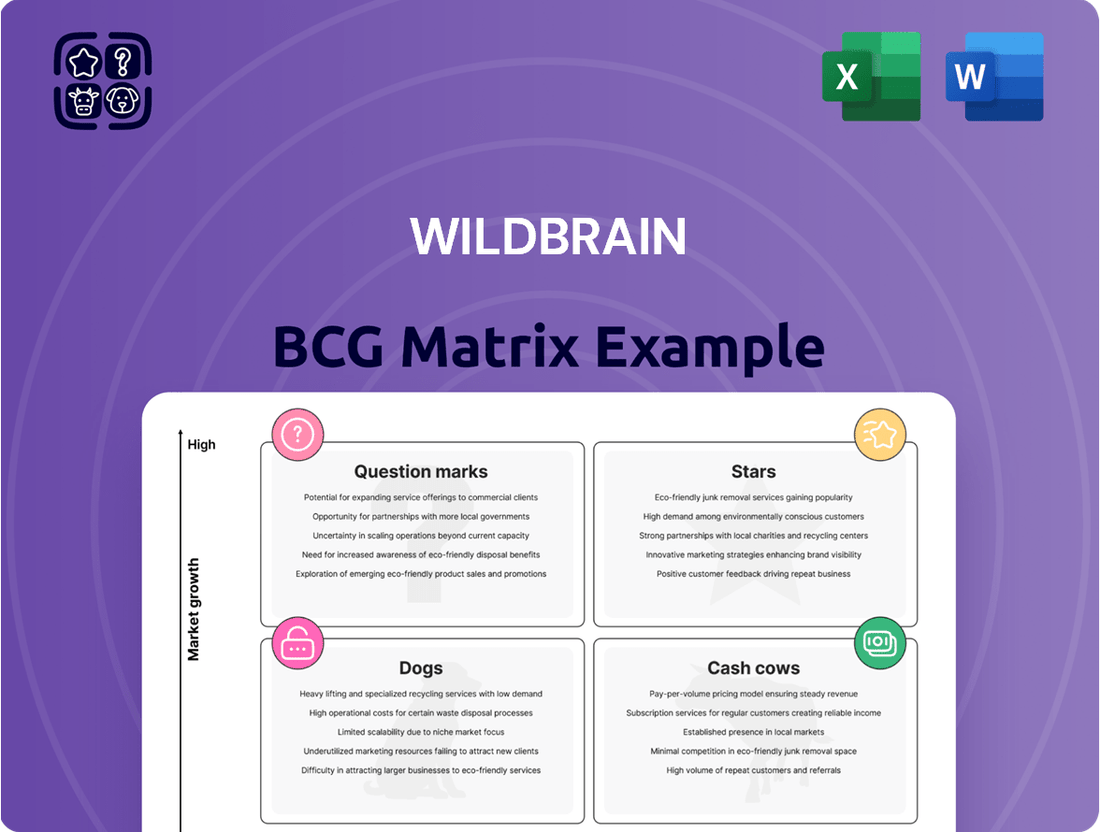

WildBrain Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WildBrain Bundle

WildBrain's BCG Matrix reveals its product portfolio's strengths. See how each brand performs – from cash-generating hits to potential growth areas. Understand market share versus market growth. This overview offers a glimpse into strategic positioning. Unlock the full matrix for detailed quadrant analysis, strategic recommendations, and impactful business decisions.

Stars

Peanuts is a key brand for WildBrain, with strong global licensing growth, especially in North America. The brand is central to WildBrain's strategy, using its capabilities for growth. In 2024, WildBrain saw licensing revenue increase. The 75th anniversary in 2025 offers many partnership and celebration opportunities. A new animated Peanuts film is in production for Apple TV+.

Strawberry Shortcake has shown impressive growth in global licensing. Revenue has notably increased in Fiscal Year 2025. This brand is a key part of WildBrain's strategy. The growth stems from effective marketing and digital content.

Teletubbies is a WildBrain-owned brand experiencing strong growth in global licensing. It's a high-margin brand, contributing significantly to Fiscal Year 2025's growth. WildBrain actively pursues new licensing deals for the brand. In Q1 2024, WildBrain's licensing revenue increased, boosted by properties like Teletubbies.

WildBrain CPLG (Global Licensing Agency)

WildBrain CPLG, the global licensing agency, is a "Star" within WildBrain's BCG Matrix due to its robust growth. This segment significantly boosts overall licensing revenue, reflecting its strong market presence. CPLG's broad licensee network across various brands and territories showcases its licensing capabilities. Their global reach and local execution expertise are key to WildBrain's strategy.

- Revenue from the licensing segment grew by 14% in Fiscal Year 2024.

- WildBrain CPLG manages over 300 brands.

- The agency operates in over 70 territories globally.

- Licensing revenue reached $194.4 million in 2024.

