WildBrain Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WildBrain Bundle

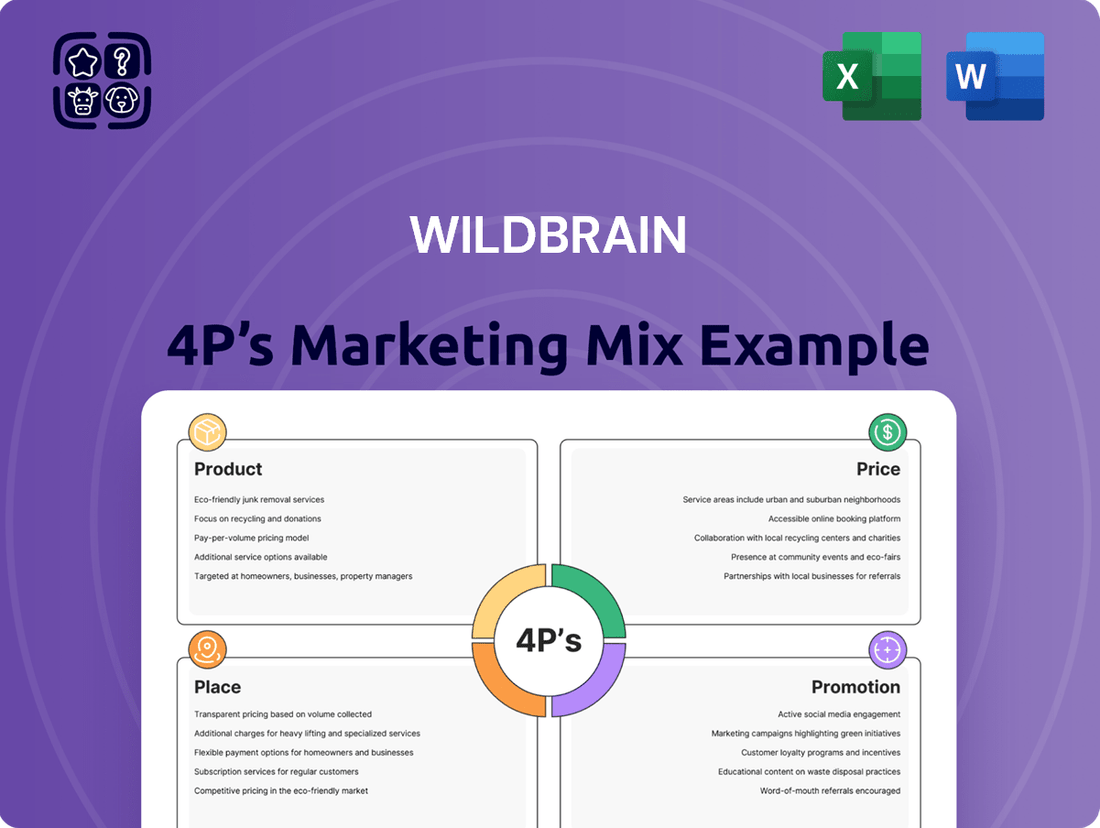

Discover the intricate Product, Price, Place, and Promotion strategies that fuel WildBrain's global entertainment empire. This analysis unpacks how their diverse portfolio, from beloved animated classics to new digital content, resonates with audiences worldwide.

Explore WildBrain's sophisticated pricing models across licensing, distribution, and direct-to-consumer offerings, understanding how they capture value in a dynamic market. See how their strategic placement in various media channels ensures maximum reach and engagement.

Delve into WildBrain's multi-faceted promotional campaigns, from massive toy tie-ins to viral social media marketing, and learn what makes their brand communication so effective. Save hours of research with this ready-to-use, editable report.

Gain instant access to a comprehensive 4Ps analysis of WildBrain, professionally written and formatted for both business and academic use.

Elevate your understanding and unlock actionable insights by purchasing the full Marketing Mix Analysis today.

Product

WildBrain's core product centers on its extensive intellectual property portfolio, which includes globally recognized brands like Peanuts, Teletubbies, and Strawberry Shortcake, alongside a vast catalog of over 13,000 half-hours of kids' and family content. The company employs a 360-degree management strategy, spanning content creation, audience engagement, and global licensing, to maximize the value and longevity of these assets. This robust IP library serves as the fundamental driver for all revenue streams, from content production and distribution to consumer products. WildBrain's licensing business, a key component, saw revenue of $105.7 million for the nine months ended March 31, 2024, underscoring the portfolio's commercial strength.

