WildBrain Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WildBrain Bundle

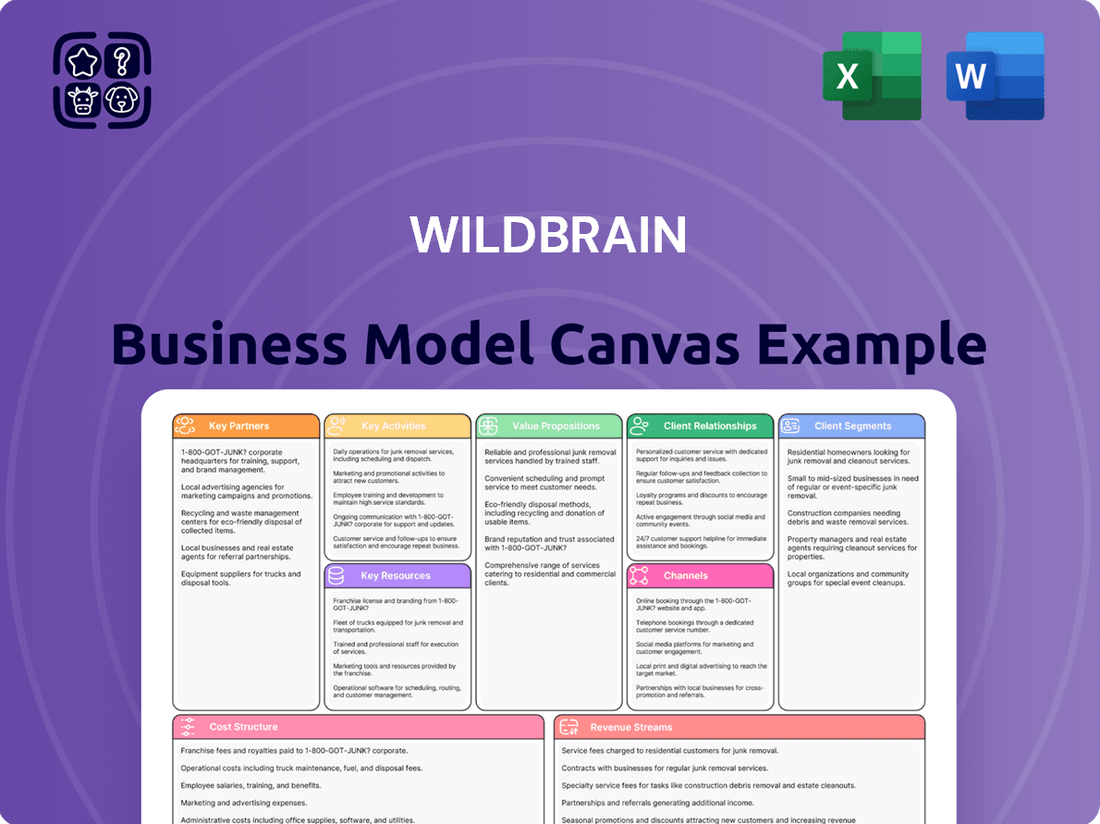

Unlock the full strategic blueprint behind WildBrain's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

WildBrain's core distribution strategy relies on partnerships with major SVOD/AVOD players like Netflix and Amazon Prime Video, alongside traditional linear broadcasters worldwide. These relationships are crucial, providing global reach and guaranteed licensing revenue for WildBrain's extensive library and new productions. For instance, in 2024, such multi-year licensing agreements continue to offer predictable cash flows, underpinning the company's financial stability. These collaborations ensure a diverse audience for content such as Peppa Pig and Teletubbies.

WildBrain’s partnerships with global toy manufacturers, apparel companies, and major retailers are crucial for monetizing its intellectual property beyond screen content. These licensees, like master toy partners for popular brands such as Peanuts or Teletubbies, invest significantly in product development and distribution. This collaboration generates high-margin royalty revenue for WildBrain, directly impacting its brand longevity and profitability. For instance, consumer products, along with content production and distribution, contribute substantially to WildBrain’s revenue streams, with licensing often being a key driver.

WildBrain Spark maintains a crucial partnership with YouTube, operating as one of the largest kids' multi-channel networks globally, boasting over 350 million subscribers and 1.2 trillion lifetime views as of early 2024. This collaboration extends beyond just content distribution, encompassing vital data analytics for audience insights, advertising sales optimization, and robust audience development strategies. Furthermore, strategic alliances with emerging digital platforms like TikTok are essential for WildBrain to maintain cultural relevance and effectively reach new, diverse demographics, ensuring broad content accessibility.

