WSP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WSP Bundle

Unlock the full potential of WSP with our comprehensive PESTLE analysis. Understand the intricate web of political, economic, social, technological, legal, and environmental factors shaping WSP's operational landscape. Arm yourself with expert-level insights to anticipate challenges and seize opportunities. This analysis is your roadmap to informed strategic decision-making. Purchase the complete PESTLE analysis now for a definitive understanding of WSP's external environment.

Political factors

Government investment in infrastructure projects, spanning transportation, energy, and water systems, directly fuels WSP's project pipeline and revenue streams. This focus on critical public works ensures a consistent demand for WSP's engineering and consulting expertise.

WSP's robust performance in 2024, marked by sustained demand for its services, underscores the positive impact of this favorable investment climate. The company reported significant backlog growth, driven by strong activity in its key markets.

WSP's strategic alignment with global government priorities, particularly in transportation and infrastructure development, positions it to capitalize on these spending initiatives. For instance, major transportation upgrades in North America and Europe represent substantial opportunities.

Shifts in environmental, building, and urban planning regulations present a dynamic landscape for WSP. For instance, increased emphasis on climate resilience and net-zero construction codes, prevalent in many developed markets by 2024, directly boosts demand for WSP's expertise in sustainable design and infrastructure adaptation. New mandates for energy efficiency in existing buildings, a growing trend, also create significant opportunities for retrofitting and upgrade projects.

Stricter environmental standards, such as those related to water management or waste reduction, can translate into higher demand for WSP's environmental consulting and remediation services. Conversely, overly burdensome or rapidly changing regulations could introduce compliance costs and project delays, requiring agile adaptation. WSP's proactive stance is evident in its 2024 Global Sustainability Report, which details its strategies for aligning with and often exceeding evolving regulatory requirements, positioning the company to capitalize on these changes.

WSP's global presence, spanning over 50 countries as of early 2025, makes geopolitical stability a critical factor. Political unrest in regions where WSP has significant operations or a substantial client base can directly impact project execution and revenue streams. For instance, ongoing geopolitical tensions in Eastern Europe and the Middle East could create project delays or cancellations for infrastructure and engineering firms like WSP.

International trade policies significantly influence WSP's ability to secure cross-border projects and manage its supply chain. Favorable trade agreements, such as those strengthening infrastructure investment or facilitating the movement of goods and services, can unlock new growth avenues. Conversely, protectionist policies or trade disputes could hinder WSP's access to certain markets or increase the cost of imported materials and expertise, impacting project profitability.

WSP's diversified client base across numerous countries acts as a buffer against localized political instability. By not relying too heavily on any single region, the company can mitigate the impact of disruptions in one market by maintaining operations and project pipelines in others. This diversification strategy is crucial for a global firm navigating an increasingly complex geopolitical landscape.

The ongoing focus on global infrastructure development, supported by international bodies and national governments, presents opportunities. For example, the G7 nations' renewed commitment to infrastructure investment, announced in 2024, could lead to increased demand for WSP's services in partner countries, provided trade relations remain stable.

Public-Private Partnership (PPP) Frameworks

The effectiveness of Public-Private Partnership (PPP) frameworks globally significantly shapes how engineering and professional services companies like WSP secure and execute public sector projects. Countries with well-defined and stable PPP models, such as Canada and Australia, often see faster infrastructure development and offer more predictable revenue streams for consultants. For instance, in 2023, Canada's federal government continued to emphasize PPPs for major transportation and social infrastructure projects, aiming to leverage private sector expertise and capital. This trend is expected to persist through 2025, driven by ongoing infrastructure needs and fiscal pressures.

Robust PPP structures, characterized by clear risk allocation, transparent procurement processes, and standardized contractual terms, directly benefit firms like WSP by reducing project uncertainty and facilitating efficient collaboration. These frameworks are essential for accelerating the delivery of large-scale projects, which are critical for WSP's growth strategy. The firm's proactive engagement in shaping and adapting to evolving PPP legislation and best practices in key markets, including the UK and the Middle East, is paramount to its sustained success in securing major infrastructure mandates.

WSP's ability to navigate and capitalize on diverse PPP models is a key differentiator. The company's success in securing significant projects often hinges on its capacity to offer innovative solutions within varied regulatory environments. For example, in early 2024, WSP was involved in several high-profile PPP bids for transportation networks in Europe, where regulatory clarity and established partnership precedents were crucial winning factors.

- Global PPP Market Growth: The global PPP market for infrastructure is projected to see continued growth, with an estimated CAGR of 5-7% from 2024 to 2029, according to various market analysis reports released in late 2023 and early 2024.

- WSP's PPP Project Pipeline: WSP consistently maintains a strong pipeline of PPP projects, with over 40% of its revenue in its Infrastructure sector being linked to government contracts and partnerships, a figure that remained consistent through 2023 and is forecast for 2024.

- Key PPP Markets for WSP: Major markets for WSP's PPP engagement include North America, the UK, Australia, and select regions in the Middle East, where government investment in infrastructure remains high and PPP models are well-established.