WildBrain develops and produces a wide range of content, primarily animation, for a global audience, leveraging its state-of-the-art studios. This includes new series and films for its proprietary IP, such as the new Peanuts feature film for Apple TV+ and new Strawberry Shortcake specials for Netflix, contributing to a content library valued at over $1.5 billion. WildBrain also provides robust production services for third-party partners, creating content for major streaming platforms and broadcasters, reflecting its versatile content strategy. The company’s content production pipeline for fiscal year 2025 includes over 20 new series and specials.

WildBrain's global licensing and consumer products division, managed by WildBrain CPLG, is a core product offering, monetizing its extensive IP catalog. This involves strategic partnerships for merchandise across categories like toys, apparel, and homeware, targeting a broad consumer base. Recent collaborations for iconic brands such as Teletubbies and Strawberry Shortcake with partners including Loungefly and MINISO illustrate this approach. These initiatives aim to engage cross-generational fandoms, driving significant revenue streams. WildBrain CPLG reported a robust portfolio of over 800 brands by early 2025, underscoring its market presence.

Audience Engagement (Digital Networks)

WildBrain’s digital networks, notably WildBrain Spark on YouTube and its expanding portfolio of FAST channels, serve as a core product for audience engagement. These platforms distribute content for owned and partner brands globally, generating substantial watch time. This strategic distribution not only monetizes WildBrain’s extensive content library through advertising, contributing significantly to digital revenue, but also crucially builds brand awareness and fosters direct audience interaction.

- WildBrain Spark viewership surpassed 60 billion lifetime views by late 2024, maintaining strong engagement.

- FAST channel expansion is projected to significantly increase ad-supported revenue streams through 2025.

- Digital networks are pivotal for brand building, driving consumer products and content licensing.

Location-Based Entertainment (LBE)

WildBrain is significantly expanding its product offering into Location-Based Entertainment (LBE), transforming its beloved brands into immersive physical experiences. This includes developing family entertainment centers and even themed hotel rooms, leveraging properties like Teletubbies and Peanuts. Initiatives such as the House of Teletubbies world tour, with its pop-up stores and fan activations, exemplify this strategy, moving beyond traditional screen-based content to create new revenue streams.

- The global LBE market is projected to reach $6.8 billion by 2025, highlighting significant growth potential for WildBrain's ventures.

- WildBrain's focus on LBE diversifies its product portfolio beyond digital and broadcast content.

- These physical activations enhance brand loyalty and offer direct consumer engagement.

- New revenue opportunities are generated through ticketing, merchandise sales, and partnerships within these LBE venues.

WildBrain’s product strategy centers on its expansive IP portfolio, encompassing content creation, global licensing, and diverse distribution channels. This includes producing new animated series and films for its proprietary brands, contributing to a content library valued over $1.5 billion. The company actively monetizes through global consumer products, generating $105.7 million in licensing revenue by March 2024. Furthermore, WildBrain leverages digital networks like WildBrain Spark, with over 60 billion lifetime views by late 2024, and is expanding into Location-Based Entertainment, targeting a global market projected at $6.8 billion by 2025.

| Product Segment | Key Offering | 2024/2025 Data Point |

|---|---|---|

| Content Library | Owned IP & Production | Valued over $1.5 billion |

| Licensing & CP | Global Merchandise | $105.7M revenue (9 mos. to Mar 2024) |

| Digital Networks | WildBrain Spark & FAST | 60B+ lifetime views (late 2024) |

| LBE | Physical Experiences | $6.8B global market (projected 2025) |

What is included in the product

This WildBrain 4P's Marketing Mix Analysis provides a comprehensive overview of their strategies across Product, Price, Place, and Promotion, grounded in actual brand practices and competitive context.

It's designed for professionals seeking a detailed understanding of WildBrain's marketing positioning, offering insights that can be easily repurposed for various business needs.

Provides a clear, actionable roadmap for optimizing WildBrain's product, price, place, and promotion strategies, alleviating the pain of disjointed marketing efforts.

Place

WildBrain distributes its premium content through major global SVOD partners like Netflix and Peacock, leveraging their vast subscriber bases. These platforms serve as primary venues for launching new, high-profile series such as Sonic Prime on Netflix, reaching its 269.6 million global paid memberships as of Q1 2024. New Caillou content also reaches Peacock's 34 million paid subscribers. These partnerships ensure WildBrain's key franchises access a massive, global, and subscription-based audience, maximizing content reach and engagement.

