTB's dedication to transparency and regulatory compliance, including adherence to stringent global standards and client fund segregation, establishes a secure trading environment.

Customer Relationships

XTB prioritizes direct, personalized customer support via phone, email, and live chat, often multilingual, ensuring clients receive prompt help with account, technical, and trading matters. This commitment is vital for fostering trust and client satisfaction, as demonstrated by their consistent efforts to maintain high service standards.

XTB cultivates strong customer relationships by prioritizing educational engagement. In 2024, the company continued to offer a robust suite of learning resources, including live webinars and in-depth market analysis reports. These initiatives empower clients with the knowledge needed to navigate financial markets effectively.

By equipping users with the tools and understanding to make informed trading decisions, XTB fosters confidence and independence. This commitment to client education goes beyond transactional services, building a foundation for long-term loyalty and mutual success. For example, their platform often features educational modules covering topics from basic charting to advanced trading strategies.

For institutional clients and high-volume individual traders, XTB offers personal account managers. These managers provide tailored support, leveraging direct communication to understand each client's unique trading needs and objectives.

This personalized approach is crucial for fostering strong relationships. By offering dedicated assistance and market insights, XTB aims to enhance client loyalty and retention within its most valuable customer segments.

For instance, in Q1 2024, XTB reported a significant increase in client numbers, underscoring the importance of such dedicated services for growth. The company's strategy emphasizes building long-term partnerships.

CRM Systems and Feedback Mechanisms

XTB leverages sophisticated Customer Relationship Management (CRM) systems to meticulously record client interactions, preferences, and valuable feedback. This allows for a highly personalized and proactive approach to client service, ensuring that each customer's unique needs are anticipated and met. In 2024, XTB continued to enhance its CRM capabilities, aiming to streamline communication and deepen client engagement across all touchpoints.

To foster continuous improvement, XTB actively solicits client feedback through regular surveys and maintains direct communication channels. This data-driven approach is crucial for understanding evolving client needs and refining the company's product and service offerings. For instance, feedback gathered in late 2023 and early 2024 directly influenced the development of new educational resources and platform enhancements.

- Personalized Service: XTB's CRM systems enable tailored communication and product recommendations based on individual client behavior and stated preferences.

- Proactive Engagement: By tracking client interactions, XTB can proactively address potential issues and offer timely support or relevant market insights.

- Continuous Improvement: Feedback mechanisms, including surveys and direct outreach, are vital for identifying areas of strength and opportunities for enhancement in XTB's services.

- Data-Driven Strategies: The insights gleaned from CRM data and client feedback inform XTB's strategic decisions regarding product development, marketing, and customer support initiatives.

Community Building and Social Media Interaction

XTB fosters community through active engagement on social media, sharing market insights and educational content. This digital presence extends their reach, offering support and information beyond direct client interactions. By cultivating a sense of community, XTB aims to build loyalty and attract new users.

- Social Media Presence: XTB maintains active profiles on platforms like YouTube, Facebook, and X (formerly Twitter), where they regularly post market analysis, educational videos, and trading tips. For instance, their YouTube channel frequently features webinars and tutorials.

- Community Engagement: The company encourages interaction by responding to comments and questions on social media, creating a dialogue with its user base. This direct engagement helps build trust and provides valuable feedback.

- Information Dissemination: Social media serves as a key channel for disseminating timely market news and expert opinions, keeping clients informed and prepared for trading opportunities.

- Brand Building: Consistent and valuable content shared across platforms helps to reinforce XTB's brand as a knowledgeable and supportive financial partner.

XTB's customer relationships are built on a foundation of personalized support, extensive educational resources, and proactive engagement, all amplified by robust CRM systems. This multifaceted approach, evident in their 2024 initiatives, aims to foster client loyalty and empower traders.

The company actively uses client feedback, gathered through surveys and direct communication, to refine its offerings, as seen in platform enhancements influenced by data from late 2023 and early 2024. XTB's commitment to education, including live webinars and market analysis in 2024, equips clients, building trust and long-term partnerships.

