WSP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WSP Bundle

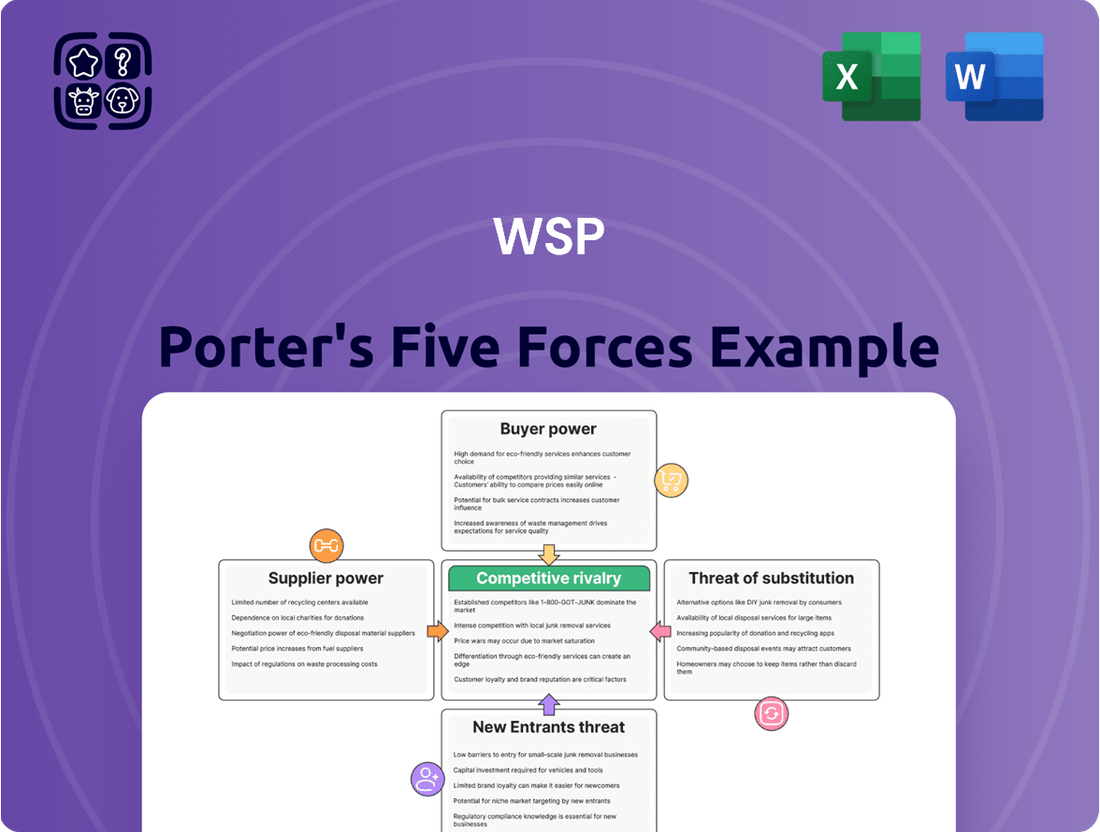

WSP's competitive landscape is shaped by five key forces, revealing the intensity of rivalry, the power of suppliers and buyers, and the ever-present threats of new entrants and substitutes. Understanding these dynamics is crucial for navigating the consulting engineering sector. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore WSP’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

WSP's reliance on highly skilled labor, such as engineers and project managers, grants significant bargaining power to this supplier group. The scarcity of specialized professionals in areas critical to WSP's operations, combined with robust demand, can lead to increased labor costs.

For instance, in 2024, the global demand for specialized engineering talent remained high, with certain niche sectors experiencing talent shortages. This dynamic allows skilled individuals and labor unions to negotiate for better compensation and working conditions, directly impacting WSP's operational expenses.

To mitigate this, WSP must implement competitive compensation packages and focus on effective talent retention strategies to secure and maintain its essential workforce. Failure to do so could result in higher project costs and potential delays.

Suppliers of specialized engineering software, like Building Information Modeling (BIM) and Computer-Aided Design (CAD) tools, wield considerable leverage. This power stems from the proprietary nature of their technology and the substantial costs and effort involved in switching to alternative systems. For a company like WSP, deeply reliant on these advanced platforms for seamless project execution, this dependence allows suppliers to dictate pricing and contractual terms, directly affecting operational expenditures.

