WSP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WSP Bundle

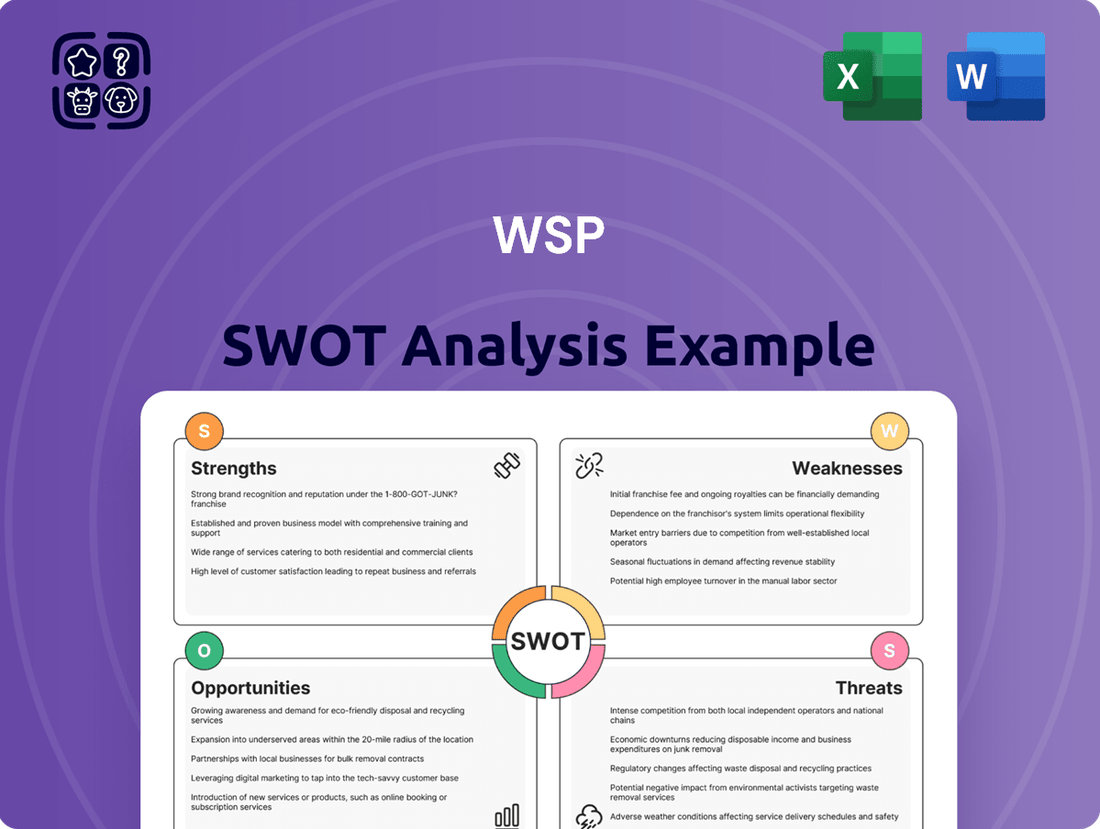

Discover the core strengths and potential pitfalls of WSP with our comprehensive SWOT analysis. Understand their innovative capabilities and strategic market positioning that sets them apart in the industry.

Our detailed report dives deep into the opportunities WSP can leverage for future growth and the challenges they may face. Gain a clear understanding of their competitive advantages and areas for development.

Want the full story behind WSP's market dominance and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

WSP Global is a powerhouse in the professional services sector, consistently recognized as a leader worldwide. For instance, in 2023, the company reported revenues exceeding CAD 14.4 billion, solidifying its top-tier status. This impressive financial performance underscores its significant market share and influence across the globe.

The firm's strength lies in its remarkably diversified portfolio, encompassing a wide array of critical sectors. These include vital areas like transportation, infrastructure, environment, buildings, water, energy, and mining. This broad operational scope not only insulates WSP from sector-specific downturns but also creates a robust and resilient revenue stream, a key advantage in the dynamic global market.

