WSP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WSP Bundle

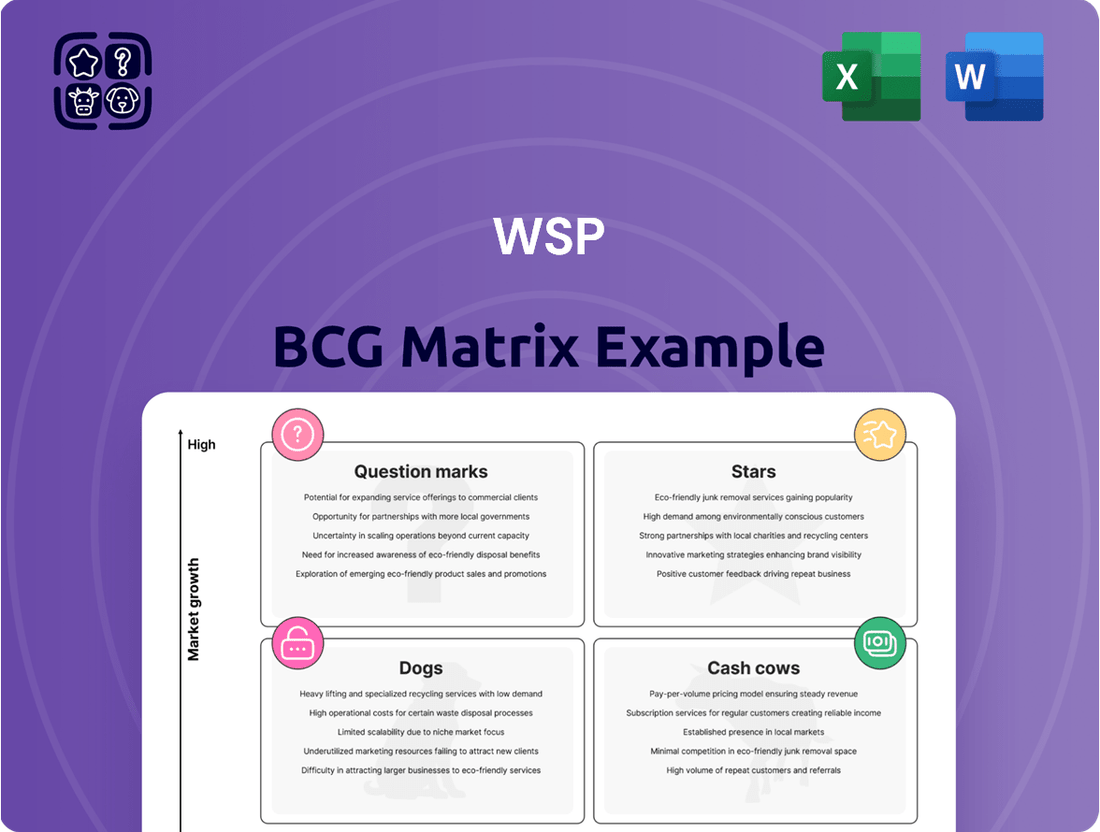

Understanding the Boston Consulting Group (BCG) Matrix is crucial for any business looking to optimize its product portfolio and resource allocation. This powerful framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual representation of their market share and growth potential. By analyzing these placements, you can identify areas for investment, divestment, and strategic focus.

This preview offers a glimpse into how the BCG Matrix can illuminate your company's product landscape. Imagine having a clear roadmap to prioritize your most promising products and efficiently manage those that are underperforming. The insights gained can significantly impact your profitability and long-term market position.

Don't settle for a partial understanding; unlock the full strategic advantage with our comprehensive BCG Matrix. Purchase the complete report to gain detailed quadrant placements, data-driven recommendations, and a clear action plan for smart investment and product decisions. Elevate your strategic planning today!

Stars

WSP is aggressively investing in digital transformation, pouring resources into AI, geospatial technology, and predictive analytics. This strategy directly addresses the burgeoning demand for technologically advanced infrastructure solutions, a market segment experiencing substantial growth. Their commitment is evidenced by a strategic partnership with Microsoft, specifically aimed at revolutionizing the architecture, engineering, and construction (AEC) sector with cutting-edge digital and AI capabilities.