Access to state-of-the-art technology is not merely an advantage but a necessity for WSP to retain its competitive edge in the global engineering and professional services market. The market for these specialized software solutions is concentrated, with a few key players dominating. For instance, Autodesk, a major provider of design and engineering software, reported revenues of $5.1 billion in 2023, highlighting the significant financial scale and influence of such suppliers.

For highly specialized projects, like complex infrastructure designs or those needing unique local regulatory expertise, WSP often relies on sub-consultants. If there are only a handful of firms possessing this niche skill set, their ability to negotiate higher fees, known as bargaining power, significantly increases. This can impact WSP's project costs and profitability.

To counter this, WSP actively cultivates a wide and diverse network of potential sub-consultant partners. This broadens their options and reduces reliance on any single specialist. Furthermore, the company strategically invests in developing its own in-house capabilities for certain specialized areas, thereby internalizing expertise and lessening external dependency.

Global Supply Chain for Project Materials

While WSP is a consulting firm, its influence in specifying materials for projects can create a degree of bargaining power for suppliers. This is particularly true when specific, high-performance, or proprietary materials are required for complex engineering solutions. For instance, in 2024, the global construction materials market saw significant price volatility, with lumber prices fluctuating by as much as 20% and steel prices experiencing a 15% increase due to supply chain disruptions and demand shifts. This volatility means suppliers who can guarantee consistent availability and pricing for specialized components can hold considerable sway.

The bargaining power of suppliers for WSP is generally moderate, primarily because WSP is a service provider and not a direct high-volume purchaser of raw materials. However, disruptions in the supply chain for critical components, such as specialized electrical equipment or advanced composites used in infrastructure projects, can create leverage for those suppliers. For example, reports in early 2024 indicated lead times for certain advanced engineering components had extended by up to 50%, allowing suppliers of these niche items to command higher prices or dictate terms. WSP's ability to source alternative materials or design around specific supplier dependencies mitigates this power to some extent.

- Supplier Concentration: The market for many construction and engineering materials is fragmented, reducing individual supplier power.

- Material Substitutability: For many standard materials, WSP can often specify alternatives, limiting supplier leverage.

- Project Scale: While WSP manages large projects, its role is often advisory, meaning it doesn't typically wield the purchasing volume of a direct contractor.

- Supplier Dependence on WSP: In cases where WSP's specifications are critical for market entry or significant project wins, suppliers may have less bargaining power.

IT Infrastructure and Data Services

WSP’s reliance on IT infrastructure, cloud services, and data management solutions from external vendors means these technology suppliers hold significant bargaining power. The growing sophistication and vital role of data security and digital collaboration tools amplify this influence.

For instance, major cloud providers like Microsoft Azure and Amazon Web Services (AWS) are critical for many global firms, including WSP, to manage their extensive data. These providers often have limited direct competitors for certain advanced services, allowing them to dictate terms. In 2024, the global IT infrastructure market continued its growth trajectory, with cloud services accounting for a substantial and increasing portion of IT spending by large enterprises.

- High switching costs: Migrating complex IT systems and vast datasets to new providers can be prohibitively expensive and time-consuming.

- Concentration of providers: A few dominant players control large segments of the cloud computing and specialized data services market.

- Criticality of services: Disruption to IT infrastructure or data services can halt WSP's global operations and impact client trust.

- Demand for specialized solutions: The need for advanced cybersecurity and data analytics tools further consolidates power with providers offering these niche capabilities.

The bargaining power of suppliers for WSP is generally moderate, influenced by the availability of substitutes and the concentration of suppliers. While WSP leverages its scale to negotiate, reliance on specialized inputs like advanced engineering software or niche expertise can empower specific vendors. For instance, the continued demand for specialized engineering talent in 2024 meant that skilled professionals could command higher wages, impacting labor costs for companies like WSP.

The concentration of providers in critical areas like IT infrastructure and cloud services also grants significant leverage to these suppliers. High switching costs associated with migrating complex systems and vast datasets mean WSP must carefully manage relationships with these essential technology partners. The global IT infrastructure market, with cloud services forming an increasing share of enterprise spending in 2024, underscores this reliance.

| Supplier Category | Bargaining Power Factors | Impact on WSP | 2024 Context/Data |

|---|---|---|---|

| Skilled Labor | Scarcity of specialized talent, robust demand | Increased labor costs, potential project delays | High demand for engineers, niche talent shortages reported |

| Specialized Software | Proprietary technology, high switching costs | Dictated pricing, contractual terms, increased operational expenditures | Autodesk revenue $5.1 billion (2023); continued reliance on BIM/CAD |

| IT Infrastructure/Cloud Services | High switching costs, concentration of providers, criticality of services | Leverage for vendors, dictates terms | Continued growth in cloud services spending by large enterprises |

What is included in the product

This analysis unpacks the competitive forces impacting WSP, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and WSP's strategic positioning within this framework.