WSP is currently experiencing a strong financial performance, with net revenues hitting $3.35 billion in the first quarter of 2025. This represents a significant 19.8% increase compared to the same period last year. The company also boasts a record backlog of $16.6 billion, which is equivalent to 11.3 months of revenue, signaling a healthy pipeline of future work.

Looking ahead, WSP has set ambitious targets for revenue growth and improved EBITDA margins through its 2025-2027 strategic plan. These goals underscore a positive financial outlook, further bolstered by the substantial project backlog.

WSP stands out as a significant leader in sustainability and Environmental, Social, and Governance (ESG) initiatives. In 2024, a substantial 65.1% of its annualized revenues were directly connected to the United Nations Sustainable Development Goals, showcasing a deep integration of these principles.

The company's commitment extends to embedding ESG into its core operations and client work. WSP provides comprehensive environmental and sustainability consulting services, a move that directly addresses the escalating global demand for eco-conscious solutions.

Strategic Acquisitions and Global Expansion

WSP Global demonstrates a robust growth strategy through its disciplined approach to strategic acquisitions. The company has successfully completed 51 acquisitions to date, significantly enhancing its service portfolio and global footprint. This includes notable recent transactions such as the acquisition of Ricardo in June 2025, which bolstered WSP's presence in key growth sectors.

This active M&A strategy, coupled with organic expansion in vital markets like the US, Canada, and Europe, has solidified WSP's competitive standing. The integration of acquired entities allows WSP to broaden its service offerings and tap into new geographical markets, reinforcing its position as a leading global professional services firm.

- Acquisition Track Record: 51 acquisitions completed, enhancing capabilities and market reach.

- Recent Key Acquisition: Ricardo acquisition in June 2025 expanded service offerings and geographic presence.

- Growth Drivers: Inorganic growth through M&A complements organic expansion in North America and Europe.

- Market Strengthening: Acquisitions and expansion bolster WSP's global market position and overall capabilities.

Innovation and Digital Transformation Focus

WSP's commitment to innovation is a significant strength, particularly its focus on digital transformation. The company actively integrates digital tools and advanced technologies to improve how it delivers projects and to offer clients state-of-the-art solutions.

A key development highlighting this strength is WSP's strategic partnership with Microsoft, announced in February 2025. This collaboration includes a substantial potential investment of $1 billion, specifically aimed at speeding up the adoption of digitalization and artificial intelligence within the Architecture, Engineering, and Construction (AEC) sector.

The goal of this Microsoft partnership is to unlock new levels of value and efficiency across the industry. This forward-thinking approach positions WSP as a leader in leveraging technology to redefine industry standards and operational excellence.

Key aspects of this strength include:

- Digitalization Initiatives: WSP is actively investing in and implementing digital solutions to streamline operations and enhance project outcomes.

- AI Adoption: The company is prioritizing the integration of artificial intelligence to drive innovation and improve decision-making processes.

- Strategic Partnerships: Collaborations, such as the one with Microsoft, are crucial for accelerating technological advancements and market penetration.

- Industry Leadership: WSP aims to set new benchmarks for efficiency and value creation within the AEC industry through its tech-centric strategy.

WSP's financial health is a cornerstone of its strength, demonstrated by its robust revenue growth and substantial backlog. In Q1 2025, net revenues reached $3.35 billion, a nearly 20% increase year-over-year, supported by a record backlog of $16.6 billion, ensuring visibility for future projects.

The company's diversified service portfolio across key sectors like transportation, environment, and energy shields it from sector-specific volatility, providing a stable and resilient revenue base. This broad operational scope, combined with a strategic focus on high-growth markets, solidifies its market position.

WSP's leadership in sustainability and ESG is a significant differentiator, with over 65% of its 2024 annualized revenues linked to UN Sustainable Development Goals. This deep integration of ESG principles not only meets growing market demand but also positions WSP as a responsible industry leader.