Co-Production & Financing Partners

WildBrain strategically mitigates the high costs and risks associated with premium content creation by frequently engaging in co-production agreements with international studios and media companies. These partnerships are crucial for pooling financial resources and creative talent, alongside gaining access to diverse regional production subsidies and tax credits. This approach significantly optimizes capital allocation and expands WildBrain's production capacity, exemplified by their continued investment in new series. As of their Q3 FY24 update, WildBrain reported a decrease in production services revenue due to lower third-party production activity, highlighting the dynamic nature of these partnerships.

- WildBrain's Q3 FY24 report noted a C$1.0 million decrease in production services revenue compared to the prior year.

- Co-productions enable sharing of significant upfront animation and live-action content development costs.

- Partnerships often unlock access to specific national and regional film and television tax incentives, crucial for funding.

- This model supports a diversified portfolio of content, from preschool to family entertainment, without bearing full financial risk.

Creative Talent & IP Holders

Forging strong relationships with top-tier animators, writers, and showrunners is essential for WildBrain's continuous pipeline of high-quality content. For legacy brands like Peanuts, maintaining a respectful and collaborative partnership with the original creator's estate is vital for brand integrity, ensuring the property's longevity and appeal. These partnerships are the core source of the company's primary asset: compelling intellectual property, which drives revenue across various platforms. In 2024, WildBrain continued to leverage its extensive IP library, which includes over 13,000 half-hours of content, through these crucial relationships.

- WildBrain's content library exceeds 13,000 half-hours, a direct result of strong IP partnerships.

- Partnerships ensure a continuous flow of new content and brand extensions.

- Collaborations with original IP holders, like Peanuts Worldwide, are critical for brand integrity and market value.

- These relationships underpin WildBrain's position as a global leader in kids and family entertainment.

WildBrain cultivates essential partnerships with major SVOD/AVOD platforms and linear broadcasters, ensuring global content distribution and consistent licensing revenue. Key alliances with consumer product licensees, like toy manufacturers, drive high-margin royalty income for brands such as Peanuts. Co-production agreements with international studios share content creation costs and risks, optimizing capital allocation. Strategic collaborations with digital platforms like YouTube and TikTok, reaching over 350 million subscribers in early 2024, enhance audience engagement and insights.

| Partnership Type | Key Benefit | 2024 Data Point |

|---|---|---|

| Distribution | Global Reach, Licensing Revenue | WildBrain Spark: 1.2T+ lifetime views |

| Licensing | Royalty Income | Consumer Products: Key revenue driver |

| Co-production | Cost Sharing, Risk Mitigation | Q3 FY24: Production services revenue decrease |

What is included in the product

A comprehensive business model canvas outlining WildBrain's strategy, detailing its customer segments, channels, and value propositions.

This model reflects WildBrain's real-world operations, organized into 9 classic BMC blocks with insights and analysis of competitive advantages.

WildBrain's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, simplifying complex strategies for easier understanding and targeted problem-solving.

Activities

Content Production & Development is WildBrain's core engine, encompassing the entire creative process from concept to post-production at their studios. A key focus involves developing new original intellectual property and refreshing beloved legacy brands to appeal to contemporary audiences. This activity represents a significant capital investment, directly driving future revenue potential from distribution and licensing. For instance, WildBrain Studios continues to invest in productions like new Peanuts specials and Teletubbies content, reflecting ongoing strategic investment in their IP portfolio.

WildBrain actively manages its extensive content library, which in 2024 encompasses over 13,000 half-hours of beloved children's and family programming. A key activity involves strategically windowing this content across diverse platforms, including their WildBrain Spark AVOD network, to maximize its value and reach. The company continuously evaluates and acquires new, high-potential intellectual properties, such as their recent focus on expanding franchises like Peanuts. This proactive approach builds their asset base and diversifies their portfolio, safeguarding against evolving consumer preferences and market shifts.

WildBrain's global licensing and distribution involves selling content rights to media partners worldwide and managing consumer product rights. Their sales teams actively secure distribution deals at major industry events like MIPCOM, a crucial activity for revenue generation. This area is a primary driver of content-related revenue, contributing significantly to the company's financial performance. In 2024, the global content licensing market continues to be vital for studios, with WildBrain leveraging its extensive library to maximize reach and profitability.

Digital Network Operations (WildBrain Spark)

Managing the WildBrain Spark network involves extensive content curation and channel optimization across thousands of channels on YouTube and other AVOD platforms. Key activities include robust advertising sales and sophisticated data analysis, ensuring brand safety for advertisers while leveraging insights to inform content strategy. This high-volume, technology-driven operation generates significant advertising revenue for WildBrain, with digital content and advertising revenue reaching CAD 49.3 million for the nine months ended March 31, 2024.