Easily identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force.

Customers Bargaining Power

Government agencies and public bodies represent significant customers for WSP, especially through large-scale infrastructure and transportation projects. These clients, often operating under stringent procurement regulations, wield considerable bargaining power. Their ability to select from numerous qualified engineering and consulting firms, coupled with a strong emphasis on cost-effectiveness and detailed specifications, allows them to negotiate favorable terms.

Large private sector clients, especially in sectors like energy, mining, and real estate, often possess their own engineering and project management teams. This capability gives them significant bargaining power. They can directly compare WSP's proposed fees against their internal operational costs, creating a benchmark for value.

This internal capacity allows these clients to exert pressure on pricing. WSP must therefore consistently prove its specialized expertise and operational efficiency to justify engaging external services. For example, a major oil and gas company with a robust internal engineering division might be less willing to pay a premium for services it believes it can perform adequately in-house.

The project-based nature of professional services, common in sectors where WSP operates, means clients frequently issue tenders for specific projects. This process inherently empowers customers by opening the door to multiple bids from various qualified firms. For instance, in 2024, major infrastructure projects often saw dozens of engineering and consulting firms competing for contracts, driving down prices as firms vie for the work.

This solicitation of numerous bids directly translates into heightened competition and a stronger negotiating position for clients. They can leverage the array of proposals to secure more favorable terms, including better pricing and service level agreements. WSP’s response must be a continuous focus on differentiation through demonstrable innovation, unwavering quality, and a robust, proven track record to stand out in this environment.

Importance of Reputation and Track Record

While clients can exert considerable bargaining power, WSP's robust reputation and extensive track record of successfully delivered projects, especially those involving complex engineering and infrastructure, serve to mitigate this influence. Clients undertaking critical or highly specialized projects often prioritize proven expertise and the reduction of execution risk over solely focusing on the lowest price. This emphasis on long-term value and reliability fosters client loyalty, making them less sensitive to minor price variations.

WSP's global presence and deep specialization in areas like sustainable infrastructure and digital engineering further bolster its position. For instance, in 2023, WSP reported revenues of CAD 14.4 billion, showcasing its scale and the demand for its specialized services. This established capability allows WSP to command premium pricing for its unique offerings, thereby reducing the bargaining power of customers who require such specialized solutions.

- Proven Expertise: WSP's history of completing large-scale, complex projects worldwide demonstrates its capability and reduces perceived risk for clients.

- Specialized Offerings: Deep expertise in niche areas like sustainable design and digital transformation creates unique value propositions that lessen price sensitivity.

- Client Loyalty: A strong track record fosters repeat business and long-term relationships, reducing the likelihood of clients switching based solely on price.

- Risk Mitigation: For high-stakes projects, clients are often willing to pay more for a provider with a demonstrable ability to deliver successfully and on time.

Client Access to Industry Benchmarks

Clients, particularly those with a strong understanding of the consulting landscape, can easily access industry benchmarks for both pricing and the expected results of projects. This readily available information allows them to compare WSP's proposals against market standards and negotiate more effectively on fees and deliverables.

This transparency means WSP needs to ensure its pricing strategies are competitive. It's crucial for WSP to clearly communicate the distinctive value and the tangible return on investment that clients can expect from engaging their services.

- Client Empowerment Through Data: Sophisticated clients often leverage industry reports and peer comparisons to gauge fair market pricing for consulting services.

- Negotiation Leverage: Access to benchmarks gives clients a strong position to negotiate WSP's fees and project scope, demanding competitive rates.

- WSP's Value Proposition: WSP must articulate its unique selling points and the ROI it delivers to justify its pricing beyond simple benchmark comparisons.

- Market Dynamics: In 2024, the consulting market saw increased demand for outcome-based pricing, reflecting clients' desire for quantifiable results and cost transparency.