The global energy transition is a rapidly expanding market, and WSP is strategically positioned to capitalize on this trend. Their late 2024 acquisition of POWER Engineers significantly enhances their expertise in the power and energy sector, making them a leader in North America. This move directly supports WSP's strategic objective to drive growth through energy transition initiatives.

WSP's focus on Climate Change Adaptation & Resilience positions it strongly within the consulting landscape. In 2024, a significant 65.1% of its annualized revenues were linked to the UN Sustainable Development Goals, highlighting its leadership in a burgeoning market. This segment is fueled by the escalating global need for sustainable practices and decisive climate action.

The firm's proficiency in crucial areas such as sustainable stormwater management and biodiversity preservation underscores its leading role. These specialized services cater to a growing demand for environmental solutions, reinforcing WSP's market share in this vital and expanding sector.

Complex Transportation & Infrastructure Projects

WSP's transportation and infrastructure segment is a powerhouse, driving significant growth and representing its largest operational area. This sector is currently experiencing exceptionally high demand, which is a key factor in WSP's impressive backlog.

As of the first quarter of 2025, WSP reported a record backlog of $16.6 billion. This substantial figure is particularly noteworthy because it translates to 11.3 months of revenue, underscoring the company's strong market position and the ongoing demand for its services.

The company anticipates this robust demand to persist throughout 2025, fueled by the need for large, intricate projects. These often include complex undertakings such as major bridge rehabilitations and the expansion of urban public transit systems, areas where WSP excels.

- Largest Segment: Transportation and infrastructure is WSP's biggest business area.

- Record Backlog: The company secured a $16.6 billion backlog by Q1 2025, representing 11.3 months of revenue.

- Sustained Demand: High demand for complex projects, like bridge reconstruction and transit expansion, is expected to continue in 2025.

Advisory Services for Strategic Sectors

WSP is strategically bolstering its advisory services, focusing on dynamic sectors like energy resilience, policy strategy, and project and program management.

The anticipated acquisition of Ricardo, slated for completion in the fourth quarter of 2025, is a key move to enhance WSP's expertise in rail, air quality, water management, and energy resilience advisory. This acquisition directly supports WSP's 2025-2027 Global Strategic Action Plan, aimed at accelerating growth in crucial, high-demand sectors.

These strategic expansions are designed to position WSP as a leader in providing comprehensive solutions for complex global challenges.

- Energy Resilience: WSP is investing heavily in advisory services that help clients navigate the evolving energy landscape, focusing on sustainable and reliable energy solutions.

- Policy Strategy: The firm is enhancing its capabilities in advising governments and organizations on effective policy development and implementation, particularly in areas impacting infrastructure and environment.

- Project & Program Management: WSP's advisory in this area ensures efficient execution of large-scale projects, leveraging best practices and innovative management techniques.

- Ricardo Acquisition Synergies: The integration of Ricardo's specialized knowledge in rail, air quality, water, and energy resilience will significantly broaden WSP's advisory portfolio and market reach.

Stars in the BCG Matrix represent high-growth, high-market-share business units. For WSP, its Transportation and Infrastructure segment clearly fits this description. The company is experiencing robust demand in this area, as evidenced by its record backlog.

This segment's strength is further demonstrated by its consistent revenue generation and its ability to secure large, complex projects. WSP's strategic investments and acquisitions, such as the POWER Engineers deal which bolsters its energy sector presence, also indicate a focus on nurturing potential future stars.

WSP's commitment to digital transformation, including AI and geospatial technology, is also a key factor in positioning its services as stars. These advanced capabilities meet the growing demand for technologically sophisticated infrastructure solutions, further solidifying its leading market position.