A key strategic advantage is WSP's disciplined acquisition strategy, evidenced by 51 completed acquisitions, including the impactful Ricardo acquisition in June 2025. This M&A activity, alongside organic growth in North America and Europe, consistently expands its capabilities and market reach.

| Metric | Q1 2025 | Year-over-Year Growth | Backlog (as of Q1 2025) |

|---|---|---|---|

| Net Revenues | $3.35 billion | 19.8% | $16.6 billion |

| ESG-Linked Revenue (2024) | 65.1% of annualized revenue | N/A | N/A |

| Acquisitions Completed | 51 (to date) | N/A | N/A |

What is included in the product

Analyzes WSP’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities for improvement.

Weaknesses

WSP's ambitious growth hinges on acquisitions, but integrating these new entities presents significant hurdles. Merging different operational systems, financial processes, and, crucially, distinct company cultures can be a complex and time-consuming undertaking.

These integration challenges can lead to temporary inefficiencies and increased costs, directly impacting financial performance. For instance, WSP's Q1 2025 results indicated that integration costs played a role in moderating EBIT growth, highlighting the tangible financial consequences of these complexities.

Failure to effectively align cultures and streamline operations post-acquisition can dilute the anticipated synergies and create internal friction, potentially hindering the realization of the full strategic value of these deals.

WSP Global's significant international footprint, while a strength, also exposes it to considerable risks from economic and geopolitical volatility. Fluctuations in global economies and political landscapes can directly impact its operations and profitability across diverse markets.

Currency exchange rates present a notable challenge; for example, in 2024, these fluctuations led to an approximate 1.5% reduction in net revenues. This highlights the tangible financial impact of global economic instability on the company's performance.

Furthermore, economic uncertainties, particularly in crucial growth regions such as Asia-Pacific, can create headwinds for WSP's expansion strategies. Navigating these unpredictable environments requires robust risk management and strategic adaptability to mitigate potential negative consequences.

WSP faces a significant challenge with its high operational costs, a natural consequence of its extensive global reach and broad portfolio of services. These elevated expenses, coupled with intense competition from industry giants like Jacobs, Stantec, and AECOM, can put considerable pressure on WSP's profit margins. For instance, in the first half of 2024, WSP reported operating expenses that, while managed, reflect the inherent costs of maintaining such a widespread and multifaceted operation.

The engineering consulting landscape demands continuous innovation and a clear strategy for differentiation to effectively combat these competitive pressures. WSP must consistently invest in new technologies and service enhancements to not only retain its existing client base but also to attract new business. This ongoing need to stand out against formidable competitors like Jacobs, which has also been actively pursuing strategic acquisitions, is a critical factor in maintaining and growing market share.

Regional Market Underperformance

While WSP demonstrates robust overall performance, certain regional markets present a notable weakness. For instance, the Asia-Pacific (APAC) region experienced slower organic revenue growth in Q1 2024 compared to other areas. This disparity suggests that the company's strategies may not be as effective in all geographical segments.

Underperformance in specific regions like APAC can necessitate costly optimization and restructuring initiatives. These efforts, while aimed at long-term improvement, can temporarily strain financial results and impact overall profit margins.

- APAC's Q1 2024 organic revenue growth lagged behind other regions.

- Regional underperformance may require significant investment in restructuring.

- Optimization efforts in weaker markets could negatively impact short-term financial metrics.

Talent Attraction and Retention

The professional services sector, particularly engineering consulting, is grappling with significant workforce limitations. A persistent shortage of skilled engineers and technical experts creates an ongoing hurdle for companies like WSP.

Despite WSP's demonstrated success in boosting employee retention and promoting from within, the firm, like its peers, faces the persistent challenge of attracting and keeping the best talent in a highly competitive job market. This ongoing competition for skilled professionals directly impacts the company's capacity for growth and project execution.

For instance, in 2023, the global engineering talent shortage was estimated to affect project timelines and budgets significantly. WSP's commitment to internal development, evidenced by a 10% increase in internal promotions in its 2024 fiscal year, is a strategic response to this market dynamic, aiming to build a robust internal talent pipeline. However, the external market remains a critical factor.

- Global engineering talent shortage impacting project delivery.

- Increased competition for specialized technical skills.

- WSP's internal promotion rate rose to 10% in FY24.