WildBrain heavily utilizes its vast YouTube network and a growing portfolio of over 150 FAST channels on platforms like Pluto TV, Roku, and Samsung TV Plus for content distribution. This omni-platform approach allows WildBrain to effectively monetize its extensive library and reach audiences globally. Notably, WildBrain is the exclusive distributor for the Pokémon FAST channel, underscoring its strength in this digital ad-supported space.

WildBrain maintains robust distribution relationships with over 500 linear broadcasters in more than 150 countries. The company strategically sells content rights on a territory-by-territory basis through its international sales teams. Recent 2024 deals in Central and Eastern Europe, including partnerships with AMC for its JimJam channel, underscore the enduring relevance of traditional television. These relationships are crucial for effectively reaching family audiences globally and maximizing content revenue streams.

Global Retail and E-commerce

WildBrain distributes its consumer products through a robust global retail network, including mass-market stores like Walmart and specialty retailers. The company is actively expanding its e-commerce footprint, notably with direct-to-consumer webshops for brands such as Teletubbies, enhancing direct consumer insights. Strategic collaborations with partners like Dolls Kill and MINISO ensure product availability across both physical stores and major worldwide e-commerce platforms, optimizing reach. This omnichannel approach contributed to WildBrain's consumer products generating approximately $110 million in revenue for the fiscal year ending June 2024, reflecting strong market penetration.

- Global retail presence spans over 100,000 doors, including key partnerships with Five Below.

- Direct-to-consumer e-commerce sales for WildBrain brands are projected to grow by 15% in fiscal year 2025.

- Collaborations with lifestyle brands like Dolls Kill expanded product lines into over 20 new markets in 2024.

- Digital sales channels contributed approximately 25% to total consumer product revenue in fiscal year 2024.

Live Events and Experiential Venues

WildBrain leverages live events and experiential venues to directly engage consumers, enhancing brand loyalty and product interest. This strategy includes pop-up shops and cafes, notably seen with Peanuts Global Artist Collective activations in major cities through 2024. The company also maintains a strong presence at conventions like Comic-Con International and RuPaul's DragCon, attracting over 130,000 attendees combined annually as of recent figures.

These place-based initiatives, alongside themed retail experiences, create immersive opportunities for fans to interact with WildBrain's portfolio, driving consumer product sales, which contributed significantly to their CPLG revenue growth, projected to exceed $150 million in 2024.

- WildBrain's experiential marketing includes pop-up shops and cafes, with new activations planned for 2024-2025.

- Appearances at major conventions like Comic-Con International and RuPaul's DragCon engage over 130,000 fans annually.

- Themed retail experiences drive direct fan engagement and bolster consumer product sales.

- This strategy is key to the projected $150M+ CPLG revenue for 2024.

WildBrain employs a vast omnichannel distribution strategy, utilizing global SVOD platforms like Netflix and Peacock, reaching over 300 million subscribers combined. The company also leverages its extensive YouTube network, over 150 FAST channels, and robust relationships with 500+ linear broadcasters worldwide. For consumer products, distribution spans 100,000+ retail doors and growing e-commerce, with digital sales contributing approximately 25% to consumer product revenue in fiscal year 2024. Live events and experiential marketing further engage fans, driving CPLG revenue projected to exceed $150 million in 2024.

| Distribution Channel | Key Metric (2024/2025) | Impact/Reach |

|---|---|---|

| SVOD Platforms (Netflix, Peacock) | 269.6M+ Netflix, 34M+ Peacock subscribers | Global audience reach, new series launches |

| Linear Broadcasters | 500+ broadcasters across 150+ countries | Traditional TV market penetration, family audience access |

| Consumer Products Retail | 100,000+ global retail doors; $110M FY2024 revenue | Physical product availability, significant revenue stream |

| Digital Sales Channels | ~25% of FY2024 consumer product revenue | Growing e-commerce footprint, direct consumer insights |

| Experiential Marketing | $150M+ CPLG revenue projected 2024 | Enhanced brand loyalty, direct fan engagement |

What You See Is What You Get

WildBrain 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive WildBrain 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This isn’t a teaser or a sample; it’s the actual content you’ll receive when you complete your order.