For key client segments, dedicated account managers provide tailored support, underscoring XTB's strategy to cultivate strong, lasting relationships. This personalized touch contributes to their growth, as evidenced by significant client number increases reported in Q1 2024.

| Relationship Aspect | XTB's Approach | 2024 Data/Insight |

|---|---|---|

| Personalized Support | Direct assistance via phone, email, live chat, and dedicated account managers. | Continued enhancement of CRM systems for tailored client interactions. |

| Educational Engagement | Webinars, market analysis reports, platform tutorials. | Robust suite of learning resources offered throughout 2024. |

| Feedback Integration | Surveys, direct communication channels for client input. | Feedback influencing product development and service refinement. |

| Community Building | Active social media presence with market insights and Q&A. | Regularly posting educational content on platforms like YouTube. |

Channels

XTB's core service delivery hinges on its proprietary xStation trading platform, available as both a web-based application and dedicated mobile apps. This dual accessibility ensures clients can engage with financial markets seamlessly, whether on their desktop or on the go. In 2024, XTB continued to see strong adoption of its digital channels, with a significant majority of new client onboarding and trading activity occurring through these platforms.

These platforms are the direct conduit for clients to interact with a vast array of financial instruments, from forex and indices to commodities and cryptocurrencies. They are engineered to facilitate trade execution, account management, and access to real-time market data, making them central to the client experience.

The global reach of XTB is significantly amplified by the ubiquity of its web and mobile platforms. This digital-first approach allows the company to serve a geographically diverse client base efficiently. As of the first half of 2024, XTB reported a substantial increase in active users across its xStation platforms, underscoring their importance in client retention and acquisition.

XTB's official website acts as a vital gateway, providing comprehensive details on their diverse financial services, extensive educational resources, timely market analysis, and a streamlined account opening procedure. This digital presence is the primary touchpoint for both prospective and current customers seeking information.

The secure client portal is an indispensable tool for registered users, enabling them to efficiently manage personal profiles, execute fund deposits and withdrawals, and access detailed account statements. It's designed for secure and convenient client self-service.

In 2024, XTB reported a significant increase in client acquisition, with their online platforms playing a pivotal role. The website's accessibility and the portal's user-friendliness contributed to attracting a broader client base, reflecting the importance of these channels in their growth strategy.

XTB leverages a robust digital marketing strategy to reach its target audience. This includes significant investment in search engine optimization (SEO) and paid search advertising (SEM) to capture potential clients actively seeking investment opportunities. In 2023, XTB reported a substantial increase in active clients, partly driven by these digital acquisition efforts.

Social media marketing and display advertising are also key components, focusing on building brand visibility and engaging with a broader investor community. These channels are crucial for informing prospective customers about XTB's offerings and driving traffic to their trading platforms. The company's digital presence is designed to be a primary driver for new client acquisition.

In 2024, XTB continued to refine its digital advertising spend, aiming for greater efficiency in client acquisition. The company allocated a significant portion of its marketing budget to digital channels, recognizing their direct impact on customer growth. This strategic focus aims to maximize lead generation and conversion rates through precisely targeted online campaigns.

Affiliate and Introducing Broker (IB) Networks

Affiliate and Introducing Broker (IB) networks are crucial for XTB's client acquisition strategy, particularly in emerging markets. These partners act as a sales force, bringing in new clients through their established networks and marketing activities. This model allows XTB to expand its global presence efficiently, minimizing direct operational investment in each territory.

In 2024, XTB continued to leverage these partnerships, recognizing their ability to drive significant client inflow. The commission-based structure incentivizes affiliates and IBs to actively promote XTB's trading platforms and services. This channel is particularly effective for reaching diverse client segments that might be harder to access through traditional marketing alone.

- Client Acquisition: Affiliates and IBs are key drivers of new customer onboarding.

- Market Expansion: This channel facilitates entry into new geographical regions.

- Cost-Effective Reach: Partners extend XTB's marketing reach without proportional fixed costs.

- Performance-Based: The commission model ensures partners are motivated by results.

Direct Sales and Institutional Partnerships

XTB leverages dedicated direct sales teams to cultivate relationships with institutional clients and high-net-worth individuals, offering a highly personalized approach to client acquisition and management. This strategy is crucial for addressing the sophisticated financial requirements of these segments, ensuring tailored solutions and dedicated support.

Strategic partnerships are also a cornerstone of XTB's institutional outreach, enabling access to broader networks and specialized client bases. These collaborations facilitate the onboarding of significant clientele through direct negotiation and customized service packages, reflecting XTB's commitment to serving the institutional market effectively.

For instance, XTB's institutional business, particularly in markets like Poland, has seen consistent growth. In 2024, XTB reported significant increases in its institutional client base, driven by these direct engagement strategies. The company's focus on building direct relationships allows for a deeper understanding of client needs, leading to more effective service delivery and client retention.