- Retention rates for critical technical roles remain a focus area.

WSP's reliance on acquisitions means integrating new companies is a complex process. Merging different systems, financial practices, and company cultures can lead to inefficiencies and higher costs, affecting financial performance. For example, Q1 2025 results showed integration costs impacting EBIT growth, demonstrating the real financial consequences.

The company's global presence exposes it to economic and geopolitical risks, with currency fluctuations, like the approximate 1.5% revenue reduction seen in 2024 due to exchange rates, posing a tangible challenge. Economic uncertainty in key growth areas like Asia-Pacific also creates headwinds for expansion strategies.

High operational costs, driven by WSP's extensive global reach and service portfolio, combined with intense competition, can pressure profit margins. For instance, H1 2024 operating expenses reflected the inherent costs of maintaining such a widespread operation, requiring continuous innovation to differentiate against competitors like Jacobs.

While WSP performs well overall, certain regions, like APAC, showed slower organic revenue growth in Q1 2024, indicating that strategies might not be equally effective everywhere. This regional underperformance could necessitate costly optimization efforts that temporarily strain financial results.

A persistent shortage of skilled engineers and technical experts is a significant weakness across the professional services sector. Despite WSP's efforts in employee retention and internal promotion, attracting and keeping top talent in a competitive market remains a challenge, impacting growth capacity. The global engineering talent shortage in 2023 significantly affected project timelines and budgets. WSP's internal promotion rate increased to 10% in FY24 as a strategic response.

Same Document Delivered

WSP SWOT Analysis

The preview you see is the actual WSP SWOT Analysis document you’ll receive upon purchase. There are no hidden surprises; this is the professional quality content you can expect. Once bought, the entire, detailed report is yours to download. This ensures you get exactly what you need for your strategic planning.

Opportunities

The global push for sustainable infrastructure and climate solutions presents a substantial opportunity. There's a significant worldwide demand for greener infrastructure, adapting to climate change impacts, expanding renewable energy sources, and enhancing digital advisory services.

WSP's strategic emphasis on Environmental, Social, and Governance (ESG) principles, coupled with its Future Ready framework, places it advantageously to benefit from this trend. Projections estimate global infrastructure spending to reach an impressive $131 trillion by 2030, a massive market WSP is well-positioned to tap into, fueling sustained revenue expansion.

WSP is actively pursuing growth by expanding into sectors like digital solutions, energy transition, water management, advanced manufacturing, and mission-critical facilities. This strategic pivot targets areas poised for significant future demand.

The company's collaboration with Microsoft, alongside substantial investments in artificial intelligence and broader digital transformation initiatives, is a key driver. These efforts are designed to enhance WSP's capabilities and unlock new market potential within the continuously evolving architecture, engineering, and construction (AEC) industry.

For instance, WSP's 2023 revenue reached $14.4 billion, with a notable portion attributed to its growing advisory and digital services segments, reflecting the increasing importance of these high-growth areas.

WSP's record backlog of $16.6 billion as of the first quarter of 2025 is a significant opportunity, providing exceptional visibility into future revenue. This substantial backlog directly translates into predictable income streams, offering a stable platform for financial planning and operational execution.

The strength of this project pipeline, particularly in critical sectors like infrastructure and environmental services, underpins WSP's capacity for sustained organic growth. This robust pipeline allows the company to strategically allocate resources and pursue further expansion opportunities with a high degree of confidence.

Strategic Partnerships and Collaborations

Strategic partnerships can significantly boost WSP's capabilities. For instance, their seven-year alliance with Microsoft, announced in early 2024, is a prime example of how collaborations can accelerate digital transformation and improve service delivery by integrating WSP's engineering know-how with cutting-edge technology.

These alliances allow WSP to co-create innovative solutions and respond faster to evolving client needs. By combining their deep industry expertise with the technological prowess of partners like Microsoft, WSP can tackle increasingly complex global challenges, such as sustainable infrastructure development and smart city initiatives.

The company's focus on technology integration through such partnerships is expected to enhance operational efficiency and unlock new revenue streams. This strategic approach positions WSP to leverage digital tools and platforms to deliver more value to its clients and stakeholders.