The bargaining power of customers for WSP is substantial, driven by clients' ability to source services from multiple providers and their increasing access to market data. This allows them to negotiate for better pricing and terms, especially on large infrastructure projects where competition is fierce, as seen in 2024 with numerous engineering firms bidding on contracts. WSP must therefore emphasize its unique value proposition and proven expertise to justify its fees and secure favorable project agreements, as clients can easily benchmark services and demand competitive rates.

| Customer Segment | Bargaining Power Drivers | WSP's Mitigation Strategies |

|---|---|---|

| Government Agencies | Stringent procurement, cost-effectiveness focus, multiple qualified bidders | Demonstrating specialized expertise, long-term value, risk reduction |

| Large Private Sector Clients | Internal engineering capacity, ability to benchmark against internal costs | Highlighting unique capabilities, operational efficiency, proven track record |

| General Client Base | Access to industry pricing benchmarks, project-based tendering | Clear communication of ROI, articulation of unique selling points, competitive pricing |

What You See Is What You Get

WSP Porter's Five Forces Analysis

The document you see is the exact, professionally crafted WSP Porter's Five Forces Analysis you will receive immediately after purchase. This preview showcases the complete, ready-to-use report, ensuring no surprises or placeholder content. You'll gain instant access to this comprehensive analysis, formatted and prepared for your strategic planning needs.

Rivalry Among Competitors

The engineering and professional services consulting market is incredibly fragmented, featuring a significant number of large, highly capable global players. Firms like AECOM, Jacobs, Arcadis, and Stantec are prominent examples, all offering extensive service portfolios that directly overlap with WSP's core business areas. This widespread presence of formidable competitors fuels intense rivalry for significant projects on a global scale.

This fierce competition isn't just about winning contracts; it's also a constant battle for market share and top talent. Companies actively compete to attract and retain skilled professionals, as human capital is a critical differentiator in this knowledge-intensive industry. The drive to secure lucrative projects and maintain a competitive edge in talent acquisition intensifies the rivalry among these global giants.

For example, in 2023, the global market for management consulting, a segment closely related to engineering and professional services, was valued at approximately $335 billion, indicating a substantial and competitive landscape. Major industry players consistently report significant revenue growth, underscoring their ability to win large-scale projects amidst this competitive pressure. WSP itself reported revenues of CAD 14.4 billion for the fiscal year 2023, demonstrating its significant standing within this dynamic market.

Competitive rivalry in the consulting sector is intense, but WSP differentiates itself by focusing on specialized expertise rather than broad service offerings. This approach allows WSP to command premium pricing for its high-value advisory services and complex, innovative solutions, setting it apart from competitors offering more generalized or commoditized services. For instance, WSP's significant investments in areas like digital engineering and sustainability consulting, which are projected to see substantial growth in demand through 2025, directly address evolving client needs and market trends.

In commoditized areas of engineering and environmental services, where offerings are largely standardized, price competition intensifies. This is particularly true for routine projects or in established markets where differentiation is minimal. WSP faces the challenge of remaining competitive on price in these segments while simultaneously securing higher-margin, specialized work.

This intense price pressure can significantly erode profit margins, especially for projects that are less complex or require less specialized expertise. For instance, in 2024, many infrastructure maintenance contracts saw bidding wars where the lowest price often determined the winner, impacting overall profitability for firms involved in such bids.

WSP needs to carefully manage its project portfolio, balancing the need to participate in broader market segments with the strategic pursuit of projects that allow for greater value capture through specialized knowledge and innovation. This dual approach is crucial for maintaining financial health and market share.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) are a constant feature in the professional services sector, significantly shaping competitive dynamics. This consolidation leads to the emergence of larger, more dominant players, thereby intensifying rivalry for all firms, including WSP. These strategic combinations enable companies to broaden their service portfolios, extend their global footprint, and acquire valuable expertise, compelling competitors like WSP to remain agile and strategic in their own expansion plans.

WSP Global has demonstrably participated in this M&A trend. For instance, in 2023, WSP completed the acquisition of the transportation and infrastructure consulting firm AECOM's Australia and New Zealand business for approximately $97 million CAD. This move expanded WSP's presence in a key market and added significant talent and project capabilities, directly impacting its competitive standing.

- Industry Consolidation: The professional services industry saw significant M&A activity in 2023 and early 2024, with major engineering and consulting firms actively pursuing acquisitions to gain market share and capabilities.

- WSP's M&A Strategy: WSP Global has consistently pursued strategic acquisitions to enhance its service offerings and geographic reach, reflecting a proactive approach to competitive positioning.

- Impact on Rivalry: Acquisitions create larger, more integrated competitors, increasing pressure on existing players like WSP to innovate and optimize their own growth strategies to maintain competitiveness.

- Talent and Service Expansion: M&A allows firms to quickly acquire new talent pools and specialized service lines, offering a competitive advantage over those relying solely on organic growth.