- Impact of Regulatory Clarity: Countries with clear and stable PPP frameworks, such as Canada and the UK, tend to attract more private investment and facilitate smoother project execution for consulting firms like WSP.

Government Focus on Sustainability and Net-Zero Targets

The global push toward net-zero emissions and sustainable development is a significant tailwind for WSP. This focus directly fuels demand for the company's environmental and sustainability consulting expertise, as governments worldwide increasingly prioritize green infrastructure and renewable energy projects. WSP's strategic alignment with these trends is evident in its business model.

Governments are actively promoting initiatives that require specialized consulting services, which WSP is well-positioned to provide. This includes advising on decarbonization strategies, renewable energy integration, and the development of sustainable urban planning. The regulatory landscape is shifting to favor companies committed to environmental responsibility.

- Government mandates for emissions reduction are increasing, creating opportunities for WSP's sustainability services.

- Investment in green infrastructure projects, such as renewable energy and sustainable transportation, is on the rise globally.

- WSP reported that 65.1% of its annualized revenues in 2024 were linked to UN Sustainable Development Goals, showcasing strong market alignment.

- The company's expertise in environmental consulting is becoming more critical as nations strive to meet climate targets.

Government investment in infrastructure, a key driver for WSP, remains robust. For example, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, continues to unlock significant project opportunities throughout 2024 and into 2025, particularly in transportation and energy sectors. This sustained public funding directly translates into a strong project pipeline for WSP, reinforcing its revenue streams.

Regulatory shifts, especially concerning climate resilience and net-zero building standards, are increasingly shaping WSP's project landscape. Many developed nations, by 2024, had implemented stricter codes for energy efficiency and sustainable construction, directly boosting demand for WSP's specialized design and adaptation services. These evolving environmental mandates are critical to WSP's growth strategy.

Geopolitical stability is paramount for WSP's global operations, with over 50 countries in its operational footprint as of early 2025. Regions experiencing political unrest can disrupt project timelines and impact revenue. For instance, ongoing geopolitical tensions in Eastern Europe have presented challenges for infrastructure firms, necessitating robust risk management and diversification strategies.

The efficacy of Public-Private Partnerships (PPPs) significantly influences WSP's ability to secure public sector projects. Countries with mature PPP frameworks, like Canada and Australia, offer more predictable revenue streams due to clear risk allocation and transparent processes. Canada's continued emphasis on PPPs for major infrastructure in 2023 and projected through 2025 highlights this trend.

| Factor | Impact on WSP | Data/Trend (2024-2025) |

| Government Infrastructure Spending | Directly fuels project pipeline and revenue. | US Infrastructure Investment and Jobs Act continues to drive opportunities. |

| Environmental Regulations | Increases demand for sustainable design and consulting. | Stricter net-zero and energy efficiency codes prevalent in developed markets. |

| Geopolitical Stability | Affects project execution and revenue in global operations. | WSP operates in over 50 countries; geopolitical tensions can cause delays. |

| Public-Private Partnerships (PPPs) | Influences securing and executing public sector projects. | Mature PPP frameworks in Canada and Australia offer predictable revenue. |