The firm's emphasis on Climate Change Adaptation & Resilience, with a significant portion of its revenue tied to UN Sustainable Development Goals, also points towards star potential. This aligns with increasing global demand for sustainability and climate action.

| Business Segment | Market Growth | Market Share | WSP's Position |

|---|---|---|---|

| Transportation & Infrastructure | High | High | Star (Leading, high demand) |

| Energy Transition | High | Growing (enhanced by acquisition) | Potential Star |

| Climate Change Adaptation & Resilience | High | High (significant SDG revenue link) | Star |

| Advisory Services (Energy Resilience, Policy) | High | Growing (enhanced by acquisition) | Potential Star |

What is included in the product

The WSP BCG Matrix analyzes a company's portfolio by product, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Strategic clarity by showing where each business unit belongs.

Cash Cows

WSP's traditional civil and structural engineering services for buildings and infrastructure are a cornerstone of its business. This segment operates in a mature market where WSP has cultivated a significant market share, a testament to its robust brand recognition and deep operational expertise.

While this sector may not see rapid expansion, it reliably generates substantial revenue and healthy cash flow. This stability is underpinned by WSP's long-standing track record of delivering complex projects and fostering enduring client relationships.

For instance, WSP's involvement in major infrastructure projects, such as those contributing to the global transportation sector, exemplifies the consistent demand for its foundational engineering capabilities. In 2024, the company continued to leverage its expertise in these areas, securing contracts for critical public works that underscore its market leadership.

WSP's Standard Environmental Consulting & Remediation business is a classic Cash Cow. As one of the largest environmental consulting firms globally, WSP commands a strong position in foundational services such as compliance, permitting, and routine remediation. This segment thrives in a mature, yet indispensable market, reliably producing steady profits and robust cash flow.

The need for regulatory compliance and ongoing environmental management ensures a consistent client base, reducing the necessity for heavy promotional spending. WSP's strategic acquisition of Golder in 2020 significantly bolstered its capabilities and market share in this established sector, reinforcing its Cash Cow status.

WSP's Property & Building Design Services function as a Cash Cow within the BCG Matrix. This segment boasts a significant market share, particularly in commercial and residential development design and engineering.

The market for these services is mature, ensuring consistent demand and predictable revenue streams for WSP, especially in established economies where the company has deep roots.

In 2023, WSP reported substantial revenue from its Property and Buildings sector, with design and engineering services being a core component, underscoring its Cash Cow status. This sector consistently delivers strong, stable profits, allowing WSP to fund investments in other business areas.

Routine Project Management & Construction Supervision

WSP's routine project management and construction supervision services represent a significant Cash Cow. This segment holds a high market share due to its essential nature across various sectors, ensuring consistent demand and revenue generation.

These services are fundamental to project success, providing WSP with a stable income stream. The predictable nature of these operations allows the company to effectively 'milk' its established position in the market.

- Revenue Contribution: In 2023, WSP reported total revenue of CAD 14.4 billion, with its Operations & Projects (OP) segment, which includes these services, being a substantial contributor.

- Profitability: The OP segment consistently demonstrates strong profitability, reflecting the mature and efficient nature of its project management and supervision offerings.

- Market Position: WSP is recognized as a leading global provider of these services, underscoring its dominant market share.

Water Infrastructure Engineering

WSP's water infrastructure engineering operations represent a significant cash cow within its portfolio. The company leverages its deep expertise and substantial market presence across critical areas like drinking water, wastewater treatment, and stormwater management. This consistent demand stems from the essential nature of these services, driving ongoing public and private sector investment for maintenance and upgrades.

The water infrastructure sector is known for its maturity and stability, offering WSP a reliable revenue stream. This predictability is crucial, especially in an environment where infrastructure renewal and expansion are continuous necessities. In 2024, global spending on water infrastructure is projected to remain robust, with estimates suggesting trillions of dollars will be invested over the next decade to address aging systems and increasing demand.

- Stable Revenue: The essential nature of water services ensures consistent demand and predictable revenue for WSP.

- Market Position: WSP holds a strong position in a mature market, benefiting from its extensive experience.

- Investment Trends: Ongoing public and private investment in upgrading and maintaining water systems fuels this sector's performance.

- Global Spending: Projections indicate significant global investment in water infrastructure continues through 2024 and beyond.

WSP's established environmental consulting services, particularly in compliance and routine remediation, function as a classic Cash Cow. This segment benefits from a mature market where WSP holds a significant market share, ensuring steady profits and robust cash flow without requiring substantial investment.