Talent Scarcity and Retention

Talent scarcity significantly intensifies competitive rivalry in the engineering and consulting sector. Firms are locked in a fierce battle to secure and keep highly skilled professionals, such as engineers, planners, and project managers. This demand is driven by the knowledge-intensive nature of the work, where expertise directly impacts project success and firm reputation.

The ability to offer compelling career development, engaging and innovative projects, and a positive work environment is paramount. Companies that excel in these areas gain a crucial advantage in attracting top-tier talent, which is essential for maintaining their project delivery capabilities and overall market standing. For instance, in 2024, many leading firms reported increased hiring targets for specialized engineering roles, highlighting the ongoing talent crunch.

- Talent Demand: Engineering and consulting firms are actively seeking specialized talent, with demand for civil, environmental, and electrical engineers remaining high in 2024.

- Retention Strategies: Companies are investing more in professional development, flexible work arrangements, and competitive compensation packages to retain key employees.

- Impact on Projects: A shortage of skilled personnel can lead to project delays and increased costs, directly affecting a firm's profitability and client satisfaction.

- Competitive Advantage: Firms with a strong employer brand and a reputation for nurturing talent are better positioned to win bids and execute complex projects successfully.

The competitive rivalry within the engineering and professional services consulting market is exceptionally high, driven by a fragmented industry structure populated by numerous capable global players. Firms like AECOM, Jacobs, Arcadis, and Stantec, alongside WSP, offer overlapping service portfolios, leading to intense competition for major projects worldwide. This rivalry extends beyond project acquisition to include a critical battle for market share and, importantly, top talent, as human capital is a key differentiator in this knowledge-intensive sector. The global management consulting market alone was valued at approximately $335 billion in 2023, illustrating the scale of this competitive landscape.

WSP distinguishes itself by focusing on specialized expertise, enabling premium pricing for high-value advisory and complex solutions, contrasting with more generalized offerings. For instance, WSP's strategic investments in digital engineering and sustainability consulting address growing client demands projected through 2025. However, in commoditized areas like routine engineering or environmental services, price competition intensifies, impacting profit margins, as seen in 2024 infrastructure maintenance contract bidding where the lowest price often determined the winner.

Industry consolidation through mergers and acquisitions (M&A) further heightens rivalry. In 2023, WSP itself acquired AECOM's Australia and New Zealand transportation and infrastructure consulting business for approximately $97 million CAD, expanding its market presence and capabilities. This trend of M&A creates larger, more dominant competitors, forcing firms like WSP to remain agile and strategic in their growth and talent acquisition efforts to maintain a competitive edge.

Talent scarcity significantly fuels this rivalry, as firms compete fiercely for skilled professionals. The demand for engineers, planners, and project managers is high due to the knowledge-intensive nature of the work. In 2024, leading firms reported increased hiring targets for specialized engineering roles, underscoring the ongoing talent crunch and the importance of offering competitive career development and flexible work arrangements to attract and retain key personnel.

| Competitive Factor | Description | Impact on WSP | 2023/2024 Data Point |

|---|---|---|---|

| Number of Competitors | Highly fragmented market with many large global players | Intensifies competition for projects and talent | Global management consulting market valued at ~$335 billion (2023) |

| Service Overlap | Competitors offer similar extensive service portfolios | Pressure on pricing and differentiation strategies | AECOM, Jacobs, Arcadis, Stantec offer direct competition |

| M&A Activity | Industry consolidation creating larger, more dominant firms | Requires agile growth strategies and strategic positioning | WSP acquired AECOM's ANZ business for ~$97M CAD (2023) |

| Talent Demand | High demand for specialized engineering and consulting professionals | Drives up recruitment costs and retention efforts | Increased hiring targets for specialized engineering roles reported in 2024 |

| Price Competition | Intensifies in commoditized service areas | Erodes profit margins on less specialized projects | Infrastructure maintenance contracts saw lowest-price wins in 2024 |

SSubstitutes Threaten

Large corporations and government entities increasingly possess the in-house engineering, planning, and environmental capabilities to handle certain tasks internally. For instance, major infrastructure projects managed by public bodies might allocate resources to their own planning divisions, reducing reliance on external firms like WSP for standard environmental impact assessments or preliminary design phases. This trend is driven by a desire for greater control and cost management, especially for recurring or less complex service needs.