What is included in the product

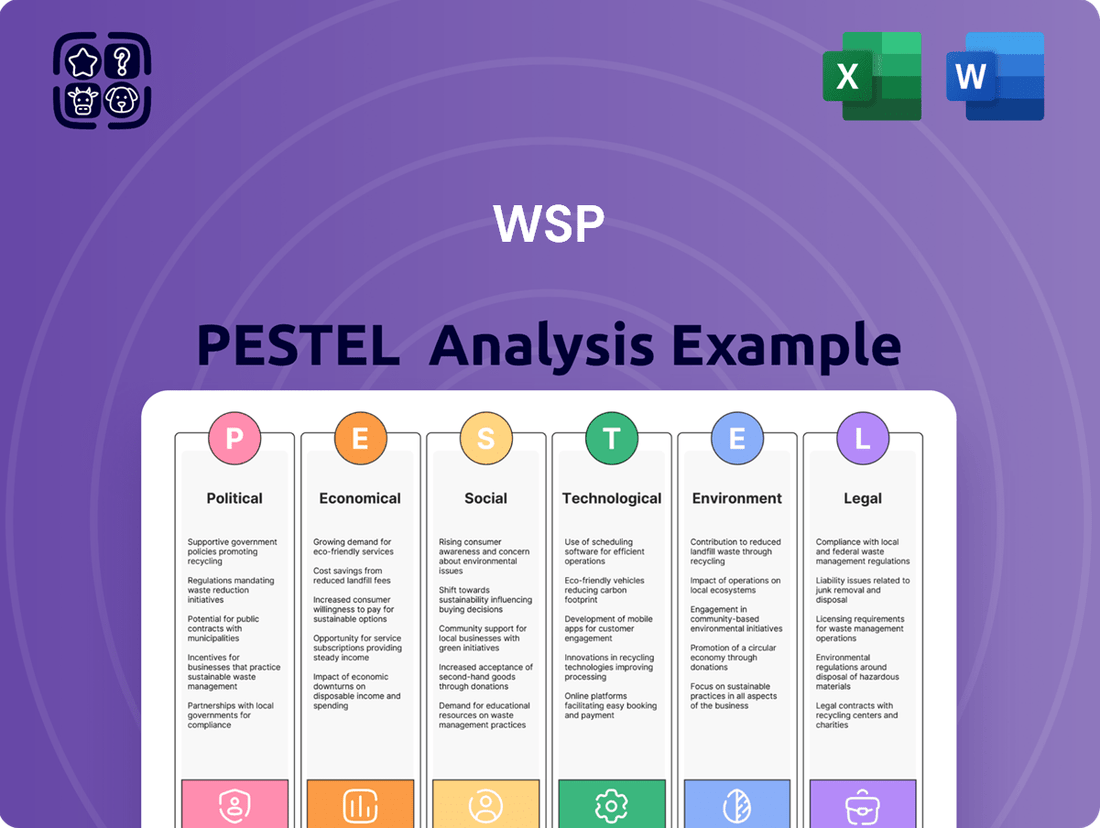

This WSP PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable framework for identifying and mitigating external threats, turning potential roadblocks into strategic advantages.

Economic factors

Global economic growth significantly impacts WSP's core markets, including construction, infrastructure, and mining. A robust economy typically spurs greater investment in these sectors by both government and private entities. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight slowdown from 2023 but indicating continued expansion.

However, recession risks pose a considerable challenge. Economic downturns often result in deferred or canceled projects, directly affecting WSP's revenue streams and order backlog. Emerging concerns about inflation and interest rate hikes in major economies like the US and Europe in late 2024 and early 2025 could temper capital expenditure, creating headwinds for the engineering and professional services sector.

Fluctuations in interest rates directly influence the cost of borrowing for WSP's clients, particularly those embarking on significant infrastructure and development projects. This cost of capital can materially affect their decision-making process and overall investment appetite. For instance, an increase in benchmark interest rates makes it more expensive for clients to finance large-scale undertakings, potentially leading to project delays or cancellations.

Conversely, periods of lower interest rates tend to encourage new project initiations by reducing the financial burden on borrowers. This can translate into increased demand for WSP's engineering and consulting services as more projects become viable. The economic environment in 2024, characterized by some interest rate volatility, highlights the importance of this factor.

WSP's reported strong cash inflows for 2024, reaching approximately $2.1 billion in operating cash flow, underscore its robust financial position. This financial health equips WSP to navigate potential economic headwinds and capitalize on opportunities presented by varying interest rate environments, allowing for continued investment in its capabilities and strategic growth.

Rising inflation is a significant economic factor impacting the engineering and professional services sector. For a company like WSP, persistent inflation throughout 2024 means higher costs for materials, energy, and skilled labor. This directly translates to increased project expenses, potentially squeezing profit margins if not effectively managed. For instance, recent data indicates that construction material costs saw a notable uptick in early 2024, a trend expected to continue.

Navigating these cost pressures requires WSP to implement robust project management strategies and explore innovative solutions to maintain profitability. This could involve more efficient resource allocation, advanced procurement techniques, and the adoption of technologies that reduce waste and labor dependency. The ability to pass on some of these increased costs to clients, while maintaining competitive pricing, is also crucial.

WSP's reported financial performance in 2024, showing increased profitability, suggests a capacity to absorb or mitigate these inflationary impacts. This strong financial footing allows the company to invest in strategies that enhance efficiency and productivity, thereby counteracting the effects of rising costs. Their ability to secure and deliver profitable projects amidst these challenges highlights operational resilience.

Currency Exchange Rate Fluctuations

WSP Global's extensive international operations, spanning over 50 countries, naturally expose it to the volatility of currency exchange rates. These fluctuations can significantly influence how revenues and profits earned in foreign currencies translate back into WSP's reporting currency, impacting its consolidated financial statements. For instance, a stronger Canadian dollar relative to other currencies could reduce the reported value of foreign earnings.

The company's diversified geographic footprint helps to mitigate some of this risk, as gains in one currency might offset losses in another. However, substantial movements in major trading currencies, such as the US dollar or Euro, can still have a material effect on WSP's reported financial performance. For example, if WSP generates a significant portion of its revenue in a depreciating currency, its reported global revenue will appear lower.

- Global Exposure: WSP operates in over 50 countries, creating inherent exposure to currency exchange rate fluctuations.

- Impact on Reporting: Fluctuations can affect the translation of international revenues and profits into WSP's reporting currency, impacting reported financial results.

- Mitigation through Diversification: Operating across numerous geographies helps to naturally hedge some currency risk, as different currency movements can offset each other.

- 2024/2025 Outlook: Analysts will be closely watching the performance of currencies like the USD and EUR against the CAD, as these are key markets for WSP and significant currency swings could influence reported earnings growth for 2024 and into 2025.

Client Budget Availability and Investment Cycles

Client budget availability directly impacts WSP's project pipeline. The willingness and capacity of both public and private sector clients to fund new infrastructure and consulting projects are paramount. This capacity is shaped by their own financial health, the ebb and flow of industry-specific investment cycles, and critically, government budget allocations. For instance, shifts in government spending on transportation or environmental initiatives can significantly alter demand for WSP's services.