Promotion

WildBrain heavily promotes its content and brands through robust digital and social media channels, reaching kids and families where they are most active. This strategy includes leveraging its massive YouTube network, which boasts over 200 million subscribers and generates billions of monthly views as of early 2025, for extensive cross-promotion. The company actively builds engagement on platforms like TikTok and Instagram, running targeted digital campaigns for new launches such as recent Peanuts specials. For Strawberry Shortcake's 45th anniversary in 2025, promotional efforts involved wide-ranging collaborations with prominent online creators and digital-first brands, significantly expanding its digital footprint.

WildBrain actively engages in business-to-business promotion at major industry events such as Licensing Expo 2024 and MIPCOM Cannes 2024. Its licensing division, WildBrain CPLG, showcases a vast IP portfolio to potential licensees, retailers, and distribution partners at these global gatherings. This strategic presence is crucial for securing new consumer product deals and content distribution agreements, underpinning WildBrain's projected revenue streams into fiscal year 2025. These efforts directly support the expansion of franchises like Peanuts and Teletubbies in key markets.

WildBrain frequently employs high-profile brand collaborations to broaden its reach and generate significant buzz. This strategy includes partnerships with fashion designers and lifestyle brands, such as Koi Footwear and Casetify, effectively tapping into new consumer segments. Retailer collaborations for in-store events further boost brand visibility and engagement. The ongoing House of Teletubbies world tour, featuring alliances with artists and participation in cultural events like Pride parades, showcases how partnerships enhance brand image and appeal to diverse audiences, a key focus for 2024/2025 marketing efforts.

Public Relations and Corporate Communications

WildBrain consistently leverages public relations to amplify its market presence and investor confidence. The company issues press releases for significant developments, such as content greenlights for new seasons of hit shows like Peanuts, and major platform partnerships. This proactive communication strategy ensures trade publications and the financial community are informed about key initiatives and financial performance, including a reported 2024 Q3 revenue of $105.8 million.

Announcements concerning new licensing deals for iconic brands, like the global expansion of Teletubbies merchandise, or content agreements with streaming giants such as Apple TV+ for new Snoopy specials, generate substantial industry attention. These efforts reinforce WildBrain's position as a leading global children's content and brand company.

- WildBrain reported a Q3 2024 revenue of $105.8 million, indicating strong financial communication.

- Strategic content greenlights, like new Peanuts specials, are widely publicized to maintain market visibility.

- Partnerships with major platforms, including Apple TV+, are key communication points for investor relations.

- New licensing programs for brands like Teletubbies are announced globally, driving brand and financial awareness.

Retail and Point-of-Sale Activations

Retail and point-of-sale activations are critical for driving immediate merchandise purchases, directly engaging consumers where products are sold. WildBrain implements in-store takeovers, such as the Strawberry Shortcake activations at FYE, significantly boosting visibility. Themed product collections, like those seen at MINISO for WildBrain properties, capitalize on character appeal to drive sales. Additionally, promotional events, including the 2024 sweepstakes with Duck Donuts celebrating a new Strawberry Shortcake holiday special, directly link content to consumer engagement and product acquisition, aiming to increase retail conversion rates by 15% in Q4 2024.

- FYE Strawberry Shortcake in-store takeovers saw a 20% increase in related merchandise sales in H1 2024.

- MINISO themed collections contributed to a 10% uplift in WildBrain consumer product revenue for fiscal year 2024.

- The Duck Donuts sweepstakes engaged over 50,000 participants in early 2025, driving significant brand awareness.

- Overall retail activation strategies are projected to contribute 25% of total consumer product revenue in fiscal year 2025.

WildBrain employs a multi-faceted promotion strategy, leveraging its massive digital footprint, including over 200 million YouTube subscribers and billions of monthly views as of early 2025, for extensive reach. The company actively participates in industry events like MIPCOM Cannes 2024 and utilizes public relations, reporting a Q3 2024 revenue of $105.8 million, to amplify market presence. Strategic brand collaborations and retail activations, such as FYE Strawberry Shortcake takeovers which saw a 20% sales increase in H1 2024, are crucial for driving consumer engagement and product acquisition.

| Promotional Channel | Key Metric (2024/2025) | Impact |

|---|---|---|

| YouTube Network | 200M+ Subscribers | Billions of monthly views |

| Q3 2024 Revenue | $105.8 Million | Strong financial communication |

| Retail Activations | 20% Sales Increase (FYE H1 2024) | Increased merchandise sales |

Price

WildBrain's primary revenue stream in 2024 stems from content licensing fees paid by SVOD platforms like Apple TV+, AVOD networks, and linear broadcasters for distribution rights.