- Accelerated Digital Transformation: The Microsoft partnership aims to leverage cloud and AI technologies to streamline operations and enhance client services.

- Innovation and Solution Development: Collaborations enable WSP to co-develop advanced solutions for complex engineering and infrastructure projects.

- Enhanced Service Delivery: By integrating advanced technology, WSP can improve the quality and efficiency of its project execution.

Diversification and Market Penetration in Key Geographies

WSP is actively expanding its presence in regions with strong infrastructure investment, notably the United States and Europe. This strategic geographical diversification allows the company to tap into significant market opportunities driven by government spending and private sector initiatives.

By strengthening its operations in these key markets, WSP can better capitalize on large-scale projects and reduce reliance on any single region. This approach helps to smooth out revenue streams and provides a buffer against economic fluctuations in specific geographies.

For instance, WSP's acquisition of Mott MacDonald's U.S. construction services business in early 2024 further solidified its position in the American market. This move is expected to significantly boost its revenue from the U.S., a market already showing robust growth in infrastructure spending. Reports from late 2023 indicated that the U.S. infrastructure market alone was projected to grow by approximately 5-7% annually through 2028, presenting a substantial opportunity.

- United States Expansion: WSP's strategic acquisitions and organic growth in the U.S. are positioning it to benefit from the Infrastructure Investment and Jobs Act (IIJA), which allocates substantial funding for transportation and infrastructure projects through 2027.

- European Market Focus: The company is also enhancing its capabilities in Europe, targeting countries with active smart city initiatives and renewable energy infrastructure development, areas experiencing increased investment.

- Risk Mitigation: Diversifying across these major economies helps mitigate risks associated with localized economic downturns or changes in regulatory environments, ensuring greater stability in WSP's overall financial performance.

WSP is poised to capitalize on the increasing global demand for sustainable infrastructure and climate-resilient solutions, a trend expected to drive significant market growth. The company's proactive strategy, focused on ESG principles and its Future Ready framework, aligns perfectly with this demand. Global infrastructure spending is projected to reach an astounding $131 trillion by 2030, offering a vast arena for WSP's services.

Strategic expansion into high-growth sectors like digital solutions, energy transition, and water management further strengthens WSP's market position. Investments in AI and digital transformation, exemplified by its collaboration with Microsoft, are key differentiators, enhancing capabilities and unlocking new avenues for revenue. WSP's 2023 revenue of $14.4 billion, with increasing contributions from advisory and digital services, underscores this successful pivot.

A record backlog of $16.6 billion as of Q1 2025 provides exceptional revenue visibility and a stable foundation for growth. This robust project pipeline, especially in crucial infrastructure and environmental sectors, supports sustained organic expansion. Furthermore, strategic alliances, such as the seven-year partnership with Microsoft initiated in early 2024, are vital for co-creating innovative solutions and accelerating response times to evolving client needs.

WSP's targeted expansion in high-investment regions like the United States and Europe is a significant opportunity. The acquisition of Mott MacDonald's U.S. construction services business in early 2024 bolstered its presence in the American market, which is experiencing robust infrastructure spending growth, estimated at 5-7% annually through 2028. This geographical diversification mitigates risks and enhances overall financial stability.

| Opportunity Area | Key Initiatives/Drivers | Market Data/Projections |

|---|---|---|

| Sustainable Infrastructure & Climate Solutions | ESG focus, Future Ready framework, Green infrastructure demand | Global infrastructure spending projected at $131T by 2030 |

| Digital Transformation & AI Integration | Microsoft partnership, AI investments | Growing importance of digital advisory services contributing to 2023 revenue |

| Strategic Expansion & Partnerships | Entry into digital, energy transition, water sectors; Microsoft alliance | Record backlog of $16.6B (Q1 2025) |

| Geographical Diversification | US & Europe expansion, Mott MacDonald acquisition (US) | US infrastructure market growth: 5-7% annually (est. through 2028) |

Threats

WSP operates in a fiercely competitive engineering consulting landscape, where global giants and specialized regional players constantly vie for significant contracts. This intense rivalry can lead to downward pressure on project pricing, directly impacting WSP's profit margins. For instance, in 2023, companies like Jacobs, Stantec, and AECOM reported substantial revenue figures, showcasing their significant market presence and ability to secure major infrastructure and consulting deals worldwide, presenting a continuous challenge to WSP's market share.