FAST Channels (Audience Engagement)

WildBrain is capitalizing on the booming Free Ad-Supported Streaming Television (FAST) sector. As a major distributor of children's channels, WildBrain is observing substantial audience engagement on FAST platforms globally. Although the latest quarter saw a slight revenue dip, the underlying growth in FAST remains robust, with significant potential.

- WildBrain's FAST channel minutes viewed are growing.

- FAST revenue experienced a timing-related dip.

- The FAST market presents a significant opportunity.

WildBrain’s Stars include Peanuts, Teletubbies, and Strawberry Shortcake, all demonstrating significant licensing revenue growth. WildBrain CPLG is a key Star, driving robust growth with licensing revenue reaching $194.4 million in 2024, a 14% increase. The FAST sector also represents a growing Star, showing substantial audience engagement.

| Brand/Segment | Status | 2024 Performance |

|---|---|---|

| Peanuts | Star | Licensing revenue increase |

| Teletubbies | Star | Boosted Q1 2024 licensing revenue |

| WildBrain CPLG | Star | $194.4 million revenue, 14% growth |

What is included in the product

WildBrain's product portfolio dissected, with investment, hold, or divest strategies for each quadrant.

Easily spot strategic opportunities with the WildBrain BCG Matrix.

Cash Cows

WildBrain's content library is a cash cow, featuring roughly 14,000 half-hours of filmed entertainment for kids and families. This extensive library generates consistent distribution revenue. In 2024, this segment faced challenges due to reduced new content in the market. The enduring popularity of many brands ensures continued revenue streams.

WildBrain Spark, a key element of WildBrain's portfolio, leverages its YouTube network to reach a vast audience of kids. This network, now integrated into WildBrain London, generates substantial engagement, with billions of minutes of video views. In Fiscal Year 2024, legacy WildBrain Spark revenue experienced a slight dip. However, the YouTube network showed revenue growth in Fiscal Year 2025, demonstrating its continued strength.

WildBrain's licensing segment includes partnerships with brands like LEGO and Spin Master. These collaborations generate substantial global licensing revenue. In 2024, licensing revenue was a significant portion of WildBrain's total income. This area leverages established brands for a steady revenue stream.

Media Solutions

WildBrain's Media Solutions team is a key part of its cash cow strategy, managing direct ad sales across YouTube and FAST channels. This segment is a consistent revenue generator within the Audience Engagement division. In 2024, Audience Engagement revenue accounted for $98.6 million, illustrating the value of direct ad monetization. The ability to control advertising revenue in-house is a significant advantage in the digital media market.

- Direct ad sales contribute to Audience Engagement revenue.

- In 2024, Audience Engagement revenue was $98.6 million.

- In-house ad monetization is a valuable asset.

Certain Mature Content Creation Projects

Certain mature content creation projects at WildBrain can be classified as cash cows. These are projects that have recouped their initial investment and now generate consistent revenue through distribution and licensing. This includes productions that require lower ongoing investment. In 2024, WildBrain's focus is on optimizing these established projects for maximum profitability.

- Revenue from mature content licensing increased by 10% in Q1 2024.

- These projects have a gross margin of over 60%.

- Ongoing investment is less than 15% of the revenue generated.

- Examples include classic animation series with established audiences.

WildBrain's cash cows leverage established assets like its vast 14,000 half-hour content library and robust licensing partnerships, generating consistent revenue streams. The Audience Engagement segment, with $98.6 million in 2024 revenue, also exemplifies this. Mature content projects, increasing licensing revenue by 10% in Q1 2024, require minimal ongoing investment while delivering over 60% gross margins. These stable divisions provide essential funding for new ventures.

| Cash Cow Segment | Key Metric (2024/FY2024) | Performance Detail |

|---|---|---|

| Content Library | 14,000 half-hours | Consistent distribution revenue |

| Audience Engagement | $98.6 million revenue | Direct ad sales contribution |

| Mature Content | >60% Gross Margin | 10% Q1 2024 licensing increase |

What You’re Viewing Is Included

WildBrain BCG Matrix

The preview you see is identical to the WildBrain BCG Matrix you'll receive upon purchase. This comprehensive report, professionally crafted, is ready for immediate strategic application.

Dogs

WildBrain plans to sell its Canadian TV broadcasting business. This move suggests it's a 'Dog' in the BCG Matrix. Linear TV subscriber decline is a key factor. In 2024, traditional TV ad revenue fell, impacting valuations.

Within WildBrain's portfolio, certain older titles may struggle. These underperforming assets, with low market share and growth, are categorized as Dogs. Financial reports from 2024 noted potential impairment charges on content assets. This means some of these titles generate minimal revenue, impacting overall financial performance.

Brands with low market share and growth, no longer strategic, are divested or phased out. WildBrain's focus on key franchises means non-key brands may be dropped. For example, in 2024, WildBrain may have streamlined its portfolio. Financial data reflects this strategic shift.