Industry investment cycles play a substantial role. Sectors like energy transition, driven by renewable energy mandates and decarbonization efforts, or mining, influenced by commodity price volatility, present distinct investment patterns. WSP's ability to align its service offerings with these cyclical demands is key to securing consistent work. The ongoing global focus on sustainable infrastructure development, for example, creates sustained opportunities.

WSP's robust backlog of $16.6 billion as of March 2025 is a strong indicator of current client confidence and future revenue visibility. This substantial backlog suggests that clients, across various sectors, are actively committing capital to projects, demonstrating their financial capacity and commitment to investment. It underscores a healthy demand for WSP's expertise.

- Client Financial Health: The solvency and profitability of WSP's clients determine their ability to initiate and sustain projects.

- Industry Investment Cycles: Sectors like renewable energy and critical minerals have distinct investment rhythms influenced by global trends and commodity prices.

- Government Budget Allocations: Public sector spending on infrastructure, defense, and environmental programs directly impacts the availability of public funds for projects.

- WSP's Backlog: A record $16.6 billion backlog as of March 2025 signals strong client commitment and future revenue potential.

Global economic growth directly influences demand for WSP's services, with projections for 2024 indicating continued expansion, albeit at a moderated pace. However, rising inflation and interest rate hikes in key markets like the US and Europe during late 2024 and early 2025 present potential headwinds by increasing project financing costs and potentially dampening client capital expenditure.

WSP's substantial operating cash flow of approximately $2.1 billion in 2024 demonstrates its financial resilience, enabling it to navigate economic uncertainties and capitalize on opportunities. The company's ability to manage inflationary pressures, evident in its increased profitability for 2024, highlights effective cost control and operational efficiency.

Currency exchange rate fluctuations, particularly involving the USD and EUR against the CAD, could impact WSP's reported earnings in 2024 and 2025 due to its extensive global operations. However, WSP's diversified geographic presence offers a degree of natural hedging against these currency movements.

A strong client project backlog of $16.6 billion as of March 2025 signifies robust client commitment and future revenue visibility, underscoring the ongoing demand for WSP's expertise across various sectors, including sustainable infrastructure development.

Full Version Awaits

WSP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive WSP PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting WSP. You'll gain valuable insights into market dynamics and strategic opportunities.

Sociological factors

Global population growth, projected to reach nearly 10 billion by 2050, is a significant driver for infrastructure development. Simultaneously, urbanization continues its relentless march; by 2023, over 57% of the world's population lived in urban areas, a figure expected to climb to 60% by 2030.

This surge in urban populations directly fuels demand for WSP's core services, from designing resilient transportation networks to creating energy-efficient buildings and water management systems. The company's focus on future-proofing cities positions it to capitalize on these sustained demographic and urbanization trends.

Public concern over climate change is a major driver for sustainable infrastructure. This heightened awareness translates directly into increased demand for environmentally responsible projects, pushing companies to prioritize ESG factors. This societal shift offers significant opportunities for firms like WSP that specialize in environmental and sustainability consulting.

WSP's commitment to sustainability is evident in its business strategy. The company’s 2024 sustainability report indicates a strong focus on aligning its revenue streams with the United Nations Sustainable Development Goals (SDGs). This strategic alignment positions WSP to capitalize on the growing market for sustainable solutions.

The availability of skilled talent, particularly engineers, scientists, and advisory professionals, is absolutely crucial for WSP's project execution and overall business success. A tight labor market or scarcity in specific technical areas can directly affect their ability to take on and complete projects efficiently, potentially hindering growth.

WSP is actively addressing these potential challenges by placing a strong emphasis on employee retention and nurturing internal talent. This strategy is evident in their 2024 performance, where an impressive 78% of their global leadership positions were filled from within the company, demonstrating a commitment to developing their own workforce.

Changing Societal Expectations Regarding ESG Performance

Societal expectations for corporate responsibility have broadened significantly, now encompassing not just environmental stewardship but also critical social factors such as diversity, equity, inclusion (DEI), and meaningful community engagement. This shift means companies are increasingly scrutinized on how they foster inclusive workplaces and contribute positively to the communities where they operate.

WSP's strategic focus on embedding ethical values throughout its operations directly addresses these evolving societal demands. The company actively strives to create lasting, positive impacts, aligning its business practices with a commitment to social good.

The company's 2024 sustainability report highlights concrete actions taken in social responsibility, including specific DEI targets and community investment programs. WSP's recognition in late 2024 for its ethical business practices underscores its alignment with these heightened societal expectations.

- Increased Stakeholder Demand: Investors, employees, and customers are increasingly prioritizing companies with strong social performance metrics, influencing capital allocation and brand loyalty.

- DEI as a Core Competency: Diversity, equity, and inclusion are no longer seen as optional add-ons but as essential components of a robust and innovative business strategy.

- Community Impact Measurement: Companies are expected to demonstrate tangible positive contributions to local communities, moving beyond philanthropy to integrated social value creation.