- Direct Sales Teams: Focused on personalized outreach and relationship building with large clients.

- Institutional Partnerships: Collaborations to expand reach and access specialized client segments.

- Tailored Service Offerings: Customized solutions designed to meet complex financial needs.

- Direct Negotiation: Facilitating onboarding for major clients through direct engagement.

XTB's primary channels are its proprietary digital platforms, the xStation web and mobile applications, which facilitate seamless trading and account management for a global client base. The official website serves as a crucial information hub and onboarding portal, complemented by a secure client portal for self-service functions.

Digital marketing, including SEO, SEM, social media, and display advertising, is instrumental in client acquisition, driving traffic and engagement. Furthermore, affiliate and Introducing Broker (IB) networks are vital for expanding reach, especially in emerging markets, by leveraging partner networks for client onboarding and promotion.

| Channel Type | Key Function | 2024 Focus/Data |

| xStation Platforms (Web & Mobile) | Trading Execution, Account Management | Majority of new client onboarding & trading activity. Substantial increase in active users. |

| Official Website | Information Gateway, Account Opening | Primary touchpoint for prospective and current customers. |

| Secure Client Portal | Profile Management, Deposits/Withdrawals | Designed for secure and convenient client self-service. |

| Digital Marketing (SEO, SEM, Social Media) | Client Acquisition, Brand Visibility | Refined digital ad spend for efficiency. Significant portion of marketing budget allocated. |

| Affiliate & IB Networks | Client Acquisition, Market Expansion | Key drivers of client inflow, particularly in emerging markets. |

| Direct Sales & Partnerships (Institutional) | High-Net-Worth & Institutional Client Acquisition | Significant increases in institutional client base reported for 2024. |

Customer Segments

Individual retail traders represent XTB's most substantial customer base, a diverse group ranging from those just beginning their investment journey to seasoned professionals. These individuals are primarily interested in trading Contracts for Difference (CFDs) across a wide array of financial markets.

For novice traders, XTB provides extensive educational resources and a user-friendly platform designed to ease their entry into trading. This support is crucial as many new traders seek to understand market dynamics and develop their strategies. XTB's commitment to education is a key differentiator in attracting and retaining this segment.

Experienced traders, on the other hand, are drawn to XTB's advanced trading tools, sophisticated analytical capabilities, and the breadth of financial instruments available. This includes access to CFDs on forex, indices, commodities, stocks, and cryptocurrencies, catering to varied trading styles and preferences. In 2024, XTB reported a significant increase in active retail clients, highlighting the platform's appeal to both new and experienced traders seeking comprehensive trading solutions.

XTB's institutional client segment includes sophisticated players like hedge funds, asset managers, and even corporate treasuries. These entities typically demand robust access to deep liquidity and advanced trading technologies to execute large volume transactions efficiently. For instance, in 2024, XTB continued to enhance its institutional offerings, focusing on providing reliable execution for its growing base of professional clients.

These institutional clients often require more than just standard trading platforms; they seek specialized support, including dedicated account management and potentially bespoke integration solutions to align with their existing infrastructure. This focus on tailored service is crucial for retaining and growing this high-value segment. The expansion into institutional services in 2024 directly contributed to XTB's diversified revenue streams, reducing reliance on retail trading volumes alone.

XTB's global investor segment spans across Europe, Asia, and Latin America, leveraging its multiple regulatory licenses to offer a secure trading environment. This broad geographical reach, supported by multilingual customer service and localized trading platforms, makes XTB a compelling choice for international investors seeking accessible financial markets.

In 2024, XTB continued to expand its global footprint, with a significant portion of its active clients based outside its home market of Poland. The company's commitment to providing a seamless, globally accessible trading experience is a primary draw for this diverse customer base.

Active Traders and Day Traders

Active traders and day traders form a core segment for XTB, valuing speed and efficiency in their market interactions. These clients are drawn to platforms that offer competitive spreads and rapid order execution, crucial for profiting from short-term price movements. XTB's advanced trading platform, including its proprietary xStation, is engineered to meet these demanding requirements.

The trading activity of this segment is a primary revenue driver. Their frequent transactions, often with substantial volume, generate significant income for XTB through spreads and commissions. For example, in the first half of 2024, XTB reported a substantial increase in client trading volumes, underscoring the importance of this customer base.