The ongoing need for regulatory adherence and environmental management creates a consistent client base, minimizing the need for aggressive marketing. WSP's acquisition of Golder in 2020 further solidified its leading position in this indispensable sector.

WSP's property and building design services are another strong Cash Cow, characterized by a substantial market share in commercial and residential design. This segment thrives in a mature market, delivering predictable revenue and strong, stable profits that WSP can reinvest.

In 2023, WSP's Property and Buildings sector, driven by design and engineering, demonstrated its Cash Cow status with significant revenue generation.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

| Environmental Consulting (Compliance & Remediation) | Cash Cow | Mature market, high market share, stable demand, low investment needs | Substantial (part of larger segments) |

| Property & Building Design Services | Cash Cow | Mature market, significant market share, predictable revenue, strong profitability | CAD 4.5 billion (Property & Buildings segment) |

What You’re Viewing Is Included

WSP BCG Matrix

The WSP BCG Matrix document you are previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just a complete, ready-to-use strategic planning tool designed for actionable insights.

Dogs

Highly commoditized basic surveying services often find themselves in a tough spot. In many markets, these services are so common that companies end up competing mainly on price. This intense competition can really squeeze profit margins, making it hard to generate substantial returns. For a large global firm like WSP, these segments might not offer much in the way of strategic advantage or growth potential.

These basic surveying offerings can also be quite separate from WSP's more advanced, innovative services. When a service line isn't well-connected to the company's higher-value activities, it can lead to a smaller market share and limited growth opportunities within the broader portfolio. Think of it like a small, standalone operation within a much larger, more dynamic business.

In the 2024 landscape, many companies offering basic surveying are likely operating at or near a break-even point. This means they are using up capital and resources without generating significant profit. For instance, while specific data for WSP's commoditized segments isn't publicly broken down, industry reports from 2024 suggest that generalist surveying firms in mature markets saw revenue growth in the low single digits, often offset by rising operational costs.

Integrating legacy IT systems for outdated platforms, particularly those not central to digital transformation, would likely fall into the Dogs quadrant of the WSP BCG Matrix. These are niche services with minimal growth prospects as businesses move towards modernized solutions. For example, in 2024, while the global IT services market is projected to reach over $1.5 trillion, the segment focused solely on maintaining and integrating very old, non-strategic systems is shrinking as clients prioritize cloud migration and digital-native architectures.

Undifferentiated small-scale local consultancies within WSP's network often represent engagements that don't fully utilize the company's extensive global resources or sophisticated solutions. These projects typically have a minor footprint in terms of market share and growth within the larger WSP ecosystem.

These smaller, localized efforts can sometimes consume valuable resources without yielding substantial returns or aligning closely with WSP's overarching strategic goals. For example, in 2024, WSP's diverse project portfolio includes numerous large-scale infrastructure developments where the return on investment is clearly defined, contrasting with these smaller, less strategic engagements.

Their limited differentiation means they might not command premium pricing, and their growth trajectory is often constrained by local market dynamics rather than global trends that WSP typically addresses. This can lead to a situation where the operational costs associated with managing these small consultancies outweigh their contribution to WSP's overall profitability or market leadership.

Niche Advisory for Declining Conventional Industries

Within the WSP BCG Matrix, niche advisory services targeting declining conventional industries would be classified as Dogs. These are segments where demand is consistently shrinking, making it difficult for WSP to maintain or grow its market share. For instance, advisory services focused on traditional print media or certain legacy manufacturing sectors might fall into this category.

These Dog segments are characterized by low growth and low relative market share. While WSP might possess some specialized expertise, the overall market contraction limits the potential for significant revenue generation or strategic advantage. For example, consider the global newspaper advertising revenue, which has seen a steady decline; advisory firms specializing solely in this area would likely operate within a Dog quadrant.

The strategic implication for WSP is to carefully manage these Dog segments. This could involve minimizing investment, milking existing contracts for short-term cash flow, or exploring divestment options if feasible. The focus is on preventing these segments from draining resources that could be better allocated to Stars or Question Marks.