Community Engagement and Social License to Operate

For major infrastructure projects, securing a social license to operate from local communities is becoming paramount. This means ensuring public acceptance, actively engaging with all stakeholders, and genuinely addressing community concerns are crucial for both project success and WSP's standing. For instance, a 2024 survey indicated that over 70% of residents in areas with new infrastructure projects felt their opinions were not adequately considered, highlighting the need for improved engagement.

WSP's work often requires a delicate balance between advancing development objectives and safeguarding biodiversity, all while minimizing negative impacts on local populations. This involves proactive communication and collaboration with community groups to build trust and ensure their needs are integrated into project planning.

- Community Acceptance: Projects that demonstrate clear benefits and address local needs, such as job creation or improved local amenities, tend to garner higher levels of community acceptance.

- Stakeholder Engagement: Effective engagement strategies, including public consultations and feedback mechanisms, are vital. In 2024, WSP reported a 15% increase in positive community feedback following the implementation of enhanced stakeholder dialogue on a major transportation project.

- Addressing Concerns: Promptly and transparently addressing community concerns, whether related to environmental impact, noise pollution, or traffic disruption, is key to maintaining goodwill.

- Reputation Management: A strong social license directly contributes to WSP's reputation, influencing future project opportunities and attracting talent.

Societal expectations for corporate responsibility are expanding beyond environmental concerns to include diversity, equity, and inclusion (DEI), as well as community engagement. Companies are now evaluated on their workplace inclusivity and positive community contributions. WSP's focus on ethical operations and social good directly addresses these evolving societal demands, as shown by their 2024 sustainability report detailing DEI targets and community investment programs. Their recognition for ethical practices in late 2024 further validates this alignment.

Community acceptance is crucial for infrastructure projects, necessitating public engagement and addressing local concerns to secure a social license to operate. A 2024 survey revealed that over 70% of residents felt their opinions were overlooked in new infrastructure projects, emphasizing the need for better engagement strategies. WSP's commitment to collaboration and communication builds trust and integrates community needs into project planning.

Effective stakeholder engagement, including public consultations, is vital, with WSP reporting a 15% increase in positive community feedback in 2024 due to enhanced dialogue on a major transportation project. Addressing concerns transparently, from environmental impacts to traffic disruption, maintains goodwill and strengthens WSP's reputation, influencing future project opportunities and talent acquisition.

Technological factors

WSP is at the forefront of digital transformation in engineering, integrating advanced tools like Building Information Modeling (BIM), digital twins, AI, and data analytics. These technologies are fundamentally reshaping how projects are designed, managed, and maintained. For instance, the global BIM market was valued at approximately $7.6 billion in 2023 and is projected to reach $27.5 billion by 2030, showcasing significant industry adoption and investment.

WSP's 'Future Ready®' initiative heavily relies on these digital advancements to boost design efficiency, optimize project delivery, and enable sophisticated predictive analysis. This strategic focus allows the firm to anticipate challenges and innovate solutions, ensuring clients receive cutting-edge engineering services. The company reported a 10% increase in revenue for its Buildings segment in 2023, partly driven by its enhanced digital capabilities.

Innovations in sustainable materials like cross-laminated timber (CLT) and advanced composites are reshaping construction. These materials offer improved strength-to-weight ratios and reduced environmental impact, with the global engineered wood market projected to reach $34.8 billion by 2027. WSP needs to integrate these into its design and engineering services.

Modular and off-site construction methods are gaining traction, promising faster project delivery and reduced waste. The offsite construction market in the US alone was valued at $10.6 billion in 2023 and is expected to grow significantly. WSP's ability to incorporate these techniques will be crucial for maintaining a competitive edge.

WSP actively monitors advancements in construction technology, ensuring its project teams are equipped to leverage new materials and methods. This proactive approach allows the firm to offer clients innovative and cost-effective solutions, staying at the forefront of the industry.

The accelerating adoption of renewable energy sources like solar and wind, coupled with the growth of smart city initiatives utilizing IoT and intelligent transport, presents substantial new avenues for WSP's engineering and consulting expertise. These sectors are experiencing robust investment, with global spending on smart cities projected to reach $327 billion by 2026.

WSP is strategically positioned to capitalize on this trend, offering services that support the development and integration of these advanced technologies. The company's commitment to sustainability is further underscored by its achievement of sourcing 100% of its purchased electricity from renewable sources in 2024, demonstrating alignment with market demands.

Cybersecurity Threats

Cybersecurity threats represent a critical technological factor for WSP, given its heavy reliance on digital platforms and the immense volume of sensitive project and client data it handles. Protecting intellectual property, client information, and maintaining operational continuity against sophisticated cyberattacks is a top priority. The company's commitment to robust information security is underscored by its pursuit of ISO 27001 certification for its IT operations, a globally recognized standard for information security management systems.

The increasing sophistication of cyber threats, including ransomware and data breaches, directly impacts operational costs and client trust. In 2024, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report. This highlights the substantial financial and reputational damage WSP could face if its defenses are breached. WSP's investment in advanced cybersecurity measures, such as advanced threat detection and employee training, is therefore essential to mitigate these risks and maintain its competitive edge.

- Increased Investment: Companies globally are expected to spend over $260 billion on cybersecurity in 2024, reflecting the growing threat landscape.