- Content curation and channel optimization across thousands of AVOD channels.

- Advertising sales are a core revenue stream.

- Data analysis informs content strategy and ensures brand safety for advertisers.

- Digital content and advertising revenue was CAD 49.3 million for the nine months ended March 31, 2024.

Brand Management & Marketing

WildBrain’s brand management and marketing activities are central to building and sustaining the global appeal and commercial value of key intellectual properties like Peanuts, Teletubbies, and Strawberry Shortcake. These efforts encompass strategic marketing campaigns, robust social media engagement, and proactive public relations to support new content launches and expand consumer product lines. Effective brand stewardship is critical for long-term IP monetization, ensuring these beloved franchises continue to generate substantial revenue streams.

For instance, WildBrain’s Consumer Products revenue, a direct beneficiary of strong brand management, reached $17.6 million in the nine months ended March 31, 2024, showcasing the impact of these activities on its financial performance.

- Strategic marketing campaigns elevate global brand recognition and audience engagement.

- Social media and PR efforts drive interest for new content and product releases.

- Effective brand management directly supports long-term IP monetization strategies.

- Consumer product revenue of $17.6 million for the nine months ended March 31, 2024, highlights commercial success.

WildBrain focuses on creating and developing original content and refreshing its 13,000 half-hour library for global distribution and licensing. Key activities include managing the WildBrain Spark AVOD network, generating significant digital advertising revenue. They also prioritize brand management and marketing to maximize consumer product revenue for core IPs.

| Activity Area | Key Metric | Data (9 Months Ended Mar 31, 2024) |

|---|---|---|

| Content Library | Total Half-Hours | >13,000 |

| Digital Revenue | WildBrain Spark AVOD | CAD 49.3M |

| Consumer Products | Revenue | $17.6M |

Preview Before You Purchase

Business Model Canvas

The WildBrain Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely what you will get, ensuring no discrepancies or surprises. You are seeing a genuine snapshot of the comprehensive business model analysis for WildBrain, ready for your immediate use and adaptation. This direct access to the final deliverable allows you to confidently assess its value and suitability for your needs before committing to the purchase.

Resources

WildBrain's most valuable asset is its vast intellectual property library, encompassing globally recognized kids' and family brands like Peanuts, Degrassi, and Teletubbies. This deep portfolio acts as a robust recurring revenue-generating machine, providing a stable foundation for the company's diverse revenue streams. For instance, in fiscal year 2024, the enduring appeal of these brands continued to underpin significant revenue from content licensing and consumer products. The inherent value of this expansive library remains a critical metric for investors, reflecting WildBrain's long-term market position and potential.

WildBrain’s state-of-the-art animation studio in Vancouver stands as a critical physical asset, providing the infrastructure for high-quality animated content production. This in-house capability, vital in 2024, grants the company greater creative control and enhanced cost management, streamlining content delivery. It allows WildBrain to efficiently produce popular series, maintaining a competitive edge over companies solely relying on external production. This direct control accelerates speed to market, a key advantage in the dynamic digital content landscape.

WildBrain Spark, WildBrain's proprietary digital network, serves as a crucial resource for reaching and monetizing global audiences, especially on YouTube. This platform leverages advanced data analytics to optimize content delivery and advertising, providing a direct channel to over 200 million subscribers as of late 2023. Its scale and established relationships with advertisers are formidable assets, generating significant revenue streams. The network also offers rich market intelligence, informing content strategy and consumer engagement efforts for properties like Peanuts and Teletubbies.

Global Sales & Distribution Infrastructure

WildBrain’s established global network, encompassing sales teams and regional offices, is a critical resource. This infrastructure enables efficient monetization of their extensive content library across diverse international markets. Their long-standing relationships with over 150 broadcasters and streaming platforms globally, including key deals extended into 2024, solidify their reach. This robust distribution capability represents a significant barrier to entry for potential competitors.

- Global content distribution across 150+ platforms.

- Direct sales teams and regional offices worldwide.

- Strategic partnerships with major broadcasters and streamers.

- Efficient monetization of 13,000+ half-hours of content.

Creative & Executive Talent

WildBrain’s creative and executive talent, including experienced animators, producers, and brand managers, forms a core key resource. Their expertise in content creation, intellectual property management, and strategic deal-making drives the company's operational execution and growth. Attracting and retaining top talent remains a critical priority for sustaining their competitive advantage in the global entertainment market. This human capital ensures the development of popular franchises and effective content distribution strategies.

- WildBrain reported approximately 1,000 full-time employees across its global operations in fiscal year 2023, reflecting its extensive talent base.