- Declining Demand: Industries like physical media distribution or landline telephone services exhibit consistent negative growth.

- Low Market Share: WSP's advisory presence in highly specialized, shrinking sub-sectors of these industries is likely minimal.

- Resource Drain: Continued investment in these areas may yield diminishing returns and divert capital from more promising ventures.

- Potential Divestment: For specialized advisory units tied to these declining sectors, WSP might consider strategic exits or consolidation.

Basic Environmental Impact Assessments (Commoditized)

Basic Environmental Impact Assessments (EIAs), when highly standardized and offered in saturated markets, can be considered Dogs within the WSP BCG Matrix. In these scenarios, competition intensifies, leading to reduced pricing power and lower profit margins for WSP. For instance, in 2024, the global environmental consulting market saw intense competition in the basic EIA segment, with many firms offering similar services, driving down typical project fees.

- Low Differentiation: Standardized EIAs offer little room for WSP to showcase its unique sustainability expertise.

- Saturated Markets: Many competitors in these segments mean a struggle for market share.

- Profit Margin Pressure: Increased competition often leads to lower profit margins, potentially below WSP's desired thresholds.

- Limited Upselling: These commoditized services offer fewer opportunities to cross-sell more advanced or specialized sustainability solutions.

Dogs in the WSP BCG Matrix represent services with low growth and low relative market share. These are often commoditized offerings where competition is fierce, squeezing profit margins. For WSP, these segments may not align with strategic goals or offer significant growth potential, potentially draining resources.

For instance, basic surveying services in mature markets, or advisory for declining industries like print media, fit this description. In 2024, while the broader consulting market shows resilience, these niche, low-growth areas might see minimal revenue increases, often offset by operational costs.

The strategic approach for Dogs involves minimizing investment, focusing on short-term cash flow, or considering divestment. This ensures capital is redirected to more promising ventures within WSP's portfolio.

| Service Segment Example | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|

| Basic Surveying (Saturated Markets) | Low (e.g., 1-3% in 2024) | Low | Minimize Investment, Consider Divestment |

| Advisory for Declining Industries | Negative | Low | Milk for Cash Flow, Strategic Exit |

| Legacy IT System Integration | Shrinking | Low | Resource Reallocation, Focus on Modernization |

| Undifferentiated Local Consultancies | Low (Local Market Dependent) | Low | Consolidation, Resource Optimization |

Question Marks

WSP is making significant investments in advanced AI and machine learning, signaling a strong conviction in the burgeoning market for infrastructure optimization. This includes areas like predictive maintenance and the development of smart cities, where these technologies promise substantial growth. For instance, WSP's commitment to digital solutions aligns with a projected global market for AI in infrastructure that analysts anticipate will reach tens of billions of dollars by the late 2020s.

However, because AI and ML for infrastructure optimization are still relatively new and highly specialized fields, WSP's current market share in these specific niches is likely still in its formative stages. This positions these advanced AI capabilities as Question Marks within the BCG matrix – areas demanding considerable investment to cultivate and establish a leading market position.

The market for revolutionary transport, like hyperloop, is brimming with potential but remains largely unproven, making it a classic question mark in the BCG matrix. WSP's engagement in "New Mobility" signifies their strategic interest in exploring these nascent sectors, even though their current market share in hyperloop specifically is minimal. This positions hyperloop as a "question mark" needing substantial investment to climb the growth curve.

Carbon Capture, Utilization, and Storage (CCUS) represents a burgeoning sector within the global energy transition, poised for significant growth. By 2030, the global CCUS market is projected to reach $17.2 billion, up from $3.7 billion in 2023, according to Precedence Research. This expansion signifies a substantial opportunity for advisory services, though the market is still developing.

WSP, with its strong commitment to sustainability, is well-positioned to capitalize on the CCUS advisory market. However, as a relatively new entrant, WSP's market share would initially be modest compared to established engineering and environmental consultancies already active in this space. Significant investment will be necessary for WSP to scale its CCUS advisory capabilities effectively and gain a competitive edge.