While these internal departments can act as substitutes, particularly for routine work, they often lack the specialized expertise or sheer capacity required for highly complex or large-scale endeavors. In 2024, many government bodies still outsource significant portions of their capital projects, recognizing the limitations of purely in-house operations. The need for niche skills, advanced technology, and broad project management experience means that external consultants remain vital for many critical undertakings.

While WSP Global's core strength lies in engineering and infrastructure, its advisory services face a threat from generic management consulting firms. These firms can offer strategic planning and project management expertise that may overlap with WSP's consulting offerings.

For instance, a large generalist consulting firm might provide comprehensive business transformation advice, including elements of project scoping and execution, which could be seen as a substitute for some of WSP's advisory work. However, these firms typically lack the deep, specialized technical engineering knowledge that WSP integrates into its solutions.

WSP's competitive advantage in this area stems from its ability to blend technical engineering acumen with strategic business insights. This integration allows WSP to provide more tailored and effective solutions for complex infrastructure and development projects, differentiating it from more generalized consulting approaches.

Advancements in artificial intelligence and machine learning present a growing threat of substitution for certain consulting tasks. For instance, AI-powered analytics tools are increasingly capable of performing data processing and initial design assessments, areas where WSP’s human consultants have traditionally operated. This could potentially reduce the demand for junior-level consulting roles focused on these specific functions.

Automation, particularly in areas like infrastructure design and project management software, offers alternative solutions to traditional service delivery. While these technologies are more likely to enhance WSP’s capabilities, they might also lead clients to perform certain routine analyses in-house, thereby reducing the need for external consulting support in those specific niches. Companies like Autodesk are continuously developing more sophisticated AI-driven design tools.

The integration of these technologies is not just about staying competitive; it's about adapting to evolving client expectations and the broader market landscape. WSP’s ability to leverage AI and automation for efficiency and enhanced service offerings will be crucial in mitigating the threat of substitution and reinforcing its value proposition against emerging technological alternatives.

Shift to Design-Build or Integrated Project Delivery Models

The increasing adoption of integrated project delivery (IPD) models, such as design-build, presents a potential threat of substitution for WSP’s standalone engineering and design services. In these models, a single entity manages both the design and construction phases, potentially bypassing the need for separate specialized consultants like WSP for certain project components.

While WSP actively participates in and partners within design-build frameworks, a fully integrated contractor possessing in-house design capabilities could directly compete with and substitute WSP’s traditional service offerings. This shift in procurement strategy, where clients seek a single point of responsibility, can reduce the demand for traditional, fragmented project delivery structures.

However, it is important to note that even within design-build, the complexity of modern infrastructure projects often necessitates the continued involvement of specialized engineering expertise, which WSP provides. The threat lies more in the consolidation of service procurement rather than a complete elimination of the need for engineering excellence.

For instance, by 2024, the global design-build market was projected to reach over $300 billion, indicating a significant trend towards this integrated approach. This growth suggests that clients are increasingly valuing the efficiency and risk reduction associated with single-entity project execution.

- Market Trend: Clients are increasingly favoring integrated project delivery models like design-build.

- Competitive Landscape: Fully integrated contractors with in-house design can substitute WSP's standalone services.

- Risk Factor: Procurement consolidation can reduce demand for traditional, fragmented consulting roles.

- Mitigation: WSP's expertise remains crucial even within integrated models due to project complexity.

- Market Size Context: The global design-build market exceeded $300 billion by 2024, highlighting client preference for integrated solutions.

DIY Solutions and Open-Source Tools

The rise of DIY solutions and open-source tools presents a significant threat of substitutes, particularly for more straightforward analytical tasks. Clients, especially those with smaller projects or those in the preliminary stages of analysis, are increasingly turning to readily available online platforms and free software. These alternatives offer a low-cost way to gather basic information and perform simple assessments, thereby reducing the demand for traditional consulting services at the lower end of the market.

For instance, the global open-source software market size was valued at approximately $37.5 billion in 2023 and is projected to grow significantly. This accessibility means that clients can often perform basic data analysis or market research without engaging external consultants. This trend is especially noticeable for tasks that don't require highly specialized expertise or customized methodologies, making these DIY approaches a viable substitute for some of the services previously offered by consulting firms.

- Accessibility of Online Tools: Platforms offering free market research data or basic financial modeling tools can be used by clients to conduct preliminary analyses themselves.

- Cost-Effectiveness of Open-Source Software: Open-source alternatives for data visualization, statistical analysis, and even project management reduce the need for expensive proprietary software and associated training.