- Client Focus: High-frequency traders and day traders requiring low spreads and rapid execution.

- Value Proposition: Access to advanced charting, technical analysis tools, and a stable trading environment.

- Revenue Contribution: Significant income generated through trading volumes and associated fees.

- Market Engagement: These traders are highly engaged, actively utilizing platform features for intraday strategies.

Investors Seeking Diversified CFD Exposure

Investors seeking diversified Contract for Difference (CFD) exposure are a significant customer segment for platforms like XTB. These individuals want access to a broad spectrum of financial markets, from traditional forex and commodities to newer asset classes like cryptocurrencies. The ability to trade across these diverse markets from a single account simplifies their investment strategy and enhances convenience.

This segment is attracted by the sheer variety of instruments offered. For example, in 2024, platforms providing access to over 2,000 different instruments, including hundreds of global stocks and ETFs via CFDs, saw strong user engagement. The appeal lies in the potential to participate in multiple market movements without needing multiple brokerage accounts.

- Broad Asset Class Access: Customers can trade forex, indices, commodities, stocks, ETFs, and cryptocurrencies.

- Single Platform Convenience: The ability to access a wide range of instruments on one platform is a major draw.

- Market Volatility Participation: Investors use CFDs to potentially profit from price fluctuations across various global markets.

- Leverage Opportunities: Many in this segment utilize leverage offered by CFDs to amplify potential returns on their capital.

XTB caters to a wide spectrum of clients, from individual retail traders to large institutional entities. Retail traders, both novice and experienced, form a substantial customer base, drawn to XTB's educational resources and advanced trading tools respectively. Institutional clients, including hedge funds and asset managers, rely on XTB for deep liquidity and efficient execution of large trades.

The company also serves a global investor base across Europe, Asia, and Latin America, emphasizing a secure trading environment and localized support. Active traders and day traders are particularly attracted to XTB's platform for its speed and efficiency, crucial for short-term trading strategies.

In 2024, XTB saw significant growth across its client segments, with a notable increase in active retail clients and continued expansion in institutional services. This diverse client base is a testament to XTB's ability to provide tailored solutions for varied trading needs and market access requirements.

Cost Structure

XTB dedicates substantial resources to the research, development, and upkeep of its proprietary trading platform, xStation. This commitment is reflected in significant investments in software engineering talent, robust IT infrastructure, and secure data centers. In 2023, XTB reported that its technology segment, encompassing platform development and maintenance, was a key area of expenditure as they continued to enhance user experience and introduce new functionalities.

The ongoing maintenance and enhancement of xStation represent a major operational expense for XTB. This includes continuous updates, bug fixes, and the integration of advanced trading tools. Cybersecurity measures are also a critical component of these costs, ensuring the safety and integrity of client data and trading operations, a paramount concern in the financial technology sector.

Maintaining a cutting-edge trading platform is not just an expense but a strategic necessity for XTB to remain competitive. In 2024, the company is expected to continue prioritizing investments in technology to offer a seamless and feature-rich trading environment. This focus on innovation is crucial for attracting and retaining clients in a rapidly evolving digital market.

XTB dedicates a significant portion of its resources to marketing and sales, a critical investment for client acquisition and brand recognition. These expenses fuel global marketing campaigns, digital advertising initiatives, strategic sponsorships, and an extensive affiliate network, all aimed at expanding their client base. In 2024, XTB continued its aggressive expansion, with marketing and sales being a primary driver of their growth in a highly competitive online brokerage landscape.

Personnel salaries and benefits form a substantial part of XTB's cost structure. This includes compensation for a global team of developers, customer support specialists, sales professionals, crucial compliance officers, and management personnel. Attracting and retaining top talent across these diverse functions is paramount for the smooth functioning and growth of XTB's operations.

Human capital represents a significant operational expenditure for XTB. For instance, in 2023, XTB reported personnel costs amounting to 378.6 million PLN, which was a notable increase from 262.4 million PLN in 2022, reflecting the expansion of their global workforce and competitive compensation packages to secure skilled employees.

Regulatory and Compliance Costs

Operating as a globally regulated broker like XTB necessitates significant investment in regulatory and compliance costs. These expenses cover the acquisition and upkeep of licenses across various jurisdictions, continuous monitoring of evolving financial regulations, and substantial legal and auditing fees. For instance, in 2023, the financial services industry saw a notable increase in compliance spending, with many firms allocating over 10% of their operating budget to regulatory adherence.