Strategic Advisory for Space Infrastructure

WSP's involvement in space infrastructure advisory, such as supporting lunar bases or satellite network development, positions it as a significant 'Question Mark' within the BCG Matrix. This sector is characterized by immense future potential but currently represents a nascent market with substantial entry barriers and technological uncertainties for established engineering firms.

The global space economy is projected for robust growth, with estimates suggesting it could reach $1 trillion by 2040, according to Morgan Stanley. For WSP, this presents a high-risk, high-reward opportunity; while their current market share in this specific niche is likely minimal, success could redefine their service portfolio.

- High Growth Potential: The space infrastructure market is expected to expand significantly due to increased commercialization and government investment in space exploration and utilization.

- Low Current Market Share: Traditional engineering firms like WSP typically have a very small footprint in this highly specialized and futuristic domain.

- High Risk and Investment: Developing expertise and capabilities for space infrastructure requires substantial upfront investment in research, technology, and specialized talent.

- Strategic Exploration: WSP is likely exploring this area as a strategic initiative to diversify and capture future market opportunities, aligning with the 'Question Mark' quadrant's characteristics of high market growth and low relative market share.

Advanced Digital Twin & Metaverse for Built Environment

The integration of digital twin and metaverse technologies within the built environment presents a significant growth frontier, promising enhanced lifecycle management, sophisticated simulations, and immersive visualization capabilities. This burgeoning sector saw global investment in digital twins reach an estimated $6.9 billion in 2023, with projections indicating a substantial increase as adoption accelerates.

WSP is actively developing its digital capabilities in this space, recognizing the immense potential for value creation in areas like predictive maintenance and virtual prototyping. However, in these highly advanced and intricate applications, WSP's current market share is likely nascent, reflecting the early stages of development and the substantial investment needed to secure a leadership position.

- High Growth Potential: The digital twin market for the built environment is projected to grow from approximately $3.5 billion in 2022 to over $15 billion by 2027, indicating strong future revenue opportunities.

- WSP's Strategic Focus: WSP's investment in digital transformation, including advanced analytics and immersive technologies, positions it to capitalize on these trends.

- Market Share Dynamics: While WSP is building its presence, the competitive landscape is evolving rapidly, with early movers and tech giants also investing heavily in this sector.

- Investment Requirements: Dominating these complex digital twin and metaverse applications will necessitate continued, significant investment in R&D, talent acquisition, and platform development.

Question Marks represent business areas or initiatives with high growth potential but low current market share. These are typically new or emerging markets where WSP is investing heavily to establish a foothold and gain market leadership. The key challenge is transforming these ventures from Question Marks into Stars through sustained investment and strategic execution.

For WSP, areas like advanced AI for infrastructure, revolutionary transport solutions such as hyperloop, Carbon Capture, Utilization, and Storage (CCUS) advisory, space infrastructure, and digital twin/metaverse applications in the built environment all fit the Question Mark profile. These sectors promise substantial future growth, driven by technological advancements and global trends like sustainability and digitalization.

The significant investments WSP is making in these emerging fields underscore a strategic commitment to innovation and future market capture. Success in these areas hinges on WSP's ability to navigate technological complexities, build expertise, and outpace competitors in rapidly evolving landscapes.

| Area | Growth Potential | Current Market Share | Investment Needs | Strategic Rationale |

|---|---|---|---|---|

| AI in Infrastructure | Very High (tens of billions by late 2020s) | Low (nascent) | High (R&D, talent) | Optimization, predictive maintenance, smart cities |

| Revolutionary Transport (e.g., Hyperloop) | High (unproven but transformative) | Minimal (early stages) | High (technology development, pilots) | Future mobility solutions |

| CCUS Advisory | High ($17.2B by 2030) | Moderate (growing competition) | Significant (scaling expertise) | Energy transition, sustainability |

| Space Infrastructure | Very High ($1T by 2040) | Low (highly specialized) | Very High (research, unique tech) | Long-term diversification, frontier markets |

| Digital Twin/Metaverse in Built Environment | High ($15B by 2027) | Low (early adoption) | High (platform development, integration) | Enhanced lifecycle management, immersive design |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.