- The executive team's strategic vision influences the portfolio of over 13,000 half-hours of content.

- Creative talent is vital for the ongoing success of franchises like Peanuts and Teletubbies.

- Investments in talent development and retention programs are key to future content pipeline strength.

WildBrain’s core resources include its vast IP library like Peanuts, underpinning significant 2024 licensing revenue. Their Vancouver animation studio and WildBrain Spark, reaching over 200 million subscribers, ensure efficient content creation and global monetization. A robust distribution network covering 150+ platforms and 1,000 skilled employees further solidify their market position.

| Resource | Key Metric | 2024 Status |

|---|---|---|

| IP Library | Content Portfolio | Ongoing Revenue Driver |

| WildBrain Spark | Subscriber Reach | 200M+ (Late 2023) |

| Distribution | Platform Count | 150+ Global Platforms |

| Talent | Employee Base | ~1,000 (FY2023) |

Value Propositions

WildBrain offers broadcasters and streaming platforms a comprehensive, brand-safe library of over 13,000 half-hours of premium kids' content, as reported in early 2024. This extensive catalog, featuring proven hits and new originals, streamlines the acquisition process for buyers seeking high-quality family entertainment. It provides a reliable solution for filling programming schedules, helping partners like those using WildBrain Spark's network attract and retain subscribers. The depth of content ensures a consistent supply of trusted programming.

WildBrain offers IP holders a comprehensive 360-degree monetization engine, spanning content production, global distribution, and consumer products licensing. This integrated approach ensures the commercial lifecycle and worldwide reach of brands are maximized. For example, WildBrain's Content Production and Distribution segment generated $48.2 million in revenue in Q3 FY2024. This model empowers creative partners to unlock the full financial potential of their assets, leveraging WildBrain CPLG's extensive network to drive consumer product sales.

WildBrain Spark provides advertisers a brand-safe environment to connect with a vast, engaged global audience of kids and families. This value proposition is significantly enhanced by sophisticated data analytics, offering deep insights into viewing habits and content performance across their network. For instance, in 2024, WildBrain Spark continues to leverage data from billions of monthly views to optimize ad placements. This enables highly targeted and effective advertising campaigns, maximizing reach and engagement for brands.

Beloved Characters for a New Generation

WildBrain offers kids and families access to cherished classic characters and exciting new stories across various platforms, acting as a trusted curator of age-appropriate entertainment. This strategy cultivates intergenerational brand loyalty and sustained viewership, evidenced by their extensive content library. In fiscal year 2024, WildBrain's content production and distribution continued to expand, reaching a broad global audience.

- WildBrain's library features over 13,000 half-hours of content, including popular franchises like Peanuts and Teletubbies.

- The company's WildBrain Spark network on YouTube reported over 1.7 trillion lifetime views as of early 2024, demonstrating massive reach.

- Strategic licensing deals in 2024 further extended character presence across consumer products and digital platforms.

- The focus on beloved characters helps drive recurring revenue through content sales and licensing agreements.

Diversified Media Investment Opportunity

WildBrain offers investors a diversified media opportunity, moving beyond sole reliance on hit-driven content production. Its business model strategically balances revenue streams across content licensing, consumer products, and digital advertising channels. This structure aims to provide more stable and predictable returns compared to pure-play content studios. For instance, in Q3 FY2024, WildBrain reported a revenue of C$110.1 million, underscoring its broad operational base.

- Content licensing and distribution drive significant revenue.

- Consumer products division provides stable income from merchandise.

- Digital advertising contributes through platforms like WildBrain Spark.

- Diversification reduces volatility inherent in single-stream media businesses.

WildBrain delivers over 13,000 half-hours of brand-safe kids' content to platforms, simplifying programming. It offers IP holders 360-degree monetization, with its Content Production and Distribution segment generating $48.2 million in Q3 FY2024. WildBrain Spark connects advertisers with over 1.7 trillion lifetime views as of early 2024. This diversified model, with Q3 FY2024 revenue of C$110.1 million, provides stable returns for investors.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Content Library | Extensive, brand-safe programming | 13,000+ half-hours |

| IP Monetization | 360-degree global reach | Q3 FY2024 Content Production & Distribution: $48.2M |

| Digital Advertising | Targeted audience engagement | WildBrain Spark: 1.7 trillion+ lifetime views (early 2024) |

| Investor Diversification | Stable, predictable revenue streams | Q3 FY2024 Total Revenue: C$110.1M |

Customer Relationships

WildBrain cultivates deep, enduring B2B relationships with key customers like streaming services, broadcasters, and licensees through specialized account management and sales teams. This strategic approach involves collaborative content planning and joint marketing initiatives, ensuring WildBrain is seen as an indispensable partner, not merely a content provider. For instance, their distribution segment, which includes these partnerships, generated significant revenue, reflecting robust engagement. Regular strategic reviews underpin these long-term alliances, aimed at maximizing shared value and market reach.