- Empowerment of Clients: A growing number of clients possess the digital literacy and resources to leverage these substitutes for their informational needs, particularly for routine or less complex requirements.

- Impact on Lower-End Services: The threat is most pronounced for consulting services that involve standard data compilation, basic report generation, or widely applicable analytical frameworks.

The threat of substitutes for WSP stems from various sources, including internal client capabilities, generalist consulting firms, AI and automation, integrated project delivery models, and DIY solutions. While these substitutes can address certain needs, they often lack the specialized technical depth that WSP provides.

Clients increasingly possess in-house expertise, particularly for routine tasks, which can substitute for some external consulting needs. However, complex projects still demand specialized skills. For instance, while government bodies might handle standard environmental assessments internally, large infrastructure projects often require external specialists.

AI and automation are also emerging as substitutes. Tools can now perform data processing and initial design assessments, potentially reducing demand for junior consulting roles. Companies like Autodesk are at the forefront of developing these AI-driven design tools.

The rise of DIY solutions and open-source software, with the open-source market valued around $37.5 billion in 2023, offers low-cost alternatives for simpler analytical tasks, impacting the lower end of the consulting market.

| Substitute Type | Description | Impact on WSP | Example/Data Point |

|---|---|---|---|

| Internal Client Capabilities | Clients performing tasks in-house. | Reduces demand for routine services. | Government bodies handling standard environmental assessments. |

| Generalist Consulting Firms | Broader advisory services. | Competes for strategic planning and project management. | Large firms offering business transformation advice. |

| AI & Automation | Automated data processing and design. | Threatens junior roles and routine analyses. | AI tools for data processing; Autodesk's AI design software. |

| Integrated Project Delivery (IPD) | Single entity managing design and construction. | Reduces need for standalone design services. | Design-build models; global market exceeded $300 billion by 2024. |

| DIY & Open-Source Tools | Client-led analysis using free tools. | Impacts basic data compilation and report generation. | Open-source software market valued at $37.5 billion in 2023. |

Entrants Threaten

Establishing a global professional services firm like WSP demands immense upfront capital and a deep reservoir of human expertise. This isn't just about office buildings; it's about recruiting, training, and keeping a large workforce of specialists in fields ranging from engineering to environmental consulting, spanning numerous countries. This substantial investment in talent acts as a significant deterrent for newcomers.

The sheer cost and time involved in building a worldwide presence and assembling specialized, expert teams create a formidable barrier to entry. For instance, a new entrant would need to replicate WSP's extensive network of over 65,000 employees across 50 countries, a feat requiring billions in investment and years of dedicated effort. This human capital intensity makes it incredibly challenging for smaller or less-resourced companies to compete effectively.

WSP Global benefits significantly from a strong brand reputation and an extensive track record of successfully delivering complex projects. This established trust is crucial for securing large contracts, especially within the public and private sectors where reliability is paramount. For instance, WSP's involvement in major infrastructure projects, like the ongoing expansion of the Montreal-Trudeau International Airport, showcases this capability.

New entrants often struggle to replicate this decades-long accumulation of credibility. Without a proven history of execution and a recognized brand, they face considerable hurdles in convincing clients to award them significant, high-stakes work. This makes it difficult for them to gain a foothold against established players like WSP, particularly in sectors demanding a high degree of client confidence and demonstrable expertise.

The engineering and environmental consulting sector faces significant hurdles for new entrants due to complex regulatory and certification demands. Navigating numerous national and international laws, professional licenses, and industry-specific certifications is a substantial barrier. This intricate compliance landscape can absorb considerable time and financial resources, particularly for firms aspiring to operate on a global scale. For instance, in 2024, companies seeking to engage in projects requiring environmental impact assessments often had to secure multiple permits and approvals, a process that could extend for over a year and cost hundreds of thousands of dollars depending on the project's scope and location. Adhering to these standards is not just about legality but also paramount for ensuring project safety and credibility.

Access to Large Client Networks and Relationships

WSP Global Inc. has built a formidable advantage through its deeply entrenched relationships with both public and private sector clients across the globe. This extensive network, developed over decades, fosters a strong foundation of trust and leads to significant repeat business. For instance, in 2023, WSP reported that approximately 70% of its revenue came from repeat clients, highlighting the power of these established connections.

New entrants into the consulting and engineering sector face a substantial hurdle in replicating WSP's client access. Building the necessary trust and forging long-term partnerships from the ground up is a time-consuming and resource-intensive endeavor. This is particularly true in an industry where project selection often hinges on established reputations and proven track records, rather than solely on competitive pricing.