Adhering to stringent financial regulations is not merely a cost but a fundamental requirement for establishing and maintaining the legality and trustworthiness of XTB's operations. This includes implementing robust anti-money laundering (AML) procedures, Know Your Customer (KYC) protocols, and capital adequacy requirements dictated by bodies like the European Securities and Markets Authority (ESMA) or the Financial Conduct Authority (FCA) in the UK.

- Licensing Fees: Costs associated with obtaining and renewing operating licenses in multiple countries.

- Compliance Monitoring: Expenses for systems and personnel dedicated to tracking and adhering to regulatory changes.

- Legal and Audit Expenses: Fees paid to legal counsel and external auditors for ensuring compliance.

- Technology Investment: Costs for implementing and maintaining technology solutions for regulatory reporting and risk management.

Liquidity Provision and Data Feed Costs

XTB's cost structure heavily relies on securing liquidity from multiple sources to guarantee competitive pricing and seamless order fulfillment for its clients. These liquidity provision costs are crucial for maintaining efficient trading operations and are a direct reflection of the firm's commitment to offering a high-quality trading experience.

Furthermore, XTB faces substantial expenses related to acquiring real-time market data feeds from various global exchanges and financial data aggregators. These data costs are fundamental to providing accurate pricing and analytical tools, directly supporting the core trading services offered to a diverse client base.

- Liquidity Provision: XTB partners with numerous liquidity providers, incurring fees to ensure tight spreads and fast execution, vital for client satisfaction.

- Data Feed Expenses: Significant costs are allocated to real-time data subscriptions from exchanges and data vendors, enabling up-to-the-minute market information.

- Operational Necessity: These expenditures are directly linked to the primary function of XTB as an online trading platform, facilitating seamless transactions.

- Competitive Edge: Investing in robust liquidity and data infrastructure allows XTB to maintain its competitive position in the financial markets.

XTB's cost structure is significantly influenced by its commitment to technology, particularly the ongoing development and maintenance of its proprietary trading platform, xStation. This includes substantial investments in software engineering, IT infrastructure, and cybersecurity to ensure a seamless and secure user experience. In 2024, this focus on technological enhancement remains a core expenditure, aiming to maintain a competitive edge in the online brokerage space.

Personnel costs are a considerable outlay for XTB, encompassing salaries and benefits for its global workforce. This covers essential roles from developers and customer support to sales and compliance officers. The company's expansion efforts, as seen in the increase in personnel costs from 262.4 million PLN in 2022 to 378.6 million PLN in 2023, underscore the importance of attracting and retaining skilled talent.

Operating as a regulated financial entity, XTB incurs significant expenses related to licensing, compliance, and legal adherence across multiple jurisdictions. These costs are essential for maintaining operational legitimacy and client trust, with the financial services industry generally allocating a notable portion of budgets to regulatory requirements, often exceeding 10% of operating expenses.

Costs associated with securing liquidity and acquiring real-time market data are fundamental to XTB's service delivery. These expenditures enable the firm to offer competitive pricing, efficient order execution, and accurate market information, directly supporting the core trading functions and client experience.

| Cost Category | Description | 2023 Data (Approximate) |

| Technology Development & Maintenance | xStation platform upgrades, IT infrastructure, cybersecurity | Significant investment, key area of expenditure |

| Personnel Costs | Salaries and benefits for global workforce | 378.6 million PLN (up from 262.4 million PLN in 2022) |

| Regulatory & Compliance | Licensing, legal fees, adherence to financial regulations | Essential operational cost, often >10% of operating budget in industry |

| Liquidity & Data Provision | Securing market liquidity, real-time data feeds | Crucial for competitive pricing and efficient trading operations |

Revenue Streams

XTB's main revenue driver comes from the spreads on Contracts for Difference (CFDs). This spread is essentially the tiny difference between the buying and selling price of an asset, which XTB pockets for each transaction. For example, if a client buys a CFD at 1.00 and sells at 0.99, XTB earns the 0.01 difference. This is how they get paid for connecting traders to the markets.

Beyond spreads, XTB also earns revenue through commissions on certain trades. While spreads are common across most CFD instruments, commissions are typically applied to specific asset classes, adding another layer to their income. These fees are the essential compensation for providing the trading platform and execution services.

In 2024, XTB reported significant revenue growth, with net profits reaching PLN 340.1 million (approximately $85 million USD) in the first quarter. This highlights the effectiveness of their spread and commission-based model in a dynamic market environment.