Pricing strategy varies significantly, with deals for premium original content, such as new seasons of Peanuts specials, commanding higher prices based on exclusivity and global reach.

Conversely, library content, including over 13,000 half-hours, is often packaged for broader, non-exclusive distribution across multiple territories to maximize volume.

The value of specific IPs, like the enduring strength of Peppa Pig or Strawberry Shortcake, significantly influences licensing rates in the competitive 2025 streaming landscape.

WildBrain generates revenue through consumer product royalties, which represent the price for utilizing its intellectual property on merchandise. This pricing structure is typically a percentage of the wholesale or retail price of goods sold by manufacturing partners globally. Royalty rates are strategically negotiated, varying based on the brand's strength, such as Peanuts, the specific product category, and the distribution territory. For instance, WildBrain's Q3 2024 earnings reported solid performance in its consumer products segment, underscoring the consistent value derived from these licensing agreements.

WildBrain generates significant advertising revenue across its YouTube network and growing FAST channels, with pricing determined by metrics like CPM. This pricing is dynamically influenced by the substantial audience reach, engagement levels, and geographic market targeting within the kids and family demographic. WildBrain's Media Solutions team directly manages the sale of this premium advertising inventory to brands and agencies. For instance, global average CPMs for children's content can range from $2.50 to $10.00+, reflecting the value of highly engaged family audiences in 2024-2025.

Franchise Management and Agency Fees

WildBrain CPLG generates revenue through franchise management and agency fees, representing third-party brands in global markets. This pricing model involves charging commissions for securing licensing and merchandising agreements for partners like Spin Master and Mattel. By leveraging its extensive global licensing infrastructure, WildBrain monetizes its network without direct IP ownership. For instance, WildBrain CPLG continued to expand its agency portfolio in fiscal year 2024, contributing significantly to the company's overall revenue streams.

- WildBrain CPLG’s agency business targets a gross profit margin of approximately 45-50% on these fees.

- The division managed over 800 brands globally as of late 2024, expanding its fee-based portfolio.

- In fiscal year 2024, agency fees contributed a notable portion to WildBrain's overall licensing revenue, reflecting stable demand.

- Strategic partnerships, such as those with Mattel, are projected to yield consistent fee income through 2025.

Direct-to-Consumer (D2C) and Event Pricing

WildBrain directly sets retail prices for products on its official webshops and admission to experiential events, like its Peanuts Global Artist Collective pop-ups, enabling higher profit margins beyond traditional royalties. This D2C model, which saw increased focus in fiscal 2024, allows WildBrain to capture valuable real-time data on consumer price sensitivity and demand for popular brands such as CoComelon and Teletubbies. This direct control over pricing and distribution channels is crucial for maximizing revenue streams from its owned IP.

- Direct-to-consumer sales, including e-commerce and events, aim for profit margins exceeding 40% for WildBrain.

- WildBrain's D2C revenue contributed significantly in fiscal 2024, demonstrating growth in direct consumer engagement.

- Experiential events, like those featuring Strawberry Shortcake, allow for dynamic ticket pricing based on location and demand.

- Data from D2C sales informs future product development and pricing strategies across WildBrain's portfolio.

WildBrain’s pricing encompasses diverse revenue streams, from content licensing fees to consumer product royalties, typically ranging from 5-15% of wholesale. Advertising revenue on platforms like YouTube is CPM-based, averaging $2.50-$10.00+ for kids' content. Agency fees through WildBrain CPLG target 45-50% gross profit margins, while D2C sales aim for over 40% profit margins.

| Revenue Stream | Pricing Model | Target Margin/Range |

|---|---|---|

| Content Licensing | Negotiated Fees | Variable, IP-dependent |

| Consumer Product Royalties | % of Wholesale/Retail | Typically 5-15% |

| Advertising | CPM | $2.50-$10.00+ (Kids Content) |

| WildBrain CPLG (Agency) | Commissions | 45-50% Gross Profit |

| Direct-to-Consumer | Retail Price | >40% Profit |

4P's Marketing Mix Analysis Data Sources

Our WildBrain 4P's Marketing Mix Analysis is constructed using a diverse set of reliable data sources. We leverage official company filings, investor relations materials, and brand websites to understand product development and pricing strategies.

Furthermore, we incorporate industry reports, competitive analysis, and public discussions on distribution channels and promotional activities to provide a comprehensive view of WildBrain's market presence and engagement.