- Extensive Global Client Network: WSP maintains relationships with a broad spectrum of public and private sector clients worldwide.

- High Repeat Business Rate: In 2023, WSP benefited from repeat business accounting for roughly 70% of its revenue.

- Barrier to Entry: New competitors must invest heavily in time and resources to build similar levels of trust and relationships.

- Industry Reliance on Partnerships: The sector's dependence on long-term collaborations and referrals makes it difficult for newcomers to gain traction.

Economies of Scale and Global Reach

WSP’s substantial economies of scale present a significant barrier to new entrants. As a global leader with operations in numerous countries, WSP leverages its size to achieve cost efficiencies in technology, research and development, and centralized support functions. For instance, in 2023, WSP reported net revenue of approximately CAD 16.3 billion, underscoring its vast operational capacity.

The company's global reach is another deterrent. WSP can undertake large, complex international projects by deploying specialized expertise and resources seamlessly across borders. This capability is difficult for newcomers to match, as building a comparable global network and client base requires immense time and investment. For example, WSP’s involvement in major infrastructure projects worldwide, such as the ongoing expansion of the London Underground, demonstrates this global advantage.

New entrants would face considerable challenges in replicating WSP’s established infrastructure and integrated service offerings. The capital required to build a similar global footprint, invest in advanced technology, and develop the necessary human capital would be prohibitive.

- Economies of Scale: WSP’s global operational scale leads to cost advantages in procurement, technology deployment, and shared services, making it difficult for smaller new entrants to compete on price.

- Global Reach: WSP's established presence in multiple continents allows it to serve multinational clients and manage diverse, large-scale projects, a feat requiring significant time and resources for new firms to replicate.

- Integrated Services: The ability to offer a comprehensive suite of services across various sectors and geographies, supported by a vast knowledge base, further solidifies WSP's competitive position against nascent competitors.

- Capital Investment: The substantial capital investment needed to match WSP's infrastructure, technological capabilities, and talent pool creates a high entry barrier for potential new market participants.

The threat of new entrants for a firm like WSP is considerably low due to the immense capital required and the deep expertise needed. It’s not just about physical assets, but the substantial investment in a global workforce of specialists and the time it takes to build that talent pool. For instance, replicating WSP’s network of over 65,000 employees across 50 countries in 2024 would demand billions in investment and years of effort.

Complex regulatory requirements and the need for professional certifications across various jurisdictions also act as significant deterrents. Navigating these intricate compliance landscapes can absorb substantial time and financial resources, making it challenging for new firms to operate globally. In 2024, securing multiple permits for environmental impact assessments alone could cost hundreds of thousands of dollars and take over a year.

WSP’s established reputation and long-standing client relationships, often leading to high repeat business, create another substantial hurdle. In 2023, WSP noted that approximately 70% of its revenue came from repeat clients, underscoring the difficulty for newcomers to build similar trust and gain access to lucrative projects. The sector's reliance on partnerships and referrals further solidifies WSP's advantage against nascent competitors.

Economies of scale achieved through WSP's global operational footprint also present a significant barrier. In 2023, WSP reported net revenue of around CAD 16.3 billion, demonstrating its vast capacity to achieve cost efficiencies in technology, R&D, and support functions. This makes it difficult for smaller, new entrants to compete on price or undertake similarly large, complex international projects.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2023-2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment in talent, technology, and global infrastructure. | Prohibitive for most new firms aiming for global scale. | Replicating WSP's workforce of 65,000+ employees across 50 countries (2024) requires billions. |

| Regulatory & Certification Hurdles | Complex and varied national/international laws, licenses, and certifications. | Time-consuming and costly compliance processes. | Environmental permits in 2024 could cost hundreds of thousands and take over a year. |

| Brand Reputation & Client Relationships | Established trust, proven track record, and strong client loyalty. | Difficulty in securing initial projects and building credibility. | 70% of WSP's 2023 revenue came from repeat clients. |

| Economies of Scale & Global Reach | Cost efficiencies from large-scale operations and ability to manage international projects. | Disadvantage in pricing and project capacity compared to established players. | WSP's 2023 net revenue was ~CAD 16.3 billion. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data from annual financial reports, industry expert interviews, and comprehensive market research studies to provide a thorough understanding of the competitive landscape.

We leverage data from government regulatory filings, trade association statistics, and reputable financial news outlets to accurately assess the intensity of rivalry, the bargaining power of suppliers and buyers, and the threat of new entrants and substitutes.