XTB generates revenue from swap fees, also known as overnight financing charges, for clients who hold Contract for Difference (CFD) positions overnight. These fees represent the interest rate differential between the currencies in a forex pair or the cost associated with financing the underlying asset of a CFD. This creates a consistent and predictable income source for the company.

For instance, in 2023, XTB reported significant growth in its client base, with active clients increasing substantially. This expansion directly correlates to a higher volume of overnight positions, thereby boosting swap fee revenue. These charges are a fundamental component of CFD trading, ensuring XTB’s revenue stream remains robust as trading activity continues.

While XTB primarily focuses on commission and spread-based revenue, withdrawal fees can represent a minor, albeit potential, income source. These fees are typically applied in specific circumstances, such as for certain payment methods or when exceeding a certain number of free withdrawals per month, designed to offset processing expenses.

For instance, a common practice among financial institutions is to absorb standard withdrawal costs, but exceptions might exist for expedited processing or less common currency conversions. XTB’s transparency in clearly outlining any such charges on their platform is paramount for maintaining client confidence. In 2024, such fees, if applied, would likely be a small percentage or a fixed nominal amount, contributing minimally to overall revenue but serving a practical purpose in cost management.

Currency Conversion Fees

XTB generates revenue through currency conversion fees when clients conduct transactions in a currency different from their account's base currency. This fee is applied to cover the costs associated with foreign exchange conversions, adding a small but consistent revenue stream. It's a standard practice within the international financial services sector, reflecting the operational costs of managing multi-currency accounts and transactions.

For example, if a client holds an account denominated in EUR but deposits funds in USD, XTB will convert the USD to EUR, applying a conversion fee in the process. This revenue, while not as significant as trading commissions or spreads, contributes to the company's overall profitability by offsetting the costs of FX operations and providing a minor income source.

- Currency Conversion Fees: Applied when client transactions involve different currencies than their account base currency.

- Revenue Contribution: A minor but consistent income source for XTB, covering FX conversion costs.

- Industry Standard: Common practice among international financial service providers to manage multi-currency operations.

- Operational Offset: Helps offset the costs associated with foreign exchange operations and liquidity management.

Premium Service Fees (if offered)

While XTB’s core revenue is generated through spreads and commissions, a potential premium service tier could offer an additional income stream. This would involve charging fees for enhanced features like advanced charting tools, real-time proprietary research, or personalized trading support. For instance, some financial platforms in 2024 charge upwards of $50 per month for such premium access, targeting active traders seeking an edge.

Introducing premium services allows XTB to cater to its high-value clientele more effectively. These clients often seek more sophisticated analytical tools and exclusive market commentary. This strategy enables upselling within the existing customer base, potentially increasing average revenue per user.

Consider these potential premium service components:

- Advanced Analytics Suite: Access to proprietary indicators, backtesting capabilities, and AI-driven market predictions.

- Exclusive Webinars & Masterclasses: Live sessions with senior analysts or successful traders, offering in-depth market strategies.

- Dedicated Account Management: Personalized support from experienced trading specialists for high-net-worth individuals.

- Priority Trade Execution: Faster order processing for premium account holders during peak market volatility.

XTB's revenue streams are primarily commission and spread-based, complemented by swap fees on overnight positions. Currency conversion fees and potential withdrawal fees offer minor contributions. The company also explores premium service tiers to enhance revenue per user.

| Revenue Stream | Description | 2024 Data/Commentary |

|---|---|---|

| Spreads on CFDs | Difference between buy and sell prices on Contracts for Difference. | Key revenue driver; Q1 2024 net profits reached PLN 340.1 million. |

| Commissions | Fees charged on specific asset trades. | Complements spread revenue; supports overall income generation. |

| Swap Fees | Overnight financing charges for holding CFD positions. | Boosted by client base growth; provides consistent income. |

| Currency Conversion Fees | Charged for transactions in currencies different from the account base currency. | Minor but consistent, offsetting FX operational costs. |

| Withdrawal Fees | Potential fees for specific withdrawal methods or exceeding free limits. | Minimal contribution, primarily for cost offsetting. |

Business Model Canvas Data Sources

The XTB Business Model Canvas is meticulously constructed from a blend of internal financial data, comprehensive market research, and expert strategic analysis. These diverse data sources ensure that every component of the canvas is grounded in actionable insights and industry realities.