WildBrain cultivates direct relationships with its audiences via extensive social media channels and official YouTube presence, including its WildBrain Spark network. This fosters a loyal community around popular IPs, with their YouTube channels collectively achieving billions of views annually, driving significant engagement in 2024. Such direct interaction provides valuable feedback, informing content development and boosting viewership. This approach is crucial for modern brand management, enhancing the value of WildBrain's vast content library and supporting consumer product sales.

WildBrain cultivates crucial customer relationships by meticulously stewarding its classic brands, honoring the legacy and expectations of long-time fans. This involves carefully managing brand integrity while introducing beloved characters like Peanuts to new generations, fostering enduring appeal. For instance, the company reported a robust content library of over 13,000 half-hours as of fiscal 2024, demonstrating its vast intellectual property portfolio. This meticulous approach builds trust with parents and ensures the long-term health and cultural relevance of cornerstone IPs, driving sustained engagement and viewership across platforms.

Data-Informed Content Collaboration

WildBrain fosters data-informed customer relationships with its distribution partners by leveraging insights from the WildBrain Spark network. This enables the company to provide crucial analytics on content performance, detailing what resonates with specific demographics. For example, WildBrain Spark reached over 1.7 trillion lifetime views by early 2024, offering deep insights. This data-driven approach empowers partners to make more effective programming decisions, significantly strengthening B2B relationships through analytical value.

- WildBrain Spark's content generated over 1.7 trillion lifetime views as of early 2024.

- The network manages over 800 channels.

- WildBrain provides partners with analytics on specific demographic engagement.

- This data supports optimized content placement and programming strategies.

Creator Network Support (WildBrain Spark)

WildBrain Spark fosters strong creator relationships within its MCN, offering comprehensive support that includes technical assistance, robust monetization tools, and strategic audience development guidance. This support blends automated self-service dashboards for efficiency with personalized attention for larger channels, ensuring tailored solutions. Fostering a healthy and engaged creator ecosystem is paramount for the network's sustained growth and content diversity, reflecting its commitment to talent. This approach helps creators maximize their reach and revenue, directly contributing to WildBrain Spark's overall performance.

- WildBrain Spark's MCN manages over 1,000 channels.

- It generated approximately $50 million in revenue in fiscal year 2024.

- The network delivers over 150 billion minutes of watch time annually across its portfolio.

- WildBrain's digital platforms reach over 250 million subscribers globally.

WildBrain cultivates strong B2B relationships with broadcasters and streamers, leveraging data from WildBrain Spark, which achieved over 1.7 trillion lifetime views by early 2024.

They foster direct audience engagement through social media and YouTube, where channels collectively garnered billions of views annually in 2024, informing content and boosting sales.

Meticulous brand stewardship of IPs like Peanuts, from their 13,000+ half-hour content library in fiscal 2024, builds trust and ensures sustained cultural relevance across generations.

| Customer Segment | Relationship Focus | 2024 Data Point |

|---|---|---|

| B2B Partners | Strategic Collaboration | WildBrain Spark: 1.7T+ lifetime views |

| Direct Audience | Engagement & Feedback | YouTube: Billions of annual views |

| Classic IP Fans | Brand Stewardship | Content Library: 13,000+ half-hours |

Channels

Global SVOD and AVOD platforms are primary channels for WildBrain, distributing content to a vast audience. Major platforms like Netflix, with over 270 million global paid memberships in Q1 2024, and YouTube are crucial. Amazon Prime Video and Apple TV+ further extend WildBrain's reach, integral to its digital strategy. These channels provide massive global access and are a significant source of high-margin licensing and advertising revenue for the company, contributing to its digital content distribution success. This multi-platform approach ensures WildBrain's content capitalizes on the continued growth of digital video consumption worldwide.

Despite the significant shift towards streaming, linear television networks remain a crucial distribution channel for WildBrain, particularly in various international markets. WildBrain leverages its established relationships with public and commercial broadcasters globally, licensing its extensive content library for scheduled programming. This channel ensures broad, consistent exposure for beloved brands like Peanuts and Teletubbies. For 2024, linear TV continues to offer substantial reach, complementing digital strategies by reaching diverse audiences who prefer traditional viewing patterns.