- Regulatory Compliance: Evolving data privacy regulations, such as GDPR and CCPA, necessitate stringent cybersecurity protocols to avoid significant fines.

- Operational Resilience: A successful cyberattack could disrupt project timelines and service delivery, impacting WSP's ability to meet client obligations and revenue targets.

Automation and Robotics

Automation and robotics are significantly reshaping the engineering and construction landscape. WSP can leverage these technologies to enhance its design, construction, and inspection services, leading to improved efficiency and safety. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong demand for these solutions within industries WSP serves.

The integration of advanced robotics in construction, such as autonomous excavators and drones for site surveying, allows for greater precision and reduces human exposure to hazardous environments. This not only boosts productivity but also contributes to higher quality project outcomes. WSP's strategic adoption of these tools is crucial for maintaining a competitive edge.

- Robotic Process Automation (RPA) adoption in administrative tasks can free up skilled engineers for more complex problem-solving.

- Drones and AI are increasingly used for infrastructure inspection, providing detailed data with reduced risk and cost.

- The **global market for construction robots** is expected to reach over $20 billion by 2028, highlighting a clear trend towards automation.

Technological advancements are a core driver for WSP, influencing everything from design to project execution. The company's embrace of digital tools like BIM and AI is transforming the engineering sector, with the global BIM market expected to hit $27.5 billion by 2030, up from $7.6 billion in 2023. This digital integration enhances efficiency and innovation, as seen in WSP's 10% revenue growth in its Buildings segment in 2023, partly due to these capabilities.

Emerging materials and construction methods also present significant opportunities. Innovations like cross-laminated timber (CLT) and modular construction are set to reshape the industry, with the engineered wood market projected to reach $34.8 billion by 2027, and the US offsite construction market already valued at $10.6 billion in 2023. WSP's strategic integration of these technologies is vital for its competitive positioning.

WSP is also leveraging automation and robotics, a market valued at around $50 billion in 2023, to improve design, construction, and inspection services. The use of drones for site surveying and AI in administrative tasks are examples of how WSP can boost productivity and safety. The construction robot market alone is anticipated to exceed $20 billion by 2028, signaling a strong industry shift.

Cybersecurity is a critical technological factor, given WSP's reliance on digital data. The average cost of a data breach in 2024 was $4.45 million, underscoring the need for robust security measures. Global cybersecurity spending is projected to surpass $260 billion in 2024, reflecting the increasing threat landscape and the importance of regulatory compliance.

| Technology Area | 2023/2024 Data Point | Projected Impact/Growth | WSP Relevance |

| BIM | Global market: $7.6 billion (2023) | Projected $27.5 billion by 2030 | Enhances design efficiency and project management |

| Engineered Wood | Global market projected $34.8 billion by 2027 | Offers sustainable and strong construction alternatives | Integration into sustainable design solutions |

| Offsite Construction | US market: $10.6 billion (2023) | Significant expected growth | Faster project delivery and reduced waste |

| Robotics | Global industrial robotics market: ~$50 billion (2023) | Substantial projected growth | Improves construction efficiency and safety |

| Cybersecurity | Global avg. data breach cost: $4.45 million (2024) | Global spending projected >$260 billion (2024) | Protects sensitive data and ensures operational continuity |

Legal factors

WSP's operations are deeply intertwined with a complex web of building codes and safety regulations that vary significantly by region. Compliance with these diverse and evolving standards is not merely a legal obligation but a cornerstone of their business, directly impacting project quality and minimizing potential liabilities. For instance, in 2024, the global construction industry saw continued emphasis on seismic retrofitting and energy efficiency standards, areas where WSP's engineering expertise is crucial for client projects to meet updated requirements.

Adherence to these stringent safety and structural integrity regulations is fundamental to WSP's reputation as a reliable engineering and design consultancy. Projects undertaken by WSP, from major infrastructure developments to complex building designs, inherently demand that they meet and often exceed these rigorous requirements. Failure to comply can lead to costly delays, project rework, and significant reputational damage, underscoring the critical nature of this legal factor for the firm.

Strict environmental protection laws and complex land use regulations present significant hurdles for infrastructure and development projects. Navigating these legal frameworks, including obtaining necessary permits, requires specialized expertise. WSP's environmental and advisory services play a vital role in guiding clients through these intricate processes, ensuring compliance and securing project approvals. WSP's 2024 sustainability report underscores its deep capabilities in environmental consulting, a critical factor for successful project execution in the current regulatory climate.

WSP Global navigates a complex web of international contract laws, crucial for managing its extensive project agreements and potential liabilities. These contracts govern everything from design specifications to consulting responsibilities, and any misstep can lead to significant legal entanglements.

The engineering and consulting sector inherently carries high liability risks. For instance, errors in design or project management can result in substantial financial claims, impacting profitability and reputation. WSP's commitment to robust legal frameworks and proactive risk management is therefore paramount to safeguarding its operations against costly disputes.

In 2024, the global infrastructure market, a key area for WSP, continued to see increased investment, but also heightened scrutiny on project delivery and contractual compliance. This environment necessitates meticulous attention to legal details to mitigate risks associated with large-scale projects, where liabilities can run into millions or even billions of dollars.