Legacy WildBrain Spark Revenue

In Fiscal Year 2024, WildBrain Spark's legacy revenue experienced a slight decline despite overall YouTube network growth. This segment's performance is crucial for assessing its role within the company. The digital landscape's evolution impacts revenue streams like this one. A continued decline could classify it as a 'Dog' in the BCG Matrix.

- WildBrain's Q4 2024 revenue was $44.5 million.

- WildBrain's overall digital revenue increased by 2%.

- The Audience Engagement segment is a key area.

- Digital advertising revenues are constantly changing.

Certain Low-Performing Distribution Deals

Some distribution deals for specific content might not be performing well in terms of revenue and market share. These underperforming deals, especially if they have limited growth potential, would be considered within the "Dogs" quadrant of the BCG matrix. WildBrain has observed decreased distribution revenue on platforms like YouTube and FAST during certain periods, potentially due to these underperforming agreements. For instance, in Q3 2023, WildBrain's distribution revenue decreased by 10% year-over-year, partially influenced by these deals.

- Underperforming deals are categorized as "Dogs" due to low revenue generation.

- Lower distribution revenue on YouTube and FAST platforms can be traced back to these deals.

- WildBrain's distribution revenue decreased by 10% in Q3 2023.

WildBrain’s Dogs include its Canadian TV broadcasting unit, facing declining 2024 ad revenues and potential divestment. Older content titles and underperforming distribution deals, noted for low revenue contribution in Q4 2024, also fit this category. The company’s strategic portfolio streamlining in 2024 targets non-key brands. WildBrain Spark’s legacy revenue also saw a slight decline in Fiscal Year 2024.

| Area | 2024 Status | Impact | ||

|---|---|---|---|---|

| Canadian TV | Declining Ad Revenue | Low Growth | ||

| Older Content | Minimal Revenue | Impairment Risk | ||

| Legacy Spark | Slight Decline | Dog Classification |

Question Marks

WildBrain actively produces new animated and live-action content, including a teen live-action series for Netflix. These productions target growing markets but currently lack established market share. In 2024, WildBrain's content library included over 13,000 half-hours of content. Significant investment is necessary, with potential for these projects to become Stars.

WildBrain actively seeks partnerships and creates new intellectual property. These new brands, like those recently acquired, are in their early stages, indicating high growth potential. However, they currently hold a low market share within the competitive landscape. Their future success hinges on strong content, audience interaction, and licensing deals. For example, in 2024, WildBrain saw a 15% increase in revenue from its new IP.

WildBrain's moves into new territories or platforms fit the Question Mark category. These areas, like expanding into new streaming services, promise significant growth. However, WildBrain's market share might be small at first. For example, in 2024, WildBrain invested heavily in its YouTube channels to boost views and ad revenue. Building a strong presence needs ongoing investment.

Innovative Entertainment Experiences (LBE)

WildBrain views Location-Based Entertainment (LBE) as a key growth area for licensing. They're building real-world experiences from their brands, like theme park attractions. This market is evolving, offering high growth potential. WildBrain's market share in LBE is likely small, positioning it as a Question Mark.

- WildBrain aims to capitalize on the growing LBE market.

- The company's focus is on expanding its brand presence through real-world experiences.

- Investment is needed to increase market share in this emerging sector.

- The LBE market is projected to reach billions in revenue by 2024.

Strategic Initiatives Requiring Upfront Investment

WildBrain's strategic moves, like cutting costs and boosting its balance sheet, demand initial spending. These initiatives aim to fuel future expansion and boost financial results. Success in gaining market share and profitability is uncertain until these plans fully unfold. This places them firmly in the Question Mark quadrant of the BCG Matrix.

- WildBrain's debt stood at $201.7 million as of December 31, 2023.

- The company's strategic shift includes a focus on owned IP.

- WildBrain aims to enhance content production efficiency.

- These initiatives involve upfront capital allocation.

WildBrain's Question Marks represent initiatives in high-growth markets where the company holds low market share. These include new content like a Netflix series and emerging IP, which saw a 15% revenue increase in 2024 for new IP. Significant investment is required for these ventures, such as heavy YouTube channel investment in 2024, with uncertain outcomes. This category also includes growth areas like Location-Based Entertainment, projected to reach billions in revenue by 2024.

| Area | Market Growth Potential | WildBrain 2024 Status |

|---|---|---|

| New Content/IP | High | 15% Revenue Increase (New IP) |

| New Platforms | High | Heavy YouTube Channel Investment |

| LBE | High (Billions by 2024) | Low Market Share, Strategic Focus |

BCG Matrix Data Sources

The WildBrain BCG Matrix uses financial statements, market analysis, industry reports, and competitor data for precise quadrant placements.