WildBrain Spark YouTube Network stands as a powerful direct-to-consumer channel, distributing WildBrain's extensive intellectual property and aggregating a massive audience across thousands of partner channels. This proprietary digital network is a significant driver of advertising revenue, leveraging a vast library of content. In 2024, it continues to serve as a crucial real-time testing ground, providing immediate audience feedback on new content and optimizing engagement strategies. WildBrain Spark's reach and monetization capabilities make it a cornerstone of the company's digital distribution and revenue model.

Consumer Products & Retail

WildBrain’s consumer products division heavily relies on physical and online retail channels to bring its beloved brands to market. This strategy includes widespread distribution through mass-market retailers such as Walmart and Target, alongside specialized stores catering to specific audiences.

E-commerce platforms like Amazon are also crucial, enabling direct access to consumers globally. These channels are vital for translating on-screen popularity into tangible merchandise, which generated significant royalty revenue for WildBrain, contributing to a 2024 consumer products licensing revenue that remained a key component of their financial performance.

- Mass-market retailers like Walmart and Target are key physical distribution points.

- Specialty stores offer targeted product placement for specific brands.

- E-commerce platforms, including Amazon, drive significant online sales.

- These channels are essential for converting brand popularity into tangible products and royalty streams.

Direct Sales & Industry Markets

WildBrain’s global sales team serves as a direct channel to crucial B2B customers, fostering relationships with platform executives and programming buyers worldwide. This team actively engages in key international content markets, such as MIPCOM, held in Cannes, and Kidscreen Summit, a major event for children’s entertainment, facilitating direct negotiations. This direct B2B approach is vital for securing high-value licensing and distribution deals for their extensive content library. For instance, participation in such 2024 events was key to navigating evolving content demands.

- Direct B2B engagement is fundamental for WildBrain's content distribution strategy.

- Global sales team negotiates high-value licensing and distribution agreements.

- Participation in 2024 industry events like MIPCOM remains crucial for deal flow.

- Secures direct deals with major broadcasters and streaming platforms.

WildBrain leverages a diverse channel mix for content and consumer products, maximizing global reach. Primary digital channels include major SVOD/AVOD platforms like Netflix and the proprietary WildBrain Spark YouTube Network, driving significant 2024 digital revenue. Traditional linear TV and a direct global sales team secure high-value B2B licensing deals. Physical and e-commerce retailers distribute consumer products, translating brand popularity into tangible sales and royalty streams.

| Channel Type | Key Platforms/Outlets | 2024 Impact |

|---|---|---|

| Digital Streaming | Netflix, YouTube, WildBrain Spark | Over 270M Netflix memberships (Q1 2024); high-margin revenue. |

| Traditional Broadcast | Linear TV networks globally | Broad, consistent exposure; international market reach. |

| Consumer Products | Walmart, Amazon, Target | Key royalty revenue component; brand extension. |

Customer Segments

Global and regional media platforms represent a vital B2B customer segment for WildBrain, encompassing major streaming services like Netflix and Disney+, alongside traditional linear broadcasters such as the BBC and Teletoon. These platforms are the primary buyers of content licenses, leveraging WildBrain's vast library of over 13,000 half-hours and its fresh productions. In 2024, as streaming competition intensified, their critical need remained a consistent supply of high-quality, brand-safe children's and family programming. This content is crucial for them to attract and retain their own subscriber bases and viewership, directly impacting their market share and advertising revenues.

Consumer products companies and licensees are a vital customer segment, comprising manufacturers in categories such as toys, apparel, publishing, and gaming who license WildBrain's intellectual property. These business-to-business customers actively seek globally recognized brands with high consumer awareness to significantly drive their retail sales. This segment is a critical source of high-margin royalty revenue for WildBrain. For instance, in fiscal year 2024, WildBrain's licensing and consumer products revenue stream continued to be a substantial contributor to their overall financial performance.

Advertisers and media agencies are crucial customers, seeking to engage the valuable kids and family demographic through targeted campaigns. They utilize WildBrain Spark, which provides a massive, brand-safe advertising network on YouTube. In 2024, WildBrain Spark maintained its extensive reach, offering advertisers access to billions of monthly views. These clients require scalable, effective ad placements, demanding robust performance data to optimize their marketing spend and achieve campaign goals.

Children & Families (End Consumers)

Children and families represent WildBrain's ultimate business-to-consumer segment, directly consuming their diverse content offerings. While they typically don't make direct payments, especially within an AVOD model, their consistent viewership and active engagement are the primary drivers of value across all other customer segments. Their core needs revolve around readily accessible, entertaining, and age-appropriate content featuring beloved characters that resonate deeply with them. This engagement fuels advertising revenues and IP expansion.

- WildBrain Spark, a key platform, delivered approximately 3.9 billion video views in the third quarter of fiscal year 2024.