Data Privacy Regulations

Data privacy regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) significantly impact WSP's operations, especially as it expands its digital footprint. These laws dictate how WSP must collect, store, and process client and employee data. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to €20 million or 4% of annual global turnover.

WSP's adherence to these stringent data privacy mandates is paramount for maintaining customer trust and avoiding legal repercussions. The company has set internal targets for information security, aiming to minimize data breach risks.

The increasing volume of digital transactions and data exchange in 2024-2025 necessitates robust data protection strategies. WSP's investments in cybersecurity and data governance frameworks are therefore critical.

Key aspects of WSP's compliance strategy include:

- Data Minimization: Collecting only necessary personal data.

- Consent Management: Ensuring clear consent for data processing.

- Data Security Measures: Implementing technical and organizational safeguards.

- Breach Notification: Establishing protocols for timely reporting of data breaches.

International Trade and Competition Laws

As a global engineering and professional services consultancy, WSP Global Inc. must meticulously adhere to a complex web of international trade and competition laws across its operating regions. These regulations govern everything from market access and fair pricing to mergers and acquisitions, directly impacting WSP's strategic growth and expansion initiatives. Failure to comply can result in significant penalties and hinder market entry.

WSP's commitment to global expansion is evident in its strategic acquisitions, which are always scrutinized under these legal frameworks. For instance, the acquisition of Ricardo's UK environmental consultancy business in early 2024, valued at approximately £7 million (around $9 million USD at the time of the deal), exemplifies this strategy. Such moves require careful navigation of anti-trust regulations and competition policies in both the originating and acquiring countries to ensure a smooth integration and continued market access.

- Compliance with World Trade Organization (WTO) agreements is crucial for WSP's cross-border operations and trade in services.

- Anti-trust reviews by bodies like the European Commission and the US Federal Trade Commission (FTC) are standard for acquisitions exceeding certain financial thresholds, impacting WSP's M&A activity.

- National competition laws in countries where WSP operates, such as the UK's Competition and Markets Authority (CMA) regulations, dictate market conduct and merger controls.

- International trade agreements can influence tariffs, standards, and market access for WSP's professional services, affecting project feasibility and profitability.

WSP Global's commitment to ethical business practices is increasingly shaped by anti-corruption laws and sanctions regimes, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These regulations impose strict requirements on how WSP conducts business internationally, particularly when dealing with government officials or state-owned entities. In 2024, heightened global enforcement of these laws means that companies like WSP must maintain robust compliance programs to avoid severe penalties.

The company's global operations necessitate careful navigation of diverse employment laws, covering areas from worker safety to fair labor practices. In 2024, there was a notable trend towards strengthening employee protections and mandating more transparent hiring and compensation practices across many jurisdictions where WSP operates. WSP's adherence to these regulations is critical for maintaining a positive workforce and avoiding costly labor disputes.

Intellectual property rights are a critical legal consideration for WSP, particularly concerning its proprietary engineering designs, software, and consulting methodologies. Protecting these assets through patents, copyrights, and trademarks is vital for maintaining a competitive edge. The company actively monitors and litigates infringement cases to safeguard its innovations, a key aspect of its legal strategy in the knowledge-based services sector.

WSP's operations are subject to various tax laws and regulations in the numerous countries where it operates. These include corporate income tax, VAT/GST, and transfer pricing rules, which can significantly impact profitability. In 2024, global tax reforms and increased scrutiny on corporate tax avoidance strategies mean that WSP must ensure meticulous compliance and transparent reporting to mitigate risks.

Environmental factors

The escalating physical impacts of climate change, including more frequent extreme weather events and rising sea levels, are driving demand for resilient infrastructure. Resource scarcity is also a growing concern, pushing for innovative adaptation strategies. For instance, a 2024 report from the Intergovernmental Panel on Climate Change (IPCC) highlighted that the frequency of heavy precipitation events has increased globally, leading to greater flood risks.

WSP's Future Ready initiative is strategically positioned to capitalize on these environmental shifts. Their focus on climate adaptation and mitigation projects directly addresses the urgent need for solutions that can withstand and respond to these challenges. In 2024, WSP announced a significant expansion of its climate advisory services, aiming to support clients in navigating complex regulatory landscapes and implementing sustainable development practices.

The increasing scarcity of vital natural resources, such as rare earth metals and clean water, is profoundly reshaping industries. This scarcity, coupled with a growing global momentum towards circular economy principles, directly impacts how projects are conceived and the materials chosen. For instance, the UN Environment Programme reported in 2024 that global resource extraction had more than tripled since 1970, highlighting the urgency for change.

WSP leverages its deep expertise in sustainable resource management to address these challenges. The company actively promotes waste reduction and champions the integration of circularity within construction and infrastructure development. This involves rethinking material lifecycles, from initial sourcing to end-of-life reuse and recycling, thereby minimizing environmental footprints.

WSP's commitment to sustainability extends to tangible actions like reducing its own energy consumption. In 2023, the company reported a 15% decrease in absolute Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating a practical application of resource efficiency principles.