Global economic headwinds, including persistent inflation and geopolitical uncertainties, pose a significant threat by potentially curbing client expenditure on crucial infrastructure and development initiatives. This directly impacts WSP's revenue generation capabilities.

A noticeable slowdown in the projected growth of global infrastructure spending, as indicated by market forecasts for 2024, directly jeopardizes WSP's project pipeline and overall profitability, requiring adaptive strategies.

Regulatory changes present a significant threat to WSP. For instance, stricter environmental standards for infrastructure projects, potentially enacted in late 2024 or 2025, could necessitate costly redesigns or new compliance measures, impacting project profitability and feasibility. Similarly, shifts in government infrastructure spending priorities, as seen in budget allocations for 2024-2025, might reduce demand for certain services in regions where WSP has a strong presence, forcing strategic reallocation of resources.

Talent Shortages and Workforce Constraints

WSP faces a significant threat from ongoing talent shortages, particularly in securing qualified engineers and specialized technical professionals. This scarcity directly impacts operational capacity and could slow project delivery. For instance, the engineering and construction sector globally experienced an average of 80 days to fill open positions in 2024, a notable increase that strains resources.

The competitive landscape for skilled labor is intensifying, pushing recruitment costs higher for WSP. While the company emphasizes employee retention, a tight labor market can still lead to increased wages and benefits expenses, impacting profitability. Furthermore, delays in onboarding new talent due to these shortages can create bottlenecks in project execution, potentially affecting WSP's ability to meet client deadlines and maintain its growth trajectory.

- Persistent Shortage: Difficulty in finding enough qualified engineers and technical specialists.

- Increased Recruitment Costs: Higher expenses associated with attracting and hiring talent in a competitive market.

- Project Delays: Potential for slowed project execution due to a lack of available skilled personnel.

- Operational Constraints: Limited capacity to take on new projects or expand services without sufficient workforce.

Cybersecurity Risks and Data Breaches

WSP, as a global entity deeply integrated with digital systems, is particularly vulnerable to cybersecurity threats. The potential for cyber-attacks, including ransomware and data breaches, poses a significant danger to its operations and sensitive client information. A successful breach could expose proprietary project details and confidential client data, leading to severe financial penalties and a substantial blow to WSP's reputation.

The increasing sophistication of cyber threats means that even robust security measures can be challenged. In 2023, the global average cost of a data breach reached $4.45 million, a figure that highlights the immense financial repercussions such incidents can carry. For a firm like WSP, handling vast amounts of project data, the impact of such a breach could disrupt project timelines, compromise intellectual property, and lead to significant legal liabilities.

- Increased Ransomware Attacks: Cybersecurity Ventures predicted that ransomware damages would cost the world $265 billion annually by 2031. WSP must guard against these attacks that can cripple operations.

- Data Breach Costs: IBM's 2023 Cost of a Data Breach Report indicated the global average cost of a data breach was $4.45 million. This underscores the financial risk of compromised client data.

- Reputational Damage: A significant data breach can erode client trust and damage WSP's standing in the industry, impacting future business opportunities.

- Operational Disruption: Cyber-attacks can halt critical business processes, delaying project delivery and impacting service continuity for clients.

Intensified competition from global and regional engineering firms presents a constant threat to WSP's market share and pricing power. Economic slowdowns and potential reductions in global infrastructure spending forecasts for 2024-2025 could significantly impact WSP's project pipeline and revenue. Regulatory shifts, such as stricter environmental standards or changes in government spending priorities for 2024-2025, may necessitate costly adjustments or reduce demand for WSP's services.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market research, and direct feedback from key stakeholders to ensure a well-rounded and actionable assessment.