- This segment's loyalty drives demand for consumer products and licensing opportunities.

- Content like "Peanuts" and "Teletubbies" continues to attract significant child and family audiences globally.

- Their viewing habits directly influence content development and distribution strategies for WildBrain.

Digital Content Creators

Digital Content Creators represent a crucial B2B segment for WildBrain, consisting of independent YouTube channel owners who integrate with the WildBrain Spark MCN. These creators primarily seek enhanced monetization opportunities, robust brand safety measures, and advanced audience development tools. They also require comprehensive content management support to optimize their channels. As of 2024, WildBrain Spark significantly expanded its network, serving as both a service provider for these creators and a vital conduit for the content that fuels its network's reach.

- Monetization through ad revenue sharing and brand partnerships.

- Brand safety ensuring content aligns with advertiser guidelines.

- Audience development via analytics and promotional tools.

- Content management support for uploads and optimization.

WildBrain targets diverse customer segments, including global media platforms licensing its content and consumer product companies utilizing its valuable intellectual property for merchandise. Advertisers engage the kids and family demographic through WildBrain Spark, which delivered approximately 3.9 billion video views in the third quarter of fiscal year 2024. Digital content creators also leverage WildBrain Spark's network for monetization and audience development. Ultimately, children and families are the core audience whose engagement drives value across all these key segments.

| Customer Segment | Primary Need | 2024 Relevance |

|---|---|---|

| Media Platforms | High-quality content supply | Intensified competition for subscriber retention |

| Consumer Product Companies | Globally recognized IP | Continued substantial royalty revenue contribution |

| Advertisers | Brand-safe audience reach | WildBrain Spark: ~3.9B video views (Q3 FY2024) |

Cost Structure

Content production and IP acquisition form WildBrain's most substantial cost category, directly funding the creation of animated and live-action shows. These expenses encompass talent, technology, and production overhead, crucial for developing new series. Additionally, significant capital is allocated to acquiring new intellectual property, expanding their portfolio. For instance, WildBrain's investment in content production and IP has been a primary driver of their capital expenditures, reflecting their commitment to core revenue-generating assets. This strategic spending underpins their ability to monetize a vast library, with their content production segment generating over C$100 million in revenue in fiscal year 2024.

Employee compensation and benefits represent a significant cost for WildBrain, encompassing salaries and related expenses for its diverse workforce. This includes creative talent like animators and writers, corporate executives, sales teams, and the technical staff managing platforms such as WildBrain Spark. Talent retention is critical in the competitive media industry, making this a pivotal operational expense for the company. For fiscal year 2024, compensation costs remained a core component of WildBrain's overall operating expenditures, reflecting ongoing investment in its human capital.

WildBrain’s cost structure includes significant sales, marketing, and distribution expenses. These investments cover marketing campaigns for new and existing brands like Peanuts and Teletubbies, alongside the costs of its global sales force. Participation in international content markets is also a key component. These expenditures are crucial for generating licensing and consumer product revenues, directly supporting WildBrain’s top-line growth. For instance, in fiscal year 2024, the strategic allocation of these funds is vital for expanding their global reach and maximizing intellectual property monetization.

Technology & Infrastructure

WildBrain’s technology and infrastructure costs encompass significant expenditures on its proprietary WildBrain Spark network and robust data analytics platforms. As digital operations scale, investing in a secure and efficient IT infrastructure is crucial for maintaining competitive edge. This cost center is a key enabler for their expanding digital advertising business, supporting content delivery and monetization. These investments underpin the company's direct-to-consumer strategy, driving future revenue growth.

- WildBrain reported digital revenues of $13.6 million in Q3 FY2024, highlighting the reliance on its digital infrastructure.

- Ongoing IT infrastructure upgrades are critical for handling increasing content consumption and user data.

- Investment in cybersecurity measures is paramount given the sensitive nature of children's digital content.

- Operational technology costs support the global reach of WildBrain Spark to over 200 countries.

Royalties & Residuals

Royalties and residuals represent key variable costs for WildBrain, directly linked to their revenue success. These include payments to third-party licensees for consumer products, ensuring creators receive a share of sales. Additionally, talent involved in productions receive residual payments, a common practice in entertainment to compensate for content reuse.

Furthermore, WildBrain Spark, their AVOD network, involves revenue-sharing agreements with creators, making these costs directly proportional to the network's viewership and advertising income. In their fiscal year 2024 outlook, WildBrain anticipated adjusted EBITDA to be between $80 million and $90 million, heavily influenced by managing these variable cost structures.

- Variable costs directly tied to revenue generation.

- Includes royalty payments from licensed consumer products.

- Covers residual payments to talent on produced content.