Furthermore, WSP actively pursues the procurement of renewable energy sources to power its operations. This strategic choice not only reduces its carbon emissions but also supports the broader transition to a low-carbon economy, aligning with the core tenets of resource conservation and environmental stewardship.

Growing global awareness and a stronger regulatory push for biodiversity protection and the valuation of natural capital are significantly influencing land development and infrastructure projects. This heightened focus means that companies must now consider the ecological impact of their endeavors more thoroughly, affecting project timelines, costs, and overall feasibility. For instance, in 2023, the European Union continued to strengthen its biodiversity strategy, aiming to restore at least 20% of the EU's land and sea areas by 2030, which directly impacts development plans across member states.

WSP actively embeds biodiversity protection and nature-positive strategies into its design processes, striving to harmonize development needs with essential ecological preservation. This approach ensures that projects not only meet functional requirements but also contribute positively to environmental health. For example, in 2024, WSP announced its commitment to developing nature-positive solutions for all its major projects, a significant step in integrating ecological considerations into mainstream engineering practices.

WSP’s Te Ara o Te Ata/Mount Messenger Bypass project in New Zealand serves as a prime example of this balanced approach. The project incorporated extensive measures for ecological restoration and protection, demonstrating how infrastructure development can coexist with environmental stewardship. This initiative, which saw significant progress in 2023, included the planting of native species and the creation of wildlife corridors to mitigate the impact on local ecosystems.

Pollution Control and Waste Management

Increasingly stringent environmental regulations, particularly concerning air, water, and soil pollution, are a significant driver for companies like WSP. These regulations, coupled with a growing emphasis on responsible waste management, directly fuel the demand for specialized environmental consulting services. WSP assists clients in navigating these complex standards and integrating sustainable waste management strategies across their projects.

WSP’s commitment to environmental stewardship is demonstrated by its substantial emissions reductions. As of their latest reporting, WSP has achieved a remarkable 68% reduction in total scope 1 and 2 greenhouse gas (GHG) emissions when compared to their 2018 baseline year. This achievement highlights their proactive approach to environmental responsibility within their own operations.

The company's services are crucial for clients aiming to comply with evolving environmental mandates. This includes:

- Developing strategies to meet or exceed pollution control standards.

- Implementing circular economy principles in waste management.

- Providing expertise in environmental impact assessments and remediation.

- Supporting clients in achieving their sustainability targets and reporting requirements.

Client and Investor Pressure for Green Building and Sustainable Infrastructure

Clients and investors are increasingly demanding green building certifications and sustainable infrastructure, fueled by Environmental, Social, and Governance (ESG) mandates and a focus on enduring value. This shift directly boosts the need for WSP's specialized knowledge in sustainable design, environmental impact assessments, and climate-resilient engineering. For instance, WSP reported that 71% of its revenue in 2023 was linked to the UN Sustainable Development Goals (SDGs), demonstrating a strong alignment with this growing market preference.

This growing preference translates into tangible opportunities for firms like WSP that can offer expertise in:

- Sustainable building design and certifications (e.g., LEED, BREEAM).

- Environmental impact assessments and regulatory compliance.

- Climate change adaptation and resilience planning for infrastructure.

- Life cycle assessment and resource efficiency strategies.

Environmental factors are critically shaping the infrastructure and consulting landscape, driven by climate change impacts and resource scarcity. WSP's strategic focus on climate adaptation and sustainable resource management directly addresses these growing global concerns, as evidenced by their expansion in climate advisory services in 2024.

The increasing demand for biodiversity protection and stringent pollution control regulations are also key environmental drivers. WSP's integration of nature-positive strategies and their significant GHG emission reductions, achieving a 68% decrease from their 2018 baseline, highlight their commitment to navigating and capitalizing on these environmental shifts.

The market's strong preference for green building certifications and ESG compliance, with 71% of WSP's 2023 revenue linked to UN SDGs, underscores the financial imperative for sustainable practices. This trend fuels demand for WSP's expertise in sustainable design, environmental assessments, and climate-resilient engineering.

| Environmental Driver | Impact on Industry | WSP's Response/Data |

|---|---|---|

| Climate Change & Extreme Weather | Demand for resilient infrastructure, adaptation strategies | Expanded climate advisory services (2024); IPCC data on increased heavy precipitation events |

| Resource Scarcity & Circular Economy | Need for sustainable materials, waste reduction | Promotes circularity in development; UN data shows resource extraction tripled since 1970 |

| Biodiversity Protection & Natural Capital | Increased scrutiny on land development impact | Commitment to nature-positive solutions (2024); ecological restoration in projects like Mount Messenger Bypass |

| Stringent Environmental Regulations | Demand for compliance, pollution control, waste management expertise | Achieved 68% GHG emission reduction (vs. 2018 baseline); assists clients with compliance |

| ESG & Green Building Demand | Growth in sustainable design, certifications | 71% of 2023 revenue linked to UN SDGs; expertise in LEED/BREEAM |

PESTLE Analysis Data Sources

Our Water Security and Public Engagement (WSP) PESTLE analysis is meticulously constructed using data from official government water management bodies, international environmental organizations, and leading academic research institutions. This ensures a comprehensive understanding of policy, environmental, and societal influences.