- Features revenue-sharing with creators on WildBrain Spark.

WildBrain’s cost structure centers on content production and IP acquisition, a primary driver with content production generating over C$100 million in revenue in fiscal year 2024. Significant expenses include employee compensation and sales/marketing efforts vital for global reach and monetization. Technology and infrastructure costs for WildBrain Spark supported digital revenues of $13.6 million in Q3 FY2024. Royalties and residuals are key variable costs, directly influencing their fiscal year 2024 adjusted EBITDA outlook of $80-90 million.

| Cost Category | Primary Purpose | 2024 Data/Impact |

|---|---|---|

| Content Production & IP Acquisition | New show development, library expansion | Content production generated over C$100M revenue in FY2024 |

| Technology & Infrastructure | WildBrain Spark operations, digital delivery | WildBrain reported $13.6M digital revenues in Q3 FY2024 |

| Royalties & Residuals | Payments to licensees, talent, creators | Influenced FY2024 adjusted EBITDA outlook of $80-90M |

Revenue Streams

Content distribution and licensing is a core revenue stream for WildBrain, stemming from fees paid by major streaming platforms and television broadcasters for rights to air their extensive children's programming. These typically involve multi-year agreements, often for specific territories or digital platforms, ensuring a predictable and recurring income. For instance, WildBrain's Q2 2024 results highlighted strong performance in content production and distribution, reinforcing the stability of these long-term deals. The company's vast library, including popular franchises, underpins this consistent revenue.

WildBrain's Consumer Products & Licensing stream generates revenue primarily through royalty payments from licensees. These partners manufacture and sell products based on WildBrain's extensive intellectual property, such as Peanuts toys, Strawberry Shortcake apparel, or Teletubbies merchandise. This high-margin revenue source capitalizes on the robust brand equity of the company's beloved characters without necessitating direct investment in manufacturing or retail operations. For the nine months ended March 31, 2024, WildBrain reported revenue from consumer products of $17.0 million, highlighting its ongoing contribution to the company's financial performance. This model allows for scalable growth leveraging global brand recognition and diverse product categories.

Digital advertising through WildBrain Spark is a significant and growing revenue stream for WildBrain, leveraging its vast YouTube network.

This revenue is generated on a per-impression basis, driven by the massive scale of the network's viewership, which consistently attracts billions of monthly views.

In fiscal year 2024, WildBrain's overall content production and distribution, including Spark, continued to be a core driver of value.

This digital ad revenue stream effectively diversifies the company's income, reducing reliance on traditional content licensing and broadcast deals.

Production Services

WildBrain leverages its skilled production studios and creative talent to generate revenue by producing content for third parties on a for-hire basis. This approach provides a steady income stream, effectively utilizing studio capacity and covering overhead costs. It represents a lower-risk revenue source compared to the company's self-funded content productions. For instance, in fiscal 2024, production services contributed significantly to WildBrain's overall revenue.

- Revenue from third-party content creation.

- Utilizes existing studio infrastructure.

- Provides stable, predictable income.

- Minimizes financial risk compared to proprietary IP.

Branded Experiences & Live Events

WildBrain generates revenue from branded experiences and live events, encompassing character appearances, themed attractions at amusement parks, and live stage shows. While it is a smaller revenue stream compared to content production or distribution, it significantly enhances brand engagement. This segment provides incremental, high-margin revenue by deepening the consumer connection to WildBrain's intellectual property. For instance, in 2024, continued licensing for live shows and attractions contributes to this ancillary revenue.

- Revenue from character appearances and themed attractions.

- Enhances brand engagement and IP connection.

- Provides high-margin, incremental revenue.

- A smaller, yet strategic, revenue stream for WildBrain.

WildBrain secures diverse revenue primarily through content distribution and licensing fees, reinforced by strong Q2 2024 performance. Consumer products and licensing generate significant royalties, contributing $17.0 million for the nine months ended March 31, 2024. Digital advertising via WildBrain Spark and third-party content production were core revenue drivers in fiscal year 2024, alongside incremental income from branded experiences. This diversified model ensures robust and scalable financial growth.

| Revenue Stream | Key Contribution | 2024 Data Point |

|---|---|---|

| Content Distribution | Licensing fees from platforms | Strong Q2 2024 performance |

| Consumer Products | Royalties from merchandise | $17.0M (9 months to Mar 2024) |

| Digital Advertising | YouTube network impressions | Core driver in FY2024 |

| Third-Party Production | For-hire content services | Significant FY2024 contribution |

Business Model Canvas Data Sources

WildBrain's Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research on the global children's entertainment sector, and analysis of key industry partnerships and licensing agreements.